Professional Documents

Culture Documents

Problem Set No. 2 ES 321: Solving

Problem Set No. 2 ES 321: Solving

Uploaded by

Joselito Daroy0 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

number 9.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageProblem Set No. 2 ES 321: Solving

Problem Set No. 2 ES 321: Solving

Uploaded by

Joselito DaroyCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

PROBLEM SET NO.

2

ES 321

9. Alpha company is planning to invest in a machine the use of which will result in

the following:

Annual revenues of $10,000 in the first year and increases of $5,000 each

year, up to year 9. From year 10, the revenues will remain constant

(%52,000 for an indefinite period.

The machine is to be overhauled every 10 years. The expense for each

overhaul is $40,000.

If Alpha expects a present worth of at least $100,000 at a MARR of 10% for this

project, what is the maximum investment that Alpha should be prepared to

make?

CF diagram

Present worth total cash inflow: Pg PA P

5 ,000 ( 1 0.10 )9 1 1

Pg n 9

0.10 0.10 ( 1 0.10 )

Pg $97 ,107.35

1 ( 1 0.10 )9

PA 10 ,000

0.10

PA P 57 ,590.24

52 ,000

1 0.10

9

P Pg PA P P 375 ,228.35

0.10

P 220 ,530.76

Present worth total cash outflow: X InitialInvestment

40 ,000

X

1 01.0 10 1

X 25 ,098.16 X InitialInvestment 25 ,098.16 I

If Pg PA P X I $100 ,000 ; Solving I

I $375 ,228.35 $25 ,098.16 $100 ,000

I P 250 ,130.19

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- ECON - MODULE - 2. For PrintingDocument15 pagesECON - MODULE - 2. For PrintingMarcial Jr. Militante75% (4)

- Time Value of Money Solutions PDFDocument12 pagesTime Value of Money Solutions PDFIoana Dragne100% (1)

- Equity Analysis of A Project: Capital Budgeting WorksheetDocument8 pagesEquity Analysis of A Project: Capital Budgeting WorksheetanuradhaNo ratings yet

- CourseheroDocument2 pagesCourseheroSharjaaah50% (2)

- 015 June 10, 2023 Problem Solving PRCDocument20 pages015 June 10, 2023 Problem Solving PRCPrince EG DltgNo ratings yet

- Time Value of Money Practice Problems - SolutionsDocument12 pagesTime Value of Money Practice Problems - Solutionslex_jung100% (1)

- Gitman IM Ch09Document24 pagesGitman IM Ch09Imran FarmanNo ratings yet

- ASSIGNMENT 3 - Evaluating A Single ProjectDocument9 pagesASSIGNMENT 3 - Evaluating A Single ProjectKhánh Đoan Lê ĐìnhNo ratings yet

- Capital Budgeting Techniques: ProblemsDocument3 pagesCapital Budgeting Techniques: ProblemsripplerageNo ratings yet

- Chapter 13 SolutionsDocument5 pagesChapter 13 SolutionsStephen Ayala100% (1)

- HWPL Peace Education Lesson 6Document52 pagesHWPL Peace Education Lesson 6Joselito DaroyNo ratings yet

- Tugas GSLC Corp Finance Session 16Document6 pagesTugas GSLC Corp Finance Session 16Javier Noel ClaudioNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNo ratings yet

- TVM Review LectureDocument20 pagesTVM Review LectureKalle AhiNo ratings yet

- TVM Review LectureDocument19 pagesTVM Review LectureAnu KulNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- TVM Review LectureDocument19 pagesTVM Review Lectureruvina monteiroNo ratings yet

- Lecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingDocument38 pagesLecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingHồng KhánhNo ratings yet

- Addtl Exercises 10 12Document5 pagesAddtl Exercises 10 12John Lester C AlagNo ratings yet

- Chapter 2Document14 pagesChapter 2Kumar ShivamNo ratings yet

- 202E13Document24 pages202E13Sammy Ben MenahemNo ratings yet

- Villar, Valeriano Jr. D. - EconDocument13 pagesVillar, Valeriano Jr. D. - Econjung biNo ratings yet

- Week 7&8: AssignmentDocument11 pagesWeek 7&8: AssignmentkmarisseeNo ratings yet

- 5 - Capital Investment Appraisal (Part-2)Document10 pages5 - Capital Investment Appraisal (Part-2)Fahim HussainNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- P10-7 Net Present Value - Independent Projects Project ADocument2 pagesP10-7 Net Present Value - Independent Projects Project AIntan N TNo ratings yet

- M03 Broo6637 1e Im C03Document21 pagesM03 Broo6637 1e Im C03Inzhu SarinzhipNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Jelita Nurhaliza - MatBis - TugasPraktisi3Document19 pagesJelita Nurhaliza - MatBis - TugasPraktisi3JELITA NURHALIZANo ratings yet

- Chapter 18 Answer KeyDocument9 pagesChapter 18 Answer KeyNCT100% (1)

- Tutorial-1 2012 Mba 680 Solutions1Document5 pagesTutorial-1 2012 Mba 680 Solutions1Pratheek MedipallyNo ratings yet

- Capital Budgeting Template-Jumawid, Joyce S.Document8 pagesCapital Budgeting Template-Jumawid, Joyce S.Aian Kit Jasper SanchezNo ratings yet

- Ast Answer Shere Partnership FormationDocument13 pagesAst Answer Shere Partnership FormationNicole AgostoNo ratings yet

- Acc 223 CB PS3 AkDocument19 pagesAcc 223 CB PS3 AkAeyjay ManangaranNo ratings yet

- May 2014 Q3Document1 pageMay 2014 Q3Chahak BhallaNo ratings yet

- ValuationDocument3 pagesValuationPratik ChourasiaNo ratings yet

- Ch6è Ç Ä È È È É¡ Ç ®Document7 pagesCh6è Ç Ä È È È É¡ Ç ®fgknpqvfzcNo ratings yet

- Afm New Topic CompiledDocument59 pagesAfm New Topic Compiledganesh bhaiNo ratings yet

- Solutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument16 pagesSolutions To Chapter 9 Using Discounted Cash-Flow Analysis To Make Investment Decisionsmuhammad ihtishamNo ratings yet

- Dewa Satria Rachman LubisDocument13 pagesDewa Satria Rachman LubisDewaSatriaNo ratings yet

- Corporate Finance: Capital BudgetingDocument29 pagesCorporate Finance: Capital BudgetingPigeons LoftNo ratings yet

- Benito Juhantyo Wibbowo 1714422056 NPVDocument6 pagesBenito Juhantyo Wibbowo 1714422056 NPVBenito JuhantyoNo ratings yet

- Jordan Pippen Total: Multiple Choice Answers and SolutionsDocument25 pagesJordan Pippen Total: Multiple Choice Answers and SolutionsNelia Mae S. VillenaNo ratings yet

- ANSWER KEY ON PARTNERSHIP MOCK TESTxDocument6 pagesANSWER KEY ON PARTNERSHIP MOCK TESTxzhyrus macasilNo ratings yet

- Lahore School of Economics Financial Management II Review of FM I - 1Document3 pagesLahore School of Economics Financial Management II Review of FM I - 1Daniyal AliNo ratings yet

- 202E13Document28 pages202E13Ashish BhallaNo ratings yet

- (Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part B)Document2 pages(Solution Answers) Advanced Accounting by Dayag, Version 2017 - Chapter 2 (Partnership - Continuation) - Solution To Multiple Choice (Part B)John Carlos DoringoNo ratings yet

- Business Finance - CH 6 SolutionDocument6 pagesBusiness Finance - CH 6 SolutionRita100% (1)

- Financial Analysis of ProjectsDocument61 pagesFinancial Analysis of ProjectsMohamed MustefaNo ratings yet

- Chapter 2 Partnership Operationsdoc PDF FreeDocument25 pagesChapter 2 Partnership Operationsdoc PDF Freemaria evangelistaNo ratings yet

- Chapter 6 Invetsment ExercisesDocument14 pagesChapter 6 Invetsment ExercisesAntonio Jose DuarteNo ratings yet

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFDocument38 pagesFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (11)

- Tutorial Qs 1ADocument11 pagesTutorial Qs 1Ashajea aliNo ratings yet

- MMM041 MCQ Test Feedback To Students 202021Document3 pagesMMM041 MCQ Test Feedback To Students 202021ArisaNo ratings yet

- Ans 1 Future Value of Annuity ProblemDocument4 pagesAns 1 Future Value of Annuity ProblemParth Hemant PurandareNo ratings yet

- Lecture 3Document13 pagesLecture 3saher.khkefat12No ratings yet

- TQM-Module 1Document23 pagesTQM-Module 1Joselito DaroyNo ratings yet

- DC Generator Sample ProblemDocument20 pagesDC Generator Sample ProblemJoselito DaroyNo ratings yet

- Laplace Transform Sample ProblemsDocument5 pagesLaplace Transform Sample ProblemsJoselito DaroyNo ratings yet

- Application of Laplace TransformDocument25 pagesApplication of Laplace TransformJoselito DaroyNo ratings yet

- Ohm's LawDocument3 pagesOhm's LawJoselito DaroyNo ratings yet

- DC and Ac SourcesDocument3 pagesDC and Ac SourcesJoselito DaroyNo ratings yet

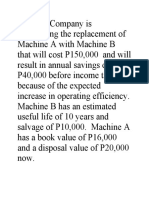

- Cost in Using The Present MethodDocument1 pageCost in Using The Present MethodJoselito DaroyNo ratings yet

- Hje ExampleDocument4 pagesHje ExampleJoselito DaroyNo ratings yet

- Charge, Current, Voltage and PowerDocument8 pagesCharge, Current, Voltage and PowerJoselito DaroyNo ratings yet

- ExamDocument6 pagesExamJoselito DaroyNo ratings yet

- Assgn 1Document9 pagesAssgn 1Joselito DaroyNo ratings yet

- ExamDocument6 pagesExamJoselito DaroyNo ratings yet

- Economy Prob Set 1Document12 pagesEconomy Prob Set 1Joselito DaroyNo ratings yet

- Assgn 1Document7 pagesAssgn 1Joselito DaroyNo ratings yet

- Economy Prob Set 2Document9 pagesEconomy Prob Set 2Joselito DaroyNo ratings yet

- Number 4Document2 pagesNumber 4Joselito DaroyNo ratings yet

- Examples For Cost Estimation TechniquesDocument8 pagesExamples For Cost Estimation TechniquesJoselito DaroyNo ratings yet

- Number 1Document1 pageNumber 1Joselito DaroyNo ratings yet

- Economic Analysis of Industrial Projects: Allied Technical CorporationDocument4 pagesEconomic Analysis of Industrial Projects: Allied Technical CorporationJoselito DaroyNo ratings yet

- B-C RatioDocument3 pagesB-C RatioJoselito DaroyNo ratings yet