Professional Documents

Culture Documents

Financial Intermediation Unit 2 and Financial Markets Unit 1

Financial Intermediation Unit 2 and Financial Markets Unit 1

Uploaded by

yadavmihir630 ratings0% found this document useful (0 votes)

18 views4 pagesFinancial Intermediation Unit 2 and Financial Market

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial Intermediation Unit 2 and Financial Market

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views4 pagesFinancial Intermediation Unit 2 and Financial Markets Unit 1

Financial Intermediation Unit 2 and Financial Markets Unit 1

Uploaded by

yadavmihir63Financial Intermediation Unit 2 and Financial Market

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

LN. CHANDLER = = sa

Favaveat Sratoranetiber = \)

Lamppicza 4 GOVelves ehamnetleng | elon]

Soleo a Fumds or Sau’ :

Surplus sketon> $e Bekeest SUPIR URhab bite FUSED SI

! i Ro, Teecyctensh,| ater, Dineigle GecryTritncnel Rawvice &

| onit oo one davher me eranlio!

/ pa ee umethert by whieh eae ae 1"

(GS) 9 ssancint irenuepiation -\e pete a ampostance, Em

FINANCIAL INTERMEDIATION Sehene FI

“The institutions in the financial markets such as commercial ban!

process of financial intermedia

‘Ves Var

ori feaT capital inv.

fh a ondd- and quity shares) Wt was estimated Dyet

; en G tcrmgdnes pena toe

Gr tahhance growthPbyipooling funds heiall bnd geattoresavets ME §

jent manner by using their informational advantage

fas fund fo finance productive activi

|

eye

ie) 7 2S ota ta1-4-)

f]

expansion of the finaic

ayon'st denoted by the ratio of financial assets, of all kinds to.

Sr arcemTics prowih, (tra certain extent, gre_h of savings is facilitated

accompanies growth (10 a certain enter Grit oh Son acl eng

PF naACAT instrMESTS ARE EXP :

lo ensuFy ther most efficient translonsmyposyor

han in developed countt

Fimancial servicesycontributed

Fomrin the late eighties.

REFERENCES On

wear ank finda, Repoton Copa! Account Convert Jane 1957. Oy mma sH a

R

eT pankof nia, Report on Currency and Fiance 1.1, 199495: Fc eyntartoytrd $e 6s (

room apaat net oc PIROED. Sp at ae vp

RAY eer on Gate eons Natoma |

EA Vay Rah? oy, Panonesad past One :

NP | ioe OO Sydn autem For GI an s

A FINANCIAL INT RMEDIATION

The institutions in the financial markets such as commercial banks and non-bank intermediaries

undertake the important process of financial intermediation whereby the funds or savings of the

surplus sectors are channelled to deficit sectors. The financial institutions channel the funds of

surplus economic units to those wanting to spend on real capital investment, Funds are transferred

through the creation of financial liabilities such as bonds and equity shares. It was estimated by

the Prime Directory that in 1996-97 there were 20,158 financial intermediaries.

Financial intermediation can enhance growth by pooling funds of the small and scattered savers

and allocating them for investment in an efficient manner by using their informational advantage

in the loan market. They are principal mobilisers of surplus funds to finance productive activity

and to the extent that they promote capital accumulation, they promote growth. -

Financial institutions provide three transformation services. Firstly, liability, asset and size

transformation consisting of mobilisation of funds and their allocation (provision of large loans

on the basis of numerous small deposits). Secondly, maturity transformation by offering the savers

the relatively short-term claim or liquid deposit they prefer and providing borrowers long-term

loans which are better matched to the cash flows generated by their investment. Finally, risk

transformation by transforming and reducing the risk involved in direct lending by acquiring

more diversified portfolios than individual savers can: The expansion of the financial network or

an increase in financial intermediation as denoted by the ratio of financial assets of all kinds to

gross national product accompanies growth. To a certain extent, gre /th of savings is facilitated

by the increase in the range of financial instruments and expansion f markets.

The ability of the financial intermediaries to ensure the most efficient transformation of

mobilised funds into real capital has not, however, received the attention it deserves. Institutional

mechanisms to ensure end use of funds have not been efficient in their functioning, leaving the

investor unprotected. Efficient financial intermediation involves reduction of the transaction cost

of transferring funds from original savers to financial investors. The total cost of intermediation

is influenced by financial layering which makes the individual institution's costs additive in the

total cost of intermediating between savers and ultimate borrowers. The aggregate cost of financial

intermediation from the original saver to ultimate investor is much higher in developing countries

than in developed countries.

Financial services contributed 6 per cent of GNP (1995) as compared to 3.7 per cent before

liberalisation in the late eighties. Theories of endogenous growth have established firm linkages

between financial intermediation and economic growth.

* REFERENCES

Reserve Bank of India, Report on Capital Account Convertibility, June 1997.

Reserve Bank of India, Report on Currency and Finance, Vol. I, 1994-95.

Reserve Bank of India, Annual Report, 1996-97.

Ln. ALMECHANISM FORTHE EXCHANGE TRADING OF FINANCIAL

Chawolle PRODUCTS UNBER A Rae WER PRO RART eI PANTS

ant WNTHE FINBIAL MARKETS ARE BORROWE; 7

—~ SECURITIES ) AND LENDERS (BUYERS OF LOR\TIE

Repamee INTERMEDIARIES , FINANCIAL MARKETS COMPRISE SF TWO

— (Zeer DISTINGT TYPES OF MARKETS ((A)MONEYMARKETIG) CAPITAL MARE

7K RebERRSD RH Poh NaN tet fox shotigin J aatamsae Gun. blame a

Capital Marketa ye qd matt wherein eres cougars gpa reee>

markt fr lononn csi. ceifiats of depogt, comercial pes. andwasury bills eth

tem egy sod 22 SL ee SuSE ft mosey wa ‘ =

Geb isments ne

oR Ranawersl mnvitels regan WS por Ali kribenat WU Law aemk |

See ee sway Geeta Cee Saal eet

\ aL SYSTEM, THEY ARF

TMPORTANT COMPONENT OF THE FIT

+ Secondany—

imaret for ting

utetanding tsues

~ | Aron downer IP

ofcapital market isto

+ mighlise long-term saving to finance long-term invesuments

ode ape Te Re of ego qaseguly- to eniwpenes +

a ‘roader ownership of productive assets;

= {ppoude haus a mech esti "

+ + Tver the gots of uansacuenig aid infOmnations and" "PH Erne

‘pppoe eticiency of capital allocaig tung cgmptitv pricing witb

Money Market and Capital Market. ate Ses ¢

A “Thee song nk between the méngy makes he ait makgt "8 er

} + Ofte, finsiclal institutions actively inthe capital Maik ae lio inidiged in fa

5 eee ee .

Far Aner Link between tg y+ 3 Eyafeid inthe money mackt ae usd vide gui oe ier ini ane

Bases ead, irimrandins | Sdemption of fads raised ta the Copal al a

Bamtt — sicondary Capital, ~velopinent process of financial markets, the evelopment of the moncy markeiypicdll

ehroyt2 ae ee oe ree eee a apr

Tape oF Market AL ese yie dolepment ofthe 3 Zt se,

fe. sf Saptal masket ean be futher asi 5 ad seca i pita

\ passe Sa

oe ae Fispente

> + he presence of a

whe “Mare

pita market

‘iomiauy ds st

Ta a oe a ah aE cee EDS

abe be pana het reas Lo Sinan To rig I Goan

igo pray eo epee Gane Te GUS of ele sre nsccaaey mee as Ron

Primary Capital Market and Secondary Capital Markco

+ Teaecnsiny

1 Oaqatea) ” "paler ponders

Menen Kol’ male ovens

Aakers tcdrmwip) SARE

om

Devrclong er shor! shee

down Pater fu BE

Ben a well as

Exendooghen i npr lane eect

ven hugh ha mks anys grt no yn

Fae a

~ Re pra tient for ne ease tb alums pinging snes

‘Biased Oy items PO Gar mae Rea aise eae aes eee

SE lair help is cigar ia RCIA

, ) es Tea Tavoable condilions forte tondgny manRCHThiz neem nliosoeabe meat

BG mendes pend Ea a ee ge

Binog tenon, * ama Safe Sonne

ARomk tenn haeenloricerinte ‘Thuoyant secondary marker i Tnapensable forthe fessiee of alban puna capital we

Poamdcan's crcesphee, scorn mse ER A Bvoyam See en Oladhy (remeber),

Q- Treun Art colds api antcoty Rae eas boancpreank

YNean Money! ‘i to Nan wr

Crowle mm COA na colbert War SAA

ies 4 WedNh Dod rat fead ay Ne

Bender ob Noa tony”

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cash Credit SystemDocument6 pagesCash Credit Systemyadavmihir63No ratings yet

- FAQs - World Instant Noodles Association Desribe - 1234Document5 pagesFAQs - World Instant Noodles Association Desribe - 1234yadavmihir63No ratings yet

- JBT's Filling & Sterilization Technology For Baby Food in Glass JarsDocument11 pagesJBT's Filling & Sterilization Technology For Baby Food in Glass Jarsyadavmihir63No ratings yet

- Estimating Discount Rates: DCF ValuationDocument60 pagesEstimating Discount Rates: DCF Valuationyadavmihir63No ratings yet

- Overview of Mutual FundsDocument28 pagesOverview of Mutual Fundsyadavmihir63No ratings yet

- Risk and Return Models: Equity and DebtDocument24 pagesRisk and Return Models: Equity and Debtyadavmihir63No ratings yet

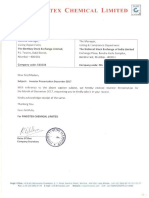

- Finotex ChemcialDocument43 pagesFinotex Chemcialyadavmihir63No ratings yet

- Raw Milk From Silo To Feed Balance Tank 1500-3016-PP01: Pump Application: Pump Tag NoDocument1 pageRaw Milk From Silo To Feed Balance Tank 1500-3016-PP01: Pump Application: Pump Tag Noyadavmihir63No ratings yet

- Collective Investment Vehicle Formed With The Specific Objective of Raising Money From Large Number of IndividualsDocument120 pagesCollective Investment Vehicle Formed With The Specific Objective of Raising Money From Large Number of Individualsyadavmihir63No ratings yet

- SPMAT EffectiveMaterialsManagement WhitePaperDocument12 pagesSPMAT EffectiveMaterialsManagement WhitePaperyadavmihir63No ratings yet

- Originate Industries ProfileDocument4 pagesOriginate Industries Profileyadavmihir63No ratings yet

- Diaphragm Pump NOVADOS - H3Document2 pagesDiaphragm Pump NOVADOS - H3yadavmihir63No ratings yet