Professional Documents

Culture Documents

W.P. 758 Vincraft Vs - FBR, Etc 1.6.2017 DB

Uploaded by

Muhammad Ilyas ShafiqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

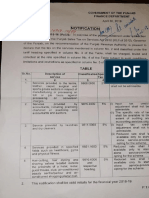

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

W.P. 758 Vincraft Vs - FBR, Etc 1.6.2017 DB

Uploaded by

Muhammad Ilyas ShafiqCopyright:

Available Formats

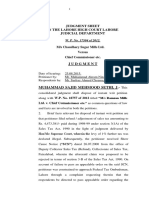

JUDGMENT SHEET

IN THE PESHAWAR HIGH COURT PESHAWAR

JUDICIAL DEPARTMENT

Writ Petition No. 758 -P/2017.

M/s Vincraft (Pvt.) Ltd.

Vs.

Federal Board of Revenue and others.

JUDGMENT

Date of hearing: 01.06.2017

Petitioner(s): By Mr.Shumail Ahmad Butt, advocate.

Respondent(s): By M/s.Ghulam Shoaib Jally, advocate, for

respondent No.1 and Rehmanullah,

advocate, for respondents No.2 and 3.

Mian Zamrud Shah, adv. for respdts.4 & 5.

*****

IJAZ ANWAR, J. - Through this single judgment,

we intend to dispose of this and the connected writ petitions

Nos. 759-P and 761-P of 2017 involving common question

of law and fact. The common relief that has been sought in

this and the connected writ petitions are that:-

“I) The impugned act of the Respondent

No.4 for conducting forcible raid on the

premises of the petitioner and taking into

custody Computer, records and other

valuable documents etc without any notice

and without any receipt in the garb of

Section 175 of the Income Tax Ordinance is

illegal, unconstitutional, wrong,

unauthorized, based on high handedness and

thus liable to be declared as such.

2

II)That the Respondent No.4 are bound to at

once return all the Paraphernalia so

illegally taken into custody from the

premises of the petitioner so that the

petitioner may run his business without any

undue fear and the Respondent be refrained

from taking any action against the petitioner

in similar fashion in perpetuity.

III)That the Respondents are not authorized

to proceed against the petitioner in any

manner on the basis of impugned acts as the

elements of fabrication and manipulation on

the behest of the rivals of the petitioner is

very much present and existing any such act

of the Respondent is without lawful

authority, ultra vires of the Constitution and

thus of no legal effect.

IV)The respondents may perpetually be

restrained from proceedings adversely

against the petitioners till the writ petition so

filed by the petitioner is decided by an

independent Court of competent jurisdiction

and stay may kindly be granted”.

2. The facts narrated in this case are that the

petitioner is a private limited company duly incorporated

under the Companies Ordinance, 1984 and engaged in the

business of outdoor furniture and sanitary Pipes and fittings.

The petitioner has been duly authorized by the Board of

Director to file this petition. It is alleged that despite all the

non-conducive atmosphere in this part of the country for the

Industrialists, the petitioner and its sister concerns are

contributing sizably towards the economy of this Province.

It is alleged that the petitioner remained very clear and open

towards its liability towards tax authorities and submitted

Income Tax Returns in times and no return was however

objected by the Income Tax Department. It is alleged that

3

one Hafeez-ur-Rehman an Ex-employee having personal

grudge with the petitioner, conveyed wrong information to

the respondents which resulted into the illegal and highly

agonizing raid by the respondents on 17.2.2017 at the

headquarters office of the petitioner and its sister concerns

without notice or any prior information. It is alleged that

without their being any legal warrant from the Court of law,

the respondents forcibly entered into the premises of Head

Office and forcibly snatched and took into possession the

valuable documents, records and computers of the

petitioner. It is alleged that while seizing these documents

and computers no receipt was ever provided. The petitioner

when approached the respondent No.4 and complained

about the illegal activities, was handed over the fabricated

notice of inquiry dated 17.2.2017 allegedly issued under

section 175 of the Income Tax Ordinance, 2001 and refused

to return the documents and computers impounded illegally.

3. The respondents were put to notice and

directed to file their comments. The respondents No.4 and 5

have accordingly filed their comments, wherein they denied

the allegations leveled by the petitioner. They summarized

their defence in paras 6 and 7 of the comments, besides

objecting on the jurisdiction of this Court.

4. Paras 6 and 7 of the comments are reproduced

for ready reference:-

“That the contents of the corresponding

para are pathetically untrue, incorrect and

4

whimsical. The purpose of such narration on

the part of the petitioner is just to sensitize to

matter.

The answering respondent conducted search

of the business/manufacturing premises of

petitioner in accordance with the provisions

of section 175 of Income Tax Ordinance,

2001 read with SRO 115(1) 2015 dated

09.02.2015. The visiting team went totally

unarmed and entered the premises of

petitioner with permission and in a peaceful

manner. The petitioner themselves not only

provided free access to their

business/manufacturing premises but also

handed over the requisite record to the

answering respondents visiting team. During

the course of search, the authorized officers

examined certain record/documents and

computers which were taken into custody for

the purpose of detailed examination and

further investigation under the law.

Here it is pertinent to mention that the

petitioner is not a law abiding citizen, as

after taking custody of the record, as the

answering respondent team was about to

leave, the petitioner’s armed men stopped

the answering respondent and put them in

illegal confinement. The respondents’

officials were not allowed to leave the

premises. So much so that eventually when

the respondent No.4 came to know about the

illegal confinement of his officials, the same

sought the help of the area Police to rescue

his officials from the garb of petitioners’

armed personals. Later on FIR was also

lodged against the petitioner. Copy of the

FIR is hereby enclosed”.

5. The learned counsel for the respondents at the

very outset raised preliminary objection regarding the

maintainability of this constitutional petition on the ground

that the survey/search of the premises was conducted by

the authorized officer while exercising the powers under

section 175 of the Income Tax Ordinance, 2001, therefore,

5

under section 122 of the Income Tax Ordinance, the

petitioner has his remedy by submission of the case as a

taxpayer and in case aggrieved there from to avail remedies

provided under that fora.

6. In response, learned counsel for the petitioner

formulated his arguments and argued that impounding the

computers and other record of the petitioner and by the

respondents allegedly exercising their power under section

175 of the Income Tax Ordinance, 2001 that evidence can

be used against the petitioner under section 216 (3) (g) for

the purpose of Sales tax, Federal Excise Tax and Customs

Tax, etc therefore, the search as required under section 40

of the Sales Tax Act, 1990 was mandatory and having not

been conducted in accordance with law, has no legal

sanctity. Similarly, the raid of the premises without such

search warrant as prescribed under the law would be illegal

and where the respondents have not conducted themselves

in accordance with law, the writ petition would be

competent.

7. Learned counsel for the petitioner argued that

section 175 of the Income Tax Ordinance, 2001 is para-

materia to section 38 of the Sales Tax Act, 1990, therefore,

while conducting such search, the procedure prescribed

under section 40 of the Sales Tax Act, 1990 would be

applicable, wherein the relevant provisions of Criminal

Procedure Code, 1898 relating to search was made

6

applicable. Learned counsel for the petitioner relied upon

2014 SCMR-30 to contend that such type of raids without

notice and without the prior permission from the Magistrate

was declared as illegal. Learned counsel also referred to an

un-reported judgment of the Apex Court in C.P. No.1534 of

2016 titled “Additional Director General of Intelligence and

Investigation, Customs House, Peshawar vs. M/s Universal

Plastic Industries” dated 31.5.2016, wherein while making

reference to sections 38 and 40 of the Sales Tax Act, 1990,

the judgment of the Peshawar High Court striking down the

raid as un-authorized was maintained and leave was

refused. Learned counsel for the petitioner referred to

sections 101,102, 103 read with section 165 of the Criminal

Procedure Code, 1898 and contended that any search of the

premises without following the procedure prescribed under

Cr.P.C. is illegal and was struck down in a number of

judgments by the Superior Courts. He placed reliance on

2003 PTD 1034, 2007 PTD 2356, 2005 SCMR 1166, PLD

1991 SC-630, 1999 P.CrLJ 1546, 1997 SCMR-408, PLD

1996 SC-574, 2005 PTD 1200 and 2005SCMR-37. He

while specifically referring to the impugned order dated

17.2.2017 whereby access was sought to the premises and

on the strength of that letter they forcibly entered the

premises and after examination of some record

subsequently impounded the record, documents and

computers, the learned counsel for petitioner contended that

it was not a final order, therefore, the provision of section

7

122 of the Income Tax Ordinance 2001 cannot be invoked.

Similarly, the judgments which he referred and placed

reliance also arisen out of constitutional petition decided by

the High Courts and maintained by the Supreme Court of

Pakistan. He contended that this Court can entertain the writ

petition in the given circumstances.

8. The learned counsel for the respondents,

however, while arguing the case on merits submitted that

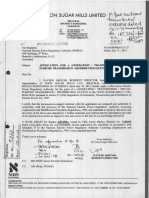

the Resumption memo duly prepared under section 175 (1)

(e) suggests that it was produced to the visiting team by the

taxpayers themselves and no force as alleged was used or it

can be termed as a raid. Learned counsel argued that it was

purely a factual controversy and therefore, the same cannot

be resolved in writ jurisdiction, besides availability of

alternate remedy for him.

9. Learned counsel for the respondents referred to

the notification dated 09.02.2015 and contended that certain

officers were duly authorized under the law to enter for

search as mentioned under section 175 of the Income Tax

Ordinance, 2001. He further argued that the petitioner are

bound to allow free access to the Authorized Officer for

the purpose of survey or making of Audit of the Taxpayers,

therefore, there is no occasion for the petitioner to have

invoked the constitutional jurisdiction of this Court and

request for the dismissal of the writ petition.

10. Arguments heard and record perused.

8

11. The record shows that the petitioner was

issued a notice of enquiry under section 175 of the Income

Tax Ordinance, 2001, scheduled for 17/2/2017. A team was

constituted to verify the facts which they received after

certain credible information/enquiry about undeclared bank

account and suppression of sales. This visit pursuant to the

notice has been termed by the petitioner as raid, use of force

in impounding certain record/documents and computers.

12. The point of law for the determination of this

Court as emerged from the arguments of the learned

counsel for the parties is that whether the Commissioner or

any Officer authorized, when given access to any premises

can further impound any accounts, documents or computer

desk etc without the permission of the taxpayer and then

make inventory of such impounded material, without

adopting the procedure prescribed under sections 101,102,

103 read with section 165 of the Criminal Procedure Code,

1898 and whether section 38 of the Sales Tax Act, 1990 is

para-materia to section 175 of the Income Tax Ordinance,

2001 and if so the Authorized Officer is bound to follow

the procedure as prescribed under section 40 of the Sales

Tax Act, 1990. To find out the answers to these questions,

we for the purpose of convenience reproduce section 175 of

the In come Tax Act, 2001 as:-

175. Power to enter and search premises.-

(1) In order to enforce any provision of this

Ordinance (including for the purpose of

9

making an audit of a taxpayer or a survey

of persons liable to tax), the Commissioner

or any officer authorized in writing by the

Commissioner for the purposes of this

section__

(a)shall, at all times and without prior

notice, have full and free access to any

premises, place, accounts, documents or

computer;

(b)may stamp, or make an extract or copy

of any accounts, documents or computer-

stored information to which access is

obtained under clause (a);

(c)may impound any accounts or

documents and retain them for so long as

may be necessary for examination or for

the purposes of prosecution’

(d)may, where a hard copy or computer

disk of information stored on a computer is

not made available, impound and retain the

computer for as long as is necessary to

copy the information required; and

(e)may make an inventory of any articles

found in any premises or place to which

access is obtained under clause (a)

(2)The Commissioner may authorize any

valuer or expert to enter any premises and

perform any task assigned to him by the

Commissioner]

(3)The occupier of any premises or place to

which access is sought under sub-section

(1) shall provide all reasonable facilities

and assistance for the effective exercise of

the right of access.

(4)Any accounts, documents or computer

impounded and retained under sub-section

(1) shall be signed for by the Commissioner

or an authorized officer.

(5)A person whose accounts, documents or

computer have been impounded and

retained under sub-section (1) may examine

them and make extracts or copies from

them during regular office hours under

such supervision as the Commissioner may

determine.

10

(6)Where any accounts, documents or

computer impounded and retained under

sub-section (1) are lost or destroyed while

in the possession of the Commissioner, the

Commissioner shall make reasonable

compensation to the owner of the accounts,

documents or computer for the loss or

destruction.

(7)This section shall have effect

notwithstanding any rule of law relating to

privilege or the public interest in relation to

access to premises or places, or the

production of accounts, documents or

computer stored information.

(8)In this section, “occupier” in relation to

any premises or place, means the owner,

manager or any other responsible person

on the premises or place”.

13. We have examined very carefully the

arguments of learned counsel for the petitioner, when he

argued that in section 175 (a), specifically the powers to

enter and have free access to any premises has been given

only under section 175 (1)(a) but in the subsequent

provisions where documents, computers can be impounded

no such powers/authority is conferred “without prior

notice” is mentioned purposely by the legislation, therefore

the learned counsel tried to deduce this law point that since

these are stringent actions, therefore, they cannot be carried

out without prior notice and search procedure as prescribed

under the Cr.P.C., 1898.

14. We may observe here that the Income Tax

Ordinance, 2001 is a legislation later in time to the Sales

Tax Act, 1990, therefore, if the intention of the legislation

11

was to have considered the respective sections 38 of the

Sale Tax and 175 of the Income Tax Ordinance as para-

meteria then there was no need of giving numerous detail in

section 175 of the Income Tax Ordinance. We found that

section 175 is a self contained section and provided the

actions step by step in section 175 (1) (a) and thereafter. All

these sub sections cannot be read disjunctively but be read

conjunctively, because the actions i.e. taken by the

Commissioner or Officers authorized follows one after the

other. Section 175 (1) (a) allow the Authorized Officer to

have full and free access to any premises, place, accounts

and documents or computer, sub-section (b) then if required

allow such officer to make an extract or copy of any

accounts, documents, computer stored-information to which

excess is obtained under clause (a). Now, if the authorized

officer found that on examining the computer and the

record/documents it is found that it required further

examination or, there is suppression of some important facts

about evasion in tax, he may impound any account or

documents and retained them for so long as may be

necessary for examination or for purpose of prosecution.

Section 175 (1) sub clause (e) further support this

discussion, wherein an inventory of any article found in any

premises is prepared. In this sub-clause (e) of section

175(1) again the words “to which access is obtained under

clause 1 clause (a)” is used which is very important,

because it dispel this arguments that inventory of such

12

impounded materials can be made only when a proper

procedure of search is carried out as required under the

Criminal Procedure Code, 1898.

15. Sub-section (7) of Section 175 of the Income

Tax Ordinance, 2001 give this section an overriding effect

on any other law/rules relating to privileges or the public

interest in relation to access to premises for or places or the

production of accounts, documents or computer stored-

information. Thus, it excludes the impression of search

warrant or search procedure as required under Criminal

Procedure Code, 1898.

16. Similarly, the arguments that the action taken

by the respondents under section 175 and the evidence

procured can be used against the petitioner under section

216 (3) clause (g) even in the matters of Sales Tax etc,

therefore, the procedure prescribed under section 40 of the

Sales Tax is required to be followed. We put this arguments

to the respondents to respond, the representative of the

respondents present in Court and their counsel have stated

at the bar that the information that is obtained under section

175 of the Income Tax Ordinance shall not be used against

the petitioner as prescribed under section 216 (3)(g) of the

Income Tax Ordinance, 2001. Be that as it may, the matter

is still under inquiry as prescribed under section 175 of the

Income Tax Ordinance, 2001 and secondly where any such

information that is obtained, and is used against the

13

petitioner in the matter of Sales Tax etc that would be seen

at its appropriate time.

17. We have also examined the case law referred

by the learned counsel for the petitioner and found that the

judgments relied upon are distinguishable, because only

sections 38 and 40 of the Sales Tax Act, 1990 read with

sections 101, 102, 103 and 165 of the Cr.P.C. 1898, were

discussed. None of the case referred have discussed the

effect of section 175 of the Income Tax Ordinance, 2001.

18. It is also observed that where the search under

section 175 of the Income Tax Ordinance, 2001 has not

been subjected to the search procedure as required under the

Criminal Procedure Code, 1898, we cannot of our own

import that procedure or the provisions contained in section

40 of the Sales Tax Act, 1990 into section 175 Income Tax

Ordinance, 2001 nor we can of our own alleges omission on

the part of legislation in not mentioning. Rather we observe

that it was with reasons because sub-section 7 of section

175 of the Income Tax Ordinance, 2001, was given an

overriding effect over any rule or law relating to privileges

or the public interest in relation to access to premises or

places and searches, examination of record, impounding

documents/computers that is carried out under the mandate

of above sub-sections. Similarly, the law mandated the

respondents to be given full and free access to the premises

14

without prior notice and involving police for search was

never the intention of legislation.

19. For the aforesaid reasons, we are thus clear in

our mind that the action taken by the respondents cannot be

termed as illegal, the respondents acted within the para-

meters set by section 175 of the Income Tax Ordinance,

2001 and in no way can be termed as without jurisdiction.

20. This and the connected writ petitions are thus

not maintainable and dismissed.

CHIEF JUSTICE

JUDGE

Announced.

Dated: 01.06.2017.

*T.Shah*

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The New Quantum Financial SystemDocument10 pagesThe New Quantum Financial SystemMartin100% (4)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- GAD Proposal December 2018Document11 pagesGAD Proposal December 2018Noryn SarenceNo ratings yet

- Chinese Triad SocietyDocument2 pagesChinese Triad SocietyEmhil Natividad Flores100% (1)

- CISO Roles ResponsibilitiesDocument6 pagesCISO Roles ResponsibilitiesVignesh KumarNo ratings yet

- Case Digest On Criminal Law IDocument2 pagesCase Digest On Criminal Law IVanessa Yvonne GurtizaNo ratings yet

- 2017LHC3575Document6 pages2017LHC3575Muhammad Ilyas ShafiqNo ratings yet

- REGULATIONSDocument4 pagesREGULATIONSMuhammad Ilyas ShafiqNo ratings yet

- SECP Guide on Converting Company StatusDocument16 pagesSECP Guide on Converting Company StatuszuunaNo ratings yet

- How to Register an NGO as a Non-Profit Company in PakistanDocument49 pagesHow to Register an NGO as a Non-Profit Company in PakistanWaqar MughalNo ratings yet

- Agreement TilesSupply 20150726Document6 pagesAgreement TilesSupply 20150726Muhammad Ilyas ShafiqNo ratings yet

- Companies Act 2017Document430 pagesCompanies Act 2017Abdul MuneemNo ratings yet

- PPFAS EGM NoticeDocument12 pagesPPFAS EGM NoticeMuhammad Ilyas ShafiqNo ratings yet

- Agreement TilesSupply 20150726Document6 pagesAgreement TilesSupply 20150726Muhammad Ilyas ShafiqNo ratings yet

- SECP Guide on Converting Company StatusDocument16 pagesSECP Guide on Converting Company StatuszuunaNo ratings yet

- MCB ChallanDocument4 pagesMCB ChallanMuhammad Ilyas Shafiq71% (7)

- Pra 5%Document2 pagesPra 5%Muhammad Ilyas ShafiqNo ratings yet

- Annual Report 2013Document120 pagesAnnual Report 2013Muhammad Ilyas ShafiqNo ratings yet

- 2015 LHC 5713Document11 pages2015 LHC 5713Muhammad Ilyas ShafiqNo ratings yet

- Chart of Accounts PDFDocument15 pagesChart of Accounts PDFMuhammad Ilyas ShafiqNo ratings yet

- Noon SML App GeneDocument29 pagesNoon SML App GeneMuhammad Ilyas ShafiqNo ratings yet

- C A 876-879of2005 PDFDocument79 pagesC A 876-879of2005 PDFMuhammad Ilyas ShafiqNo ratings yet

- C A 876-879of2005 PDFDocument79 pagesC A 876-879of2005 PDFMuhammad Ilyas ShafiqNo ratings yet

- HuddocDocument15 pagesHuddocMuhammad Ilyas ShafiqNo ratings yet

- 2011 PTD (Trib.) 936 PDFDocument13 pages2011 PTD (Trib.) 936 PDFMuhammad Ilyas ShafiqNo ratings yet

- Deed of PartnershipDocument5 pagesDeed of PartnershipMuhammad Ilyas ShafiqNo ratings yet

- Syllabus LLBDocument26 pagesSyllabus LLBshahbaztahir92% (12)

- Cyprus QuestionDocument9 pagesCyprus QuestionMuhammad Ilyas ShafiqNo ratings yet

- Film Analysis Guilty by SuspicionDocument2 pagesFilm Analysis Guilty by SuspicioncardeguzmanNo ratings yet

- Did New World Order Fabians Murder John Smith MP ?Document3 pagesDid New World Order Fabians Murder John Smith MP ?justgiving100% (5)

- People of The State of California v. Moore - Document No. 4Document2 pagesPeople of The State of California v. Moore - Document No. 4Justia.comNo ratings yet

- Annotated BibliographyDocument14 pagesAnnotated BibliographyJohn GainesNo ratings yet

- Finkelhor y Browne (1985) The Traumatic Impact of Child Sexual AbuseDocument12 pagesFinkelhor y Browne (1985) The Traumatic Impact of Child Sexual AbuseDaniel Mella100% (1)

- ElGamal - A Public Key Cryptosystem and A Signature Scheme Based On Discrete Logarithms ElGamalDocument4 pagesElGamal - A Public Key Cryptosystem and A Signature Scheme Based On Discrete Logarithms ElGamalemersoncpazNo ratings yet

- Brain TeasersDocument5 pagesBrain TeasersSwami KarunakaranandaNo ratings yet

- Magsumbol vs. People 743 SCRA 188, November 26, 2014Document6 pagesMagsumbol vs. People 743 SCRA 188, November 26, 2014CHENGNo ratings yet

- Rule 132 Section 34 - Offer of Evidence Conviction UpheldDocument2 pagesRule 132 Section 34 - Offer of Evidence Conviction UpheldDan LocsinNo ratings yet

- Sujit - Tiwari - Vs - State - of - Gujarat - 10102018 - GUJHC (FN - 35) J.P-8.15Document38 pagesSujit - Tiwari - Vs - State - of - Gujarat - 10102018 - GUJHC (FN - 35) J.P-8.15Rahul kumarNo ratings yet

- Khadija Khan B.ALL.B 2 Year (4 Semester) Internal Assessment 3 Criminal LawDocument4 pagesKhadija Khan B.ALL.B 2 Year (4 Semester) Internal Assessment 3 Criminal Lawkhadija khanNo ratings yet

- A Study of Child Abuse in India: Current Issues and PreventionDocument5 pagesA Study of Child Abuse in India: Current Issues and PreventionEditor IJTSRDNo ratings yet

- Republic Act 9231 For Elective ReportDocument22 pagesRepublic Act 9231 For Elective ReportKhareen LinaoNo ratings yet

- Fiction Versus RealityDocument6 pagesFiction Versus RealityKara HearleyNo ratings yet

- Act No. 2 of 2021the Cyber Security and Cyber CrimesDocument49 pagesAct No. 2 of 2021the Cyber Security and Cyber CrimesKaso MuseNo ratings yet

- معلومات إرشادية بشأن مشاركة المتضررين في إجراءات المحكمة الخاصة بلبنانDocument26 pagesمعلومات إرشادية بشأن مشاركة المتضررين في إجراءات المحكمة الخاصة بلبنانSpecial Tribunal for LebanonNo ratings yet

- Indian Penal Code - Comparative Study of CulpabDocument16 pagesIndian Penal Code - Comparative Study of CulpabPhotos LSSDNo ratings yet

- IPC - Section 498 A and Arnesh Kumar V State of BiharDocument30 pagesIPC - Section 498 A and Arnesh Kumar V State of BiharDivya Arora100% (1)

- Cybercrime2 1Document6 pagesCybercrime2 1Clarito LopezNo ratings yet

- Pakistan & Karakoram HighwayDocument399 pagesPakistan & Karakoram HighwayAnonymous 74EiX2Mzgc80% (5)

- GSVDocument10 pagesGSVfitriaNo ratings yet

- Domestic ViolenceDocument2 pagesDomestic ViolenceIsrar AhmadNo ratings yet

- Defilement CaseDocument5 pagesDefilement CaseWat KenNo ratings yet

- 3400 Bags of Heroin Seized by Hampden District Attorney Gulluni's Narcotics TaskforceDocument2 pages3400 Bags of Heroin Seized by Hampden District Attorney Gulluni's Narcotics TaskforceJim LeydonNo ratings yet

- Domestic ViolenceDocument10 pagesDomestic ViolenceAnkit GuptaNo ratings yet