Professional Documents

Culture Documents

Financial Ratios Midterm Exam

Uploaded by

zavriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Ratios Midterm Exam

Uploaded by

zavriaCopyright:

Available Formats

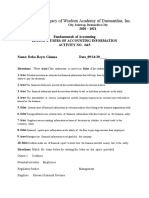

MIDTERM EXAMINATION

FINANCIAL MANAGEMENT

Name: Ronnie Mae Galvez Score:

Course/Year: BSA – 3rd yr. Class Schedule: Friday

Problem 1- Financial Statement Analysis

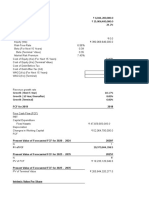

Phina Asa Trading

Statement of Financial Position

As of December 31, XXXX

Assets

2020 2019

Current Assets

Cash Php 58,000 Php 64,000

Trade Receivables 228,000 170,000

Merchandise Inventory 226,000 222,000

Prepaid Expenses 12,000 16,000

Total Current Assets Php 524,000 Php 472,000

Non-Current Assets

Property, Plant, and Equipment 1,050,000 816,000

Total Assets Php 1,574,000 Php 1,288,000

Liabilities & Owner's Equity

Current Liabilties 284,000 252,000

Non-Current Liabilities 578,000 396,000

Total Liabilities 862,000 648,000

Owner's Equity 712,000 640,000

Total Liabilities & Owner's Equity Php 1,574,000 Php 1,288,000

Phina Asa Trading

Income Statement

As of December 31

2020 2019

Net Sales Php 1,716,000 Php 1,606,000

Cost of Goods Sold 1,026,000 1,018,000

Gross Profit 690,000 588,000

Selling and Admin.Expenses 488,000 474,000

Operating Income 202,000 114,000

Interest Expense 40,000 28,000

Income Before Income Taxes (IBIT) 162,000 86,000

Income Tax Expense 66,000 34,000

Net Income Php 96,000 Php 52,000

Required: Compute the following ratios for 2020:

1. Current Ratio = 524,000 / 284,000 = 1.845

2. Quick Ratio = (58,000 + 228,000) / 284,000 = 1.007

3. Receivable Turnover = 1,716,000 / 199,000 = 8.623 times

ATR = (170,000 + 228,000) / 2 = 199,000

4. Average Collection Period = 360 / 8.623 = 41.7488 or 42 days

ADS = 1,716,000 / 360 = 4,766.67

5. Inventory Turnover = 1,026,000 / 224,000 = 4.58 times

AI = (222,000 + 226,000) / 2 = 224,000

6. Average Sales Period = 360 / 4.58 = 78.60 days

7. Working Capital = 524,000 – 284,000 = 240,000

8. Debt Ratio = 862,000 / 1,574,000 = 0.5476

9. Equity Ratio = 712,000 / 1,574,000 = 0.452

10. Debt to Equity Ratio = 862,000 / 712,000 = 1.21

11. Time Interest Earned = 202,000 / 40,000 = 5.05

12. Gross Profit Ratio = 690,000 / 1,716,000 = 0.402

13. Operating Profit Margin = 202,000 / 1,716,000 = 0.1177

14. Net Profit Margin = 96,000 / 1,716,000 = 0.0559

15. Return on Assets = 96,000 / 1,431,000 = 0.067

ATA = (1,288,000 + 1,574,000) / 2 = 1,431,000

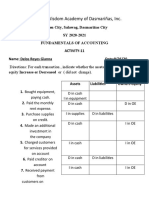

Problem 2- Financial Statement Analysis

The following data represent selected information from the comparative Income

Statement and Balance Sheet for Starla Company for the years ended December

31,2019 and 2020:

2020 201 9

Net Sales (all on Credit) P370,000 P333,000

Cost of Goods Sold 160,000 150,000

Gross Profit 210,000 183,000

Income from operations 95,000 87,000

Interest Expense 8,000 8,000

Net Income 70,000 57,000

Cash 10,000 14,000

Accounts receivable, net 30,000 25,000

Inventory 43,000 40,000

Prepaid Expenses 5,000 7,000

Total Current Assets 88,000 86,000

Total Noncurrent Assets 112,000 104,000

Total Current Liabilities 70,000 60,000

Total Noncurrent Liabilities 40,000 45,000

Ordinary Share capital,no-par* 60,000 60,000

Retained earnings 30,000 25,000

*Note:10,000 ordinary shares have been issued and outstanding since the company was established.

They had a market value of P90 per share at 12/31/19 and they were selling for P91.50 per share at

P91.50 per share at 12/31/2020.

Required: Compute the following ratios for 2020:

1. Current Ratio = 88,000 / 70,000 = 1.257

2. Quick Ratio = (10,000 + 30,000) / 70,000 = 0.571

3. Receivable Turnover = 370,000 / 27,500 = 13.45 times

ATR = (25,000 + 30,000) / 2 = 27,500

4. Average Collection Period = 360 / 13.45 = 26.766 days

ADS = 370,000 / 360 = 1,027.78

5. Inventory Turnover = 160,000 / 41,500 = 3.855 times

AI = (40,000 + 43,000) / 2 = 41,500

6. Average Sales Period = 360 / 3.855 = 93.385

7. Working Capital = 88,000 – 70,000 = 18,000

8. Debt Ratio = 110,000 / 200,000 = 0.55

9. Equity Ratio = 90,000 / 200,000 = 0.45

10. Debt to Equity Ratio = 110,000 / 90,000 = 1.22

11. Time Interest Earned = 95,000 / 8,000 = 11.875

12. Gross Profit Ratio = 210,000 / 370,000 = 0.568

13. Operating Profit Margin = 95,000 / 370,000 = 0.257

14. Net Profit Margin = 70,000 / 370,000 = 0.189

15. Return on Assets = 70,000 / 195,000 = 0.359

ATA = (190,000 + 200,000) / 2 = 195,000

END OF TEST

Success does not happen by chance. It takes dedication, hard effort, learning, studying,

sacrifice, and, most importantly, a love of what you are doing and not doing what you

love.

-FPDL

Prepared by:

Florante P. De Leon, CTT, DBA (CAR)

You might also like

- Jackielyn Magpantay Chart of AccountsDocument9 pagesJackielyn Magpantay Chart of AccountsIgnite NightNo ratings yet

- Financial Ratios Midterm ExamDocument4 pagesFinancial Ratios Midterm Examzavria100% (1)

- Square Pharma Valuation ExcelDocument43 pagesSquare Pharma Valuation ExcelFaraz SjNo ratings yet

- Quiz Financial MarketDocument3 pagesQuiz Financial MarketAmie Jane MirandaNo ratings yet

- FinMan Module 2 Financial Markets & InstitutionsDocument13 pagesFinMan Module 2 Financial Markets & Institutionserickson hernanNo ratings yet

- MB0045 Financial Management Answer KeyDocument21 pagesMB0045 Financial Management Answer Keysureshganji06No ratings yet

- Review of Asit Baran Pati course ranking system indicatorsDocument2 pagesReview of Asit Baran Pati course ranking system indicatorsakash srivastava100% (4)

- Chapter 05: Operating and Financial Leverage Break-Even AnalysisDocument54 pagesChapter 05: Operating and Financial Leverage Break-Even AnalysisPrince Alexis GarciaNo ratings yet

- Part 1 of Module I GBERMICDocument12 pagesPart 1 of Module I GBERMICjhie boterNo ratings yet

- Answer Key For Week 1 To 3 ULO 8 To 10Document7 pagesAnswer Key For Week 1 To 3 ULO 8 To 10Margaux Phoenix KimilatNo ratings yet

- Outlining ActivityDocument2 pagesOutlining Activityzavria71% (7)

- 05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersDocument6 pages05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersMerr Fe PainaganNo ratings yet

- Projected Financials for Water Refilling StationDocument9 pagesProjected Financials for Water Refilling StationjaneNo ratings yet

- Activity #2: Case Analysis Involving Financial Statements: AnswerDocument2 pagesActivity #2: Case Analysis Involving Financial Statements: AnswerJeramie Sarita SumaotNo ratings yet

- BF Case Study Sweet Beginnings Co 1Document3 pagesBF Case Study Sweet Beginnings Co 1Bryan Caadyang100% (1)

- Lecture 2 Statement of Changes in Equity Multiple ChoiceDocument5 pagesLecture 2 Statement of Changes in Equity Multiple ChoiceJeane Mae Boo100% (1)

- Chapter 15 - Working CapitalDocument19 pagesChapter 15 - Working CapitalAmjad J AliNo ratings yet

- Accounting Education Program Financial Market ReviewDocument3 pagesAccounting Education Program Financial Market Reviewalajar opticalNo ratings yet

- Tax 321 Prelim Quiz 1 Key PDFDocument13 pagesTax 321 Prelim Quiz 1 Key PDFJeda UsonNo ratings yet

- Bond Yield To Maturity (YTM) FormulasDocument2 pagesBond Yield To Maturity (YTM) FormulasIzzy BNo ratings yet

- Specialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryDocument10 pagesSpecialized Industries Airlines: Name: Jayvan Ponce Subject: Pre 4 Auditing and Assurance: Specialized IndustryCaptain ObviousNo ratings yet

- AuditDocument5 pagesAuditKyanna Mae LecarosNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- Why Is Economics Central To An Understanding of The Problems of DevelopmentDocument1 pageWhy Is Economics Central To An Understanding of The Problems of DevelopmentMaureen LeonidaNo ratings yet

- Financial Market Quiz 2 FABRIADocument5 pagesFinancial Market Quiz 2 FABRIAClaire Magbunag AntidoNo ratings yet

- Gov QuizDocument42 pagesGov QuizNichole Tumulak100% (1)

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- Examination About Investment 16Document2 pagesExamination About Investment 16BLACKPINKLisaRoseJisooJennieNo ratings yet

- Gray Electronic Repair ServicesDocument1 pageGray Electronic Repair ServicesFarman AfzalNo ratings yet

- Determine working capital policies ROI and cash conversion cyclesDocument2 pagesDetermine working capital policies ROI and cash conversion cyclesGreys Maddawat MasulaNo ratings yet

- Capital Budgeting: Decision Criteria: True-FalseDocument40 pagesCapital Budgeting: Decision Criteria: True-Falsedavid80dcnNo ratings yet

- Advanced Accounting Vol 2 Guerrero and Peralta ManDocument1 pageAdvanced Accounting Vol 2 Guerrero and Peralta ManEli PerezNo ratings yet

- Chapter 3 Lecture Hand-Outs - Problem SolvingDocument5 pagesChapter 3 Lecture Hand-Outs - Problem SolvingLuzz LandichoNo ratings yet

- STRATEGIC MANAGEMENT GUIDEDocument21 pagesSTRATEGIC MANAGEMENT GUIDEnadineNo ratings yet

- Investasi Bisnis LogamDocument3 pagesInvestasi Bisnis LogamCarihunian DepokNo ratings yet

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosNo ratings yet

- Chapter 17Document9 pagesChapter 17Maketh.ManNo ratings yet

- Chap 013Document667 pagesChap 013Rhaine ArimaNo ratings yet

- Calculate ROI, Residual Income for divisionsDocument4 pagesCalculate ROI, Residual Income for divisionsLealyn CuestaNo ratings yet

- Standard Unmodified Auditor ReportDocument3 pagesStandard Unmodified Auditor ReportRiz WanNo ratings yet

- Mortgage Markets Practice Problems SolutionsDocument8 pagesMortgage Markets Practice Problems Solutionsjam linganNo ratings yet

- Chapter 27 AnswerDocument5 pagesChapter 27 AnswerporchieeannNo ratings yet

- Problem 14-5: Kayla Cruz & Gabriel TekikoDocument7 pagesProblem 14-5: Kayla Cruz & Gabriel TekikoNURHAM SUMLAYNo ratings yet

- Capital Structure and Leverage Chapter - One Part-1Document38 pagesCapital Structure and Leverage Chapter - One Part-1shimelisNo ratings yet

- Diagnostic Quiz On Accounting 2Document9 pagesDiagnostic Quiz On Accounting 2Anne Ford67% (3)

- Financial Modeling Chapter 2 Calculating Cost of Capital 2015Document64 pagesFinancial Modeling Chapter 2 Calculating Cost of Capital 2015NEERAJ N RCBSNo ratings yet

- Horizontal Analysis Interpretation PDFDocument2 pagesHorizontal Analysis Interpretation PDFAlison JcNo ratings yet

- Role of Financial Management in OrganizationDocument8 pagesRole of Financial Management in OrganizationTasbeha SalehjeeNo ratings yet

- Audit Quiz 2Document1 pageAudit Quiz 2Von Andrei MedinaNo ratings yet

- This Study Resource Was: Chapter 4: Developing A Competitive Strategy Contemporary Cost Management TechniquesDocument1 pageThis Study Resource Was: Chapter 4: Developing A Competitive Strategy Contemporary Cost Management TechniquesJanelleNo ratings yet

- 2Document13 pages2Ashish BhallaNo ratings yet

- Chapter 3 - TheoriesDocument10 pagesChapter 3 - TheoriesXynith Nicole RamosNo ratings yet

- Balanced ScorecardDocument14 pagesBalanced ScorecardLand DoranNo ratings yet

- FINMAN Answer KeyDocument7 pagesFINMAN Answer KeyReginald ValenciaNo ratings yet

- QUIZZERDocument4 pagesQUIZZERchowchow123No ratings yet

- Nacua CAC Unit2 ActivityDocument13 pagesNacua CAC Unit2 ActivityJasper John NacuaNo ratings yet

- Cash Flow Statement1Document2 pagesCash Flow Statement1Mila Mercado0% (1)

- Income Tax Expense CalculationDocument4 pagesIncome Tax Expense CalculationHana Grace MamangunNo ratings yet

- Ch01 McGuiganDocument31 pagesCh01 McGuiganJonathan WatersNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Finman FinalsDocument4 pagesFinman FinalsDianarose RioNo ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Claims Activity.Document2 pagesClaims Activity.zavriaNo ratings yet

- Fitt 1 - Activity 5Document1 pageFitt 1 - Activity 5zavriaNo ratings yet

- Objective: Philippine Physical Fitness TestDocument2 pagesObjective: Philippine Physical Fitness Testzavria0% (1)

- Activity 1Document1 pageActivity 1zavriaNo ratings yet

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- Academic writing assessmentDocument2 pagesAcademic writing assessmentzavriaNo ratings yet

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Part 2Document3 pagesPart 2zavriaNo ratings yet

- Title Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas IncDocument1 pageTitle Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas InczavriaNo ratings yet

- Claims Activity.Document2 pagesClaims Activity.zavriaNo ratings yet

- Academic writing assessmentDocument2 pagesAcademic writing assessmentzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity 9: Delos Reyes Gianna 12 - DisciplineDocument1 pageActivity 9: Delos Reyes Gianna 12 - DisciplinezavriaNo ratings yet

- Forming Opinions from FactsDocument2 pagesForming Opinions from FactszavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity 7 - Accounting PrinciplesDocument2 pagesActivity 7 - Accounting PrincipleszavriaNo ratings yet

- Activity-6 ACCOUNTING PRINCIPLEDocument2 pagesActivity-6 ACCOUNTING PRINCIPLEzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- General Journal Date: Delos Reyes Gianna Grade 12 - DisciplineDocument2 pagesGeneral Journal Date: Delos Reyes Gianna Grade 12 - DisciplinezavriaNo ratings yet

- Starting a Bakery BusinessDocument1 pageStarting a Bakery BusinesszavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- 26086130294Document2 pages26086130294Whales CallNo ratings yet

- Exchange Traded FundDocument26 pagesExchange Traded Fundharsh thakkar100% (3)

- Jaarverslag ASML - Adoptieverslag - 2015Document130 pagesJaarverslag ASML - Adoptieverslag - 2015MarcNo ratings yet

- Working Capital Management at Heritage FoodsDocument34 pagesWorking Capital Management at Heritage FoodsMohmmedKhayyumNo ratings yet

- Joint Venture ADV CH1Document8 pagesJoint Venture ADV CH1Tilahun GirmaNo ratings yet

- Loan Capital and Financial InstrumentsDocument23 pagesLoan Capital and Financial Instrumentsathirah jamaludinNo ratings yet

- United Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Document0 pagesUnited Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Elegant EmeraldNo ratings yet

- Coke - DmafDocument2 pagesCoke - DmafPrecious Gail SantosNo ratings yet

- PNC INFRATECH - ASM ProjectDocument11 pagesPNC INFRATECH - ASM ProjectAbhijeet kohatNo ratings yet

- Recommended TextbookDocument4 pagesRecommended TextbookjozsefczNo ratings yet

- Buy Back of SharesDocument12 pagesBuy Back of SharesShashank AgrawalNo ratings yet

- Img 20200707 0003 PDFDocument26 pagesImg 20200707 0003 PDFJade MarieNo ratings yet

- Accounting For ManagersDocument3 pagesAccounting For ManagersMaulik RadadiyaNo ratings yet

- ANNUAL REPORT CORRECTED FinalDocument118 pagesANNUAL REPORT CORRECTED FinalJhomel AlcantaraNo ratings yet

- WORKSHEET Erlinda Seechua AutosavedDocument3 pagesWORKSHEET Erlinda Seechua AutosavedJeraldine DejanNo ratings yet

- Solved ProblemDocument4 pagesSolved ProblemSophiya NeupaneNo ratings yet

- Fund Flow PDFDocument16 pagesFund Flow PDFSamruddhiSatav0% (1)

- Tax Rate Calculation and WACC for SignifyDocument9 pagesTax Rate Calculation and WACC for SignifyShivam GoelNo ratings yet

- Ratio Analysis On Asian PaintsDocument16 pagesRatio Analysis On Asian PaintsMadhumita AcharjeeNo ratings yet

- ACCA Paper F7: Financial ManagementDocument11 pagesACCA Paper F7: Financial ManagementLai AndrewNo ratings yet

- 677261-Foundations of Financial Management Ch04Document28 pages677261-Foundations of Financial Management Ch04pcman92No ratings yet

- Factors Affecting Share PricesDocument40 pagesFactors Affecting Share PricesRam PhalNo ratings yet

- Balance Sheet SimpleDocument3 pagesBalance Sheet Simplegeovanny ordonezNo ratings yet

- Fundamentals of Accountancy, Business and Management 2Document58 pagesFundamentals of Accountancy, Business and Management 2Carmina Dongcayan100% (1)

- Brigham15e Ch03Document14 pagesBrigham15e Ch03Aruzhan TanirbergenNo ratings yet

- UNIT - 1 - Capital Budgeting Techniques - Prasanna ChandraDocument17 pagesUNIT - 1 - Capital Budgeting Techniques - Prasanna ChandraRakshith SNo ratings yet

- Ratios FormulasDocument6 pagesRatios FormulasvmktptNo ratings yet