Professional Documents

Culture Documents

The Wall Street Journal: Winning Cotntnodity Traders May Be Made, Not Born

Uploaded by

hamada sharaf0 ratings0% found this document useful (0 votes)

114 views1 pageTurtle Article

Original Title

Wsj Turtle Article

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTurtle Article

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

114 views1 pageThe Wall Street Journal: Winning Cotntnodity Traders May Be Made, Not Born

Uploaded by

hamada sharafTurtle Article

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

THE WALL STREET JOURNAL

TUESDAY, SEPTEMBER 5, 1989 ©>l 989 Dow 1 ones & Company, Inc. A fl Rights Reserved

Winning Cotntnodity Traders

May Be Made, Not Born

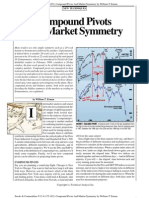

YOUR A Turtle Race Worth Watching

MONEY Performance of 14 commodity-trading advisers taught by Richa rd Dennis

AVERAGE

MATTERS ANNUAL FIRST HALF ANNUAL QUARTERLY

B Y STANLEY W. A NGRIST COMPOUND 1989 RETURNS RETURNS

RETURN RETURN (Range: 85-88) 1 (Range 85-89) 1

Can the skills of successful commodity Stig Ostgaard 124.1% 0.4% 87 .8 to 296.7% 49.0 to 317.5%

trading be learned? Or are they innate, some Elizabeth Cheval 114.1 41.1 51.6 to 178.0 -2 7.1 to 203.3

sort of sixth sense a lucky few are born with?

Michael Cavallo 107.7 16.1 33.6 to 307.4 -54.7 to 195.5

Richard Dennis, the legendary Chicago com-

modity trader, who turned a grubstake of$400 into Chesapeake2 94.4 6.4 45.7 to 147.7 -13.1 to 160.1

an estimated $200 mil- Paul Rabar 89.1 20.0 78.1 to 125.9 -24.8 to 189.6

lion or so in 18 years, Philip Lu 88.9 36.0 36.3 to 132.3 -9.2 to 148.2

bas no doubt. Following Craig Soderquist 82 .4 21.3 58.9 to 135.9 -20.0 to 132.2

an experiment with a James DiMaria 70.9 0.8 17.3 to 154.9 -20.2 to 192.3

group of would-be

Brian Proctor 64.5 -13.2 -20.1 to 151.9 -41.6 to 155.8

traders recruited from

around the country, he's Howard Seidler 64.2 23.0 15.8 to 123.6 -16.6 to 90.3

convinced the secrets of Tom Shanks 63 .7 18.8 -29 .1 to 195.1 -37 .8 to 183.1

commodity trading can Jeff Gordon 41 .8 16.4 3.2 to 111.1 -5 .6 to 83.9

be learned. Michael Carr 38.9 13.7 -18.1 to 88.0 -3 1.7 to 112.4

Over the past 4 1,2

years, a group of 14 By Comparison

commodity traders be Richard Dennis Barclay CTA lndex 3 25.10% 10.90% 4.3 to 55.4% -12.10% to 32.4%

taught earned an aver- S&P 500 19.20% 16.50% 5. 10% to 31.6% -22.50% to 21.3 %

age annual compolllld rate of return of 80%. 1n 1) Returns overstate performance because traders paid small or no commissions and no management fees through first

contrast, about 70% of all non-professional com- quarter of 1988. However, they received no interest credit on trading capital.

2) Chesapeake Capital Corp. is jointly owned by R. Jerry Parker and Russell J. Sands.

modity traders lose money on a yearly basis.

3) The performance of more than 110 commodity-tradi ng advisers who have been trading more than four years

"Trading was even more teachable than I 4) Total return, including dividends -Source Barclay Trading Group Ltd.

imagined," be says. "ln a strange sort of way,

it was almost bumbling." Dennis taught them bis methods. methods of trading. In general, Mr. Dennis is

Mr. Dennis says be bad debated the learning About 1000 applicants answered each ad. known as a trend-following trader, that is, one

vs. innate-ability question with some of his He selected 80 people to come to Chicago for who determines that a market is moving up or

associates for years. While they argued that his interviews. From these, he chose 13 for the pro- down and then takes an appropriate position to

skills are "ineffable, mystical, subjective or gram in 1984 and 10 in 1985. During the four profit from that movement. When classroom

intuitive," be says, bis own answer was far sim- years of the program three people were dropped. work ended he gave each student $1 million in

pler. The 40-year-old Mr. Dennis attributes his Oflhe remaining 20, 16 are known to be trading capital Lo trade.

success to several trading methods he devel- public funds, three are believed to be trading for In choosing participants for the program, Mr.

oped and, perhaps more important, the disci- themselves, and one bas gone into another field. Dennis says be was biased toward people with

pline to follow those methods. The students were called the "turtles". (Mr. mathematical and game-playing aptitudes ... .

To prove his point, Mr. Dennis decided to Dennis, who says he bad just returned from Russell Sands, 34, another turtle, recently

run a real-life experiment. In late 1983 and Asia when he started the program, explains that formed a partnership with Mr. Parker to trade

again in 1984, be placed ads in The Wall Street he described it to someone by saying, ''We are commodities for others. He told Mr. Dennis

Journal, Barron's and the New York Times going Lo grow traders just like they grow turtles that the riskiest thing be ever did was quit a job

seeking people who wanted to be trained as in Singapore.") on Wall Street to move to Las Vegas to play

traders. The job required that they move to Mr. Dennis provided classroom training for backgammon and blackjack professionally.

Chicago, where they would receive a small two weeks, teaching the fundamentals of com- He won a world championship in backgam-

salary and a percentage of any profits while Mr. modity trading and the principles behind his mon in 1980.

You might also like

- Notes: by Felipe Tudela © Felipe TudelaDocument6 pagesNotes: by Felipe Tudela © Felipe TudelaSamado ZOURENo ratings yet

- Dan Zanger Trading MethodDocument6 pagesDan Zanger Trading MethodNeeluNo ratings yet

- Eos033 Yte Jul Aug 2019 Final Spreads WebDocument39 pagesEos033 Yte Jul Aug 2019 Final Spreads WebravibehlNo ratings yet

- Harvard IRIDocument39 pagesHarvard IRIBarry100% (1)

- 01-03-12 Stock Market Trends & ObservationsDocument149 pages01-03-12 Stock Market Trends & ObservationsrkarrowNo ratings yet

- Richard Dennis Profile On Business WeekDocument3 pagesRichard Dennis Profile On Business Weekthcm2011No ratings yet

- EOS024 YTE JulAug 2018 FINAL SINGLEPAGE WEBDocument76 pagesEOS024 YTE JulAug 2018 FINAL SINGLEPAGE WEBravibehlNo ratings yet

- Tudor Investments Letter October 2010Document14 pagesTudor Investments Letter October 2010danno52000No ratings yet

- Gerald Marisch - The W.D. Gann Method of Trading PDFDocument211 pagesGerald Marisch - The W.D. Gann Method of Trading PDFturtlespiritflutesNo ratings yet

- Tim Wood Market Analysis Without The Wall Street Hope and HypeDocument4 pagesTim Wood Market Analysis Without The Wall Street Hope and Hyperichard_costaNo ratings yet

- The Absent SignalDocument60 pagesThe Absent SignalCharles BaronyNo ratings yet

- Dow rallies but ends lower as selling pressure broadensDocument12 pagesDow rallies but ends lower as selling pressure broadensNazerrul Hazwan KamarudinNo ratings yet

- Planet - : EconomicsDocument9 pagesPlanet - : EconomicsVenkatNo ratings yet

- GANN Curtis Arnold'Document5 pagesGANN Curtis Arnold'analyst_anil14No ratings yet

- Lesson7 - Earnings - SF PDF Cms PDFDocument2 pagesLesson7 - Earnings - SF PDF Cms PDFWkbwNo ratings yet

- K-Ratio - Gold Timing by KaeppelDocument4 pagesK-Ratio - Gold Timing by Kaeppelstummel6636No ratings yet

- TASC Magazine March 2009Document70 pagesTASC Magazine March 2009Trend ImperatorNo ratings yet

- Stocks, Bonds, U.S. Dollar Index, Precious Metals and Special OpportunitiesDocument12 pagesStocks, Bonds, U.S. Dollar Index, Precious Metals and Special OpportunitiesTRIFMAKNo ratings yet

- Tutorials in Applied Technical Analysis: Managing ExitsDocument15 pagesTutorials in Applied Technical Analysis: Managing ExitsPinky BhagwatNo ratings yet

- TurtleDocument12 pagesTurtleanon-373190No ratings yet

- Price Headley Trade King Webinar SlidesDocument15 pagesPrice Headley Trade King Webinar Slidesbigtrends100% (2)

- Gann HiLo Activator BarsDocument2 pagesGann HiLo Activator BarsNeoHoodaNo ratings yet

- In Correlation To The Patterns of Eclipse Cycles: Rally?Document1 pageIn Correlation To The Patterns of Eclipse Cycles: Rally?James WarrenNo ratings yet

- Ben Graham ReferencesDocument5 pagesBen Graham ReferencesabhijitnaikNo ratings yet

- Financial Statement ChecklistDocument4 pagesFinancial Statement ChecklistBhaskar AgarwalNo ratings yet

- Tecnical AnalysisDocument3 pagesTecnical AnalysisSathiyaseelan JeyathevanNo ratings yet

- PuwhDocument193 pagesPuwhErn Demir100% (1)

- Gmma Relationships PDFDocument5 pagesGmma Relationships PDFWillyam SetiawanNo ratings yet

- Intraday Timing For Low Risk Swing Trading by Walter Bressert PDFDocument21 pagesIntraday Timing For Low Risk Swing Trading by Walter Bressert PDFXmd InOutNo ratings yet

- Lev&Thiagaraian 1993JARDocument27 pagesLev&Thiagaraian 1993JARBeeHoofNo ratings yet

- Price Is the Best Indicator for Trend FollowingDocument6 pagesPrice Is the Best Indicator for Trend FollowingSrini VasanNo ratings yet

- FTJ 4Document8 pagesFTJ 4Kovacs ImreNo ratings yet

- The Matras Increasing Earnings ApproachDocument4 pagesThe Matras Increasing Earnings ApproachANIL1964No ratings yet

- 2013 Picking NewslettersDocument24 pages2013 Picking NewslettersganeshtskNo ratings yet

- 01-18-12 Stock Market Trends & ObservationsDocument163 pages01-18-12 Stock Market Trends & Observationsrkarrow100% (1)

- Edge Ratio of Nifty For Last 15 Years On Donchian ChannelDocument8 pagesEdge Ratio of Nifty For Last 15 Years On Donchian ChannelthesijNo ratings yet

- TASC CompoundPivotsDocument11 pagesTASC CompoundPivotsAnkit KabraNo ratings yet

- The Solitary Trader: Tim RaymentDocument3 pagesThe Solitary Trader: Tim RaymentAdemir Peixoto de AzevedoNo ratings yet

- Mahony - Soros S SecretsDocument2 pagesMahony - Soros S SecretssimvanonNo ratings yet

- Mark Minervini (@markminervini) - Twitter6Document1 pageMark Minervini (@markminervini) - Twitter6LNo ratings yet

- Catalogue V 24Document18 pagesCatalogue V 24percysearchNo ratings yet

- Catalogue V 16Document11 pagesCatalogue V 16percysearchNo ratings yet

- Strategies Using ETFsDocument16 pagesStrategies Using ETFscmms88No ratings yet

- 4 Spring 2014 SAMT Journal PDFDocument36 pages4 Spring 2014 SAMT Journal PDFpatthai100% (1)

- Capital Accumalation and Wealth Building Index - PHPDocument278 pagesCapital Accumalation and Wealth Building Index - PHPGeorge Bailey50% (2)

- Portfolio Alpha From Relative StrengthDocument26 pagesPortfolio Alpha From Relative StrengthAlexanderSW.ChongNo ratings yet

- RSI Indicator Signals Stock Market BottomsDocument5 pagesRSI Indicator Signals Stock Market BottomsapplicoreNo ratings yet

- Profiting: With Chart PatternsDocument59 pagesProfiting: With Chart PatternsRehan KhanNo ratings yet

- Aether Analytics Strategy DeckDocument21 pagesAether Analytics Strategy DeckAlex BernalNo ratings yet

- 10 SAMT Journal Spring 2016 PDFDocument46 pages10 SAMT Journal Spring 2016 PDFpatthai100% (1)

- Wiley - Trade Stocks and Commodities With The Insiders - Secrets of The COT Report - 978-0-471-74125-1Document2 pagesWiley - Trade Stocks and Commodities With The Insiders - Secrets of The COT Report - 978-0-471-74125-1jarullah jarullahNo ratings yet

- Understanding Tape Reading and Active Stock TradingDocument97 pagesUnderstanding Tape Reading and Active Stock TradingVuzNo ratings yet

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningFrom EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningNo ratings yet

- Stay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindFrom EverandStay Rich with a Balanced Portfolio: The Price You Pay for Peace of MindRating: 3 out of 5 stars3/5 (1)

- The Paradox of Svalbard: Climate Change and Globalisation in the ArcticFrom EverandThe Paradox of Svalbard: Climate Change and Globalisation in the ArcticNo ratings yet

- Cairo 2050 Vision V 2009 Gopp 12 MB PDFDocument199 pagesCairo 2050 Vision V 2009 Gopp 12 MB PDFhamada sharafNo ratings yet

- En Gbpusd 20171020 ADocument1 pageEn Gbpusd 20171020 Ahamada sharaf100% (1)

- DOCUMENT Trading Signals ManualDocument1 pageDOCUMENT Trading Signals Manualhamada sharafNo ratings yet

- الجديد في المملحات PDFDocument34 pagesالجديد في المملحات PDFhamada sharafNo ratings yet

- Plug & Play KitchenettesDocument24 pagesPlug & Play Kitchenetteshamada sharafNo ratings yet

- دليل السيارة دايو نوبيراDocument171 pagesدليل السيارة دايو نوبيراhamada sharafNo ratings yet

- 35الأرزDocument35 pages35الأرزhamada sharafNo ratings yet

- Wrigley Case FinalDocument9 pagesWrigley Case FinalhnooyNo ratings yet

- Market-Tables - Tuesday 15 January 2019Document18 pagesMarket-Tables - Tuesday 15 January 2019allegreNo ratings yet

- Chapter Seven: Risk Management For Changing Interest Rates: Asset-Liability Management and Duration TechniquesDocument37 pagesChapter Seven: Risk Management For Changing Interest Rates: Asset-Liability Management and Duration TechniquesmskskkdNo ratings yet

- Company ValuationDocument55 pagesCompany ValuationAli Jumani100% (1)

- Arundel CaseDocument7 pagesArundel CaseShishirNo ratings yet

- Techcombank Exchange Rates AssignmentDocument28 pagesTechcombank Exchange Rates AssignmentOanh TruongNo ratings yet

- Open Quick Links: Top Frame TabsDocument20 pagesOpen Quick Links: Top Frame TabsManthan ShahNo ratings yet

- Tute 2 QuestionsDocument7 pagesTute 2 QuestionsChi QuỳnhNo ratings yet

- Mcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1Document11 pagesMcgill Personal Finance Essentials Transcript Module 5: The Art of Investing 1, Part 1shourav2113No ratings yet

- HDFC Bank's Foreign Exchange SynopsisDocument17 pagesHDFC Bank's Foreign Exchange SynopsisMohmmedKhayyumNo ratings yet

- ILLUSTRATIVE PROBLEMS Share SplitDocument5 pagesILLUSTRATIVE PROBLEMS Share SplitMary Jane Cabanilla PantonialNo ratings yet

- What are Stock Indices and their ImportanceDocument3 pagesWhat are Stock Indices and their ImportanceNatural agroNo ratings yet

- CFA一级基础段权益投资 Jcy 金程(打印版)Document76 pagesCFA一级基础段权益投资 Jcy 金程(打印版)Evelyn YangNo ratings yet

- FBE 529 Spring 2020 Lecture 5 PDFDocument16 pagesFBE 529 Spring 2020 Lecture 5 PDFJIAYUN SHENNo ratings yet

- Transaction ExposureDocument419 pagesTransaction ExposureJelly Sunarli0% (1)

- Yield Curve and Term Structure Theory ExplainedDocument25 pagesYield Curve and Term Structure Theory ExplainedchanstriNo ratings yet

- 1.2 Types of Business OwnershipDocument41 pages1.2 Types of Business Ownershipdftkgkx9bvNo ratings yet

- Hemayah Takaful Savings Plus PlanDocument8 pagesHemayah Takaful Savings Plus PlanMuhammad UmarNo ratings yet

- 500,000 PHP to USD conversion rate todayDocument1 page500,000 PHP to USD conversion rate todayPatriceNo ratings yet

- Chapter 5 FIMDocument13 pagesChapter 5 FIMMintayto TebekaNo ratings yet

- Apple Target MarketDocument2 pagesApple Target MarketScribdTranslationsNo ratings yet

- FSA With CommentsDocument7 pagesFSA With CommentshananNo ratings yet

- Merchant Banking in IndiaDocument61 pagesMerchant Banking in IndiarimpyanitaNo ratings yet

- Assignment 10 Part A & BDocument4 pagesAssignment 10 Part A & Bkainat fatimaNo ratings yet

- Pricing Swap Default RiskDocument11 pagesPricing Swap Default RiskUmlol TitaniNo ratings yet

- Michigan Growth Capital Symposium SEC No-Action Letter (May 4, 1995)Document10 pagesMichigan Growth Capital Symposium SEC No-Action Letter (May 4, 1995)Joe WallinNo ratings yet

- Curve RidingDocument3 pagesCurve RidingbakausoNo ratings yet

- RCC 1Document97 pagesRCC 1Ranz Nikko N PaetNo ratings yet

- Exchange Rate 3Document5 pagesExchange Rate 3Josh AppiahNo ratings yet

- What The Heck Is Going On With LEAS and BBDADocument54 pagesWhat The Heck Is Going On With LEAS and BBDAtriguy_2010No ratings yet