Professional Documents

Culture Documents

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

Dy ManagerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961

Uploaded by

Dy ManagerCopyright:

Available Formats

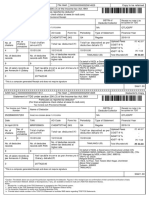

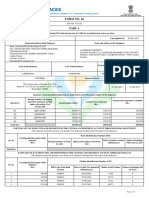

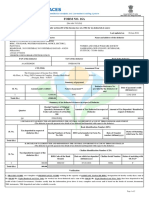

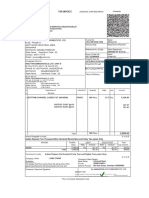

SAM Hash 00000000000000001813 File Hash 00000000000160887717 Copy to be retained

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

037379600018235 MAHARASHTRA STATE DISTRIBUTION COMPANY LIMITED KHAMGAON NA QTKXPEGC

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

29 January 2019 NGPM04542G NGPWT512 26Q Q3 Regular 2018-19

Total challan Total tax deposited as per Upload Fees (`) 178.00

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % (`) 16.02

389626.00 389626.00 389626.00 SGST 9 % (`) 16.02

IGST 18 % -

No. of challans No. of challans unmatched MAHARASHTRA (27)

Total (Rounded off) (`) 210.00

3 0 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 03737

No. of deductee No. of deductee

where tax deducted at Integrated Data Management Services Private Limited

records records with PAN

higher rate 116/117, Shree Swami Samarth Nandur Road, At Post Khamgaon

--

181 181 - Khamgaon - 444303

MAHARASHTRA

*This is a computer generated Receipt and does not require signature

SAM 1.00

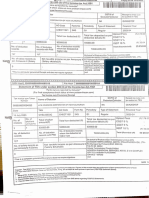

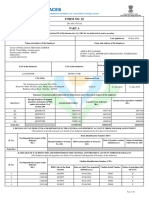

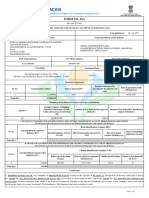

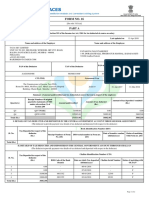

SAM Hash 00000000000000001813 File Hash 00000000000160887717 Deductor's Copy

Statement of TDS under section 200 (3) of the Income-tax Act,1961

Particulars as reported by deductor*

(For final acceptance check status at www.tin-nsdl.com)

Tax Invoice cum Provisional Receipt

Tax Invoice cum GSTIN of Receipt no.(note i) (to

Name of Deductor be quoted on TDS

Token Number Deductor/Collector

037379600018235 MAHARASHTRA STATE DISTRIBUTION COMPANY LIMITED KHAMGAON NA QTKXPEGC

Date TAN AO Code Form No Periodicity Type of Statement Financial Year

29 January 2019 NGPM04542G NGPWT512 26Q Q3 Regular 2018-19

(`) 178.00

Total challan Total tax deposited as per Upload Fees

Total tax deducted (`)

amount(`) deductee details (`) CGST 9 % (`) 16.02

SGST 9 % (`) 16.02

389626.00 389626.00 389626.00

IGST 18 % -

No. of challans No. of challans unmatched MAHARASHTRA (27)

(`) 210.00

Total (Rounded off)

3 0 On behalf of NSDL e-Governance Infrastructure Limited (CIN

U72900MH1995PLC095642), (GSTIN: 27AAACN2082N1Z8), (TIN-

FC Managed by NSDL e-Gov) (SAC: 998319)

No. of deductee records TIN-FC ID: 03737

No. of deductee No. of deductee

where tax deducted at Integrated Data Management Services Private Limited

records records with PAN

higher rate 116/117, Shree Swami Samarth Nandur Road, At Post Khamgaon

--

181 181 - Khamgaon - 444303

MAHARASHTRA

*This is a computer generated Receipt and does not require signature

SAM 1.00

*Caution: The details above are as per the particulars reported by the deductor. Figures in this receipt is/are no confirmation of their correction/verification of data

from Tax Information Network. Details of discrepancies, if any, are available at www.tin-nsdl.com (TDS/TCS Statement Status).

Notes:

i. Receipt No. is valid only if the TDS Statement is accepted at the TIN Central system.

ii. Verify status of the TDS Statement through the TDS/TCS Statement Status facility.

iii. File correction Statement to rectify error including deductee PAN.

iv. Provide latest mobile number in the TDS/TCS Statement to facilitate SMS alerts regarding TDS/TCS Statements.

You might also like

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- 252289600057294Document1 page252289600057294Pricila MercyNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961aapka.kapil3758No ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961GST JINo ratings yet

- TDS BalamuruganDocument1 pageTDS Balamuruganbharani.mudomsNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961suneet bansalNo ratings yet

- TCS Ack. Q4 FY 1718Document1 pageTCS Ack. Q4 FY 1718Ravi kantNo ratings yet

- Copy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TDS Under Section 200 (3) of The Income-Tax Act, 1961krishnaNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AGnana SekarNo ratings yet

- Copy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961Document1 pageCopy To Be Retained Statement of TCS Under Section 206C of The Income-Tax Act, 1961suneet bansalNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToEr Sumit SiwatchNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPridex Medical Technologies LLNo ratings yet

- Ahnpp9921f Q4 2023-24Document3 pagesAhnpp9921f Q4 2023-24ps245702No ratings yet

- BBGPV1509K Q2 2019-20 Vandana S PrasadDocument2 pagesBBGPV1509K Q2 2019-20 Vandana S PrasadKapil PandeyNo ratings yet

- AJPL0602Document1 pageAJPL0602shrungar.ornament1No ratings yet

- Mukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884Document1 pageMukon Constructions Pvt. LTD.: 1 Manpower Supply For The Month of Aug. 2019 9985 Lum Sum - 16,90,884lucky dudeNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToShankara NarayananNo ratings yet

- Testing Instruments Manufacturing Co. Pvt. LTD.: Tim CDocument4 pagesTesting Instruments Manufacturing Co. Pvt. LTD.: Tim Cabhjt629No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToPravin AwalkondeNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form 16Document7 pagesForm 16Finisher SquadNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRichardNoelFernandesNo ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Private YofDocument9 pagesPrivate YofSasi KumarNo ratings yet

- GST ChallanDocument1 pageGST ChallanVineet KhuranaNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Auvpb1446l 2018-19Document2 pagesAuvpb1446l 2018-19Sunil SharmaNo ratings yet

- Fy2018-19 Part A PDFDocument2 pagesFy2018-19 Part A PDFVoot VootNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- DD ProjectDocument2 pagesDD Projectjatin kuashikNo ratings yet

- Form 16Document2 pagesForm 16Kushal MalhotraNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Form 16 FY 2018-19 PDFDocument9 pagesForm 16 FY 2018-19 PDFSujata ChoudharyNo ratings yet

- Gopal Trading Co.Document1 pageGopal Trading Co.tabu 1No ratings yet

- Form No 16 FY 19-20Document10 pagesForm No 16 FY 19-20Snehal RanawareNo ratings yet

- Jac JW 23241548Document3 pagesJac JW 23241548Jugal mahatoNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAkriti JhaNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From Tomuinbaig11No ratings yet

- Form No. 16A: From ToDocument1 pageForm No. 16A: From ToShail MehtaNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Form 16 SV PDFDocument2 pagesForm 16 SV PDFPravin HireNo ratings yet

- GST ChallanDocument1 pageGST ChallanSanjayThakkarNo ratings yet

- Form16 PDFDocument2 pagesForm16 PDFyyyNo ratings yet

- Jac JW 23241546Document3 pagesJac JW 23241546Jugal mahatoNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRomendro ThokchomNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish GuptaNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- ST2023082901012350924 FFDocument2 pagesST2023082901012350924 FFtayyabNo ratings yet

- పెరుగుదల - వికాస నియమాలుDocument6 pagesపెరుగుదల - వికాస నియమాలుIliyas GNo ratings yet

- Jac JW 23241545Document3 pagesJac JW 23241545Jugal mahatoNo ratings yet

- It 000133172232 2023 01Document1 pageIt 000133172232 2023 01omer akhterNo ratings yet

- GST ChallanDocument2 pagesGST ChallanPRADIP KUMARNo ratings yet

- Global Sourcing OptionsDocument25 pagesGlobal Sourcing OptionsKazi ZamanNo ratings yet

- ELS 13 Agustus 2022 RevDocument16 pagesELS 13 Agustus 2022 RevYANNo ratings yet

- Weekly Home Learning Plan: Empowerment Technologies S.Y 2020-2021 1 SemesterDocument4 pagesWeekly Home Learning Plan: Empowerment Technologies S.Y 2020-2021 1 SemesterGlenzchie Taguibao90% (10)

- Syllabus Part Ii - Course Content HINT 730 Information Management in Healthcare Course DescriptionDocument14 pagesSyllabus Part Ii - Course Content HINT 730 Information Management in Healthcare Course DescriptionSarybell Del ValleNo ratings yet

- Pipe Stress Analysis Per ASME B 31.3Document10 pagesPipe Stress Analysis Per ASME B 31.3Agung Pramu Aji100% (1)

- Mother BoardDocument29 pagesMother BoardSwayamprakash PatelNo ratings yet

- Legends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, ESE - EndDocument6 pagesLegends: L-Lecture T - Tutorial/Teacher Guided Theory Practice P - Practical C - Credit, ESE - EndbhattparthivNo ratings yet

- Proteus Series: Metering PumpsDocument8 pagesProteus Series: Metering PumpsOmar TadeoNo ratings yet

- Complete 11 KV Assemblies Final 01-2016Document70 pagesComplete 11 KV Assemblies Final 01-2016zararNo ratings yet

- Manzana Insurance - Fruitvale BranchDocument10 pagesManzana Insurance - Fruitvale Branchankit_dadesiNo ratings yet

- CI200 Service Manual (ENG)Document64 pagesCI200 Service Manual (ENG)Alejandro Barnechea (EXACTA)No ratings yet

- Performance Analysis of Full-Adder Based On Domino Logic TechniqueDocument22 pagesPerformance Analysis of Full-Adder Based On Domino Logic TechniqueTechincal GaniNo ratings yet

- Resource Allocation Failure Service Degraded PDFDocument11 pagesResource Allocation Failure Service Degraded PDFyacine bouazniNo ratings yet

- Management PricipalDocument7 pagesManagement PricipalmdivyalakshmiNo ratings yet

- 6.6KW User ManualDocument8 pages6.6KW User ManualAminNo ratings yet

- Action Research in Your ClassroomDocument12 pagesAction Research in Your Classroommr_n_manNo ratings yet

- USU3910-based Multi-BBU Interconnection (SRAN10.1 - 04)Document92 pagesUSU3910-based Multi-BBU Interconnection (SRAN10.1 - 04)DitarezaNo ratings yet

- Red Hat JBoss Enterprise Application Platform-7.2-Performance Tuning Guide-En-USDocument50 pagesRed Hat JBoss Enterprise Application Platform-7.2-Performance Tuning Guide-En-USEdgar Orlando Bermudez AljuriNo ratings yet

- Qa Tester JDDocument3 pagesQa Tester JDIonutz AsafteiNo ratings yet

- L6-PDS-01-H-5215-S-40232-B - 220kV PRTN DRG D27+R1 Series Reactor R96CDocument82 pagesL6-PDS-01-H-5215-S-40232-B - 220kV PRTN DRG D27+R1 Series Reactor R96CSatish KumarNo ratings yet

- 9.13 Surge Protection For PROFIBUS FMS, PROFIBUS DP, and Profibus PaDocument4 pages9.13 Surge Protection For PROFIBUS FMS, PROFIBUS DP, and Profibus PaRodrigoBurgosNo ratings yet

- Notebook Power System Introduction TroubleshootingDocument44 pagesNotebook Power System Introduction TroubleshootingJosé Santos100% (5)

- The Origin of The Name "Zookeeper"Document4 pagesThe Origin of The Name "Zookeeper"akurathikotaiahNo ratings yet

- Users Guide To Taking A Nutanix Certification ExamDocument12 pagesUsers Guide To Taking A Nutanix Certification ExamAdi YusufNo ratings yet

- Edc PDFDocument7 pagesEdc PDFKarim SamhyNo ratings yet

- EBSR122 SecurityDocument34 pagesEBSR122 SecurityrkvenkiNo ratings yet

- Kanban Excercise-1Document2 pagesKanban Excercise-1Viraj vjNo ratings yet

- Pantone - CMYK - RGB ConversionDocument41 pagesPantone - CMYK - RGB ConversionmanhhungvpcNo ratings yet

- WinCC WebNavigator en-US en-USDocument160 pagesWinCC WebNavigator en-US en-USzuda.ahamdNo ratings yet

- CS 341 Software Design Project Assignment 3 Design Extension Due: Nov. 13, in ClassDocument3 pagesCS 341 Software Design Project Assignment 3 Design Extension Due: Nov. 13, in ClassMilkessaAddunyaaKanaaNo ratings yet