Professional Documents

Culture Documents

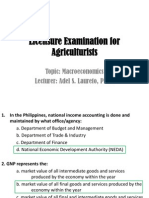

Please Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every Question

Uploaded by

RafaelWbOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Please Choose The Most Correct Answer. You Can Choose Only ONE Answer For Every Question

Uploaded by

RafaelWbCopyright:

Available Formats

Please choose the most correct answer. You can choose only ONE answer for every question.

1. Only when inflation increases unexpectedly

a. the real interest rate will be lower than the nominal inflation rate.

b. will the Ricardian equivalence hold.

c. will employing more workers become cheaper and unemployment decrease.

d. None of the above.

2. Assume an economy with population growth and with technological progress. Which ONE of

the following is NOT true when the economy is in its golden rule steady state:

a. The economy cannot increase consumption by changing the savings rate.

b. Newly accumulated capital in every period is higher than the capital lost to

depreciation.

c. Output per worker increases at the growth rate of the technological progress.

d. The capital-labor ratio is constant

3. How much a firm invests depends on the size of the optimal capital stock. The optimal capital

stock in turn

a. Depends positively on the interest rate

b. Depends positively on the depreciation rate

c. Depends negatively on the interest rate

d. Depends positively on the opportunity costs

4. What is TRUE concerning the wage bargaining process?

a. The bargaining power of unions increases with lower inflation

b. In many countries, wages are negotiated by unions which face a trade-off between

higher nominal wages and higher unemployment.

c. If workers and firms expect an increase in labor productivity, this will increase

nominal wages but not real wages.

d. When unemployment is low, unions have a strong negotiation power and push actual

prices up.

2 FEB11002X February 2012

5. During the Great Depression in the US in the beginning of the 20th century (1929 1933) a

large number of banks went bankrupt. Many economists believe that one of the reasons for the

crisis was the low money supply. What can NOT be considered a reason why money supply

was so low during these times?

a. People were afraid that banks were not able to pay back their deposits and preferred to

hold more cash than before. This decreased the money multiplier by increasing the

currency-deposit ratio and thus decreased M1.

b. The central bank was decreasing the monetary base by decreasing the minimum

reserve requirements, thus decreasing M1.

c. The high amount of withdrawals left the banks with smaller reserves, which obliged

the banks to reduce credits. This decreased M1.

d. Fearing a bank run, banks were becoming more cautious and started keeping higher

reserves for credits they granted. This decreased the money multiplier by increasing the

reserve ratio and thus decreased M1.

6. Consider the IS-LM model with international capital flows. Assume a small open economy

with flexible exchange rate and starting from the situation where all markets are in

equilibrium, what are the consequences of an expansionary fiscal policy?

a. An appreciation of the real exchange rate. The IS curve will shift temporarily upwards,

but public spending crowds out net exports, the economy will come back to the initial

equilibrium.

b. An upward shift of the IS curve and a new equilibrium with the same interest rate but a

higher GDP than before.

c. A depreciation of the real exchange rate and a temporary downward shift of the IS-

curve, before coming back to the initial equilibrium.

d. The LM curve will shift downwards, because of capital inflows. The IS curve will shift

upwards because of a lower interest rate. In the long run, there will be a rise in

domestic GDP but the same interest rate as in the initial equilibrium.

7. Which one of the following theoretical concepts tells me that an increase in government

spending by 10% increases the countrys total GDP by more than 10%?

a. The Money multiplier

b. The Keynesian multiplier

c. Okuns law

d. The yield curve

3 FEB11002X February 2012

8. Study the graphic above. Start from the assumption that the points in Panel A are all drawn

correctly. Point A is also correctly reported in Panel B. However, from the remaining points in

panel B only two have been reported correctly according to their counterparts in panel A.

Which are the two remaining points that are incorrectly reported in panel B?

a. Point H and G are incorrect

b. Point F and I are incorrect

c. Point I and G are incorrect

d. Point G and F are incorrect

9. Assume that the nominal interest rate is 5% and it is also expected to stay at this level. The

face value of a risk-free bond with a one year maturity is 500. According to the no-profit

rule, what should be the price of the one year maturity bond?

a. 423,54

b. 425

c. 450

d. 476,19

10. The Impossible Trinity refers to the impossibility for a country to have simultaneously

a. free capital flows, a fixed exchange rate and an independent monetary policy

b. a high interest rate, capital inflows and positive net exports

c. flexible exchange rates, low inflation and low unemployment

d. None of the above

4 FEB11002X February 2012

11. Which of the following transactions are recorded in the Financial Account of the Balance of

Payments

a. Reserve assets and direct investments

b. Trade in goods and services

c. Errors and omissions

d. All of the above

12. In the AS-AD framework, the short-run AS curve shift upwards when we see which one of the

following?

a. An increase in actual inflation

b. A negative supply shock

c. A decrease in money supply

d. A decrease in the natural unemployment rate

13. Consider an economy that exists for two periods. We define the following variables: T 1 is

todays net taxes; T2 is tomorrows net taxes; D1 is the governments total debt at the start of

today; D2 is the governments total debt at the start of tomorrow; G1 is todays government

spending; G2 is tomorrows government spending; rG is the real interest rate paid on

government debt. All variables are positive. Which ONE of the following is a correct

intertemporal budget constraint of the government?

a. D1 + G1 + G2/(1 + rG ) = T1 + T2/(1 + rG)

b. D1 + D2/(1 + rG) + G1 + G2/(1 + rG) = T1 + T2/(1 + rG)

c. D1 + D2/(1 + rG) (T1 + T2/(1 + rG)) = G1 + G2/(1 + rG)

d. D1 + G1 + T1 = (D2 + G2 + T2)/(1 + rG)

14. Which ONE of the following statements about consumption smoothing is NOT true?

a. Automatic stabilizers lead to consumption smoothing by the government.

b. The permanent income hypothesis refers to the fact that throughout my lifetime I earn

exactly the same amount in all periods and I dont need to borrow or save.

c. Consumption smoothing refers to the fact that when faced with a temporary change in

income, consumers save or borrow to spread the effects on consumption over time.

d. Consumption smoothing explains why the desired demand function in the Keynesian

Cross is flatter than the 45 degree line.

5 FEB11002X February 2012

15. The degree of openness of an economy can be measured by

a. The Keynesian multiplier

b. The inflation rate

c. The unemployment rate

d. The ratio of exports plus imports over GDP

16. The Big Mac costs 3 Euros in Rotterdam and 250 Yen in Tokyo. The current exchange rate is

1 Euro = 100 Yens. When you calculate the Big Mac index for these two countries what can

you conclude?

a. Calculating the Big Mac index tells me that prices in Tokyo are higher than in

Rotterdam. Therefore the purchasing power of 1 Euro is lower than the purchasing

power of 1 Yen.

b. Calculating the Big Mac index tells me that prices in Rotterdam are higher than in

Tokyo and therefore inflation is higher in Tokyo.

c. Calculating the Big Mac index tells me that with the same amount of Euros I can buy

more Big Macs in Tokyo than in Rotterdam and therefore the absolute purchasing

power parity doesnt hold here.

d. It doesnt tell me anything because the Big Mac index can only compare prices in US

dollars.

17. Which ONE of the following is NOT considered to have a positive impact on economic

growth?

a. Protection of human rights

b. Good health of the work force

c. The provision of public infrastructure

d. High fertility rate (average number of children per woman)

18. Which of the following is a function played by asset markets?

a. Bringing together borrowers and lenders

b. Determine the price of risk

c. Determine the price of time

d. All of the above

6 FEB11002X February 2012

19. Suppose that the demand for money is given by the Cambridge equation M=kPY, and assume

that the stock of money (M) grows less than the GDP (Y). k is considered to be constant. This

implies that:

a. The inflation rate is positive

b. The inflation rate is negative

c. The inflation rate is equal to zero

d. This information does not allow us to say anything about the inflation rate.

20. The nominal interest rate

a. equals the real interest rate in the Keynesian Cross

b. is the price of holding money

c. depends on the inflation rate

d. All of the above

21. Fill in: implementing a minimum wage above the equilibrium wage _______ the demand for

labor and ________ the supply of labor.

a. decreases, increases

b. increases, decreases

c. increases, increases

d. decreases, decreases

22. Which ONE of the following statements is NOT correct?

a. A successful long-term supply policy shifts the short and the long run AS curve to the

right. The natural level of output increases.

b. Many policies aiming at reducing inefficiencies are likely to introduce more distortions

and thus to create again inefficiency.

c. Public goods are always provided by the public sector

d. The theory of electoral business cycles predicts that in order to get reelected,

governments do their best so that the economy will be booming on election day.

7 FEB11002X February 2012

investments,

depreciation k

s y

0 k* K/L

23. The economy described above is at point k*. There is no technological progress and no

population growth. To which one of the following statements can you agree?

a. The economy is at its golden rule steady state. The capital-labor ratio stays constant,

output increases, consumption is constant and at its optimal level.

b. The economy suffers from dynamic inefficiency. It would be better off when it would

increase the capital-labor ratio so that output increases. Consumption will then also

increase.

c. The economy suffers from dynamic efficiency. It would be better off when it would

decrease the capital-labor ratio so that output decreases. Consumption will then

increase.

d. The economy is not in a steady state. However, since at the current capital-labor ratio,

investment is bigger than the capital lost through depreciation, the capital-labor ratio

will increase until in the steady state investment equals depreciation. This steady-state

will not necessarily maximize consumption.

24. Which one of the following statements on the Consumer Price Index (CPI) is true?

a. The CPI is likely to overestimate inflation because it uses a fixed basket of goods and

when goods get more expensive the consumers buy less of them.

b. The CPI is likely to overestimate inflation because it does not include imported goods.

c. The CPI is always higher than the GDP deflator which tends to underestimate

inflation.

d. The CPI is likely to overestimate inflation because contrary to the GDP deflator it

doesnt include an improvement in quality of goods.

8 FEB11002X February 2012

25. Which ONE of the following items that has been used or is still used as money has no intrinsic

value?

a. The Euro

b. Cigarettes

c. Gold

d. Commodity money

26. Patents increase the overall welfare of an economy and are thus desirable because of which

ONE of the following?

a. Patents grant the inventor the exclusive economic rights on the product he has

developed, attributing him monopoly rights forever.

b. Knowledge is non-excludable and without patents underinvestment in the production

of knowledge is likely.

c. With patents firms charge a price for their patent-protected product which is higher

than the marginal cost of production.

d. None of the above

27. Which ONE of the following options does NOT finish the sentence correctly?

When the Ricardian Equivalence holds

a. the public and private sector borrow and lend at the same interest rate.

b. we see that the timing of taxation doesnt matter for intertemporal consumption

choices, only the total amount of government expenditures matters.

c. households are able to borrow and lend as much as they need in order to reach their

preferred consumption in every period (given their intertemporal budget constraint).

d. the government is borrowing for the households and thus allows them to reach a

higher utility function than households could reach on their own.

28. If the money supply M1 is 8,8 billion , the currency in circulation equals 0,8 billion and

required reserves at the central bank are 5% of the deposits at the commercial banks. Then the

total reserves of the banking system at the central bank are equal to R. What is the value of R?

a. 16 billion

b. 400 million

c. 440 million

d. 800 million

9 FEB11002X February 2012

29. The primary current account (PCA) depends

a. negatively of the real exchange rate

b. positively of the real exchange rate

c. negatively on domestic taxes

d. negatively of the foreign GDP, Y*

30. Along a given TR-curve

a. the money supply is held constant

b. inflation is held constant

c. money demand is held constant

d. the interest rate is held constant

31. Consider two countries (Sweden and Tunisia) in which Syrian and Tunisian investors buy and

sell one-year maturity bonds (with the same risk). The Uncovered Interest Rate Parity

Condition predicts that

a. if today the interest rate in Sweden is higher than in Tunisia, the Swedish krona

appreciates today and stays at a higher level even though interest rates of both

countries will converge.

b. if the Swedish krona appreciates today, Swedens interest rate has to decrease today in

order for returns on Swedish and Tunisian bonds to be equal.

c. if today the interest rate in Sweden is higher than in Tunisia, the Swedish krona

appreciates today but will have depreciated in one year so that returns of bonds in both

countries are equal.

d. if a Tunisian investor buys a one-year maturity bond in Sweden today, he will not have

any exchange rate risk in one year because he has agreed with his bank on a forward

exchange rate, which fixes already today the exchange rate in one year. Therefore,

returns on bonds in both countries are equal.

32. Keynesians defend the usefulness of demand policies based on which argument?

a. Prices adjust quickly so that the short run AS curve has a steep slope.

b. The movement towards the long run AS curve is slow.

c. The backward looking component of underlying inflation plays a minor role so that

economic agents make large forecasting errors.

d. The forward looking component of underlying inflation plays a mayor role so that

economic agents make large forecasting errors.

10 FEB11002X February 2012

33. Consider an economy without technological progress. Output per worker is given by f(k) =

4k0,5, where k =K/L is the capital labor ratio. The savings rate is equal to s = 0.25. The growth

rate of the labor force is equal to n = 0.05 and the depreciation rate of capital =0.05. What is

the value of the capital-labor ratio k in the steady state?

a. 10

b. 25

c. 100

d. 250

34. Suppose that the underlying level of inflation in an economy decreases. This implies that

a. The short-run Phillips curve shifts down

b. The short-run Phillips curve shifts up

c. The long-run unemployment decreases and the long-run Phillips curve shifts to the

left.

d. The long-run unemployment increases and the long-run Phillips curve shifts to the

right

35. In the figure above you see the evolution of three economic variables. In the period t = 1 there

is an exogenous change in the variable labeled 1. Which event could be displayed here and

what should be the correct label of the three variables displayed in the graph? (note: The order

in which the variables are displayed in the graph (above/below) contains no information about

the absolute values of the variables)

a. Increase in Money supply: 1= Money supply 2= Real GDP 3= Price level

b. Increase in government spending: 1 = Government spending 2 = Money supply 3

=Real GDP

c. An adverse supply shock: 1= Real GDP 2 = Interest rate 3 = Price level

d. An increase in the inflation target: 1 = inflation rate 2 = interest rate 3 = Money supply

11 FEB11002X February 2012

36. Assume a closed economy. In this model the position of the long-run aggregate demand curve

is determined by:

a. The natural level of output

b. The long run inflation target of the central bank

c. The extent the central bank reacts to an inflation and output gap (as described by the

parameters a and b in the Taylor rule)

d. The interest rate on the world market, i*

37. Consider the following two statements:

I. In the presence of unexpectedly high positive inflation rates it is easier for the

government to maintain the debt/GDP ratio stable over time.

II. Macroeconomic stabilization policies are aimed at stabilizing the governments debt

over GDP ratio.

a. Statement I and II are correct.

b. Statement I and II are incorrect.

c. Statement I is correct and statement II is incorrect.

d. Statement I is incorrect and statement II is correct.

38. Which ONE of the following statements concerning central banks is true?

a. In the Euro area, the European central bank is the only institution that can create

money.

b. A central bank following the Taylor rule will never change the money supply but only

the interest rate.

c. The European central bank decreases the interest rate to increase money supply.

d. When the country has a flexible exchange rate regime, the central bank cannot conduct

an independent monetary policy.

39. Suppose that, starting from the equilibrium with full employment, a country is hit by an

adverse supply shock and the central bank responds with an expansionary monetary policy.

What are the consequences?

a. Stagflation, meaning high unemployment and high inflation, in the short run and a

permanent increase in inflation in the long run.

b. Stagflation, meaning high unemployment and high inflation, in the long run.

c. A contraction of output and a lower inflation rate as before the shock in the long run.

d. A temporary increase of the inflation rate and a temporary increase in output before

going back to the initial equilibrium.

12 FEB11002X February 2012

40. Consider the following two statements:

I. Governments only employ demand policies in case of market failures.

II. Many policy interventions might worsen economic fluctuations because their

implementation takes time.

a. Statement I and II are correct.

b. Statement I is correct and statement II is incorrect.

c. Statement I is incorrect and statement II is correct.

d. Both statements are incorrect.

13 FEB11002X February 2012

You might also like

- 0304 - Ec 2Document29 pages0304 - Ec 2haryhunterNo ratings yet

- ECON 1000 - Final - 2012WDocument8 pagesECON 1000 - Final - 2012WexamkillerNo ratings yet

- Economics Ansswers/solutionsDocument11 pagesEconomics Ansswers/solutionsPramod kNo ratings yet

- Spring2005 Econ1012 Midterm2 Ver1Document11 pagesSpring2005 Econ1012 Midterm2 Ver1Kshitij AgrawalNo ratings yet

- Eco 104 Practice Questions For FinalDocument9 pagesEco 104 Practice Questions For FinalFariha FarjanaNo ratings yet

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- AP Macroecnomics Practice Exam 1Document20 pagesAP Macroecnomics Practice Exam 1KayNo ratings yet

- Problem Session-1 02.03.2012Document12 pagesProblem Session-1 02.03.2012charlie simoNo ratings yet

- AP Macroeconomics TestDocument10 pagesAP Macroeconomics TestTomMusic100% (1)

- PracticDocument7 pagesPracticyourmaxaluslifeNo ratings yet

- TUT Macro Unit 1 (Sept 2016)Document4 pagesTUT Macro Unit 1 (Sept 2016)Shuba ShiniNo ratings yet

- De Thi Cuoi Ki KTVM CompressDocument8 pagesDe Thi Cuoi Ki KTVM CompressThùy PhươngNo ratings yet

- Last Assignment by Sajjad Malik v2Document56 pagesLast Assignment by Sajjad Malik v2muzamilmf5No ratings yet

- Final 2015Document15 pagesFinal 2015Ismail Zahid OzaslanNo ratings yet

- AP Macroeconomics Test Answers and Key ConceptsDocument12 pagesAP Macroeconomics Test Answers and Key ConceptsNathan WongNo ratings yet

- Intros 5Document25 pagesIntros 5drfendiameenNo ratings yet

- 301MC2W04Document2 pages301MC2W04Taimoor ArifNo ratings yet

- 101 Old FinalDocument13 pages101 Old Finalntc7035No ratings yet

- ECO 205 - Muptiple ChoiceDocument12 pagesECO 205 - Muptiple Choicet524qjc9bvNo ratings yet

- Final 2016Document15 pagesFinal 2016Ismail Zahid OzaslanNo ratings yet

- ADAS Model ExplainedDocument4 pagesADAS Model ExplainedTuyền Lý Thị LamNo ratings yet

- TBS Final Exam MACRO 2017Document6 pagesTBS Final Exam MACRO 2017OussemaNo ratings yet

- 4351ce3d6a51f5b863e327584702366bDocument4 pages4351ce3d6a51f5b863e327584702366bkarelimmanuelshangraihanNo ratings yet

- Homework 3Document5 pagesHomework 3CHUA JO ENNo ratings yet

- Bài tập ôn tậpDocument7 pagesBài tập ôn tậpLinh NguyễnNo ratings yet

- EC290 Mock Midterm FinalDocument8 pagesEC290 Mock Midterm FinalNikhil VenugopalNo ratings yet

- End Term MEP 16 With AnswersDocument9 pagesEnd Term MEP 16 With AnswersVimal AnbalaganNo ratings yet

- W10 EconomicsDocument8 pagesW10 Economicsjonathanchristiandri2258No ratings yet

- Eastern Mediterranean University Department of Economics 2016-2017 Spring Semester Econ 102 - Midterm Exam Exam Booklet: ADocument7 pagesEastern Mediterranean University Department of Economics 2016-2017 Spring Semester Econ 102 - Midterm Exam Exam Booklet: Ae110807No ratings yet

- macroII Ecofin Final Exam May2020 PartaDocument5 pagesmacroII Ecofin Final Exam May2020 PartaSebastian BurgosNo ratings yet

- CFA Problems: Monetary and Fiscal Policy, International Trade and Capital FlowsDocument9 pagesCFA Problems: Monetary and Fiscal Policy, International Trade and Capital FlowsAditya NugrohoNo ratings yet

- Exercise #1 - Intro To MacroeconomicsDocument2 pagesExercise #1 - Intro To MacroeconomicsRyan CornistaNo ratings yet

- FN 101 All Past PaperDocument107 pagesFN 101 All Past PaperJill MethodNo ratings yet

- 122 1003Document34 pages122 1003api-27548664No ratings yet

- Mac - Tut 5 Saving and InvenstmentDocument4 pagesMac - Tut 5 Saving and InvenstmentHiền NguyễnNo ratings yet

- ECO 210 - MacroeconomicsDocument5 pagesECO 210 - MacroeconomicsRahul raj SahNo ratings yet

- AP Macroeconomics Practice Exam 1Document12 pagesAP Macroeconomics Practice Exam 1Nguyễn Phương LiênNo ratings yet

- Practice Questions For Mid TermDocument5 pagesPractice Questions For Mid TermPulakrit BokalialNo ratings yet

- RB CAGMAT REVIEW Macroeconomics Reviewer - Yet Sample QuestionsDocument35 pagesRB CAGMAT REVIEW Macroeconomics Reviewer - Yet Sample QuestionsSylveth Novah Badal Denzo100% (1)

- MACROECONOMICS QUESTIONSDocument3 pagesMACROECONOMICS QUESTIONSdongxuan0120No ratings yet

- Macro Tut 4 - With AnsDocument11 pagesMacro Tut 4 - With AnsNguyen Tra MyNo ratings yet

- Basic Concept of M EcoDocument4 pagesBasic Concept of M EcofiroozdasmanNo ratings yet

- Pearson Exam Paper Micro UnitDocument10 pagesPearson Exam Paper Micro UnitHarry PattisonNo ratings yet

- Ae 19Document18 pagesAe 19mary rose silaganNo ratings yet

- Practice Quizzes Topic 10-C33Document6 pagesPractice Quizzes Topic 10-C33phươngNo ratings yet

- MR MOYO'S ECONOMICS REVISION NOTESDocument30 pagesMR MOYO'S ECONOMICS REVISION NOTESFaryalNo ratings yet

- Sample Paper MCQ Micro EconomicsDocument8 pagesSample Paper MCQ Micro EconomicsbineshwarNo ratings yet

- Chapter 4 and 5 - For StudentsDocument6 pagesChapter 4 and 5 - For Studentsdesada testNo ratings yet

- Take Home Test November 11Document8 pagesTake Home Test November 11Monzar RickettsNo ratings yet

- Economics exam questionsDocument14 pagesEconomics exam questionsbopgalebelayNo ratings yet

- KTVM 1Document12 pagesKTVM 1Minh Hân NguyễnNo ratings yet

- International Finance-Final ExamDocument5 pagesInternational Finance-Final ExamTrang ĐoànNo ratings yet

- Econ 212 Exam Multiple Choice and Long Answer QuestionsDocument10 pagesEcon 212 Exam Multiple Choice and Long Answer QuestionsChristian Josué RecinosNo ratings yet

- Pratice 10_Money and BankingDocument6 pagesPratice 10_Money and Bankinghgiang2308No ratings yet

- Economy q3Document5 pagesEconomy q3obnamiajuliusNo ratings yet

- Additional Practice Questions and AnswersDocument32 pagesAdditional Practice Questions and AnswersMonty Bansal100% (1)

- AP Macroeconomics - Unit 8 - 8.1 Final Exam QuestionsDocument19 pagesAP Macroeconomics - Unit 8 - 8.1 Final Exam QuestionsJame Chan33% (6)

- ECON 1000 Midterm W PracticeDocument7 pagesECON 1000 Midterm W Practiceexamkiller100% (1)

- RB Cagmat Review Macroeconomics O - ADocument35 pagesRB Cagmat Review Macroeconomics O - AShainabe RivaNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Fixed-Income Volatility ManageDocument6 pagesFixed-Income Volatility ManageRafaelWbNo ratings yet

- Session 5, Notes On Papers:: A Practitioner's Guide To Arbitrage Pricing TheoryDocument4 pagesSession 5, Notes On Papers:: A Practitioner's Guide To Arbitrage Pricing TheoryRafaelWbNo ratings yet

- Greatest Brazilian Guitar PlayersDocument1 pageGreatest Brazilian Guitar PlayersRafaelWbNo ratings yet

- Answer Key - Final Exam - 2017 PDFDocument1 pageAnswer Key - Final Exam - 2017 PDFRafaelWbNo ratings yet

- Music List 2Document2 pagesMusic List 2RafaelWbNo ratings yet

- Answer Key - Resit Exam - 2016 PDFDocument1 pageAnswer Key - Resit Exam - 2016 PDFRafaelWbNo ratings yet

- Multiple Choice QuestionsDocument18 pagesMultiple Choice QuestionsRafaelWbNo ratings yet

- Music List 2Document3 pagesMusic List 2RafaelWbNo ratings yet

- During Our Coffee ChatDocument1 pageDuring Our Coffee ChatRafaelWbNo ratings yet

- ReserfwrfDocument1 pageReserfwrfRafaelWbNo ratings yet

- Accounting First SessionDocument1 pageAccounting First SessionRafaelWbNo ratings yet

- Greatest Brazilian Guitar Players PDFDocument1 pageGreatest Brazilian Guitar Players PDFRafaelWbNo ratings yet

- Answer Key - Final Exam - 2017 PDFDocument1 pageAnswer Key - Final Exam - 2017 PDFRafaelWbNo ratings yet

- Topics DiscussionDocument2 pagesTopics DiscussionRafaelWbNo ratings yet

- Answer Key - Resit Exam - 2016Document1 pageAnswer Key - Resit Exam - 2016RafaelWbNo ratings yet

- Answer Key - Final Exam - 2017Document1 pageAnswer Key - Final Exam - 2017RafaelWbNo ratings yet

- Topics DiscussionDocument2 pagesTopics DiscussionRafaelWbNo ratings yet

- Answer Key - Resit Exam - 2016 PDFDocument1 pageAnswer Key - Resit Exam - 2016 PDFRafaelWbNo ratings yet

- Troc at RocaDocument1 pageTroc at RocaRafaelWbNo ratings yet

- Troc at RocaDocument1 pageTroc at RocaRafaelWbNo ratings yet

- Garoto - Jorge Do Fusa, Arranjo de Baden PowellDocument5 pagesGaroto - Jorge Do Fusa, Arranjo de Baden PowellDrPestanaMDNo ratings yet

- Troc at RocaDocument1 pageTroc at RocaRafaelWbNo ratings yet

- Music ListDocument1 pageMusic ListRafaelWbNo ratings yet

- ReserfwrfDocument1 pageReserfwrfRafaelWbNo ratings yet

- PDF Powell Choro para MetronomoDocument7 pagesPDF Powell Choro para MetronomoJuninho MartinsNo ratings yet

- Excel Tutorial9-HandoutDocument30 pagesExcel Tutorial9-HandoutRafaelWbNo ratings yet

- PDF Powell Retrato BrasileiroDocument6 pagesPDF Powell Retrato Brasileirofrpobletr3sNo ratings yet

- Greece Needs To Be Excluded From The Euro ZoneDocument1 pageGreece Needs To Be Excluded From The Euro ZoneRafaelWbNo ratings yet

- Greece Needs To Be Excluded From The Euro ZoneDocument1 pageGreece Needs To Be Excluded From The Euro ZoneRafaelWbNo ratings yet

- 280 Nenova HarfordDocument4 pages280 Nenova HarfordRamon ArthurNo ratings yet

- The Impact of Crude Oil Price Fluctuations On Indian EconomyDocument37 pagesThe Impact of Crude Oil Price Fluctuations On Indian EconomyIJRASETPublicationsNo ratings yet

- Macroeconomics: Chapter 1: Introduction & Macroeconomic ConceptsDocument93 pagesMacroeconomics: Chapter 1: Introduction & Macroeconomic ConceptsJosephThomasNo ratings yet

- MGI Myanmar Full Report June 2013-2Document152 pagesMGI Myanmar Full Report June 2013-2asldkfjalkNo ratings yet

- Chapter 2 - Comparative Economic DevelopmentDocument62 pagesChapter 2 - Comparative Economic DevelopmentKenzel lawasNo ratings yet

- KFC ProjectDocument56 pagesKFC Projectayushimanu9567% (3)

- Thesis On Exchange Rate DeterminationDocument5 pagesThesis On Exchange Rate DeterminationYolanda Ivey100% (2)

- Indicators of Social and Economic DevelopmentDocument5 pagesIndicators of Social and Economic DevelopmentDr. Muhammad Ali DinakhelNo ratings yet

- BOP Issue Analysis-Short VersionDocument30 pagesBOP Issue Analysis-Short VersionHari ShettyNo ratings yet

- An Excerpt From "Destined For War: Can America and China Escape Thucydides's Trap?"Document24 pagesAn Excerpt From "Destined For War: Can America and China Escape Thucydides's Trap?"OnPointRadioNo ratings yet

- International Finance CheatsheetDocument1 pageInternational Finance CheatsheetHoa Mai NguyễnNo ratings yet

- Answer KeyDocument46 pagesAnswer KeyNHI NGUYỄN KHẢNo ratings yet

- Chapter Two (Ayodola)Document28 pagesChapter Two (Ayodola)sitespirit96No ratings yet

- Ef4331 Case Study 1Document4 pagesEf4331 Case Study 1Johnny LamNo ratings yet

- MCQ Parity KeyDocument6 pagesMCQ Parity Key21070653No ratings yet

- The Worker Elite - Notes On The Labor AristocracyDocument48 pagesThe Worker Elite - Notes On The Labor AristocracyALexNo ratings yet

- © 2012 Pearson Prentice Hall. All Rights ReservedDocument22 pages© 2012 Pearson Prentice Hall. All Rights ReservedAHMAD ALINo ratings yet

- SCHEME OF VALUATION; INTERNATIONAL FINANCIAL MANAGEMENTDocument9 pagesSCHEME OF VALUATION; INTERNATIONAL FINANCIAL MANAGEMENTbhupesh tkNo ratings yet

- Econometrics 2 Aflevering 3Document15 pagesEconometrics 2 Aflevering 3Jonathan AndersenNo ratings yet

- Parking Pain: INRIX Studies Parking Woes in Major U.S. CitiesDocument44 pagesParking Pain: INRIX Studies Parking Woes in Major U.S. Citieswfaachannel8100% (1)

- Amit Bhaduri-Development With DignityDocument72 pagesAmit Bhaduri-Development With DignityHema LakshmiNo ratings yet

- MBF13e Chap07 Pbms - FinalDocument21 pagesMBF13e Chap07 Pbms - FinalMatthew Stojkov100% (6)

- REVIEW QUESTIONS ON PARITY RELATIONSHIPSDocument5 pagesREVIEW QUESTIONS ON PARITY RELATIONSHIPSMoud Khalfani100% (1)

- Methods of Forecasting Forex RatesDocument22 pagesMethods of Forecasting Forex RatesDulcet LyricsNo ratings yet

- TMIF Chapter FourDocument69 pagesTMIF Chapter FourYibeltal AssefaNo ratings yet

- Global Parking Index 2017: Sydney and New York Top Cities for Most Expensive Parking RatesDocument18 pagesGlobal Parking Index 2017: Sydney and New York Top Cities for Most Expensive Parking RatesAbu Fathi Mifth HudaNo ratings yet

- Exchange Rate 1: The Monetary Approach in The Long-RunDocument26 pagesExchange Rate 1: The Monetary Approach in The Long-RunTrần Hoàn Hạnh NgânNo ratings yet

- Chapter 4Document39 pagesChapter 4FaisalAltafNo ratings yet

- Engineering Economics Class12Document19 pagesEngineering Economics Class12Santhosh AkashNo ratings yet

- EYReport PDFDocument309 pagesEYReport PDFSushant MalhotraNo ratings yet