Professional Documents

Culture Documents

Flowchart of Tax Remedies

Uploaded by

Kevin Patrick Magalona Degayo0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

149216191-Flowchart-of-Tax-Remedies.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesFlowchart of Tax Remedies

Uploaded by

Kevin Patrick Magalona DegayoCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

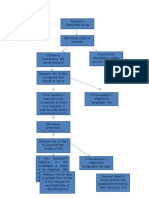

Taxpayer’s Submission of

Tax Returns

BIR issues Letter of

Authority

If there is discrepancy, BIR If there is no discrepancy,

sends Notice of Informal action will NOT be

Conference pursued.

Taxpayer has 15 days to

respond from receipt of

notice

If the taxpayer’s response If the taxpayer’s response

is not acceptable or there is acceptable, the action

is no response, it shall be will NOT be pursued.

endorsed to Assessment

Division

BIR issues preliminary

assessment notice (PAN)

Taxpayer has 15 days to

respond from receipt of

PAN

If the taxpayer’s response If the taxpayer’s response

is not acceptable or there is acceptable, the case is

is no response, BIR shall dismissed.

issue Final Assessment

Notice (FAN) & Letter of

Demand

Taxpayer has 30 days to

Taxpayer failed to timely

protest from receipt of FAN

protest, the assessment

(request for reconsideration

becomes final, executory

or reinvestigation)

and demandable.

Taxpayer protested within

30 days from receipt of

FAN.

Taxpayer has 60 days from

protest within which to

submit supporting

documents

BIR Commissioner has 180 If the taxpayer’s response

days from receipt of is acceptable, the case is

supporting documents dismissed

within which to act on the

protest

BIR Commissioner did not Taxpayer has 30 days from

act on the receipt of BIR’s denial

protest/unacted within which to appeal

claim/lapse of 180 day before the CTA Division

period

Taxpayer has 30 days from

receipt of BIR’s denial

within which to appeal

before the CTA Division

Taxpayermay file Petition

for Review before the CTA

Division

Petition dismissed. Petition granted.

Assessment null and void.

Taxpayer may file M/R

within 15 days from

receipt of decision

Motion denied. Motion granted.

Assessment null and void.

Taxpayer may file Petition

for Review before the CTA

En Banc

Petition dismissed. Petition granted.

Assessment null and void.

Taxpayer may file M/R

within 15 days from

receipt of decision

Motion denied. Motion granted.

Assessment null and void.

Taxpayer may file Petition

for Review before the SC

You might also like

- Tax Assessment ProcessDocument1 pageTax Assessment ProcessMarie MoralesNo ratings yet

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- Tax AssessmentDocument11 pagesTax AssessmentRon VillanuevaNo ratings yet

- Tax Remedies Flowchart (Revised)Document6 pagesTax Remedies Flowchart (Revised)GersonGamas0% (1)

- Tax Rem FlowchartDocument4 pagesTax Rem FlowchartDennisSaycoNo ratings yet

- Tax Review Q and A Quiz 1 and 2 FinalsDocument19 pagesTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaNo ratings yet

- Remedies Under Local Government CodeDocument15 pagesRemedies Under Local Government Codecmv mendoza100% (3)

- Tax Remedies SummaryDocument6 pagesTax Remedies Summarypja_14100% (2)

- Flowchart of Tax Remedies I. Remedies UnDocument12 pagesFlowchart of Tax Remedies I. Remedies UnKevin Ken Sison Ganchero100% (2)

- Tax Flowchart Remedies (Tokie)Document9 pagesTax Flowchart Remedies (Tokie)Tokie TokiNo ratings yet

- Tax Remedies ReviewerDocument9 pagesTax Remedies ReviewerheirarchyNo ratings yet

- Flowchart Remedies of A TaxpayerDocument2 pagesFlowchart Remedies of A TaxpayerRab Thomas BartolomeNo ratings yet

- 108 Republic of The Philippines v. Ret (Andojoyan)Document3 pages108 Republic of The Philippines v. Ret (Andojoyan)Mich Kristine BANo ratings yet

- Assessment Process FlowchartDocument4 pagesAssessment Process FlowchartMaria Reylan GarciaNo ratings yet

- VAT Refund (Section 112) v. Tax Refund (Section 229) NIRCDocument1 pageVAT Refund (Section 112) v. Tax Refund (Section 229) NIRCKaren Supapo100% (2)

- Chapter 10 - Concepts of Vat 7thDocument11 pagesChapter 10 - Concepts of Vat 7thEl Yang100% (3)

- Manny Pacquiao Tax Case DigestDocument3 pagesManny Pacquiao Tax Case Digestbigbird1021780% (1)

- Tax Remedies Under The NircDocument119 pagesTax Remedies Under The NircAnonymous a4JYe5d150% (2)

- BusinessWorld - Marinated Meat and Fish Products No Longer VAT-exemptDocument2 pagesBusinessWorld - Marinated Meat and Fish Products No Longer VAT-exemptPJ NavarroNo ratings yet

- MamalateoDocument12 pagesMamalateoKim Orven M. SolonNo ratings yet

- Taxation Law Ii Compiled Bar Questions and Answers (2012)Document5 pagesTaxation Law Ii Compiled Bar Questions and Answers (2012)Aubrey CaballeroNo ratings yet

- Tax Finals ReviewerDocument51 pagesTax Finals ReviewerCelestino Law100% (2)

- Donor's Tax and Foreign Tax Credit (Presentation Slides)Document5 pagesDonor's Tax and Foreign Tax Credit (Presentation Slides)Kez100% (1)

- TAXREV SANTOSsyllabusDocument7 pagesTAXREV SANTOSsyllabusJoma CoronaNo ratings yet

- Sample PANDocument5 pagesSample PANArmie Lyn Simeon100% (1)

- Questions and Answers On Philippine Donor's TaxDocument4 pagesQuestions and Answers On Philippine Donor's TaxBlesilda OracoyNo ratings yet

- Final Exam in Tax 2Document5 pagesFinal Exam in Tax 2elminvaldezNo ratings yet

- Tax2 - Ch1-5 Estate Taxes ReviewerDocument8 pagesTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)

- 2017 Bar Examinations On Civil LawDocument10 pages2017 Bar Examinations On Civil LawAVNo ratings yet

- TAX REMEDIES NotesDocument6 pagesTAX REMEDIES NotesLemuel Angelo M. Eleccion100% (2)

- VAT ReviewerDocument18 pagesVAT ReviewerNash Ortiz LuisNo ratings yet

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument11 pagesTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- Tax Remedies in Flowchart 102019Document2 pagesTax Remedies in Flowchart 102019Cecilbern ayen BernabeNo ratings yet

- Tax RemediesDocument51 pagesTax RemediesBevz23100% (6)

- Tax2 - Local Taxation ReviewerDocument4 pagesTax2 - Local Taxation Reviewercardeguzman89% (9)

- Flowchart of Tax Remedies I. Remedies Un PDFDocument12 pagesFlowchart of Tax Remedies I. Remedies Un PDFJunivenReyUmadhayNo ratings yet

- 3113 4 Zero Rated TransactionsDocument5 pages3113 4 Zero Rated TransactionsConic DurangparangNo ratings yet

- Remedies of The TaxpayerDocument4 pagesRemedies of The TaxpayerAngelyn Sanjorjo50% (2)

- Tax Answer-KeyDocument8 pagesTax Answer-KeyShirliz Jane Benitez100% (2)

- Lease of Properties: ExemptDocument12 pagesLease of Properties: Exemptmariyha PalangganaNo ratings yet

- RR 12-85Document3 pagesRR 12-85mnyng100% (1)

- Tax 2 (Remedies & CTA Jurisdiction)Document13 pagesTax 2 (Remedies & CTA Jurisdiction)Monice RiveraNo ratings yet

- Securities Regulation Code. QuestionsDocument3 pagesSecurities Regulation Code. QuestionsIELTS100% (1)

- Revenue Regulations No 12-99Document3 pagesRevenue Regulations No 12-99Zoe Dela Cruz0% (1)

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- Comparison Train Law and NircDocument37 pagesComparison Train Law and Nircczabina fatima delica89% (19)

- Rmo 43-90 PDFDocument5 pagesRmo 43-90 PDFRieland Cuevas67% (3)

- Tax Remedies of The GovernmentDocument16 pagesTax Remedies of The GovernmentrmsenyoritaNo ratings yet

- Tax Remedies QuizzerDocument3 pagesTax Remedies QuizzerCharrie Grace Pablo29% (7)

- Powers of The BIRDocument11 pagesPowers of The BIRmartina lopez100% (1)

- Archbishop Reyes Ave, Cebu City, Cebu, 6000Document5 pagesArchbishop Reyes Ave, Cebu City, Cebu, 6000Ralf Arthur Silverio100% (1)

- Cpar Tax Problems ReviewerDocument8 pagesCpar Tax Problems ReviewerAnonymous swtSOYwLrMNo ratings yet

- Flowchart of Tax RemediesDocument3 pagesFlowchart of Tax RemediesJunivenReyUmadhayNo ratings yet

- Flowchart TaxremDocument6 pagesFlowchart TaxremYohanna J K GarcesNo ratings yet

- Tax Remedies and IncrementsDocument16 pagesTax Remedies and Incrementscobe.johnmark.cecilioNo ratings yet

- 9 12 SAT (Afternoon)Document8 pages9 12 SAT (Afternoon)Daryl Noel TejanoNo ratings yet

- Assessment Tax Flow ChartDocument3 pagesAssessment Tax Flow ChartkawaiimiracleNo ratings yet

- GROUP 1 Tax RemediesDocument6 pagesGROUP 1 Tax RemediesEunice Kalaw VargasNo ratings yet

- Procedure in Protest Cases - TCCDocument2 pagesProcedure in Protest Cases - TCCattyaarongocpa9645No ratings yet

- Busuanga Pasture Reserve 04032014 UpdatedDocument13 pagesBusuanga Pasture Reserve 04032014 UpdatedPetrovich Tamag100% (2)

- CTS CorpDocument1 pageCTS CorpPetrovich TamagNo ratings yet

- Over View On The: Orientation Training On Forest Protection and Law EnforcementDocument9 pagesOver View On The: Orientation Training On Forest Protection and Law EnforcementPetrovich TamagNo ratings yet

- Philippine Valuation Standards - RT PunzalanDocument26 pagesPhilippine Valuation Standards - RT PunzalanShielaMarie MalanoNo ratings yet

- Reaction Paper OKDocument1 pageReaction Paper OKPetrovich TamagNo ratings yet

- A Look at Piaget's Stages of Cognitive Development: The Sensorimotor StageDocument9 pagesA Look at Piaget's Stages of Cognitive Development: The Sensorimotor StagePetrovich TamagNo ratings yet

- Org Chart Onshore v1Document1 pageOrg Chart Onshore v1Petrovich TamagNo ratings yet

- National Code of Ethics and Responsibilities PDFDocument48 pagesNational Code of Ethics and Responsibilities PDFPetrovich Tamag50% (2)

- KXP Enterprises: Tel. No.:9425108 TO: Date: December 7, 2015 Re: Quotation For Original Inks and TonersDocument1 pageKXP Enterprises: Tel. No.:9425108 TO: Date: December 7, 2015 Re: Quotation For Original Inks and TonersPetrovich TamagNo ratings yet

- Income Tax On IndividualsDocument2 pagesIncome Tax On IndividualsPetrovich TamagNo ratings yet

- MEMO UsufructDocument2 pagesMEMO UsufructPetrovich TamagNo ratings yet

- 100 Items OB Questions byDocument17 pages100 Items OB Questions byPetrovich Tamag100% (1)

- Article II SyllabusDocument3 pagesArticle II SyllabusPetrovich TamagNo ratings yet

- New Era University: Col Lege of Business AdministrationDocument2 pagesNew Era University: Col Lege of Business AdministrationPetrovich TamagNo ratings yet

- AttentionDocument1 pageAttentionPetrovich TamagNo ratings yet

- Arnold Vs Will ItsDocument8 pagesArnold Vs Will ItsPetrovich TamagNo ratings yet

- C. New Non-Professional Driver's License Qualifications:: Application Fee Computer Fee TotalDocument2 pagesC. New Non-Professional Driver's License Qualifications:: Application Fee Computer Fee TotalPetrovich TamagNo ratings yet

- Judicial AffidavitDocument4 pagesJudicial AffidavitPetrovich Tamag100% (1)

- Income Tax ChartDocument2 pagesIncome Tax ChartPetrovich TamagNo ratings yet