Professional Documents

Culture Documents

Amazon Computation

Uploaded by

pradhan130 ratings0% found this document useful (0 votes)

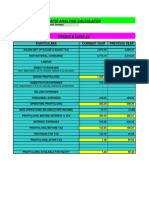

6 views1 pageThe document contains sections to provide details of an assessee such as name, date of birth, PAN, assessment year, and profession. It lists various types of incomes including salary, rent, business, interest, and other sources to calculate gross total income. It includes sections for deductions allowed under sections 80G, 80C, 80TTA, 80GG, 80D, 80E and others to determine taxable income. The final sections contain calculations to determine tax payable, rebate under section 87A, education cess, aggregate income tax, tax payment made through TDS, balance tax payable or refund, and signature of the assessee.

Original Description:

Original Title

985039_20170426025839_amazon_computation.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains sections to provide details of an assessee such as name, date of birth, PAN, assessment year, and profession. It lists various types of incomes including salary, rent, business, interest, and other sources to calculate gross total income. It includes sections for deductions allowed under sections 80G, 80C, 80TTA, 80GG, 80D, 80E and others to determine taxable income. The final sections contain calculations to determine tax payable, rebate under section 87A, education cess, aggregate income tax, tax payment made through TDS, balance tax payable or refund, and signature of the assessee.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageAmazon Computation

Uploaded by

pradhan13The document contains sections to provide details of an assessee such as name, date of birth, PAN, assessment year, and profession. It lists various types of incomes including salary, rent, business, interest, and other sources to calculate gross total income. It includes sections for deductions allowed under sections 80G, 80C, 80TTA, 80GG, 80D, 80E and others to determine taxable income. The final sections contain calculations to determine tax payable, rebate under section 87A, education cess, aggregate income tax, tax payment made through TDS, balance tax payable or refund, and signature of the assessee.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

COMPUTATION OF INCOME TAX

assessee details

NAME

DATE OF BIRTH

PAN

ASSESSMENT YEAR

PROFESSION

ADDRESS WITH PIN CODE

MOBILE

incomes

INCOME FROM SALARY

INCOME FROM RENT

INCOME FROM BUSINESS

INCOME FROM INTEREST

ANY OTHER INCOME

GROSS TOTAL INCOME (add all above)

deductions

80 G

80C

80 TTA

80GG

80D

80E

OTHER

tax calculations

INCOME AFTER DEDUCTIONS

TAX PAYABLE ON INCOME

REBATE U/S 87A

TAX PAYABLE AFTER REBATE

EDUCATION CESS

AGGREGATE INCOME TAX

TAX PAYMENT MADE

TDS

BALANCE TAX PAYABLE

TAX REFUND

SIGNATURE OF ASSESSEE

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- 335872Document7 pages335872pradhan13No ratings yet

- Tax ClearanceDocument1 pageTax ClearanceEbube ChindaNo ratings yet

- Corporate Membership Application FormDocument2 pagesCorporate Membership Application Formpradhan13100% (1)

- Masterfile - Database Nym - EditedDocument19 pagesMasterfile - Database Nym - EditedNymp BautistaNo ratings yet

- SRA Tax Return GuideDocument8 pagesSRA Tax Return Guidechopp7510No ratings yet

- Pay StubDocument1 pagePay StubIan MañagoNo ratings yet

- Tds16a Revised As Per Notification No. 92010 Dated 18022010Document1 pageTds16a Revised As Per Notification No. 92010 Dated 18022010Sameer GanekarNo ratings yet

- Description DescriptionDocument6 pagesDescription Descriptionヴァム ヴァンヴァムNo ratings yet

- Online Webinar Broucher Carrier in AccountingDocument12 pagesOnline Webinar Broucher Carrier in AccountingShradha Rohan BayasNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Pay Stub Tmplates 7 PDFDocument1 pagePay Stub Tmplates 7 PDFLekan iskilu AbdulkareemNo ratings yet

- Sample Accounting ExcelDocument23 pagesSample Accounting ExcelClarisse30No ratings yet

- 6 Month JST Programme VmeDocument8 pages6 Month JST Programme VmeHemanth Krishna RavipatiNo ratings yet

- Interest Computation Under The Look-Back Method For Property Depreciated Under The Income Forecast MethodDocument1 pageInterest Computation Under The Look-Back Method For Property Depreciated Under The Income Forecast MethodIRSNo ratings yet

- 25 - Ratio Analysis Calculator - VviDocument12 pages25 - Ratio Analysis Calculator - VvikmdarjiNo ratings yet

- Accounting For Vat: The BahamasDocument24 pagesAccounting For Vat: The Bahamasrazi12129094No ratings yet

- Income Tax CalculatorDocument4 pagesIncome Tax CalculatorAchin AgarwalNo ratings yet

- Tally ERP9 GST 2020Document4 pagesTally ERP9 GST 2020prr technologiesNo ratings yet

- PaySlip - Advanced FormatDocument2 pagesPaySlip - Advanced FormatYogendra RautNo ratings yet

- Oracle R12 Supplier FieldsDocument30 pagesOracle R12 Supplier FieldsLarry CaldwellNo ratings yet

- Amit VatsDocument5 pagesAmit VatsMohd DilshadNo ratings yet

- Ghana Revenue Authority: Company Self Assessment FormDocument2 pagesGhana Revenue Authority: Company Self Assessment Formokatakyie1990No ratings yet

- Manajemen Pajak Tax PlanningDocument36 pagesManajemen Pajak Tax PlanningBob AldiNo ratings yet

- IC Google Expense Report TemplateDocument10 pagesIC Google Expense Report TemplateNarendraNo ratings yet

- Individual Tax Return FormDocument2 pagesIndividual Tax Return FormGe EMNo ratings yet

- ViewPDF AspxDocument3 pagesViewPDF AspxAllan DerickNo ratings yet

- Disbursement Voucher Checking Account MOOEDocument7 pagesDisbursement Voucher Checking Account MOOEMark Patrics Comentan VerderaNo ratings yet

- Taxhouse BDDocument43 pagesTaxhouse BDkamal parvezNo ratings yet

- Mnnit Tsa 07.02.2024 Eat 31 Mannu TaxiDocument9 pagesMnnit Tsa 07.02.2024 Eat 31 Mannu TaxiSingh AmarNo ratings yet

- Pago ZoomDocument2 pagesPago Zoomgerencia2014No ratings yet

- ETS Ease Tax Solutions ProfileDocument10 pagesETS Ease Tax Solutions ProfileEase Tax Solutions ETSNo ratings yet

- Withholding Return SampleDocument15 pagesWithholding Return Sampleoyesigye DennisNo ratings yet

- InvoicepdfDocument3 pagesInvoicepdfEsteban ArgandoñaNo ratings yet

- PaymentInvoice Pratyuosh9085 417925Document1 pagePaymentInvoice Pratyuosh9085 417925Pratyuosh SrivastavNo ratings yet

- Air India (Contracted Company Infivation PVT LTD) : Tax InvoiceDocument1 pageAir India (Contracted Company Infivation PVT LTD) : Tax InvoiceHari RamNo ratings yet

- Paseo Hotels Due DiligenceDocument5 pagesPaseo Hotels Due DiligenceYazieeNo ratings yet

- Management PrinciplesDocument2 pagesManagement Principlesamon zuluNo ratings yet

- PaymentInvoice Pratyuosh9085 404664Document1 pagePaymentInvoice Pratyuosh9085 404664Pratyuosh SrivastavNo ratings yet

- Indian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianDocument4 pagesIndian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianVignesh KanagarajNo ratings yet

- Mnnit Tsa 06.02.2024 Eat 31 Prolyx IndiDocument10 pagesMnnit Tsa 06.02.2024 Eat 31 Prolyx IndiSingh AmarNo ratings yet

- Computation ITRDocument1 pageComputation ITRsuneetbansalNo ratings yet

- Payment Voucher SampleDocument1 pagePayment Voucher Samplebutterflykel100% (19)

- Paramount FlyerDocument1 pageParamount FlyerSami SattiNo ratings yet

- RR No. 02-2006 - Annex ADocument1 pageRR No. 02-2006 - Annex AMichelle Go100% (1)

- Invoice Zoom (Juni-Juli 2023)Document3 pagesInvoice Zoom (Juni-Juli 2023)YAUMIL HAERIAH TAHIRNo ratings yet

- E Tax 2Document1 pageE Tax 2TemesgenNo ratings yet

- Creditable Tax Withheld: Goods ManufacturedDocument3 pagesCreditable Tax Withheld: Goods ManufacturedJanua_Luca_as__4392No ratings yet

- The Ultimate SaaS Finance Cheat SheetDocument4 pagesThe Ultimate SaaS Finance Cheat SheetNickNo ratings yet

- Tax Invoice: Page 1 of 2Document2 pagesTax Invoice: Page 1 of 2Radhi HirziNo ratings yet

- Tax Invoice: Page 1 of 2Document2 pagesTax Invoice: Page 1 of 2Radhi HirziNo ratings yet

- ALK Balance SheetDocument26 pagesALK Balance SheetSofia Pradnya ParamithaNo ratings yet

- Intertech Fluid Power 2019Document38 pagesIntertech Fluid Power 2019Sue StevenNo ratings yet

- Coi Ay23-24Document1 pageCoi Ay23-24honey roshanNo ratings yet

- Basic Accounting - Part 1Document62 pagesBasic Accounting - Part 1Shayne Aldrae Cacalda100% (1)

- Excel Based Bulk CustomizationDocument10 pagesExcel Based Bulk CustomizationRama RaoNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaskiezer agrudaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ratio Analysis Template 2Document3 pagesRatio Analysis Template 2pradhan13No ratings yet

- SSAOpenCyberReceipt16 02 2022Document2 pagesSSAOpenCyberReceipt16 02 2022pradhan13No ratings yet

- Pavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557Document1 pagePavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557pradhan13No ratings yet

- Imc-Ihk Specialist Schedule 2017Document6 pagesImc-Ihk Specialist Schedule 2017pradhan13No ratings yet

- CPP Market SurveyDocument13 pagesCPP Market Surveypradhan13No ratings yet

- Ross Warner HR Solutions Kailash Vaib: Datum Recruitment ServicesDocument1 pageRoss Warner HR Solutions Kailash Vaib: Datum Recruitment Servicespradhan13No ratings yet

- Job Description: Send Me Jobs Like ThisDocument2 pagesJob Description: Send Me Jobs Like Thispradhan13No ratings yet

- House No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar SinghDocument3 pagesHouse No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar Singhpradhan13No ratings yet

- Copycooperative Financial Ratio Calculator 2011Document10 pagesCopycooperative Financial Ratio Calculator 2011pradhan13No ratings yet

- Uganda PDFDocument2 pagesUganda PDFpradhan13No ratings yet

- Period Financier Transaction Type Amount (Us$)Document2 pagesPeriod Financier Transaction Type Amount (Us$)pradhan13No ratings yet

- Cot 1411 Carioca SPRLDocument2 pagesCot 1411 Carioca SPRLpradhan130% (1)

- Tax Audit Plan and ProgrammeDocument39 pagesTax Audit Plan and Programmepradhan13No ratings yet

- Consultants ListsDocument30 pagesConsultants Listspradhan13No ratings yet

- Conversion Gate02Document5 pagesConversion Gate02pradhan13No ratings yet

- State Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJDocument2 pagesState Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJpradhan13No ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet