Professional Documents

Culture Documents

Legacy of Wisdom Academy of Dasmariñas, Inc

Uploaded by

zavriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Legacy of Wisdom Academy of Dasmariñas, Inc

Uploaded by

zavriaCopyright:

Available Formats

Legacy of Wisdom Academy of Dasmariñas, Inc.

Golden City, Salawag, Dasmariñas City

SY 2020-2021

FUNDAMENTALS OF ACCOUNTING

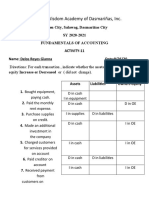

Lesson 10- Accounting Equation

ACTIVITY-11

Name: Gianna Delos Reyes

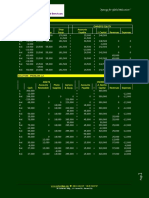

COMPUTATION OF MISSING AMOUNTS

Drill NO. 1 : Mr. Pedro Perez started a car wash business on January 1, 2019. His initial investments

were cash amounting to ₱ 50,000 and one piece of cleaning equipment worth ₱20,000. Compute for the

correct total owner’s equity as of Jan. 1 2019.

Account title Assets =50,000 Liabilities +20,000 Owner’s

Equity or

Capital

Cash ₱50,000 +90,000

Cleaning 20,000

equipment

TOTAL 70,000

To compute for owner’s equity:

Account Title Owner’s =50,000 Assets + 20,000 Liabilities

Equity or

capital

Perez, capital ₱70,000 =-0 ₱70,000 ₱-0

Using the basic accounting equation, the correct owner’s equity as of JAN. 1, 2019 IS ₱70,000.

Total assets ₱70,000

Less liabilities

Total owner’s equity ₱ 70,000

Drill NO. 2 . Using the same given from Drill No.1 , assume that on January 15, 2019 Mr Pedro Perez

borrowed ₱40,000 cash from his friend to increase the working capital. Working capital is the

difference between current assets and current liabilities. On January 16, 2019, he used ₱5,000 of the

money borrowed to buy cleaning supplies. Compute for the correct total assets as of Jan 16, 2019.

Answer:

Account title Assets = Liabilities + Owner’s

Equity or

capital

Cash ₱ 85,000

Cleaning 20,000

equipment

Cleaning 5,000

supplies

Accounts ₱40,000

payable

Perez, capital ₱ 70,000

TOTAL ₽110,000 ₱40,000 ₱70,000

Using the basic accounting equation, the correct total assets as of January 16, 2019 is₱110,000

TOTAL LIABILITIES ₱40,000

ADD: Total Owner’s Equity 70,000

TOTAL ASSETS ₱110,000

Cash was computed this way:

Cash balance January1, 2019 ₱50,000

Add: amount borrowed from a friend 40,000

Deduct: Amount used to buy cleaning supplies 5,000

Subtotal 90,000

Cash balance, January 16, 2019 ₱ 85,000

Drill no.3

Ms. Juana Jimenez started a food catering business on January 1 , 2019. By December 31, 2019, total

assets totalled ₱150,000 and total owner’s equity was 90,000. Compute for the correct total liabilities as

of Dec 31, 2019.

Using the basic accounting equation we can derive:

Liabilities = Assets- Owner’s Equity or Capital

TOTAL ASSETS ₱ 150,000

Deduct total Owner’s Equity 90,000

Total liabilities ₱60,000

DRILL NO. 4

In addition to the given Drill 3 , Juana Jimenez reported total catering revenues of ₱ 80,000 and a

total expenses of ₱45,000 for 2019. Compute for the correct net income by the year ended December 31,

2019.

Total catering revenues ₱80,000

Deduct Total expenses ₱45,000

Net income ₱35,000

Continuing Drill no.4 . Assume that Juana Jimenez had initial investments of ₱50,000 cash and there

was no other transactions that took place in 2019 that would affect owner’s equity aside from owner’s

cash withdrawal . Compute for the correct cash withdrawal made by Juana in 2019.

Answer:

Initial investment cash P50,000

Cash withdrawal (2019) P35,000

Correct cash withdrawal P85,000

DRILL NO 5.

Total Owner’s Equity 90,000

Dec 31, 2019

Deduct initial investment 50,000

Jan 1, 2019

Net Income 35,000

Total withdrawals made 50,000

ACRONYMS : CREW

Capital contribution by the owner ( increases ownre’s equity) = CC

Revenue earned( increases owner’s equity) = Rev.

Expenses incurred( decreases owner’s euity) = Exp.

Withdrawals made by the owner ( decreases equity) = W/D

DRILL NO. 6

Filemon Car Repair Shop started the business with the Total Assets of₱100,000 and a total liabilities of

₱ 50,000 on January 1, 2019. During the year the business recorded ₱140,000 in car repair revenue, ₱

85,000 in expenses and Filemon withdrew ₱12,000.

Required:

1. Compute for the correct balance of Filemon ‘s Car Repair Shop for the year Ended Dec. 31,

2019.

CORRECT BALANCE = P93,000

2. Compute for the correct change ( net movement) in Filemon , Capital during the year 2019.

CAPITAL = P50,000

3. Compute for the correct change( net movement) in Filemon ,Capital account from the beginning

of the year to the end of the year. CAPITAL ACCOUNT = P287,000

Total car repair revenue 100,000

Deduct total expenses 50,000

Net Income (1) 50,000

Net Income 140,000

Deduct Withdrawal 12,000

Filemon, Capital, Jan 1, 2019 (2) 50,000

Add Change in Felimon Capital 337,000

Filemon, Capital Dec 31, 2019 (3) 93,000

You might also like

- Bus Math Grade 11 Q2 M2 W3Document12 pagesBus Math Grade 11 Q2 M2 W3Ronald AlmagroNo ratings yet

- 2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsDocument25 pages2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsMoon Binn100% (2)

- Assignment November11 KylaAccountingDocument2 pagesAssignment November11 KylaAccountingADRIANO, Glecy C.No ratings yet

- Senior High School S.Y. 2019-2020Document4 pagesSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- Module 2 - RevisedDocument31 pagesModule 2 - RevisedAries Gonzales Caragan25% (4)

- Drill ABMDocument1 pageDrill ABMGeorge Gonzales78% (23)

- (Transaction # 1Document3 pages(Transaction # 1Caryl May Esparrago MiraNo ratings yet

- Kay TravelDocument2 pagesKay TravelEllen Joy Peniero67% (3)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- Legacy of Wisdom Academy of Dasmariñas, IncDocument5 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Module 3Document47 pagesModule 3Harrold HarryNo ratings yet

- Intervention in Fabm 1: PHP 35,000 PHP 15,000 PHP 107,000 PHP 70,000 PHP 120,000 22Document12 pagesIntervention in Fabm 1: PHP 35,000 PHP 15,000 PHP 107,000 PHP 70,000 PHP 120,000 22sarah macatangayNo ratings yet

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Document35 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Service Firm (Part 1)Ponsica Romeo50% (2)

- Chapter18 - Answer PDFDocument25 pagesChapter18 - Answer PDFAvon Jade RamosNo ratings yet

- Journalizing BadethDocument4 pagesJournalizing BadethBernadette F. Cantre100% (1)

- Abm General and Special JournalDocument63 pagesAbm General and Special JournalEstelle Gammad33% (3)

- Sales Cost of SalesDocument4 pagesSales Cost of SalesRio Awitin50% (2)

- Financial Statement AnalysisDocument25 pagesFinancial Statement AnalysisAldrin CustodioNo ratings yet

- Lesson 9.4 Adjusting EntriesDocument36 pagesLesson 9.4 Adjusting EntriesDanica Medina50% (2)

- Abm Abm Abm AbmDocument27 pagesAbm Abm Abm AbmNoaj Palon100% (1)

- Fabm1 Preparing Adjusting EntriesDocument19 pagesFabm1 Preparing Adjusting EntriesVenice0% (1)

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Hourly Employee Earnings Rate M T W TH F Reg. OT GrossDocument6 pagesHourly Employee Earnings Rate M T W TH F Reg. OT GrossAislin Joy SabusapNo ratings yet

- Week 4 5 ULOb Lets Check Activity 1 SolutionDocument3 pagesWeek 4 5 ULOb Lets Check Activity 1 Solutionemem resuentoNo ratings yet

- Seatwork 5: Application A. Owner's EquityDocument7 pagesSeatwork 5: Application A. Owner's EquityAngela GarciaNo ratings yet

- Acctg Principles and ConceptsDocument25 pagesAcctg Principles and ConceptsAdelyn Dizon50% (2)

- Bamuya Fabm Act-3Document2 pagesBamuya Fabm Act-3Irish C. BamuyaNo ratings yet

- Republic of The Philippines Department of Education Region Vii, Central Visayas Division of Cebu Province Self-Learning Home Task (SLHT)Document20 pagesRepublic of The Philippines Department of Education Region Vii, Central Visayas Division of Cebu Province Self-Learning Home Task (SLHT)Joseph Entera100% (2)

- Fabm - Q2 - Las-For LearnersDocument113 pagesFabm - Q2 - Las-For LearnersABM-AKRISTINE DELA CRUZNo ratings yet

- Journalizing TransactionsDocument24 pagesJournalizing TransactionsManuel Panotes Reantazo50% (2)

- Rovelyn E. Forcadas ABM-11 Activity #9-BDocument2 pagesRovelyn E. Forcadas ABM-11 Activity #9-BRovelyn E. ForcadasNo ratings yet

- Answers in Fundamentals of Accountancy, Business and Management 1Document14 pagesAnswers in Fundamentals of Accountancy, Business and Management 1Sherilyn Diaz0% (2)

- A.) Income StatementDocument2 pagesA.) Income StatementShawn Mendez100% (2)

- Fundamentals of Accountancy Business Management 2: Learning PacketDocument33 pagesFundamentals of Accountancy Business Management 2: Learning PacketArjae Dantes50% (2)

- FABM 2 - Lesson1 5Document78 pagesFABM 2 - Lesson1 5Sis HopNo ratings yet

- Topic: Accounting Cycle of A Service BusinessDocument5 pagesTopic: Accounting Cycle of A Service BusinessJohn Rey BusimeNo ratings yet

- Identify Which of The Following Transactions FallDocument1 pageIdentify Which of The Following Transactions FallAdoree Ramos75% (4)

- Week 7-8Document8 pagesWeek 7-8Kim Albero Cubel0% (1)

- Fundamentals of Accountancy Business and Management 1: Learning Activity Sheet Posting To The LedgerDocument18 pagesFundamentals of Accountancy Business and Management 1: Learning Activity Sheet Posting To The Ledgerwhat's up mga kaibiganNo ratings yet

- CAT 1 Module 1 SolutionsDocument21 pagesCAT 1 Module 1 SolutionsKizyll0% (1)

- FABM2 Week5Document14 pagesFABM2 Week5Hazel TolentinoNo ratings yet

- August 1 2 8 9 15 16 Trade DiscountDocument26 pagesAugust 1 2 8 9 15 16 Trade DiscountEDSERLITO REÑOS100% (2)

- Assessment QuizDocument2 pagesAssessment QuizFrancis Raagas67% (3)

- Module in Fabm 1: Department of Education Schools Division of Pasay CityDocument6 pagesModule in Fabm 1: Department of Education Schools Division of Pasay CityAngelica Mae SuñasNo ratings yet

- Description Account Title SFP Element: Accounts PayableDocument4 pagesDescription Account Title SFP Element: Accounts PayableEnrique BongaisNo ratings yet

- The Following Are Transactions of Bagalia Trucking Services For The Month of AugustDocument4 pagesThe Following Are Transactions of Bagalia Trucking Services For The Month of AugustKhriza Joy SalvadorNo ratings yet

- Act 110 Module 2Document28 pagesAct 110 Module 2Nashebah A. BatuganNo ratings yet

- Activity:: I. Define The Following TermsDocument3 pagesActivity:: I. Define The Following TermsAnonymousNo ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- Fundamentals of Abm 2 Q2 Module 1 Week 1 2Document13 pagesFundamentals of Abm 2 Q2 Module 1 Week 1 2ganda dyosaNo ratings yet

- What's MoreDocument5 pagesWhat's MoreJade Payba50% (2)

- FABM Dictionary 1Document32 pagesFABM Dictionary 1Candy TinapayNo ratings yet

- Fabm1 Completing The Accounting CycleDocument16 pagesFabm1 Completing The Accounting CycleVeniceNo ratings yet

- 2016 14 PPT Acctg1 Adjusting EntriesDocument20 pages2016 14 PPT Acctg1 Adjusting Entriesash wu100% (3)

- Accounting 2 Week 1 4 LPDocument33 pagesAccounting 2 Week 1 4 LPMewifell100% (1)

- Problem 4 SFPDocument11 pagesProblem 4 SFPMylene SantiagoNo ratings yet

- 1.2 Accounting Concepts and PrinciplesDocument4 pages1.2 Accounting Concepts and PrinciplesVillamor NiezNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Financial Statement ExampleDocument21 pagesFinancial Statement ExampleLucky MehNo ratings yet

- Accounting Journal of EntriesDocument8 pagesAccounting Journal of EntriesKristo Ver TamposNo ratings yet

- Fitt 1 - Activity 5Document1 pageFitt 1 - Activity 5zavriaNo ratings yet

- Claims Activity.Document2 pagesClaims Activity.zavriaNo ratings yet

- Part 2Document3 pagesPart 2zavriaNo ratings yet

- Objective: Philippine Physical Fitness TestDocument2 pagesObjective: Philippine Physical Fitness Testzavria0% (1)

- Activity 1Document1 pageActivity 1zavriaNo ratings yet

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Outlining ActivityDocument2 pagesOutlining Activityzavria71% (7)

- Delos Reyes - Grade 12 - EAPPDocument2 pagesDelos Reyes - Grade 12 - EAPPzavriaNo ratings yet

- Delos Reyes - Grade 12 - EAPPDocument2 pagesDelos Reyes - Grade 12 - EAPPzavriaNo ratings yet

- Title Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas IncDocument1 pageTitle Impact of Online Teaching Towards The Behavior of The Students in Legacy of Wisdom Academy of Dasmarinas InczavriaNo ratings yet

- The Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionDocument2 pagesThe Family Guy Is Not Appropriate To Watch During School.: Write Down Whether Each Example Is Fact or OpinionzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Claims Activity.Document2 pagesClaims Activity.zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity-6 ACCOUNTING PRINCIPLEDocument2 pagesActivity-6 ACCOUNTING PRINCIPLEzavriaNo ratings yet

- Read The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerDocument2 pagesRead The Two Paraphrases of The Original Text Below. Select The Most Appropriate Paraphrase Then Explain Your AnswerzavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- General Journal Date: Delos Reyes Gianna Grade 12 - DisciplineDocument2 pagesGeneral Journal Date: Delos Reyes Gianna Grade 12 - DisciplinezavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity 7 - Accounting PrinciplesDocument2 pagesActivity 7 - Accounting PrincipleszavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument2 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity - 1Document1 pageActivity - 1zavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Activity 9: Delos Reyes Gianna 12 - DisciplineDocument1 pageActivity 9: Delos Reyes Gianna 12 - DisciplinezavriaNo ratings yet

- Legacy of Wisdom Academy of Dasmariñas, IncDocument1 pageLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet

- Pnadk 970Document64 pagesPnadk 970Kasolo DerrickNo ratings yet

- Ahmed Abd ElmoneimDocument13 pagesAhmed Abd Elmoneimmohamed ashorNo ratings yet

- Advanced Accounting 4th Edition Jeter Solutions Manual Full Chapter PDFDocument50 pagesAdvanced Accounting 4th Edition Jeter Solutions Manual Full Chapter PDFanwalteru32x100% (15)

- Assignment 3 AdmissionDocument8 pagesAssignment 3 AdmissionKavyashri PNo ratings yet

- Valuation of BondsDocument7 pagesValuation of BondsHannah Louise Gutang PortilloNo ratings yet

- Financial Analysis of Mozaffar Hossain Spinning Mills: Submitted byDocument12 pagesFinancial Analysis of Mozaffar Hossain Spinning Mills: Submitted byEhsanul AzimNo ratings yet

- How Fed Became The Dealer of Last Resort PaperDocument9 pagesHow Fed Became The Dealer of Last Resort PaperMichael Joseph KellyNo ratings yet

- Edita's Opertionalization StrategyDocument13 pagesEdita's Opertionalization StrategyMaryNo ratings yet

- Managing Risk For Our Global Corporate TreasuryDocument46 pagesManaging Risk For Our Global Corporate TreasuryIonNo ratings yet

- Corporate Level StrategyDocument33 pagesCorporate Level StrategyDave NamakhwaNo ratings yet

- Solution Engineering EconomicsDocument130 pagesSolution Engineering EconomicsSparrowGospleGilbertNo ratings yet

- An 270921Document110 pagesAn 270921sunil_sanstoreNo ratings yet

- Management of Financial ServicesDocument309 pagesManagement of Financial ServicesSeena AlexanderNo ratings yet

- FRS Updates NotesDocument6 pagesFRS Updates NotesChammy TeyNo ratings yet

- Accounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutDocument77 pagesAccounting Application by Computer (TallyPrime) - BAAC 2205 - HandoutWijdan Saleem EdwanNo ratings yet

- Foreign Exchange MarketDocument24 pagesForeign Exchange MarketGaurav DhallNo ratings yet

- The Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Document50 pagesThe Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Trúc Ly Cáp thịNo ratings yet

- Perception of Investors Towards Online Trading: IntrodutionDocument64 pagesPerception of Investors Towards Online Trading: IntrodutionArjun S A100% (1)

- Maths Work Sheet (1) Chapter - 1Document10 pagesMaths Work Sheet (1) Chapter - 1ibsaashekaNo ratings yet

- Audit of Accounts of Non-Corporate Entities (Bank Borrowers)Document50 pagesAudit of Accounts of Non-Corporate Entities (Bank Borrowers)Manikandan ManoharNo ratings yet

- Lecture 3 QuestionsDocument9 pagesLecture 3 QuestionsPubg KrNo ratings yet

- SFP Act 2021Document4 pagesSFP Act 2021moreNo ratings yet

- Biopharmaceutical Sector: Market Update - September 9, 2021Document43 pagesBiopharmaceutical Sector: Market Update - September 9, 2021Atrocitus RedNo ratings yet

- Balance Sheet: AssetsDocument19 pagesBalance Sheet: Assetssumeer shafiqNo ratings yet

- Loan AmortizationDocument3 pagesLoan AmortizationMarvin AlmariaNo ratings yet

- Shareholderse of SGX-Catalist Listed Rokko Approved S$8.0M Acuisition of Jade Precision Engineering Pte LTDDocument2 pagesShareholderse of SGX-Catalist Listed Rokko Approved S$8.0M Acuisition of Jade Precision Engineering Pte LTDWeR1 Consultants Pte LtdNo ratings yet

- SOUTHWEST AIRWAYS CORPORATION NewDocument8 pagesSOUTHWEST AIRWAYS CORPORATION NewMelrose UretaNo ratings yet

- Financial Markets Meaning, Types and WorkingDocument15 pagesFinancial Markets Meaning, Types and WorkingRainman577100% (1)

- Investment Thesis GoeasyDocument12 pagesInvestment Thesis GoeasyArturoNo ratings yet