Professional Documents

Culture Documents

Business Combi and Conso Handout

Uploaded by

Karlo Jude AcideraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combi and Conso Handout

Uploaded by

Karlo Jude AcideraCopyright:

Available Formats

AFAR REVIEW NOTES

Business combinations and consolidated financial statements

CONTROL PREMIUM

Additional investment

Part of purchase price

Affects goodwill/(gain)

Ignored in computing NCI

CONTINGENT CONSIDERATION

ERRATUM:

Sorry, sets 4 and 2, mali nasabi ko sa klase. Measurement period is always one year. Adjustments to goodwill (gain) can be

done in the measurement period. Beyond the measurement period, any adjustment to the ELCC will now affect P/L instead of

goodwill (gain).

WORKING PAPER ELIMINATION ENTRIES:

DIVIDEND RECEIVED

Dividend income xx

Partial NCI xx

Dividends declared - Subsidiary xx

SUBSIDIARY-SHE

Ordinary Share - Subsidiary xx

Share Premium - Subsidiary xx

Retained Earnings - Subsidiary xx

Investment in Subsidiary xx

NCI xx

OVERVALUATION OF ASSETS (OVA), UNDERVALUATION OF ASSETS (UVA), GOODWILL

Equipment xx

Inventory xx

Goodwill xx

Investment in Subsidiary xx

NCI xx

AMORTIZATION OF IMPAIRMENT LOSS

Operating Expense xx

PPE, net xx

Impairment Loss xx

Goodwill xx

Cost of Sales xx

Inventory xx

INTERCOMPANY SALES AND PURCHASES

Sales xx

Cost of Sales xx

UNREALIZED PROFIT IN ENDING INVENTORY (UPEI)

Cost of Sales xx

Inventory xx

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 1 of 16

REALIZED PROFIT IN BEGINNING INVENTORY (RPBI)

Retained Earnings – Parent xx

NCI (only for upstream sales) xx

Cost of Sales xx

COMPUTATION OF INCOME (I call it the “mega formula”)

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) xx

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT xx

3. Subsidiary Net Income (fractional year, if applicable) xx xx

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

rd

16. Realized gain – down (depreciation, sale to 3 party) xx

rd

17. Realized gain – up (depreciation, sale to 3 party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) xx xx

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

Consolidated Net Income = CNI-P + NCI-NI ; Consolidated Comprehensive Income = CCI-P + NCI-CI

Other Formulae:

Non-controlling Interest, beginning ₱xx Sales – Parent ₱xx

Non-controlling Interest – Net Income xx Sales – Subsidiary xx

Dividend Share (xx) Intercompany Sales & Purchases at Selling Price (xx)

Non-controlling Interest, end ₱xx Consolidated Sales ₱xx

Retained Earnings – Parent (date of acquisition) ₱xx Cost of Sales – Parent ₱xx

Consolidated Net Income – Parent xx Cost of Sales – Subsidiary xx

Dividends declared by Parent (xx) Intercompany Sales & Purchases at Selling Price (xx)

Consolidated Retained Earnings ₱xx Unrealized Profit in Ending Inventory (UPEI) xx

Ordinary Share – Parent ₱xx Realized Profit in Beginning Inventory (RPBI) (xx)

Share Premium – Parent xx Amortization of Undervalued Assets xx

Consolidated Retained Earnings xx Amortization of Overvalued Assets (xx)

Non-controlling Interest xx Consolidated Cost of Sales ₱xx

Consolidated Shareholder’s Equity ₱xx

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 2 of 16

Shareholder’s Equity - Subsidiary, end ₱xx Consolidated Sales ₱xx

Net Income of Subsidiary xx Consolidated Cost of Sales (xx)

Dividends declared by Subsidiary (xx) Consolidated Gross Profit ₱xx

Shareholder’s Equity – Subsidiary, at book value ₱xx

Overvalued Assets (OVA) (xx)

Undervalued Assets (UVA) xx

Amortization of OVA xx

Amortization of UVA (xx)

Net Assets at fair value ₱xx

Inventory – Parent, at book value ₱xx Expenses – Parent ₱xx

Inventory – Subsidiary, at book value xx Expenses – Subsidiary xx

Undervaluation of Inventory xx Amortization of UVA xx

Amortization of Undervaluation of Inventory (xx) Amortization of OVA (xx)

Overvaluation of Inventory (xx) Realized Loss – Depreciation xx

Amortization of Undervaluation of Inventory xx Realized Gain – Depreciation (xx)

UPEI xx Consolidated Expense ₱xx

Consolidated Inventory ₱xx

Sample problem: #119-122, Practical Accounting 2 (2013 ed.) by Antonio J. Dayag

On January 1, 2013, Bristol Company acquired 80% of Animation Company’s common stock for P280,000 cash. At that date,

Animation rfeported (sic) common stock outstanding of P200,000 and retained earnings of P100,000 and the fair value of the

non-controlling interest was P70,000. The book values and fair values of Animation’s assets and liabilities were equal, except for

other intangible assets which had a fair value of P50,000 greater than book value and an 8-year remaining life. Animation reported

the following data for 2013 and 2014:

Year Net Income Comprehensive Income Dividends Paid

2013 P 25,000 P 30,000 P 5,000

2014 35,000 45,000 10,000

Bristol reported separate net income from own operations of P100,000 and paid dividends of P30,000 for both the years.

119. What is the amount of consolidated comprehensive income reported for 2013?

a. 125,000 b. 123,750

c. 118,750 d. 130,000

120. Using the same information in No. 120 (sic), what is the amount of comprehensive income attributable to the controlling

interest for 2013?

a. 123,750 b. 118,750

c. 119,000 d. 104,000

121. Using the same information in No. 120 (sic), what is the amount of consolidated comprehensive income for 2014?

a. 145,000 b. 135,000

c. 138,750 d. 128,750

122. Using the same information in No. 120 (sic), what is the amount of comprehensive income attributable to the controlling

interest for 2014?

a. 138,750 b. 131,000

c. 128,750 d. 135,000

Solution:

Fair value of consideration given 280,000 Amortization of

Fair value of NCI 70,000 undervaluation of

Fair value of Subsidiary 350,000 assets: 50,000/8 years

Book value of Subsidiary’s SHE (200,000 + 100,000) (300,000) = 6,250 per

Allocated excess 50,000 year

Increase in intangible assets undervaluation (50,000)

Goodwill 0

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 3 of 16

(using the “mega formula”) FOR YEAR 2013:

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) 100,000

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT xx

3. Subsidiary Net Income (fractional year, if applicable) 20,000 5,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (5,000) (1,250)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain plus other comprehensive income xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME 115,000 3,750

Other Comprehensive Income 4,000 1,000

COMPREHENSIVE INCOME 119,000 4,750

Consolidated Net Income: 115,000 + 3,750 = 118,750

Consolidated Comprehensive Income: 119,000 + 4,750 = 123,750

(using the “mega formula”) FOR YEAR 2014:

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) 100,000

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT xx

3. Subsidiary Net Income (fractional year, if applicable) 28,000 7,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (5,000) (1,250)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain plus other comprehensive income xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 4 of 16

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME 123,000 5,750

Other Comprehensive Income 8,000 2,000

COMPREHENSIVE INCOME 131,000 7,750

Consolidated Net Income: 123,000 + 5,750 = 128,750

Consolidated Comprehensive Income: 131,000 + 7,750 = 138,750

INTER-COMPANY SALES OF INVENTORY

2 goals of Working Paper Elimination Entries:

Elimination of the effects in the Statement of Comprehensive Income of the inter-company sale in the period of sale,

removing the sales revenue from the intercompany sale and the related cost of goods sold recorded by the selling

affiliate.

Elimination from the inventory on the Statement of Financial Position of any profit or loss on the intercompany sale that

has not been realized by resale of said inventories to outside parties.

Unrealized Profit in Ending Inventory (UPEI) – merchandise purchased from affiliated company (either parent or subsidiary)

that remains unsold on the Balance Sheet date results in the overstatement of the purchaser’s ending inventory.

Working Paper Elimination Entry: see page 1

Realized Profit in Beginning Inventory (RPBI) – on a FIFO basis, the UPEI in the previous year gets realized through sales to

outside parties in the next year.

Working Paper Elimination Entry: see page 2

Nota bene: RPBI HAS NO IMPACT ON CONSOLIDATED INVENTORY

Sample problem: #133-135, ibid.

Income statement information for the year 2012 for Perfect Corporation and its 60% owned subsidiary, Seven Corporation is as

follows:

Perfect Seven

Sales 900,000 350,000

Cost of Sales (400,000) (250,000)

Gross Profit 500,000 100,000

Operating expenses (250,000) (50,000)

Seven’s Net Income 50,000

Perfect’s Net Income 250,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 5 of 16

Intercompany sales for 2012 are upstream (from Seven to Perfect) and total 100,000. Perfect’s December 31, 2011 and December

31, 2012 inventories contain unrealized profits of 5,000 and 10,000, respectively.

133. The consolidated sales for 2012:

a. 900,000 b. 1,150,000

c. 1,190,000 d. 1,250,000

134. The consolidated cost of sales for 2012:

a. 545,000 b. 550,000

c. 555,000 d. 560,000

135. The profit attributable to equity holders of parent or CNI contributable to Controlling Interests for 2012:

a. 277,000 b. 280,000

c. 282,000 d. 305,000

Solution (using other formulae):

Sales – Parent ₱900,000

Sales – Subsidiary 350,000

Intercompany Sales & Purchases at Selling Price (100,000)

Consolidated Sales ₱1,150,000

Cost of Sales – Parent ₱400,000

Cost of Sales – Subsidiary 250,000

Intercompany Sales & Purchases at Selling Price (100,000)

Unrealized Profit in Ending Inventory (UPEI) 10,000

Realized Profit in Beginning Inventory (RPBI) (5,000)

Amortization of Undervalued Assets xx

Amortization of Overvalued Assets (xx)

Consolidated Cost of Sales ₱555,000

Solution (using the “mega formula”)

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) xx

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT 250,000

3. Subsidiary Net Income (fractional year, if applicable) 30,000 20,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (6,000) (4,000)

10. RPBI – downstream xx

11. RPBI – upstream 3,000 2,000

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 6 of 16

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 277,000 18,000

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

INTER-COMPANY SALES OF LAND

The selling entity’s gain must be eliminated since the land owned by a combined must be reported at original/historical cost,

regardless of who (between the parent and subsidiary) holds the land.

SALE ELIMINATION

Downstream Against controlling interest

Upstream – wholly owned Against controlling interest

Upstream – partially owned Proportionately against controlling interest and NCI

Working Paper Elimination Entries:

Gain on sale of land xx

Land xx

If subsequently sold to outside parties,

Retained earnings xx

Gain on sale of land xx

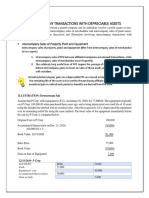

INTER-COMPANY SALES OF PPE OR DEPRECIABLE ASSETS

The working paper elimination entries must be able to:

Eliminate the gain

Restore the accumulated depreciation

Restore the cost of asset

In short, the working paper elimination entries restores the asset to its value AS IF THE INTER-COMPANY SALES DIDN’T

HAPPEN.

Example:

The seller sells an equipment costing P90,000 and 30% (Useful life of 10 years, 3 years has passed) depreciated to a buyer who

is an affiliate for P70,000.

Entries to recognize the inter-company sales:

Seller Buyer

Cash 70,000 Equipment 70,000

Accumulated depreciation 27,000 Cash 70,000

Equipment 90,000

Gain on sale of equipment 7,000

Working Paper Elimination Entry:

Gain on sale of equipment 7,000

Equipment 20,000

Accumulated Depreciation 27,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 7 of 16

MORE SAMPLE PROBLEMS TO TEST THE “OTHER FORMULAE” AND OTHER PARTS OF THE “MEGA FORMULA”

Problems 94-106, ibid. (names of companies changed)

On January 1, 2011, Patrick Company acquired 90% of Star Company in exchange for 5,400 shares of P10 par common stock

having a market value of 120,600. Patrick and Star condensed balance sheets were as follows:

Patrick Company and Star Company

Balance Sheets at January 1, 2011

(before combination)

Patrick Company Star Company

ASSETS

Cash 30,900 37,400

Accounts receivable, net 34,200 9,100

Inventories 22,900 16,100

Equipment, net 179,000 40,000

Patents 10,000

TOTAL ASSETS 267,000 112,600

LIABILITIES AND STOCKHOLDERS’ EQUITY

Accounts payable 4,000 6,600

Bonds payable, 10% 100,000

Common stock, P10 par 100,000 50,000

Additional paid-in capital 15,000 15,000

Retained earnings 48,000 41,000

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY 267,000 112,600

At the date of acquisition, all assets and liabilities of Star Company have book value approximately equal to their respective

market values except the following as determined by appraisal as follows:

Inventories (FIFO method) 17,100

Equipment, net (remaining life: 4 years) 48,000

Patents (remaining life: 10 years) 13,000

Goodwill (no impairment)

94. Compute for the amount of partial goodwill on January 1, 2011.

a. 2,600 b. 3,800

c. 14,400 d. 25,200

95. Using the same information in No. 94, compute the non-controlling interests (in net assets) on January 1, 2011.

a. 10,600 b. 11,200

c. 11,800 d. 13,090

96. Using the same information in No. 94, compute the consolidated retained earnings, January 1, 2011.

a. 48,000 b. 52,100

c. 84,900 d. 89,000

97. Using the same information in No. 94, compute the equity holders of parent – retained earnings, January 1, 2011.

a. 48,000 b. 52,100

c. 84,900 d. 89,000

In addition to the information in No. 94, assuming that on December 31, 2011, the following results were given:

Dividends Paid Net Income

Patrick Company 15,000 30,200

Star Company 4,000 9,400

98. Using cost method to record results of operations, compute the investment in Star Company balance on December 31, 2011.

a. 0 b. 120,600

c. 122,160 d. 125,460

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 8 of 16

99. Using the same information in Nos. 94 and 98, compute the dividend income for 2011 using the cost method.

a. 0 b. 3,600

c. 4,000 d. 8,400

100. Using the same information in Nos. 94 and 98, compute the non-controlling interest in net income on December 31, 2011.

a. 0 b. 540

c. 610 d. 940

101. Using the same information in Nos. 94 and 98, compute the non-controlling interest on December 31, 2011.

a. 10,600 b. 11,140

c. 12,010 d. 12,300

102. Using the same information in Nos. 94 and 98, compute the profit for the period attributable to equity holders of parent

on December 31, 2011.

a. 26,600 b. 32,090

c. 36,000 d. 44,100

103. Using the same information in Nos. 94 and 98, compute the consolidated group net income on December 31, 2011.

a. 26,600 b. 32,090

c. 32,700 d. 44,100

104. Using the same information in Nos. 94 and 98, compute the consolidated retained earnings, December 31, 2011.

a. 64,760 b. 65,090

c. 69,400 d. 69,800

105. Using the same information in Nos. 94 and 98, compute the Equity holders of Parent – Retained earnings, December 31,

2011.

a. 64,760 b. 65,090

c. 69,400 d. 69,800

106. Using the same information in Nos. 94 and 98, compute the consolidated total equity (stockholders’ equity on December

31, 2011.

a. 108,090 b. 300,690

c. 312,700 d. 317,410

Solutions:

94. Remember my PowerPoint presentation?

Let’s use the same formula:

FV of consideration transferred 120,600

Book value of net assets (106,000 x 90%) (95,400)

Allocated excess 25,200

OVA [(1,000+8,000+3,000) x 90%] (10,800)

Partial goodwill 14,400

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 9 of 16

95. FV of net assets acquired: 118,000

NCI % 10%

NCI 11,800

96, 97. Retained Earnings – Parent (date of acquisition) ₱48,000

Consolidated Net Income – Parent xx

Dividends declared by Parent (xx)

Consolidated Retained Earnings, 1/1/2011 ₱48,000

98. FV of consideration given by parent: 120,600 (cost method)

99. Dividend received by parent = dividend paid by subsidiary = 4,000

x NCI % 90%

Dividend Income = 3,600

100. Use the “mega formula”

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) 30,200

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (3,600)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT xx

3. Subsidiary Net Income (fractional year, if applicable) 8,460 940

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (2,970) (330)*

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 32,090 610

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

* Amortization of UVA:

Inventories: 1,000/year

Equipment: 8,000/4 years

Patent: 3,000/10 years

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 10 of 16

101. Shareholder’s Equity – Subsidiary, end (50,000+15,000+41,000) ₱106,000

Net Income of Subsidiary 9,400

Dividends declared by Subsidiary (4,000)

Shareholder’s Equity – Subsidiary, at book value ₱111,400

Overvalued Assets (OVA) (xx)

Undervalued Assets (UVA) (1,000+8,000+3,000) 12,000

Amortization of OVA xx

Amortization of UVA (3,300)

Net Assets at fair value ₱120,100

NCI in net assets: 120,000 x 10% = 12,010

102. Refer to “mega formula” (No. 100)

103. Consolidated Net Income = CNI-P + NCI-NI = 32,090 + 610 = 32,700

104, 105. Retained Earnings – Parent (date of acquisition) ₱48,000

Consolidated Net Income – Parent (see No. 103) 32,090

Dividends declared by Parent (15,000)

Consolidated Retained Earnings, 12/31/2011 ₱65,090

106. Ordinary Share – Parent (100,000 + consideration: 5,400 shares x 10 par) ₱154,000

Share Premium – Parent (15,000 + APIC on consideration: 120,600-54,000) 81,600

Consolidated Retained Earnings (see No. 104, 105) 65,090

Non-controlling Interest (see No. 101) 12,010

Consolidated Shareholder’s Equity ₱312,700

Problem 160-162, ibid.

Saul is a 90%-owned subsidiary of Paul Corporation, acquired at book value several years ago. Comparative separate company

income statements for these affiliated corporation for 2012 are as follows:

Paul Corp. Saul Corp.

Sales 1,500,000 700,000

Dividend income 108,000

Gain on sale of building 30,000

Income credits 1,638,000 700,000

Cost of sales 1,000,000 400,000

Operating expenses 300,000 150,000

Income debits 1,300,000 550,000

Net income credits over debits 338,000 150,000

On January 5, 2012, Paul sold a building with a 10-year remaining useful life to Saul at a gain of 30,000. Saul paid dividends of

120,000 during 2012.

160. The NCI-NI for 2012 is

a. 12,000 b. 12,300

c. 15,000 d. 15,300

161. The profit attributable to equity holders of Parent or CNI-P for 2012 is

a. 342,000 b. 340,700

c. 338,000 d. 335,000

162. The Consolidated/group net income for 2012 is

a. 342,000 b. 353,000

c. 380,000 d. 443,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 11 of 16

Solutions (using the “mega formula”)

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) 338,000

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (108,000)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT 230,000

3. Subsidiary Net Income (fractional year, if applicable) 135,000 15,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (30,000)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) 3,000

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 338,000 15,000

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

Consolidated Net Income = CNI-P + NCI-NI = 338,000 + 15,000 = 353,000

Problems 163-166, ibid.

Silver Corporation is a 90% owned subsidiary of Proto Corporation, acquired several years ago at book value. For the years 2011

and 2012, Proto and Silver report the following:

2011 2012

Proto’s separate income (IFOOP/SIP) 300,000 400,000

Silver’s net income 80,000 60,000

The only inter-company profit transaction between Proto and Silver during 2011 and 2012 was the January 1, 2011 sale of land.

The land had a book value of 20,000 and was sold inter-company for 30,000, its appraised value at the time of sale.

163. If the land was sold by Proto to Silver (downstream sales) and that Silver still owns the land at December 31, 2012, compute

the CNI-P for 2011 and 2012.

a. 363,000; 454,000 b. 362,000; 454,000

c. 372,000; 460,000 d. 362,000; 460,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 12 of 16

164. Using the same information in No. 163, the Consolidated/group net incomes for 2011 and 2012 are:

a. 362,000; 454,000 b. 380,000; 460,000

c. 370,000; 460,000 d. 372,000; 460,000

165. Using the same information in No. 163, except that the land was sold by Silver to Proto (upstream sales) and Proto still

owns the land at December 31, 2012, compute the CNI-P for 2011 and 2012.

a. 363,000; 454,000 b. 362,000; 454,000

c. 370,000; 460,000 d. 363,000; 460,000

166. Using the same information in No. 165, the Consolidated/group net incomes for 2011 and 2012 are:

a. 362,000; 454,000 b. 380,000; 460,000

c. 370,000; 460,000 d. 372,000; 460,000

Solutions (mega formula)

2011 - downstream

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) xx

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT 300,000

3. Subsidiary Net Income (fractional year, if applicable) 72,000 8,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (10,000)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 362,000 8,000

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

Consolidated Net Income = CNI-P + NCI-NI = 362,000 + 8,000 = 370,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 13 of 16

2012 - downstream

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) xx

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT 400,000

3. Subsidiary Net Income (fractional year, if applicable) 54,000 6,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (xx) (xx)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 454,000 6,000

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

Consolidated Net Income = CNI-P + NCI-NI = 454,000 + 6,000 = 460,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 14 of 16

2011 - upstream

Parent Subsidiary

SUBSEQUENT TO DATE OF ACQUISITION

1. Parent net income (full) xx

2. Dividend received (Dividend-Subsidiary x Controlling interest rate) (xx)

INCOME FROM OPERATIONS OF PARENT / SEPARATE INCOME - PARENT 300,000

3. Subsidiary Net Income (fractional year, if applicable) 72,000 8,000

4. Amortization of UVA (UVA/remaining life x fractional year, if applicable) (xx) (xx)

5. Amortization of OVA (OVA/remaining life x fractional year, if applicable) xx xx

6. Gain xx xx

7. Impairment Loss (xx) (xx)

INTERCOMPANY SALE OF INVENTORY

8. UPEI – downstream (xx)

9. UPEI – upstream (xx) (xx)

10. RPBI – downstream xx

11. RPBI – upstream xx xx

INTERCOMPANY SALE OF PPE

12. Unrealized gain – down (year of sale) (xx)

13. Unrealized gain – up (year of sale) (xx) (xx)

14. Unrealized loss – down (year of sale) xx

15. Unrealized loss – up (year of sale) xx xx

16. Realized gain – down (depreciation, sale to 3rd party) xx

17. Realized gain – up (depreciation, sale to 3rd party) xx xx

18. Realized loss – down (depreciation, sale to 3rd party) (xx)

19. Realized loss – up (depreciation, sale to 3rd party) (xx) (xx)

INTERCOMPANY SALE OF LAND

20. Unrealized gain – down (year of sale) (xx)

21. Unrealized gain – up (year of sale) (9,000) (1,000)

22. Unrealized loss – down (year of sale) xx

23. Unrealized loss – up (year of sale) xx xx

24. Realized gain – down (sale to 3rd party) xx

25. Realized gain – up (sale to 3rd party) xx xx

26. Realized loss – down (sale to 3rd party) (xx)

27. Realized loss – up (sale to 3rd party) (xx) (xx)

NET INCOME (CNI-P and NCI-NI) 363,000 7,000

Other Comprehensive Income xx xx

COMPREHENSIVE INCOME (CCI-P and NCI-CI) xx xx

Consolidated Net Income = CNI-P + NCI-NI = 363,000 +7,000 = 370,000

2012 – upstream, same with 2011 – upstream

Consolidated Net Income = CNI-P + NCI-NI = 454,000 + 6,000 = 460,000

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 15 of 16

Problem 140, ibid.

Power Co. is a manufacturer and Slack Co., its 100%-owned subsidiary, is a retailer. The companies are vertically integrated.

Thus, Slack purchases all of its inventory from Power. On January 1, 2012, Slack’s inventory was 30,000. For the year ended

December 31, 2012, its purchases were 150,000, and its cost of sales was 166,500. Power’s sales to Slack reflect a 50% mark-up

on cost. Slack then resells the goods to outside entities at a 100% mark-up on cost. At what amount should the intercompany

inventory purchased from power be reported in the consolidated balance sheet at December 31, 2012?

a. 3,000 b. 9,000

c. 13,500 d. 46,000

Solution (other formulae)

Inventory – Parent, at book value ₱xx

Inventory – Subsidiary, at book value (30,000+150,000-166,500) 13,500

Undervaluation of Inventory xx

Amortization of Undervaluation of Inventory (xx)

Overvaluation of Inventory (xx)

Amortization of Undervaluation of Inventory xx

UPEI (Ending inventory of 13,500/150% x 50% 4,500

Consolidated Inventory ₱9,000

Problem 193, ibid.

During 2012, Pard Corp. sold goods to its 80% owned subsidiary, Seed Corp. At December 31, 2012, ½ of these goods were

included in Seed’s ending inventory. Reported 2012 selling expenses were 1,100,000 and 400,000 for Pard and Seed,

respectively. Pard’s selling expenses included 50,000 in freight-out costs for goods sold to Seed. What amount of selling expenses

should be reported in the consolidated financial statements?

a. 1,500,000 b. 1,480,000

c. 1,475,000 d. 1,450,000

Solution (other formulae)

Expenses – Parent ₱1,100,000

Expenses – Subsidiary 400,000

Amortization of UVA xx

Amortization of OVA (xx)

Realized Loss – Depreciation xx

Realized Gain – Depreciation (xx)

Inventoriable cost (not to be included as expense) (50,000)

Consolidated Expense ₱1,450,000

Good luck and God bless sa exams niyo! Sorry this came super late. Alam niyo naman, busy 7 days a week.

Patrick Louie E. Reyes, CPA http://bit.ly/afarconso Page 16 of 16

You might also like

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- In y Ter CompanyDocument6 pagesIn y Ter CompanyEllenNo ratings yet

- Inventory Part2Document13 pagesInventory Part2Elai grace Fernandez100% (3)

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- Consolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedDocument11 pagesConsolidation Objectives: PAS 27 Objective of Setting The Standard To Be AppliedAdam SmithNo ratings yet

- Quiz No. 5 Answer KeyDocument8 pagesQuiz No. 5 Answer KeyHalsey Shih Tzu100% (1)

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- Multiple Choice QuestionsDocument8 pagesMultiple Choice QuestionsNicole Lin100% (1)

- Midterm Exam-Advacctgii 2Nd Sem 2011-2012Document18 pagesMidterm Exam-Advacctgii 2Nd Sem 2011-2012Allie LinNo ratings yet

- Business Combination and Consolidation On Acquisition Date (Summary)Document6 pagesBusiness Combination and Consolidation On Acquisition Date (Summary)Ma Hadassa O. Foliente33% (3)

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- Advac Solmal Chapter 13Document16 pagesAdvac Solmal Chapter 13john paul100% (1)

- CH 02Document24 pagesCH 02Dima100% (2)

- Business CombinationDocument10 pagesBusiness CombinationLora Mae JuanitoNo ratings yet

- Ch4 Test BankDocument70 pagesCh4 Test Bank斌王No ratings yet

- Chaptersin BUSINESS COMBDocument29 pagesChaptersin BUSINESS COMBalmira garcia100% (1)

- CH 06Document23 pagesCH 06Ahmed Al EkamNo ratings yet

- Quiz 7 Solutions Installment and Cost Recovery MethodsDocument9 pagesQuiz 7 Solutions Installment and Cost Recovery MethodsTricia Mae Fernandez100% (2)

- Illustration: Business Combination Achieved in StagesDocument26 pagesIllustration: Business Combination Achieved in StagesArlene Diane Orozco100% (1)

- AFAR - BC TwoDocument3 pagesAFAR - BC TwoJoanna Rose DeciarNo ratings yet

- Business Com Chapter 23Document5 pagesBusiness Com Chapter 23Nino Joycelee TuboNo ratings yet

- Intercompany Sales - Inventories ProblemsDocument13 pagesIntercompany Sales - Inventories ProblemsMhelka Tiodianco100% (2)

- Consolidated Financial Statements ActivityDocument9 pagesConsolidated Financial Statements ActivityJESSA ANN A. TALABOC100% (3)

- CPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFDocument6 pagesCPAR - P2 - 7406 - Business Combination at Date of Acquisition With Answer PDFAngelo Villadores100% (4)

- Accounting for Business CombinationsDocument4 pagesAccounting for Business CombinationsAbraham Chin67% (3)

- Intercompany Sale of Depreciable AssetsDocument2 pagesIntercompany Sale of Depreciable AssetsTriechia LaudNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- MC 789Document59 pagesMC 789Minh Nguyễn83% (6)

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Chapter 16Document27 pagesChapter 16Red Christian Palustre100% (1)

- Prelim Quiz 001 - Joint Arrangements: Contributions Profit andDocument3 pagesPrelim Quiz 001 - Joint Arrangements: Contributions Profit andJashim Usop100% (1)

- Test Bank MillanDocument55 pagesTest Bank MillanBusiness MatterNo ratings yet

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Final Examination ReviewDocument21 pagesFinal Examination ReviewToni Marquez100% (1)

- Week 4Document4 pagesWeek 4Mariadelaida Uribe De PlazaNo ratings yet

- Quiz Number 2 BuscombDocument12 pagesQuiz Number 2 BuscombRyan CapistranoNo ratings yet

- Home Office, Branch and Agency Accounting: Problem 11-1: True or FalseDocument13 pagesHome Office, Branch and Agency Accounting: Problem 11-1: True or FalseVenz Lacre100% (1)

- File: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple ChoiceDocument48 pagesFile: Chapter 04 - Consolidated Financial Statements and Outside Ownership Multiple Choicejana ayoubNo ratings yet

- Arroyo - HW in Advacc 2 C14 Business CombinationsDocument4 pagesArroyo - HW in Advacc 2 C14 Business CombinationsAnjj Arroyo100% (1)

- Business Combination - Statutory MergerDocument7 pagesBusiness Combination - Statutory Mergerma.soledad san diegoNo ratings yet

- 08 Business CombinationDocument9 pages08 Business CombinationtrishaNo ratings yet

- Accounting for Derivatives and Hedging Multiple ChoiceDocument36 pagesAccounting for Derivatives and Hedging Multiple ChoicePutmehudgJasdNo ratings yet

- Chapter 18Document16 pagesChapter 18Christian Blanza LlevaNo ratings yet

- ABC Co. Acquisition of XYZ Inc FinancialsDocument3 pagesABC Co. Acquisition of XYZ Inc Financialsmhar lon100% (2)

- 2nd Exam 2021 With AnswerDocument10 pages2nd Exam 2021 With Answergeraldine martinezNo ratings yet

- Sample partnership liquidation problemsDocument3 pagesSample partnership liquidation problemsJay Bee SalvadorNo ratings yet

- Buscom Quiz 2 MidtermDocument2 pagesBuscom Quiz 2 MidtermRafael Capunpon VallejosNo ratings yet

- Consolidated FS - QUIZ PART 3Document4 pagesConsolidated FS - QUIZ PART 3Christine Jane Ramos100% (1)

- Handouts ConsolidationComprehensive ExercisesDocument11 pagesHandouts ConsolidationComprehensive ExercisesAD ArconNo ratings yet

- Badvac1x - Mod 3 TemplatesDocument42 pagesBadvac1x - Mod 3 TemplatesKyla de SilvaNo ratings yet

- Valle Quiz AbcDocument6 pagesValle Quiz Abclorie anne valle100% (2)

- Consolidated Financial Statement ExerciseDocument4 pagesConsolidated Financial Statement ExerciseAnonymous OzWtUONo ratings yet

- 13 Consolidated Financial StatementDocument5 pages13 Consolidated Financial StatementabcdefgNo ratings yet

- Consolidated Financial StatementsDocument27 pagesConsolidated Financial StatementsAlyssa CasimiroNo ratings yet

- Consolidated statement of comprehensive incomeDocument11 pagesConsolidated statement of comprehensive incomeAli OptimisticNo ratings yet

- Intercompany Fixed AssetsDocument5 pagesIntercompany Fixed Assetstungoldonette3No ratings yet

- Working Paper EntriesDocument2 pagesWorking Paper EntriesRixer PrietoNo ratings yet

- Vertical Income Statement TemplateDocument2 pagesVertical Income Statement TemplateForam VasaniNo ratings yet

- Business Finance: Session 3: Financial StatementsDocument45 pagesBusiness Finance: Session 3: Financial StatementsXia AlliaNo ratings yet

- Conso FS Subsequent To Date of AcquisitionDocument5 pagesConso FS Subsequent To Date of Acquisitionguliramsam5No ratings yet

- Second DegreeDocument1 pageSecond DegreeJesary Marc ArnosaNo ratings yet

- Iaccess Brochure PDFDocument4 pagesIaccess Brochure PDFKarlo Jude AcideraNo ratings yet

- Civil Law Obligations and Contracts Memory AidDocument24 pagesCivil Law Obligations and Contracts Memory AidKarinaYapNo ratings yet

- Exponent Rules & Practice PDFDocument2 pagesExponent Rules & Practice PDFKarlo Jude AcideraNo ratings yet

- Obligations and Contracts: Atty. Bathan-Lasco Sample ProblemsDocument26 pagesObligations and Contracts: Atty. Bathan-Lasco Sample ProblemsKarlo Jude AcideraNo ratings yet

- Civil Law Obligations and Contracts Memory AidDocument24 pagesCivil Law Obligations and Contracts Memory AidKarinaYapNo ratings yet

- LANDBANK Iaccess FAQs PDFDocument16 pagesLANDBANK Iaccess FAQs PDFYsabella May Sarthou CervantesNo ratings yet

- Forex & DerivativesDocument11 pagesForex & DerivativesAries Gonzales CaraganNo ratings yet

- Iaccess Brochure PDFDocument4 pagesIaccess Brochure PDFKarlo Jude AcideraNo ratings yet

- Forex & DerivativesDocument6 pagesForex & Derivativessarahbee100% (1)

- Second DegreeDocument1 pageSecond DegreeJesary Marc ArnosaNo ratings yet

- Digest RR 13-2018Document9 pagesDigest RR 13-2018Maria Rose Ann BacilloteNo ratings yet

- Membership Application FormDocument1 pageMembership Application FormKarlo Jude AcideraNo ratings yet

- #02 Conceptual FrameworkDocument5 pages#02 Conceptual FrameworkZaaavnn VannnnnNo ratings yet

- LANDBANK Iaccess FAQs PDFDocument16 pagesLANDBANK Iaccess FAQs PDFYsabella May Sarthou CervantesNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Iaccess Brochure PDFDocument4 pagesIaccess Brochure PDFKarlo Jude AcideraNo ratings yet

- COA Internship Weekly ReportDocument2 pagesCOA Internship Weekly ReportKarlo Jude AcideraNo ratings yet

- CS Form NoDocument1 pageCS Form NoKarlo Jude AcideraNo ratings yet

- Exponent Rules & Practice PDFDocument2 pagesExponent Rules & Practice PDFKarlo Jude AcideraNo ratings yet

- Practicum Report: Commission On Audit Ro2Document1 pagePracticum Report: Commission On Audit Ro2Karlo Jude AcideraNo ratings yet

- Irba Faq On NoclarDocument17 pagesIrba Faq On NoclarKarlo Jude AcideraNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Ngas & NposDocument1 pageNgas & NposKarlo Jude AcideraNo ratings yet

- #07 PAS 34 (Interim Reporting)Document2 pages#07 PAS 34 (Interim Reporting)Zaaavnn VannnnnNo ratings yet

- Ngas & NposDocument7 pagesNgas & NposRenalyn MadeloNo ratings yet

- NOCLAR FAQs for SAICA MembersDocument17 pagesNOCLAR FAQs for SAICA MembersKarlo Jude AcideraNo ratings yet

- Table 2 ResearchDocument4 pagesTable 2 ResearchKarlo Jude AcideraNo ratings yet

- Business Combi and Conso HandoutDocument16 pagesBusiness Combi and Conso HandoutKarlo Jude Acidera100% (2)

- Business PlanDocument13 pagesBusiness PlanShilpaNo ratings yet

- Nature & Significance of ManagementDocument49 pagesNature & Significance of ManagementPalak Gupta100% (2)

- Project ControllingDocument39 pagesProject ControllingSamuel Richard0% (1)

- Unit - 3: Service MarketingDocument19 pagesUnit - 3: Service MarketingcharangowdaNo ratings yet

- Oblicon 12 - Contracts CH 2 Notes PDFDocument7 pagesOblicon 12 - Contracts CH 2 Notes PDFJoy LuNo ratings yet

- Common Mistakes of Students To Financial Activities: FL - Erudition Free Webinar by Abm 12Document38 pagesCommon Mistakes of Students To Financial Activities: FL - Erudition Free Webinar by Abm 12Larisha Frixie M. DanlagNo ratings yet

- CH 35Document5 pagesCH 35Vishal GoyalNo ratings yet

- KC Services Provides Landscaping Services in Edison Kate Chen TheDocument1 pageKC Services Provides Landscaping Services in Edison Kate Chen TheAmit PandeyNo ratings yet

- Risk Based ThinkingDocument10 pagesRisk Based Thinkingnorlie0% (1)

- Payslip:: Petrofac International LTDDocument1 pagePayslip:: Petrofac International LTDRakesh PatelNo ratings yet

- Global Strategy Development and ImplementationDocument25 pagesGlobal Strategy Development and ImplementationVipul NimbolkarNo ratings yet

- Product Design FMEADocument1 pageProduct Design FMEAsbiasotoNo ratings yet

- Unit II Make or Buy DecisionDocument11 pagesUnit II Make or Buy Decisionbharath_skumarNo ratings yet

- Coke and Pepsi Case AnalysisDocument4 pagesCoke and Pepsi Case AnalysisKeeley Q JianNo ratings yet

- SAP SD Interview QuestionsDocument59 pagesSAP SD Interview QuestionsAbhishek MhaskeNo ratings yet

- Citi BankDocument40 pagesCiti BankZeeshan Mobeen100% (1)

- Corporate GovernanceDocument30 pagesCorporate GovernanceMehdi BouaniaNo ratings yet

- Econ Micro Canadian 1st Edition Mceachern Solutions ManualDocument13 pagesEcon Micro Canadian 1st Edition Mceachern Solutions ManualMrsJenniferCarsonjrcy100% (57)

- Greek Letters of FinanceDocument40 pagesGreek Letters of FinanceshahkrunaNo ratings yet

- PCI DSS v4 0 DESV FAQsDocument3 pagesPCI DSS v4 0 DESV FAQsjldtecnoNo ratings yet

- Ebay Order Baterias 9V - Edenorte-FusionadoDocument4 pagesEbay Order Baterias 9V - Edenorte-FusionadoYamilka MedranoNo ratings yet

- Ebook Cornerstones of Financial Accounting 4Th Edition Rich Test Bank Full Chapter PDFDocument55 pagesEbook Cornerstones of Financial Accounting 4Th Edition Rich Test Bank Full Chapter PDFfreyahypatias7j100% (9)

- Gazette Order Details 1995 Drugs PricesDocument26 pagesGazette Order Details 1995 Drugs PricesNaveenbabu SoundararajanNo ratings yet

- Chapter 2 MindMapDocument1 pageChapter 2 MindMapArslan Ahmad100% (1)

- CRM Unit 1 Question BankDocument5 pagesCRM Unit 1 Question BankshahulNo ratings yet

- 1.1 Power BI Adoption - What Is The Series AboutDocument13 pages1.1 Power BI Adoption - What Is The Series AboutChetan ParmarNo ratings yet

- CDP Mastery Test 1.1Document13 pagesCDP Mastery Test 1.1Asnifah AlinorNo ratings yet

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDocument12 pagesMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- The Organisational Context ContinuedDocument32 pagesThe Organisational Context ContinuedKerica HenryNo ratings yet

- Ferrell Hirt Ferrell: A Changing WorldDocument36 pagesFerrell Hirt Ferrell: A Changing WorldYogha IndraNo ratings yet