Professional Documents

Culture Documents

IP SILO Results Note 171101

Uploaded by

gloridoroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IP SILO Results Note 171101

Uploaded by

gloridoroCopyright:

Available Formats

01 November 2017

Siloam International (SILO IJ)

Results Note

HOLD (Unchanged)

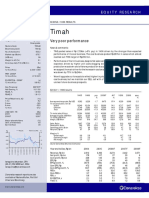

Stock Data Weak 9M17 earnings

Target price (Rp) Rp10,800

Weak 9M17 earnings (-26% yoy), below ours and consensus

Prior TP (Rp) Rp11,100

Shareprice (Rp) Rp9,750 Patient volume pick-up in 3Q17

Equity | Indonesia | Healthcare

Upside/downside (%) +10.8 Completed right issue to fund expansions and working capital

Sharesoutstanding (m) 1,445 Maintain HOLD with lower TP of Rp10,800 (from Rp11,100)

Marketcap. (US$ m) 1,039

Free float (%) 2,920.0 Weak 9M17 earnings (-26% yoy), below ours and consensus estimates.

Avg. 6m dailyT/O (US$ m) 0.2 Siloam International Hospital (SILO) booked earnings of Rp63bn (-26% yoy)

albeit net margin improvement to 1.5% from 1% in 9M16 from rising interest

Price Performance

income. This forms 65/53% of ours and consensus estimates, but 4Q average in

3M 6M 12M last two years only tend to form 0-5% of full-year result. Therefore, we believe

Absolute (%) 5.5 -28.4 -1.3 9M17 SILO’s earnings were below ours and consensus estimates. Revenue grew

Relative to JCI (%) 1.5 -34.1 -12.8 12% yoy, supported by outpatient (OPD) by 15% yoy and inpatient (IPD) by 11%

yoy in 9M17. Nevertheless, new hospitals opening in 2017 also increases

52w high/low (Rp) 9,750 - 8,945

operational cost which caused lower operating margin by 50bps in 9M17.

150

140 Patient volume pick up in 3Q17. SILO’s patient volume has improved in 3Q17

130 (+18% qoq) after weak 2Q17 performance (-4.5% qoq). The strong growth

120 recovery was seen in both OPD and IPD by 18/16% qoq in 3Q17 (vs. -4/-5% qoq

110

in 2Q17). Interestingly, private patient volume rebounded by 15% qoq growth in

100

3Q17 after declining by 7% qoq in 2Q17, whereas BPJS (National Healthcare

90

80

Security) patient admissions continue to show strong growth of 20% qoq in 3Q17

Oct-17

Oct-17

Mar-17

Mar-17

Jan-17

Jan-17

May-17

May-17

Jun-17

Jul-17

Nov-16

Nov-16

Dec-16

Apr-17

Aug-17

Aug-17

Sep-17

Feb-17

from 3% qoq only in 2Q17. As of 9M17, BPJS has reached 31% from overall

patient volume from 23% only in 9M16.

SILO-Rebase JCI Index-Rebase

Major Shareholders Completed right issue to fund expansions and working capital. SILO has

Lippo Karawaci 70.8% completed its second right issue, raising Rp3.1tn. LPKR (Lippo Karawaci) remains

as majority shareholder with 51% ownership while Prime Health Company Limited

(CVC) increased its ownership to 15.7% from 15% on first right issue. 88% of

fund proceed will be used for business expansions, including to build and/or

Estimate Change; Vs. Consensus

acquire new hospital while remaining will be used as working capital.

2017 2018

Latest EPS (Rp) 66 100 Maintain HOLD with lower TP of Rp 10,800. We cut our earnings by 11/6%

Vs. Prior EPS (%) (11.0) (6.0) for FY17/18F as we factored in higher depreciation from new hospital opening and

Vs. Consensus (%) (27.0) (10.0) raising interest income from recent right issue. However, we leave our operating

forecast relatively unchanged given on-track results. Our new TP of

Source: Bloomberg

Rp10,800/share implies EV/EBITDA of 16.5x FY17F. We like SILO given its

improving execution in their expansion but expect company to enhance its

profitability after more hospitals mature, which would serve as upside potential to

our call.

Year To 31 Dec 2015A 2016A 2017F 2018F 2019F

Revenue (RpBn) 4,144 5,168 6,381 7,797 8,943

EBITDA (RpBn) 548 651 729 867 934

EBITDA Growth (%) 22.5 18.8 12.0 18.9 7.7

Net Profit (RpBn) 70 86 86 125 144

EPS (Rp) 54 66 66 96 111

EPS Growth (%) (2.0) 22.2 0.2 45.3 14.8

Net Gearing (%) (7.3) (23.1) (46.7) (42.1) (51.8)

PER (x) 180.1 147.5 147.2 101.3 88.2

Eveline Liauw PBV (x) 7.3 4.1 3.9 3.8 3.6

PT Indo Premier Sekuritas Dividend Yield (%) 0.0 0.0 0.0 0.0 0.0

eveline.liauw@ipc.co.id EV/EBITDA (x) 20.8 17.6 14.7 12.4 11.2

+62 21 5793 1169 Source : SILO, IndoPremier Share Price Closing as of : 31-October-2017

Refer to Important disclosures in the last page of this report

SILO Results Note

Fig. 2: … but flattish private patient vol growth at 0.6% yoy

Fig. 1: Strong BPJS patient vol growth at 58% yoy in 9M17

in 9M17

(People)

(People)

1,136,000

700,000

600,000 1,134,000

500,000

1,132,000

400,000

1,130,000

300,000

200,000 1,128,000

100,000 1,126,000

-

9M17 9M16 1,124,000

9M17 9M16

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 3: Recovery in traffic volume after drop in 2Q17 Fig. 4: Revenue historical and forecast

Quarterly patient admissions Growth QoQ

Outpatient Inpatient

('000 people) (Rp bn)

700 30%

10,000

600 25% 9,000

20% 8,000

500

7,000

15%

400 6,000

10% 5,000

300

5% 4,000

200 3,000

0%

2,000

100 -5% 1,000

0 -10% -

2Q14 4Q14 2Q15 4Q15 2Q16 4Q16 2Q17 2013A 2014A 2015A 2016A 2017F 2018F 2019F

Source: Company, IndoPremier Source: Company, IndoPremier

Fig. 5: Gross profit to grow CAGR 17% 2016-19F Fig. 6: Net profit to improve from diminishing impairment

Gross Profit Gross margin Net Profit Net margin

(Rp tn)

2.5 30% (Rp bn)

29.5%

30% 160 2.5%

2.2%

2.0

29% 140

28.5% 1.7% 2.0%

28.4% 120 1.7% 1.6% 1.6%

29%

1.5

100 1.4%

28% 1.5%

1.0 27.3% 27.3% 80

27.2% 28%

60 1.0%

27%

0.5 40

27% 0.5%

20

- 26%

2014A 2015A 2016A 2017F 2018F 2019F

- 0.0%

2014A 2015A 2016A 2017F 2018F 2019F

Source: Company, IndoPremier Source: Company, IndoPremier

Refer to Important disclosures in the last page of this report 2

SILO Results Note

Fig. 7: 3Q17 results summary

Year to Dec 31 (Rp bn) 9M17 9M16 YoY 3Q17 2Q17 QoQ % of ours % of cons.

Revenue 4,292.1 3,824.4 12% 1,534.2 1,346.0 14% 67% 70%

Gross profit 1,219.9 1,121.6 9% 450.2 371.8 21% 70% 68%

Operating profit 218.0 213.3 2% 101.9 30.5 234% 65% 61%

Net profit 62.9 85.5 -26% 36.0 (13.6) -366% 65% 53%

Margin

Gross profit margin 28.4% 29.3% 29.3% 27.6%

Operating profit margin 5.1% 5.6% 6.6% 2.3%

Net profit margin 1.5% 2.2% 2.3% -1.0%

Source: Company, IndoPremier

Fig. 8: Changes in earnings forecast

(Old) (New) Change

Year to Dec 31 (Rp bn) 2017F 2018F 2017F 2018F 2017F 2018F

Revenue 6,381 7,797 6,381 7,797 0% 0%

Gross profit 1,748 2,139 1,745 2,117 0% -1%

Operating profit 334 419 329 412 -2% -2%

EBITDA 729 844 758 896 4% 6%

Net profit 96 134 86 125 -11% -6%

Margin

Gross profit margin 27.4% 27.4% 27.3% 27.2%

Operating profit margin 5.2% 5.4% 5.2% 5.3%

EBITDA margin 11.4% 10.8% 11.9% 11.5%

Net profit margin 1.5% 1.7% 1.4% 1.6%

Source: Company, IndoPremier

Refer to Important disclosures in the last page of this report 3

SILO Results Note

Year To 31 Dec (RpBn) 2015A 2016A 2017F 2018F 2019F

Income Statement

Net Revenue 4,144 5,168 6,381 7,797 8,943

Cost of Sales (2,968) (3,646) (4,636) (5,680) (6,501)

Gross Profit 1,177 1,522 1,745 2,117 2,442

SG&A Expenses (965) (1,231) (1,416) (1,706) (1,992)

Operating Profit 211 292 329 412 451

Net Interest (35) (29) (32) (45) (49)

Forex Gain (Loss) 0 0 0 0 0

Others-Net (70) (90) (123) (121) (122)

Pre-Tax Income 106 172 174 246 279

Income Tax (44) (74) (74) (105) (119)

Minorities 9 (13) (14) (16) (16)

Net Income 70 86 86 125 144

Balance Sheet

Cash & Equivalent 160 740 1,528 1,424 1,832

Receivable 575 776 444 756 548

Inventory 140 178 202 269 307

Other Current Assets 81 212 254 313 372

Total Current Assets 956 1,907 2,428 2,762 3,059

Fixed Assets - Net 1,553 1,694 1,746 1,762 1,719

Goodwill 0 0 0 0 0

Non Current Assets 454 579 591 576 584

Total Assets 2,986 4,216 4,801 5,151 5,420

ST Loans 2 1 1 1 2

Payable 255 314 0 703 728

Other Payables 365 403 598 680 755

Current Portion of LT Loans 7 7 7 2 0

Total Current Liab. 630 726 1,202 1,387 1,484

Long Term Loans 23 10 10 2 0

Other LT Liab. 593 351 360 390 404

Total Liabilities 1,246 1,087 1,572 1,780 1,889

Equity 1,380 2,675 2,675 2,675 2,675

Retained Earnings 364 447 533 659 802

Minority Interest (4) 7 21 37 53

Total SHE + Minority Int. 1,740 3,129 3,230 3,371 3,531

Total Liabilities & Equity 2,986 4,216 4,801 5,151 5,420

Source : SILO,IndoPremier

Refer to Important disclosures in the last page of this report 4

SILO Results Note

Year to 31 Dec 2015A 2016A 2017F 2018F 2019F

Cash Flow

Net Income (Excl.Extraordinary&Min.Int) 62 99 100 141 160

Depr. & Amortization 334 357 401 456 483

Changes in Working Capital (77) (183) 653 (215) 228

Others 64 42 (43) 119 46

Cash Flow From Operating 383 315 1,111 501 917

Capital Expenditure (351) (623) (464) (456) (448)

Others 5 3 15 15 14

Cash Flow From Investing (346) (620) (450) (441) (434)

Loans (14) (14) 0 (12) (5)

Equity 0 1,295 1 0 0

Dividends 6 0 0 0 0

Others (123) (282) (44) (56) (59)

Cash Flow From Financing (131) 999 (43) (68) (63)

Changes in Cash (94) 694 618 (8) 420

Financial Ratios

Gross Margin (%) 28.4 29.5 27.3 27.2 27.3

Operating Margin (%) 5.1 5.6 5.2 5.3 5.0

Pre-Tax Margin (%) 2.6 3.3 2.7 3.2 3.1

Net Margin (%) 1.7 1.7 1.4 1.6 1.6

ROA (%) 2.4 2.4 1.9 2.5 2.7

ROE (%) 4.1 3.5 2.7 3.8 4.2

ROIC (%) 4.3 3.6 3.2 4.3 4.6

Acct. Receivables TO (days) 0.6 0.6 0.3 0.4 0.4

Acct. Receivables - Other TO (days) 42.0 47.2 34.5 27.7 26.3

Inventory TO (days) 24.1 22.9 24.4 24.1 22.6

Payable TO (days) 27.5 28.5 35.8 41.7 40.2

Acct. Payables - Other TO (days) 0.0 0.0 0.0 0.0 0.0

Debt to Equity (%) 1.9 0.6 0.6 0.2 0.0

Interest Coverage Ratio (x) 0.2 0.1 0.1 0.1 0.1

Net Gearing (%) (7.3) (23.1) (46.7) (42.1) (51.8)

Source : SILO,IndoPremier

Refer to Important disclosures in the last page of this report 5

Head Office

PT INDO PREMIER SEKURITAS

Wisma GKBI 7/F Suite 718

Jl. Jend. Sudirman No.28

Jakarta 10210 - Indonesia

p +62.21.5793.1168

f +62.21.5793.1167

INVESTMENT RATINGS

BUY : Expected total return of 10% or more within a 12-month period

HOLD : Expected total return between -10% and 10% within a 12-month period

SELL : Expected total return of -10% or worse within a 12-month period

ANALYSTS CERTIFICATION.

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the

research analyst's compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in the report.

DISCLAIMERS

This research is based on information obtained from sources believed to be reliable, but we do not make any representation or warranty nor accept any

responsibility or liability as to its accuracy, completeness or correctness. Opinions expressed are subject to change without notice. This document is prepared for

general circulation. Any recommendations contained in this document does not have regard to the specific investment objectives, financial situation and the

particular needs of any specific addressee. This document is not and should not be construed as an offer or a solicitation of an offer to purchase or subscribe or

sell any securities. PT. Indo Premier Sekuritas or its affiliates may seek or will seek investment banking or other business relationships with the companies in this

report.

You might also like

- WIKA Maintains Healthy Balance SheetDocument6 pagesWIKA Maintains Healthy Balance SheetmidiakbaraNo ratings yet

- Intp 080318Document3 pagesIntp 080318Cristiano DonzaghiNo ratings yet

- Astra Agro Lestari Earnings ReviewDocument7 pagesAstra Agro Lestari Earnings ReviewPutri CandraNo ratings yet

- Bank Central Asia: Steady Albeit Moderating GrowthDocument6 pagesBank Central Asia: Steady Albeit Moderating GrowthNathanNo ratings yet

- Semen Indonesia: Cheap Valuation Amidst Better MomentumDocument4 pagesSemen Indonesia: Cheap Valuation Amidst Better MomentumRendy SentosaNo ratings yet

- RHB Report My - Luxchem - Mids Results Review - 20200615 - RHB 119388617818399315ee6afbd9bc7dDocument6 pagesRHB Report My - Luxchem - Mids Results Review - 20200615 - RHB 119388617818399315ee6afbd9bc7dseliper biruNo ratings yet

- Indo Premier BISI - A Good Start This YearDocument6 pagesIndo Premier BISI - A Good Start This YearKPH BaliNo ratings yet

- United Tractors BUY: Another Upgrade On Strong ResultsDocument6 pagesUnited Tractors BUY: Another Upgrade On Strong ResultsbenuNo ratings yet

- Company Update - EXCL 20181102 3Q18 Results Data Volume Support EXCL RevenueDocument8 pagesCompany Update - EXCL 20181102 3Q18 Results Data Volume Support EXCL RevenueMighfari ArlianzaNo ratings yet

- Berger Paints (India) Limited 21 QuarterUpdateDocument7 pagesBerger Paints (India) Limited 21 QuarterUpdatevikasaggarwal01No ratings yet

- Kencana Petroleum Berhad: Ending The Year Within Our Expectation - 30/09/2010Document3 pagesKencana Petroleum Berhad: Ending The Year Within Our Expectation - 30/09/2010Rhb InvestNo ratings yet

- IND_Aneka Tambang_Company Update_20240401_RHBDocument9 pagesIND_Aneka Tambang_Company Update_20240401_RHBOzanNo ratings yet

- IIFL Growth PotentialDocument24 pagesIIFL Growth Potentialanu nitiNo ratings yet

- Genting Berhad: Singaporean Dreams Coming Through-27/08/2010Document5 pagesGenting Berhad: Singaporean Dreams Coming Through-27/08/2010Rhb InvestNo ratings yet

- RHB Report Ind - Ace Hardware - Company Update RMC - 20211001 - RHB 285299977312511961566620a6b77Document8 pagesRHB Report Ind - Ace Hardware - Company Update RMC - 20211001 - RHB 285299977312511961566620a6b77alvin maulana.pNo ratings yet

- Telekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Document5 pagesTelekom Malaysia Berhad: No Commitment On Capital Management Yet - 31/5/2010Rhb InvestNo ratings yet

- VP-Apr 07'11Document2 pagesVP-Apr 07'11Ovais IqbalNo ratings yet

- Traders Club - Nov. 21Document5 pagesTraders Club - Nov. 21Peter ErnstNo ratings yet

- Inco 070606Document3 pagesInco 070606Cristiano DonzaghiNo ratings yet

- Motherson Sumi LTD: Market PerformerDocument4 pagesMotherson Sumi LTD: Market PerformerAnubhav GuptaNo ratings yet

- RALS Lebaran Sales BoostDocument5 pagesRALS Lebaran Sales BoostTanjung YanugrohoNo ratings yet

- LPPF Mansek 01112016Document6 pagesLPPF Mansek 01112016nirwana.construction01No ratings yet

- Sterlite Industries: Worst Seems To Be Priced inDocument3 pagesSterlite Industries: Worst Seems To Be Priced inramanathanseshaNo ratings yet

- Voltamp Transformers 26112019Document5 pagesVoltamp Transformers 26112019anjugaduNo ratings yet

- Tins 060831Document2 pagesTins 060831Cristiano DonzaghiNo ratings yet

- Itmg 080314Document3 pagesItmg 080314Cristiano DonzaghiNo ratings yet

- Texchem Resources Berhad: Below Expectations - 01/03/2010Document3 pagesTexchem Resources Berhad: Below Expectations - 01/03/2010Rhb InvestNo ratings yet

- Malindo Feedmill: 3Q21F Earnings Preview: Anticipating Weak 3Q Outlook Focus On 4QDocument6 pagesMalindo Feedmill: 3Q21F Earnings Preview: Anticipating Weak 3Q Outlook Focus On 4QdkdehackerNo ratings yet

- IJM Plantations Berhad: Benefitting From Improved Prices, But Valuations Still Stretched - 26/08/2010Document3 pagesIJM Plantations Berhad: Benefitting From Improved Prices, But Valuations Still Stretched - 26/08/2010Rhb InvestNo ratings yet

- RHB Report Ind - Bank Rakyat Indonesia - Results Review - 20211028 - RHB Reg 54958767321026161797d7587da3 - 1637763187Document7 pagesRHB Report Ind - Bank Rakyat Indonesia - Results Review - 20211028 - RHB Reg 54958767321026161797d7587da3 - 1637763187alvin maulana.pNo ratings yet

- Astra Agro Lestari TBK: Soaring Financial Performance in 3Q20Document6 pagesAstra Agro Lestari TBK: Soaring Financial Performance in 3Q20Hamba AllahNo ratings yet

- AnandRathi On Affle India Pain in Developed Markets Continues MaintainingDocument6 pagesAnandRathi On Affle India Pain in Developed Markets Continues MaintainingamsukdNo ratings yet

- Ascendas REIT Maintains Buy Rating on Portfolio GrowthDocument4 pagesAscendas REIT Maintains Buy Rating on Portfolio GrowthphuawlNo ratings yet

- Summarecon Agung: Indonesia Company GuideDocument10 pagesSummarecon Agung: Indonesia Company GuideGoro ZhouNo ratings yet

- YTL Power Intl Berhad: 3Q Net Profit Up 20.5% YoY - 31/5/2010Document3 pagesYTL Power Intl Berhad: 3Q Net Profit Up 20.5% YoY - 31/5/2010Rhb InvestNo ratings yet

- Quity Esearch: FY12 Result: Bitter and SweetDocument2 pagesQuity Esearch: FY12 Result: Bitter and SweetDarwin TjongNo ratings yet

- Jasa Marga Upgrade Jul28 v2Document6 pagesJasa Marga Upgrade Jul28 v2superrich92No ratings yet

- EEI 3Q17 earnings miss forecasts on weak domestic and foreign operationsDocument8 pagesEEI 3Q17 earnings miss forecasts on weak domestic and foreign operationsKurt YuNo ratings yet

- L&T Tech Services | HOLD - An imbalanced equationDocument9 pagesL&T Tech Services | HOLD - An imbalanced equationdarshanmadeNo ratings yet

- Bharti Airtel Company Update - 270810Document6 pagesBharti Airtel Company Update - 270810Robin BhimaiahNo ratings yet

- Korea Investment & Sekuritas Indonesia CPIN - The Resilient IntegratorDocument8 pagesKorea Investment & Sekuritas Indonesia CPIN - The Resilient Integratorgo joNo ratings yet

- Unichem Lab (UNILAB) : Riding Strong On Base BusinessDocument6 pagesUnichem Lab (UNILAB) : Riding Strong On Base Businesscos.secNo ratings yet

- LPI Capital Berhad: Off To Decent Start-12/04/2010Document3 pagesLPI Capital Berhad: Off To Decent Start-12/04/2010Rhb InvestNo ratings yet

- Voltamp Q2FY10 Result UpdateDocument2 pagesVoltamp Q2FY10 Result Updatepatelbhavin1992No ratings yet

- Andhra Bank: Operating Performance Inline Slippages RiseDocument5 pagesAndhra Bank: Operating Performance Inline Slippages RiseearnrockzNo ratings yet

- Top Glove Maintains FULLY VALUED Despite Earnings Shortfall from Aspion AcquisitionDocument10 pagesTop Glove Maintains FULLY VALUED Despite Earnings Shortfall from Aspion AcquisitionSHOBANA96No ratings yet

- IJM Land Berhad: On Track - 01/03/2010Document4 pagesIJM Land Berhad: On Track - 01/03/2010Rhb InvestNo ratings yet

- Voltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Document5 pagesVoltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Darwish MammiNo ratings yet

- Mega Manunggal Init Clsa 2016Document20 pagesMega Manunggal Init Clsa 2016suksesNo ratings yet

- BURSA-CIH-20100825-Raising Our Glass To A Record YearDocument5 pagesBURSA-CIH-20100825-Raising Our Glass To A Record Yearlimml63No ratings yet

- IDirect PrimaPlastics CoUpdate Jun19Document4 pagesIDirect PrimaPlastics CoUpdate Jun19Alokesh PhukanNo ratings yet

- RMB Nigeria Stockbrokers: Positioned For High ReturnsDocument37 pagesRMB Nigeria Stockbrokers: Positioned For High ReturnsJul ANo ratings yet

- IJM Corporation Berhad: 1QFY03/11 Net Profit Grows 27% YoY - 26/08/2010Document4 pagesIJM Corporation Berhad: 1QFY03/11 Net Profit Grows 27% YoY - 26/08/2010Rhb InvestNo ratings yet

- Bumi Serpong Damai: Solid Marketing Sales AchievementDocument5 pagesBumi Serpong Damai: Solid Marketing Sales Achievementowen.rijantoNo ratings yet

- Idea Cellular research report recommends Sell rating on expected decline in marginsDocument5 pagesIdea Cellular research report recommends Sell rating on expected decline in marginstousa1002No ratings yet

- Mirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaDocument7 pagesMirae Asset Sekuritas Indonesia Indocement Tunggal PrakarsaekaNo ratings yet

- SKF India - 31 July 2018Document6 pagesSKF India - 31 July 2018chaitanya.jNo ratings yet

- Malaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Document4 pagesMalaysia Airports Berhad: 1HFY12/10 Hit by Associate Losses - 18/08/2010Rhb InvestNo ratings yet

- Genting Berhad: Better Years Ahead - 01/03/2010Document5 pagesGenting Berhad: Better Years Ahead - 01/03/2010Rhb InvestNo ratings yet

- JLPT N4 Grammar Master EbookDocument293 pagesJLPT N4 Grammar Master Ebooksonal shah91% (23)

- Business Model Canvas PosterDocument1 pageBusiness Model Canvas PostersunnyNo ratings yet

- Silabus CG S1 - 1202Document10 pagesSilabus CG S1 - 1202AyrinNo ratings yet

- My Notebook UTSDocument22 pagesMy Notebook UTSgloridoroNo ratings yet

- 02 FabmDocument28 pages02 FabmMavs MadriagaNo ratings yet

- Chapter 9 PDFDocument22 pagesChapter 9 PDFramprasadNo ratings yet

- Fuel Injector Reference For 3500Document9 pagesFuel Injector Reference For 3500ingcalderonNo ratings yet

- Law of ThermodynamicsDocument17 pagesLaw of ThermodynamicsEmmanuel Kenneth Contreras PotoyNo ratings yet

- Poa Cri 173 Comparative Models in Policing 1Document10 pagesPoa Cri 173 Comparative Models in Policing 1Karen Angel AbaoNo ratings yet

- What We Get Wrong About Closing The Racial Wealth GapDocument67 pagesWhat We Get Wrong About Closing The Racial Wealth GapAnonymous H7mNlJT27100% (2)

- Warranty Conditions: Clause Accreditation Employee Enabled by ALSTOM GRID CUSTOMER Service Villeurbanne (France)Document2 pagesWarranty Conditions: Clause Accreditation Employee Enabled by ALSTOM GRID CUSTOMER Service Villeurbanne (France)Shafiqul IslamNo ratings yet

- Argumentative Essay: Pet AbuseDocument4 pagesArgumentative Essay: Pet AbuseRyan KwokNo ratings yet

- Crop Loan WaiverDocument2 pagesCrop Loan Waiverdrmallikarjun19No ratings yet

- Triple Canopy Base InfoDocument5 pagesTriple Canopy Base InfojmusseryNo ratings yet

- The History of The Treman, Tremaine, Truman Family in AmericaDocument1,324 pagesThe History of The Treman, Tremaine, Truman Family in AmericaJakob AyresNo ratings yet

- Abalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Document18 pagesAbalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Leizl A. VillapandoNo ratings yet

- Pakistan Donor ProfileDocument47 pagesPakistan Donor ProfileAtif Ahmad KhanNo ratings yet

- Faculty of Hospitality and Tourism ManagementDocument2 pagesFaculty of Hospitality and Tourism Managementizumi tandukarNo ratings yet

- Account Statement From 1 Nov 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Nov 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMukesh SharmaNo ratings yet

- G.R. No. L-17739 December 24, 1964 ITOGON-SUYOC MINES, INC., Petitioner, Jose Baldo, Sangilo-Itogon Workers Union and Court of Industrial RELATIONS, RespondentsDocument4 pagesG.R. No. L-17739 December 24, 1964 ITOGON-SUYOC MINES, INC., Petitioner, Jose Baldo, Sangilo-Itogon Workers Union and Court of Industrial RELATIONS, RespondentsAddAllNo ratings yet

- Conspiracy Theories: Secrecy and Power in American Culture. by Mark Fenster. MinDocument4 pagesConspiracy Theories: Secrecy and Power in American Culture. by Mark Fenster. MinMano RatyiNo ratings yet

- Unit 1 SBQ ss20Document2 pagesUnit 1 SBQ ss20api-300666330No ratings yet

- Pictorials During The Launching of School Reading Program Project "ABAKADA KA" (Anolingan Basa Alang Sa Kahibalo Ug Dakong Kalambuan Nimo)Document5 pagesPictorials During The Launching of School Reading Program Project "ABAKADA KA" (Anolingan Basa Alang Sa Kahibalo Ug Dakong Kalambuan Nimo)Rose Mae Cagampang PawayNo ratings yet

- Taxation PDFDocument8 pagesTaxation PDFleighNo ratings yet

- First Merit List - Private Sector HITEC/HBS Medical/Dental CollegesDocument2 pagesFirst Merit List - Private Sector HITEC/HBS Medical/Dental CollegesIftikhar hussain shahNo ratings yet

- Tema 8 Texto LamptonDocument20 pagesTema 8 Texto LamptonKriseweteNo ratings yet

- BBA140 2018 Semester 1 Final ExamDocument7 pagesBBA140 2018 Semester 1 Final ExamEdwin Biggie MwaleNo ratings yet

- Chapter 2 Taxes, Tax Laws and Tax AdministrationDocument7 pagesChapter 2 Taxes, Tax Laws and Tax AdministrationElisa Jane AbellaNo ratings yet

- Bonds Payable ProblemsDocument12 pagesBonds Payable ProblemsHAKUNA MATATANo ratings yet

- 2008-2016 Persons Bar Q and ADocument75 pages2008-2016 Persons Bar Q and AAw Lapuz100% (2)

- foster care reportDocument64 pagesfoster care reportLindsey BasyeNo ratings yet

- SC upholds hierarchy of courts in dismissing directly filed certiorari petitionDocument277 pagesSC upholds hierarchy of courts in dismissing directly filed certiorari petitionKris NageraNo ratings yet

- Q1 WK 8 Activity Sheets - HousekeepingDocument14 pagesQ1 WK 8 Activity Sheets - Housekeepingmarissa clateroNo ratings yet

- DL 80Document2 pagesDL 80Siler ElijahNo ratings yet