Professional Documents

Culture Documents

10E - Build A Spreadsheet 02-44

Uploaded by

MISRET 2018 IEI JSCOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10E - Build A Spreadsheet 02-44

Uploaded by

MISRET 2018 IEI JSCCopyright:

Available Formats

DATA INPUT

Accounting Records:

Raw materials purchases $ 350,000

Direct Labor 508,000

Indirect labor 218,000

Selling and administration salaries 266,000

Building depreciation 160,000

Other selling and administration expenses 380,000

Other factory costs 688,000

Sales revenue 2,990,000

Sales price 260

Building devoted to production 75%

Building devoted to selling and admin 25%

Inventory data: January 1 December 31

Raw materials $ 31,600 $ 36,400

Work in process 71,400 124,200

Finished goods 222,200 195,800

Units in finished goods 1,350 1,190

Tax rate 40%

SOLUTION

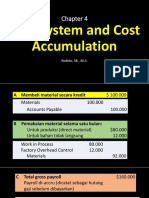

1. Manufacturing overhead:

Indirect labor $ 218,000

Building depreciation 120,000

Other factory costs 688,000

Total $1,026,000

2. Cost of goods manufactured:

Direct material:

Raw material inventory, Jan. 1 $ 31,600

Add: Purchases of raw material 350,000

Raw material available for use $ 381,600

Deduct: Raw-material inventory Dec. 31 36,400

Raw material used $ 345,200

Direct labor 508,000

Manufacturing overhead 1,026,000

Total manufacturing costs $ 1,879,200

Add: Work-in-process inventory, Jan 1 71,400

Subtotal $ 1,950,600

Deduct: Work-in-process inventory, Dec. 31 124,200

Cost of goods sold $ 1,826,400

3. Cost of good sold:

Finished-goods inventory, Jan. 1 $ 222,200

Add: Cost of goods manufactured 1,826,400

Cost of goods available for sale $2,048,600

Deduct: Finished-goods inventory, Dec. 31 195,800

Cost of goods sold $1,852,800

4. Net income:

Sales revenue $ 2,990,000

Less: Cost of goods sold 1,852,800

Gross Margin $ 1,137,200

Selling and administrative expenses:

Salaries $ 266,000

Building depreciation 40,000

Other 380,000 686,000

Income before taxes $ 451,200

Income tax expense 180,480

Net income $ 270,720

5. Units manufactured during the year:

Units sold during the year: 11,500

Units manufactured during the year: 11,340

You might also like

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Business Finance Assignment 2Document6 pagesBusiness Finance Assignment 2Muhammad Ali KhanNo ratings yet

- 10E - Build A Spreadsheet 02-28Document2 pages10E - Build A Spreadsheet 02-28MISRET 2018 IEI JSC100% (1)

- Cost Accounting Hilton 14Document13 pagesCost Accounting Hilton 14Vin TenNo ratings yet

- Homework Chapter 2 - Phuong AnhDocument5 pagesHomework Chapter 2 - Phuong AnhNguyễn Ánh NgọcNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Three Formal SchedulesDocument5 pagesThree Formal SchedulesKimberly ToraldeNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNo ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (25)

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Shelsa Nabila - 027031801017 - LabAkbiDocument6 pagesShelsa Nabila - 027031801017 - LabAkbiShelsa NabilaNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Topic 1 - Assignment 1 CostDocument4 pagesTopic 1 - Assignment 1 CostAnna Cabrera0% (1)

- Chapter 6Document24 pagesChapter 6jake doinog88% (16)

- Cost of Goods SoldDocument14 pagesCost of Goods Soldmuhammad irfan50% (2)

- Cost CH 4 Cost System 2019Document19 pagesCost CH 4 Cost System 2019KPP Madya Dua Jakarta PusatNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Cost Accounting Chapter 2 Assignment #5Document4 pagesCost Accounting Chapter 2 Assignment #5Tawan Vihokratana100% (1)

- Cost System and Cost Accumulation: Kodirin, Ak., M.ADocument19 pagesCost System and Cost Accumulation: Kodirin, Ak., M.AShofiyyatul MaulaNo ratings yet

- Problem 2-6 (Book)Document11 pagesProblem 2-6 (Book)Cherry Doong CuantiosoNo ratings yet

- Problem 2-6 (Book)Document12 pagesProblem 2-6 (Book)Lara FloresNo ratings yet

- Tugas 2Document2 pagesTugas 2Silvia Fudjiyani79No ratings yet

- Handout - CADocument10 pagesHandout - CAArfeen ArifNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Answer Sheet Practice Wiley Question Exam 2 M04-M07 Fall 2020Document2 pagesAnswer Sheet Practice Wiley Question Exam 2 M04-M07 Fall 2020bryan.canarisNo ratings yet

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Lecture 5.2-General Cost Classifications (Problem 2)Document2 pagesLecture 5.2-General Cost Classifications (Problem 2)Nazmul-Hassan Sumon80% (5)

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- CFAS - Asynchronus ActivityDocument10 pagesCFAS - Asynchronus ActivityAira Santos VibarNo ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- 10E - Build A Spreadsheet 02-43Document2 pages10E - Build A Spreadsheet 02-43MISRET 2018 IEI JSCNo ratings yet

- Assignment No 1: Waterway's CorporationDocument3 pagesAssignment No 1: Waterway's CorporationBilal AhmedNo ratings yet

- Chapter 1 Question Review - 102Document5 pagesChapter 1 Question Review - 102Mark Joseph CanoNo ratings yet

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Chapter 5Document12 pagesChapter 5?????0% (1)

- Chapter 2 Sol 31-39Document8 pagesChapter 2 Sol 31-39Something ChicNo ratings yet

- Quiz 1 - Cost Terms, Inventory - PrintableDocument8 pagesQuiz 1 - Cost Terms, Inventory - PrintableEdward Prima KurniawanNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Cost AccountingDocument11 pagesCost Accounting001.maya100% (11)

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- 21S20029 - Natanael Sirait - Tugas 1Document10 pages21S20029 - Natanael Sirait - Tugas 1Natanael SiraitNo ratings yet

- Manufacturing Costs and Inventory Costing: Session 4Document37 pagesManufacturing Costs and Inventory Costing: Session 4MarcoNo ratings yet

- Chapter 14Document22 pagesChapter 14Dan ChuaNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- End of Chapter 1 Exercises - Toralde, Ma - Kristine E.Document7 pagesEnd of Chapter 1 Exercises - Toralde, Ma - Kristine E.Kristine Esplana ToraldeNo ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- Standard Costing and Variance AnalysisDocument2 pagesStandard Costing and Variance AnalysisMISRET 2018 IEI JSCNo ratings yet

- Activity Based Costing: Samit Paul IIM, RanchiDocument21 pagesActivity Based Costing: Samit Paul IIM, RanchiMISRET 2018 IEI JSCNo ratings yet

- Kalamazoo ZooDocument4 pagesKalamazoo ZooMISRET 2018 IEI JSC100% (1)

- Process Costing: Samit Paul IIM, RanchiDocument17 pagesProcess Costing: Samit Paul IIM, RanchiMISRET 2018 IEI JSCNo ratings yet

- Case Study - Destin Brass Products CoDocument6 pagesCase Study - Destin Brass Products CoMISRET 2018 IEI JSCNo ratings yet

- Problem - Chapter 02Document1 pageProblem - Chapter 02MISRET 2018 IEI JSCNo ratings yet

- Chapter 23Document7 pagesChapter 23MISRET 2018 IEI JSCNo ratings yet

- Strategy MangmtDocument23 pagesStrategy MangmtMISRET 2018 IEI JSCNo ratings yet

- Problem - Chapter 02Document1 pageProblem - Chapter 02MISRET 2018 IEI JSCNo ratings yet

- 02 02 Assignment Problem (SC)Document1 page02 02 Assignment Problem (SC)MISRET 2018 IEI JSCNo ratings yet

- Chapter 1Document4 pagesChapter 1MISRET 2018 IEI JSCNo ratings yet

- Web QuizDocument4 pagesWeb QuizMISRET 2018 IEI JSCNo ratings yet

- Chapter 7 PDFDocument4 pagesChapter 7 PDFMISRET 2018 IEI JSCNo ratings yet

- Micro Economics Quiz OneDocument3 pagesMicro Economics Quiz OneMISRET 2018 IEI JSCNo ratings yet

- 10E - Build A Spreadsheet 02-43Document2 pages10E - Build A Spreadsheet 02-43MISRET 2018 IEI JSCNo ratings yet

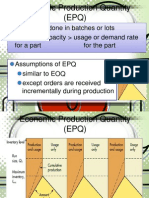

- Economic Production Quantity (EPQ)Document54 pagesEconomic Production Quantity (EPQ)Bryan Joseph Jumawid100% (3)

- OM D Mid Quiz 2Document1 pageOM D Mid Quiz 2HMM HMMNo ratings yet

- Baltimore County OIG Report ResponseDocument3 pagesBaltimore County OIG Report ResponseChris BerinatoNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- Invty MgtORDocument36 pagesInvty MgtORkevin punzalan100% (1)

- US Crude Inventory Modeling in ExcelDocument6 pagesUS Crude Inventory Modeling in ExcelNumXL ProNo ratings yet

- Types of Business According To ActivitiesDocument2 pagesTypes of Business According To ActivitiesKayzelleNo ratings yet

- Instructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoDocument8 pagesInstructions. Write Your Final Answers On The Answer Sheet Provided. For Problem Solving Items, Please Write Solutions On The Answer Sheet AlsoJozette TorinoNo ratings yet

- WarehouseDocument15 pagesWarehousesagarika ghosh0% (1)

- ch23 SolDocument18 pagesch23 SolJohn Nigz PayeeNo ratings yet

- Ratio AnalysisDocument19 pagesRatio AnalysisItee GuptaNo ratings yet

- Cost Reduction StrategiesDocument10 pagesCost Reduction StrategiesmeetsarkarNo ratings yet

- Periodic and PerpetualDocument2 pagesPeriodic and PerpetualLayNo ratings yet

- Sample Periodic and Perpetual EntriesDocument8 pagesSample Periodic and Perpetual EntriesJomar ArcillaNo ratings yet

- The Importance of Process CostingDocument3 pagesThe Importance of Process CostingPraWin KharateNo ratings yet

- Product Costing TechniquesDocument20 pagesProduct Costing TechniquesZander0% (1)

- Nama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaDocument4 pagesNama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaInnabilaNo ratings yet

- Navi Star Supplier GuidelinesDocument104 pagesNavi Star Supplier GuidelinesEduardo UscangaNo ratings yet

- US Stroller AnsDocument4 pagesUS Stroller AnsBrayan Jimenez Barba0% (1)

- Financial Accounting First Canadian Edition Canadian 1st Edition Waybright Test Bank DownloadDocument39 pagesFinancial Accounting First Canadian Edition Canadian 1st Edition Waybright Test Bank DownloadSherry Belvin100% (24)

- Third Party.......... LogisticsDocument6 pagesThird Party.......... LogisticsApurve PatilNo ratings yet

- Math 104-184 Midterm 2 2012W Practice QuestionsDocument2 pagesMath 104-184 Midterm 2 2012W Practice QuestionsheartxannaNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- SM Horngren Cost Accounting 14e Ch17Document48 pagesSM Horngren Cost Accounting 14e Ch17Shrouk__Anas100% (2)

- ok-EAS Manpro Gasal 2020-2021Document2 pagesok-EAS Manpro Gasal 2020-2021Samuel ArelianoNo ratings yet

- ABC Inventory ControlDocument63 pagesABC Inventory Controlsanjiv_nidamboor100% (2)

- C1150429 Sintya MustikaDocument43 pagesC1150429 Sintya MustikaArie RisyaldiNo ratings yet

- Practical Accounting Problems IIDocument12 pagesPractical Accounting Problems IIJericho PedragosaNo ratings yet

- Assessment of Procurement Demand of Milk Plant Using Quality Control Tools A Case StudyDocument6 pagesAssessment of Procurement Demand of Milk Plant Using Quality Control Tools A Case StudyMohammad JawadNo ratings yet