Professional Documents

Culture Documents

Excel Budget Problem

Uploaded by

api-313254091Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Excel Budget Problem

Uploaded by

api-313254091Copyright:

Available Formats

Introduction to Management Accounting Solutions Manual

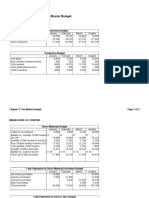

WASATCH MANUFACTURING

Master Budget

Sales Budget

December January February March April May

Unit sales 8,444 8,900 9,900 9,200 9,500 8,600

Unit selling price $ 9 $ 9 $ 9 $ 9 $ 9 $ 9

Total sales Revenue $ 76,000 $ 80,100 $ 89,100 $ 82,800 $ 85,500 $ 77,400

Req. 1

Cash Collections Budget

January February March Quarter

Cash sales $28,035 $31,185 $28,980 $88,200

Credit sales $ 52,065.00 $ 57,915.00 $ 53,820.00 $163,800

Total collections $80,100 $89,100 $82,800 $252,000

Req. 2

Production Budget

January February March Quarter

Unit sales 8,900 9,900 9,200 $28,000

Plus: Desired ending inventory 1,485 1,380 1,425 1,425

Total needed 10,385 11,280 10,625 29,425

Less: Beginning inventory 1,335 1,485 1,380 1,335

Units to produce 9,050 9,795 9,245 28,090

Req. 3

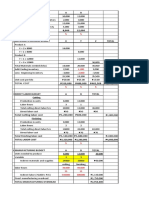

Direct Materials Budget

January February March Quarter

Chapter 9: The Master Budget and Responsibility Accounting 1

Introduction to Management Accounting Solutions Manual

Units to be produced 9,050 9,795 9,245 28,090

Multiply by: Quantity of DM needed per unit 2 2 2 2

Quantity of DM needed for production 18,100 19,590 18,490 56,180

Plus: Desired ending inventory of DM 1,959 1,849 1,787 1,787

Total quantity of DM needed 20,059 21,439 20,277 57,967

Less: Beginning inventory of DM 1,810 1,959 1,849 1,810

Quantity of DM to purchase 18,249 19,480 18,428 56,157

Multiply by: Cost per pound $ 1.50 $ 1.50 $ 1.50 $ 1.50

Total cost of DM purchases $27,374 $29,220 $27,642 $84,236

April May

Unit Sales 9,500 8,600

Plus: Desired End Inventory 860

Total Needed 10,360

Less: Beginning Inventory 1,425

Units to produce 8,935

DM needed per unit 2

Quantity of DM needed for production 17,870

Req. 4

Cash Payments for Direct Material Purchases Budget

January February March Quarter

December purchases (From AP) $22,000 $22,000

January purchases $8,212 $19,161 $27,374

February purchases $5,844 $20,454 $26,298

March purchases $8,293 $8,293

Total disbursements $30,212 $25,005 $28,747 $83,964

Req. 5

Chapter 9: The Master Budget and Responsibility Accounting 2

Introduction to Management Accounting Solutions Manual

Cash Payments for Direct Labor Costs

January February March Quarter

Direct Labor $3,530 $3,820 $3,606 $10,955

Req. 6

Cash Payments for Manufacturing Overhead Budget

January February March Quarter

Rent (fixed) $6,500 $6,500 $6,500 $19,500

Other MOH (fixed) $2,100 $2,100 $2,100 $6,300

Variable manufacturing overhead $ 12,670 $ 13,713 $ 12,943 $39,326

Total disbursements $21,270 $22,313 $21,543 $65,126

Req. 7

Cash Payments for Operating Expenses Budget

January February March Quarter

Variable operating expenses $ 10,680 $ 11,880 $ 11,040 $ 33,600

Fixed operating expenses $ 1,400 $ 1,400 $ 1,400 $ 4,200

Total disbursements $ 12,080 $ 13,280 $ 12,440 $ 37,800

Req. 8

Combined Cash Budget

January February March Quarter

Cash balance, beginning $6,000 $5,008 $11,860 $6,000

Plus: cash collections (req. 1) 80,100 89,100 82,800 252,000

Total cash available 86,100 94,108 94,660 258,000

Less cash payments:

DM purchases (req. 4) 30,212 25,005 28,747 83,964

Direct labor (req. 5) 3,530 3,820 3,606 10,955

Chapter 9: The Master Budget and Responsibility Accounting 3

Introduction to Management Accounting Solutions Manual

MOH costs (req 6) 21,270 22,313 21,543 65,126

Operating expenses (req 7) 12,080 13,280 12,440 37,800

Tax payment 10,800 10,800

Equipment purchases 15000 6,000 4000 25,000

Total cash payments 82,092 81,219 70,335 233,645

Ending cash before financing 4,008 12,890 24,325 24,355

Financing:

Borrowings 1,000 1,000

Repayments -1000 -1,000

Interest -30 -30

Total financing 1,000 -1,030 0 -30

Cash balance, ending $5,008 $11,860 $24,325 $24,325

Req. 9

Budgeted Manufacturing Cost per Unit

Direct materials cost per unit $3.00

Direct labor cost per unit $0.39

Variable MOH cost per unit $1.40

Fixed MOH per unit (given in problem) $0.80

Cost of manufacturing each unit $5.59

Req. 10

Damon Manufacturing

Budgeted Income Statement

For the Quarter Ended March 31

Sales $ 252,000

Cost of goods sold 156,520

Gross profit 95,480

Operating expenses 37,800

Depreciation expense 5,200

Chapter 9: The Master Budget and Responsibility Accounting 4

Introduction to Management Accounting Solutions Manual

Operating income 52,480

Less: interest expense -30

Less: provision for income tax 14,686

Net income $37,764

Chapter 9: The Master Budget and Responsibility Accounting 5

You might also like

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Masterbudget Acct2020Document4 pagesMasterbudget Acct2020api-249190933No ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Ivan Madrigals Comprehensive Master Budget Project Version ADocument5 pagesIvan Madrigals Comprehensive Master Budget Project Version Aapi-315768301No ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Comprehensive BudgetDocument5 pagesComprehensive Budgetapi-317125310No ratings yet

- Excel Budget ProjectDocument6 pagesExcel Budget Projectapi-314303195No ratings yet

- Excel Budget Problem TemplateDocument2 pagesExcel Budget Problem Templateapi-324651338No ratings yet

- Master Budget ProjectDocument7 pagesMaster Budget Projectapi-404361400No ratings yet

- Wasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions ManualDocument12 pagesWasatch Manufacturing Master Budget: Managerial Accounting - Fourth Edition Solutions Manualapi-356769323No ratings yet

- Excel Budget ProjectDocument7 pagesExcel Budget Projectapi-341205347No ratings yet

- Chapter 9 HomeworkDocument2 pagesChapter 9 Homeworkapi-311464761No ratings yet

- Acct 2020 Excel Budget Problem Student Template 1Document5 pagesAcct 2020 Excel Budget Problem Student Template 1api-316764247No ratings yet

- Tanner McqueenDocument4 pagesTanner Mcqueenapi-242859321No ratings yet

- Problems: Set A: SolutionDocument8 pagesProblems: Set A: Solutionapi-395519937No ratings yet

- MASTER BUDGET CHAPTERDocument28 pagesMASTER BUDGET CHAPTERMarc Jim Gregorio100% (1)

- P9-57a 5th Ed Blank Worksheet OnlyDocument7 pagesP9-57a 5th Ed Blank Worksheet Onlyapi-2483356370% (1)

- Acct 2020 Excel Master BudgetDocument6 pagesAcct 2020 Excel Master Budgetapi-302665852No ratings yet

- Acct 2020 Excel Budget ProblemDocument6 pagesAcct 2020 Excel Budget Problemapi-307661249No ratings yet

- Acct 2020 EportfolioDocument5 pagesAcct 2020 Eportfolioapi-311375616No ratings yet

- Cameron Fisher Excel Budget ProjectDocument2 pagesCameron Fisher Excel Budget Projectapi-340519862No ratings yet

- Managerial Accounting Final ProjectDocument5 pagesManagerial Accounting Final Projectapi-382641983No ratings yet

- Numbers tables converted to Excel worksheetsDocument8 pagesNumbers tables converted to Excel worksheetsAhmed MahmoudNo ratings yet

- Master Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingDocument13 pagesMaster Decker: Expansion Opporttunities: Calculation of Differential Analysis For Deck BuildingRitam ChatterjeeNo ratings yet

- Business Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Document35 pagesBusiness Name Patatasty Currency Symbol P Year End Month December Reporting Year 2020 Year End Reporting Date 29 February 2020Raschelle MayugbaNo ratings yet

- Key To Corrections - LEVEL 2 MODULE 7Document9 pagesKey To Corrections - LEVEL 2 MODULE 7UFO CatcherNo ratings yet

- Ponderosa-IncDocument6 pagesPonderosa-IncpompomNo ratings yet

- Excel Project P9-59aDocument3 pagesExcel Project P9-59aapi-272100463No ratings yet

- Sales Budget and Financial ProjectionsDocument12 pagesSales Budget and Financial ProjectionsAbejero Trisha Nicole A.No ratings yet

- jjcute-Functional-Budget-SolutionDocument4 pagesjjcute-Functional-Budget-Solutionjanjan3256No ratings yet

- COMM1170 Organisational Resources Tutorial - Week 10 Cash BudgetDocument10 pagesCOMM1170 Organisational Resources Tutorial - Week 10 Cash BudgetLia LeNo ratings yet

- Budget ProjectDocument18 pagesBudget Projectapi-318385102No ratings yet

- Sweat GaloreDocument17 pagesSweat GaloreMuhdAfiq50% (2)

- Condensed Income Statements and Financial Analysis, 1991-1993Document20 pagesCondensed Income Statements and Financial Analysis, 1991-1993Safaljot Singh100% (1)

- Wasatch ManufacturingDocument12 pagesWasatch Manufacturingapi-301899907No ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - ChaseDocument6 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - ChaseJason RobillardNo ratings yet

- WOODDocument12 pagesWOODJayson ReyesNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Bigbud 4th Ed Womack BaileyDocument26 pagesBigbud 4th Ed Womack Baileyapi-356759536No ratings yet

- Wasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions ManualDocument10 pagesWasatch Manufacturing: Managerial Accounting - Fourth Edition Solutions Manualapi-231890132100% (1)

- BigbudhunterkaarlsenDocument25 pagesBigbudhunterkaarlsenapi-356428418No ratings yet

- Carolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1Document8 pagesCarolyn Trowbridge Acct 2020 Excel Budget Problem Student Template 1api-284502690No ratings yet

- CH 8 ExerciseshDocument14 pagesCH 8 Exercisesh김가온No ratings yet

- Enter The Data Only in The Yellow Cells.: Agg Plan - LevelDocument7 pagesEnter The Data Only in The Yellow Cells.: Agg Plan - LevelJason RobillardNo ratings yet

- Budgeting ProblemDocument7 pagesBudgeting ProblemBest Girl RobinNo ratings yet

- Profitability DemoDocument225 pagesProfitability Demoshahin2014No ratings yet

- 08 Activity 1Document4 pages08 Activity 1Althea ObinaNo ratings yet

- Assignment Managerial Accounting Chapter 8Document4 pagesAssignment Managerial Accounting Chapter 8nabila IkaNo ratings yet

- Exercise 1 Margarett Company: Sales BudgetDocument4 pagesExercise 1 Margarett Company: Sales BudgetHannaniah PabicoNo ratings yet

- Budgeting ExerciseDocument2 pagesBudgeting Exercisekristel bulalacaoNo ratings yet

- Sales Budget Jan Feb Mar April May TotalDocument2 pagesSales Budget Jan Feb Mar April May Totalwhat everNo ratings yet

- BAD2 Chapter 2 HW TemplatesDocument16 pagesBAD2 Chapter 2 HW TemplatesLIFENG YUNo ratings yet

- Module 4 Inclass QuestionsDocument3 pagesModule 4 Inclass QuestionsPhát GamingNo ratings yet

- Tutorial #3 - Group 5 - PA1 - MarkedDocument8 pagesTutorial #3 - Group 5 - PA1 - MarkedThanh NguyenNo ratings yet

- % July August September Forecasted Sales Gross ProfitDocument8 pages% July August September Forecasted Sales Gross ProfitГанбаяр АнударьNo ratings yet

- Sweet Home Company Sales, Cash Receipts, Production, and Direct Material Budgets for 2020Document2 pagesSweet Home Company Sales, Cash Receipts, Production, and Direct Material Budgets for 2020Bub CrizNo ratings yet

- Wasatch Manufacturing Master BudgetDocument6 pagesWasatch Manufacturing Master Budgetapi-255137286No ratings yet

- Accounting Chapter 9 Eportfolio ExcelDocument12 pagesAccounting Chapter 9 Eportfolio Excelapi-273030710No ratings yet

- SaaS Sales Force Economics: Excel ModelDocument86 pagesSaaS Sales Force Economics: Excel ModelCazoomi100% (3)

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Biology Signature AssignmentDocument4 pagesBiology Signature Assignmentapi-313254091No ratings yet

- English 2030-Final 1Document6 pagesEnglish 2030-Final 1api-313254091No ratings yet

- Reflection Psy1100Document3 pagesReflection Psy1100api-313254091No ratings yet

- English 2030 ReflectionDocument2 pagesEnglish 2030 Reflectionapi-313254091No ratings yet

- Acting Philosophy StatementDocument2 pagesActing Philosophy Statementapi-313254091No ratings yet

- Personal RenaissanceDocument4 pagesPersonal Renaissanceapi-313254091No ratings yet

- Amazon Financial AnalysisDocument5 pagesAmazon Financial Analysisapi-313254091No ratings yet

- Biology Reflection 2Document1 pageBiology Reflection 2api-313254091No ratings yet

- Math 1010 ProjectDocument5 pagesMath 1010 Projectapi-313254091No ratings yet

- Manning AccountingDocument9 pagesManning Accountingapi-313254091No ratings yet

- AssessingacareerinmarketingmanagerpostionDocument7 pagesAssessingacareerinmarketingmanagerpostionapi-313254091No ratings yet

- StatementofgoalsandchoicespersuasioneffectDocument1 pageStatementofgoalsandchoicespersuasioneffectapi-313254091No ratings yet

- TransgendersuicidereportDocument6 pagesTransgendersuicidereportapi-313254091No ratings yet

- "Being My Authentic Self" A Profile About Aydian DowlingDocument6 pages"Being My Authentic Self" A Profile About Aydian Dowlingapi-313254091No ratings yet

- FlashmemoirDocument5 pagesFlashmemoirapi-313254091No ratings yet

- OpinionsummaryDocument4 pagesOpinionsummaryapi-313254091No ratings yet

- Research Question: What Are The Potential Repercussions of Global Warming in The Southwest?Document6 pagesResearch Question: What Are The Potential Repercussions of Global Warming in The Southwest?api-313254091No ratings yet

- CampaignfinancereformDocument2 pagesCampaignfinancereformapi-313254091No ratings yet

- RhetoricalanalysisDocument4 pagesRhetoricalanalysisapi-313254091No ratings yet

- Comm 1010 Team Report-2Document15 pagesComm 1010 Team Report-2api-313254091No ratings yet

- A Shadow of A DoubtDocument5 pagesA Shadow of A Doubtapi-313254091No ratings yet

- Campaignfinanceresearchpaper 4Document9 pagesCampaignfinanceresearchpaper 4api-313254091No ratings yet

- SHORLUBE Self Lubricating Bearings PDFDocument20 pagesSHORLUBE Self Lubricating Bearings PDFNickNo ratings yet

- CECB School Profile 23122020 1Document6 pagesCECB School Profile 23122020 1Anas SaadaNo ratings yet

- BR COREnew Rulebook v1.5 ENG-nobackground-lowDocument40 pagesBR COREnew Rulebook v1.5 ENG-nobackground-lowDavid Miller0% (1)

- International Organizations and RelationsDocument3 pagesInternational Organizations and RelationsPachie MoloNo ratings yet

- Arctic Monkeys Do I Wanna KnowDocument4 pagesArctic Monkeys Do I Wanna KnowElliot LangfordNo ratings yet

- ICCT COLLEGES FOUNDATION INC. PHYSICAL EDUCATION DEPARTMENTDocument2 pagesICCT COLLEGES FOUNDATION INC. PHYSICAL EDUCATION DEPARTMENTmarites_olorvidaNo ratings yet

- Marine Environmental ResearchDocument11 pagesMarine Environmental ResearchPierre Otoniel Carmen MunaycoNo ratings yet

- Katherine Keesling - The Votive Statues of The Athenian Acropolis - (2003, Camb)Document302 pagesKatherine Keesling - The Votive Statues of The Athenian Acropolis - (2003, Camb)vadimkoponevmail.ru100% (2)

- MS For SprinklerDocument78 pagesMS For Sprinklerkarthy ganesanNo ratings yet

- Partnership Dissolution QuizDocument8 pagesPartnership Dissolution QuizLee SuarezNo ratings yet

- Race, Gender, and the Politics of Visible IdentityDocument21 pagesRace, Gender, and the Politics of Visible IdentityrebenaqueNo ratings yet

- 11g SQL Fundamentals I Student Guide - Vol IIDocument283 pages11g SQL Fundamentals I Student Guide - Vol IIIjazKhanNo ratings yet

- Route StructureDocument3 pagesRoute StructureAndrei Gideon ReyesNo ratings yet

- All About The Hathras Case - IpleadersDocument1 pageAll About The Hathras Case - IpleadersBadhon Chandra SarkarNo ratings yet

- Device Test ModeDocument14 pagesDevice Test ModeNay SoeNo ratings yet

- Clarifying Oracle EPM Versioning - PatchesDocument3 pagesClarifying Oracle EPM Versioning - PatchesSathish BalaNo ratings yet

- 3 Materi 5 TOEFLDocument14 pages3 Materi 5 TOEFL0029 Lona Anggina NstNo ratings yet

- 7vk61 Catalog Sip E6Document18 pages7vk61 Catalog Sip E6Ganesh KCNo ratings yet

- Revised SCOPE OF WORK and SCCDocument363 pagesRevised SCOPE OF WORK and SCCZia KhanNo ratings yet

- Lcasean PaperDocument6 pagesLcasean Paperkean ebeoNo ratings yet

- PDF Penstock Manual DLDocument160 pagesPDF Penstock Manual DLWilmer Fernando DuarteNo ratings yet

- Final test grammar and vocabulary practiceDocument5 pagesFinal test grammar and vocabulary practicexico_euNo ratings yet

- Window Server 2008 Lab ManualDocument51 pagesWindow Server 2008 Lab ManualpadaukzunNo ratings yet

- Physico-Chemical Characteristics and Afatoxins Production of Atractylodis Rhizoma To Diferent Storage Temperatures and HumiditiesDocument10 pagesPhysico-Chemical Characteristics and Afatoxins Production of Atractylodis Rhizoma To Diferent Storage Temperatures and HumiditiesWSNo ratings yet

- Cad MCQ Unit 5Document3 pagesCad MCQ Unit 5ddeepak123No ratings yet

- An Introduction To Insurance AccountingDocument86 pagesAn Introduction To Insurance AccountingTricia PrincipeNo ratings yet

- Dell M1000e Install Admin TroubleshootingDocument78 pagesDell M1000e Install Admin Troubleshootingsts100No ratings yet

- Vampire Stories in GreeceDocument21 pagesVampire Stories in GreeceΓιώργος ΣάρδηςNo ratings yet

- Lighting Design: Azhar Ayyub - Akshay Chaudhary - Shahbaz AfzalDocument27 pagesLighting Design: Azhar Ayyub - Akshay Chaudhary - Shahbaz Afzalshahbaz AfzalNo ratings yet

- Automotive Plastic Product Design Interview QuestionsDocument13 pagesAutomotive Plastic Product Design Interview QuestionsAbhijith Alolickal100% (2)