Professional Documents

Culture Documents

Capital Spending: NWC Change

Uploaded by

Elizabeth RenaudOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Spending: NWC Change

Uploaded by

Elizabeth RenaudCopyright:

Available Formats

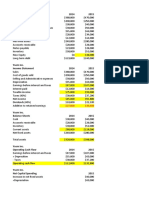

Chapter 2, Question #20: Calculating Cash Flows

2015, Cusic Industries

Sales $20,300

COGS $14,500

Depreciation Expense $2,900

Interest Expense $690

Dividends Paid $660

Tax Rate for 2015: 40%

Beginning of the Year:

Beginning of Year End of Year

NFA $15,470 $17,120

Current Assets $4,630 $5,345

Current Liabilities $2,520 $2,785

a. Net Income for 2015

Sales $20,300

COGS $14,500

Depreciation Expense $2,900

EBIT $2,900 To find taxes, multiply pretax income

Interest Expense $690

by tax rate of 40%

Pretax Income $2,210

Taxes $884

Net Income $1326

b. Operating Cash Flow for 2015

OCF = Operating Income + Depreciation – Tax

OCF = 2,900 + 2,900 – 884

OCF = $4916

c. Cash Flow from Assets 2015

Cash Flow from Assets = OCF – Capital Spending – NWC change

Capital Spending = Ending NFA – Beginning NFA + Depreciation

=17,120-15,470+2,900

=4,550

NWC Change = (5,345-4630) – (2,785-2520)

NWC Change= 715-265= 450

So, Cash flow from Assets = 4916-4550-450

Cash flow from Assets = -$84

Yes this cash flow number can be negative due to the company investing in assets.

d. Cash Flow to Creditors & Stockholders

Cash Flow to Creditors = Interest- Change in LTD

Cash Flow to Creditors = 690- 0

Cash Flow to Creditors = $690

Cash Flow to Stockholders= Cash from Assets- Cash flow to Creditors

Cash Flow to Stockholders= -84-690

Cash Flow to Stockholders = -$774

You might also like

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- RWJJ Chapter 2: Solutions To Assigned Questions and ProblemsDocument9 pagesRWJJ Chapter 2: Solutions To Assigned Questions and ProblemsvzzrNo ratings yet

- Materi - INCOME TAX ACCOUNTING - 26march2021Document18 pagesMateri - INCOME TAX ACCOUNTING - 26march2021Septian Dwi AnggoroNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- Afif Juwandira-1162003016-Jawaban UTS Semester GenapDocument10 pagesAfif Juwandira-1162003016-Jawaban UTS Semester GenapYusuf AssegafNo ratings yet

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Cash Flows and Financial Statements at YsomDocument4 pagesCash Flows and Financial Statements at YsomKrishna Sharma0% (1)

- Problem Cash FlowDocument3 pagesProblem Cash FlowKimberly AnneNo ratings yet

- LA 2 Construction Contracts PDFDocument3 pagesLA 2 Construction Contracts PDFliliNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- WA12Document2 pagesWA12IzzahIkramIllahiNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Chapter 2 - Concept Questions and Exercises StudentDocument9 pagesChapter 2 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- Jawaban UTS Manajemen KeuanganDocument16 pagesJawaban UTS Manajemen KeuanganMikhail BarenovNo ratings yet

- Apostila 00 Sem RespostasDocument14 pagesApostila 00 Sem Respostasandrea mendonçaNo ratings yet

- Answers To Concepts Review and Critical Thinking QuestionsDocument6 pagesAnswers To Concepts Review and Critical Thinking QuestionsHimanshu KatheriaNo ratings yet

- Basic Corporate TaxationDocument11 pagesBasic Corporate TaxationJoy ConsigeneNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- MK Cap Budgeting CH 9 - 10 Ross PDFDocument17 pagesMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNo ratings yet

- E. Ch02 P15 Flujo Caja, EVA, MVA SolutionDocument3 pagesE. Ch02 P15 Flujo Caja, EVA, MVA SolutionDarling Desirée Togna SalasNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsDocument9 pagesChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- Global Marketing Export Strategy AssignmentDocument19 pagesGlobal Marketing Export Strategy AssignmentYisfalem AlemayehuNo ratings yet

- Assignment 4 - SolutionsDocument2 pagesAssignment 4 - SolutionsstoryNo ratings yet

- Sunset Boards Case StudyDocument3 pagesSunset Boards Case StudyMeredith Wilkinson Ramirez100% (2)

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (20)

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Browning - Ch02 P15 Build A ModelDocument3 pagesBrowning - Ch02 P15 Build A ModelAdamNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Finance 2Document7 pagesFinance 2Vũ Hải YếnNo ratings yet

- Direct IndirectDocument3 pagesDirect IndirectRojane Maagad IINo ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- Highland Malt Accounting Project PDFDocument12 pagesHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Course Folder Fall 2022Document26 pagesCourse Folder Fall 2022Areeba QureshiNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Income Statement: Company NameDocument3 pagesIncome Statement: Company NameCarloNo ratings yet

- Solutions To End-Of-Chapter ProblemsDocument14 pagesSolutions To End-Of-Chapter ProblemsTushar MalhotraNo ratings yet

- 6306903Document4 pages6306903maudiNo ratings yet

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Financial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsDocument9 pagesFinancial Statements, Taxes, and Cash Flow: Solutions To Questions and ProblemsJulyMoon RMNo ratings yet

- Fernandez CoDocument3 pagesFernandez CoNorie FernandezNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Exercises - Chapter 11Document19 pagesExercises - Chapter 11Jhoni Lim67% (3)

- Quis - AK.A - Kelompok 16-1Document7 pagesQuis - AK.A - Kelompok 16-1Apri ZdenkNo ratings yet

- W8 - AS5 - Statement of CashFlowsDocument1 pageW8 - AS5 - Statement of CashFlowsJere Mae MarananNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet