Professional Documents

Culture Documents

Inheritance Act Instruction For Use With Form E See Form: Section 1

Inheritance Act Instruction For Use With Form E See Form: Section 1

Uploaded by

familyproperty0 ratings0% found this document useful (0 votes)

13 views5 pagesPrintable Instructions form for use with my book "Inheritance Act Claims by Adult Children". Please search on Amazon for further details.

Original Title

IHA Form

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrintable Instructions form for use with my book "Inheritance Act Claims by Adult Children". Please search on Amazon for further details.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views5 pagesInheritance Act Instruction For Use With Form E See Form: Section 1

Inheritance Act Instruction For Use With Form E See Form: Section 1

Uploaded by

familypropertyPrintable Instructions form for use with my book "Inheritance Act Claims by Adult Children". Please search on Amazon for further details.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

Inheritance Act Instruction Form: Section 1

For use with Form E

See

Client

1.1 Full name

1.2 Date of birth

1.3 Occupation

Deceased Parent

1.4 Name

1.5 Date and cause of death

1.6 Place of death

1.7 Death certificate? Y/N

1.8 DP’s age at death

1.9 Will or intestacy?

Estate

1.10 Gross value

1.11 Net value

1.12 Date of grant of probate

1.13 Last issue date

Contents of Estate

1.14.1 Land and real property

1.14.2 Cash, savings, investments

1.14.3 Beneficial interests (including

discretionary trusts)

1.14.4 Other

1.14.5 Distribution of estate under

Will/intestacy

Supplementary information

about AC

1.15 AC’s interest under the Will/intestacy

1.16 AC’s state of health

1.17 AC’s current earning capacity

Beneficiary/other claimant information

Complete this section for any significant beneficiary or potential Inheritance Act

claimant

1.18.1 Name

1.18.2 Age

1.18.3 General health

1.18.4 Disabilities

1.18.5 Relationship to DP

1.18.5 Dependants

1.18.6 If joint owner of property with DP, state

property and approximate total value

1.18.7 Gifts from DP during DP’s lifetime

You might also like

- Form EUTR1A PDFDocument23 pagesForm EUTR1A PDFBrian Aguilar0% (2)

- The Executor's Handbook: A Step-by-Step Guide to Settling an Estate for Personal Representatives, Administrators, and Beneficiaries, Fourth EditionFrom EverandThe Executor's Handbook: A Step-by-Step Guide to Settling an Estate for Personal Representatives, Administrators, and Beneficiaries, Fourth EditionNo ratings yet

- Vaf1 GuidanceDocument8 pagesVaf1 Guidancevidhyaa1011No ratings yet

- Form Eu1: Application For A Residence CardDocument8 pagesForm Eu1: Application For A Residence CardasilvaronaldoNo ratings yet

- Iht205 2006 2Document4 pagesIht205 2006 2pacecurranbtinternetNo ratings yet

- Form of Application For Financial Assistance From Chief Ministers Distress Relief FundDocument1 pageForm of Application For Financial Assistance From Chief Ministers Distress Relief FundratheeshermNo ratings yet

- Form e EngDocument28 pagesForm e EngmistyguiquingNo ratings yet

- Form MN1 June 2014Document17 pagesForm MN1 June 2014Amy PainterNo ratings yet

- Irish Citizen Child Application FormDocument19 pagesIrish Citizen Child Application FormArildo LealNo ratings yet

- Form E Inancial Tatement: in The District Court / High CourtDocument23 pagesForm E Inancial Tatement: in The District Court / High CourtrstlamNo ratings yet

- IHT400-092020 EnglishDocument16 pagesIHT400-092020 EnglishelizabethmwestNo ratings yet

- IQVisa AppDocument2 pagesIQVisa AppAden BanksNo ratings yet

- Application For Survivors Benefits Pension/Provident FundDocument9 pagesApplication For Survivors Benefits Pension/Provident FundXANPHOXYL KIBETNo ratings yet

- Form mn1Document16 pagesForm mn1Vijay KoriNo ratings yet

- Form MN1: Application For Registration of A Child Under 18 As A British CitizenDocument31 pagesForm MN1: Application For Registration of A Child Under 18 As A British CitizenMuhammad Naveed JoyiaNo ratings yet

- Form An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant SocietyDocument16 pagesForm An (Afd) Application For Naturalisation: Building A Safe, Just and Tolerant Societyjana a100% (1)

- Estate Planning QuestionnaireDocument8 pagesEstate Planning QuestionnaireBeau100% (1)

- Stamp 4 Form - BLANKDocument44 pagesStamp 4 Form - BLANKelissons.santosNo ratings yet

- FS14 Dealing With An Estate FcsDocument21 pagesFS14 Dealing With An Estate FcsIp CamNo ratings yet

- Solution Manual For Wills Trusts and Estate Administration 8th EditionDocument33 pagesSolution Manual For Wills Trusts and Estate Administration 8th Editionsadafidoudind100% (11)

- General GuidanceDocument18 pagesGeneral GuidanceJake1111No ratings yet

- Electronic Form Only: Online Request To Be A Supporter and Declaration of Financial SupportDocument14 pagesElectronic Form Only: Online Request To Be A Supporter and Declaration of Financial SupportAlan AvilesNo ratings yet

- D StatmentDocument8 pagesD StatmentHihiNo ratings yet

- IHT400 - Inheritance Tax Account - Heritage WillsDocument16 pagesIHT400 - Inheritance Tax Account - Heritage WillsrmarcgypsyNo ratings yet

- Last Will Testament FormDocument8 pagesLast Will Testament Formmaansjayden56No ratings yet

- Form B (OS)Document17 pagesForm B (OS)Steffaballe Ran kaddaNo ratings yet

- Form rs1 04 19Document20 pagesForm rs1 04 19Szabolcs HunyadiNo ratings yet

- Legitime in Testate Succession: Mortis (Time of Death)Document6 pagesLegitime in Testate Succession: Mortis (Time of Death)No MercyNo ratings yet

- Phillife - Claimant Statement Form - Death ClaimDocument1 pagePhillife - Claimant Statement Form - Death ClaimRomeo Ocenar MabutolNo ratings yet

- 1 MPB-501 - Application For Pension 2 MPC - 60Document10 pages1 MPB-501 - Application For Pension 2 MPC - 60Anitha Mary DambaleNo ratings yet

- Vaf1 Guidance NotesDocument9 pagesVaf1 Guidance NotesAyatmirzaNo ratings yet

- Death Claim Form: CLAIMFORM DC-s Nov2016 v2 Page 1 of 3Document3 pagesDeath Claim Form: CLAIMFORM DC-s Nov2016 v2 Page 1 of 3vertine belerNo ratings yet

- Cle Client Info FormDocument3 pagesCle Client Info Formapi-339018506No ratings yet

- Form mn1 07 18Document31 pagesForm mn1 07 18ictbdNo ratings yet

- Application For A Re-Entry Visa For Minors, Including Minors With Stamp 6Document9 pagesApplication For A Re-Entry Visa For Minors, Including Minors With Stamp 6Bahia El RefaiNo ratings yet

- Pen AppllicationDocument2 pagesPen AppllicationTagore NavabothuNo ratings yet

- Affidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)Document2 pagesAffidavit of Successor: (One Box MUST Be Checked or The Form Will Be Rejected)johnbbb111No ratings yet

- Claimant's Statement For Death Claim - Non RADocument4 pagesClaimant's Statement For Death Claim - Non RAtcdieselsolutionsrsaNo ratings yet

- Petition For A Nonimmigrant WorkerDocument16 pagesPetition For A Nonimmigrant WorkerulrichNo ratings yet

- Advocate Data Sheet For Filing CasesDocument1 pageAdvocate Data Sheet For Filing CasesSundararajan Sathyamurthi100% (1)

- United States Court of Appeals Second Circuit.: Nos. 64-67, Dockets 28244-28247Document10 pagesUnited States Court of Appeals Second Circuit.: Nos. 64-67, Dockets 28244-28247Scribd Government DocsNo ratings yet

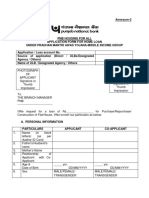

- Application Form For PMAY MIG Loan PDFDocument8 pagesApplication Form For PMAY MIG Loan PDFakibNo ratings yet

- Immigrant Investor Programme Application Form: Iip&Stepapplications@Justice - IeDocument22 pagesImmigrant Investor Programme Application Form: Iip&Stepapplications@Justice - IeIndra WidyaNo ratings yet

- See Rule - 4 (I) Application For Information Under Section 6 (1) of The ActDocument1 pageSee Rule - 4 (I) Application For Information Under Section 6 (1) of The ActPranati ReleNo ratings yet

- SBCAOpenForm Karnatka BankDocument7 pagesSBCAOpenForm Karnatka BankMirtunjay KumarNo ratings yet

- One Person CorporationDocument2 pagesOne Person CorporationkealaNo ratings yet

- Form MN1: Application For Registration of A Child Under 18 As A British CitizenDocument31 pagesForm MN1: Application For Registration of A Child Under 18 As A British CitizenOZ KaiserNo ratings yet

- Electronic Form Only: Online Request To Be A Supporter and Declaration of Financial SupportDocument14 pagesElectronic Form Only: Online Request To Be A Supporter and Declaration of Financial Supportbaptisteguerlinx4No ratings yet

- A Form For ChildDocument8 pagesA Form For ChildOva AssociationNo ratings yet

- VAF1 GuidanceDocument5 pagesVAF1 GuidanceNarcisa OrtizNo ratings yet

- Form AN: Application For Naturalisation As A British CitizenDocument16 pagesForm AN: Application For Naturalisation As A British Citizenmyousif63No ratings yet

- NF 1015 Applicable For Housing Loan Pradhan Mantri Awas Yojana 9pmayDocument9 pagesNF 1015 Applicable For Housing Loan Pradhan Mantri Awas Yojana 9pmaytpchowo100% (1)

- Pag Ibig Fpc011 Proof of Surviving Legal HeirsDocument2 pagesPag Ibig Fpc011 Proof of Surviving Legal HeirsChemtech-tupt EF Class100% (2)

- 1578403715777-Family PensionDocument1 page1578403715777-Family PensionSingh FactoryNo ratings yet

- Income Affidavit Rajnesh NehaDocument9 pagesIncome Affidavit Rajnesh NehaMukesh NarayanNo ratings yet

- Form For Withdrawal by Claimant Due To Death of SubscriberDocument6 pagesForm For Withdrawal by Claimant Due To Death of SubscriberPraveen Kumar GundalaNo ratings yet

- Preview: Petition For A Nonimmigrant Worker: H1 ClassificationsDocument17 pagesPreview: Petition For A Nonimmigrant Worker: H1 ClassificationsSai Sunil ChandraaNo ratings yet

- Death Claim Form: CLAIMFORM DC-aps Nov2016 v2 Page 1 of 2Document5 pagesDeath Claim Form: CLAIMFORM DC-aps Nov2016 v2 Page 1 of 2Lisa MendilloNo ratings yet

- Widow's Key: Innovative Approaches for Overcoming Personal LossFrom EverandWidow's Key: Innovative Approaches for Overcoming Personal LossRating: 5 out of 5 stars5/5 (1)