Professional Documents

Culture Documents

Certificate of Collection of Tax: (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )

Uploaded by

osi rahmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Certificate of Collection of Tax: (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )

Uploaded by

osi rahmanCopyright:

Available Formats

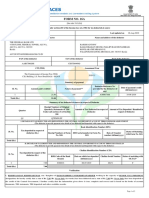

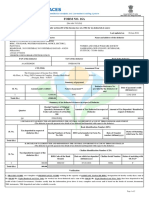

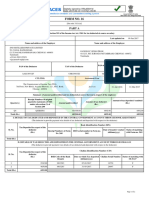

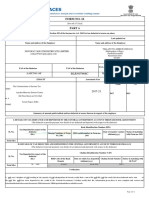

(Name and address of the person or the office of the person issuing the certificate)

(office letterhead may be used)

Certificate of Collection of Tax

[section 58 of the Income Tax Ordinance, 1984 (XXXVI of 1984)]

No. Date

01 Name of the person from whom tax has been collected

02 Address

03 Does the person have a Twelve-digit TIN? Yes No

04 Twelve-digit TIN (if answer of 03 is Yes)

05. Particulars of tax collection (add lines if necessary)

Sl Date of Description of collection of tax Section Amount of tax Remarks

Collection collected ৳

1

2

Total

06. Payment of collected tax to the credit of the Government (add lines if necessary)

Sl Challan* Challan date Bank Name Total amount Amount Remarks

Number in the challan ৳ relating to the

this certificate

৳

1

2

Total

In words:

*if payment is made in any other mode specified by the Board, provide information relevant to that mode.

Certified that the information given above is correct and complete.

Name of the person issuing the certificate Signature and seal

Designation

TCAN

Phone & E-mail Date

You might also like

- Accounting MannualDocument1 pageAccounting Mannualosi rahmanNo ratings yet

- Certificate of Deduction of Tax: ( (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )Document1 pageCertificate of Deduction of Tax: ( (Section 58 of The Income Tax Ordinance, 1984 (XXXVI of 1984) )shibbir002No ratings yet

- Chapter Xii.Document8 pagesChapter Xii.Far DinNo ratings yet

- D D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)Document3 pagesD D MM Y Y Yy: (Separate Forms Need To Be Filled For Each Tax Type)nikhil kumarNo ratings yet

- TDS 281Document3 pagesTDS 281Gaurav singh BishtNo ratings yet

- Form No 16Document2 pagesForm No 16scorpio.vinodNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Form 16 Excel FormatDocument4 pagesForm 16 Excel FormatAUTHENTIC SURSEZNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRajesh AntonyNo ratings yet

- Form 16 BDocument1 pageForm 16 BSurendra Kumar BaaniyaNo ratings yet

- Ayhpk8466h 2022Document4 pagesAyhpk8466h 2022AnilNo ratings yet

- Income Tax Payment Challan: PSID #: 47684385Document1 pageIncome Tax Payment Challan: PSID #: 47684385gandapur khanNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Certificate of Collection or Deduction of Income Tax (Including Salary) (Under Rule 42)Document1 pageCertificate of Collection or Deduction of Income Tax (Including Salary) (Under Rule 42)muhammad mustafa iqbalNo ratings yet

- Form 16 ADocument2 pagesForm 16 Asatyampandey7986659533No ratings yet

- (See Rule 31 (1) (B) )Document2 pages(See Rule 31 (1) (B) )B RNo ratings yet

- It 000136741219 2023 05Document1 pageIt 000136741219 2023 05wali khelNo ratings yet

- Dot Notice Za360120004512f 20200127041536Document5 pagesDot Notice Za360120004512f 20200127041536Gopikrishna KNo ratings yet

- TDS-ChallanFormatDocument1 pageTDS-ChallanFormatAnand_Gupta_6499No ratings yet

- It 000132223866 2023 01Document1 pageIt 000132223866 2023 01mazharehsan08No ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Income Tax Payment Challan: PSID #: 43327453Document1 pageIncome Tax Payment Challan: PSID #: 43327453gandapur khanNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Income Tax Payment Challan: PSID #: 42125287Document1 pageIncome Tax Payment Challan: PSID #: 42125287Muhammad Qaisar LatifNo ratings yet

- It 000130629196 2021 00Document1 pageIt 000130629196 2021 00muhammad faiqNo ratings yet

- BLFPN0819K 2021Document4 pagesBLFPN0819K 2021anjana19780316No ratings yet

- DirectTaxesPaymentPSID UpdateNatureDocument1 pageDirectTaxesPaymentPSID UpdateNatureSkjhkjhkjhNo ratings yet

- Itr 62 Form 16 ADocument1 pageItr 62 Form 16 Atonychacko67No ratings yet

- It 000134800902 2023 03Document1 pageIt 000134800902 2023 03AbbasNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Income Tax Payment Challan: PSID #: 43320237Document1 pageIncome Tax Payment Challan: PSID #: 43320237gandapur khanNo ratings yet

- It 000016485106 2011 00Document1 pageIt 000016485106 2011 00AMMAR REHMANINo ratings yet

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceJohnArbNo ratings yet

- Indian Income Tax Challan FOR Payment of Tds and TcsDocument4 pagesIndian Income Tax Challan FOR Payment of Tds and Tcsrahulbhardwaj1986100% (2)

- Bgupv5366d Q4 2019-20Document2 pagesBgupv5366d Q4 2019-20Parth VaishnavNo ratings yet

- TAN CertificateDocument1 pageTAN Certificatesabir hussainNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Tax Deduction at Source (TDS) GST ActDocument34 pagesTax Deduction at Source (TDS) GST Actdpo sheikhpuraNo ratings yet

- Printed From: (I T R 6 2 1 6 A, 1) (1)Document1 pagePrinted From: (I T R 6 2 1 6 A, 1) (1)ManikdnathNo ratings yet

- Tax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceDocument1 pageTax Information Authorization: Form (Rev. January 2021) Department of The Treasury Internal Revenue ServiceMatthew PickettNo ratings yet

- Adjustable Tax-PSIDDocument1 pageAdjustable Tax-PSIDWaris Corp.No ratings yet

- Tax Deduction at Source: DDO's RoleDocument12 pagesTax Deduction at Source: DDO's Rolenaiduu497No ratings yet

- 4 - Irs 8822Document1 page4 - Irs 8822Hï FrequencyNo ratings yet

- 1form 16 Novopay PDFDocument2 pages1form 16 Novopay PDFTirupathi Rao TellaputtaNo ratings yet

- Form No. 16A (See Rule31 (L) (B) )Document4 pagesForm No. 16A (See Rule31 (L) (B) )Nirmal MalooNo ratings yet

- Bukpk8886r 2022Document4 pagesBukpk8886r 2022SanthoshRajNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasWeng Tuiza EstebanNo ratings yet

- It 000144773140 2024 10Document1 pageIt 000144773140 2024 10hizbullahjantankNo ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- Aecpv2564e 2019Document4 pagesAecpv2564e 2019Quality CapitalNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Atypj5139q 2022Document4 pagesAtypj5139q 2022Alliance CorporationNo ratings yet

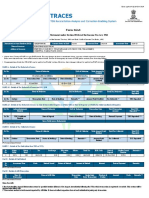

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Vikas VidhurNo ratings yet

- Property LedgerDocument2 pagesProperty LedgerHemant ChaudhariNo ratings yet

- Income Tax Payment Challan: PSID #: 30308134Document1 pageIncome Tax Payment Challan: PSID #: 30308134Azam mughalNo ratings yet

- MMFPS8373F 2022Document4 pagesMMFPS8373F 2022Bhavesh SharmaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet