Professional Documents

Culture Documents

Certificate of Deduction of Tax: ( (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )

Uploaded by

shibbir002Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Deduction of Tax: ( (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )

Uploaded by

shibbir002Copyright:

Available Formats

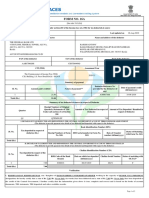

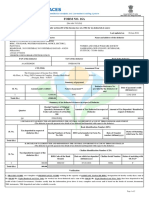

(Name and address of the person or the office of the person issuing the certificate)

(office letterhead may be used)

Certificate of Deduction of Tax

[(section 58 of the Income Tax Ordinance, 1984 (XXXVI of 1984)]

No. Date

01 Name of the payee

02 Address of the payee

03 Does the payee have a Twelve-digit TIN? Yes No

04 Twelve-digit TIN (if answer of 03 is Yes)

05 Period for which payment is made From (date) to (date)

06. Particulars of the making of payment and the deduction of tax (add lines if necessary)

Sl Date of Description of payment Section Amount of Amount of tax Remarks

payment payment deducted

1

2

Total

07. Payment of deducted tax to the credit of the Government (add lines if necessary)

Sl Challan* Challan Bank Name Total amount Amount Remarks

Number date in the challan relating to this

certificate

1

2

Total

In words:

*if payment is made in any other mode specified by the Board, provide information relevant to that mode.

Certified that the information given above is correct and complete.

Name of the person issuing the certificate Signature and seal

Designation

TCAN

Phone & E-mail Date

You might also like

- Certificate Tax CollectionDocument1 pageCertificate Tax Collectionosi rahmanNo ratings yet

- Certificate of Collection of Tax: (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )Document1 pageCertificate of Collection of Tax: (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )osi rahmanNo ratings yet

- Chapter Xii.Document8 pagesChapter Xii.Far DinNo ratings yet

- TDS 281Document3 pagesTDS 281Gaurav singh BishtNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- Form 16B TDS CertificateDocument1 pageForm 16B TDS CertificateSurendra Kumar BaaniyaNo ratings yet

- It 000136741219 2023 05Document1 pageIt 000136741219 2023 05wali khelNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- Form No 16Document2 pagesForm No 16scorpio.vinodNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- BLFPN0819K 2021Document4 pagesBLFPN0819K 2021anjana19780316No ratings yet

- Ayhpk8466h 2022Document4 pagesAyhpk8466h 2022AnilNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- It 000144773140 2024 10Document1 pageIt 000144773140 2024 10hizbullahjantankNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- PDF 04Document2 pagesPDF 04Pawan UdyogNo ratings yet

- For Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearDocument1 pageFor Withholding Taxes Only: Name of LTU/ MTU/ RTO Salary Month Nature of Tax Payment Tax YearJazzy BadshahNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- It 000148938139 2024 01Document1 pageIt 000148938139 2024 01abdulraufattari69No ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Income Tax Payment Challan: PSID #: 42079719Document1 pageIncome Tax Payment Challan: PSID #: 42079719gandapur khanNo ratings yet

- It 000144761478 2024 10Document1 pageIt 000144761478 2024 10hizbullahjantankNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- TDS-ChallanFormatDocument1 pageTDS-ChallanFormatAnand_Gupta_6499No ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- It 000144628237 2024 10Document1 pageIt 000144628237 2024 10hizbullahjantankNo ratings yet

- Income Tax Payment Challan: PSID #: 146916470Document1 pageIncome Tax Payment Challan: PSID #: 146916470Madiah abcNo ratings yet

- Income Tax Payment Challan: PSID #: 148643587Document1 pageIncome Tax Payment Challan: PSID #: 148643587Ehtsham AliNo ratings yet

- Itr 62 Form 17Document2 pagesItr 62 Form 17ManikdnathNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanzeshanNo ratings yet

- IT-000132223866-2023-01Document1 pageIT-000132223866-2023-01mazharehsan08No ratings yet

- It 000134800902 2023 03Document1 pageIt 000134800902 2023 03AbbasNo ratings yet

- Form 26AS Annual Tax StatementDocument4 pagesForm 26AS Annual Tax StatementQuality CapitalNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment ChallanWaris Corp.No ratings yet

- CGPPV3292L 2022Document4 pagesCGPPV3292L 2022SANJAY KUMARNo ratings yet

- It 000144914729 2024 11Document1 pageIt 000144914729 2024 11MUHAMMAD TABRAIZNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Subhransu SarangiNo ratings yet

- Income Tax Payment Challan: PSID #: 173203210Document1 pageIncome Tax Payment Challan: PSID #: 173203210Muhammad QayyumNo ratings yet

- Income Tax Payment Challan: PSID #: 165120097Document1 pageIncome Tax Payment Challan: PSID #: 165120097FBR GujranwalaNo ratings yet

- TAX-STATEMENTDocument4 pagesTAX-STATEMENTSANJAY KUMARNo ratings yet

- Form 16 TDS CertificateDocument3 pagesForm 16 TDS CertificateBijay TiwariNo ratings yet

- Muhammad Mehtab Aslam FBR ChallanDocument1 pageMuhammad Mehtab Aslam FBR ChallanKingRafayIINo ratings yet

- It 000141614736 2022 00Document1 pageIt 000141614736 2022 00Shahbaz MuhammadNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ishita shahNo ratings yet

- It 000136606018 2022 00Document1 pageIt 000136606018 2022 00Amazon wall streetNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961manu singhNo ratings yet

- Aqbpj6946k 2022Document4 pagesAqbpj6946k 2022shree juvekarNo ratings yet

- BFPPG3437J 2022Document4 pagesBFPPG3437J 2022Vidhyesh GawasNo ratings yet

- It 000143553567 2022 00Document1 pageIt 000143553567 2022 00danishahmed2126No ratings yet

- Ay 2021-22Document4 pagesAy 2021-22Aman JaiswalNo ratings yet

- It 000144378527 2022 00Document1 pageIt 000144378527 2022 00حنفیت اور شیعت مقلدNo ratings yet

- A Guide to District Court Civil Forms in the State of HawaiiFrom EverandA Guide to District Court Civil Forms in the State of HawaiiNo ratings yet

- CDO Example CodetestDocument1 pageCDO Example Codetestshibbir002No ratings yet

- Statement of Assets, Liabilities and Expenses: (DD-MM-YYYY)Document3 pagesStatement of Assets, Liabilities and Expenses: (DD-MM-YYYY)shibbir002No ratings yet

- Statement of Assets, Liabilities and Expenses: (DD-MM-YYYY)Document3 pagesStatement of Assets, Liabilities and Expenses: (DD-MM-YYYY)shibbir002No ratings yet

- Statement of Assets, Liabilities and Expenses: (DD-MM-YYYY)Document3 pagesStatement of Assets, Liabilities and Expenses: (DD-MM-YYYY)shibbir002No ratings yet