Professional Documents

Culture Documents

B 6. Insurable Intere T E.6 Coinsurance Cla Se: Insurance

Uploaded by

Anonymous JqimV1E0 ratings0% found this document useful (0 votes)

3 views1 pagehgf567-997

Original Title

Scan 0046

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthgf567-997

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: Insurance

Uploaded by

Anonymous JqimV1Ehgf567-997

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 1

35 a - - 3.

c - - MODULE

5. c 32- INSURANCE

- 7. c - - 1st: _/8= - %

22.

a - - 4. b - - 6. b - - 8. b - - 2nd: _/8= - %

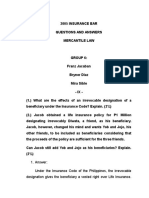

MULTIPLE-CHOICE ANSWERS

MULTIPLE-CHOICE ANSWER EXPLANATIONS

B.6. Insurable Interest E.6. Coinsurance Clause

1. (a) In the case of property insurance, the insurable 6. (b) Although Clark has insurance coverage exceed-

interest must exist when the loss occurs. It need not exist ing the fair value of the warehouse, he may only recover the

when the policy is issued. Therefore, answer (b) is incor- actual amount of his loss. The coinsurance clause does not

rect. Answers (c) and (d) are incorrect because there are no apply when the insured property is totally destroyed. Fair

such requirements that the property be owned in fee simple Insurance will pay 1501225 of the $200,000 loss, or

or by individuals. $133,333, while Zone Insurance will pay 751225 of the

$200,000 loss, or $66,667. Thus, Clark will receive a total

2. (a) To have an insurable interest in property, there

of $200,000 from Fair and Zone.

must be both a legal interest and a possibility of pecuniary

loss. Although a legal interest may involve ownership or a 7. (c) The recoverable loss is calculated using the eo-

security interest, general creditors do not have the requisite insurance formula.

interest to have an insurable interest. Answer (b) is incorrect Amount of insurance

because a mortgagee has an insurable interest for the mort- Actual loss x

Coinsurance % x FMV of property at time of loss

gage balance still owed. Answer (c) is incorrect because

Brown has an insurable interest in key company personnel The amount recoverable from Owners is calculated as fol-

whose death could result in pecuniary loss for Brown. An- lows:

swer (d) is incorrect because Brown has an insurable interest $180,000 x

$150,000.

-8-0')l-'o:":;x":"$"-'2-=-5:":0,""0-00- = $135,000

in his partner whose death could cause him great monetary

loss. 8. (b) When property is covered by a coinsurance

3. (c) An insurable interest in property exists if the clause, the insured party agrees to maintain insurance equal

insured has both a legal interest in the property and the pos- to a given percentage of the value of the property, usually

sibility of incurring a pecuniary loss. The legal interest may 80%. If the percentage of coverage is less thari the specified

be ownership or a security interest. A corporate retailer has percentage and partial destruction of the property occurs,

an ownership interest in its inventory, and the possibility of then the insured will be liable for a portion of the loss.

incurring a monetary loss. A partner also has an ownership However, a coinsurance clause applies only when there has

interest in partnership property, with the possibility of incur- been partial destruction of property. If the insured property

ring a monetary loss. - is totally destroyed, the coinsurance clause does not apply

and the insured party will recover the face value of the in-

C. Subrogation su~ance policy. Thus, Pod will recover $150,000 from

Owners Insurance Co. and $50,000 from Group Insurance

4. (b) Once the insurance company pays its insured,

Co. for a total of $200,000.

Massaro, it steps into Massaro's shoes and obtains the same

rights against third parties that Massaro had. Since Lux was

at fault in this accident, the insurance company has rights

against Lux as well as any insurance company that has in-

sured Lux. Answer (a) is incorrect because the insurance

company can nevertheless recover from third parties based

on the right of subrogation. Answer (c) is incorrect because

the insurance company has the right to collect from Lux as

well as an insurer. Answer (d) is incorrect because the rele-

vant concept is the right of subrogation, not contribution.

E. Fire Insurance

5. (c) An important element of a property insurance

contract is the existence of an insurable interest. The insur-

able interest requirement is met when an entity has both a

legal interest in the property and a possibility of monetary

loss if the property is damaged. Since Merit still owns the

office building at the time of the fire, they fulfill both these

requirements. 'Papco also has an insurable interest which

began on Februaryx when they entered into the contract to

purchase the building. Papco's legal interest results from

their contract to purchase the building. Papco's monetary

interest results from their potential loss of future use of the

building. Thus, in this situation, both Papco and Merit have

an insurable interest.

You might also like

- Risk Management & Insurance Planning Sample Questions: DisclaimerDocument3 pagesRisk Management & Insurance Planning Sample Questions: DisclaimerpousaliNo ratings yet

- M ULE E: OD D Btor-Creditor RelationshipsDocument2 pagesM ULE E: OD D Btor-Creditor RelationshipsZeyad El-sayedNo ratings yet

- BNL Reviewer - Set ADocument8 pagesBNL Reviewer - Set ARowena JeanNo ratings yet

- Bar Question InsuranceDocument17 pagesBar Question InsuranceMary Kristin Joy GuirhemNo ratings yet

- Answers - Chapter 2Document3 pagesAnswers - Chapter 2Nazlı YumruNo ratings yet

- Answer Key - Ic - Mock Exam - Set B PDFDocument8 pagesAnswer Key - Ic - Mock Exam - Set B PDFZyzy Lepiten75% (28)

- Answer: Under The Insurance Code of The Philippines, The Irrevocable Designation Gives The Beneficiary A Vested Right Over Life InsuranceDocument7 pagesAnswer: Under The Insurance Code of The Philippines, The Irrevocable Designation Gives The Beneficiary A Vested Right Over Life InsuranceCon PuNo ratings yet

- ch-4 RiskDocument18 pagesch-4 RiskYebegashet AlemayehuNo ratings yet

- Risk CH 4Document15 pagesRisk CH 4Mubarik AhmedinNo ratings yet

- Insurance Contracts Module 9 ReviewDocument3 pagesInsurance Contracts Module 9 ReviewSunshine Khuletz67% (12)

- Risk Management Solution Manual Chapter 09Document7 pagesRisk Management Solution Manual Chapter 09DanielLam100% (10)

- Double Insurance ReportDocument14 pagesDouble Insurance Reportwesternwound82No ratings yet

- Answer Key for IC Mock Exam Set BDocument9 pagesAnswer Key for IC Mock Exam Set BrandomNo ratings yet

- Licensing Exam PhilippinesDocument20 pagesLicensing Exam PhilippinesTGiF TravelNo ratings yet

- Life Insurance Concepts, Premiums and Types of PoliciesDocument20 pagesLife Insurance Concepts, Premiums and Types of PoliciesTGiF TravelNo ratings yet

- Secured Transactions Bankruptcy ProceedsDocument33 pagesSecured Transactions Bankruptcy Proceedssashimiman100% (3)

- Bar Question InsuranceDocument18 pagesBar Question InsuranceRon AceNo ratings yet

- Risk Management Solution Manual Chapter 09Document10 pagesRisk Management Solution Manual Chapter 09Abdelnasir HaiderNo ratings yet

- Separate Insurable Interests of Business Owner & Creditor Covering Same StocksDocument5 pagesSeparate Insurable Interests of Business Owner & Creditor Covering Same StocksRocky YapNo ratings yet

- Commercial Law OutlineDocument46 pagesCommercial Law Outlinejustgottabezen100% (3)

- Chapter 19 MCQs pg 1-5Document5 pagesChapter 19 MCQs pg 1-5Sorina CorpaciNo ratings yet

- Traditional Licensing Review Mock Exam - v2023.05.08Document18 pagesTraditional Licensing Review Mock Exam - v2023.05.08valdezkristineanneNo ratings yet

- Ishal Shukat Ali (2172079)Document5 pagesIshal Shukat Ali (2172079)Ahsan BaigNo ratings yet

- rejda_rmi14_im02_PRDocument6 pagesrejda_rmi14_im02_PRYaasiin MacloowNo ratings yet

- IM - Chapter 4 AnswerDocument7 pagesIM - Chapter 4 AnswerEileen WongNo ratings yet

- Tutorial Chapter 5Document3 pagesTutorial Chapter 5NUR AMANI SYAMIMI MOHAMAD NAZIRNo ratings yet

- Principles of Risk Management and Insurance 13th Edition Rejda Solutions ManualDocument36 pagesPrinciples of Risk Management and Insurance 13th Edition Rejda Solutions Manualoutlying.pedantry.85yc100% (23)

- Orca Share Media1560502291818 PDFDocument17 pagesOrca Share Media1560502291818 PDFamor macayanNo ratings yet

- Trad Ic Mock Exam Answer KeyDocument15 pagesTrad Ic Mock Exam Answer KeyGener ApolinarioNo ratings yet

- L M NotesDocument8 pagesL M NotesBABYLEN BAHALANo ratings yet

- Insurance Principles and Types ExplainedDocument16 pagesInsurance Principles and Types ExplainedVagifNo ratings yet

- Insurance Exam Questions and AnswersDocument19 pagesInsurance Exam Questions and Answerstoll_meNo ratings yet

- Answer Key - Life - Mock Exam 1Document8 pagesAnswer Key - Life - Mock Exam 1Alex MacasaetNo ratings yet

- Tutorial 1Document2 pagesTutorial 1Don ĐỗNo ratings yet

- Sol. Man. - Chapter 12 - Insurance Contracts - 2020 EditionDocument4 pagesSol. Man. - Chapter 12 - Insurance Contracts - 2020 EditionKathleen Rose BambicoNo ratings yet

- Q & A Insurance LawDocument37 pagesQ & A Insurance LawChevy MacalmaNo ratings yet

- Module 25 Commercial PaperDocument4 pagesModule 25 Commercial PaperZeyad El-sayedNo ratings yet

- Chapter 2 Insurance and RiskDocument26 pagesChapter 2 Insurance and RiskDIEM NGUYEN LENo ratings yet

- Answers To Test Yourunderstanding QuestionsDocument5 pagesAnswers To Test Yourunderstanding QuestionsDean Rodriguez100% (2)

- Traditional IC Mock Exam - 02042020 PDFDocument37 pagesTraditional IC Mock Exam - 02042020 PDFMikaella SarmientoNo ratings yet

- Trad Ic Mock ExamDocument15 pagesTrad Ic Mock ExamArvin AltamiaNo ratings yet

- Importance of InsuranceDocument13 pagesImportance of InsuranceFahmi AbdullaNo ratings yet

- Risk Management Solution Manual Chapter 02Document6 pagesRisk Management Solution Manual Chapter 02DanielLam86% (7)

- Insurance Reviewer Notes by Atty. SaclutiDocument12 pagesInsurance Reviewer Notes by Atty. SaclutiGayFleur Cabatit RamosNo ratings yet

- Confirmation of Property Insurance: Insured(s) AddressDocument2 pagesConfirmation of Property Insurance: Insured(s) AddressAli LavasaniNo ratings yet

- Unit 7 Exercises To StsDocument7 pagesUnit 7 Exercises To StsHưng TrầnNo ratings yet

- Risk 4Document9 pagesRisk 4Tadele BekeleNo ratings yet

- Sample Final Exam For Risk Management and InsuranceDocument6 pagesSample Final Exam For Risk Management and InsuranceJohn KueyNo ratings yet

- Unit 7 - Exercises - To StsDocument7 pagesUnit 7 - Exercises - To StsHà ThưNo ratings yet

- Dwnload Full Principles of Risk Management and Insurance 13th Edition Rejda Solutions Manual PDFDocument36 pagesDwnload Full Principles of Risk Management and Insurance 13th Edition Rejda Solutions Manual PDFimbreedjejunity.8hi2yz100% (11)

- RFBT Quizzer Covers Insurance Code, Government Procurement, Labor Laws & MoreDocument48 pagesRFBT Quizzer Covers Insurance Code, Government Procurement, Labor Laws & Morelairekk onyotNo ratings yet

- INSURANCE EXAM REVIEWDocument6 pagesINSURANCE EXAM REVIEWJon EsberNo ratings yet

- Presentation ON Fire InsuranceDocument20 pagesPresentation ON Fire InsuranceS. M. Faysal 172-11-5575No ratings yet

- Final RMDocument7 pagesFinal RMKim LiênNo ratings yet

- - Đề Cương InsuranceDocument35 pages- Đề Cương InsuranceHùng Mạnh PhíNo ratings yet

- Chapter Three Insurance 3.1. Definition of InsuranceDocument12 pagesChapter Three Insurance 3.1. Definition of InsurancegozaloiNo ratings yet

- Pce Part B Set ADocument11 pagesPce Part B Set Azara100% (1)

- 11 BST Businessservices tp01Document6 pages11 BST Businessservices tp01RajatNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1ENo ratings yet

- Taxes: Determining Personal Holding Company StatusDocument2 pagesTaxes: Determining Personal Holding Company StatusAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1ENo ratings yet

- Scan 0089Document2 pagesScan 0089Anonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument2 pagesModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Taxes: Determining Personal Holding Company StatusDocument2 pagesTaxes: Determining Personal Holding Company StatusAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sio ZSCDocument2 pagesTaxes: Corporate: Sio ZSCAnonymous JqimV1ENo ratings yet

- Module 36 Taxes Corporat: Multipl - HOI E RSDocument2 pagesModule 36 Taxes Corporat: Multipl - HOI E RSAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Individual TaxesDocument2 pagesIndividual TaxesAnonymous JqimV1ENo ratings yet

- MOD L S: Corporat: U E AXE EDocument2 pagesMOD L S: Corporat: U E AXE EAnonymous JqimV1ENo ratings yet

- K. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsDocument2 pagesK. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: I Dividual: I F e R C ADocument2 pagesModule 33 Taxes: I Dividual: I F e R C AAnonymous JqimV1ENo ratings yet

- Taxes: Individual: S S, S A - , CDocument2 pagesTaxes: Individual: S S, S A - , CAnonymous JqimV1ENo ratings yet

- Taxation of Partnership DistributionsDocument3 pagesTaxation of Partnership DistributionsAnonymous JqimV1ENo ratings yet

- Scan 0054Document2 pagesScan 0054Anonymous JqimV1ENo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Taxes: Individual Income Tax ConceptsDocument2 pagesTaxes: Individual Income Tax ConceptsAnonymous JqimV1ENo ratings yet

- Taxes: Alimony and Interest IncomeDocument1 pageTaxes: Alimony and Interest IncomeAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOODocument1 pageModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1ENo ratings yet

- U I T U: Module 33 Taxes I Divi UALDocument1 pageU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1ENo ratings yet

- Individual Tax Module MCQsDocument3 pagesIndividual Tax Module MCQsAnonymous JqimV1ENo ratings yet

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceDocument1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1ENo ratings yet

- BH-2 ATS Master DraftDocument22 pagesBH-2 ATS Master Draftlegal sammysNo ratings yet

- Van Den Berghs LTD V ClarkDocument6 pagesVan Den Berghs LTD V ClarkShivanjani KumarNo ratings yet

- Section 1 Questions 1-13Document13 pagesSection 1 Questions 1-13ielts Ice GiangNo ratings yet

- 1MA1 2F Que 20181109 PDFDocument20 pages1MA1 2F Que 20181109 PDFmehNo ratings yet

- Law of Negotiable InstrumentsDocument16 pagesLaw of Negotiable InstrumentsSahrish Tahir100% (1)

- Mergers & Inquisitions - Financial Institutions Group - FIG Investment Banking GuideDocument43 pagesMergers & Inquisitions - Financial Institutions Group - FIG Investment Banking GuideGABRIEL SALONICHIOSNo ratings yet

- Engineering Economics ReviewDocument23 pagesEngineering Economics ReviewDaisy Ann MoleñoNo ratings yet

- Elements With AnswersDocument6 pagesElements With AnswersJosue RicaldeNo ratings yet

- Coded Quant Data ComparisionDocument4 pagesCoded Quant Data ComparisionsarveshaNo ratings yet

- Financial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedDocument9 pagesFinancial Performance Analysis of Islamic Bank in Bangladesh: A Case Study On Al-Arafah Islami Bank LimitedPremier PublishersNo ratings yet

- FDBDNZFGMJFH MdsfsdfsDocument187 pagesFDBDNZFGMJFH Mdsfsdfsshri100% (1)

- BSP Circular No. 925-16Document77 pagesBSP Circular No. 925-16Helena HerreraNo ratings yet

- Common Currency in AsiaDocument8 pagesCommon Currency in AsiaAbhishekGuptaNo ratings yet

- 萬通終身年金Document16 pages萬通終身年金koiNo ratings yet

- Ch. 5 - The Open EconomyDocument35 pagesCh. 5 - The Open EconomyaritjahjaNo ratings yet

- Pearson Edexcel A Level Business Workbook 2 - SampleDocument15 pagesPearson Edexcel A Level Business Workbook 2 - SampleNabiha ZamanNo ratings yet

- 5 CsDocument1 page5 CsGroovy모니카No ratings yet

- Project Proposal for Seb Chizaw School in Addis Ababa, EthiopiaDocument31 pagesProject Proposal for Seb Chizaw School in Addis Ababa, EthiopiaSemirNo ratings yet

- For The Partial Fulfillment of The Requirement For The Degree of 2013-2015Document56 pagesFor The Partial Fulfillment of The Requirement For The Degree of 2013-2015Vishram NaikNo ratings yet

- IF MCQsDocument6 pagesIF MCQsNaoman ChNo ratings yet

- CHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONDocument15 pagesCHINA HUANENG GROUP CONTROL PERFORMANCE EVALUATIONYouJianNo ratings yet

- Economic NumericalDocument26 pagesEconomic NumericalSantosh ThapaNo ratings yet

- United States District CourtDocument58 pagesUnited States District CourtheatherNo ratings yet

- Multi CurvesDocument32 pagesMulti CurvesdeepzcNo ratings yet

- Bank Accounting PolicyDocument29 pagesBank Accounting Policykotha123No ratings yet

- Chapter 4 - Consolidated Financial Statements (Part 1)Document32 pagesChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNo ratings yet

- IfmDocument209 pagesIfmSalim Akhtar KhanNo ratings yet

- Sukanya Samriddhi YojanaDocument22 pagesSukanya Samriddhi YojanaKirti ChotwaniNo ratings yet

- Analysisof Financial StatementsDocument208 pagesAnalysisof Financial StatementsSebastianNo ratings yet