Professional Documents

Culture Documents

Finance Banking Fundamentals India Formulae Sheet 19082016 PDF

Finance Banking Fundamentals India Formulae Sheet 19082016 PDF

Uploaded by

sahilku0 ratings0% found this document useful (0 votes)

16 views1 pageOriginal Title

Finance_Banking_Fundamentals_India_Formulae_Sheet_19082016.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views1 pageFinance Banking Fundamentals India Formulae Sheet 19082016 PDF

Finance Banking Fundamentals India Formulae Sheet 19082016 PDF

Uploaded by

sahilkuCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

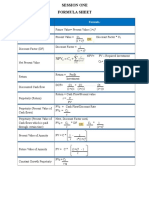

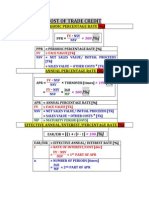

Finance & Banking Fundamentals

List of Formulae

Simple Interest (S.I) = P*r*t/100

Compound Interest (C.I) = [P*(1+r/100)^t – P]

CAGR = [(Final Value/Initial Value)^1/n]- 1

FV = PV*(1+r/100)^t

PV = FV/(1+r/100)^t

= PV of all cash inflows-PV of all cash outflows

NPV

e.g: NPV = -PV (C1) + PV (C2) + PV (C3)….

Inflation = Nominal Rate of Interest - Real Rate of Interest

= (Market value of the fund investments + Income receivable - Expenses payable)/

NAV

Total no. of Outstanding units

Market capitalization = Market Price * Number of Outstanding Shares of the Company

(cap for short)

Bond Price = Σ C / (1 + r /m )^m*t

C = Coupon or Cash flows

r = Yield Rate in the Market

m = Number of times compounding happens in a year

t = Time period in years

Trading Position = Total Purchases- Total Sales (could be in value or in quantity)

Spread = Average Lending Rate – Average Deposit Rate

NII = Interest Earned on Loans - Interest Paid on Deposits

Risk Weighted Assets = Asset Value*Risk Weight Assigned

CRAR =Capital/ Risk Weighted Assets (Term used for NBFCs)

Finance Charges = Interest Paid on Purchase Price for the Lease Period (Hire Purchase)

Lease Rental = [(Purchase Price ‐ Residual Value) + Finance Charges] /Lease Period

Net Owned Funds = Owners’ Equity – Losses (Term used for NBFCs)

www.learnwithflip.com

You might also like

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- Corporate Finance Formula SheetDocument9 pagesCorporate Finance Formula SheetWilliamNo ratings yet

- List of 63 Useful Exam Formulas For Paper F9Document4 pagesList of 63 Useful Exam Formulas For Paper F9Muhammad Imran UmerNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Financial Management Formula SheetDocument2 pagesFinancial Management Formula SheetSantosh Kumar100% (3)

- Management Advisory Services PDFDocument50 pagesManagement Advisory Services PDFDea Lyn Bacula100% (6)

- MTH302 All FormulasDocument5 pagesMTH302 All Formulasstudentcare mtnNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Foundations of Airport Economics and FinanceFrom EverandFoundations of Airport Economics and FinanceRating: 5 out of 5 stars5/5 (1)

- Finance & Banking Fundamentals IndiaDocument1 pageFinance & Banking Fundamentals IndiaMayank NandwaniNo ratings yet

- Finance & Banking Fundamentals India Formulae SheetDocument1 pageFinance & Banking Fundamentals India Formulae Sheetshweta mandiliaNo ratings yet

- Important FormulasDocument5 pagesImportant FormulasKhalil AkramNo ratings yet

- Wealth Management: (Page 1 of 2) (Printed Only On One Side)Document2 pagesWealth Management: (Page 1 of 2) (Printed Only On One Side)mohakbhutaNo ratings yet

- Session One FormulasDocument1 pageSession One FormulasSalarAliMemonNo ratings yet

- CheatSheet (Finance)Document1 pageCheatSheet (Finance)Guan Yu Lim100% (3)

- Corporate FinanceDocument10 pagesCorporate Financeandrea figueroaNo ratings yet

- FM II Midterm Formula SheetDocument1 pageFM II Midterm Formula SheetSalman J. SyedNo ratings yet

- Formula SheetDocument1 pageFormula SheetZhi Cheng OngNo ratings yet

- Formula SheetDocument3 pagesFormula SheetjainswapnilNo ratings yet

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoNo ratings yet

- TCM Formulae List Updated 05082015Document2 pagesTCM Formulae List Updated 05082015Anurag GuptaNo ratings yet

- Finance 3000 Midterm2 Formula Sheet: October 28, 2015Document2 pagesFinance 3000 Midterm2 Formula Sheet: October 28, 2015Jack JacintoNo ratings yet

- Corporate Finance - FormulasDocument3 pagesCorporate Finance - FormulasAbhijit Pandit100% (1)

- Formulae ListDocument2 pagesFormulae ListRohit ShawNo ratings yet

- Time LineDocument2 pagesTime LineM Mansoor HussainNo ratings yet

- EM302 Formula Sheet 2013Document4 pagesEM302 Formula Sheet 2013Jeff JabeNo ratings yet

- FIN3201 (F) Formula Sheet JAN2015Document3 pagesFIN3201 (F) Formula Sheet JAN2015natlyhNo ratings yet

- Formulae SheetDocument4 pagesFormulae SheetSameer SharmaNo ratings yet

- 08-b. Current Liabilities Management - Commercial Paper Formula, CommerceDocument2 pages08-b. Current Liabilities Management - Commercial Paper Formula, CommerceShohojShorolNo ratings yet

- AFM. Resources. Useful FormulasDocument4 pagesAFM. Resources. Useful FormulasAnonymous MeNo ratings yet

- 1 Rec Formula ResearchDocument20 pages1 Rec Formula Researchbhobot riveraNo ratings yet

- FRL 300 Formula Sheet Common FinalDocument3 pagesFRL 300 Formula Sheet Common FinalAnonymous WimU99ilUNo ratings yet

- CFM - FormulasDocument3 pagesCFM - FormulasAbhijit PanditNo ratings yet

- FM Formula Sheet 02Document2 pagesFM Formula Sheet 02Aninda DuttaNo ratings yet

- Financial Management FormulasDocument5 pagesFinancial Management Formulasrera zeoNo ratings yet

- CFIN Formula Sheet UpdatedDocument2 pagesCFIN Formula Sheet UpdatedChakri MunagalaNo ratings yet

- Formulas To LearnDocument3 pagesFormulas To LearnHuệ LêNo ratings yet

- Abm FormulasDocument39 pagesAbm FormulasYogambica Pilladi0% (1)

- Chapter 9 - FormulaDocument2 pagesChapter 9 - Formula2023607226No ratings yet

- FormulasDocument7 pagesFormulaskasimgenelNo ratings yet

- CFA Level I Formula SheetDocument27 pagesCFA Level I Formula SheetAnonymous P1xUTHstHT100% (4)

- I (P Q) - (V Q) - F: The Fundamental EquationDocument1 pageI (P Q) - (V Q) - F: The Fundamental Equationssregens82No ratings yet

- Market PriceDocument1 pageMarket PriceAdeeba NazNo ratings yet

- MGT201 Financial Management Formulas Lect 1 To 22Document13 pagesMGT201 Financial Management Formulas Lect 1 To 22Farhan UL HaqNo ratings yet

- Formula Sheet FIN 300Document3 pagesFormula Sheet FIN 300Stephanie NaamaniNo ratings yet

- Financial Management FormulasDocument9 pagesFinancial Management FormulasTannao100% (2)

- FINC 3511 - Corporate Finance - FormulasDocument2 pagesFINC 3511 - Corporate Finance - FormulasirquadriNo ratings yet

- SECTION 10 Need To KnowDocument2 pagesSECTION 10 Need To KnowAnisur RahmanNo ratings yet

- Fin 3101Document5 pagesFin 3101Park JiyeonNo ratings yet

- Fins1613 FormulasDocument7 pagesFins1613 FormulasEllia ChenNo ratings yet

- Formulas Finance AccountingDocument2 pagesFormulas Finance Accountingrera zeoNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)