Professional Documents

Culture Documents

Capital Cash Flow Model Offers

Uploaded by

Rajan Kumar Upadhyay0 ratings0% found this document useful (0 votes)

13 views3 pagesThis document summarizes the capital cash flow model and key financial metrics for Desert Partner USG from 1988-1992. It shows cash available, interest expense, capital cash flow, and present value totals for each year. It also lists the equity value, total debt, debt breakdown by type, levered beta, cost of asset, sales growth, and market cap comparisons to book and offer values. In 3 sentences:

The capital cash flow model projects cash available, interest expense, and capital cash flow for Desert Partner USG from 1988-1992. It also provides the company's equity value, total debt, levered beta, cost of asset, sales growth rate, and compares market cap, offer price, and book value

Original Description:

excel working of usg

Original Title

Usg Working

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the capital cash flow model and key financial metrics for Desert Partner USG from 1988-1992. It shows cash available, interest expense, capital cash flow, and present value totals for each year. It also lists the equity value, total debt, debt breakdown by type, levered beta, cost of asset, sales growth, and market cap comparisons to book and offer values. In 3 sentences:

The capital cash flow model projects cash available, interest expense, and capital cash flow for Desert Partner USG from 1988-1992. It also provides the company's equity value, total debt, levered beta, cost of asset, sales growth rate, and compares market cap, offer price, and book value

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views3 pagesCapital Cash Flow Model Offers

Uploaded by

Rajan Kumar UpadhyayThis document summarizes the capital cash flow model and key financial metrics for Desert Partner USG from 1988-1992. It shows cash available, interest expense, capital cash flow, and present value totals for each year. It also lists the equity value, total debt, debt breakdown by type, levered beta, cost of asset, sales growth, and market cap comparisons to book and offer values. In 3 sentences:

The capital cash flow model projects cash available, interest expense, and capital cash flow for Desert Partner USG from 1988-1992. It also provides the company's equity value, total debt, levered beta, cost of asset, sales growth rate, and compares market cap, offer price, and book value

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

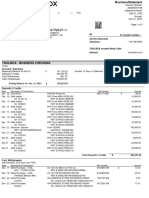

capital cash flow model

OFFERS

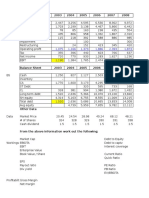

DESERT PARTNER USG

$42 $37

$5 DEB

1SH

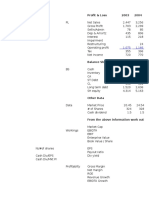

1988 1989 1990 1991 1992

CASH AVAILABLE 634 130 175 166 160

add Intrest Expense 196 282 276 265 260

subtract junior deb. Intrest 22 47 55 64 74

Capital cash flow 808 365 396 367 346

404 365 396 367 346

Present Value 94.83 365.00 396.00 367.00 346.00

TV

EQUITY 2064 million USD

DEBT 824.026

commercial paper

& notes payable 39049

long term debt under 1 yr 39020

long term debt under 1 yr 745957

E+D 2888.026

BETA_LEVERED 1.37

Beta_U 1.084293

New Beta Debt 1.288481

Rm-Rf 8.9

Rf 7.5 market knowledge

cost of asset 17.1502

sales growth Err:523 5%

MARKET CAP 2064

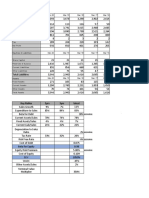

MARKET OFFER MARKET

OFFER PRICE/BOOK VALUE PRICE/BO PRICE/BO PRICE/BO

OK VALUE OK VALUE OK VALUE

2.9 13.2 1 12.2

1.8 12.8 1.8 10.2

1.2 13.4 1.3 15.7

1.9 11.6 2 13.1

1.4 12.8 2.5 11.6

1.4 12.7 1.7 11.6

1.4 10.4

1.7666666667 12.75 1.671429 12.11429

BOOK VALUE 13

OFFER PRICE FOR USG 22.96667 21.72857

MARKET PRICE FOR USG 44.115 41.91543

Since expected EPS 3.46

You might also like

- Ceres MGardening MCompany MSubmission MTemplateDocument6 pagesCeres MGardening MCompany MSubmission MTemplateRohith muralidharanNo ratings yet

- Newfield QuestionDocument8 pagesNewfield QuestionFaizan YousufNo ratings yet

- Case Harvard - Marriott Corporation Restructuring - SpreadsheetDocument25 pagesCase Harvard - Marriott Corporation Restructuring - SpreadsheetCarla ArecheNo ratings yet

- Calaveras ExhibitsDocument16 pagesCalaveras ExhibitsLucasNo ratings yet

- Case 10 Value Line Publishing October 2002Document16 pagesCase 10 Value Line Publishing October 2002YogaPratamaDosenNo ratings yet

- Dows ExcelDocument18 pagesDows ExcelJaydeep SheteNo ratings yet

- Exhibit 4 Industry Information For Frozen NoveltiesDocument25 pagesExhibit 4 Industry Information For Frozen NoveltiesIrakli SaliaNo ratings yet

- Key Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitDocument2 pagesKey Ratios 5yrs 3yrs Latest: Sales Other Income Total Income Total Expenditure Ebit Interest Tax Net ProfitmohithNo ratings yet

- Restructuring at Neiman Marcus Group (A) Bankruptcy ValuationDocument66 pagesRestructuring at Neiman Marcus Group (A) Bankruptcy ValuationShaikh Saifullah KhalidNo ratings yet

- Coprorate Failure and ReconstructionDocument9 pagesCoprorate Failure and ReconstructionHeema KanthariaNo ratings yet

- Session XX-classDocument9 pagesSession XX-classswaroop shettyNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- Paramount Student SpreadsheetDocument12 pagesParamount Student Spreadsheetanshu sinhaNo ratings yet

- (Billions) : Q2 2012 Data, Except Where NotedDocument17 pages(Billions) : Q2 2012 Data, Except Where Notedchatterjee rikNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionAjaxNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionGourav DadhichNo ratings yet

- 1982 Sales 1983 Budget $ % of Total $ % of TotalDocument14 pages1982 Sales 1983 Budget $ % of Total $ % of TotalShriniwas NeheteNo ratings yet

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- Newfield QuestionDocument8 pagesNewfield QuestionNasir MazharNo ratings yet

- RoughDocument10 pagesRoughAashish JhaNo ratings yet

- ReebokDocument23 pagesReebokChristian Fernández OchoaNo ratings yet

- Bcel 2019Q1Document1 pageBcel 2019Q1Dương NguyễnNo ratings yet

- Chapter 8 Roic Rnoa Lecture 17TH AprilDocument14 pagesChapter 8 Roic Rnoa Lecture 17TH AprilUmme Laila JatoiNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet

- Dominic InterpretationDocument11 pagesDominic Interpretationdominic wurdaNo ratings yet

- IMT CeresDocument5 pagesIMT Ceresnikhil hoodaNo ratings yet

- Bcel 2019Document1 pageBcel 2019Dương NguyễnNo ratings yet

- Iblf Excel (Mehedi)Document12 pagesIblf Excel (Mehedi)Md. Mehedi HasanNo ratings yet

- Polaroid 1996 CalculationDocument8 pagesPolaroid 1996 CalculationDev AnandNo ratings yet

- HBS Tire City Solution 1Document5 pagesHBS Tire City Solution 1Abhinav KumarNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionCesar CameyNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionPedro José ZapataNo ratings yet

- Monmouth Inc SolutionDocument9 pagesMonmouth Inc SolutionPedro José ZapataNo ratings yet

- ValuationDocument10 pagesValuationismat arteeNo ratings yet

- Monmouth Inc Solution 5 PDF FreeDocument12 pagesMonmouth Inc Solution 5 PDF FreePedro José ZapataNo ratings yet

- Monmouth Inc Solution 5 PDF FreeDocument12 pagesMonmouth Inc Solution 5 PDF FreePedro José ZapataNo ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDocument7 pagesInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- Financial Statements-Ceres Gardening CompanyDocument9 pagesFinancial Statements-Ceres Gardening CompanyHarshit MalviyaNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- ASTRAL RECORDS - EditedDocument11 pagesASTRAL RECORDS - EditedNarinderNo ratings yet

- IMT CeresDocument4 pagesIMT CeresArjun RajNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- Pepsico DCF Valuation SolutionDocument45 pagesPepsico DCF Valuation SolutionSuryapratap KhuntiaNo ratings yet

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Document21 pagesBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoNo ratings yet

- New Microsoft Excel WorksheetDocument5 pagesNew Microsoft Excel Worksheetsara_AlQuwaifliNo ratings yet

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarNo ratings yet

- Analysis:-: Measuring Sensitivity For 1% Change in Spot Gold PricesDocument4 pagesAnalysis:-: Measuring Sensitivity For 1% Change in Spot Gold PricesKshitishNo ratings yet

- Sun Microsystems Case JasdeepDocument6 pagesSun Microsystems Case JasdeepJasdeep SinghNo ratings yet

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataAjax0% (1)

- Class 9 SolutionsDocument14 pagesClass 9 SolutionsvroommNo ratings yet

- New Earth Mining Inc.Document20 pagesNew Earth Mining Inc.Asif Rahman100% (1)

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Love Verma Ceres Gardening SubmissionDocument8 pagesLove Verma Ceres Gardening Submissionlove vermaNo ratings yet

- Top 50 World BanksDocument1 pageTop 50 World BanksKicki AnderssonNo ratings yet

- Name Karandeep Singh: $226 (In Thousands)Document5 pagesName Karandeep Singh: $226 (In Thousands)Rishabh TiwariNo ratings yet

- Zhichi Co ExcelDocument6 pagesZhichi Co Excelsanjay gautamNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- Block Fi PDFDocument12 pagesBlock Fi PDFAkshay DaveNo ratings yet

- Cost Accounting: Quiz 1Document11 pagesCost Accounting: Quiz 1ASILINA BUULOLONo ratings yet

- Quiz 1 - Intermediate AccountingDocument2 pagesQuiz 1 - Intermediate AccountingMary GlaineNo ratings yet

- Ai - AuDocument42 pagesAi - AuPanache ZNo ratings yet

- Chapter 10: Plant Assets, Natural Resources and Intangibles Important TermsDocument2 pagesChapter 10: Plant Assets, Natural Resources and Intangibles Important TermsMarwan DawoodNo ratings yet

- Developing A Business PlanDocument25 pagesDeveloping A Business PlanDum DumNo ratings yet

- Untitled 3Document11 pagesUntitled 3Jelwin Enchong BautistaNo ratings yet

- Accounting For Sales PDFDocument20 pagesAccounting For Sales PDFJasmine Acta100% (1)

- Basics of Accounting in Small Business NewDocument50 pagesBasics of Accounting in Small Business NewMohammed Awwal NdayakoNo ratings yet

- Accounting Assignment RefDocument2 pagesAccounting Assignment RefAnatta NgNo ratings yet

- Nisha Nur Aini - 43219110183 - TM 02 - AKM IIDocument11 pagesNisha Nur Aini - 43219110183 - TM 02 - AKM IInisha nuraini100% (1)

- 2024 12 31 StatementDocument3 pages2024 12 31 StatementAlex NeziNo ratings yet

- AssignmentDocument7 pagesAssignmentGrace MwendeNo ratings yet

- Moodys ExaminationDocument184 pagesMoodys Examinationabhijit gupNo ratings yet

- FAC3702 Study GuideDocument308 pagesFAC3702 Study GuideLizelle MoutonNo ratings yet

- Mangal V Jha: G - Wing Samanvay Park Maintenance StatementDocument6 pagesMangal V Jha: G - Wing Samanvay Park Maintenance StatementNew GmailNo ratings yet

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- CHAPTER 3 Trial BalanceDocument7 pagesCHAPTER 3 Trial Balancesaksaman74No ratings yet

- Company Profile of HDFC BankDocument3 pagesCompany Profile of HDFC BankAkash Ðaya Sinha50% (4)

- Indian School of Business Financial Accounting in Decision Making (FADM) Digital Headstart Module: 2021-22Document7 pagesIndian School of Business Financial Accounting in Decision Making (FADM) Digital Headstart Module: 2021-22ROKGame 1234No ratings yet

- H1 - Account Receivables - PT Samcro 2020Document105 pagesH1 - Account Receivables - PT Samcro 2020Siska TriandriyaniNo ratings yet

- CH 04Document66 pagesCH 04Dr-Bahaaeddin AlareeniNo ratings yet

- Donegan S Lawn Care Service Began Operations in July 2011 TheDocument1 pageDonegan S Lawn Care Service Began Operations in July 2011 Thetrilocksp SinghNo ratings yet

- LLP FORMATION Checklist.18984827 PDFDocument8 pagesLLP FORMATION Checklist.18984827 PDFShashank JathanNo ratings yet

- Limited Companies Financial StatementsDocument4 pagesLimited Companies Financial Statementskaleem khanNo ratings yet

- Acctg 100C 06 PDFDocument2 pagesAcctg 100C 06 PDFQuid DamityNo ratings yet

- FINANCIAL ACCOUNT YEAR 10 2nd Term TERM TESTDocument4 pagesFINANCIAL ACCOUNT YEAR 10 2nd Term TERM TESTJanet HarryNo ratings yet

- FRP FinalDocument88 pagesFRP Finalgeeta44No ratings yet

- Chapter 43 - Statement of Cash FlowsDocument13 pagesChapter 43 - Statement of Cash FlowsRoxan PacsayNo ratings yet

- BIF Capital StructureDocument13 pagesBIF Capital Structuresagar_funkNo ratings yet