Professional Documents

Culture Documents

Ratio 1

Ratio 1

Uploaded by

CeciliaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio 1

Ratio 1

Uploaded by

CeciliaCopyright:

Available Formats

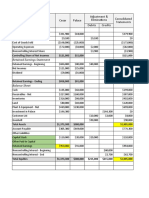

Financial Ratios for JFC

30,368,734,579

a. Current ratio : 23,831,414,500 =1.27

16,733,346,023 + 726,002,456 + 3,376,701,591

b. Quick ratio : 23,831,414,500 = 0.87

c. Accounts Receivable Turnover Ratio:

5,432,775,539 + 3,376,701,591

Average Accounts Receivable : 2 = 4,404,738,565

108,020,745,396

Accounts Receivable Turnover Ratio: 4,404,738,565 = 24.52

d. Inventory Turnover Ratio:

5,478,416,309 + 5,987,346,224

Average Inventory : 2 = 5,732,881,266.5

92,815,488,315

Inventory Turnover Ratio : 5,732,881,266.5 = 16.19

e. Turnover in days:

365

Receivable turnover in days : 24.52 = 14.89

365

Inventory turnover in days : 16.19 = 22.54

7,730,119,679 + 267,618,436

f. Times-interest-earned Ratio : 267,618,436 = 29.88

38,446,947,773

g. Debt Ratio : 72,728,352,258 = 0.53

38,446,947,773

h. Debt-to-equity ratio : 34,281,404,485 = 1.12

6,053,508,622

i. Return on Sales : 108,992,340,770 = 0.06

6,053,508,622 + 267,618,436 (1−0.30)

j. Return on Assets : 267,618,436 = 23.32

k. Return on Stockholders’ Equity :

34,281,404,485 + 31,756,589,904

Average Common Stockholders’ Equity: 2 = 33,018,997,194.5

6,053,508,622

Return on Stockholders’ Equity: 33,018,997,194.5 = 0.18

6,164,735,373

l. Earnings per share : 1,072,616,009 = 5.75

4.89

m. Price-earnings ratio : 5.75 = 0.85

1.86

n. Dividend Yield : 4.89 = 0.38

o. Dividend payout ratio :

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Bu127 PQDocument618 pagesBu127 PQah75% (4)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Income Taxation Answer Key Only 1 1Document60 pagesIncome Taxation Answer Key Only 1 1Paul Justin Sison Mabao88% (32)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial Accounting Valix and Peralta Volume Three - 2008 Edition 1Document27 pagesFinancial Accounting Valix and Peralta Volume Three - 2008 Edition 1jamilahpanantaon83% (12)

- Learning Objective 1: Audit Planning and Analytical ProceduresDocument10 pagesLearning Objective 1: Audit Planning and Analytical ProceduresCeciliaNo ratings yet

- Bio SyllabusDocument6 pagesBio SyllabusCeciliaNo ratings yet

- Heizer Om10 Ch16 JIT and LEANDocument52 pagesHeizer Om10 Ch16 JIT and LEANCeciliaNo ratings yet

- Psa 700 RedraftedDocument55 pagesPsa 700 RedraftedCeciliaNo ratings yet

- sd5 Financial Statement AnalysisDocument7 pagessd5 Financial Statement Analysisxxx101xxxNo ratings yet

- Ast TX 1001 Capital Assets (Batch 22)Document3 pagesAst TX 1001 Capital Assets (Batch 22)CeciliaNo ratings yet

- University of The East Biological Sciences: Names of Members Section ScoreDocument1 pageUniversity of The East Biological Sciences: Names of Members Section ScoreCeciliaNo ratings yet

- Reasoning InferenceDocument3 pagesReasoning InferenceCecilia100% (1)

- Ashis Dhal - PPTX 5Document12 pagesAshis Dhal - PPTX 5amitratha77No ratings yet

- Balance Sheet: As at March 31, 2022Document32 pagesBalance Sheet: As at March 31, 2022Ahire Ganesh Ravindra bs20b004No ratings yet

- Exercicios Do Capitulo 4 (Finanças Empresariais)Document3 pagesExercicios Do Capitulo 4 (Finanças Empresariais)Gonçalo AlmeidaNo ratings yet

- JRFP2020 Policy ManualDocument13 pagesJRFP2020 Policy Manualfabyan17No ratings yet

- Shareholding Pattern As On June 30, 2020Document9 pagesShareholding Pattern As On June 30, 2020Mit AdhvaryuNo ratings yet

- Latihan Soal Consolidation Worksheet With DiscussionDocument5 pagesLatihan Soal Consolidation Worksheet With DiscussionNicolas ErnestoNo ratings yet

- Max Diversified Equity FundDocument1 pageMax Diversified Equity FundNimish PavanNo ratings yet

- Finals - Fina 221Document14 pagesFinals - Fina 221MARITONI MEDALLANo ratings yet

- Pearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31St Edition Anderson Test Bank Full Chapter PDFDocument66 pagesPearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31St Edition Anderson Test Bank Full Chapter PDFWilliamDanielsezgj100% (10)

- Chapter09 SMDocument14 pagesChapter09 SMkike-armendarizNo ratings yet

- ACCA - FR Financial Reporting - CBEs 18-19 - FR - CBE Mock - 1Document52 pagesACCA - FR Financial Reporting - CBEs 18-19 - FR - CBE Mock - 1NgọcThủyNo ratings yet

- Import - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalDocument2 pagesImport - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalNguyễn Thanh LongNo ratings yet

- Investment Calculator - 1Document2 pagesInvestment Calculator - 1Ionut FratilaNo ratings yet

- 05 17 2019 GCIS CDC Annual StockholdersDocument31 pages05 17 2019 GCIS CDC Annual StockholdersammendNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- Employee Stock OptionDocument13 pagesEmployee Stock OptionAbhijeet TalapatraNo ratings yet

- Test Bank For Forensic Accounting Robert Rufus 0133050475Document19 pagesTest Bank For Forensic Accounting Robert Rufus 0133050475AnitaSchwartzorzdg100% (44)

- Insights Factorresearch Com Research Trend Following Factor Investing Unexpected CousinsDocument1 pageInsights Factorresearch Com Research Trend Following Factor Investing Unexpected CousinssdfghNo ratings yet

- 16-009292 DE 1176 EXHIBIT F (Larry's MTG Statement & BU Wire Conf)Document17 pages16-009292 DE 1176 EXHIBIT F (Larry's MTG Statement & BU Wire Conf)larry-612445No ratings yet

- Equity Risk Premium (ERP) UpdatedDocument57 pagesEquity Risk Premium (ERP) UpdatedSaurav VidyarthiNo ratings yet

- Shipping Corporation of India: Project Report OnDocument6 pagesShipping Corporation of India: Project Report OnAnuj BhagatNo ratings yet

- Retained Earnings1Document11 pagesRetained Earnings1Rowena RogadoNo ratings yet

- Crescent Standard Modaraba: Managed by B.R.R. Investment (Private) LimitedDocument10 pagesCrescent Standard Modaraba: Managed by B.R.R. Investment (Private) Limiteds_kha100% (2)

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (3)

- Lettuce ProductionDocument14 pagesLettuce ProductionJay ArNo ratings yet

- Mas-03: Absorption & Variable CostingDocument4 pagesMas-03: Absorption & Variable CostingClint AbenojaNo ratings yet

- Consolidated Financial Statements of Volkswagen AG As of December 31 2022Document429 pagesConsolidated Financial Statements of Volkswagen AG As of December 31 2022AbdullahNo ratings yet

- Tutorial - Week5 AnsDocument6 pagesTutorial - Week5 AnsAnis AshsiffaNo ratings yet