ACMA Work Sheet & Asst.

Material December 2018

Arba Minch University

Department of Accounting and Finance

Msc Program

Advanced Cost and Management Accounting

Work Sheet and Assignment Material

General instructions:

- Attempt all of the following questions and submit your answer for

questions number 3, 5, 7, 8, 10, 11, 12 and 13 individually. And the last

five questions (questions 16-20) in Group.

- Last submission date: January 7/2019.

Question 1:

(a) From the following information you are required to construct:

(i) a break-even chart, showing the break-even point and the margin of safety;

(ii) a chart displaying the contribution level and the profit level; (iii) a

profit–volume chart.

Sales 6000 units at Br.12 per unit = Br.72 000

Variable costs 6000 units at Br.7 per unit = Br.42 000

Fixed costs = Br.20 000

(b) State the purposes of each of the three charts in (a) above.

(c) Outline the limitations of break-even analysis.

(d) What are the advantages of graphical presentation of financial data to executives?

Question 2:

A company produces and sells two products with the following costs:

Product X Product Y

Variable costs per Br. of sales Br.0.45 Br.0.6

Fixed costs per period Br.1 212 000 Br.1 212 000

Total sales revenue is currently generated by the two products in the following proportions:

Product X 70%

Product Y 30%

Required:

(a) Calculate the break-even sales revenue per period, based on the sales mix assumed above.

Page 1 of 12

� ACMA Work Sheet & Asst. Material December 2018

(b) Prepare a profit–volume chart of the above situation for sales revenue up to Br.4 000 000.

Show on the same chart the effect of a change in the sales mix to product X 50%, product

Y 50%. Clearly indicate on the chart the break-even point for each situation.

(c) Of the fixed costs Br.455 000 are attributable to product X. Calculate the sales revenue

required on product X in order to recover the attributable fixed costs and provide a net

contribution of Br.700 000 towards general fixed costs and profit.

Question 3:

M Ltd manufactures three products which have the following revenue and costs (Br. per unit).

Product 1 2 3

Selling price 2.92 1.35 2.83

Variable costs 1.61 0.72 0.96

Fixed costs:

Product-specific 0.49 0.35 0.62

General 0.46 0.46 0.46

Unit fixed costs are based upon the following annual sales and production volumes (thousand

units):

Product 1 2 3

98.2 42.1 111.8

Required:

(a) Calculate:

i. the break-even point sales (to the nearest Br. hundred) of M Ltd based on the current

product mix;

ii. the number of units of Product 2 (to the nearest hundred) at the breakeven point determined

in (i) above;

(b) Comment upon the viability of Product 2.

Question 4:

Keppel Manufacturing had a bad year in 2012, operating at a loss for the first time in its history.

The company’s income statement showed the following results from selling 200,000 units of

product: net sales Br.2,000,000; total costs and expenses Br.2,120,000; and net loss Br.120,000.

Costs and expenses consisted of the following.

Total Variable Fixed

Cost of goods sold Br.1,295,000 Br. 975,000 Br.320,000

Selling expenses 575,000 325,000 250,000

Administrative expenses 250,000 100,000 150,000

Br.2,120,000 Br.1,400,000 Br.720,000

Management is considering the following independent alternatives for 2013.

Page 2 of 12

� ACMA Work Sheet & Asst. Material December 2018

1. Increase unit selling price 30% with no change in costs and expenses.

2. Change the compensation of salespersons from fixed annual salaries totaling Br.170,000

to total salaries of Br.50,000 plus a 6% commission on net sales.

3. Purchase new high-tech factory machinery that will change the proportion between

variable and fixed cost of goods sold to 40:60.

Instructions

(a) Compute the break-even point in dollars for 2012.

(b) Compute the break-even point in dollars under each of the alternative courses of action.

Which course of action do you recommend? (Round to the nearest dollar.)

Question 5:

McCune Corporation has collected the following information after its first year of sales. Net sales

were Br.1,000,000 on 50,000 units; selling expenses Br.200,000 (30% variable and 70% fixed);

direct materials Br.300,000; direct labor Br.170,000; administrative expenses Br.250,000 (30%

variable and 70% fixed); manufacturing overhead Br.240,000 (20% variable and 80% fixed).

Top management has asked you to do a CVP analysis so that it can make plans for the coming

year. It has projected that unit sales will increase by 20% next year.

Instructions

(a) Compute (1) the contribution margin for the current year and the projected year, and (2)

the fixed costs for the current year. (Assume that fixed costs will remain the same in the

projected year.)

(b) Compute the break-even point in units and sales dollars for the current year.

(c) The company has a target net income of Br.187,000. What is the required sales in dollars

for the company to meet its target?

(d) If the company meets its target net income number, by what percentage could its sales

fall before it is operating at a loss? That is, what is its margin of safety ratio?

(e) The company is considering a purchase of equipment that would reduce its direct labor

costs by Br.70,000 and would change its manufacturing overhead costs to 10% variable

and 90% fixed (assume total manufacturing overhead cost is Br.240,000, as above).

It is also considering switching to a pure commission basis for its sales staff. This would change

selling expenses to 80% variable and 20% fixed (assume total selling expense is Br.200,000, as

above). Compute (1) the contribution margin and (2) the contribution margin ratio, and

Page 3 of 12

� ACMA Work Sheet & Asst. Material December 2018

(3) recompute the break-even point in sales dollars. Comment on the effect each of

management’s proposed changes has on the break-even point.

Question 6:

Lorge Corporation manufactures and sells three different models of exterior doors. Although the

doors vary in terms of quality and features, all are good sellers. Lorge is currently operating at

full capacity with limited machine time.

Sales and production information relevant to each model is shown below.

Product

Economy Standard Deluxe

Selling price Br.270 Br.450 Br.650

Variable costs and expenses Br.150 Br.261 Br.425

Machine hours required 0.6 0.9 1.2

Instructions

(a) Ignoring the machine time constraint, which single product should Lorge produce?

(b) What is the contribution margin per unit of limited resource for each product?

(c) If additional machine time could be obtained, how should the additional time be used?

Question 7:

The Cubbie Inn is a restaurant in DeKalb, Illinois. It specializes in deluxe sandwiches in a

moderate price range. Bill Michael, the manager of Cubbie Inn, has determined that during the

last 2 years the sales mix and contribution margin ratio of its offerings are as follows.

Percent of Contribution

Total Sales Margin Ratio

Appetizers 15% 60%

Main entrees 60% 25%

Desserts 10% 60%

Beverages 15% 80%

Bill is considering a variety of options to try to improve the profitability of the restaurant.

His goal is to generate a target net income of Br.120,000. The company has fixed costs of

Br.300,000 per year.

Instructions

(a) Calculate the total restaurant sales and the sales of each product line that would be

necessary to achieve the desired target net income.

Page 4 of 12

� ACMA Work Sheet & Asst. Material December 2018

(a) Bill believes the restaurant could greatly improve its profitability by reducing the

complexity and selling price of its entrees to increase the number of clients that it serves.

It would then more heavily market its appetizers and beverages. He is proposing to

reduce the contribution margin ratio on the main entrees to 10% by dropping the average

selling price. He envisions an expansion of the restaurant that would increase fixed costs

by 40%. At the same time, he is proposing to change the sales mix to the following.

Percent of Contribution

Total Sales Margin Ratio

Appetizers 25% 60%

Main entrees 40% 10%

Desserts 10% 60%

Beverages 25% 80%

Compute the total restaurant sales, and the sales of each product line that would be necessary to

achieve the desired target net income.

(c) Suppose that Bill reduces the selling price on entrees and increases fixed costs as proposed in

part (b), but customers are not swayed by the marketing efforts and the sales mix remains what it

was in part (a). Compute the total restaurant sales and the sales of each product line that would

be necessary to achieve the desired target net income. Comment on the potential risks and

benefits of this strategy.

Question 8:

The following variable costing income statements are available for American Company and

National Company.

American Company National Company

Sales Br.1,000,000 Br.1,000,000

Variable costs 500,000 150,000

Contribution margin 500,000 850,000

Fixed costs 300,000 650,000

Net income Br. 200,000 Br. 200,000

Instructions

(a) Compute the break-even point in dollars and the margin of safety ratio for each company.

(b) Compute the degree of operating leverage for each company and interpret your results.

(c) Assuming that sales revenue increases by 30%, prepare a variable costing income

statement for each company.

Page 5 of 12

� ACMA Work Sheet & Asst. Material December 2018

(d) Assuming that sales revenue decreases by 30%, prepare a variable costing income

statement for each company.

(e) Discuss how the cost structure of these two companies affects their operating leverage

and profitability.

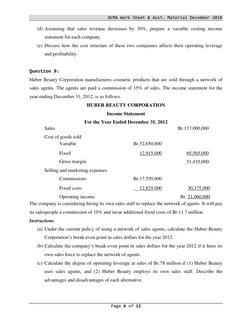

Question 9:

Huber Beauty Corporation manufactures cosmetic products that are sold through a network of

sales agents. The agents are paid a commission of 15% of sales. The income statement for the

year ending December 31, 2012, is as follows.

HUBER BEAUTY CORPORATION

Income Statement

For the Year Ended December 31, 2012

Sales Br.117,000,000

Cost of goods sold

Variable Br.52,650,000

Fixed 12,915,000 65,565,000

Gross margin 51,435,000

Selling and marketing expenses

Commissions Br.17,550,000

Fixed costs 12,825,000 30,375,000

Operating income Br. 21,060,000

The company is considering hiring its own sales staff to replace the network of agents. It will pay

its salespeople a commission of 10% and incur additional fixed costs of Br.11.7 million.

Instructions

(a) Under the current policy of using a network of sales agents, calculate the Huber Beauty

Corporation’s break-even point in sales dollars for the year 2012.

(b) Calculate the company’s break-even point in sales dollars for the year 2012 if it hires its

own sales force to replace the network of agents.

(c) Calculate the degree of operating leverage at sales of Br.78 million if (1) Huber Beauty

uses sales agents, and (2) Huber Beauty employs its own sales staff. Describe the

advantages and disadvantages of each alternative.

Page 6 of 12

� ACMA Work Sheet & Asst. Material December 2018

(d) Calculate the estimated sales volume in sales dollars that would generate an identical net

income for the year ending December 31, 2012, regardless of whether Huber Beauty

Corporation employs its own sales staff and pays them a 10% commission as well as

incurring additional fixed costs of Br.11.7 million, or continues to use the independent

network of agents.

Question 10:

The West Division of Nieto Company reported the following data for the current year.

Sales $3,000,000

Variable costs 1,950,000

Controllable fixed costs 600,000

Average operating assets 5,000,000

Top management is unhappy with the investment center’s return on investment (ROI). It asks the

manager of the West Division to submit plans to improve ROI in the next year.

The manager believes it is feasible to consider the following independent courses of action.

1. Increase sales by $320,000 with no change in the contribution margin

percentage.

2. Reduce variable costs by $100,000.

3. Reduce average operating assets by 4%.

Instructions:

(a) Compute the return on investment (ROI) for the current year.

(b) Using the ROI formula, compute the ROI under each of the proposed courses of action.

(Round to one decimal.)

Question 11:

Presented below is selected information for three regional divisions of Medina Company.

Divisions

North West South

Contribution margin $ 300,000 $ 500,000 $ 400,000

Controllable margin $ 150,000 $ 400,000 $ 225,000

Average operating assets $1,000,000 $2,000,000 $1,500,000

Minimum rate of return 13% 16% 10%

Instructions

(a) Compute the return on investment for each division.

(b) Compute the residual income for each division.

Page 7 of 12

� ACMA Work Sheet & Asst. Material December 2018

(c) Assume that each division has an investment opportunity that would provide a rate of

return of 19%.

(1) If ROI is used to measure performance, which division or divisions will probably

make the additional investment?

(2) If residual income is used to measure performance, which division or divisions will

probably make the additional investment?

Question 12:

Presented below is selected financial information for two divisions of Yono Brewing.

Lager Lite Lager

Contribution margin $500,000 $ 300,000

Controllable margin 200,000 (c)

Average operating assets (a) $1,000,000

Minimum rate of return (b) 13%

Return on investment 25% (d)

Residual income $ 90,000 $ 200,000

Instructions

Supply the missing information for the lettered items.

Question 13

Your company currently produces and sells 4 products, Alpha, Beta, Gamma and Delta. The

following information relates to Period 3.

Alpha Beta Gamma Delta

Production (units) 180 150 120 180

Costs per unit:

Direct material Br. 46 Br. 58 Br. 35 Br. 70

Direct labour Br. 21 Br. 14 Br. 7 Br. 14

Machine hours per unit 4 3 2 3

Number of production runs 6 5 4 6

Number of requisitions raised 30 30 30 30

Number of orders completed 18 15 12 18

Page 8 of 12

� ACMA Work Sheet & Asst. Material December 2018

Currently the production overhead is absorbed by the machine-hour rate method and the

following are the total production overhead costs for Period 3. Machine Department Br. 24,540

Set-up costs 6,300

Receiving costs 7,200

Inspection costs 3,150

Dispatch costs 7,560

48,750

Cost drivers have been identified as follows:

Set-up costs Number of production runs

Stores receiving Number of requisitions raised

Inspection Number of production runs

Dispatch Number of orders completed

You are required to calculate:

(a) (i) The machine-hour rate currently used to absorb the production overhead.

(ii) The total cost per unit for each product if overheads are absorbed by the method in

(a)(i).

(b) The cost per unit for each product using an ABC approach.

Question 14

Jomit plc has budgeted for the following overhead costs for Period 6.

Material receipt costs Br. 31,200

Power costs 39,000

Material handling costs 27,300

The company produces 3 products, P, Q and R for which the following budgeted information is

available for Period 6.

Product P Q R

Output (units) 4,000 3,000 1,600

Material batches 20 10 32

Per Unit

Direct material (kg) 4 6 3

Direct material (Br. ) 6 5 9

Direct labour (hours) 0.2 0.5 1.0

Number of power operations 6 3 2

Direct labour rate per hour Br. 8 Br. 8 Br. 8

Page 9 of 12

� ACMA Work Sheet & Asst. Material December 2018

Currently the overhead costs are each absorbed using a rate per direct labor hour.

However, the company is considering applying overheads using an ABC approach and has

identified drivers for the activities as follows:

Material receipt costs number of batches of material

Power costs number of power operations

Material handling costs kg of material handled

You are required to calculate:

(a) The total cost per unit for each product using the current overhead absorption method.

(b) The total cost per unit for each product using the ABC method.

Question 15

Your company currently produces a range of three products, D, E and F to which the following

details relate for Period 2.

D E F

Production (units) 1,500 2,500 14,000

Material cost per unit Br. 18 Br. 10 Br. 20

Labour hours per unit 1 3 2

Machine hours per unit 3 2 6

Labour costs are Br. 8 per hour and production overheads are currently absorbed in the

conventional system by reference to machine hours. Total production overheads for Period 2

have been analysed as follows:

Set-up costs Br. 327,250

Handling costs 187,000

Machining costs 140,250

Inspection costs 280,500

935,000

(a) Calculate the cost per unit for each product using conventional methods.

The introduction of an ABC is being considered and to that end the following volume of

activities have been identified with the current output levels.

D E F

Number of set-ups 90 138 576

Number of material issues 16 28 116

Page 10 of 12

� ACMA Work Sheet & Asst. Material December 2018

Number of inspections 180 216 804

(b) Calculate the cost per unit for each product using the ABC approach.

PART II: Answer the following question in your group.

Question 16:

(i) Costs may be classified in a number of ways including classification by behavior, by

function, by expense type, by controllability and by relevance.

(ii) Management accounting should assist in EACH of the planning, control and decision

making processes in an organization.

Required: Discuss the ways in which relationships between statements (i) and (ii) are relevant in

the design of an effective management accounting system.

Question 17: Activity-Based Costing

The activity-based costing (ABC) approach allocate overhead costs to products by first assigning

the overhead costs to major activities done by the organization, and then using the appropriate

cost driver for each activity, the overhead costs are allocated to the product in proportion to the

amount of the cost driver consumed by the product. ABC proponents indicate that ABC captures

the economics of the production process more closely than traditional volume-based costing

systems (Cooper and Kaplan 1990). ABS also identifies the different levels of activities. The

cost hierarchy under ABS categorizes costs into different cost pools on the bases of the

difference in the cost deriver, whether it is a unit, batch, or product line.

Required: Discuss the difference between ABC and a traditional costing system. Explain the

advantages and disadvantages of the ABC system. Is it applicable to all types of organizations?

Search the internet for companies that applied this system and discuss the degree of success they

met. What are the measures of success that are used in evaluating the success of ABC?

Question 18: EVA® Case

Economic value added (EVA) is a measure of profitability for performance evaluation. The Coca

Cola Company, General Electric, and Intel are a few of the companies that use EVA to measure

their financial performance. Proponents of EVA suggest that this measure comes closer than any

other to capturing the true economic profit of an enterprise. They also indicate that EVA is the

performance measure that is most directly linked to the creation of shareholder wealth over time

(Stern Stewart & Co. website: www. sternstewart.com). On the other hand, the results of some

academic studies do not support the claims about the superiority of EVA (e.g., Biddle et al

1997).

Page 11 of 12

� ACMA Work Sheet & Asst. Material December 2018

Required: Explain the EVA as a measure of performance. Discuss its advantages and

disadvantages. Explain why companies adopt it as a base for their compensation scheme. From

your readings, do you believe that EVA is superior to other performance measures?

Question 19: Balanced Scorecard

An article by Robert S. Kaplan and David D. Norton in 1992 sparked the interest in the concept

of the balanced scorecard. A balanced scorecard is a model of business performance evaluation

that balances measures of financial performance, internal operations, innovation and learning,

and customer satisfaction (Hilton 2002). The balanced scorecard does not focus only on financial

objectives. It also considers operational measures such as customer satisfaction, internal

innovation, and learning and growth. This allows for measuring the present performance, in

addition it captures information on how well the organization is prepared to perform in the

future.

Required: Explain the idea behind the balanced scorecard. Show how companies in different

industries are using it, and how successful it is. What types of measures are used? What are the

bases for the inclusion of a measure in a typical scorecard system?

Question 20: Non-financial Performance Measures

It is common to measure the company performance using financial measures. Financial measures can be

accounting-based such as earnings, return on assets, and return on equity, or market-based such as stock

prices. Increasingly, companies are also using nonfinancial measures such as customer satisfaction,

market share, and employees’ satisfaction, among others to evaluate the performance of its managers.

Using nonfinancial measures may increase the efficiency of the management, and may reflect information

that is not captured by financial performance measures.

Required: Discuss the importance of nonfinancial measures and their applications. Explain the reasons

for using them alongside the financial measures. What kind of information is provided by the

nonfinancial measures that is not captured by the financial measures?

Page 12 of 12