Professional Documents

Culture Documents

Fiscal Reconciliation Exercise

Uploaded by

Maria Devina0 ratings0% found this document useful (0 votes)

24 views1 pagetaxation exercise

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxation exercise

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views1 pageFiscal Reconciliation Exercise

Uploaded by

Maria Devinataxation exercise

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

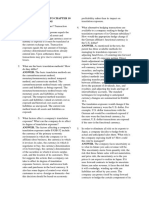

Exercise 1

Unearned revenue = 150,000; tax = 40%

Tax 2015 150k 60,000

Accounting Tax

2015 50,000 100,000 40,000

2016 50,000 (50,000) (20,000)

2017 50,000 (50,000) (20,000)

1. Is there deferred tax? YES DTA because taxable income > accounting income will

deduct the tax paid in the future

2. Income tax expense 40% x 50,000 = 20,000

3. Current tax expense 60,000

4. Deferred tax = 40,000 (40% x (150,000 – 50,000) or 60,000 – 20,000)

Exercise 2

2015 = 200,000; 2016 = +10,000; 2017 = +20,000; 2018 = +15,000

DTL = 10,000 + 20,000 + 15,000 = 45,000

Taxable income = 200,000 – DTL = 155,000

1. Deferred tax? YES DTL because taxable income < accounting income will increase the

amount tax paid in the future

2. Income tax expense = 40% * 200,000 = 80,000

3. Current tax expense = 40% * 155,000 = 62,000

4. Deferred tax 2015 = 62,000 – 80,000 = (18,000)

Exercise 3

2015 = 200,000 tax = 0.4*200,000 = 80,000

DTA = 30,000 + 70,000 + 10,000 = 110,000

Taxable income = 200,000 + 110,000 = 310,000 tax = 310,000 * 0.4 = 124,000

Deferred tax = 124,000 – 110,000 = 14,000

You might also like

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- 2014 Volume 2 CH 5 AnswersDocument6 pages2014 Volume 2 CH 5 AnswersGirlie SisonNo ratings yet

- Chapter 11 TaxDocument11 pagesChapter 11 Taxkp_popinjNo ratings yet

- Book 3Document1 pageBook 3Quincy Lawrence DimaanoNo ratings yet

- What is TDS? Advance Tax and ProblemsDocument8 pagesWhat is TDS? Advance Tax and ProblemsNishantNo ratings yet

- Section TWO 2024Document5 pagesSection TWO 2024basuonyshowNo ratings yet

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- Jawaban 8 - Accounting For Income TaxDocument2 pagesJawaban 8 - Accounting For Income TaxBie SapuluhNo ratings yet

- Lobrigas Unit6 AssessmentDocument4 pagesLobrigas Unit6 AssessmentClaudine LobrigasNo ratings yet

- Cash FlowDocument2 pagesCash FlowMamadou Aliou BALDENo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Chap15 Tax PbmsDocument10 pagesChap15 Tax PbmskkNo ratings yet

- Fa ReportDocument1 pageFa ReportAlfonso Miguel BuenoNo ratings yet

- Finalchapter-16 2Document22 pagesFinalchapter-16 2Jud Rossette ArcebesNo ratings yet

- TaxDocument8 pagesTaxClaire BarrettoNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- Areesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDocument2 pagesAreesha Shakeel Fa18-Baf-002 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNo ratings yet

- Lab Chapter 17Document5 pagesLab Chapter 17Tran Kim Tram PhanNo ratings yet

- 6 LeveragesDocument7 pages6 LeveragesMumtazAhmadNo ratings yet

- Chap 016Document12 pagesChap 016dbjn100% (1)

- Chapter 14 Solved Problems and ExercisesDocument17 pagesChapter 14 Solved Problems and ExercisesMelady Sison CequeñaNo ratings yet

- Tutorial 12 (Answer)Document6 pagesTutorial 12 (Answer)Vidya IntaniNo ratings yet

- Laiba Tufail Malik Fa18-Baf-005 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesDocument2 pagesLaiba Tufail Malik Fa18-Baf-005 Please Determined Tax Liability On Taxable Income For The Tax Year 2020 in Following CasesLaiba TufailNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

- Fav2chp4 9Document122 pagesFav2chp4 9Emey CalbayNo ratings yet

- Gene Sacdalan Accounting 18 HomeworkDocument4 pagesGene Sacdalan Accounting 18 HomeworkGene Justine SacdalanNo ratings yet

- Calculate TaxDocument8 pagesCalculate TaxPhilipp WiegandNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Assignment No 3Document4 pagesAssignment No 3shumailaNo ratings yet

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument5 pagesSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847No ratings yet

- 03 Task Performance 1Document2 pages03 Task Performance 1Stella MarisNo ratings yet

- Graduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Document3 pagesGraduated Income Tax Rates: Effective January 1, 2018 Until December 31, 2022Jecah May R. RiegoNo ratings yet

- Contemporary Taxation: COMSATS University IslamabadDocument4 pagesContemporary Taxation: COMSATS University IslamabadRabia EmanNo ratings yet

- A. Cooper 1: Account Debit CreditDocument4 pagesA. Cooper 1: Account Debit CreditCooper89No ratings yet

- ExploreDocument4 pagesExploreNorlyn RunesNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Activity 13 May 2023 Key To CorrectionDocument1 pageActivity 13 May 2023 Key To CorrectionJohn Paul MagbitangNo ratings yet

- IAS - 12 (DEFERRED TAX) (Exercise)Document8 pagesIAS - 12 (DEFERRED TAX) (Exercise)Saad AtharNo ratings yet

- Income Tax Sample ProblemsDocument12 pagesIncome Tax Sample ProblemsYellow BelleNo ratings yet

- Particular Amount: Profit Before Tax Dep. & Amortization Financial CostDocument5 pagesParticular Amount: Profit Before Tax Dep. & Amortization Financial CostviewpawanNo ratings yet

- Tax Chapter 3 AssignmentDocument5 pagesTax Chapter 3 AssignmentAriin TambunanNo ratings yet

- Acct AssignaccountingmentDocument2 pagesAcct AssignaccountingmentvinayaartalaNo ratings yet

- Practice Problem 114 - Quarterly Corporate Tax ComputationDocument2 pagesPractice Problem 114 - Quarterly Corporate Tax ComputationJanna Mari FriasNo ratings yet

- Nama: Calvin Wijaya Kelas: LA86 NIM: 2301854220 Subyek: Managerial AccountingDocument2 pagesNama: Calvin Wijaya Kelas: LA86 NIM: 2301854220 Subyek: Managerial AccountingMichaelNo ratings yet

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- DEFERRED TAXES 4-Year ExamplsDocument4 pagesDEFERRED TAXES 4-Year Examplsryanclarke628No ratings yet

- Tax Planning For IndividualDocument2 pagesTax Planning For IndividualJaynil ShahNo ratings yet

- Torres Ma. Deidre Yciar L - Chapter 13 ADocument5 pagesTorres Ma. Deidre Yciar L - Chapter 13 AAriana Marie ArandiaNo ratings yet

- TAX2 ReyesDocument9 pagesTAX2 ReyesClaire BarrettoNo ratings yet

- Financial statements, cash flows, and taxes solutionsDocument2 pagesFinancial statements, cash flows, and taxes solutionstakesomethingNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- Gross Receipts Less: OSD (X Taxable Income Tax Due Basic Excess (2,550,000 - 2,000,000 Total Tax DueDocument10 pagesGross Receipts Less: OSD (X Taxable Income Tax Due Basic Excess (2,550,000 - 2,000,000 Total Tax DueMarie CarreraNo ratings yet

- Deferred Tax Assets: - Arise From Temporary Differences Where, Initially, Tax Rules RequireDocument14 pagesDeferred Tax Assets: - Arise From Temporary Differences Where, Initially, Tax Rules RequireSaddy ButtNo ratings yet

- Working TaxDocument19 pagesWorking TaxMuhammad QasimNo ratings yet

- Aral Pan 9 EquationDocument5 pagesAral Pan 9 EquationRashiel Jane Paronia CelizNo ratings yet

- Exercise 3-3 to 3-10 Net Income CalculationsDocument13 pagesExercise 3-3 to 3-10 Net Income CalculationsAnne GuamosNo ratings yet

- The Rise of States and The Age of CommerceDocument2 pagesThe Rise of States and The Age of CommerceMaria DevinaNo ratings yet

- Not A Religious StateDocument2 pagesNot A Religious StateMaria DevinaNo ratings yet

- Quiz 3 KeyDocument1 pageQuiz 3 KeyMaria DevinaNo ratings yet

- The First Steps Towards National RevivalDocument2 pagesThe First Steps Towards National RevivalMaria DevinaNo ratings yet

- Popular Culture in Indonesia - Fluid Identity in Post-Authoritarian PoliticDocument2 pagesPopular Culture in Indonesia - Fluid Identity in Post-Authoritarian PoliticMaria DevinaNo ratings yet

- Pancasila and The Christians in IndonesiaDocument2 pagesPancasila and The Christians in IndonesiaMaria DevinaNo ratings yet

- SecularismDocument2 pagesSecularismMaria DevinaNo ratings yet

- Sesi 13 Whistle Blowing SystemDocument26 pagesSesi 13 Whistle Blowing SystemMaria Devina100% (1)

- Questions CH 10Document4 pagesQuestions CH 10Maria DevinaNo ratings yet

- Summary Week 2 - Maria Devina Sanjaya (392626)Document2 pagesSummary Week 2 - Maria Devina Sanjaya (392626)Maria DevinaNo ratings yet

- Chapter 2-5Document15 pagesChapter 2-5Maria DevinaNo ratings yet

- Kunci PR 1Document6 pagesKunci PR 1Maria DevinaNo ratings yet

- Quiz 2 KeyDocument1 pageQuiz 2 KeyMaria DevinaNo ratings yet

- Quiz 1 KeyDocument1 pageQuiz 1 KeyMaria DevinaNo ratings yet

- Bagian ADocument3 pagesBagian AMaria DevinaNo ratings yet

- 13 12 08 The International Ir Framework 2 1Document37 pages13 12 08 The International Ir Framework 2 1Egar PamujiNo ratings yet

- Uts Psa 2016Document4 pagesUts Psa 2016Maria DevinaNo ratings yet

- Practice Test A - StructureDocument6 pagesPractice Test A - StructureMichael Cruz RodríguezNo ratings yet

- Summary Buat UASDocument5 pagesSummary Buat UASMaria DevinaNo ratings yet

- Baker Adhesives PaperDocument11 pagesBaker Adhesives PaperMaria DevinaNo ratings yet

- Toefl Reading 1Document2 pagesToefl Reading 1Maria DevinaNo ratings yet

- KMK TerminologiDocument1 pageKMK TerminologiMaria DevinaNo ratings yet

- Case Week 5Document3 pagesCase Week 5Maria DevinaNo ratings yet

- Answer Case 3Document1 pageAnswer Case 3Maria DevinaNo ratings yet

- Flowchart KURANG LAKU - Maria Devina Sanjaya (392626)Document1 pageFlowchart KURANG LAKU - Maria Devina Sanjaya (392626)Maria DevinaNo ratings yet

- EFM2e, CH 07, Slides-1Document51 pagesEFM2e, CH 07, Slides-1Maria DevinaNo ratings yet

- Fiscal Reconciliation ExerciseDocument1 pageFiscal Reconciliation ExerciseMaria DevinaNo ratings yet

- EFM2e, CH 06, SlidesDocument21 pagesEFM2e, CH 06, SlidesMaria DevinaNo ratings yet

- EFM2e, CH 05, SlidesDocument16 pagesEFM2e, CH 05, SlidesMaria DevinaNo ratings yet