Professional Documents

Culture Documents

Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961

Uploaded by

suneet bansalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961

Uploaded by

suneet bansalCopyright:

Available Formats

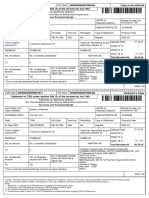

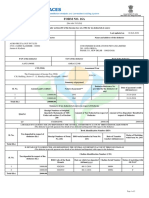

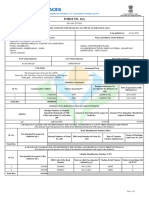

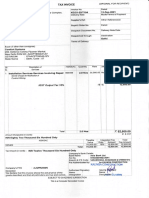

SAM Hash 00000000000000001813 File Hash 00000000000019212504 Copy to be retained

Statement of TCS under section 206C of the Income-tax Act, 1961

Particulars as reported by collector*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum Token Receipt no.(note i) (to

Number

Name of Collector GSTIN of Deductor/Collector

be quoted on TDS

621399600058285 DSV JEWELLERS PRIVATE LIMITED NA QVBDBCYF

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

14 October 2022 DELD23909E DELW 2741 27EQ Q2 Regular 2022-23

Upload Fees (`) 42.37

Total challan Total tax deposited as per

Total tax collected (`) CGST 9 %

amount(`) party details (`) -

SGST 9 % -

22117.00 21859.00 21859.00

IGST 18% (`) 7.63

No. of challans No. of challans unmatched DELHI (07) Total (Rounded off)

(`) 50.00

3 1 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of party records TIN-FC ID: 62139

No. of party

No. of party records where tax deducted at Religare Broking Limited

records with PAN

higher rate S P Services A-214, Shop N-1, Gali No-1

Master Chamber, Shakarpur

6 6 - New Delhi - 110092

DELHI

*This is a computer generated Receipt and does not require signature

SAM 1.00

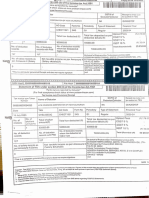

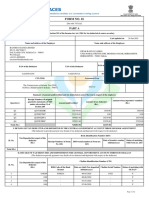

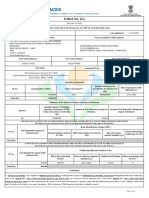

SAM Hash 00000000000000001813 File Hash 00000000000019212504 Collector's Copy

Statement of TCS under section 206C of the Income-tax Act, 1961

Particulars as reported by collector*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum Token Receipt no.(note i) (to

Number

Name of Collector GSTIN of Deductor/Collector

be quoted on TDS

621399600058285 DSV JEWELLERS PRIVATE LIMITED NA QVBDBCYF

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

14 October 2022 DELD23909E DELW 2741 27EQ Q2 Regular 2022-23

Total challan Total tax deposited as per Upload Fees (`) 42.37

Total tax collected (`)

amount(`) party details (`) CGST 9 % -

SGST 9 % -

22117.00 21859.00 21859.00

IGST 18 % (`) 7.63

No. of challans No. of challans unmatched DELHI (07) Total (Rounded off) (`) 50.00

3 1 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of party records TIN-FC ID: 62139

No. of party

No. of party records where tax deducted at Religare Broking Limited

records with PAN

higher rate S P Services A-214, Shop N-1, Gali No-1

Master Chamber, Shakarpur

6 6 - New Delhi - 110092

DELHI

*This is a computer generated Receipt and does not require signature

SAM 1.00

*Caution: The details above are as per the particulars reported by the collector. Figures in this receipt is/are no confirmation of their correction/verification of data

from Tax Information Network. Details of discrepancies, if any, are available at www.tin-nsdl.com (TDS/TCS Statement Status).

Notes:

i. Receipt No. is valid only if the TDS Statement is accepted at the TIN Central system.

ii. Verify status of the TDS Statement through the TDS/TCS Statement Status facility.

iii. File correction Statement to rectify error including deductee PAN.

iv. Provide latest mobile number in the TDS/TCS Statement to facilitate SMS alerts regarding TDS/TCS Statements.

You might also like

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961aapka.kapil3758No ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961krishnaNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- TCS Ack. Q4 FY 1718Document1 pageTCS Ack. Q4 FY 1718Ravi kantNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961GST JINo ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- CardStatement 2022-11-16Document7 pagesCardStatement 2022-11-16d24436701No ratings yet

- Aahfv8985a Q1 2023-24Document2 pagesAahfv8985a Q1 2023-24Century Flour Mills Limited Head OfficeNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q2 - Ay202223Document3 pagesSomya Amritanshu - Arcpa1206b - Q2 - Ay202223Sourabh PunshiNo ratings yet

- PaymentInvoice Pratyuosh9085 404664Document1 pagePaymentInvoice Pratyuosh9085 404664Pratyuosh SrivastavNo ratings yet

- Akdpn3820e Q3 2023-24Document3 pagesAkdpn3820e Q3 2023-24truth.astrology0751No ratings yet

- Ayfpv2618c Q1 2021-22Document2 pagesAyfpv2618c Q1 2021-22sandeep kumarNo ratings yet

- PaymentInvoice Pratyuosh9085 417925Document1 pagePaymentInvoice Pratyuosh9085 417925Pratyuosh SrivastavNo ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- CDMA - RamayanpetDocument1 pageCDMA - Ramayanpetrohit panchariyaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Atzpr8899q Q2 2023-24Document2 pagesAtzpr8899q Q2 2023-24Akansha Jain100% (1)

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Dy ManagerNo ratings yet

- Aagfp0227q Q1 2023-24Document2 pagesAagfp0227q Q1 2023-24Century Flour Mills Limited Head OfficeNo ratings yet

- Rashmi RanaDocument2 pagesRashmi RanaRashmi RanaNo ratings yet

- FSMPP1416G Q1 2023-24Document3 pagesFSMPP1416G Q1 2023-24Parvez AhmadNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- Tax Invoice: The Terminus, 2nd Floor, 32-MAR, BG-12, AA-1B, New Town, Rajarhat, Kolkata. GSTN: 19AACCT5982B1Z7Document2 pagesTax Invoice: The Terminus, 2nd Floor, 32-MAR, BG-12, AA-1B, New Town, Rajarhat, Kolkata. GSTN: 19AACCT5982B1Z7RAKHAL BAIRAGINo ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From Tovaibhav kharbandaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToEr Sumit SiwatchNo ratings yet

- Form No. 16: Part ADocument7 pagesForm No. 16: Part AMirza Aftab BaigNo ratings yet

- BFJPJ5437H 2019-20 SignedDocument5 pagesBFJPJ5437H 2019-20 SignedUjjwal JoshiNo ratings yet

- Sheri Chen Pay - StubDocument1 pageSheri Chen Pay - StubJoseph HeatonNo ratings yet

- Ack Cespc6304p 2022-23 811632260201122Document1 pageAck Cespc6304p 2022-23 811632260201122knowthebest787No ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- KIA QuotationDocument1 pageKIA Quotationshishir tiwariNo ratings yet

- InvoiceDocument1 pageInvoiceGaurav SachanNo ratings yet

- Somya Amritanshu - Arcpa1206b - Q3 - Ay202223Document2 pagesSomya Amritanshu - Arcpa1206b - Q3 - Ay202223Sourabh PunshiNo ratings yet

- Mushak: 6.3: Details of Registered PersonDocument1 pageMushak: 6.3: Details of Registered PersonAnonymous ZGcs7MwsLNo ratings yet

- Ack Bqgpa0377p 2022-23 794790900120722Document1 pageAck Bqgpa0377p 2022-23 794790900120722inspiremetonewworldNo ratings yet

- Internet Bill For July-21Document2 pagesInternet Bill For July-21Rishabh SinghNo ratings yet

- 40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Document1 page40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Srishti GaurNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- No:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDDocument1 pageNo:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDsreyanshauddyNo ratings yet

- Ack 638167400230723Document1 pageAck 638167400230723gamers SatisfactionNo ratings yet

- GST Credit Note WB 2212205 A A 65120Document1 pageGST Credit Note WB 2212205 A A 65120web webNo ratings yet

- Broadband Bill Dec 2020Document1 pageBroadband Bill Dec 2020Irfan AzmiNo ratings yet

- Assessment c1826Document2 pagesAssessment c1826sugi mugiNo ratings yet

- 1707 SunerDocument2 pages1707 SunerGSAFINNo ratings yet

- Aaihs0353j Q1 2023-24Document2 pagesAaihs0353j Q1 2023-24Century Flour Mills Limited Head OfficeNo ratings yet

- No:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0019540753 - Issue Date 11.03.2022: Alliance Broadband Services Pvt. LTDShrNo ratings yet

- Swiggy PiDocument1 pageSwiggy Pikashinathvpillai0No ratings yet

- Servcing of Control PanelDocument2 pagesServcing of Control PanelVikas MantriNo ratings yet

- Barun YadavDocument1 pageBarun Yadavprashant singhNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToDevasyrucNo ratings yet

- No:-0014518992 - Issue Date 23.11.2020: Alliance Broadband Services Pvt. LTDDocument1 pageNo:-0014518992 - Issue Date 23.11.2020: Alliance Broadband Services Pvt. LTDgoutammandNo ratings yet

- ComputationDocument2 pagesComputationSagar GargNo ratings yet

- Prayag Pande - Ajypp0194m - Q1 - Ay202223 - 16aDocument2 pagesPrayag Pande - Ajypp0194m - Q1 - Ay202223 - 16agitu sorgtNo ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- Life in Town and in Country in EnglandDocument6 pagesLife in Town and in Country in EnglandchubiborNo ratings yet

- Jackson V AEG Live July 17th 2013 Transcripts of Arthur Erk (Entertainment Industry Certified Public Accountant)Document125 pagesJackson V AEG Live July 17th 2013 Transcripts of Arthur Erk (Entertainment Industry Certified Public Accountant)TeamMichaelNo ratings yet

- Annexure-I: DOB............... Age... ... Date of Retirement...........................Document8 pagesAnnexure-I: DOB............... Age... ... Date of Retirement...........................Inked IntutionsNo ratings yet

- Criminal Law I CasesDocument6 pagesCriminal Law I CasesArchelaus Philo KarpusNo ratings yet

- Temecula City Council Resolution Condemning RacismDocument3 pagesTemecula City Council Resolution Condemning RacismThe Press-Enterprise / pressenterprise.comNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument7 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsHeli CrossNo ratings yet

- 2022-1046 N-LIMA BGC PROPERTIES (F)Document1 page2022-1046 N-LIMA BGC PROPERTIES (F)Mary Grace CanjaNo ratings yet

- UntitledDocument28 pagesUntitledUNNATINo ratings yet

- Petition For A Writ of Certiorari, Demarest v. Town of Underhill, No. - (U.S. May 8, 2023)Document40 pagesPetition For A Writ of Certiorari, Demarest v. Town of Underhill, No. - (U.S. May 8, 2023)RHTNo ratings yet

- Finna Weekly Report (New)Document4 pagesFinna Weekly Report (New)Theofanne CrsNo ratings yet

- Agreement Between Owner & ConctractorDocument4 pagesAgreement Between Owner & ConctractorValesh MonisNo ratings yet

- Staff Travel PolicyDocument22 pagesStaff Travel PolicyКумуду АрамбевалаNo ratings yet

- Possession FruitsDocument1 pagePossession FruitsJoedhel ApostolNo ratings yet

- Chapter 18 Reading OrganizerDocument3 pagesChapter 18 Reading OrganizerAnna SongNo ratings yet

- Bar Exam Suggested Answers - 2017 Labor Law Bar Q&A AUGUST 31, 2018 2017 Labor Law Bar Questions and AnswersDocument17 pagesBar Exam Suggested Answers - 2017 Labor Law Bar Q&A AUGUST 31, 2018 2017 Labor Law Bar Questions and AnswersImma FoosaNo ratings yet

- Deutsche Bank No Standing in BK CT TarantolaDocument16 pagesDeutsche Bank No Standing in BK CT Tarantolabsprop7776578No ratings yet

- ST Mary's Academy Vs CarpitanosDocument1 pageST Mary's Academy Vs CarpitanosJune Steve Barredo100% (1)

- Law 304.1: TAXATION 1: Course SyllabusDocument6 pagesLaw 304.1: TAXATION 1: Course SyllabusJoseph GabutinaNo ratings yet

- BSI-TR-03162 - EnglishDocument31 pagesBSI-TR-03162 - EnglishCesar Augusto Villanueva RodriguezNo ratings yet

- Expenses SheetDocument31 pagesExpenses SheetVinay SinghNo ratings yet

- SCL Delay and Disruption Protocol - Rider 1 - FINALDocument18 pagesSCL Delay and Disruption Protocol - Rider 1 - FINALTanveerAhmed NiaziNo ratings yet

- Local Taxation SummaryDocument21 pagesLocal Taxation SummaryAngie DouglasNo ratings yet

- Francisco Vs NLRCDocument2 pagesFrancisco Vs NLRCCamille GrandeNo ratings yet

- Nicki Minaj LetterDocument5 pagesNicki Minaj LetterTHR50% (2)

- FIP501 Foundational Financial Planning and Financial Management Course Addendum - September 2020Document8 pagesFIP501 Foundational Financial Planning and Financial Management Course Addendum - September 2020rimi2215_382182883No ratings yet

- Knowledge Through SixDocument10 pagesKnowledge Through Sixzaki77100% (1)

- Solicitation LetterDocument2 pagesSolicitation LetterCSLZIUR75% (4)

- Administrative Circular NO. 82-2006, September 19, 2006Document3 pagesAdministrative Circular NO. 82-2006, September 19, 2006JemaicaNo ratings yet

- Rajiv Gandhi National University of Law, PunjabDocument2 pagesRajiv Gandhi National University of Law, PunjabShubham PandeyNo ratings yet