Professional Documents

Culture Documents

Problem 4

Uploaded by

G-Malacas, Sheryn Mae0 ratings0% found this document useful (0 votes)

6 views1 pageCompany D acquired all of the net assets of Company K in an asset acquisition. D issued 80,000 shares of its common stock, valued at $8,000,000, to K in exchange for its net assets. While most of K's assets and liabilities reflected their book values, K had an unreported customer list asset valued at $3,000,000 and its plant assets were overvalued by $5,000,000 on K's balance sheet. Prior to the acquisition, D had total assets of $30,000,000 and K had total assets of $10,000,000.

Original Description:

Original Title

problem 4

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCompany D acquired all of the net assets of Company K in an asset acquisition. D issued 80,000 shares of its common stock, valued at $8,000,000, to K in exchange for its net assets. While most of K's assets and liabilities reflected their book values, K had an unreported customer list asset valued at $3,000,000 and its plant assets were overvalued by $5,000,000 on K's balance sheet. Prior to the acquisition, D had total assets of $30,000,000 and K had total assets of $10,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageProblem 4

Uploaded by

G-Malacas, Sheryn MaeCompany D acquired all of the net assets of Company K in an asset acquisition. D issued 80,000 shares of its common stock, valued at $8,000,000, to K in exchange for its net assets. While most of K's assets and liabilities reflected their book values, K had an unreported customer list asset valued at $3,000,000 and its plant assets were overvalued by $5,000,000 on K's balance sheet. Prior to the acquisition, D had total assets of $30,000,000 and K had total assets of $10,000,000.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

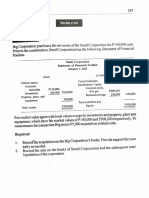

Company acquires all of K Company in an acquisition properly accounted for as an asset

acquisition. D issues 80,000 shares of common stock with a fair value of P8,000,000 for K’s

net assets. The fair values of K’s assets and liabilities approximate their book values, except

K has customer lists valued at P3,000,000 that are not reported on its balance sheet, and its

plant assets are overvalued by P5,000,000. Here are the balance sheets of D and K prior to the

acquisition:

D Company K Company

Assets P30,000,000 P10,000,000

Liabilities P16,000,000 P6,000,000

Common stock, $1 par 1,000,000 100,000

Additional paid-in capital 9,000,000 2,900,000

Retained Earnings 4,000,000 1,000,000

P30,000,000 P10,000,000

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Quiz 1 - Business CombiDocument6 pagesQuiz 1 - Business CombiKaguraNo ratings yet

- ACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SDocument24 pagesACC 113 Accounting For Business Combinations Common Final Exam SY2122 1SGiner Mabale StevenNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Multiple Choice - ProblemsDocument2 pagesMultiple Choice - ProblemsAnthony Koko Carlobos0% (1)

- 2018cpapassers PDFDocument4 pages2018cpapassers PDFBryan Bryan BacarisasNo ratings yet

- Business Combination. Quiz IIDocument2 pagesBusiness Combination. Quiz IICattleyaNo ratings yet

- Quiz-1 ILUSORIODocument5 pagesQuiz-1 ILUSORIOGlennizze Galvez100% (5)

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Document11 pagesCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- Chapter 8Document8 pagesChapter 8Kurt dela Torre100% (1)

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Problems Chapter 6-10Document15 pagesProblems Chapter 6-10u got no jams0% (1)

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.No ratings yet

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Problem 1Document1 pageProblem 1G-Malacas, Sheryn MaeNo ratings yet

- Problem 1Document1 pageProblem 1G-Malacas, Sheryn MaeNo ratings yet

- Adfina 4Document1 pageAdfina 4sonly amatosaNo ratings yet

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Exercises (7-27-18)Document2 pagesExercises (7-27-18)Justin ManaogNo ratings yet

- For Questions 6Document3 pagesFor Questions 6Meghan Kaye LiwenNo ratings yet

- Chapter 19 Exercises & ProblemsDocument10 pagesChapter 19 Exercises & ProblemsRiza Mae AlceNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- Cpareviewschoolofthephilippines ChanchanDocument8 pagesCpareviewschoolofthephilippines ChanchanDavid David100% (1)

- Drill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingDocument5 pagesDrill 5 - Business Com, Consolidted FS, Forex - For Print FSUU AccountingRobert CastilloNo ratings yet

- Business Combination HO Questions1Document8 pagesBusiness Combination HO Questions1Nicole Gole CruzNo ratings yet

- AtcpDocument2 pagesAtcpnavie VNo ratings yet

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationMeghan Kaye LiwenNo ratings yet

- Guerrero CH14 - ProblemsDocument14 pagesGuerrero CH14 - ProblemsClaireNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Quiz in Business Combi, Conso and Corpo LiqDocument11 pagesQuiz in Business Combi, Conso and Corpo LiqExequielCamisaCrusperoNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- Business CombinationDocument1 pageBusiness CombinationNicki Salcedo0% (2)

- Total Assets P 57,000,000 P 17,640,000 P 11,760,000Document2 pagesTotal Assets P 57,000,000 P 17,640,000 P 11,760,000Ian De DiosNo ratings yet

- Name: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationDocument2 pagesName: Section: Date: Score: Long Exam On Non-Profit Organization and Business CombinationLiezelNo ratings yet

- Bus Com 13Document4 pagesBus Com 13Chabelita MijaresNo ratings yet

- Practical Accounting II - 2nd PreboardDocument9 pagesPractical Accounting II - 2nd PreboardKim Cristian Maaño0% (1)

- Straight ProblemsDocument12 pagesStraight Problemsnana100% (2)

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- WEEK 5 AFAR.04 Business Combination DrillDocument10 pagesWEEK 5 AFAR.04 Business Combination DrillHermz ComzNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- Advanced Financial Accounting and Reporting: G.P. CostaDocument27 pagesAdvanced Financial Accounting and Reporting: G.P. CostaryanNo ratings yet

- Corporate Liquidation & Joint Venture2Document5 pagesCorporate Liquidation & Joint Venture2jjjjjjjjjjjjjjjNo ratings yet