Professional Documents

Culture Documents

Adfina 4

Uploaded by

sonly amatosa0 ratings0% found this document useful (0 votes)

7 views1 pagebus comb

Original Title

adfina4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbus comb

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views1 pageAdfina 4

Uploaded by

sonly amatosabus comb

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

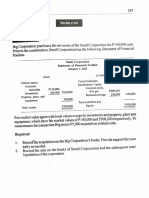

3.

X Company acquires all of Y Company in an acquisition properly accounted for as an asset

acquisition. X issues 80,000 shares of common stock with a fair value of P8,000,000 for Y’s net assets.

The fair values of Y’s assets and liabilities approximate their book values, except Y has customer lists

valued at P3,000,000 that are not reported on its balance sheet, and its plant assets are overvalued by

P5,000,000. Here are the balance sheets of X and Y prior to the acquisition:

X Company Y Company

Assets P30,000,000 P10,000,000

Liabilities P16,000,000 P 6,000,000

Common stock, $1 par 1,000,000 100,000

Additional paid-in capital 9,000,000 2,900,000

Retained earnings 4,000,000 1,000,000

P30,000,000 P10,000,000

How much goodwill is recognized for this acquisition?

a. P 2,000,000

b. P 3,000,000

c. P 6,000,000

d. P 11,000,000

ANS: C

Cost P8,000,000

Fair value of net assets acquired

Reported assets P 5,000,000

Customer lists 3,000,000

Liabilities (6,000,000) 2,000,000

Goodwill P6,000,000

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Problem 4Document1 pageProblem 4G-Malacas, Sheryn MaeNo ratings yet

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- Problem 1Document1 pageProblem 1G-Malacas, Sheryn MaeNo ratings yet

- Problem 1Document1 pageProblem 1G-Malacas, Sheryn MaeNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- For Questions 6Document3 pagesFor Questions 6Meghan Kaye LiwenNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationMeghan Kaye LiwenNo ratings yet

- PDF Partnership Liquidation Alynna Joy P Ibanezdocx DLDocument32 pagesPDF Partnership Liquidation Alynna Joy P Ibanezdocx DLKrizia Mae Uzielle PeneroNo ratings yet

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- Provision For Annual Leave 2Document2 pagesProvision For Annual Leave 2elsana philipNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- This Study Resource Was: Asian Academy For Excellence Foundation, IncDocument5 pagesThis Study Resource Was: Asian Academy For Excellence Foundation, IncAnne Marieline BuenaventuraNo ratings yet

- This Study Resource Was: Asian Academy For Excellence Foundation, IncDocument5 pagesThis Study Resource Was: Asian Academy For Excellence Foundation, IncAnne Marieline BuenaventuraNo ratings yet

- Partnership Liquidation. Alynna Joy P. IbanezDocument32 pagesPartnership Liquidation. Alynna Joy P. IbanezAllynna Joy83% (6)

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- PP Corporation Acquires SS CorporationDocument4 pagesPP Corporation Acquires SS CorporationNinaNo ratings yet

- Total Assets P 57,000,000 P 17,640,000 P 11,760,000Document2 pagesTotal Assets P 57,000,000 P 17,640,000 P 11,760,000Ian De DiosNo ratings yet

- Talisay Corporation Financial StatementsDocument10 pagesTalisay Corporation Financial StatementsRiza Mae AlceNo ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- SimexDocument3 pagesSimexRoland Ron BantilanNo ratings yet

- Business Combination. Quiz IIDocument2 pagesBusiness Combination. Quiz IICattleyaNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- Answer Key POD Cup Jr. Final RoundDocument6 pagesAnswer Key POD Cup Jr. Final RoundRitsNo ratings yet

- Ans 31 To 41Document2 pagesAns 31 To 41Mallet S. GacadNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- Cfas Pfa 01Document194 pagesCfas Pfa 01Kimberly Claire Atienza100% (1)

- PFA 1 Chapter 1 Current Assets SolutionsDocument38 pagesPFA 1 Chapter 1 Current Assets SolutionsAsi Cas Jav0% (1)

- AA-4101-Midterm-with-answersDocument9 pagesAA-4101-Midterm-with-answersAlyssa AnnNo ratings yet

- PFRS 3 Business Combination ProblemsDocument3 pagesPFRS 3 Business Combination ProblemsRay Allen UyNo ratings yet

- Financial difficulties and corporate liquidationsDocument16 pagesFinancial difficulties and corporate liquidationsMidas Troy Victor100% (1)

- Bus Com 13Document4 pagesBus Com 13Chabelita MijaresNo ratings yet

- Intermediate Accounting Practice Sets 1Document17 pagesIntermediate Accounting Practice Sets 1Mhaydel Garcia67% (3)

- Drill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingDocument5 pagesDrill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingRobert CastilloNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzNo ratings yet

- AFAR - 07 - New Version No AnswerDocument7 pagesAFAR - 07 - New Version No AnswerjonasNo ratings yet

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)student80% (5)

- Statement of Financial Position Basic Problems Problem 1-1 (IFRS)Document18 pagesStatement of Financial Position Basic Problems Problem 1-1 (IFRS)Marjorie PalmaNo ratings yet

- Quiz 2 - Statement of Changes in Equity-CompressedDocument4 pagesQuiz 2 - Statement of Changes in Equity-CompressedJm BalessNo ratings yet

- Business Combination2Document2 pagesBusiness Combination2sonly amatosaNo ratings yet

- Business Combination2Document2 pagesBusiness Combination2sonly amatosaNo ratings yet

- Business Combination2Document2 pagesBusiness Combination2sonly amatosaNo ratings yet

- Revenue Cycle Audit ObjectivesDocument2 pagesRevenue Cycle Audit ObjectivesRinokukun100% (1)

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationsonly amatosaNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Capital BudgetingDocument12 pagesCapital Budgetingjunhe898No ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Adfina 9Document1 pageAdfina 9sonly amatosaNo ratings yet

- Business Combination Goodwill CalculationDocument2 pagesBusiness Combination Goodwill Calculationsonly amatosaNo ratings yet

- Title 46 Professional and Occupational Standards Part XIX. Certified Public AccountantsDocument31 pagesTitle 46 Professional and Occupational Standards Part XIX. Certified Public Accountantssonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Fair Value Book ValueDocument2 pagesFair Value Book Valuesonly amatosaNo ratings yet

- 4 .P Acquires All of The Voting Shares of S by Issuing 500,000 Shares of P1 Par Common StockDocument1 page4 .P Acquires All of The Voting Shares of S by Issuing 500,000 Shares of P1 Par Common Stocksonly amatosaNo ratings yet

- Adfina 10Document1 pageAdfina 10sonly amatosaNo ratings yet

- Adfina 12Document1 pageAdfina 12sonly amatosaNo ratings yet

- Adfina 22Document1 pageAdfina 22sonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Adfina 11Document2 pagesAdfina 11sonly amatosa0% (1)

- 8.bats Inc, A New Corporation Formed and Organized Because of The Recent Consolidation of II Inc, and JJDocument1 page8.bats Inc, A New Corporation Formed and Organized Because of The Recent Consolidation of II Inc, and JJsonly amatosaNo ratings yet

- Adfina 13Document1 pageAdfina 13sonly amatosaNo ratings yet

- Adfina 12Document1 pageAdfina 12sonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- At-5906 Audit ReportDocument10 pagesAt-5906 Audit Reportshambiruar100% (4)

- CparDocument6 pagesCparmxviolet100% (4)