Professional Documents

Culture Documents

Weekly Bulletin: MET-Bytes

Uploaded by

Mehul BariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Bulletin: MET-Bytes

Uploaded by

Mehul BariCopyright:

Available Formats

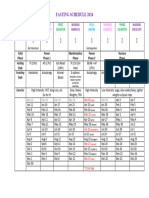

MET-Bytes: Weekly Bulletin 21-26 October, 2018

TRENDING…..

Micro lenders take a hit over NBFC liquidity woes

Liquidity crunch of NBFCs is having a ripple effect on Micro-finance Institutions, due to which they have slowed

disbursements of loans to MFIs. MFI delegations would meet NBFCs with a plea to release funds to small micro

lenders who depend on NBFCs for 50-60% of their working capital requirement. Micro lenders claim that since

they belong to low risk category in terms of Asset-liability Management, NBFCs should not stop releasing funds to

them. To deal with problem of liquidity, MFIs are borrowing funds at a higher rate. The smaller MFIs are the most

hit by this situation because the larger ones get a relief from investors infusing equity of about Rs 4,061 crore in

FY18, about 87% going to latter.

RIL takes Reliance Jio Route for Jio Payments Bank Launch

RIL is moving its JioMoney prepaid mobile wallet customers to Jio Payments Bank. Jio Payments bank is a joint

venture between RIL and SBI, one of the 8 payments banks licensed to operate in India. Reliance Jio is testing its

payments bank on its employees by allowing them to use the service, so that company can test loopholes its

infrastructure and network before its launch .Payments Bank offers services such as small savings account,

payments, and remittance services to small business and low-income households. They ease the account opening

process as it technology based and paperless. RIL integrated with SBI’s YONO platform on its MyJio app, where

the features of SBI’s YONO can be accessed through the My Jio application. SBI plans to engage Reliance Jio as

preferred partner for network and connectivity solutions.

Infosys Finacle , R3 announce partnerships for Blockchain Solutions

Infosys subsidiary Finacle would collaborate with R3 a Blockchain software firm to enable banks to easily access

and deploy Finacle’s blockchain solutions on Corda, R3’s blockchain platform. Banks will get easy access to

blockchain solutions via Corda, enabling them to save costs and create efficiencies and minimize risk while dealing

with their business partners and customer. Finacle Trade Connect, blockchain based trade finance solution will

help banks to connect with trade partners and companies on unified distributed network. It would help banks in

trade and supply chain finance products such as Open Account, Letter of Credit, Invoice Financing, Bills Collection,

PO financing, Bank Guarantees and Packing credit. Finacle Payments Connect will enable banks to process their

real-time payments with other banks.Therefore banks can use these solutions to facilitate trade and payments

services for other to their international subsidiaries or other financial institutions.

IDFC Bank to be renamed as IDFC First Bank

IDFC Bank has proposed to change its name to 'IDFC First Bank Ltd' as it is in the process of amalgamating non-

banking financial company ‘Capital First’ with itself. The Board of Directors of IDFC Bank at its meeting Wednesday

decided to seek approval of the Reserve Bank of India to rename the bank as 'IDFC First Bank Limited'. Capital First

and IDFC Bank, with this merger in an all-stock deal, would create a Rs 88,000-crore combined entity. The share

swap ratio for the merger is fixed at 139:10, meaning IDFC Bank will issue 139 shares for every 10 shares of Capital

First.

Mobile phones, not cards, lead India’s digital payments push

Mobile phones have become a bigger source of non-cash payment methods in retail transactions than customers

swiping their cards at Point of Sale (POS) machines. And the implementation of Goods and Services Tax (GST) a

catalyst for digital payments in the Indian economy.ATM withdrawals fell drastically while the retail digital

payment methods such as UPI, PPI and Mobile Banking increased due to Demonetization. However, as cash came

back in the system, the growth in digital payments decelerated. Prior to GST, ATM withdrawals were high but, the

trend reversed in the post-GST period. Digital payments started increasing overtook the value of ATM withdrawals.

The rising dominance of e-commerce, which involves online payments, could be one factor. As more and more

players enter the digital payment space, cash incentives for consumers have increased significantly. It is also

possible that the combined incentives from online sellers and digital payment platforms have taken away a part of

demand from what used to require cash transactions. Also with a decline in ‘without tax’ transactions due to

willingness to be a part of the tax-credit chain under the GST, over the counter cash purchases might have become

more expensive.

AP signs pacts for fintech ecosystem in Vizag

The Andhra Pradesh government has entered into agreements with several global groups and firms to create a

complete ecosystem of financial technologies at Fintech Valley Vizag. The AP government has signed pacts with

HDFC Bank, Whub of Hong Kong, Fintech Association of Hong Kong, SOSA of Israel, Singex, Wadhwani Foundation,

Bizoforce and Udayam Association. The agreement with HDFC Bank is to promote the Fintech Valley among

startups in the bank's network, facilitate banking requirements of the startups there, and promote HDFC banking

products within other government departments. The collaboration with Whub and SOSA is to set up an

international landing pad in Hong Kong, Israel and Ney York respectively for startups from AP to expand

operations, gain knowledge and access market opportunities. While the agreement with Singex enables hosting

innovation festivals in AP, the collaboration with the Wadhwani Foundation is aimed at promoting

entrepreneurship, innovation and startups in the state. The arrangement with the Fintech Association of Hong

Kong Collaboration is targeted at leveraging Hong Kong’s Fintech ecosystem and building an AP-HK gateway for

Fintech startups and knowledge transfer.

India’s economic growth not inclusive enough, inequality rises

Economic growth in India has not been inclusive enough, even though the economic growth is fast it hasn’t

percolated down through the economy. The index measuring social and environmental needs ranks at 101 for

India, which makes it poor performing than other BRICS nations. The countries which have performed better have

managed to have broad based public participation in economic expansion and financial development through

measures aiming at higher literary, better healthcare, greater gender equality. Only when social barriers are

broken can these reforms maximize gains in poverty reduction. Basic education and good health are important for

economic growth and development of the economy. India needs to bridge the disparity in social classes an only

then would its financial development rise at faster pace

How RBI's move will affect wallet-to-wallet transfers

The RBI has issued new guidelines for allowing interoperability for mobile wallets which are KYC compliant. This

means it will let the customers transfer funds between different mobile wallets (Paytm, PhonePe etc). This will

help increase the number of wallet transactions as it will provide ease to the customer, by the way of transferring

funds from one wallet to another in a few seconds. For instance, a user can transfer funds from his Paytm wallet to

PhonePe wallet in seconds. The move came in after the industry witnessed that more and more customers are

preferring mobile phones and other electronic mediums over cards. The data collected by RBI shows that wallet

transactions rose to 340.65 million in August from 225.43 million in the same month last year, which is 51.11 % YoY

increase.

Ujjivan, Equitas tank on RBI clarification over listing small finance banks

The RBI on Friday clarified that promoters of small finance banks have to compulsorily list their banking

units separately within 3 years of its operation. As both Ujjivan Financial and Equitas Holdings run small

finance banks, their shares slumped down by 19% and 28% respectively. This practically led to wiping

out the entire capital gains on these shares since their IPO in 2016. The other clarifications included that

promoters of small finance banks should also maintain atleast 40% of stake till the banks do not

complete 5 years since commencing operations. For Equitas this means that by 24 September 2019 it

will have to list their small finance bank division separately, whereas for Ujjivan Financial it will have

time till 30 January 2020 to comply to the order.

Goldman to debut online consumer banking in Japan

Goldman Sachs plans to enter japan with its Retail banking business, using a low-overhead digital model cultivated

in the U.S. to break into what it sees as growth market for financial technology. The online banking service of

Goldman in USA Marcus, offers loans and high-interest savings to 2 million customers with 30 billion dollars of

deposits and wants to replicate the same in Japan. Banking sector’s rapid technological progress has convicted the

company to expand its customer base beyond its traditional clientele of big business and wealthy customers and

wealthy customers to regular customers.

You might also like

- Presentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Document61 pagesPresentation For Viva: Sagar Srinivas Mandal HPGD/JL17/2564Mandal SagarNo ratings yet

- The Evolution of Open BankingDocument7 pagesThe Evolution of Open BankingJerry PatelNo ratings yet

- FINTECHSDocument3 pagesFINTECHSMahima SharmaNo ratings yet

- Final Black BookDocument27 pagesFinal Black Bookruanonlineservices2023No ratings yet

- Fin TechDocument7 pagesFin TechHarsh ChaudharyNo ratings yet

- Fintech Ecosystem Fintech Start-Ups FintechDocument2 pagesFintech Ecosystem Fintech Start-Ups FintechTimNo ratings yet

- Srinivasan 2211288 10 E WAC IIDocument4 pagesSrinivasan 2211288 10 E WAC IISrinivasan CNo ratings yet

- Major Role of Technology in Financial InclusionDocument5 pagesMajor Role of Technology in Financial InclusiondebasishpahiNo ratings yet

- essay 2024Document6 pagesessay 20244th zenz starNo ratings yet

- Mod1 - MBO-14-Banking - Services and InnovationDocument31 pagesMod1 - MBO-14-Banking - Services and InnovationakashvagadiyaNo ratings yet

- YES BANK'S FUTURE IN FINTECHDocument5 pagesYES BANK'S FUTURE IN FINTECHDeepak BhatiaNo ratings yet

- BANk CIA1.2 1720253Document14 pagesBANk CIA1.2 1720253Aashish mishraNo ratings yet

- Introduction To The CompanyDocument28 pagesIntroduction To The CompanyMukesh ManwaniNo ratings yet

- Tally BIZ PresentationDocument10 pagesTally BIZ PresentationTurner TuringNo ratings yet

- Are you ready for the mobile banking revolutionDocument10 pagesAre you ready for the mobile banking revolutionSachin SinghNo ratings yet

- FinTech Newsletter Highlights Key Developments in Indian FinTech SpaceDocument10 pagesFinTech Newsletter Highlights Key Developments in Indian FinTech SpacePRIYANSHU KUMARNo ratings yet

- Assignment 1 Development in Banking Sector From 2010 Till 2023Document5 pagesAssignment 1 Development in Banking Sector From 2010 Till 2023Komal RautNo ratings yet

- Monthly Digest July 2020 Eng 96 PDFDocument34 pagesMonthly Digest July 2020 Eng 96 PDFVeeresh IreniNo ratings yet

- Impact of Covid-19 On "Financial Service Sector" & "Pharmaceutical Sector"Document16 pagesImpact of Covid-19 On "Financial Service Sector" & "Pharmaceutical Sector"Milind VatsiNo ratings yet

- Final Project On Financial InclusionDocument33 pagesFinal Project On Financial InclusionPriyanshu ChoudharyNo ratings yet

- Chapter-Iii Industry Profile & Company ProfileDocument19 pagesChapter-Iii Industry Profile & Company ProfileKitten KittyNo ratings yet

- Banking and Economy August 2021 RecapDocument17 pagesBanking and Economy August 2021 RecapHarika VenuNo ratings yet

- BankingDocument4 pagesBankingRehaan DanishNo ratings yet

- BFSI Sector in India: Digital Transformation, Trends, and Use CasesDocument25 pagesBFSI Sector in India: Digital Transformation, Trends, and Use CasesPranita TangadeNo ratings yet

- BS Adfree 19.05.2019Document9 pagesBS Adfree 19.05.2019Battula Surender SudhamaNo ratings yet

- Group27 Aye FinanceDocument8 pagesGroup27 Aye FinanceShreenidhi M RNo ratings yet

- Financial InclusionDocument6 pagesFinancial InclusionsignNo ratings yet

- Embedded Finance FINALDocument20 pagesEmbedded Finance FINALomafolabomiNo ratings yet

- 10 Challenges That Could Make or Break IndiaDocument3 pages10 Challenges That Could Make or Break IndiaarchanaNo ratings yet

- Monthly Digest July 2021 Eng 54Document34 pagesMonthly Digest July 2021 Eng 54Max MahoneNo ratings yet

- Commerical Banking JUNE 2022Document11 pagesCommerical Banking JUNE 2022Rajni KumariNo ratings yet

- Fintech ScopeDocument5 pagesFintech Scopearpit85No ratings yet

- Monthly Digest August 2020 Eng 79Document33 pagesMonthly Digest August 2020 Eng 79Salil ShauNo ratings yet

- Banking Current Affairs JULY 2017Document6 pagesBanking Current Affairs JULY 2017arunbestudentNo ratings yet

- Payments BankDocument33 pagesPayments BankAdnan patelNo ratings yet

- Financial Innovations in Deposit Products of Major Indian BanksDocument18 pagesFinancial Innovations in Deposit Products of Major Indian BanksRanjeeta Kumari0% (1)

- BANK Research ReportDocument12 pagesBANK Research ReportAntraNo ratings yet

- Payments BankDocument14 pagesPayments BankDurjoy BhattacharjeeNo ratings yet

- Background Note - Financing India S MSMEsDocument4 pagesBackground Note - Financing India S MSMEsassmexellenceNo ratings yet

- Fintech Case StudyDocument5 pagesFintech Case StudyAMIT KUMAR CHAUHAN100% (1)

- What Is Financial InclusionDocument4 pagesWhat Is Financial InclusionIshaan DhankaniNo ratings yet

- 7 P's of ICICI BANKDocument13 pages7 P's of ICICI BANKSumit VishwakarmaNo ratings yet

- Chapter-Ii Industry Profile & Company ProfileDocument84 pagesChapter-Ii Industry Profile & Company ProfileMubeenNo ratings yet

- HDFC Core BankingDocument32 pagesHDFC Core Bankingakashshah1069100% (1)

- Final Project On Financial InclusionDocument33 pagesFinal Project On Financial InclusionUtkarsh SinghNo ratings yet

- CM Project of Mehak Juneja (18BSP1729)Document5 pagesCM Project of Mehak Juneja (18BSP1729)mehak junejaNo ratings yet

- FIN 401 Final Report BodyDocument9 pagesFIN 401 Final Report Body1711........100% (1)

- ICICIBank Vodafone Jan2011Document3 pagesICICIBank Vodafone Jan2011Vighnesh Bhat MNo ratings yet

- Payment Banks: Digital Revolution in Indian Banking SystemDocument7 pagesPayment Banks: Digital Revolution in Indian Banking SystemResearch SolutionsNo ratings yet

- Hospitality Indusrty Top 10Document6 pagesHospitality Indusrty Top 10pooja36No ratings yet

- Porter Five Forces in Banking IndustryDocument8 pagesPorter Five Forces in Banking IndustryarvindNo ratings yet

- Payment Banks in India: Indian Institute of Technology, RoorkeeDocument19 pagesPayment Banks in India: Indian Institute of Technology, RoorkeeShihab LeverNo ratings yet

- Yes BankDocument30 pagesYes BankVivek PrakashNo ratings yet

- Fin TechDocument4 pagesFin TechTanmay Shubham PantNo ratings yet

- Payment Banks: A Step Closer Towards Financial Inclusion: Friday, 21 August 2015Document4 pagesPayment Banks: A Step Closer Towards Financial Inclusion: Friday, 21 August 2015amankumar sahuNo ratings yet

- FintechDocument6 pagesFintechParamNo ratings yet

- M6 - IIFT GK Compendium (2022-23)Document81 pagesM6 - IIFT GK Compendium (2022-23)Ayush BeryNo ratings yet

- Employee Convenience Center Project ReportDocument30 pagesEmployee Convenience Center Project ReportMaxPanduNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Operating Manual: Please Read These Operating Instructions Before Using Your FreedomchairDocument24 pagesOperating Manual: Please Read These Operating Instructions Before Using Your FreedomchairNETHYA SHARMANo ratings yet

- 8.4 Example: Swiss Market Index (SMI) : 188 8 Models of VolatilityDocument3 pages8.4 Example: Swiss Market Index (SMI) : 188 8 Models of VolatilityNickesh ShahNo ratings yet

- InteliLite AMF20-25Document2 pagesInteliLite AMF20-25albertooliveira100% (2)

- 2nd QUARTER EXAMINATION IN P. E 2019-2020Document3 pages2nd QUARTER EXAMINATION IN P. E 2019-2020Lyzl Mahinay Ejercito MontealtoNo ratings yet

- Hanwha Engineering & Construction - Brochure - enDocument48 pagesHanwha Engineering & Construction - Brochure - enAnthony GeorgeNo ratings yet

- Emilio Aguinaldo CollegeDocument1 pageEmilio Aguinaldo CollegeRakeshKumar1987No ratings yet

- Copy Resit APLC MiniAssignmentDocument5 pagesCopy Resit APLC MiniAssignmentChong yaoNo ratings yet

- X RayDocument16 pagesX RayMedical Physics2124No ratings yet

- Oracle® E-Business Suite: Integrated SOA Gateway Implementation Guide Release 12.2Document202 pagesOracle® E-Business Suite: Integrated SOA Gateway Implementation Guide Release 12.2yadavdevenderNo ratings yet

- Strategic Flexibility: The Evolving Paradigm of Strategic ManagementDocument3 pagesStrategic Flexibility: The Evolving Paradigm of Strategic Managementnanthini kanasanNo ratings yet

- ChromosomesDocument24 pagesChromosomesapi-249102379No ratings yet

- SeparatorDocument2 pagesSeparatormmk111No ratings yet

- LogDocument119 pagesLogcild MonintjaNo ratings yet

- Body Shaming Among School Going AdolesceDocument5 pagesBody Shaming Among School Going AdolesceClara Widya Mulya MNo ratings yet

- Corporate Governance in SMEsDocument18 pagesCorporate Governance in SMEsSana DjaanineNo ratings yet

- Drug Study TramadolDocument7 pagesDrug Study TramadolZyrilleNo ratings yet

- ProjectDocument86 pagesProjectrajuNo ratings yet

- British Isles Composition GuideDocument4 pagesBritish Isles Composition GuidesonmatanalizNo ratings yet

- Biamp Vocia Catalog Apr2020Document24 pagesBiamp Vocia Catalog Apr2020Mahavir Shantilal DhokaNo ratings yet

- Moon Fast Schedule 2024Document1 pageMoon Fast Schedule 2024mimiemendoza18No ratings yet

- History and Development of the Foodservice IndustryDocument23 pagesHistory and Development of the Foodservice IndustryMaria Athenna MallariNo ratings yet

- Chronological OrderDocument5 pagesChronological OrderDharWin d'Wing-Wing d'AriestBoyzNo ratings yet

- Starting A Business Candle Making 2009Document2 pagesStarting A Business Candle Making 2009Carlo Fabros Junio100% (4)

- Muv PDFDocument6 pagesMuv PDFDenisse PxndithxNo ratings yet

- Service Positioning and DesignDocument3 pagesService Positioning and DesignSaurabh SinhaNo ratings yet

- The Interview: P F T IDocument14 pagesThe Interview: P F T IkkkkccccNo ratings yet

- Class 7thDocument24 pagesClass 7thPriyaNo ratings yet

- Final - WPS PQR 86Document4 pagesFinal - WPS PQR 86Parag WadekarNo ratings yet

- TNTCL Cost Data 2021 22Document95 pagesTNTCL Cost Data 2021 22Akd DeshmukhNo ratings yet

- Grade 8 Lily ExamDocument3 pagesGrade 8 Lily ExamApril DingalNo ratings yet