Professional Documents

Culture Documents

Worksheet valuation model for Robertson company

Uploaded by

Saksham GoyalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Worksheet valuation model for Robertson company

Uploaded by

Saksham GoyalCopyright:

Available Formats

-1-

WORKSHEET TO ACCOMPANY YOUR ANSWER BOOKLET

Name:_________________________________ Roll Number:_____________________________________

WORKSHEET 1: ASSUMPTIONS

2002 2003 2004 2005 2006 2007

2%

Annual Growth Rate of sales

40%

Income tax rate

45%

Net Working Capital/ Sales ratio

35%

PP&E / Sales

Discount rate

Terminal Growth Rate

-2-

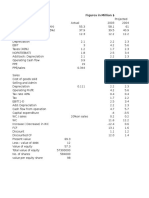

WORKSHEET 2: VALUATION BASE MODEL ASSUMING IMPROVEMENTS IN OPERATIONS REALISED

2002

Actual 2003 2004 2005 2006 2007

Cost of Goods Sold / Sales 68.0%

SGA / Sales 22.0%

Sales 55.3

Cost of Goods Sold 37.9

SG&A 12.3

Depreciation 2.1

Other

EBIT 3.0

Taxes 1.2

EBIAT 1.8

Depreciation 2.1

Cash Flows from Operations 3.9

-3-

2003 2004 2005 2006 2007

Cash Flows from Operations (FROM PREVIOUS

SHEET)

Deduct Change in NWC

Deduct Capital Expenditures

Deduct Change in Other Assets

Cash Flow to Capital

Terminal Value of Cash Flows to Capital

Present Value of Cash Flows to Capital

Present Value of Terminal Value

Total Present Value of Cash Flows to Capital

Debt Outstanding at Acquisition Date

Present Value of Common Stock

Present Value of Robertson Common Stock per

Share

-4-

WORKSHEET 3: VALUATION ASSUMING NET WORKING CAPITAL IN LINE WITH BEST AMONG COMPARABLE

COMPANIES + OTHER IMPROVEMENTS CONSIDERED IN BASE CASE

2002

Actual 2003 2004 2005 2006 2007

Cost of Goods Sold / Sales 68.0%

SGA / Sales 22.0%

Sales 55.3

Cost of Goods Sold 37.9

SG&A 12.3

Depreciation 2.1

Other

EBIT 3.0

Taxes 1.2

EBIAT 1.8

Depreciation 2.1

Cash Flows from Operations 3.9

-5-

2003 2004 2005 2006 2007

Cash Flows from Operations (FROM PREVIOUS

PAGE)

Deduct Change in NWC

Deduct Capital Expenditures

Deduct Change in Other Assets

Cash Flow to Capital

Terminal Value of Cash Flows to Capital

Present Value of Cash Flows to Capital

Present Value of Terminal Value

Total Present Value of Cash Flows to Capital

Debt Outstanding at Acquisition Date

Present Value of Common Stock

Present Value of Robertson Common Stock per

Share

You might also like

- Monmouth Case SolutionDocument19 pagesMonmouth Case SolutionAkshat Nayer40% (10)

- Valuation Analysis For Robertson ToolDocument5 pagesValuation Analysis For Robertson ToolPedro José ZapataNo ratings yet

- Taos Museum of Southwestern Arts and CraftsDocument11 pagesTaos Museum of Southwestern Arts and Craftssourovkhan0% (1)

- CH 04Document56 pagesCH 04Hiền AnhNo ratings yet

- BAV Model v4.7Document26 pagesBAV Model v4.7jess236No ratings yet

- Analyze Martin Manufacturing's financial positionDocument2 pagesAnalyze Martin Manufacturing's financial positionSean Chris ConsonNo ratings yet

- GE's Talent Machine: Developing Leaders at GEDocument15 pagesGE's Talent Machine: Developing Leaders at GEhyjwf100% (1)

- Rural Marketing Course Outline PDFDocument4 pagesRural Marketing Course Outline PDFSaksham GoyalNo ratings yet

- Case Study - Swiss ArmyDocument16 pagesCase Study - Swiss Armydineshmaan50% (2)

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDocument1 pageSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNo ratings yet

- DCF Analysis for Robertson Tool CompanyDocument14 pagesDCF Analysis for Robertson Tool Companyhao pengNo ratings yet

- Monmouth VfinalDocument6 pagesMonmouth VfinalAjax100% (1)

- Trent LTD - 2023.07.01Document34 pagesTrent LTD - 2023.07.01pulkitnarang1606No ratings yet

- Trent LTD - 2023.06.03Document34 pagesTrent LTD - 2023.06.03pulkitnarang1606No ratings yet

- Monmouth Inc Figures in Million $Document3 pagesMonmouth Inc Figures in Million $amanNo ratings yet

- Robertson Tool Company Operating and Financial Data 1998-2002Document7 pagesRobertson Tool Company Operating and Financial Data 1998-2002dineshjn20000% (2)

- 3 Companies CS - Calculations 2022Document27 pages3 Companies CS - Calculations 2022shubhangi.jain582No ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAnuj SaxenaNo ratings yet

- 1 - Nike Cost of CapitalDocument8 pages1 - Nike Cost of CapitalJayzie LiNo ratings yet

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataAjax0% (1)

- Net Synergies and Valuation of SBC Acquisition of AT&TDocument16 pagesNet Synergies and Valuation of SBC Acquisition of AT&TAnonymous 5z7ZOpNo ratings yet

- Cost of Capital - NikeDocument6 pagesCost of Capital - NikeAditi KhaitanNo ratings yet

- Millions of Dollars Except Per-Share DataDocument23 pagesMillions of Dollars Except Per-Share DataPedro José ZapataNo ratings yet

- Monmouth Case SolutionDocument16 pagesMonmouth Case SolutionAjaxNo ratings yet

- Cash Flow Analysis Col Pal 13-07-2023Document17 pagesCash Flow Analysis Col Pal 13-07-2023RohitNo ratings yet

- Millions of Dollars Except Per-Share DataDocument7 pagesMillions of Dollars Except Per-Share DataalejandroNo ratings yet

- Financial Analysis - WalmartDocument3 pagesFinancial Analysis - WalmartLuka KhmaladzeNo ratings yet

- Five-Year Performance OverviewDocument2 pagesFive-Year Performance OverviewAjees AhammedNo ratings yet

- AAP Q4 2022 Earnings - FinalDocument10 pagesAAP Q4 2022 Earnings - FinalDaniel KwanNo ratings yet

- (041621) Nike, Inc. - Cost of CapitalDocument8 pages(041621) Nike, Inc. - Cost of CapitalPutri Alya RamadhaniNo ratings yet

- 1Q14 Earnings Conference Call: A Leader in Alternative Investments in Latin AmericaDocument22 pages1Q14 Earnings Conference Call: A Leader in Alternative Investments in Latin AmericaPedro Cabral RovieriNo ratings yet

- Flujo de Caja NvtaDocument14 pagesFlujo de Caja NvtaPablo Alejandro JaldinNo ratings yet

- Lloyds Banking Group PLC 2017 Q1 RESULTSDocument33 pagesLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobNo ratings yet

- MonmouthDocument28 pagesMonmouthAndrew SumirNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Half-Year Financial: Interim Report AS OF JUNE 30, 2020Document54 pagesHalf-Year Financial: Interim Report AS OF JUNE 30, 2020Rathawit SingpanjanateeNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. Zenderrohin gargNo ratings yet

- Presentation of M.S &SDocument22 pagesPresentation of M.S &SArun SanalNo ratings yet

- Anexo 2: Selected Linear Financial Data in Millions of Dollars (Except Share Data), 1992-2003Document7 pagesAnexo 2: Selected Linear Financial Data in Millions of Dollars (Except Share Data), 1992-2003Milton Raul Rivas saballosNo ratings yet

- Evaluating Financial Performance: Finance Jaime F. ZenderDocument33 pagesEvaluating Financial Performance: Finance Jaime F. ZenderYudi Ahmad FaisalNo ratings yet

- Annual Financials For Funskool Inc.: View RatiosDocument16 pagesAnnual Financials For Funskool Inc.: View RatiosJames19898No ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Quartely Income Statement, Since 2011Document66 pagesQuartely Income Statement, Since 2011ionela.neagu.30No ratings yet

- Income Statement AnalysisDocument6 pagesIncome Statement AnalysisMohammad Al AkoumNo ratings yet

- Lbo W DCF Model SampleDocument33 pagesLbo W DCF Model Samplejulita rachmadewiNo ratings yet

- Strategic Management BookletDocument29 pagesStrategic Management Bookletmismail306No ratings yet

- 2015 Schaeffler Annual Report enDocument336 pages2015 Schaeffler Annual Report enAshwin Hemant LawanghareNo ratings yet

- Compilation Notes Financial Statement AnalysisDocument8 pagesCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNo ratings yet

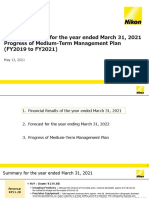

- Nikon 2021 Fiscal Year Financial ReportDocument48 pagesNikon 2021 Fiscal Year Financial ReportNikonRumorsNo ratings yet

- PNX Income Statement AnalysisDocument12 pagesPNX Income Statement AnalysisDave Emmanuel SadunanNo ratings yet

- Ericsson Financial Report 2023 Q3Document50 pagesEricsson Financial Report 2023 Q3Ahmed HussainNo ratings yet

- Lenovo Intergration Plan Annual 2004 PresentationDocument26 pagesLenovo Intergration Plan Annual 2004 PresentationKelvin Lim Wei LiangNo ratings yet

- Pt11. Equity AnalysisDocument20 pagesPt11. Equity AnalysisANASTASIA AMEILIANo ratings yet

- Nike - Case StudyDocument9 pagesNike - Case StudyAnchal ChokhaniNo ratings yet

- Nike - Case Study MeenalDocument9 pagesNike - Case Study MeenalAnchal ChokhaniNo ratings yet

- 3 Statement Model - BlankDocument6 pages3 Statement Model - BlankAina MichaelNo ratings yet

- Emerson q2 Earnings Conference Call Presentation en Us 7508616Document27 pagesEmerson q2 Earnings Conference Call Presentation en Us 7508616samsNo ratings yet

- WackerDocument200 pagesWackerpetar2001No ratings yet

- Full Advanced Accounting Jeter 5Th Edition Solutions Manual PDF Docx Full Chapter ChapterDocument36 pagesFull Advanced Accounting Jeter 5Th Edition Solutions Manual PDF Docx Full Chapter Chapterpermutestupefyw1tod100% (22)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Predictive Modelsfor Election Results - Full PaperDocument11 pagesPredictive Modelsfor Election Results - Full PaperSaksham GoyalNo ratings yet

- Mathematical Modeling for Real-World Management ProblemsDocument2 pagesMathematical Modeling for Real-World Management ProblemsSaksham GoyalNo ratings yet

- Term IV CoursesDocument3 pagesTerm IV CoursesSaksham GoyalNo ratings yet

- Single MC Scheduling-ProblemDocument1 pageSingle MC Scheduling-ProblemSaksham GoyalNo ratings yet

- Classification TreeDocument1 pageClassification TreeSaksham GoyalNo ratings yet

- BDMDMDocument2 pagesBDMDMSaksham GoyalNo ratings yet

- Valuation - 10 Sessions Course OverviewDocument1 pageValuation - 10 Sessions Course OverviewSaksham GoyalNo ratings yet

- 20 Session Financial Modelling - Rajiv BhutaniDocument6 pages20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNo ratings yet

- IIM Nagpur 2018 Project Finance Reading RequirementsDocument3 pagesIIM Nagpur 2018 Project Finance Reading RequirementsSaksham GoyalNo ratings yet

- SCM Assignment 2:: 1. Decision ProblemDocument1 pageSCM Assignment 2:: 1. Decision ProblemSaksham GoyalNo ratings yet

- Key Ratios Comparable Cos.Document1 pageKey Ratios Comparable Cos.Saksham GoyalNo ratings yet

- Corporate Valuations Preparation QuestionsDocument3 pagesCorporate Valuations Preparation QuestionsSaksham GoyalNo ratings yet

- IMC Course Covers Promo Tools, Planning, Eco-SystemDocument7 pagesIMC Course Covers Promo Tools, Planning, Eco-SystemSaksham GoyalNo ratings yet

- Management - Entrepreneurship For The Development Sector - Course OutlineDocument2 pagesManagement - Entrepreneurship For The Development Sector - Course OutlineSaksham GoyalNo ratings yet

- FSA Description T5Document1 pageFSA Description T5Saksham GoyalNo ratings yet

- Project Appraisal and Financing Course OutlineDocument3 pagesProject Appraisal and Financing Course OutlineSaksham GoyalNo ratings yet

- Project Appraisal and Financing IIM Nagpur - Full Course OutlineDocument3 pagesProject Appraisal and Financing IIM Nagpur - Full Course OutlineSaksham GoyalNo ratings yet

- BDMDM Course Outline 2018-19Document4 pagesBDMDM Course Outline 2018-19Saksham GoyalNo ratings yet

- The Example Is Based On A Firm With Forecasted Revenues of 20Document1 pageThe Example Is Based On A Firm With Forecasted Revenues of 20Saksham GoyalNo ratings yet

- The Value of Investment Banking Relationships - Research Paper IIDocument36 pagesThe Value of Investment Banking Relationships - Research Paper IISaksham GoyalNo ratings yet

- Term IV CoursesDocument3 pagesTerm IV CoursesSaksham GoyalNo ratings yet

- Advanced Marketing Research - 2017-18Document3 pagesAdvanced Marketing Research - 2017-18Naveen ChoudhuryNo ratings yet

- Strategic Marketing - Course OutlineDocument3 pagesStrategic Marketing - Course OutlineSaksham GoyalNo ratings yet

- 20 Session Financial Modelling - Rajiv BhutaniDocument6 pages20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNo ratings yet

- Supply Chain Management Course OutlineDocument2 pagesSupply Chain Management Course OutlineSaksham GoyalNo ratings yet

- 20 Session Financial Modelling - Rajiv BhutaniDocument6 pages20 Session Financial Modelling - Rajiv BhutaniSaksham GoyalNo ratings yet

- Outline - Advanced Analytics 2017-19Document2 pagesOutline - Advanced Analytics 2017-19Saksham GoyalNo ratings yet

- BFMS Course OutlineDocument5 pagesBFMS Course OutlineSaksham GoyalNo ratings yet

- Letter To Builder For VATDocument5 pagesLetter To Builder For VATPrasadNo ratings yet

- Managing Services & Designing ChaptersDocument6 pagesManaging Services & Designing Chaptersshannen robinNo ratings yet

- Sending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPDocument4 pagesSending DDDDWith Multiple Tabs of Excel As A Single Attachment in ABAPKumar Krishna KumarNo ratings yet

- Internship PresentationDocument3 pagesInternship Presentationapi-242871239No ratings yet

- ANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Document41 pagesANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Georgios XydeasNo ratings yet

- SMDDocument2 pagesSMDKhalil Ur RehmanNo ratings yet

- O2C Cycle in CloudDocument24 pagesO2C Cycle in Cloudmani100% (1)

- Econ 201 MicroeconomicsDocument19 pagesEcon 201 MicroeconomicsSam Yang SunNo ratings yet

- SLEMCoopDocument3 pagesSLEMCoopPaul Dexter GoNo ratings yet

- Congson Vs NLRCDocument2 pagesCongson Vs NLRCDan Christian Dingcong CagnanNo ratings yet

- Bangalore University SullabusDocument35 pagesBangalore University SullabusJayaJayashNo ratings yet

- APSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Document28 pagesAPSS1B17 - Contemporary Chinese Society and Popcult - L2 (Week 3)Arvic LauNo ratings yet

- ARCHITECTURAL INTERNSHIP ReportDocument41 pagesARCHITECTURAL INTERNSHIP ReportsinafikebekeleNo ratings yet

- Syllabus Corporate GovernanceDocument8 pagesSyllabus Corporate GovernanceBrinda HarjanNo ratings yet

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxNo ratings yet

- English For Hotel-1-1Document17 pagesEnglish For Hotel-1-1AQilla ZaraNo ratings yet

- PDFDocument14 pagesPDFBibhuti B. Bhardwaj100% (1)

- B&O Annual Report 2015-16Document136 pagesB&O Annual Report 2015-16anon_595151453No ratings yet

- Prepaid Shipping TitleDocument2 pagesPrepaid Shipping TitleShivam AroraNo ratings yet

- How industrial engineering can optimize mining operationsDocument6 pagesHow industrial engineering can optimize mining operationsAlejandro SanchezNo ratings yet

- Consumer Buying Behaviour - FEVICOLDocument10 pagesConsumer Buying Behaviour - FEVICOLShashank Joshi100% (1)

- Balance ScorecardDocument11 pagesBalance ScorecardParandeep ChawlaNo ratings yet

- Deloitte Supply Chain Analytics WorkbookDocument0 pagesDeloitte Supply Chain Analytics Workbookneojawbreaker100% (1)

- Sri Ganesh Engg - ProfileDocument19 pagesSri Ganesh Engg - Profileshikharc100% (1)

- GEAR 2030 Final Report PDFDocument74 pagesGEAR 2030 Final Report PDFAnonymous IQlte8sNo ratings yet

- Det Syll Divisional Accountant Item No 19Document2 pagesDet Syll Divisional Accountant Item No 19tinaantonyNo ratings yet

- Take RisksDocument3 pagesTake RisksRENJITH RNo ratings yet