Professional Documents

Culture Documents

Eco Financials PDF

Uploaded by

Adnan Kamal0 ratings0% found this document useful (0 votes)

14 views2 pagesOriginal Title

eco Financials.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesEco Financials PDF

Uploaded by

Adnan KamalCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

INTERNATIONAL ECONOMIC REVIEW.

‘Vol. 35, No. 1, February 1994

RELATIVE RISK AVERSION WITH ARROW-DEBREU SECURITIES*

By Dovcias W. Mirena!

‘This note considers a porfolio problem with a complete set of Arrow-Debren

securities, each of which pays @ positive return in only one state. It is shown

that an increase én the return to asset i in state j eauses an inerease (no change:

‘a decrease) in demand for asset iif and only if relative risk aversion evaluated

in state ‘is less than (equal to: greater than) unity. Demands forall other assets

change in the opposite direction.

This note demonstrates a fink between the level of relative risk aversion and

portfolio behavior in the context of a complete set of Arrow-Debreu securities. The

result complements those of Hadar and Seo (1990), who analyzed stochastically

dominating shifts of the return distribution of a stochastically independent asset in

a non-Arrow-Debreu context.

Theorem. Ler there he n states and n assets, such that asset i (i = Vy ++ m)

pays a return r; > 0 in state i and zero otherwise. Then an investor with initial

wealth Wo and with utility function U(W) defined over final wealth W, with U’ > 0

and U" < 0, will choose to increase (leave unchanged, decrease) the portfolio

fraction w; placed in asset i in response to an increase in r; if and only if rela

risk aversion evaluated at W= Wow)t; is less than (equal 10, greater than) one; the

portfolio fractions w; (for all j # i) will change in the opposite direction from that

of Wr.

PRoor, Let p, be the probability of state j (7 1). Utility conditional

on state j is UW) = U(Wow;r;). Denoting the Lagrange multiplier as A, the

Lagrangian is

(Dy L= & pUWow;r) +l — Dy

‘The first-order conditions are

(2a) PaU'(Wownrn) Wore

Oh bane

2b)

* Manuscript teesived Apt 1992: revised December 192.

"Lam grteful to Rom Balvers and two referes for helpfl comments

287

Copyright © 2001. All Rights Reseved.

258 DOUGLAS W. MITCHELL

Note that the second-order conditions are satisfied. Totally differentiating the

first-order conditions (and denoting U' and U" evaluated at WoWwar, as Uj, and U',

respectively) gives

(Ba) paU', Worgdwy = —p,U%Warnwydry ~ ppUiWodry + dA,

(3b) Dd dw, =6

mn

Solve Ga) for dw, sum over all A letting dr, = 0 for all + i, and use (3b} to obtain

dd = [rj hy + UN UD Wer] an] 8 PEA) Wo

1

Use (4) in the #th equation of (3a) solved for dw;, to obtain

(5) dwyldr; = (U1) "Ur, We — Ry)

xD pal (U5)

we

/e ping (U4) t

’

where R; = —(Wow;r UYU > 0 is the coefficient of relative risk aversion

evaluated at final wealth contingent on state i. Equation (5) shows that dw;/dr; >

0, = 0, or 1.

Using (4) in the jth equation of (3a) (j + #) with dr; = 0 yields

(UD Ur, WoO Rips 4 UD |

mm

Equation (5") shows that dw,/dr,(j = i) has the sign of (R; ~ 1). QED.

See Mitchell (1992) for a discussion of income and substitution effects in the case

of constant relative risk aversion.

West Virginia University, U.S.A

REFERENCES

Hapan, J. AND T. K. Se0, “The Effects of Shifts in a Return Distribution on Optimal Portfolies.”

International Economic Review 34 (1990), 721-136,

Mince, D. W., “An Argument for Relative Risk Aversion below Uni

University, March 1992,

working paper, West

Vi

_Copyright.©.2001 All Rights Reseyed. oe cnsnucranaranaanananannn

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Implied Volatility Formula of European Power Option Pricing: ( ) RespectivelyDocument8 pagesImplied Volatility Formula of European Power Option Pricing: ( ) RespectivelyAdnan KamalNo ratings yet

- Sustainable Green Banking: The Case of Greece: Angelos PapastergiouDocument12 pagesSustainable Green Banking: The Case of Greece: Angelos PapastergiouAdnan KamalNo ratings yet

- LepDocument2 pagesLepAdnan KamalNo ratings yet

- An Examination of The Maturity Effect in The Indian Commodities Futures MarketDocument8 pagesAn Examination of The Maturity Effect in The Indian Commodities Futures MarketAdnan KamalNo ratings yet

- SET50 Index Options: SET50 Index Options Is A Contract Written by A Seller That Conveys To The Buyer The RightDocument4 pagesSET50 Index Options: SET50 Index Options Is A Contract Written by A Seller That Conveys To The Buyer The RightAdnan KamalNo ratings yet

- Academic Program 20802 PDFDocument98 pagesAcademic Program 20802 PDFAdnan KamalNo ratings yet

- PH.D BA - Class Schedule 1-2018Document1 pagePH.D BA - Class Schedule 1-2018Adnan KamalNo ratings yet

- Bank Board Structure and Performance: Evidence For Large Bank Holding CompaniesDocument22 pagesBank Board Structure and Performance: Evidence For Large Bank Holding CompaniesAdnan KamalNo ratings yet

- Petition Form PDFDocument1 pagePetition Form PDFAdnan KamalNo ratings yet

- PH.D BA - Class Schedule 1-2018Document1 pagePH.D BA - Class Schedule 1-2018Adnan KamalNo ratings yet

- Registration Form For Semester 1-2018Document1 pageRegistration Form For Semester 1-2018Adnan KamalNo ratings yet

- Meyers Risk Aversion OptimizationDocument25 pagesMeyers Risk Aversion OptimizationAdnan KamalNo ratings yet

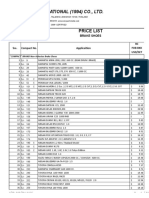

- Price Lists Bangladesh-Car PartsDocument28 pagesPrice Lists Bangladesh-Car PartsAdnan KamalNo ratings yet

- Wiley American Finance AssociationDocument40 pagesWiley American Finance AssociationAdnan KamalNo ratings yet

- Econometric SDocument38 pagesEconometric SAdnan KamalNo ratings yet

- Social Responsible Investment Instituational Aspects Performance and Investor BehaviourDocument9 pagesSocial Responsible Investment Instituational Aspects Performance and Investor BehaviourAdnan KamalNo ratings yet

- Stock Market Liberazation and Economic ReformDocument7 pagesStock Market Liberazation and Economic ReformAdnan KamalNo ratings yet

- Lazy Investors, Discretionary Consumption, and The Cross Section of Stock Returns by Ravi Jagannathan and Yong Wang October 18, 2005Document22 pagesLazy Investors, Discretionary Consumption, and The Cross Section of Stock Returns by Ravi Jagannathan and Yong Wang October 18, 2005Adnan KamalNo ratings yet

- Quality Dimension Value InvestingDocument23 pagesQuality Dimension Value InvestingAdnan KamalNo ratings yet

- 6 WoraphonDocument15 pages6 WoraphonAdnan KamalNo ratings yet