Professional Documents

Culture Documents

Coursehero

Uploaded by

SharjaaahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Coursehero

Uploaded by

SharjaaahCopyright:

Available Formats

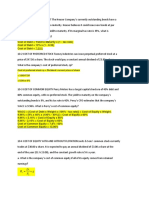

Fitch Industries is in the process of choosing the better of two equal-risk, mutually exclusive

capital expenditure projects- M and N. The relevant cash flows for each project are shown in the

following table. The firm’s cost of capital is 14%

Project M Project N

Initial Investment (CF0): $28,500 $27,000

Year (t) Cash Inflows (CF1)

1 $10,000 $11,000

2 $10,000 $10,000

3 $10,000 $9,000

4 $10,000 $8,000

a.) Calculate each project’s payback period.

Project M: $28,500 / $10,000 = 2.85 years

Project N: 2 + [($27,000 - $21,000) / $9,000] = 2.67 years

b.) Calculate the net present value (NPV) for each project.

Project M: $10,000 * PVIFA14%, 4 years - $28,500

= ($10,000 * 2.914) - $28,500 = $640

Project N:

PV = CFt *

Year CFt PVIF (14%) PVIF

1 $11,000 0.877 $9,647

2 10,000 0.769 $7,690

3 9,000 0.675 $6,075

4 8,000 0.592 $4,736

PV (Cash inflows) $28,148

Initial investment 27,000

NPV $1,148

c.) Calculate the internal rate of return (IRR) and (MIRR) for each project.

Discount Rate NPV NPV (N)

(%) (M)

0 $11,500 $11,000

5 6,960 6,903

10 3,199 3,490

15 50 618

16 -518 99

Project M:

IRR 15.086%

Project N:

IRR 16.1935%

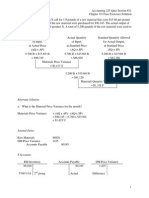

d.) Summarize the preferences dictated by each measure you calculated, and indicate which

project you would recommend. Explain why.

M N

Payback Period 2.85 yrs. 2.67 yrs.

NPV $637 $1,155

IRR 15.1% 16.2%

Project N would be recommended due to the following factors:

(1) higher NPV; (2) shorter payback period; (3) higher IRR. NPV has much “higher

power” than IRR, since it ranks Capital Budgeting ranks.

e.) Draw the net present value profiles for these projects on the same set of axes, and explain

the circumstances under which a conflict in rankings might exist.

You might also like

- GSLC Session 16 NPV AnalysisDocument6 pagesGSLC Session 16 NPV AnalysisJavier Noel ClaudioNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Financial Management Chapter 11 AnswerDocument14 pagesFinancial Management Chapter 11 Answerandrik_2091% (11)

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Fin 2Document34 pagesFin 2Janica BerbaNo ratings yet

- Financial Management - AssignmentDocument1 pageFinancial Management - AssignmentGeralf Jade Mojana100% (1)

- A Case Study of D'Leon IncDocument13 pagesA Case Study of D'Leon IncTimNo ratings yet

- Comparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuityDocument3 pagesComparing Projects with Unequal Lives Using Replacement Chain Method and Equivalent Annual AnnuitydzazeenNo ratings yet

- Determining relevant cash flows for hoist replacementDocument19 pagesDetermining relevant cash flows for hoist replacementJhoni Lim67% (3)

- Kelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4Document9 pagesKelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4RoyNo ratings yet

- Strategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Document6 pagesStrategic Finance Assignment No 1-Q2-5, B Q2-34 (T.V.O.M) (Solution)Zahid UsmanNo ratings yet

- Case Study in Stock ValuationDocument15 pagesCase Study in Stock ValuationDaneen Gastar100% (2)

- Revision Questions - Q&ADocument3 pagesRevision Questions - Q&Arosario correiaNo ratings yet

- FIN 301 B Porter Rachna CH 11-1 Soln.Document1 pageFIN 301 B Porter Rachna CH 11-1 Soln.Nam TranNo ratings yet

- Risk and Refinements in Capital Budgeting: Multiple Choice QuestionsDocument8 pagesRisk and Refinements in Capital Budgeting: Multiple Choice QuestionsRodNo ratings yet

- Capital Budgeting ExampleDocument12 pagesCapital Budgeting Exampleljohnson10950% (4)

- Cheating SheetDocument13 pagesCheating SheetAlfian Ardhiyana PutraNo ratings yet

- Exercise Stock ValuationDocument2 pagesExercise Stock ValuationUmair ShekhaniNo ratings yet

- Cultivating A Synergic Relationship With ShareholdersDocument6 pagesCultivating A Synergic Relationship With ShareholdersJeric Lagyaban AstrologioNo ratings yet

- Balance Sheet Completion Using Ratios Complete The 2012 Balance Sheet For ODocument1 pageBalance Sheet Completion Using Ratios Complete The 2012 Balance Sheet For OBKS SannyasiNo ratings yet

- The Time Value of Money - Business FinanceDocument24 pagesThe Time Value of Money - Business FinanceMd. Ruhul- Amin33% (3)

- Assignment Chapter 9Document4 pagesAssignment Chapter 9Anis Trisna PutriNo ratings yet

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- Chapter 23 HomeworkDocument10 pagesChapter 23 HomeworkTracy LeeNo ratings yet

- Chapter 18Document16 pagesChapter 18Faisal AminNo ratings yet

- TEST 5 PreparationDocument8 pagesTEST 5 PreparationAna GloriaNo ratings yet

- Answers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905Document7 pagesAnswers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905HasanAbdullahNo ratings yet

- CH5 Tutorial ManagementDocument18 pagesCH5 Tutorial ManagementSam Sa100% (1)

- Solutions To Problems: LG 1 BasicDocument13 pagesSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- Chapter 14-Payout Policy: Multiple ChoiceDocument20 pagesChapter 14-Payout Policy: Multiple ChoiceadssdasdsadNo ratings yet

- Look Before You Leverage!Document2 pagesLook Before You Leverage!cws0829444367% (3)

- Chapter 14 Working Capital Current Asset Management 5 1Document77 pagesChapter 14 Working Capital Current Asset Management 5 1Ela Pelari100% (2)

- Plan Your Cash Flow and Finances with These ToolsDocument4 pagesPlan Your Cash Flow and Finances with These Toolscialee100% (2)

- IygfigDocument52 pagesIygfigDelfiaNo ratings yet

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalDocument2 pagesCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)

- ch12 - Problems and SolutionsDocument44 pagesch12 - Problems and SolutionsErica Borres0% (1)

- Long QuestionsDocument18 pagesLong Questionssaqlainra50% (2)

- Chapter 10Document36 pagesChapter 10chiny0% (1)

- Finance Assignmnt 2Document6 pagesFinance Assignmnt 2Flourish edible Crockery100% (1)

- Solutions To Quiz 1Document4 pagesSolutions To Quiz 1Chakri MunagalaNo ratings yet

- Go-Kart Tire Production ExamDocument4 pagesGo-Kart Tire Production ExamCheick Omar CompaoreNo ratings yet

- ExerciseDocument3 pagesExerciseHoang AnNo ratings yet

- Intro To Management SC (Exercise Answer)Document8 pagesIntro To Management SC (Exercise Answer)LokaNo ratings yet

- QS11 - Class Exercises SolutionDocument8 pagesQS11 - Class Exercises Solutionlyk0tex100% (2)

- CH 13#6Document13 pagesCH 13#6jjmaducdoc100% (1)

- Tugas Manajemen Keuangan II (P13-9, P13-12, P13-17)Document7 pagesTugas Manajemen Keuangan II (P13-9, P13-12, P13-17)L RakkimanNo ratings yet

- FIN - Chapter 6 - Cost of Capital - PDFDocument14 pagesFIN - Chapter 6 - Cost of Capital - PDFUtpal BaruaNo ratings yet

- Direct Cost Variances Chapter 10Document15 pagesDirect Cost Variances Chapter 10Ahsan IqbalNo ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- Problems (p.112) : Derek Abbott WK 2 HomeworkDocument4 pagesProblems (p.112) : Derek Abbott WK 2 HomeworkDerek Abbott100% (4)

- Chapter 6 and 7 NR and BPDocument2 pagesChapter 6 and 7 NR and BPCa Ada100% (1)

- Bonus Assignment 2Document4 pagesBonus Assignment 2Zain Zulfiqar67% (3)

- 14Document9 pages14Rudine Pak MulNo ratings yet

- Finman ReviewerDocument17 pagesFinman ReviewerSheila Mae Guerta LaceronaNo ratings yet

- ANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaDocument2 pagesANSWER: 4.375% or 4.38%: Stock Expected Return Standard Deviation BetaMicon100% (2)

- Chapter-6 GITMAN SOLMANDocument24 pagesChapter-6 GITMAN SOLMANJudy Ann Margate Victoria67% (6)

- EetgbfvDocument38 pagesEetgbfvchialunNo ratings yet

- Tugas GSLC Corp Finance Session 16Document6 pagesTugas GSLC Corp Finance Session 16Javier Noel ClaudioNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNo ratings yet

- Assignment: University of Central PunjabDocument5 pagesAssignment: University of Central PunjabAbdullah ghauriNo ratings yet

- Mayors Permit FinalDocument1 pageMayors Permit FinalSharjaaahNo ratings yet

- Government Accounting: 16 Each Ky Jer Pau Cza Mabuu Paste Na KyDocument22 pagesGovernment Accounting: 16 Each Ky Jer Pau Cza Mabuu Paste Na KySharjaaahNo ratings yet

- Cebu Pacific Layoffs Affect 30% of Employees Due to COVID-19 LossesDocument1 pageCebu Pacific Layoffs Affect 30% of Employees Due to COVID-19 LossesSharjaaahNo ratings yet

- SEC FinalDocument1 pageSEC FinalSharjaaahNo ratings yet

- 31-Mar 01-Apr 02-Apr 03-Apr 04-Apr 05-Apr 06-Apr Excess: ADMIN 8,580.00 PAYROLL 202,606.85Document1 page31-Mar 01-Apr 02-Apr 03-Apr 04-Apr 05-Apr 06-Apr Excess: ADMIN 8,580.00 PAYROLL 202,606.85SharjaaahNo ratings yet

- Porter's Five Forces Analysis of Cucurbita Sherbet Ice CreamDocument2 pagesPorter's Five Forces Analysis of Cucurbita Sherbet Ice CreamSharjaaahNo ratings yet

- Ia2 QuestionsDocument6 pagesIa2 QuestionsSharjaaahNo ratings yet

- Management-Aspect Edited Ni KamilDocument3 pagesManagement-Aspect Edited Ni KamilSharjaaahNo ratings yet

- Equipment Item Price Quantity Supplier: 1, 405.00 1 KyowaDocument8 pagesEquipment Item Price Quantity Supplier: 1, 405.00 1 KyowaSharjaaahNo ratings yet

- MTE - BTT - 2020: Email Address SectionDocument17 pagesMTE - BTT - 2020: Email Address SectionSharjaaahNo ratings yet

- Financial Assets and InventoriesDocument17 pagesFinancial Assets and InventoriesCrazy Solo67% (3)

- 31-Mar 01-Apr 02-Apr 03-Apr 04-Apr 05-Apr 06-Apr Excess: Manual EntryDocument6 pages31-Mar 01-Apr 02-Apr 03-Apr 04-Apr 05-Apr 06-Apr Excess: Manual EntrySharjaaahNo ratings yet

- Blank Quiz: Mid-Term ExamDocument8 pagesBlank Quiz: Mid-Term ExamSharjaaahNo ratings yet

- SEATWORK NO. 5 (CONVERSION CYCLEDocument3 pagesSEATWORK NO. 5 (CONVERSION CYCLESharjaaahNo ratings yet

- ANSWERS Seatwork No. 5Document3 pagesANSWERS Seatwork No. 5SharjaaahNo ratings yet

- Questions in Business LawDocument3 pagesQuestions in Business LawSharjaaahNo ratings yet

- Assignment No. 4 Conversion CycleDocument3 pagesAssignment No. 4 Conversion CycleSharjaaahNo ratings yet

- Critic & MemoDocument3 pagesCritic & MemoSharjaaahNo ratings yet

- Mid-Term Exam (Set A) : RequiredDocument14 pagesMid-Term Exam (Set A) : RequiredSharjaaahNo ratings yet

- MID-TERM EXAM RESULTSDocument11 pagesMID-TERM EXAM RESULTSSharjaaahNo ratings yet

- MTE - BTT - 2020: Email Address SectionDocument17 pagesMTE - BTT - 2020: Email Address SectionSharjaaahNo ratings yet

- Session 7 - AUDITING AND ASSURANCE PRINCIPLESDocument31 pagesSession 7 - AUDITING AND ASSURANCE PRINCIPLESSharjaaahNo ratings yet

- IA3 - MTE - 2020: RequiredDocument15 pagesIA3 - MTE - 2020: RequiredSharjaaahNo ratings yet

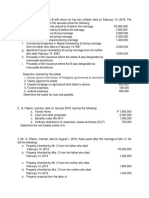

- Filipino Estate Tax Calculation for Married IndividualDocument3 pagesFilipino Estate Tax Calculation for Married IndividualSharjaaah100% (2)

- Bus - Prop. & App - LetterDocument4 pagesBus - Prop. & App - LetterSharjaaahNo ratings yet

- Camille Anne Kwok Balondo: Objective Personal InformationDocument3 pagesCamille Anne Kwok Balondo: Objective Personal InformationSharjaaahNo ratings yet

- Estate-Tax ProblemsDocument3 pagesEstate-Tax ProblemsSharjaaahNo ratings yet

- Chapter 1 AnswerDocument4 pagesChapter 1 AnswerJanine NazNo ratings yet

- CPAR TAX7411 Estate Tax With Answer 1 PDFDocument6 pagesCPAR TAX7411 Estate Tax With Answer 1 PDFstillwinmsNo ratings yet

- Problem A 980.00 0.12 0.09Document1 pageProblem A 980.00 0.12 0.09SharjaaahNo ratings yet

- IFM Chapter 11 AnswersDocument6 pagesIFM Chapter 11 AnswersPatty CherotschiltschNo ratings yet

- CCI - Guidelines For ValuationDocument13 pagesCCI - Guidelines For Valuationsujit0577No ratings yet

- Efficient Market HypothesisDocument10 pagesEfficient Market Hypothesisabag0910No ratings yet

- SEM-IV-Fin-403-416 (Till 413)Document8 pagesSEM-IV-Fin-403-416 (Till 413)salafNo ratings yet

- Soal Latihan PersekutuanDocument6 pagesSoal Latihan PersekutuanRio DjaraNo ratings yet

- Developing Klusters in Butchery IndustryDocument13 pagesDeveloping Klusters in Butchery IndustryChimegErdenebatNo ratings yet

- FII Inflows Impacted by Inflation, Exchange RatesDocument10 pagesFII Inflows Impacted by Inflation, Exchange RateshajashaikNo ratings yet

- Ven ZestDocument59 pagesVen ZestSuraj JagtianiNo ratings yet

- Analisis Laporan KeuanganDocument4 pagesAnalisis Laporan KeuanganStone BreakerNo ratings yet

- Week 8 Class ExercisesDocument3 pagesWeek 8 Class ExercisesChinhoong Ong100% (1)

- Financial Statement Analysis Chapter 2Document10 pagesFinancial Statement Analysis Chapter 2Houn Pisey100% (1)

- Arbitrage Trading in Commodities-4Document2 pagesArbitrage Trading in Commodities-4James LiuNo ratings yet

- 9.2 IAS36 - Impairment of Assets 1Document41 pages9.2 IAS36 - Impairment of Assets 1Given RefilweNo ratings yet

- CH 03Document51 pagesCH 03Lộc PhúcNo ratings yet

- Bahan UTS Pak Totok PDFDocument32 pagesBahan UTS Pak Totok PDFsilviana isyantoNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementdhruvNo ratings yet

- Asset AllocationDocument14 pagesAsset Allocationankit pushpamNo ratings yet

- Ch14 P13 Build A ModelDocument6 pagesCh14 P13 Build A ModelRayudu Ramisetti0% (2)

- Get Stock Market Updates From Telegram App: Https://T.Me/KittuswealthjourneyDocument23 pagesGet Stock Market Updates From Telegram App: Https://T.Me/KittuswealthjourneyHardik Agarwal0% (1)

- Bonds Payable QuizDocument7 pagesBonds Payable QuizChristine Jean MajestradoNo ratings yet

- Test Bank: True/False QuestionsDocument174 pagesTest Bank: True/False QuestionsMinh SinhNo ratings yet

- Investment BankingDocument61 pagesInvestment BankingAbbas Taher PocketwalaNo ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Achieving Financial PerformanceDocument8 pagesAchieving Financial PerformanceozuwoNo ratings yet

- Lloyds TSB Bank PLC: Report and Accounts 2008Document109 pagesLloyds TSB Bank PLC: Report and Accounts 2008saxobobNo ratings yet

- What Would Fisher SayDocument2 pagesWhat Would Fisher SayFeynman2014No ratings yet

- SCDL Financial ManagementDocument3 pagesSCDL Financial Managementnehagupta2537471100% (1)

- Secretarial Practices: Important QuestionsDocument3 pagesSecretarial Practices: Important QuestionsdisushahNo ratings yet

- AEMULUS - Technical View - 11 June 2020Document2 pagesAEMULUS - Technical View - 11 June 2020Mohd Amiruddin Abd RahmanNo ratings yet

- Solutions To Chapter 17 Financial Statement AnalysisDocument10 pagesSolutions To Chapter 17 Financial Statement Analysishung TranNo ratings yet