Professional Documents

Culture Documents

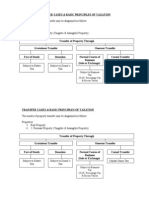

Tax Rev GenPrinciples

Uploaded by

Angela AngelesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Rev GenPrinciples

Uploaded by

Angela AngelesCopyright:

Available Formats

1. Mr. Alas sells shoes in Makati through a retail store.

He pays the VAT

on his gross sales to the BIR and the municipal license tax based on

the same gross sales to the City of Makati. He comes to you for advice

because he thinks he is being subjected to double taxation. What

advice will you give him? (1%) (2013 Bar Question)

(A) Yes, there is double taxation and it is oppressive.

(B) The City of Makati does not have this power.

(C) Yes, there is double taxation and this is illegal in the

Philippines.

(D) Double taxation is allowed where one tax is imposed by the

national government and the other by the local government.

Suggested answer:

(D) Double taxation is allowed where one tax is imposed by the national government

and the other by the local government. There is double taxation when one tax is imposed

by the national government and the other is imposed by a local government unit.4

However, the 1987 Constitution does not forbid double taxation. In Pepsi-Cola Bottling

Company of the Philippines, Inc. v. Municipality of Tanauan (G.R. No. L-31156,

February 27, 1976), the Supreme Court declared that double taxation does not violate

the uniformity rule nor does it infringe the equal protection guarantee just because one

tax is imposed by the national government and the other tax is levied by a local

government unit.

2. Bank A deposit money with Bank B which earns interest that is

subjected to the 20% final withholding tax. At the same time, Bank A

is subjected to the 5% gross receipts tax on its interest income on loan

transactions to customers. Which statement below INCORRECTLY

describes the transaction? (2012 BAR)

a) There is double taxation because two taxes – income tax and gross

receipts tax are imposed on the interest incomes described above and

double taxation is prohibited under the 1987 Constitution

b) There is no double taxation because the first tax is income tax, while the

second tax is business tax;

c) There is no double taxation because the income tax is on the interest

income of Bank A on its deposits with Bank B (passive income), while the

gross receipts tax is on the interest income received by Bank A from loans

to its debtor-customers (active income); d) Income tax on interest income

of deposits of Bank A is a direct tax, while GRT on interest income on loan

transaction is and tax.

Suggested answer:

a) There is double taxation because two taxes – income tax and gross receipts tax are

imposed on the interest incomes described above and double taxation is prohibited

under the 1987 Constitution There is no double taxation if the law imposes two different

taxes on the same income, business or property. First, the taxes herein are imposed on

two different subject matters. The subject matter of the FWT [Final Withholding Tax] is

the passive income generated in the form of interest on deposits and yield on deposit

substitutes, while the subject matter of the GRT [Gross Receipts Tax] is the privilege of

engaging in the business of banking. Second, although both taxes are national in scope

because they are imposed by the same taxing authority - the national government under

the Tax Code - and operate within the same Philippine jurisdiction for the same purpose

of raising revenues, the taxing periods they affect are different. The FWT is deducted

and withheld as soon as the income is earned, and is paid after every calendar quarter in

which it is earned. On the other hand, the GRT is neither deducted nor withheld, but is

paid only after every taxable quarter in which it is earned. (Commissioner of Internal

Revenue vs. BPI, G.R. No. 147375)

3. Real property taxes should not disregard increases in the value of real

property occurring over a long period of time. To do otherwise would

violate the canon of a sound tax system referred to as: (2011 Bar

Question)

(A) theoretical justice.

(B) fiscal adequacy.

(C) administrative feasibility.

(D) symbiotic relationship.

SUGGESTED ANSWER:

(B) fiscal adequacy

4. The Philippines adopted the semi-global tax system, which means

that: (2012 BAR)

a) All taxable incomes, regardless of the nature of income, are added

together to arrive at gross income, and all allowable deductions are

deducted from the gross income to arrive at the taxable income;

b) All incomes subject to final withholding taxes liable to income tax under

the schedular tax system, while all ordinary income as well as income not

subject to final withholding tax under the global tax system;

c) All taxable incomes are subject to final withholding taxes under the

schedular tax system;

d) All taxable incomes from sources within and without the Philippines are

liable to income tax.

SUGGESTED ANSWER:

b) All incomes subject to final withholding taxes liable to income tax under the

schedular tax system, while all ordinary income as well as income not subject to final

withholding tax under the global tax system.

5. Alain Descartes, a French citizen permanently residing in the

Philippines, received several items during the taxable year. Which

among the following is NOT subject to Philippine income taxation?

(2011 Bar Question)

(A) Consultancy fees received for designing a computer program and

installing the same in the Shanghai facility of a Chinese firm.

(B) Interests from his deposits in a local bank of foreign currency earned

abroad converted to Philippine pesos.

(C) Dividends received from an American corporation which derived 60%

of its annual gross receipts from Philippine sources for the past 7 years.

(D) Gains derived from the sale of his condominium unit located in The

Fort, Taguig City to another resident alien.

SUGGESTED ANSWER:

(A) Consultancy fees received for designing a computer program and installing the same

in the Shanghai facility of a Chinese firm.

6. An individual, who is a real estate dealer, sold a residential lot in

Quezon City at a gain of P100,000.00 (selling price of P900,000.00

and cost is P800,00.00). The sale is subject to income tax as follows:

(2012 BAR)

a) 6% capital gains tax on the gain;

b) 6% capital gains tax on the gross selling price of fair market value,

whichever is higher;

c) Ordinary income tax at the graduated rates of 5% to 32% of net taxable

income;

d) 30% income tax on net taxable income

SUGGESTED ANSWER:

c) Ordinary income tax at the graduated rates of 5% to 32% of net taxable income

Section 24, NIRC.

7. Keyrand, Inc., a Philippine corporation, sold through the local stock

exchange 10,000 PLDT shares that it bought 2 years ago. Keyrand

sold the shares for P2 million and realized a net gain of P200,000.00.

How shall it pay tax on the transaction? (2011 Bar Question)

(A) It shall declare a P2 million gross income in its income tax return,

deducting its cost of acquisition as an expense.

(B) It shall report the P200,000.00 in its corporate income tax return

adjusted by the holding period.

(C) It shall pay 5% tax on the first P100,000.00 of the P200,000.00 and 10%

tax on the remaining P100,000.00.

(D) It shall pay a tax of one-half of 1% of the P2 million gross sales.

SUGGESTED ANSWER:

(D) It shall pay a tax of one-half of 1% of the P2 million gross sales.

8. The proceeds received under a life insurance endowment contract is

NOT considered part of gross income: (2011 Bar Question)

(A) if it is so stated in the life insurance endowment policy.

(B) if the price for the endowment policy was not fully paid.

(C) where payment is made as a result of the death of the insured.

(D) where the beneficiary was not the one who took out the endowment

contract.

SUGGESTED ANSWER:

(C) where payment is made as a result of the death of the insured.

9. Passive income includes income derived from an activity in which the

earner does not have any substantial participation. This type of

income is: (2011 Bar Question)

(A) usually subject to a final tax.

(B) exempt from income taxation.

(C) taxable only if earned by a citizen.

(D) included in the income tax return.

SUGGESTED ANSWER:

(A) usually subject to a final tax.

10. The payor of passive income subject to final tax is required to

withhold the tax from the payment due the recipient. The withholding

of the tax has the effect of: (2011 Bar Question)

(A) a final settlement of the tax liability on the income.

(B) a credit from the recipient's income tax liability.

(C) consummating the transaction resulting in an income.

(D) a deduction in the recipient's income tax return.

SUGGESTED ANSWER:

(A) a final settlement of the tax liability on the income.

11. The situs of tax on the gain from sale of real property is -

(A) Place of sale

(B) Place of payment

(C) Residence of the payor

(D) Location of the property

12. ____ gain by fiction of law which is taxable applies in this instance

(A) Tax-free exchange

(B) Exchange of real property held as capital asset

(C) Sale of shares of stock not traded through the local stock exchange

(D) There is no such instance

13. What is the proper tax treatment of a partner’s distributive share from

the net profit of the general professional partnership?

(A) Subject to basic tax (personal income tax)

(B) Subject to final tax at 10%

(C) Subject to final tax at 20%

(D) Exempt, because the net profit of the partnership is already subject

to corporate tax

14. The interest income is treated as derived from source within the

philippines -

(A) If the payee is a citizen of the Philippines

(B) If the transaction took place in the Philippines

(C) If the payor is a resident of the Philippines

(D) If the payment was made in the Philippines

15. The interest income which is passive in nature is -

(A) Exempt from tax

(B) Subject to regular tax

(C) Subject to final tax

(D) subject to gross income tax

16. Mr. A, a citizen and resident of the Philippines, is a professional boxer.

In a professional boxing match held in 2013, he won prize money in United

States (US) dollars equivalent to P300,000,000.

a) Is the prize money paid to and received by Mr. A in the US taxable in the

Philippines? Why?

Suggested Answer:

a. Yes. Under the Tax Code, the income within and without of a resident citizen is

taxable. Since Mr. A is a resident Filipino citizen, his income worldwide is taxable in the

Philippines.

17. Income from dealings in property (real, personal, or mixed) is the gain

or loss derived: (2011 Bar Question)

(A) only from the cash sales of property.

(B) from cash and gratuitous receipts of property.

(C) from sale and lease of property.

(D) only from the sale of property.

SUGGESTED ANSWER:

(D) only from the sale of property.

-----------------

Walang MCIT ang NRFC

*Special type of taxes of income.

Improperly accumulated Earnings Tax - applicable only to domestic corporation

Global system of taxation

- Basic Taxes under the NIRC

1) The situs of tax on the gain from sale of RP is -

the location of the Property

2) A domestic corporation manufactures goods in a factory located in

Laguna. it sells its final products locally and abroad. Are the profits from

the sales in the Phil. and abroad

taxable as incomes derived from sources within the Phil?

- The profits from local sales are entirely derived from within Philippine sources,

while the profits from sales abroad are incomes derived partly

within and partly without. All the profits shall be taxable regardless of source

3) Juan has accumulated interest earning of P100, 000 out of his deposits

in BPI, a Phil. local bank. A friend asked Juan to loan him an amount of

P100, 000 which the former intends to use as capital to start a business.

Juan is not engaged in the lending business. Is the interest earned by Juan

from his bank deposite account subject to income tax?

- Yes, because such interest is income realized from investment; it is subject to

final tax

4) The tax base if the regular income tax for individuals is "taxable income."

Except for one, the following are the correct concepts of taxable income as a

tax

base of the regular income tax. Which is the exception?

-May be subject to tax at the rate of 8%

5) Select from the choices below that which DOES NOT correctly complete

the sentence.

-In a sale of capital asset - the net capital loss may be carried over to the next

succeeding year until fully utilized. (1 yr lang pwede iclaim ang net capital loss, Sec. 39

(b))

6) The gain by fiction of law which is taxable applies in this instance

- Exchange or barter of real property held as capital asset

7) X, the President of ABC Corp., is paid regular salaries and other

allowances and benefits. How should X be taxed on his earnings?

- ***FRINGE BENEFITS TAX AY ISANG FINAL TAX. Kapag ang Fringe Benefit

ay binigay sa rank and file employees. They will become part of the R/F employees

GROSS INCOME

- Kapag ang Fringe Benefit ay is in the nature of a de minimis benefit, hindi siya

subject to FBT.

- de minimis - of relatively small value. What is only excpeted is only up to the

threshold of the amount of the de minimis benefit. So yung excess ay taxable na.

- The regular salaries of X are subject to personal income tax whil his other

allowances and benefits are subject to final tax. X need not to file an annual income

tax return as long as his employed had collected the correct amount of withholding

taxes.

8) What is the proper tax treatment of a partner's distributive share from

the net profit of the general professional partnership?

- Subject to basic tax (Personal income tax)

9) Which of the following is absolutely exempted from income tax?

- SSS and GSIS which make investments in various businesses

10) What is the proper tax treatment of a dividend paid by a domestic

corporation to a stockholder which is another domestic corporation?

- Exempt from income tax

- pano pag reverse? RFC - DC = Not exempt, taxable. RFC - RFC = Not exempt,

taxable

11) The tax base of the MCIT which is payable by a domestic corporation is -

- Gross income for purposes of MCIT - gross sales less sales returns, discounts

and allowances and costs of goods sols, excluding passive incomes subject to final tax

12) Which of the following is not one of the recognized purposes of the

MCIT?

- It was devised as a relatively simple and effective revenue-raising instrument

compared to the normal income tax which is more difficul to control and enforce.

- read the case - CREBA v. Sec. Romulo, 2010

13) A non-profit proprietary educational institution's dominant income is

income from unrelated trade or business. May it be held liable for MCIT?

- Yes, provided that the MCIT is higher than 10% of its taxable income

14) This is a tax which may not apply to a resident foreign corporation.

- Improperly Accumulated Earnings Tax

15) What is the proper implication of a sale by a resident foreign

corporation of its real property (located in the phil) held by it as capital

asset?

- The capital gain is gross income to be declared in the annual income tax return

You might also like

- Compilation of The Labor Law and Social Legislation Bar Examinations Questions and Suggested Answers (1994-2017)Document374 pagesCompilation of The Labor Law and Social Legislation Bar Examinations Questions and Suggested Answers (1994-2017)Marefel Anora100% (20)

- CHAP 1 GEN. PRIN 7th PDFDocument87 pagesCHAP 1 GEN. PRIN 7th PDFJericho Luis100% (9)

- Summary of Final Income: Tax TableDocument3 pagesSummary of Final Income: Tax TableRealEXcellence71% (7)

- Taxation Virgilio D. Reyes 2 PDFDocument194 pagesTaxation Virgilio D. Reyes 2 PDF?????No ratings yet

- General Principles and ConceptsDocument2 pagesGeneral Principles and ConceptsCharry Ramos67% (3)

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- Chapter 06 Donor's TaxDocument16 pagesChapter 06 Donor's TaxNikki Bucatcat0% (2)

- Activities Modules Memory Q&aDocument55 pagesActivities Modules Memory Q&aElla Marie LopezNo ratings yet

- Income Tax On Individuals ContDocument12 pagesIncome Tax On Individuals ContJessa HerreraNo ratings yet

- Taxation Bar Questions (Multiple Choice Questions and Answers)Document81 pagesTaxation Bar Questions (Multiple Choice Questions and Answers)Anonymous Mickey Mouse100% (1)

- Special Exam TaxDocument11 pagesSpecial Exam TaxKenneth Bryan Tegerero TegioNo ratings yet

- Tax Review Q and A Quiz 1 and 2 FinalsDocument19 pagesTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaNo ratings yet

- Business and Transfer Taxation Chapter 13A Discussion Questions AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13A Discussion Questions AnswerKarla Faye Lagang100% (1)

- Deductions From Gross IncomeDocument49 pagesDeductions From Gross IncomeRoronoa ZoroNo ratings yet

- Bqa Remedial Law 1997-2019Document52 pagesBqa Remedial Law 1997-2019CJ Romano94% (16)

- Management Accounting Decisions 1Document2 pagesManagement Accounting Decisions 1Angela Angeles0% (1)

- 2019 Ateneo Pre Week Criminal LawDocument132 pages2019 Ateneo Pre Week Criminal Lawfreegalado100% (7)

- Bqa Remedial Law 1997-2019Document52 pagesBqa Remedial Law 1997-2019CJ Romano94% (16)

- Carolyn House Stewart SettlementDocument16 pagesCarolyn House Stewart SettlementWTSP 10No ratings yet

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- CHP 9 - Refund - Guarantees - 9 - THE - BIMCO - NEWBUILDCON - Standard - Newbuilding - Contract - Part - II, - Annex - A - (Iii)Document13 pagesCHP 9 - Refund - Guarantees - 9 - THE - BIMCO - NEWBUILDCON - Standard - Newbuilding - Contract - Part - II, - Annex - A - (Iii)Bikram ReflectionsNo ratings yet

- Taxation Bar QuestionsDocument65 pagesTaxation Bar QuestionsJazz Adaza100% (1)

- New Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsDocument8 pagesNew Train Income Tax Table Year 2018 To 2022 and 2023 OnwardsSD AccountingNo ratings yet

- MCQ Dimaampao W Answer KeyDocument25 pagesMCQ Dimaampao W Answer KeyJohn Henry Naga100% (3)

- Examination QuestionsDocument16 pagesExamination QuestionsAly Concepcion100% (1)

- Assignment 2Document3 pagesAssignment 2joessel ebolNo ratings yet

- A) B) C) D) : 1 PointDocument11 pagesA) B) C) D) : 1 Pointprey kunNo ratings yet

- Taxation Law Exam MCQDocument10 pagesTaxation Law Exam MCQSong Ong0% (1)

- Income Taxation Whole Book Cheat SheetDocument121 pagesIncome Taxation Whole Book Cheat SheetMaryane Angela100% (1)

- TaxationDocument13 pagesTaxationEmperiumNo ratings yet

- Rakham's loan to Alfonso deemed non-deductible bad debtDocument17 pagesRakham's loan to Alfonso deemed non-deductible bad debtClarince Joyce Lao DoroyNo ratings yet

- Tax RemediesDocument13 pagesTax RemediesYan MoretzNo ratings yet

- Powers and Duties of The BIRDocument7 pagesPowers and Duties of The BIROliveros DMNo ratings yet

- Who bears loss before deliveryDocument2 pagesWho bears loss before deliverykelo100% (2)

- Taxation With AnswerDocument13 pagesTaxation With AnsweraizaNo ratings yet

- Gross Income Quiz With Answer KeyDocument10 pagesGross Income Quiz With Answer KeyMylene AlfantaNo ratings yet

- Tax2 Midterm Exam-SentDocument12 pagesTax2 Midterm Exam-SentRen A EleponioNo ratings yet

- Taxation (Input Taxes)Document30 pagesTaxation (Input Taxes)Lara Joy Junio100% (4)

- 2014 BAR EXAMINATIONS TAX - Income Taxation OnlyDocument5 pages2014 BAR EXAMINATIONS TAX - Income Taxation OnlyChelle OngNo ratings yet

- Domondon's MCQDocument2 pagesDomondon's MCQAmer Hassan Guiling GuroNo ratings yet

- Problems 2 de VeraDocument2 pagesProblems 2 de VeraJoelo De VeraNo ratings yet

- Prelim Exam - Mac 421Document5 pagesPrelim Exam - Mac 421Ezzz VeriNo ratings yet

- Tax laws and principlesDocument7 pagesTax laws and principlesYeovil Pansacala100% (2)

- TAXES CORPORATIONSDocument9 pagesTAXES CORPORATIONSMervidelleNo ratings yet

- Transfer TaxesDocument3 pagesTransfer TaxesbeverlyrtanNo ratings yet

- Taxation PrinciplesDocument3 pagesTaxation PrinciplesRameinor Tambuli100% (1)

- LECTURE 10 Dealings in PropertiesDocument33 pagesLECTURE 10 Dealings in PropertiesJeane Mae BooNo ratings yet

- Tax2 FinalsDocument8 pagesTax2 FinalsKevin Elrey Arce100% (2)

- Excise Tax Questions and AnswersDocument43 pagesExcise Tax Questions and AnswersReginald ValenciaNo ratings yet

- Chapter 14-Regular Income Taxation: IndividualsDocument28 pagesChapter 14-Regular Income Taxation: Individualsarjay matanguihan100% (2)

- Deal or No Deal Tax 2 Quiz BeeDocument13 pagesDeal or No Deal Tax 2 Quiz BeeRebecca SisonNo ratings yet

- (Marshal and Holmes) TaxationDocument1 page(Marshal and Holmes) TaxationRika Miyazaki100% (1)

- Group 2 Exclusion From Gross IncomeDocument32 pagesGroup 2 Exclusion From Gross IncomeMaryrose MalaluanNo ratings yet

- Income Taxation - General Principles Review NotesDocument8 pagesIncome Taxation - General Principles Review NotesJohn Lemuel CabiliNo ratings yet

- Bar QsDocument12 pagesBar QsThrees SeeNo ratings yet

- Income TaxDocument20 pagesIncome Taxjuliaysabellepepitoaguilar100% (1)

- Midterm ExamDocument3 pagesMidterm Examfitz garlitosNo ratings yet

- General Principles: Answer: CDocument13 pagesGeneral Principles: Answer: CReno PhillipNo ratings yet

- Another Sample Problem For ACP CPG and ASPDocument8 pagesAnother Sample Problem For ACP CPG and ASPGlomarie GonayonNo ratings yet

- Income Tax: Taxation Bar Exam Questions ONDocument31 pagesIncome Tax: Taxation Bar Exam Questions ONMichael Brian TorresNo ratings yet

- AnswersDocument7 pagesAnswersQueen ValleNo ratings yet

- 2012 Taxation Bar Exam QDocument30 pages2012 Taxation Bar Exam QClambeauxNo ratings yet

- Bar QuestionsDocument30 pagesBar QuestionsEllaine VirayoNo ratings yet

- Taxation Law MCQs 2012 Bar ExamsDocument20 pagesTaxation Law MCQs 2012 Bar ExamsvenickeeNo ratings yet

- 2012 Bar Examinations On TaxationDocument19 pages2012 Bar Examinations On Taxationjamaica_maglinteNo ratings yet

- Tax SemifiDocument6 pagesTax Semifijeryl_dragneelNo ratings yet

- Taxation - Sample QuestionsDocument9 pagesTaxation - Sample QuestionsCecille TaguiamNo ratings yet

- 2011 Bar Q - TaxDocument14 pages2011 Bar Q - TaxvenickeeNo ratings yet

- Exclusionary RuleDocument3 pagesExclusionary RuleAngela AngelesNo ratings yet

- Assignment #2Document2 pagesAssignment #2Angela AngelesNo ratings yet

- Percentag E Tax: Module DiscussionDocument12 pagesPercentag E Tax: Module DiscussionAngela AngelesNo ratings yet

- CENTRAL BANK OF THE PHILIPPINES vs. CA and TOLENTINODocument3 pagesCENTRAL BANK OF THE PHILIPPINES vs. CA and TOLENTINOAngela AngelesNo ratings yet

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- CIAC jurisdiction over construction disputesDocument14 pagesCIAC jurisdiction over construction disputesAngela AngelesNo ratings yet

- PSBA vs. CADocument2 pagesPSBA vs. CAAngela AngelesNo ratings yet

- Estate Tax Amnesty CertificateDocument2 pagesEstate Tax Amnesty CertificateIsaac Dominic MacaranasNo ratings yet

- RDO No. 97 - Gingoog City, Misamis OrientalDocument377 pagesRDO No. 97 - Gingoog City, Misamis OrientalAngela AngelesNo ratings yet

- RDO No. 98 - Cagayan de Oro City, Misamis OrientalDocument1,003 pagesRDO No. 98 - Cagayan de Oro City, Misamis OrientalAngela Angeles100% (1)

- CIAC jurisdiction over construction disputesDocument14 pagesCIAC jurisdiction over construction disputesAngela AngelesNo ratings yet

- Lasallian Law Notes: Remedial LawDocument299 pagesLasallian Law Notes: Remedial LawKarl Rovin VillapandoNo ratings yet

- Effect of Credit Policy on AR Turnover RatioDocument2 pagesEffect of Credit Policy on AR Turnover RatioAngela AngelesNo ratings yet

- Macalintal V COMELEC DIgestDocument8 pagesMacalintal V COMELEC DIgestAngela Angeles100% (1)

- 2021bar Bqas Not Affected by Amended Rule On Civil Procedure and EvidenceDocument66 pages2021bar Bqas Not Affected by Amended Rule On Civil Procedure and EvidenceRaz SabulaoNo ratings yet

- Estate Tax Amnesty CertificateDocument2 pagesEstate Tax Amnesty CertificateIsaac Dominic MacaranasNo ratings yet

- Bar PrayerDocument1 pageBar PrayerAngela AngelesNo ratings yet

- Bar Exam PrayerDocument1 pageBar Exam PrayerAngela AngelesNo ratings yet

- Tax Rev GenPrinciplesDocument8 pagesTax Rev GenPrinciplesAngela AngelesNo ratings yet

- Barrister PrayerDocument1 pageBarrister PrayerAngela AngelesNo ratings yet

- 3 - Civil Law Green Notes 2018 PDFDocument334 pages3 - Civil Law Green Notes 2018 PDFJandi YangNo ratings yet

- Supreme Court: Custom SearchDocument5 pagesSupreme Court: Custom SearchAngela AngelesNo ratings yet

- Supreme Court: Custom SearchDocument5 pagesSupreme Court: Custom SearchAngela AngelesNo ratings yet

- Macalintal V COMELEC DIgestDocument8 pagesMacalintal V COMELEC DIgestAngela Angeles100% (1)

- DRC VAT Training CAs Day 1-2Document40 pagesDRC VAT Training CAs Day 1-2iftekharul alam100% (1)

- Workday1Document1 pageWorkday1raheemtimo1No ratings yet

- Form W-8BEN-E InstructionsDocument15 pagesForm W-8BEN-E InstructionsSteve ThompsonNo ratings yet

- Moore Shekha Mufti Withholding Chart Pro Tax Year 2023 RevisedDocument14 pagesMoore Shekha Mufti Withholding Chart Pro Tax Year 2023 RevisedNouman KhanNo ratings yet

- Withholding Tax on Wages GuideDocument183 pagesWithholding Tax on Wages GuideJohnallen MarillaNo ratings yet

- Hedge FundsDocument87 pagesHedge FundsTayebe RostamzadeNo ratings yet

- Module 4 - Final Income TaxationDocument4 pagesModule 4 - Final Income TaxationReicaNo ratings yet

- Commissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)Document4 pagesCommissioner of Internal Revenue vs. CA (301 SCRA 152, 1999)eunice demaclidNo ratings yet

- 0006 Abdul Qadir MemonDocument114 pages0006 Abdul Qadir Memonflower4u2008No ratings yet

- Loi n0 16 of 16 04 2018 On I RDocument88 pagesLoi n0 16 of 16 04 2018 On I RZIHERAMBERE AnastaseNo ratings yet

- Notice of AGM 23Document5 pagesNotice of AGM 23Ekta rohraNo ratings yet

- Franchise Kenya ReportDocument5 pagesFranchise Kenya ReportWycee einssNo ratings yet

- Webull Tax DocumentDocument10 pagesWebull Tax DocumentHimer VerdeNo ratings yet

- EY Tax Alert: Malaysian DevelopmentsDocument12 pagesEY Tax Alert: Malaysian DevelopmentsdanNo ratings yet

- Horngrens Accounting 11Th Edition Miller Nobles Solutions Manual Full Chapter PDFDocument59 pagesHorngrens Accounting 11Th Edition Miller Nobles Solutions Manual Full Chapter PDFconatusimploded.bi6q100% (9)

- Chapter 2Document18 pagesChapter 2geexellNo ratings yet

- IT2021112401011395488Document3 pagesIT2021112401011395488ali aabisNo ratings yet

- Myanmar Tax Booklet - 2019 2020Document60 pagesMyanmar Tax Booklet - 2019 2020Sai PhyoNo ratings yet

- BIR Tax Computation FormDocument37 pagesBIR Tax Computation FormjessiecaNo ratings yet

- It 000141511985 2022 00Document1 pageIt 000141511985 2022 00Abdul Basit KtkNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- Ngo v. Commissioner of Internal Revenue, G.R. No. 197688 (Notice), (March 3, 2021)Document7 pagesNgo v. Commissioner of Internal Revenue, G.R. No. 197688 (Notice), (March 3, 2021)Kriszan ManiponNo ratings yet

- Wage and Income - THOM - 102746942918Document12 pagesWage and Income - THOM - 102746942918Mark ThomasNo ratings yet

- April 2022 Factsheet - (Direct Plan)Document114 pagesApril 2022 Factsheet - (Direct Plan)Prince ANo ratings yet

- FW 8 ImyDocument8 pagesFW 8 ImyEla100% (1)

- Understanding Philippine Tax LawsDocument31 pagesUnderstanding Philippine Tax LawsAisha A. UnggalaNo ratings yet

- Process Vendor TDS Remittance Challan 194QDocument7 pagesProcess Vendor TDS Remittance Challan 194QSHARADNo ratings yet