Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsTax Outline

Tax Outline

Uploaded by

Nick CunananCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Annex A. ChecklistDocument2 pagesAnnex A. ChecklistroseannurakNo ratings yet

- 2018 - 01 Chase Checking PDFDocument12 pages2018 - 01 Chase Checking PDFAtul PandeyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EMCEE Script in The District Arts Month CelebrationDocument3 pagesEMCEE Script in The District Arts Month CelebrationBENJ AMIN100% (7)

- IEIII - R4 - What Would You DoDocument6 pagesIEIII - R4 - What Would You DoAdrian TorresNo ratings yet

- DIN ISO 1940-1: Balance Quality Requirements For Rotors in A Constant (Rigid) StateDocument32 pagesDIN ISO 1940-1: Balance Quality Requirements For Rotors in A Constant (Rigid) StateWagner Carvalho100% (1)

- Motion For Leave To File DemurrerDocument6 pagesMotion For Leave To File DemurrerYanilyAnnVldzNo ratings yet

- Comment To The Formal Offer of EvidenceDocument3 pagesComment To The Formal Offer of EvidenceYanilyAnnVldzNo ratings yet

- Untitled 1dcnDocument4 pagesUntitled 1dcnYanilyAnnVldzNo ratings yet

- Demurrer To EvidenceDocument4 pagesDemurrer To EvidenceYanilyAnnVldzNo ratings yet

- Jaro VS CaDocument3 pagesJaro VS CaYanilyAnnVldzNo ratings yet

- Philippine Law JournalDocument17 pagesPhilippine Law JournalYanilyAnnVldzNo ratings yet

- Vital-Gozon vs. CADocument2 pagesVital-Gozon vs. CAYanilyAnnVldz100% (2)

- Scanned With CamscannerDocument10 pagesScanned With CamscannerYanilyAnnVldzNo ratings yet

- New Era University College of LawDocument1 pageNew Era University College of LawYanilyAnnVldzNo ratings yet

- Notes in Torts (Jurado, 2009)Document4 pagesNotes in Torts (Jurado, 2009)YanilyAnnVldzNo ratings yet

- Alaban vs. CADocument2 pagesAlaban vs. CAYanilyAnnVldzNo ratings yet

- PART II SyllabusDocument4 pagesPART II SyllabusYanilyAnnVldzNo ratings yet

- People Vs CalonzoDocument2 pagesPeople Vs CalonzoYanilyAnnVldzNo ratings yet

- Legprof DwightDocument14 pagesLegprof DwightYanilyAnnVldzNo ratings yet

- What Kind of Legal System Exists in The Philippines?Document3 pagesWhat Kind of Legal System Exists in The Philippines?YanilyAnnVldzNo ratings yet

- Ahd Hdcvi HdtviDocument3 pagesAhd Hdcvi Hdtvidzaki55No ratings yet

- Riset NZTE ReportDocument93 pagesRiset NZTE ReportRdy SimangunsongNo ratings yet

- VINOYA v. NLRCDocument3 pagesVINOYA v. NLRCninaNo ratings yet

- Report Planning NursingServiceDocument13 pagesReport Planning NursingServiceallanrnmanalotoNo ratings yet

- CH 5 - RecruitingDocument5 pagesCH 5 - RecruitingRyanda Kaisar Putra PratamaNo ratings yet

- Project Report: International School of Informatics and ManagementDocument46 pagesProject Report: International School of Informatics and Managementdeepakpatni11No ratings yet

- Pepsico Inc 2019 Annual Report PDFDocument162 pagesPepsico Inc 2019 Annual Report PDFGladValNo ratings yet

- Shakti Sadhan A: Vigneshwari DeviDocument4 pagesShakti Sadhan A: Vigneshwari DeviSachin SinghNo ratings yet

- Business Plan: Solarise Energy SolutionDocument12 pagesBusiness Plan: Solarise Energy SolutionMoiz QamarNo ratings yet

- Instant Download Solution Manual For Police Ethics 2nd Edition PDF ScribdDocument32 pagesInstant Download Solution Manual For Police Ethics 2nd Edition PDF ScribdJerry Williams100% (17)

- EGE 102 Course SyllabusDocument2 pagesEGE 102 Course SyllabusDave Matthew LibiranNo ratings yet

- The Meaning of Taghut - MIAWDocument9 pagesThe Meaning of Taghut - MIAWAYYAN KHANNo ratings yet

- Adam Williamson - Geometry Online Class Archive - Art of Islamic PatternDocument3 pagesAdam Williamson - Geometry Online Class Archive - Art of Islamic PatternChris SpragueNo ratings yet

- Hopeless PlacesDocument1,304 pagesHopeless Placesmoreblessingmarvellous659No ratings yet

- Test 15 1-10-: Vocabulary / Test 15 (60 Adet Soru) Eskişehir YesdđlDocument5 pagesTest 15 1-10-: Vocabulary / Test 15 (60 Adet Soru) Eskişehir Yesdđlonur samet özdemirNo ratings yet

- Worksheet 1Document2 pagesWorksheet 1Smoked PeanutNo ratings yet

- Victoria M. Walker: Digital Travel ReporterDocument1 pageVictoria M. Walker: Digital Travel ReporterVictoria M. WalkerNo ratings yet

- Euro CodesDocument4 pagesEuro CodesKrishna KumarNo ratings yet

- Safety PlanDocument5 pagesSafety PlankannankrivNo ratings yet

- Law of DemandDocument20 pagesLaw of Demandaman27jaiswalNo ratings yet

- Factories Act - PresentationDocument6 pagesFactories Act - PresentationAyesha KhanNo ratings yet

- T-Mobile Strategic Analysis (Ca. 2006)Document57 pagesT-Mobile Strategic Analysis (Ca. 2006)Apostolos Koutropoulos50% (2)

- Quality Orientation GuideDocument25 pagesQuality Orientation Guidethu duongNo ratings yet

- HR 4Th Edition Denisi Solutions Manual Full Chapter PDFDocument27 pagesHR 4Th Edition Denisi Solutions Manual Full Chapter PDFjoy.brown211100% (18)

- GCAS02 Ethics MidtermAct2 Sahagun, NinaSamanthaCDocument1 pageGCAS02 Ethics MidtermAct2 Sahagun, NinaSamanthaCSamantha SahagunNo ratings yet

Tax Outline

Tax Outline

Uploaded by

Nick Cunanan0 ratings0% found this document useful (0 votes)

7 views11 pagesOriginal Title

Tax Outline.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views11 pagesTax Outline

Tax Outline

Uploaded by

Nick CunananCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 11

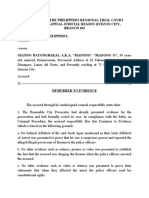

Syllabus

TAXATION 1

New Era University, College of Law

Professor Loverhette Jeffrey P. Villordon

I. General Principles of Taxation

A. Definition and concept of taxation

Paseo Realty & Development Corporation vs. Court of Appeals, G.R. No. 119286, 13 Oct.

2004

B. Nature of taxation

Mactan Cebu International Airport Authority vs. Marcos, 261 SCRA 667 (1996)

Pepsi-Cola Bottling Company of the Phil. vs. Mun. of Tanauan, Leyte, 69 SCRA 460 (1976)

Roxas y Cia vs. CTA, 23 SCRA 276 (1968)

C. Characteristics of taxation

Sunio vs. National Labor Relations Commission, 127 SCRA 390 (1984)

D. Power of taxation compared with other powers

1. Police power

Planters Products, Inc. vs. Fertiphil Corporation, G.R. No. 166006 ,14 March 2008

2. Power of eminent domain

Francia Intermediate Appellate Court, G.R. No. 76749, 28 June 1988

Domingo vs. Carlitos, G.R. No. L-18994, 29 June 1963

E. Purpose of taxation

1. Revenue-raising

2. Non-revenue/special or regulatory

Philippine Airlines vs. Edu, G.R. No. L- 41383, 15 August 1988

National Power Corporation vs. City of Cabanatuan, G.R. No. 149110, 09 April 2003

F. Principles of sound tax system

1. Fiscal adequacy

2. Administrative feasibility

3. Theoretical justice

G. Theory and basis of taxation

1. Lifeblood theory

CIR vs. Algue, Inc., et al., 158 SCRA 9 (1988)

Talento vs. Escalda, Jr., G.R. No. 180884, 27 June 2008

2. Necessity theory

Phil. Guaranty Co., Inc. v. CIR, G.R. No. L-22074, 30 April 1965

3. Benefits-protection theory (Symbiotic relationship)

4. Jurisdiction over subject and objects

H. Doctrines in taxation

1. Prospectivity of tax laws

2. Imprescriptibility

3. Double taxation

a) Strict sense

Villanueva vs. City of Iloilo, 26 SCRA 578 (1968)

b) Broad sense

San Miguel Brewery vs. City of Cebu, 43 SCRA 275 (1972)

CIR vs. Bank of Commerce, GR. No. 149636, 08 June 2005

c) Constitutionality of double taxation

d) Modes of eliminating double taxation

CIR vs. Procter & Gamble, G.R. No. 66838, 02 Dec. 1991

CIR vs. SC Johnson and Son, Inc. et al., G.R No. 127105, 25 June 1999

4. Escape from taxation

a) Shifting of tax burden

(i) Ways of shifting the tax burden

(ii) Taxes that can be shifted

(iii) Meaning of impact and incidence of taxation

b) Tax avoidance

Delpher Trades Corp. vs. IAC, 157 SCRA 349 (1988)

c) Tax evasion

CIR vs. Estate of Benigno P. Toda, Jr., G.R. No. 147188, 14 Sept. 2004

5. Exemption from taxation

a) Meaning of exemption from taxation

b) Nature of tax exemption

Manila Electric Company vs. Vera, 67 SCRA 351 (1975)

Rodriguez vs. Collector, G.R. No. L-23041, 31 July 1969

c) Kinds of tax exemption

(i) Express

(ii) Implied

CIR vs. PLDT, G.R. No. 140230, 15 December 2005

(iii) Contractual

Prov. of Misamis Oriental vs. Cagayan Electric Power and Light

Co. Inc., G.R. No. L-45355, 12 January 1990

d) Rationale/grounds for exemption

e) Revocation of tax exemption

6. Compensation and set-off

7. Compromise

Valera vs. Office of the Ombudsman, G.R. No. 167278, 27 February 2008

8. Tax amnesty

a) Definition

Commissioner of Internal Revenue vs. Marubeni Corporation, G.R. No.

137377, 18 December 2001

b) Distinguished from tax exemption

9. Construction and interpretation of:

a) Tax laws

(i) General rule

(ii) Exception

b) Tax exemption and exclusion

(i) General rule

(ii) Exception

c) Tax rules and regulations

Philippine Bank of Communications vs. CIR, G.R. No. 112024, 28 January

1999

CIR vs. Petron Corporation, G. R. No. 185568, 21 March 2012

d) Penal provisions of tax laws

e) Non-retroactive application to taxpayers

I. Scope and limitation of taxation

1. Inherent limitations

a) Public purpose

Bagatsing vs. Ramirez, G.R. No. L-41631, 17 December 1976

Gaston vs. Republic Planters Bank, G.R. No. L-77194, 15 March 1988

b) Inherently legislative

(i) General rule

(ii) Exceptions

(a) Delegation to local governments

(b) Delegation to the President

Southern Cross Cement Corporation vs. Philippine Cement

Manufacturers Corporation, G.R. No. 158540, 08 July 2004

(c) Delegation to administrative agencies

CIR vs. Fortune Tobacco Corporation, G.R. Nos. 167274-75,

21 July 2008

c) Territorial (Situs of taxation)

(i) Meaning

Manila Electric Company vs. Yatco, G.R. No. 45697, 01 November

1939

Philippine Guaranty Company vs. CIR, G.R. No. L-22074, 30 April

1965

(ii) Situs of income tax

(a) From sources within the Philippines

(b) From sources without the Philippines

(c) Income partly within and partly without the Philippines

(iii) Situs of property taxes

(a) Taxes on real property

(b) Taxes on personal property

(iv) Situs of excise tax

(a) Estate tax

(b) Donor’s tax

(v) Situs of business tax

(a) Sale of real property

(b) Sale of personal property

(c) Value-Added Tax (VAT)

d) International comity

e) Exemption of government entities, agencies, and instrumentalities

2. Constitutional limitations

a) Provisions directly affecting taxation

(i) Prohibition against imprisonment for non-payment of poll tax

(ii) Uniformity and equality of taxation

Pepsi-Cola Bottling Co. of the Philippines, Inc. vs. City of Butuan,

24 SCRA 789 (1968)

Reyes vs. Almanzor, G.R. Nos. L-49839-46,26 April 1991

(iii) Grant by Congress of authority to the president to impose tariff rates

(iv) Prohibition against taxation of religious, charitable entities, and

educational entities

Commissioner of Internal Revenue vs. Court of Appeals, G.R. No.

L-124043, 14 Oct. 1998

Lung Center of the Philippines vs. Quezon City, 433 SCRA 119

(2004)

(v) Prohibition against taxation of non-stock, non-profit institutions

CIR vs. St. Luke's Medical Center, G.R. No. 195909, 26 September

2012

(vi) Majority vote of Congress for grant of tax exemption

John Hay Peoples Alternative Coalition et al. vs. Lim, G.R. No.

119775, 24 October 2003

(vii) Prohibition on use of tax levied for special purpose

(viii) President’s veto power on appropriation, revenue, tariff bills

(ix) Non-impairment of jurisdiction of the Supreme Court

(x) Grant of power to the local government units to create its own sources of

revenue

(xi) Flexible tariff clause

(xii) Exemption from real property taxes

(xiii) No appropriation or use of public money for religious purposes

b) Provisions indirectly affecting taxation

(i) Due process

Sison, Jr. vs. Ancheta, 130 SCRA 654 (1984)

(ii) Equal protection

Tiu vs. Court of Appeals, 301 SCRA 278 (1999)

(iii) Religious freedom

(iv) Non-impairment of obligations of contracts

Cagayan Electric Power and Light Co. Inc. vs. Commissioner, G.R.

No. L-60126, 25 Sept. 1985

J. Stages of taxation

1. Levy

2. Assessment and collection

3. Payment

4. Refund

Philex Mining Corporation vs. CIR, G.R. No. 125704, 28 August 1998

State Land Investment Corporation vs. Commissioner of Internal Revenue, G.R.

No. 171956, 18 January 2008

K. Definition, nature, and characteristics of taxes

L. Requisites of a valid tax

M. Tax as distinguished from other forms of exactions

1. Tariff

2. Toll

3. License fee

4. Special assessment

5. Debt

N. Kinds of taxes

1. As to object

a) Personal, capitation, or poll tax

b) Property tax

c) Privilege tax

2. As to burden or incidence

a) Direct

b) Indirect

3. As to tax rates

a) Specific

b) Ad valorem

c) Mixed

4. As to purposes

a) General or fiscal

b) Special, regulatory, or sumptuary

5. As to scope or authority to impose

a) National – internal revenue taxes

b) Local – real property tax, municipal tax

6. As to graduation

a) Progressive

b) Regressive

c) Proportionate

II. Income taxation

A. Income tax systems

1. Global tax system

Mercury Drug Corporation vs. CIR, G.R. No. 164050, 20 July 2011

2. Schedular tax system

3. Semi-schedular or semi-global tax system

B. Features of the Philippine income tax law

1. Direct tax

2. Progressive

3. Comprehensive

4. Semi-schedular or semi-global tax system

C. Criteria in imposing Philippine income tax

1. Citizenship principle

2. Residence principle

Garrison vs. CA and Republic, G.R. Nos. L-44501-05, 19 July 1990

3. Source principle

D. Taxable period

1. Calendar period

2. Fiscal period

3. Short period

E. Kinds of taxpayers

1. Individual taxpayers

a. Citizens

i. Resident citizens

ii. Non-resident citizens

b. Aliens

i. Resident aliens

ii. Non-resident aliens

a) Engaged in trade or business

b) Not engaged in trade or business

c. Special class of individual employees (i.e. Minimum wage earner)

2. Corporations

a. Domestic corporations

b. Foreign corporations

i. Resident foreign corporations

Marubeni vs. Commissioner, G.R. No. 76573, 14 September 1989

ii. Non-resident foreign corporations

Commissioner vs. British Overseas Airways Corporation, G.R. No.

L-65773-74, 30 April 1987

(cf. South African Airways v. Commissioner of Internal Revenue, 626 Phil. 566,

574–575 (2010), and Air Canada v. CIR, G.R. no. 169507, 11 January 2016)

c. Joint venture and consortium

3. Partnerships

Pascual vs. Commissioner, G.R. No. 78133, 18 October 1988

4. General professional partnerships

Tan vs. Del Rosario, G.R. No. 109289, 03 October 1994

5. Estates and trusts

6. Co-ownerships

Oña vs. Commissioner, G.R. No. L-19342, 25 May 1972

F. Income taxation

1. Definition

2. Nature

3. General principles

G. Income

1. Definition (cf. Capital)

Madrigal vs. Rafferty, G.R. No. L-12287, 07 August 1918

2. Nature

3. When income is taxable

a. Existence of income

b. Realization of income

i. Tests of realization

ii. Actual vis-à-vis constructive receipt

c. Recognition of income

4. Tests in determining whether income is earned for tax purposes

a. Realization test

Fisher vs. Trinidad, G.R. No. L-17518, 30 October 1922

b. Claim of right doctrine or doctrine of ownership, command, or control

Commissioner vs. Javier, G.R. No. 78953, 31 July 1991

c. Economic benefit test, doctrine of proprietary interest

d. Severance test

e. All events test

CIR v. Isabel Cultural Corporation, G.R. No. 172231, 12 February 2007

H. Gross income

1. Definition

2. Concept of income from whatever source derived

3. Gross income vis-à-vis net income vis-à-vis taxable income

4. Classification of income as to source

a. Gross income and taxable income from sources within the Philippines

b. Gross income and taxable income from sources without the Philippines

c. Income partly within or partly without the Philippines

5. Sources of income subject to tax

a. Compensation income

First Lepanto Taisho Insurance Corporation vs. CIR, G.R. No. 197117, 10

April 2013

Baier-Nickel vs. Commissioner, G.R. No. 153793, 29 August 2006

Nitafan vs. Commissioner, G.R. No. 78780, 23 July 1987

b. Fringe benefits

i. Special treatment of fringe benefits

ii. Definition

iii. Taxable and non-taxable fringe benefits

Henderson vs. Collector, G.R. No. G.R. No. L-12954, 28 February

1961

c. Professional income

d. Income from business

e. Income from dealings in property

i. Types of properties

a) Ordinary assets

b) Capital assets

ii. Types of gains from dealings in property

a) Ordinary income vis-à-vis capital gain

b) Actual gain vis-à-vis presumed gain

c) Long term capital gain vis-à-vis short-term capital gain

d) Net capital gain, net capital loss

Compagnie Financiere Sucres et Denrees vs. Commissioner,

G.R. No. 133834, 28 August 2006

e) Income tax treatment of capital loss

i) Capital loss limitation rule (applicable to both corporations

and individuals)

ii) Net loss carry-over rule (applicable only to individuals)

f) Dealings in real property situated in the Philippines

g) Dealings in shares of stock of Philippine corporations

i) Shares listed and traded in the stock exchange

ii) Shares not listed and traded in the stock exchange

h) Sale of principal residence

f. Passive investment income

i. Interest income

Commissioner vs. GCL Retirement Plan, G.R. No. 95022, 23 March

1992

ii. Dividend income

Commissioner vs. Wander Philippines Inc., G.R. No. L-68375, 15 April

1988

a) Cash dividend

b) Stock dividend

Commissioner vs. A. Soriano Corporation, G.R. No. 108576, 20

January 1999

c) Property dividend

d) Liquidating dividend

iii. Royalty income

iv. Rental income

a) Lease of personal property

b) Lease of real property

v. Unreported Increase in Net Worth

Commissioner vs. Fernandez Hermanos, Inc., G.R. Nos. L-21551

and L-21557, 30 September 1969

g. Annuities, proceeds from life insurance or other types of insurance

El Oriente Fabrica De Tabacos, Inc. vs. Posadas, G.R. No. 34774, 21

September 1931

h. Prizes and awards

i. Pensions, retirement benefit, terminal leave pay or separation pay

Commissioner vs. Castaneda, G.R. No. 96016, 17 October 1991

j. Income from any source whatever

i. Forgiveness of indebtedness

ii. Recovery of accounts previously written-off – when taxable/when not taxable

iii. Receipt of tax refunds or credit

iv. Source rules in determining income from within and without

a) Interests

NDC vs. CIR, G.R. No. L-53961, 30 June 1987

b) Dividends

c) Services

d) Rentals

e) Royalties

f) Sale of real property

g) Sale of personal property

h) Shares of stock of domestic corporation

6. Situs of income taxation

7. Exclusions from gross income

a. Rationale for the exclusions

Commissioner vs. Mitsubishi Metal Corporation, G.R. No. L-54908, 22 January

1990

b. Taxpayers who may avail of the exclusions

c. Exclusions distinguished from deductions and tax credit

d. Under the Constitution, i.e. Income derived by the government or its political

subdivisions from the exercise of any essential governmental function

e. Under the Tax Code

i. Proceeds of life insurance policies

ii. Return of premium paid

iii. Amounts received under life insurance, endowment or annuity contracts

iv. Value of property acquired by gift, bequest, devise or descent

Pirovano vs. Commissioner, G.R. No. L-19865, 31 July 1965

v. Amount received through accident or health insurance

vi. Income exempt under tax treaty

vii. Retirement benefits, pensions, gratuities, etc.

viii. Winnings, prizes, and awards, including those in sports competition

f. Under special laws (i.e. Personal Equity and Retirement Account)

Dumaguete Cathedral Credit Cooperative vs. CIR, G.R. No. 182722, 22 January

2010

8. Deductions from gross income

a. General rules

i. Deductions must be paid or incurred in connection with the taxpayer’s trade,

business or profession.

ii. Deductions must be supported by adequate receipts or invoices (except

standard deduction)

Consolidated Mines, Inc. vs. Court of Tax Appeals, G.R. No. L-

18843 and L-18844, 29 August 1974

iii. Additional requirement relating to withholding. Reasonableness of deductions

Commissioner vs. Arnoldus Carpentry Shop, Inc., G.R. No. 71122, 25

March 1988

C. M. Hoskins & Co., Inc. vs. Commissioner, G.R. No. L-24059, 28

November 1969

b. Return of capital (cost of sales or services)

i. Sale of inventory of goods by manufacturers and dealers of properties

ii. Sale of stock in trade by a real estate dealer and dealer in securities

iii. Sale of services

c. Itemized deductions

i. Expenses

a) Requisites for deductibility

i) Nature: ordinary and necessary

Commissioner vs. General Foods Phils. Inc., G.R.

No. 143672, 24 April 2003

ii) Paid and incurred during taxable year

b) Salaries, wages and other forms of compensation for personal

services actually rendered, including the grossed-up monetary value of

the fringe benefit subjected to fringe benefit tax which tax should have

been paid

c) Travelling/transportation expenses

d) Cost of materials

e) Rentals and/or other payments for use or possession of property

f) Repairs and maintenance

g) Expenses under lease agreements

h) Expenses for professionals

i) Entertainment/Representation expenses

j) Political campaign expenses

k) Training expenses

ii. Interest

a) Requisites for deductibility

b) Non-deductible interest expense

c) Interest subject to special rules

i) Interest paid in advance

ii) Interest periodically amortized

iii) Interest expense incurred to acquire property for use in

trade/business/profession

iv) Reduction of interest expense/interest arbitrage

iii. Taxes

a) Requisites for deductibility

Commissioner vs. Palanca, G.R. No. L-16626, 29 October

1966

b) Non-deductible taxes

c) Treatments of surcharges/interests/fines for delinquency

d) Treatment of special assessment

e) Tax credit vis-à-vis deduction

iv. Losses

a) Requisites for deductibility

Plaridel Surety And Insurance Company vs. Commissioner,

G.R. No. L-21520, 11 December 1967

b) Other types of losses

i) Capital losses

ii) Securities becoming worthless

iii) Losses on wash sales of stocks or securities

iv) Wagering losses

v) Net Operating Loss Carry-Over (NOLCO)

v. Bad debts

a) Requisites for deductibility

Collector vs. Good Rich International Rubber Co., G.R. No.

L-22265, 22 December 1967

b) Effect of recovery of bad debts

vi. Depreciation

a) Requisites for deductibility

Basilan Estates Inc. vs. Collector, G.R. No. L-22492, 05

September 1967

b) Methods of computing depreciation allowance

i) Straight-line method

ii) Declining-balance method

iii) Sum-of-the-years-digit method

vii. Charitable and other contributions

a) Requisites for deductibility

b) Amount that may be deducted

viii. Contributions to pension trusts

Roxas vs. CTA and Commissioner, G.R. No. L-25043,26 April 1968

d. Optional standard deduction

i. Individuals, except non-resident aliens

ii. Corporations, except non-resident foreign corporations

iii. Partnerships

e. Personal and additional exemption (R.A. No. 9504, Minimum Wage Earner Law)

i. Basic personal exemptions

ii. Additional exemptions for taxpayer with dependents

iii. Status-at-the-end-of-the-year rule

iv. Exemptions claimed by non-resident aliens

f. Items not deductible

i. General rules

ii. Personal, living or family expenses

iii. Amount paid for new buildings or for permanent improvements (capital

expenditures)

iv. Amount expended in restoring property (major repairs)

v. Premiums paid on life insurance policy covering life or any other officer or

employee financially interested

vi. Interest expense, bad debts, and losses from sales of property between

related parties

vii. Losses from sales or exchange or property

viii. Non-deductible interest

ix. Non–deductible taxes

x. Non-deductible losses

xi. Losses from wash sales of stock or securities

g. Exempt corporations

i. Propriety educational institutions and hospitals

ii. Government-owned or controlled corporations

iii. Others

I. Taxation of resident citizens, non-resident citizens, and resident aliens

1. General rule that resident citizens are taxable on income from all sources within and without

the Philippines vs. Treatment of Non-resident citizens

2. Taxation on compensation income

a. Inclusions

i. Monetary compensation

a) Regular salary/wage

b) Separation pay/retirement benefit not otherwise exempt

c) Bonuses, 13th month pay, and other benefits not exempt

d) Director’s fees

ii. Non-monetary compensation (Fringe benefit not subject to tax)

b. Exclusions

i. Fringe benefit subject to tax

ii. De minimis benefits

iii. 13th month pay and other benefits, and payments specifically excluded from

taxable compensation income

c. Deductions

i. Personal exemptions and additional exemptions

ii. Health and hospitalization insurance

iii. Taxation of compensation income of a minimum wage earner

a) Definition of statutory minimum wage

b) Definition of minimum wage earner

c) Income also subject to tax exemption: holiday pay, overtime pay,

night-shift differential, and hazard pay

3. Taxation of business income/income from practice of profession

4. Taxation of passive income

a. Passive income subject to final tax

i. Interest income

ii. Royalties

iii. Dividends from domestic corporations

iv. Prizes and other winnings

b. Passive income not subject to final tax

5. Taxation of capital gains

a. Income from sale of shares of stock of a Philippine corporation

i. Shares traded and listed in the stock exchange

ii. Shares not listed and traded in the stock exchange

b. Income from the sale of real property situated in the Philippines

c. Income from the sale, exchange, or other disposition of other capital assets

J. Taxation of non-resident aliens engaged in trade or business

1. General rules

2. Cash and/or property dividends

3. Capital gains

K. Individual taxpayers exempt from income tax

1. Senior citizens

2. Minimum wage earners

3. Exemptions granted under international agreements

L. Taxation of domestic corporations

1. Tax payable

a. Regular tax

b. Minimum Corporate Income Tax (MCIT)

i. Imposition of MCIT

ii. Carry forward of excess minimum tax

iii. Relief from the MCIT under certain conditions

iv. Corporations exempt from the MCIT

v. Applicability of the MCIT where a corporation is governed both under the

regular tax system and a special income tax system

CIR vs. Philippine Airlines, G.R. No. 179259, 25 September 2013

2. Allowable deductions

a. Itemized deductions

b. Optional standard deduction

3. Taxation of passive income

a. Passive income subject to tax

i. Interest from deposits and yield, or any other monetary benefit from deposit

substitutes and from trust funds and similar arrangements and royalties

ii. Capital gains from the sale of shares of stock not traded in the stock

exchange

iii. Income derived under the expanded foreign currency deposit system

iv. Inter-corporate dividends

v. Capital gains realized from the sale, exchange, or disposition of lands and/or

buildings

b. Passive income not subject to tax

4. Taxation of capital gains

a. Income from sale of shares of stock

b. Income from the sale of real property situated in the Philippines

c. Income from the sale, exchange, or other disposition of other capital assets

5. Tax on proprietary educational institutions and hospitals

6. Tax on government-owned or controlled corporations, agencies or instrumentalities

M. Taxation of resident foreign corporations

1. General rule

2. With respect to their income from sources within the Philippines

3. Minimum Corporate Income Tax

4. Tax on certain income

a. Interest from deposits and yield, or any other monetary benefit from deposit

substitutes, trust funds and similar arrangements and royalties

b. Income derived under the expanded foreign currency deposit system

c. Capital gains from sale of shares of stock not traded in the stock exchange

d. Inter-corporate dividends

N. Taxation of non-resident foreign corporations

1. General rule

2. Tax on certain income

a. Interest on foreign loans

b. Inter-corporate dividends

c. Capital gains from sale of shares of stock not traded in the stock exchange

O. Improperly accumulated earnings of corporations

Cyanamid Philippines, Inc. vs. Commissioner, G.R. No. 108067, 20 January 2000

P. Exemption from tax on corporations

Q. Taxation of partnerships

R. Taxation of general professional partnerships

S. Withholding tax

CIR vs. Asian Transmission Corporation, G.R. No. 179617, 19 January 2011

1. Concept

2. Kinds

a. Withholding of final tax on certain incomes

b. Withholding of creditable tax at source

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Annex A. ChecklistDocument2 pagesAnnex A. ChecklistroseannurakNo ratings yet

- 2018 - 01 Chase Checking PDFDocument12 pages2018 - 01 Chase Checking PDFAtul PandeyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- EMCEE Script in The District Arts Month CelebrationDocument3 pagesEMCEE Script in The District Arts Month CelebrationBENJ AMIN100% (7)

- IEIII - R4 - What Would You DoDocument6 pagesIEIII - R4 - What Would You DoAdrian TorresNo ratings yet

- DIN ISO 1940-1: Balance Quality Requirements For Rotors in A Constant (Rigid) StateDocument32 pagesDIN ISO 1940-1: Balance Quality Requirements For Rotors in A Constant (Rigid) StateWagner Carvalho100% (1)

- Motion For Leave To File DemurrerDocument6 pagesMotion For Leave To File DemurrerYanilyAnnVldzNo ratings yet

- Comment To The Formal Offer of EvidenceDocument3 pagesComment To The Formal Offer of EvidenceYanilyAnnVldzNo ratings yet

- Untitled 1dcnDocument4 pagesUntitled 1dcnYanilyAnnVldzNo ratings yet

- Demurrer To EvidenceDocument4 pagesDemurrer To EvidenceYanilyAnnVldzNo ratings yet

- Jaro VS CaDocument3 pagesJaro VS CaYanilyAnnVldzNo ratings yet

- Philippine Law JournalDocument17 pagesPhilippine Law JournalYanilyAnnVldzNo ratings yet

- Vital-Gozon vs. CADocument2 pagesVital-Gozon vs. CAYanilyAnnVldz100% (2)

- Scanned With CamscannerDocument10 pagesScanned With CamscannerYanilyAnnVldzNo ratings yet

- New Era University College of LawDocument1 pageNew Era University College of LawYanilyAnnVldzNo ratings yet

- Notes in Torts (Jurado, 2009)Document4 pagesNotes in Torts (Jurado, 2009)YanilyAnnVldzNo ratings yet

- Alaban vs. CADocument2 pagesAlaban vs. CAYanilyAnnVldzNo ratings yet

- PART II SyllabusDocument4 pagesPART II SyllabusYanilyAnnVldzNo ratings yet

- People Vs CalonzoDocument2 pagesPeople Vs CalonzoYanilyAnnVldzNo ratings yet

- Legprof DwightDocument14 pagesLegprof DwightYanilyAnnVldzNo ratings yet

- What Kind of Legal System Exists in The Philippines?Document3 pagesWhat Kind of Legal System Exists in The Philippines?YanilyAnnVldzNo ratings yet

- Ahd Hdcvi HdtviDocument3 pagesAhd Hdcvi Hdtvidzaki55No ratings yet

- Riset NZTE ReportDocument93 pagesRiset NZTE ReportRdy SimangunsongNo ratings yet

- VINOYA v. NLRCDocument3 pagesVINOYA v. NLRCninaNo ratings yet

- Report Planning NursingServiceDocument13 pagesReport Planning NursingServiceallanrnmanalotoNo ratings yet

- CH 5 - RecruitingDocument5 pagesCH 5 - RecruitingRyanda Kaisar Putra PratamaNo ratings yet

- Project Report: International School of Informatics and ManagementDocument46 pagesProject Report: International School of Informatics and Managementdeepakpatni11No ratings yet

- Pepsico Inc 2019 Annual Report PDFDocument162 pagesPepsico Inc 2019 Annual Report PDFGladValNo ratings yet

- Shakti Sadhan A: Vigneshwari DeviDocument4 pagesShakti Sadhan A: Vigneshwari DeviSachin SinghNo ratings yet

- Business Plan: Solarise Energy SolutionDocument12 pagesBusiness Plan: Solarise Energy SolutionMoiz QamarNo ratings yet

- Instant Download Solution Manual For Police Ethics 2nd Edition PDF ScribdDocument32 pagesInstant Download Solution Manual For Police Ethics 2nd Edition PDF ScribdJerry Williams100% (17)

- EGE 102 Course SyllabusDocument2 pagesEGE 102 Course SyllabusDave Matthew LibiranNo ratings yet

- The Meaning of Taghut - MIAWDocument9 pagesThe Meaning of Taghut - MIAWAYYAN KHANNo ratings yet

- Adam Williamson - Geometry Online Class Archive - Art of Islamic PatternDocument3 pagesAdam Williamson - Geometry Online Class Archive - Art of Islamic PatternChris SpragueNo ratings yet

- Hopeless PlacesDocument1,304 pagesHopeless Placesmoreblessingmarvellous659No ratings yet

- Test 15 1-10-: Vocabulary / Test 15 (60 Adet Soru) Eskişehir YesdđlDocument5 pagesTest 15 1-10-: Vocabulary / Test 15 (60 Adet Soru) Eskişehir Yesdđlonur samet özdemirNo ratings yet

- Worksheet 1Document2 pagesWorksheet 1Smoked PeanutNo ratings yet

- Victoria M. Walker: Digital Travel ReporterDocument1 pageVictoria M. Walker: Digital Travel ReporterVictoria M. WalkerNo ratings yet

- Euro CodesDocument4 pagesEuro CodesKrishna KumarNo ratings yet

- Safety PlanDocument5 pagesSafety PlankannankrivNo ratings yet

- Law of DemandDocument20 pagesLaw of Demandaman27jaiswalNo ratings yet

- Factories Act - PresentationDocument6 pagesFactories Act - PresentationAyesha KhanNo ratings yet

- T-Mobile Strategic Analysis (Ca. 2006)Document57 pagesT-Mobile Strategic Analysis (Ca. 2006)Apostolos Koutropoulos50% (2)

- Quality Orientation GuideDocument25 pagesQuality Orientation Guidethu duongNo ratings yet

- HR 4Th Edition Denisi Solutions Manual Full Chapter PDFDocument27 pagesHR 4Th Edition Denisi Solutions Manual Full Chapter PDFjoy.brown211100% (18)

- GCAS02 Ethics MidtermAct2 Sahagun, NinaSamanthaCDocument1 pageGCAS02 Ethics MidtermAct2 Sahagun, NinaSamanthaCSamantha SahagunNo ratings yet