Professional Documents

Culture Documents

Distinguish Between Horizontal and Vertical Analysis

Distinguish Between Horizontal and Vertical Analysis

Uploaded by

MJOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Distinguish Between Horizontal and Vertical Analysis

Distinguish Between Horizontal and Vertical Analysis

Uploaded by

MJCopyright:

Available Formats

UNDERSTANDING AND INTERPRETATION OF FINANCIAL like, usually is due within 30 to 60 and usually will have

STATEMENT a very low ceiling. Long term debt, on the other hand,

What is the purpose of financial statement analysis? can be have maturities as long as 20 years and an

The objective of financial statements analysis is to almost unlimited upper limit.

determine the extent of a firm’s success in attaining its

financial goals, namely: What is meant by trading on the equity?

To earn maximum profit Trading on the equity also known as financial leverage is

To maintain solvency a phrase used to describe the situation whereby the

To attain stability cost of borrowed funds is less than the rate earned on

the funds. If debt is costing 12% and the return on

Three major financial statement user shareholders/ equity is 15%, the firm is said to be

1. Creditors – creditors lend money to a company on trading on the equity and has positive financial

either a short – term or a long term basis. leverage.

Short - term creditors include trade creditors Distinguish between horizontal and vertical analysis

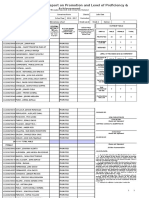

and lending institutions. Horizontal analysis is the comparison of the same

Long – term creditors include lending information for two or more years to determine the

institutions and corporate bondholders. amount of the change and percentage increase or

All creditors want to be assured of receiving decrease. For instance, if accounts receivable were

prompt payments from the company. P100,000 last year and P125,000 this year, the change

2. Equity investors – Equity investors are those who represents a P25,000 increase or 25%. Vertical analysis

purchase an ownership interest in a company. is the comparison of one item to others in the same

They want to determine if the company will be group for a given year. For instance, the P100,000 of

able to distribute dividends in the future and if its accounts receivable might have represented 35% of the

shares will rise in value. current assets last year, while the P125,000 represents

3. Management – management analyzes the company’s 45% of current assets in this year.

financial statements with a view toward favorably

impressing external parties.

Management ‘s objective is to monitor the company’s

overall performance.

What is profitability, liquidity and solvency?

Profitability is the ease with which a company

generates income

Liquidity – is the ease with which an item, such as an

asset, can be converted to cash. The liquidity of a firm

refers to the company’s ability to generate sufficient

cash to meet its short term obligations.

Solvency – is a company’s ability to meet the obligations

created by its long term debt.

Six limitations of ratio analysis

1. The greatest single limitation of ratio analysis is

that people tend to place too much reliance on

the ratios. Information gathered from ratio

analysis is only a part of what is needed to make

good economic decisions.

2. Attempting to predict the future using past

results is problematic at best.

3. The financial statements used as the basis of

the ratios are based on historical cost.

4. Figures from the balance sheet used in the

calculation of the ratios are year end numbers.

5. Comparing the ratios of a company in one

industry with those of a company in another

industry is difficult because industry

peculiarities will cause the ratios to differ.

6. There are no hard and fast rules telling the

analyst what numbers to use to calculate ratios.

WHAT ARE SOME OF THE RELATIVE ADVANTAGES OF

SHORT TERM AND LONG TERM DEBT?

Short term debt usually has no costs, while

long term debt always has costs. The main

disadvantages to short term debts are the limited

amount that can be borrowed and the due date of the

repayment. Short term debt, accounts payable and the

You might also like

- Ratio Analysis Notes and Practice Questions With SolutionsDocument23 pagesRatio Analysis Notes and Practice Questions With SolutionsAnkith Poojary67% (6)

- Gmac 1998 C-1 PDFDocument276 pagesGmac 1998 C-1 PDFJane RochesterNo ratings yet

- Lecture 5 Financial Statement AnalysisDocument42 pagesLecture 5 Financial Statement Analysismainul04029No ratings yet

- Ratio Analysis BY DR Abhishek MaheshwariDocument54 pagesRatio Analysis BY DR Abhishek MaheshwariAnand MauryaNo ratings yet

- Ratio Analysis PROJECTDocument25 pagesRatio Analysis PROJECTimrataNo ratings yet

- Finance HSC Business NotesDocument32 pagesFinance HSC Business NoteschloeNo ratings yet

- Two Financial RatiosDocument9 pagesTwo Financial RatiosWONG ZI QINGNo ratings yet

- Financial Analysis and PlanningDocument75 pagesFinancial Analysis and PlanningTewodros SetargieNo ratings yet

- Financial ManagementDocument120 pagesFinancial Managementdaniellema5752No ratings yet

- Financial Statement Analysis-IIDocument45 pagesFinancial Statement Analysis-IINeelisetty Satya SaiNo ratings yet

- Financial Statements and Analysis: ̈ Instructor's ResourcesDocument24 pagesFinancial Statements and Analysis: ̈ Instructor's ResourcesMohammad Mamun UddinNo ratings yet

- Chapter 3 Managerial-Finance Solutions PDFDocument24 pagesChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinNo ratings yet

- Impact of Liquidity On ProfitabilityDocument44 pagesImpact of Liquidity On ProfitabilityRavi ShankarNo ratings yet

- As A Creditor or Investor or Finance Manager Suggest Any 3 Ratios To Be Used For Analysis With ReasonsDocument3 pagesAs A Creditor or Investor or Finance Manager Suggest Any 3 Ratios To Be Used For Analysis With Reasonssnehachandan91No ratings yet

- A STUDY ON LIQUIDITY - Docx (2) - 1Document111 pagesA STUDY ON LIQUIDITY - Docx (2) - 1Nirmal Raj100% (1)

- 3.intro To Financial Institution and MarketDocument28 pages3.intro To Financial Institution and MarketKimberly FloresNo ratings yet

- Financial RatiosDocument30 pagesFinancial RatiosVenz LacreNo ratings yet

- (Intro To Finance) : (Segi College Kuala Lumpur)Document14 pages(Intro To Finance) : (Segi College Kuala Lumpur)sarav92No ratings yet

- Chapter 3 NotesDocument3 pagesChapter 3 NotesLeonardo WenceslaoNo ratings yet

- Receivable Managemen1Document78 pagesReceivable Managemen1dileepkumarNo ratings yet

- Empirical Perspectives On The Financial CharacteristicsDocument34 pagesEmpirical Perspectives On The Financial CharacteristicsVikas Sharma100% (3)

- Analysis and Interpretation of Financial StatementsDocument16 pagesAnalysis and Interpretation of Financial StatementsBrian ChuwaNo ratings yet

- Ratio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisDocument11 pagesRatio Analysis Brief Notes: Prof. Mayur Malviya Ratio AnalysisravikumardavidNo ratings yet

- BCO 10 Block 02 1Document52 pagesBCO 10 Block 02 1Madhumitha ANo ratings yet

- Ratio Kotak Mahindra BankDocument64 pagesRatio Kotak Mahindra Bankdk6666No ratings yet

- Financial Management QuestionsDocument47 pagesFinancial Management QuestionsSelvi balanNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisRam KrishnaNo ratings yet

- ST - Gonsalo Gracia CollegeDocument5 pagesST - Gonsalo Gracia Collegesawariya786No ratings yet

- Concept Questions:: Net WorthDocument30 pagesConcept Questions:: Net WorthRutuja KhotNo ratings yet

- BFN Note CombineDocument50 pagesBFN Note CombineTimilehin GbengaNo ratings yet

- JUNE. 2020 G.C Mekelle, Tigray, EthiopiaDocument13 pagesJUNE. 2020 G.C Mekelle, Tigray, EthiopiaAsmelash GideyNo ratings yet

- Summarizing Chapter 2Document10 pagesSummarizing Chapter 2Walaa Ragab100% (1)

- PMF Unit 5Document10 pagesPMF Unit 5dummy manNo ratings yet

- FM TheoryDocument28 pagesFM TheoryKamalesh BjNo ratings yet

- What Is Ratio AnalysisDocument19 pagesWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Credit ManagementDocument4 pagesCredit ManagementAnshUl SharMaNo ratings yet

- FM E-NotesDocument30 pagesFM E-Notessuraj mathurNo ratings yet

- Project On Kotak MahindraDocument64 pagesProject On Kotak Mahindrasamson901683% (6)

- Liquidity and ProfitabilityDocument63 pagesLiquidity and ProfitabilityMamilla Babu100% (1)

- Cas Ii Assignment ON Importance of Liquidity Ratios in The IndustryDocument7 pagesCas Ii Assignment ON Importance of Liquidity Ratios in The IndustrySanchali GoraiNo ratings yet

- Shoiab Finance AssignmentDocument6 pagesShoiab Finance AssignmentAbhishek GokhaleNo ratings yet

- Finantial Statement AnalysisDocument19 pagesFinantial Statement AnalysisShaekh AzmiNo ratings yet

- C 3 A F S: Hapter Nalysis of Inancial TatementsDocument27 pagesC 3 A F S: Hapter Nalysis of Inancial TatementsRoland BimohartoNo ratings yet

- Ratio Analysis TechniquesDocument13 pagesRatio Analysis Techniquesarshad mNo ratings yet

- Reporting GDocument14 pagesReporting GMaeve AguerroNo ratings yet

- 41-Liquidity and ProfitabilityDocument65 pages41-Liquidity and Profitabilityshameem afroseNo ratings yet

- 2111122153MBA320115Unit 3 Bqualitative Factors That Are Considered When Evaluating A Company's Financial Performance.Document7 pages2111122153MBA320115Unit 3 Bqualitative Factors That Are Considered When Evaluating A Company's Financial Performance.Mohammad Rafiq DarNo ratings yet

- Financial RatiosDocument27 pagesFinancial RatiosVenz LacreNo ratings yet

- Chapter 6 Short Term FinancingDocument19 pagesChapter 6 Short Term FinancingInes MiladiNo ratings yet

- Financial Management: Dr. Gurendra Nath BhardwajDocument14 pagesFinancial Management: Dr. Gurendra Nath Bhardwajmeeta_01219695No ratings yet

- FPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Document17 pagesFPT Group's Seperate Financial of 2020 and Consolidated Financial Statements of 2020Phạm Tuấn HùngNo ratings yet

- Management Accounting Concept and Application by Cabrera PDFDocument38 pagesManagement Accounting Concept and Application by Cabrera PDFSyrell P NaborNo ratings yet

- Assignment: Course Name: Financial Statement Analysis and Valuation Course Code: F-401Document6 pagesAssignment: Course Name: Financial Statement Analysis and Valuation Course Code: F-401Md Ohidur RahmanNo ratings yet

- Management Accounting Concept and Application by Cabrera PDFDocument29 pagesManagement Accounting Concept and Application by Cabrera PDFChristine Joy BoliverNo ratings yet

- Chapter TWO FM I1Document65 pagesChapter TWO FM I1Embassy and NGO jobsNo ratings yet

- FMA (Comperative Project On Ratio Analysis Managerial Tool)Document13 pagesFMA (Comperative Project On Ratio Analysis Managerial Tool)PowerPoint GoNo ratings yet

- Analysis of Short Term Solvency of An OrganizationFinalDocument14 pagesAnalysis of Short Term Solvency of An OrganizationFinalpronab sarkarNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Summary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingFrom EverandSummary of Michael J. Mauboussin & Alfred Rappaport's Expectations InvestingNo ratings yet

- GRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanDocument5 pagesGRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanMJNo ratings yet

- DLL - MTB 1 - Q1 - W6Document7 pagesDLL - MTB 1 - Q1 - W6MJNo ratings yet

- CPD Step 1-6 - 23jan2017Document13 pagesCPD Step 1-6 - 23jan2017MJNo ratings yet

- DLL - MTB 1 - Q1 - W6Document6 pagesDLL - MTB 1 - Q1 - W6MJNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- BLT 134 Chapter 4Document4 pagesBLT 134 Chapter 4MJNo ratings yet

- SF5 - 2016 - Grade 1 - 5Document3 pagesSF5 - 2016 - Grade 1 - 5MJNo ratings yet

- 0 MubianaDocument92 pages0 MubianaMJ100% (1)

- Maslow's Hierarchy of NeedsDocument8 pagesMaslow's Hierarchy of NeedsMJNo ratings yet

- School Form 1 (SF 1) School RegisterDocument6 pagesSchool Form 1 (SF 1) School RegisterMJNo ratings yet

- General AssemblyDocument7 pagesGeneral AssemblyMJNo ratings yet

- Chapter 19 Borrowing CostsDocument22 pagesChapter 19 Borrowing Costsmariel evangelistaNo ratings yet

- Start-Up HandbookDocument36 pagesStart-Up HandbookUIUCOTM100% (6)

- Audit Procedure: A Case Study On ACNABIN-Chartered AccountantsDocument18 pagesAudit Procedure: A Case Study On ACNABIN-Chartered AccountantsAdnanNo ratings yet

- Quizzer - Buscom 01Document7 pagesQuizzer - Buscom 01khyla Marie NooraNo ratings yet

- Valuation Report of BPCLDocument24 pagesValuation Report of BPCLJobin JohnNo ratings yet

- Canon Vietnam's "Photo Booth of Love" Campaign: Hoa Sen UniversityDocument27 pagesCanon Vietnam's "Photo Booth of Love" Campaign: Hoa Sen UniversityOanh ĐinhNo ratings yet

- 8 Steps That Will Make Life Easier For Your HeirsDocument4 pages8 Steps That Will Make Life Easier For Your HeirsJimKNo ratings yet

- Private Student LoansDocument131 pagesPrivate Student LoansForeclosure FraudNo ratings yet

- If&ls Report - FMDocument13 pagesIf&ls Report - FMUmang GadaNo ratings yet

- CH 8 Competitive Dynamics UDocument30 pagesCH 8 Competitive Dynamics UZara RamisNo ratings yet

- Assurtech Fintech Global 2019Document69 pagesAssurtech Fintech Global 2019Argus de l'Assurance100% (3)

- Far Drill 3Document16 pagesFar Drill 3ROMAR A. PIGANo ratings yet

- CFA Level II - Equity - FCFDocument9 pagesCFA Level II - Equity - FCFQuy Cuong BuiNo ratings yet

- IEA Report 26th April 2017Document33 pagesIEA Report 26th April 2017narnoliaNo ratings yet

- Deutsche Bank Ag - 2023 02 21Document6 pagesDeutsche Bank Ag - 2023 02 21Nuria PuenteNo ratings yet

- Bonus Shares and Bonus IssueDocument2 pagesBonus Shares and Bonus IssueMegha Gandhi BakhaiNo ratings yet

- Presented By-: Abhirup Ghosh Amitava Kabasi Anand Sharma Anirban Bhadhuri Joydeep SahaDocument24 pagesPresented By-: Abhirup Ghosh Amitava Kabasi Anand Sharma Anirban Bhadhuri Joydeep SahaAmitava KabasiNo ratings yet

- Brochure Add OnsDocument37 pagesBrochure Add OnsSeidorNo ratings yet

- Pay Bonus ActDocument30 pagesPay Bonus ActAaju KausikNo ratings yet

- CapSim Quiz Sample QuestionsDocument2 pagesCapSim Quiz Sample QuestionsDanieNo ratings yet

- Business Analysis of SIADocument9 pagesBusiness Analysis of SIAJasmine Siddhi BajracharyaNo ratings yet

- Circular Flow of IncomeDocument32 pagesCircular Flow of IncomeTarun SukhijaNo ratings yet

- FMR September 2023Document35 pagesFMR September 2023Zunaira SafdarNo ratings yet

- Financial-Statements ModuleDocument28 pagesFinancial-Statements ModuleUlambai100% (2)

- Research Papers in FinanceDocument7 pagesResearch Papers in Financefusolemebeg2100% (1)

- Purchase CG Fe GHDocument2 pagesPurchase CG Fe GHLenin Rey PolonNo ratings yet

- Chapter 1: Introduction To Financial ManagementDocument22 pagesChapter 1: Introduction To Financial ManagementAmirul AshrafNo ratings yet

- Capital Structure and Long-Term Financing DecisionsDocument4 pagesCapital Structure and Long-Term Financing DecisionsJade Berlyn AgcaoiliNo ratings yet

- LawxxxDocument6 pagesLawxxxJoshua Del MundoNo ratings yet