Professional Documents

Culture Documents

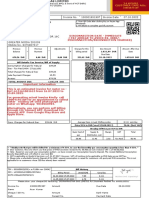

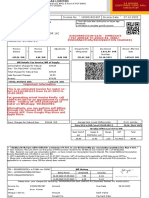

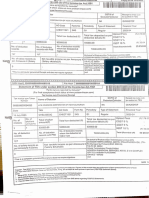

Air India (Contracted Company Infivation PVT LTD) : Tax Invoice

Uploaded by

Hari RamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Air India (Contracted Company Infivation PVT LTD) : Tax Invoice

Uploaded by

Hari RamCopyright:

Available Formats

Air India

Tax Invoice

(Original for Recipient) Finance Building, old

airport, KalinaSantacruz,

Mumbai

Reference number: Not yet generated

GSTIN: 27AACCN6194P1ZP

Date: 09-Sept-2020

Employee Name: Hariharan R

Refundable IGST CGST SGST/UGST

Description SAC Code Taxable charges Transferable Total

Salary Tax Amount Tax Amount Tax Amount payble

Amount(inc Taxes

% % %

tax)

E-commerce job related 996925 32,000.00 21,461.76 58,981.76 0.00 0.00 18.00 14,307.84 9.00 7,153.92 21,461.76

charges

Other Charges 0.00 720.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Grand 22,181.76 58,981.76 21,461.76

Total

1. Data Entry job related Charges: -Includes all Charges related to Air India Airline’s data entry job’s salary.

2. Amounts will be refund with salary as per E-Commerce rule.

3. CGST was not calculating before so tax was not approved.

4. After paying GST if you will not get salary then you can mail to income tax dept. Email:info.incometax.govt.in@gmail.com

Authorized Signature

Air India

(Contracted Company Infivation Pvt Ltd)

You might also like

- Dance Business PlanDocument13 pagesDance Business Planvai055125100% (1)

- Money Magnet ProtocolDocument2 pagesMoney Magnet ProtocolLuminita Telecan100% (1)

- JetBlue Marketing Plan FINALDocument27 pagesJetBlue Marketing Plan FINALGeorginaNo ratings yet

- Update of Management Accounting System in Coca 3Document8 pagesUpdate of Management Accounting System in Coca 3Lê Thị Thu Hiền0% (1)

- San Beda College Alabang Homework Exercise-Act851RDocument4 pagesSan Beda College Alabang Homework Exercise-Act851RJomel BaptistaNo ratings yet

- Accounting Voucher PDFDocument1 pageAccounting Voucher PDFNavin RaviNo ratings yet

- Are You GST Ready WWW - SimpletaxindiaDocument140 pagesAre You GST Ready WWW - SimpletaxindiaJeethender Kummari KuntaNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceBSCPLCHDNo ratings yet

- IDEL221100081235Document1 pageIDEL221100081235Aster RevNo ratings yet

- TaxInvoice AIN2223001692434Document2 pagesTaxInvoice AIN2223001692434Pradeep N KNo ratings yet

- Imports Under GSTDocument12 pagesImports Under GSThumanNo ratings yet

- Cetp ChargesDocument1 pageCetp ChargesBharat SharmaNo ratings yet

- PaymentInvoice Pratyuosh9085 404664Document1 pagePaymentInvoice Pratyuosh9085 404664Pratyuosh SrivastavNo ratings yet

- GSTCredit Note DL2202112 AD81754Document1 pageGSTCredit Note DL2202112 AD81754KARTICK PRASADNo ratings yet

- Tax in Voice BR 1171801 BD 16687Document1 pageTax in Voice BR 1171801 BD 16687deepak kumarNo ratings yet

- Atul Saini 22Document1 pageAtul Saini 22Fascino WhiteNo ratings yet

- Goods and Services Tax (//WWW - Gst.gov - In/) : Amended B2B - Edit InvoiceDocument3 pagesGoods and Services Tax (//WWW - Gst.gov - In/) : Amended B2B - Edit Invoicemangala ramNo ratings yet

- PaymentInvoice Pratyuosh9085 417925Document1 pagePaymentInvoice Pratyuosh9085 417925Pratyuosh SrivastavNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Tax Invoice OR1222308 AD40249Document1 pageTax Invoice OR1222308 AD40249bhabanisahu506No ratings yet

- Ack Bqgpa0377p 2022-23 794790900120722Document1 pageAck Bqgpa0377p 2022-23 794790900120722inspiremetonewworldNo ratings yet

- TaxInvoice AIN2223001617279Document2 pagesTaxInvoice AIN2223001617279Pradeep N KNo ratings yet

- Gandhi Chowk Jaypore, Odisha Gstin/Uin: 21AATFA8335N1ZB State Name: Odisha, Code: 21Document1 pageGandhi Chowk Jaypore, Odisha Gstin/Uin: 21AATFA8335N1ZB State Name: Odisha, Code: 21M D Prasad RaoNo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet

- TaxInvoice AIN2223003621241Document2 pagesTaxInvoice AIN2223003621241Pradeep N KNo ratings yet

- Vercomm 01478906Document2 pagesVercomm 01478906SHIVAM KUMARNo ratings yet

- TaxInvoice AIN2223003202667Document2 pagesTaxInvoice AIN2223003202667Pradeep N KNo ratings yet

- GST MDLDocument98 pagesGST MDLIndhuja MNo ratings yet

- ElectricityAndMaintenance Bill PDFDocument1 pageElectricityAndMaintenance Bill PDFRaja VasdevanNo ratings yet

- Swiggy PiDocument1 pageSwiggy Pikashinathvpillai0No ratings yet

- InvoiceDocument1 pageInvoiceSutharsan BoopathiNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- LAW Related-GST PresentationDocument137 pagesLAW Related-GST PresentationshreyasNo ratings yet

- Customer Receipt: Being Amount Paid For On Just DialDocument2 pagesCustomer Receipt: Being Amount Paid For On Just DialSurinder GhattauraNo ratings yet

- Feature of Simple GST Invoice Template 1.0 in Microsoft ExcelDocument8 pagesFeature of Simple GST Invoice Template 1.0 in Microsoft ExcelShivam SrivastavaNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- IGL BillDocument1 pageIGL BillArun KumarNo ratings yet

- 22-23 All PagesDocument5 pages22-23 All PagesBulbuli DasNo ratings yet

- Ccu To DelDocument1 pageCcu To DelP K PANDANo ratings yet

- Ack Abxpb2604f 2022-23 857058350180722 PDFDocument1 pageAck Abxpb2604f 2022-23 857058350180722 PDFVineet KhuranaNo ratings yet

- IGL BillDocument1 pageIGL BillArun KumarNo ratings yet

- Ads 2122 555603 PDFDocument3 pagesAds 2122 555603 PDFHarsh PatelNo ratings yet

- Tax Invoice MH1222302 CV83189Document1 pageTax Invoice MH1222302 CV83189ShruNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Retail Invoice: Alka .Document2 pagesRetail Invoice: Alka .hansNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- GSTR1 08 01 2018 PDFDocument5 pagesGSTR1 08 01 2018 PDFGourab DeyNo ratings yet

- Invoice 2Document1 pageInvoice 2Ajay MarwalNo ratings yet

- Tax Invoice TN1171803 BX70730Document1 pageTax Invoice TN1171803 BX70730citizensaravana2No ratings yet

- At 3Document2 pagesAt 3annnoyynnmussNo ratings yet

- Ramanjeet Itr 22-23Document1 pageRamanjeet Itr 22-23MK ASSOCIATESNo ratings yet

- TaxInvoice AIN2021000598956Document2 pagesTaxInvoice AIN2021000598956Aditya SinghNo ratings yet

- Gyujan 21 LTADocument1 pageGyujan 21 LTASidharth SNo ratings yet

- 40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Document1 page40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Srishti GaurNo ratings yet

- Tax in Voice or 1171803 BG 26955Document1 pageTax in Voice or 1171803 BG 26955Jyotirmay SahuNo ratings yet

- Tax in Voice or 1192008 Ad 84977Document1 pageTax in Voice or 1192008 Ad 84977Pratibha MittalNo ratings yet

- Declaration Return of Income 2015 5440019711101Document3 pagesDeclaration Return of Income 2015 5440019711101Ahlia Waqas AnjumNo ratings yet

- IJAI230300014803Document1 pageIJAI230300014803MOHIT SHARMANo ratings yet

- Bolero Bill JanuaryDocument1 pageBolero Bill JanuaryMAA KALI ENTERPRISESNo ratings yet

- PDF 169223670270722Document1 pagePDF 169223670270722adhya100% (1)

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoicesajithkariyam62No ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- Scfo Pi .01Document1 pageScfo Pi .01RiaZ MoHamMaDNo ratings yet

- Itr 22-23Document1 pageItr 22-23Ruloans VaishaliNo ratings yet

- International Accounting (IFRS) : (ACC5011) Syllabus Winter Term 2016/2017Document5 pagesInternational Accounting (IFRS) : (ACC5011) Syllabus Winter Term 2016/2017Hari RamNo ratings yet

- Business Strategy: © CMA. John D. Nevin Source: ICAI BSSCM Study MaterialDocument21 pagesBusiness Strategy: © CMA. John D. Nevin Source: ICAI BSSCM Study MaterialHari RamNo ratings yet

- Human Resource ManagementDocument29 pagesHuman Resource ManagementHari RamNo ratings yet

- Provisions of Presentation of "Proposed Dividend" in Balance Sheet: A Comparison of Companies Act 2013 and Accounting Standard RULES 2006Document8 pagesProvisions of Presentation of "Proposed Dividend" in Balance Sheet: A Comparison of Companies Act 2013 and Accounting Standard RULES 2006Hari RamNo ratings yet

- Equity For Long Term Investing: Twitter @balajispiceDocument29 pagesEquity For Long Term Investing: Twitter @balajispiceHari RamNo ratings yet

- Lesaca v. Lesaca, GR. No. L-3605, April 21, 1952Document1 pageLesaca v. Lesaca, GR. No. L-3605, April 21, 1952MonicaCelineCaroNo ratings yet

- Preparation of Financial Statements-Limited CompaniesDocument9 pagesPreparation of Financial Statements-Limited CompaniesHeavens MupedzisaNo ratings yet

- Crossen Sales Comps ($70 PSF+) - 05.23.2019Document30 pagesCrossen Sales Comps ($70 PSF+) - 05.23.2019Article LinksNo ratings yet

- Personal Monthly Budget PlannerDocument4 pagesPersonal Monthly Budget PlannerSpreadsheet123No ratings yet

- Reliance Industries Cost Sheet Ver. 1.0Document2 pagesReliance Industries Cost Sheet Ver. 1.0Pratik SinghNo ratings yet

- III Sem Me 2019-20 SessionDocument133 pagesIII Sem Me 2019-20 SessionRahul Gaur0% (1)

- ReturnDocument1 pageReturnFaisal Islam ButtNo ratings yet

- Raid Quiz Saidosd RecitDocument4 pagesRaid Quiz Saidosd RecitKristine Lirose BordeosNo ratings yet

- Lease Copy Flat 75 Brewe - 001Document22 pagesLease Copy Flat 75 Brewe - 001The Lone GunmanNo ratings yet

- Chapter 28 - AnswerDocument6 pagesChapter 28 - Answerwynellamae100% (1)

- Sec Memorandum Circular No. 11 Series of 2008Document3 pagesSec Memorandum Circular No. 11 Series of 2008Miguel Anas Jr.No ratings yet

- Chapter 6: Audit of Current LiabilityDocument14 pagesChapter 6: Audit of Current LiabilityYidersal DagnawNo ratings yet

- Business ValuationDocument6 pagesBusiness ValuationlenoraNo ratings yet

- Role of Mncs in Indian Export CompetivenessDocument10 pagesRole of Mncs in Indian Export CompetivenessSunil SamratNo ratings yet

- Accounting For Merchandising Activities: Solutions Manual For Chapter 6 435Document163 pagesAccounting For Merchandising Activities: Solutions Manual For Chapter 6 435debora yosikaNo ratings yet

- Retirement and Death of A PartnerDocument25 pagesRetirement and Death of A PartnerChandreshNo ratings yet

- Shoul - Karl Marx and Say's LawDocument20 pagesShoul - Karl Marx and Say's LawalvgromponeNo ratings yet

- Corporate Governance Case Studies: Volume SevenDocument482 pagesCorporate Governance Case Studies: Volume SevenvirusNo ratings yet

- Darden Casebook 2004 For Case Interview Practice - MasterTheCaseDocument95 pagesDarden Casebook 2004 For Case Interview Practice - MasterTheCaseMasterTheCase.comNo ratings yet

- UnknownDocument2 pagesUnknownSudip MondalNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- Provisions, Contingent Liabilities and Contingent AssetDocument37 pagesProvisions, Contingent Liabilities and Contingent AssetAbdulhafiz100% (1)

- Pressure CookerDocument12 pagesPressure CookerwentropremNo ratings yet

- Capital Structure, Cost of Capital and Value-Question BankDocument8 pagesCapital Structure, Cost of Capital and Value-Question Bankkaran30No ratings yet

- Business Plan FINALDocument13 pagesBusiness Plan FINALFrances BarenoNo ratings yet