Professional Documents

Culture Documents

Credit Rating - Fin

Uploaded by

Lyanna MormontCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Rating - Fin

Uploaded by

Lyanna MormontCopyright:

Available Formats

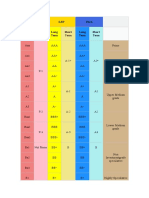

Moody's S&P Fitch Meaning

(Highest quality; EXTREMELY STRONG capacity to meet

Aaa AAA AAA

financial obligations.)

Aa1 AA+ AA+ (High quality; VERY STRONG capacity

Aa2 AA AA to meet financial obligations. It differs from

Aa3 AA- AA- the top-line rating only in small degree.)

(High quality; STRONG capacity to meet financial

A1 A+ A+

obligations

A2 A A but is somewhat more susceptible to the adverse effects

A3 A- A- of changes in circumstances and economic conditions.)

(Medium grade; ADEQUATE capacity to meet financial

Baa1 BBB+ BBB+

obligations

Baa2 BBB BBB but adverse conditions or changing circumstances are more

likely to lead to a weakened capacity to meet financial

Baa3 BBB- BBB-

commitments.)

Ba1 BB+ BB+ (Lower medium grade; LESS VULNERABLE but faces major

ongoing uncertainties and exposure to adverse conditions

Ba2 BB BB

which

could lead to inadequate capacity to meet financial

Ba3 BB- BB-

commitments.)

B1 B+ B+ (Low grade; MORE VULNERABLE and adverse business,

B2 B B financial, or economic conditions will likely impair its capacity

B3 B- B- or willingness to meet financial commitments.)

(Poor quality; CURRENTLY VULNERABLE and dependent

Caa CCC CCC

upon favourable conditions to meet commitments.)

Ca CC CC (Poor quality; CURRENTLY HIGHLY-VULNERABLE.)

C C (CURRENTLY HIGHLY-VULNERABLE to nonpayment.)

C D D (FAILED to pay one or more of its financial obligations.)

HILARIO, NICHOLE V. MARCH 13, 2015

AC1412 PRNFIN

The Philippines Credit Rating History

The Philippines received its first credit rating from Moodys and S&P in 1993

and from Fitch in 1999. Since then, the country has never gotten a rating

beyond the speculative grade. The best it has received so far is one notch

below investment grade. While the CRAs recognize the improved economic

and fiscal performance of the Philippines in recent years, they also note its

shortcomings. S&P in July 2012 raised the countrys credit rating from BB to BB+.

In June of the same year, Fitch kept its BB+ credit rating outlook for the

Philippines. Moodys rating, on the other hand, remains two notches below

investment grade. This means that at least for 2012, the much coveted

investment grade status will still remain elusive.

Current Credit Ratings under the Aquino Administration

Date Rated CREDIT AGENCY RATING

2014 May 08 Standard & Poors BBB STABLE

2014 Dec 11 Moodys Baa2 STABLE

2013 Mar 27 Fitch BBB- STABLE

S&P: BBB stable

Moodys: Baa2 stable

Fitch: BBB- stable

Standard & Poors credit rating for Philippines stands at BB+. Moodys rating for

Philippines sovereign debt is Ba1. Fitchs credit rating for Philippines is BB+. In

general, a credit rating is used by sovereign wealth funds, pension funds and

other investors to gauge the credit worthiness of Philippines thus having a big

impact on the country's borrowing costs.

You might also like

- Moody - SP - Fitch Ratings TableDocument1 pageMoody - SP - Fitch Ratings TablekrakishNo ratings yet

- CreditratingDocument20 pagesCreditratingNeethu NairNo ratings yet

- Credit Rating: Prof - Bijoy GuptaDocument21 pagesCredit Rating: Prof - Bijoy GuptaManash GopeNo ratings yet

- Credit Rating ExplainedDocument25 pagesCredit Rating ExplainedDileep SinghNo ratings yet

- AG 2012-05 - Credit Rating AgenciesDocument3 pagesAG 2012-05 - Credit Rating AgenciesR&S StuffNo ratings yet

- Standard PoorsDocument2 pagesStandard PoorsAdmir ĐozoNo ratings yet

- JCR-VIS Credit Rating Company Limited: Medium To Long-Term AAADocument4 pagesJCR-VIS Credit Rating Company Limited: Medium To Long-Term AAAFarhana RafiqNo ratings yet

- Credit RatingDocument48 pagesCredit RatingChinmayee ChoudhuryNo ratings yet

- EIU Credit Ratings ExplainedDocument1 pageEIU Credit Ratings ExplainedMaliha Khan DolaNo ratings yet

- Monetery Policy and BankingDocument8 pagesMonetery Policy and Banking17FB049 Mokter HasanNo ratings yet

- Bond Ratings ExplainedDocument2 pagesBond Ratings ExplainedcciesaadNo ratings yet

- INFORME S&P 24 ENERO 2014 (Bancos)Document6 pagesINFORME S&P 24 ENERO 2014 (Bancos)Alerta ProgresistaNo ratings yet

- Understanding the DBRS Rating ScaleDocument1 pageUnderstanding the DBRS Rating ScaleJonathan OrdóñezNo ratings yet

- Group5 CreditratingmonitoringDocument20 pagesGroup5 CreditratingmonitoringGabriel SolanaNo ratings yet

- Rating DefinitionsDocument3 pagesRating DefinitionsMuhammad Eid SaberNo ratings yet

- Congress March 2018 Box Eng 5Document4 pagesCongress March 2018 Box Eng 5Lina MurciaNo ratings yet

- Standard & Poor's Business and Financial Terms July 2014Document25 pagesStandard & Poor's Business and Financial Terms July 2014Andy LeungNo ratings yet

- StandardDocument2 pagesStandardGauravNo ratings yet

- Credit Rating of BanksDocument3 pagesCredit Rating of BankshinaNo ratings yet

- PACRA Rating Scales and DefinitionsDocument2 pagesPACRA Rating Scales and DefinitionsM Azeem IqbalNo ratings yet

- Petromax Refinery Rating Report 2012Document4 pagesPetromax Refinery Rating Report 2012Hassan Md RabiulNo ratings yet

- Crisil RatingDocument20 pagesCrisil RatingChintan AcharyaNo ratings yet

- Credit Rating of BanksDocument4 pagesCredit Rating of BanksAyesha ZulfiqarNo ratings yet

- PresentationSUMMARY (A)Document2 pagesPresentationSUMMARY (A)Rakib HasanNo ratings yet

- Moodys Affirms The Arab Bank 09mar2023 PR - 473855Document7 pagesMoodys Affirms The Arab Bank 09mar2023 PR - 473855Ivan LessiaNo ratings yet

- Definition, Types and Scales of Credit RatingDocument8 pagesDefinition, Types and Scales of Credit Ratingjannatul ferthousNo ratings yet

- Fitch Rating Report For Hamden, CT Aug 2021Document6 pagesFitch Rating Report For Hamden, CT Aug 2021Helen BennettNo ratings yet

- Padma PolyCotton Knit Fabrics Limited - 2011Document5 pagesPadma PolyCotton Knit Fabrics Limited - 2011fahim_bdNo ratings yet

- Symbols Symbolsand Definitions For BondDocument1 pageSymbols Symbolsand Definitions For BondhizelaryaNo ratings yet

- S&P Debt Rating DefinitionsDocument6 pagesS&P Debt Rating DefinitionsilyakostNo ratings yet

- FIN MAN Week 7Document40 pagesFIN MAN Week 7Losel CebedaNo ratings yet

- Rating DefinitionsDocument12 pagesRating Definitionstelly jordanNo ratings yet

- Credit RatingsDocument3 pagesCredit RatingsElvis JoseNo ratings yet

- Phil RatingsDocument8 pagesPhil RatingsTrisha Timpog100% (1)

- Session 24 Bad Debts and Provision For Doubtful DebtsDocument7 pagesSession 24 Bad Debts and Provision For Doubtful Debtsol.iv.e.a.gui.l.ar412No ratings yet

- CP Bangladesh Company Limited Rating Report 2012 CheckedDocument3 pagesCP Bangladesh Company Limited Rating Report 2012 CheckedMuannis MahmoodNo ratings yet

- UFI-M-5Document25 pagesUFI-M-5sresthapatel28No ratings yet

- Calificación de Riesgo GuatemalaDocument20 pagesCalificación de Riesgo GuatemalaErickaNo ratings yet

- UK Credit Ratings ExplainedDocument2 pagesUK Credit Ratings ExplainedRegon SabirNo ratings yet

- The Hongkong and Shanghai Banking Corporation Limited, Bangladesh BranchesDocument4 pagesThe Hongkong and Shanghai Banking Corporation Limited, Bangladesh Branchesjubayer2252No ratings yet

- Fitch US HY 2013 OutlookDocument24 pagesFitch US HY 2013 Outlookcicero_acNo ratings yet

- Credit RatingDocument18 pagesCredit RatingFathima MuhammedNo ratings yet

- International Credit Rating Agencies ExplainedDocument21 pagesInternational Credit Rating Agencies Explainedshivam jaiswalNo ratings yet

- Credit Ratings GuideDocument3 pagesCredit Ratings GuideMauricio ZvikNo ratings yet

- Credit Ratings PDFDocument1 pageCredit Ratings PDFkirti gNo ratings yet

- Philippine Financial System and Credit Risk ManagementDocument32 pagesPhilippine Financial System and Credit Risk ManagementMichael RosquitaNo ratings yet

- Lower-Rated Chinese Real Estate Developers Remain Vulnerable To Market ShiftsDocument9 pagesLower-Rated Chinese Real Estate Developers Remain Vulnerable To Market Shiftsapi-227433089No ratings yet

- Moody's Affirms Petrobras' Ba2 Ratings and Raises Its BCA To Ba2 Outlook Remains StableDocument5 pagesMoody's Affirms Petrobras' Ba2 Ratings and Raises Its BCA To Ba2 Outlook Remains StableRenan Dantas SantosNo ratings yet

- Entity Entity Rating Scale & Definitions: L T R S T RDocument2 pagesEntity Entity Rating Scale & Definitions: L T R S T RAsma AzizNo ratings yet

- RatingDocument4 pagesRatinganumnasikNo ratings yet

- Credit Rating ChartsDocument1 pageCredit Rating ChartsSapna KannaidasNo ratings yet

- Fitch Bolivia - 2019-07-02Document12 pagesFitch Bolivia - 2019-07-02Mauricio Jerez QuirogaNo ratings yet

- UBA Ghana - Rating Action CommentaryDocument6 pagesUBA Ghana - Rating Action CommentaryFuaad DodooNo ratings yet

- Capitec Bank LTDDocument14 pagesCapitec Bank LTDMpho SeutloaliNo ratings yet

- 2022 Outlook U.S. Regional BanksDocument16 pages2022 Outlook U.S. Regional BanksUdan RMNo ratings yet

- Moodys - Vietnam - Issuer in DepthDocument29 pagesMoodys - Vietnam - Issuer in DepthLâm VũNo ratings yet

- Fitch RatingsDocument4 pagesFitch RatingsAlex SanchezNo ratings yet

- Philippines credit ratings analysis from S&P, Moody's and FitchDocument3 pagesPhilippines credit ratings analysis from S&P, Moody's and FitchTrisia Corinne JaringNo ratings yet

- Debt Securities MarketDocument5 pagesDebt Securities MarketXyza Faye RegaladoNo ratings yet

- World Bank East Asia and Pacific Economic Update October 2015: Staying the CourseFrom EverandWorld Bank East Asia and Pacific Economic Update October 2015: Staying the CourseNo ratings yet

- Age Customer Number Marital Status Annual Income Mortgage Amount Payments Per Year Total Amount PaidDocument14 pagesAge Customer Number Marital Status Annual Income Mortgage Amount Payments Per Year Total Amount PaidLyanna MormontNo ratings yet

- Age Customer Number Marital Status Annual Income Mortgage Amount Payments Per Year Total Amount PaidDocument14 pagesAge Customer Number Marital Status Annual Income Mortgage Amount Payments Per Year Total Amount PaidLyanna MormontNo ratings yet

- Clearical Reasoning Part 1 1Document2 pagesClearical Reasoning Part 1 1Lian RamirezNo ratings yet

- VBADocument2 pagesVBALyanna MormontNo ratings yet

- Name Grade Remarks Jose Rizal 60 Failed 80 Andres Bonifacio 90 Passed Apolinario Mabini 100 Passed Antonio Luna 75 PassedDocument4 pagesName Grade Remarks Jose Rizal 60 Failed 80 Andres Bonifacio 90 Passed Apolinario Mabini 100 Passed Antonio Luna 75 PassedLyanna MormontNo ratings yet

- Assess The Control EnvironmentDocument1 pageAssess The Control EnvironmentLyanna MormontNo ratings yet

- ANSWERS All SubjDocument126 pagesANSWERS All SubjLyanna MormontNo ratings yet

- Branch Accounting TestbankDocument5 pagesBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- Investments 1Document1 pageInvestments 1Lyanna MormontNo ratings yet

- ANSWERS All SubjDocument126 pagesANSWERS All SubjLyanna MormontNo ratings yet

- ObligationDocument11 pagesObligationchowchow123100% (4)

- ObligationDocument11 pagesObligationchowchow123100% (4)

- Board of Accountancy - Growth of AccountingDocument2 pagesBoard of Accountancy - Growth of AccountingLyanna MormontNo ratings yet

- Audit Cash and EquivalentsDocument19 pagesAudit Cash and EquivalentsAiden PatsNo ratings yet

- 05 x05 Standard Costing & Variance AnalysisDocument49 pages05 x05 Standard Costing & Variance AnalysisLyanna MormontNo ratings yet

- Characters in Rizal's Noli Me TangereDocument2 pagesCharacters in Rizal's Noli Me TangereLyanna MormontNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesLyanna MormontNo ratings yet

- Measures of Dispersion or Variability ExplainedDocument1 pageMeasures of Dispersion or Variability ExplainedLyanna MormontNo ratings yet

- Rules of Construction in Case of Ambiguity or Omission: SEC. 17. SEC. 19. Signature by Agent Authority How ShownDocument5 pagesRules of Construction in Case of Ambiguity or Omission: SEC. 17. SEC. 19. Signature by Agent Authority How ShownLyanna MormontNo ratings yet

- Is A Digital or Virtual Currency That Uses Cryptography For Security. Enterprise Resource Planning - (ERP)Document1 pageIs A Digital or Virtual Currency That Uses Cryptography For Security. Enterprise Resource Planning - (ERP)Lyanna MormontNo ratings yet

- BL TestbankDocument47 pagesBL TestbankTrixie de LeonNo ratings yet

- New-Product Development and Product Life-Cycle StrategiesDocument22 pagesNew-Product Development and Product Life-Cycle StrategiesLyanna MormontNo ratings yet

- Student Slides Chapter 18Document15 pagesStudent Slides Chapter 18Lyanna MormontNo ratings yet

- Chapter 7Document25 pagesChapter 7Lyanna Mormont0% (1)

- Advertising, Sales Promotion, and Public RelationsDocument26 pagesAdvertising, Sales Promotion, and Public RelationsfelixprabuNo ratings yet

- AC1Document1 pageAC1Lyanna Mormont25% (4)

- Chapter 5Document26 pagesChapter 5Lyanna MormontNo ratings yet

- Philippine Seven PESTEL AnalysisDocument2 pagesPhilippine Seven PESTEL AnalysisLyanna MormontNo ratings yet

- Chapter 8Document21 pagesChapter 8Lyanna MormontNo ratings yet

- Chapter 4Document23 pagesChapter 4Lyanna MormontNo ratings yet

- CreditDocument13 pagesCreditAkhil NairNo ratings yet

- Sabah Credit CorporationDocument14 pagesSabah Credit CorporationYff DickNo ratings yet

- Bank of Boroda RajibDocument131 pagesBank of Boroda Rajibutpalbagchi100% (5)

- COUNTRY RISK PREMIUMSDocument2 pagesCOUNTRY RISK PREMIUMSyees123No ratings yet

- Ifs CiaDocument6 pagesIfs CiaAndriana MihobeeNo ratings yet

- Valuation Assignment 1Document12 pagesValuation Assignment 1Tayba AwanNo ratings yet

- Democracy 3 - Manual PDFDocument13 pagesDemocracy 3 - Manual PDFwilsonNo ratings yet

- The Global Sustainable Competitiveness Index Report 2023Document90 pagesThe Global Sustainable Competitiveness Index Report 2023ladyvampire206No ratings yet

- SYBCom - Financial Services and Production Management - Module 2Document26 pagesSYBCom - Financial Services and Production Management - Module 2Yash SuranaNo ratings yet

- Module 3: Chapter 7 Credit EvaluationDocument30 pagesModule 3: Chapter 7 Credit EvaluationHarlene Bulaong0% (1)

- Moody's Afirmó La Calificación B2 de Argentina y Bajó Su Perspectiva A NegativaDocument6 pagesMoody's Afirmó La Calificación B2 de Argentina y Bajó Su Perspectiva A NegativaCronista.comNo ratings yet

- INSTRUMENTSDocument41 pagesINSTRUMENTS微微No ratings yet

- Archana Khetan SFM OldDocument53 pagesArchana Khetan SFM OldSakshi VermaNo ratings yet

- Fixed Income Chapter 6Document29 pagesFixed Income Chapter 6Nguyen QuyetNo ratings yet

- Riesgo PaisDocument174 pagesRiesgo PaisDennis NinataypeNo ratings yet

- Montes Et Al. (2016)Document16 pagesMontes Et Al. (2016)DiegoPachecoNo ratings yet

- Unit 4 - Credit RatingDocument40 pagesUnit 4 - Credit RatingANUSHKA CHATURVEDINo ratings yet

- Lista Recomendada Bonds Latam Ex BrasilDocument4 pagesLista Recomendada Bonds Latam Ex BrasilLuiza BatistaNo ratings yet

- Case Study On Hospital Corporation of AmericaDocument40 pagesCase Study On Hospital Corporation of AmericaEduardo BautistaNo ratings yet

- Wa0000 (1) 2 2Document112 pagesWa0000 (1) 2 2Aisha rashidNo ratings yet

- Moody's FrameworkDocument30 pagesMoody's FrameworkbulbNo ratings yet

- Credit Rating-IfmDocument11 pagesCredit Rating-IfmKunal SuranaNo ratings yet

- Project Report On Credit RatingDocument15 pagesProject Report On Credit RatingShambhu Kumar100% (4)

- 16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit IDocument29 pages16Ub1624-Financial Markets and Institutions K1 - Level Multiple Choice Questions Unit Ilaale dijaanNo ratings yet

- Apollo Tyres Ratings Reaffirmed Despite Large CapexDocument4 pagesApollo Tyres Ratings Reaffirmed Despite Large Capexragha_4544vNo ratings yet

- What Is An IndentureDocument6 pagesWhat Is An IndenturecruellaNo ratings yet

- European Union Sovereign Release Calendar For 2023Document12 pagesEuropean Union Sovereign Release Calendar For 2023Denis SanduNo ratings yet

- MSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Document3 pagesMSFIN 223 - Case 1 - Du Pont (Cauton, Cortez, Dy, Lui, Mamaril, Papa, Rasco)Leophil RascoNo ratings yet

- Industry 49 - Team E - LQ6Document3 pagesIndustry 49 - Team E - LQ6Orlando Soares JúniorNo ratings yet

- Colombian Toll Road Credit Agreement SummaryDocument200 pagesColombian Toll Road Credit Agreement SummarypepitoNo ratings yet