Professional Documents

Culture Documents

Bluntly Media Valuatio1

Bluntly Media Valuatio1

Uploaded by

kundanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bluntly Media Valuatio1

Bluntly Media Valuatio1

Uploaded by

kundanCopyright:

Available Formats

Bluntly Media Valuation

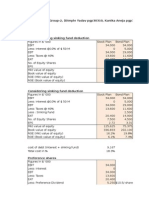

WACC calculation

For WACC, I assumed MRP as 5% and beta calculated from the exhibit 9 of the betas. For beta

calculation I have taken average unlevered beta which is given and for D/E ratio, I took average Debt and

average equity.

Formula to cal. Levered beta= unlevered beta*(1+ (1-tax)D/E ratio).

Risk free rate and cost of debt are given. For cost of equity I used CAPM model.

WACC= D/V*Kd(1-tax)+E/V*Ke = 5.7%

PV of the firm by FCFF

Assumed growth rate taken was 3%, as it should not be taken more than the industry growth, I can also

took max 3.2% not more than that.

Sales predicted on the basis of assumed growth rate.

Cost of sale, operating expenses, other current assets and depreciation predicted on the basis of the

average of previous years.

Working capital= current assets – current liabilities

Capex= change in Fixed Assets

FCFF= EBIT(1-tax) + depreciation – change in WC – Capex

PV of intermediate CF= PV of all the cash flows given @WACC calculated.

=NPV(B53,F38:J38)

PV of Terminal Value =K39/((1+B53)^6), this is for 6 years @WACC calculated for the calculated

TV.

So, PV of the firm calculated by adding PV of Intermediate CF and PV of Terminal Value.

PV of the Firm= ₹ 22,359.15

You might also like

- Iz-Lynn Chan at Far East Organization Case Study AnswerDocument2 pagesIz-Lynn Chan at Far East Organization Case Study AnswerfahadNo ratings yet

- Micoderm v0.2Document21 pagesMicoderm v0.2Glory100% (1)

- Bioco: Preparation SheetDocument0 pagesBioco: Preparation SheetMss BranchesNo ratings yet

- CASE SUBMISSION - "Buffett's Bid For Media General's Newspapers"Document8 pagesCASE SUBMISSION - "Buffett's Bid For Media General's Newspapers"Dahagam SaumithNo ratings yet

- Bioco Case StudyDocument10 pagesBioco Case StudyAntónio SoeiroNo ratings yet

- A2 - Group 1Document4 pagesA2 - Group 1Tanmay Tiwari100% (4)

- Valuing A Cross Border LBO - Yell GroupDocument5 pagesValuing A Cross Border LBO - Yell GroupSameer Kumar0% (1)

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media GeneralDahagam Saumith100% (1)

- Working Capital Management: Case: ALAC InternationalDocument55 pagesWorking Capital Management: Case: ALAC Internationaljk kumarNo ratings yet

- Decision Tree For High Places Studio (A) Decision TreeDocument1 pageDecision Tree For High Places Studio (A) Decision TreeTina Dulla100% (1)

- Friendly Cards CaseDocument3 pagesFriendly Cards CaseJeff Farley50% (2)

- Case #1 Bluntly MediaDocument3 pagesCase #1 Bluntly MediaAlexandra Bento50% (2)

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Jennifer Gaston HRMDocument9 pagesJennifer Gaston HRMvrj1091No ratings yet

- Ust Inc Case SolutionDocument16 pagesUst Inc Case SolutionJamshaid Mannan100% (2)

- Session 10 - Simulation QuestionsDocument6 pagesSession 10 - Simulation QuestionsChetan Duddagi75% (4)

- This Study Resource Was: Stryker Corp: In-Sourcing PcbsDocument5 pagesThis Study Resource Was: Stryker Corp: In-Sourcing PcbsHina SaharNo ratings yet

- Case 35 Deluxe CorporationDocument6 pagesCase 35 Deluxe CorporationCarmelita EsclandaNo ratings yet

- Dollarama Case DCFDocument22 pagesDollarama Case DCFDaniel Jinhong Park20% (5)

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Shuman Automotive CaseDocument5 pagesShuman Automotive CaseAndyChrzaszcz50% (2)

- Srikant BluntlyMediaDocument3 pagesSrikant BluntlyMediaSrikant SharmaNo ratings yet

- BBBY Case ExerciseDocument7 pagesBBBY Case ExerciseSue McGinnisNo ratings yet

- Case 11 Group 1 PDFDocument56 pagesCase 11 Group 1 PDFRumana ShornaNo ratings yet

- ALAC International - Working Capital FinancingDocument8 pagesALAC International - Working Capital FinancingAjith SudhakaranNo ratings yet

- Polyphonic Case StudyDocument11 pagesPolyphonic Case StudyVincentMBA100% (1)

- The Business Plan NotesDocument4 pagesThe Business Plan NotesSrikantNo ratings yet

- Mehak Bluntly MediaDocument18 pagesMehak Bluntly Mediahimanshu sagarNo ratings yet

- Mci Takeover Battle AnalysisDocument13 pagesMci Takeover Battle AnalysisAastha Swaroop50% (2)

- Cabot Pharma. Case ReportDocument3 pagesCabot Pharma. Case ReportdrdeathNo ratings yet

- Hill Country Snack Foods CoDocument1 pageHill Country Snack Foods CoKriti AhujaNo ratings yet

- Resolución Caso AmeritradeDocument39 pagesResolución Caso AmeritradeHernan EscuderoNo ratings yet

- Berkshire PartnersDocument2 pagesBerkshire PartnersAlex TovNo ratings yet

- Bidding On The Yell Group - Prasann S - 2015PGP334Document3 pagesBidding On The Yell Group - Prasann S - 2015PGP334Prasann ShahNo ratings yet

- Jones Electrical DistributionDocument5 pagesJones Electrical DistributionAsif AliNo ratings yet

- Hill Country Snack Foods Co - UDocument4 pagesHill Country Snack Foods Co - Unipun9143No ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Friendly CS SolutionDocument8 pagesFriendly CS SolutionEfendiNo ratings yet

- Marsh Supermarkets Inc CaseDocument11 pagesMarsh Supermarkets Inc CaseMakarand Takale75% (4)

- Continental CarriersDocument6 pagesContinental CarriersVishwas Nandan100% (1)

- PropeciaDocument14 pagesPropeciamathangiNo ratings yet

- Outreach NetworksDocument3 pagesOutreach NetworksPaco Colín50% (2)

- Continental CarriersDocument10 pagesContinental Carriersnipun9143No ratings yet

- Reversing The AMD Fusion Launch (Case Study)Document6 pagesReversing The AMD Fusion Launch (Case Study)SanyamRajvanshiNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Midland EnergyDocument9 pagesMidland EnergyPrashant MishraNo ratings yet

- Glaxo ItaliaDocument11 pagesGlaxo ItaliaLizeth RamirezNo ratings yet

- Accounting For Frequent Fliers CaseDocument15 pagesAccounting For Frequent Fliers CaseGlenPalmer50% (2)

- Yell PresentationDocument27 pagesYell PresentationSounak DuttaNo ratings yet

- DeluxeDocument4 pagesDeluxeshielamaeNo ratings yet

- Natureview Farm Case StudyDocument12 pagesNatureview Farm Case StudyAditya R Mohan100% (2)

- Sealed Air Corporation's Leveraged Recapitalization (A)Document7 pagesSealed Air Corporation's Leveraged Recapitalization (A)Jyoti GuptaNo ratings yet

- Corp Gov Group1 - Sealed AirDocument5 pagesCorp Gov Group1 - Sealed Airdmathur1234No ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

- Group2 - Clarkson Lumber Company Case AnalysisDocument3 pagesGroup2 - Clarkson Lumber Company Case AnalysisDavid WebbNo ratings yet

- Midterm Review - Key ConceptsDocument10 pagesMidterm Review - Key ConceptsGurpreetNo ratings yet

- Valuation of Corporation: Drivers of Value CreationDocument60 pagesValuation of Corporation: Drivers of Value CreationUzzaam HaiderNo ratings yet

- Financial Management - Kendle QuesuestionsDocument4 pagesFinancial Management - Kendle QuesuestionsDr Rushen SinghNo ratings yet

- Risk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had ADocument18 pagesRisk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had AAshutosh TulsyanNo ratings yet

- DCF Valuation - Aswath DamodaranDocument60 pagesDCF Valuation - Aswath DamodaranUtkarshNo ratings yet

- Integrated Services Marketing Communications: Provider GAP 4Document20 pagesIntegrated Services Marketing Communications: Provider GAP 4SrikantNo ratings yet

- GUIDE To The Library Classification System: Austin Community College Library Services 7/30/2015, B. YoungDocument2 pagesGUIDE To The Library Classification System: Austin Community College Library Services 7/30/2015, B. YoungSrikantNo ratings yet

- Revised 21-26th NOVDocument2 pagesRevised 21-26th NOVSrikantNo ratings yet

- SM FinalDocument23 pagesSM FinalSrikantNo ratings yet

- Session Plan - Services Marketing 2015-17 BatchDocument8 pagesSession Plan - Services Marketing 2015-17 BatchSrikantNo ratings yet

- Pricing CaseDocument6 pagesPricing CaseSrikantNo ratings yet

- Case StudyDocument7 pagesCase StudySrikantNo ratings yet

- HBR StrategiesDocument64 pagesHBR StrategiesSrikantNo ratings yet

- School of Business, Public Policy and Social EntrepreneurshipDocument5 pagesSchool of Business, Public Policy and Social EntrepreneurshipSrikantNo ratings yet

- Business Research: Assignment ST. Mary Maternity HospitalDocument15 pagesBusiness Research: Assignment ST. Mary Maternity HospitalSrikantNo ratings yet

- Ayush SendDocument6 pagesAyush SendSrikantNo ratings yet