Professional Documents

Culture Documents

Faq For Government Departments

Uploaded by

SAMAR & Associates0 ratings0% found this document useful (0 votes)

61 views13 pagesOriginal Title

FAQ FOR GOVERNMENT DEPARTMENTS.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views13 pagesFaq For Government Departments

Uploaded by

SAMAR & AssociatesCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 13

FAQ FOR GOVERNMENT DEPARTMENTS, LOCAL AUTHORITIES AND

OTHER LINE DEPARTMENTS

1. ARE ALL SERVICES PROVIDED BY THE GOVERNMENT OR LOCAL

AUTHORITY EXEMPTED FROM PAYMENT OF TAX ?

No, all services provided by the Government or a local authority are not exempt from

tax. As for instance, services, namely, (i) services by the Department of Posts by way of

speed post, express parcel post, life insurance, and agency services provided to a

person other than Government; (ii) services in relation to an aircraft or a vessel, inside

or outside the precincts of an airport or a port; (iii) transport of goods or passengers; or

(iv) any service, other than services covered under (i) to (iii) above, provided to

business entities are not exempt and that these services are liable to tax.

That said, most of the services provided by the Central Government, State Government,

Union Territory or local authority are exempt from tax. These include services provided

by government or a local authority or governmental authority by way of any activity in

relation to any function entrusted to a municipality under Article 243W of the

Constitution and services by a governmental authority by way of any activity in relation

to any function entrusted to a Panchayat under article 243G of the Constitution.

2. ARE GOVERNMENT OR LOCAL AUTHORITY OR GOVERNMENTAL AUTHORITY

LIABLE TO PAY TAX?

Yes. The Government or a local authority or a governmental authority is liable to pay tax

on supply of services other than the services notified as exempt or notified as neither a

supply of goods nor a supply of services under clause (b) of sub-section (2) of section 7

(Schedule III). In respect of services other than –(i) renting of immovable property; (ii)

services by the Department of Posts by way of speed post, express parcel post, life

insurance, and agency services provided to a person other than Government; and (iii)

services in relation to an aircraft or a vessel, inside or outside the precincts of an airport

or a port, the service recipients are required to pay the tax under reverse charge

mechanism.

3. WHAT IS THE MEANING OF ‘GOVERNMENT’?

As per section 2(53) of the GST Act, ‘Government’ means the Central Government. As

per clause (23) of section 3 of the General Clauses Act, 1897 the ‘Government’ includes

both the Central Government and any State Government. As per clause (8) of section 3

of the said Act, the ‘Central Government’, in relation to anything done or to be done

after the commencement of the Constitution, means the President. As per Article 53 of

the Constitution, the executive power of the Union shall be vested in the President and

shall be exercised by him either directly or indirectly through officers subordinate to him

in accordance with the Constitution.

Further, in terms of Article 77 of the Constitution, all executive actions of the

Government of India shall be expressed to be taken in the name of the President.

Therefore, the Central Government means the President and the officers subordinate to

him while exercising the executive powers of the Union vested in the President and in

the name of the President. Similarly, as per clause (60) of section 3 of the General

Clauses Act,1897, the ‘State Government’, as respects anything done after the

commencement of the Constitution, shall be in a State the Governor, and in an Union

Territory the Central Government. As per Article 154 of the Constitution, the executive

power of the State shall be vested in the Governor and shall be exercised by him either

directly or indirectly through officers subordinate to him in accordance with the

Constitution.

Further, as per article 166 of the Constitution, all executive actions of the Government of

State shall be expressed to be taken in the name of Governor. Therefore, State

Government means the Governor or the officers subordinate to him who exercise the

executive powers of the State vested in the Governor and in the name of the Governor.

4. WHO IS A LOCAL AUTHORITY?

Local authority is defined in clause (69) of section 2 of the CGST Act and means the

following:-

a “Panchayat” as defined in clause (d) of article 243 of the Constitution;

a “Municipality” as defined in clause (e) of article 243P of the Constitution;

a Municipal Committee, a Zilla Parishad, a District Board, and any other authority legally

entitled to, or entrusted by the Central Government or any State Government with the

control or management of a municipal or local fund;

a Cantonment Board as defined in section 3 of the Cantonments Act, 2006;

a Regional Council or a District Council constituted under the Sixth Schedule to the

Constitution;

a Development Board constituted under article 371 of the Constitution; or a Regional

Council constituted under article 371A of the Constitution;

5. ARE ALL LOCAL BODIES CONSTITUTED BY A STATE OR CENTRAL LAW

REGARDED AS LOCAL AUTHORITIES FOR THE PURPOSES OF THE GST ACT?

No. The definition of ‘local authority’ is very specific and means only those bodies which

are mentioned as ‘local authorities’ in clause (69) of section 2 of the GST Act. It would

not include other bodies which are merely described as a ‘local body’ by virtue of a local

law..

For example, State Governments have setup local developmental authorities to

undertake developmental works like infrastructure, housing, residential & commercial

development, construction of houses, etc. The Governments setup these authorities

under the Town and Planning Act. Examples of such developmental authorities are

“Greater Kochi Development Authority”, Trivandrum Development Authority”, Delhi

Development Authority, Ahmedabad Development Authority, Bangalore Development

Authority, Chen nai Metropolitan Development Authority, Bihar Industrial Area

Development Authority, etc. Such developmental authorities formed under the Town

and Planning Act are not qualified as local authorities for the purposes of the GST Act.

6. WOULD A STATUTORY BODY, CORPORATION OR AN AUTHORITY

CONSTITUTED UNDER AN ACT PASSED BY THE PARLIAMENT OR ANY OF THE

STATE LEGISLATURES BE REGARDED AS ‘GOVERNMENT’ OR “LOCAL

AUTHORITY” FOR THE PURPOSES OF THE GST ACT?

A statutory body, corporation or an authority created by the Parliament or a State

Legislature is neither ‘Government’ nor a ‘local authority’. Such statutory bodies,

corporations or authorities are normally created by the Parliament or a State Legislature

in exercise of the powers conferred under article 53(3)(b) and article 154(2)(b) of the

Constitution respectively. It is a settled position of law (Agarwal Vs. Hindustan Steel AIR

1970 Supreme Court 1150) that the manpower of such statutory authorities or bodies do

not become officers subordinate to the President under article 53(1) of the Constitution

and similarly to the Governor under article 154(1).

Such a statutory body, corporation or an authority as a juridical entity is separate from

the State and cannot be regarded as the Central or a State Government and also do not

fall in the definition of ‘local authority’. Thus, regulatory bodies and other autonomous

entities would not be regarded as the government or local authorities for the purposes of

the GST Act. Some example of such bodies in Kerala would be Universities, KSRTC,

Kerala Financial Corporation etc.

7. WOULD SERVICES PROVIDED BY ONE DEPARTMENT OF THE GOVERNMENT

TO ANOTHER DEPARTMENT OF THE GOVERNMENT BE TAXABLE?

Services provided by one department of the Central Government/State Government to

another department of the Central Government/ State Government are exempt

under notification No. 12/2017-Central Tax (Rate), dated 28.06.2017 [S No 8 of the

Table].

However, this exemption is not applicable to

a) services provided by the Department of Posts by way of speed post, express parcel

post, life insurance, and agency services provided to a person other than the Central

Government, the State Government and Union Territory;

b) services in relation to a vessel or an aircraft inside or outside the precincts of a port

or an airport;

c) services of transport of goods and/or passengers;

8. WHAT ARE THE TRANSPORT SERVICES PROVIDED BY THE GOVERNMENT

OR LOCAL AUTHORITIES EXEMPT FROM TAX?

Transport services provided by the Government to passengers by —

railways in a class other than— (a) first class; or (b) an air-conditioned coach;

metro, monorail or tramway;

inland waterways;

public transport, other than predominantly for tourism purpose, in a vessel between

places located in India; and

metered cabs or auto rickshaws (including E-rickshaws) are exempt from tax.

9. ARE VARIOUS CORPORATIONS FORMED UNDER THE CENTRAL ACTS OR

STATE ACTS OR VARIOUS GOVERNMENT COMPANIES REGISTERED UNDER

THE COMPANIES ACT, 1956/2013 OR AUTONOMOUS INSTITUTIONS SET UP BY

SPECIAL ACTS COVERED UNDER THE DEFINITION OF ‘GOVERNMENT’?

No. The corporations formed under the Central or a State Act or various companies

registered under the Companies Act, 1956/2013 or autonomous institutions set up by

the State Acts will not be covered under the definition of ‘Government’ and therefore,

services provided by them will be taxable unless exempted by a notification.

10. ARE VARIOUS REGULATORY BODIES FORMED BY THE GOVERNMENT

COVERED UNDER THE DEFINITION OF ‘GOVERNMENT’?

No. A regulatory body, also called regulatory agency, is a public authority or a

governmental body which exercises functions assigned to them in a regulatory or

supervisory capacity. These bodies do not fall under the definition of Government.

Examples of regulatory bodies are – Competition Commission of India, Press Council of

India, Directorate General of Civil Aviation, Forward Market Commission, Inland Water

Supply Authority of India, Central Pollution Control Board, Securities and Exchange

Board of India.

11. WILL THE SERVICES PROVIDED BY POLICE, FIRE AND RESCUE SERVICES

OR SECURITY AGENCIES OF GOVERNMENT TO PSUS OR CORPORATE

ENTITIES OR SPORTS EVENTS HELD BY PRIVATE ENTITIES BE TAXABLE?

Yes. Services provided by Police, Fire and Rescue Services or security agencies of

Government to PSU/private business entities are not exempt from GST. Such services

are taxable supplies and the recipients are required to pay the tax under reverse charge

mechanism on the amount of consideration paid to Government for such supply of

services.

Illustration: The Kerala Cricket Association, Kochi requests the Commissioner of Police,

Kochi to provide security in and around the Cricket Stadium for the purpose of

conducting the cricket match. The Commissioner of Police arranges the required

security for a consideration. In this case, services of providing security by the police

personnel are not exempt. As the services are provided by Government, Kerala Cricket

Association is liable to pay the tax on the amount of consideration paid under reverse

charge mechanism.

12. THE DEPARTMENT OF POSTS PROVIDES A NUMBER OF SERVICES. WHAT

IS THE STATUS OF THOSE SERVICES FOR THE PURPOSE OF LEVY OF TAX?

The services by way of speed post, express parcel post, life insurance and agency

services are taxable,. In respect of these services the Department of Posts is liable to

pay tax without application of reverse charge.

However, the following services provided by the Department of Posts are not liable to

tax.

Basic mail services known as postal services such as post card, inland letter, book post,

registered post provided exclusively by the Department of Posts to meet the universal

postal obligations.

Transfer of money through money orders, operation of savings accounts, issue of postal

orders, pension payments and other such services.

Agency services provided to the Government or Union territory

13. WHAT IS THE SCOPE OF AGENCY SERVICES PROVIDED BY THE

DEPARTMENT OF POSTS MENTIONED IN THE NOTIFICATION BY SRO NO.

371/2017 DTD. 30TH JUNE, 2017 (KERALA) AND NO. 12/2017-CENTRAL TAX(RATE),

DATED 28.06.2017?

The Department of Posts also provides services like distribution of mutual funds, bonds,

passport applications, collection of telephone and electricity bills on commission basis.

These services are in the nature of intermediary and generally called agency services.

In these cases, the Department of Posts is liable to pay tax without application of

reverse charge.

14. WOULD SERVICES RECEIVED BY GOVERNMENT, A LOCAL AUTHORITY, A

GOVERNMENTAL AUTHORITY FROM A PROVIDER OF SERVICE LOCATED

OUTSIDE INDIA BE TAXABLE?

No tax is payable on the services received by the Government / local authority/

governmental authority from a provider of service located outside India. However, the

exemption is applicable to only those services which are received for the purpose other

than commerce, industry or any other business or profession. In other words, if the

Government receives such services for the purpose of business or commerce, then tax

would apply on the same.

15. WHETHER THE EXEMPTION IS APPLICABLE TO ONLINE INFORMATION AND

DATABASE ACCESS OR RETRIEVAL SERVICES RECEIVED BY GOVERNMENT

OR LOCAL AUTHORITIES FROM PROVIDER OF SERVICE LOCATED IN NON

TAXABLE TERRITORY?

No. Online information and database access or retrieval services received by

Government or local authorities from non taxable territory for any purpose whether or

not in furtherance of business or commerce are liable to tax.

16. WHAT ARE THE FUNCTIONS ENTRUSTED TO A MUNICIPALITY UNDER

ARTICLE 243W OF THE CONSTITUTION?

The functions entrusted to a municipality under the Twelfth Schedule to Article 243W of

the Constitution are as under:

(i) Urban planning including town planning.

(ii) Regulation of land-use and construction of buildings.

(iii) Planning for economic and social development.

(iv) Roads and bridges.

(v) Water supply for domestic, industrial and commercial purposes.

(vi) Public health, sanitation conservancy and solid waste management.

(vii) Fire services.

(viii) Urban forestry, protection of the environment and promotion of ecological

(ix) Safeguarding the interests of weaker sections of society, including the handicapped

and mentally retarded.

(x). Slum improvement and upgradation.

(xi). Urban poverty alleviation.

(xii). Provision of urban amenities and facilities such as parks, gardens, playgrounds.

(xiii). Promotion of cultural, educational and aesthetic aspects.

(xiv). Burials and burial grounds; cremations, cremation grounds; and electric

crematoriums.

(xv). Cattle pounds; prevention of cruelty to animals.

(xvi). Vital statistics including registration of births and deaths.

(xvii). Public amenities including street lighting, parking lots, bus stops and public

(xviii). Regulation of slaughter houses and tanneries

17. WHAT ARE THE FUNCTIONS ENTRUSTED TO A PANCHAYAT UNDER

ARTICLE 243G OF THE CONSTITUTION?

The functions entrusted to a Panchayat under the Eleventh Schedule to Article 243G of

the Constitution are as under:

(i) Agriculture, including agricultural extension. (ii). Land improvement, implementation

of land reforms, land consolidation and soil conservation. (iii). Minor irrigation, water

management and watershed development. (iv). Animal husbandry, dairying and poultry.

(v). Fisheries. (vi). Social forestry and farm forestry. (vii). Minor forest produce. (viii).

Small scale industries, including food processing industries. (ix). Khadi, village and

cottage industries. (x). Rural housing. (xi). Drinking water. (xii). Fuel and fodder. (xiii).

Roads, culverts, bridges, ferries, waterways and other means of communication. (xiv).

Rural electrification, including distribution of electricity. (xv). Non-conventional energy

sources. (xvi). Poverty alleviation programme. (xvii). Education, including primary and

secondary schools. (xviii). Technical training and vocational education. (xix). Adult and

non-formal education. (xx). Libraries. (xxi). Cultural activities. (xxii). Markets and fairs.

(xxiii). Health and sanitation, including hospitals, primary health centres and

dispensaries. (xxiv). Family welfare. (xxv). Women and child development. (xxvi). Social

welfare, including welfare of the handicapped and mentally retarded. (xxvii). Welfare of

the weaker sections, and in particular, of the Scheduled Castes and the Scheduled

Tribes. (xxviii). Public distribution system. (xxix). Maintenance of community assets.

18. WHAT IS THE SIGNIFICANCE OF SERVICES PROVIDED BY GOVERNMENT

OR A LOCAL AUTHORITY BY WAY OF TOLERATING NON-PERFORMANCE OF A

CONTRACT FOR WHICH CONSIDERATION IN THE FORM OF FINES OR

LIQUIDATED DAMAGES IS PAYABLE TO THE GOVERNMENT OR THE LOCAL

AUTHORITY ?

Generally, non-performance of a contract or breach of contract is one of the conditions

normally stipulated in the Government contracts for supply of goods or services. The

agreement entered into between the parties stipulates that both the service provider and

service recipient abide by the terms and conditions of the contract. In case any of the

parties breach the contract for any reason including non-performance of the contract,

then such person is liable to pay damages in the form of fines or penalty to the other

party. Non-performance of a contract is an activity or transaction which is treated as a

supply of service and the person is deemed to have received the consideration in the

form of fines or penalty and is, accordingly, required to pay tax on such amount.

However, non performance of contract by the supplier of service in case of supplies to

Government is covered under the exemption from payment of tax. Thus any

consideration received by the Government from any person or supplier for non

performance of contract is exempted from tax.

Illustration: Public Works Department of Kerala entered into an agreement with M/s.

XYZ, a construction company for construction of office complex for certain amount of

consideration. In the agreement dated 10.7.2017, it was agreed by both the parties that

M/s. XYZ shall complete the construction work and handover the project on or before

31.12.2017. It was further agreed that any breach of the terms of contract by either

party would give right to the other party to claim for damages or penalty. Assuming that

M/s. XYZ does not complete the construction and handover the project by the specified

date i.e., on or before 31.12.2017. As per the contract, the department asks for

damages/penalty from M/s. XYZand threatened to go to the court if not paid. Assuming

that M/s XYZ has paid an amount of Rs. 10,00,000/- to the department for non

performance of contract. Such amount paid to department is exempted from payment of

tax.

19. WHETHER SERVICES IN THE NATURE OF CHANGE OF LAND USE,

COMMERCIAL BUILDING APPROVAL, UTILITY SERVICES PROVIDED BY A

GOVERNMENTAL AUTHORITY ARE TAXABLE?

Regulation of land-use, construction of buildings and other services listed in the Twelfth

Schedule to the Constitution which have been entrusted to Municipalities under Article

243W of the Constitution, when provided by governmental authority are exempt from

payment of tax.

20. WHETHER FINES AND PENALTY IMPOSED BY GOVERNMENT OR A LOCAL

AUTHORITY FOR VIOLATION OF A STATUTE, BYE-LAWS, RULES OR

REGULATIONS LIABLE TO TAX?

No. This gets covered under the exemption by way of tolerating non-performance of a

contract for which consideration in the form of fines or liquidated damages is payable to

the Government or the local authority.

22. A SMALL BUSINESS ENTITY IS CARRYING ON A BUSINESS RELATING TO

CONSULTING ENGINEER SERVICES IN DELHI. DOES IT NEED TO PAY TAX ON

THE SERVICES RECEIVED FROM GOVERNMENT OR A LOCAL AUTHORITY?

If turnover of the entity is less than the limit of Rs. 20 lakhs in a financial year, no tax

would be payable.

If the turnover of a business entity is above Rs.20 lakhs, the business entity is liable to

pay tax on the servies received from Govt. on reverse charge basis.

However, with regard to the following services,

services by the Department of Posts by way of speed post, express parcel post, life

insurance, and agency services provided to a person other than Government;

services in relation to an aircraft or a vessel, inside or outside the precincts of an airport

or a port;

services of transport of goods or passengers and

services by way of renting of immovable property.

The Govt. has to pay the tax on these services irrespective of the turnover of the

recipient.

23 WHAT IS REVERSE CHARGE IN GST?

As per 2(98) of the Act, ‘’reverse charge” means the liability to pay tax by the recipient

of supply of goods or services or both instead of the supplier of such goods or services

or both under sub-section (3) or sub-section (4) of section 9, or under sub-section (3) or

subsection (4) of section 5 of the Integrated Goods and Services Tax Act.

24. WHETHER REVERSE CHARGE IS APPLICABLE TO SERVICES PROVIDED

BY GOVERNMENT OR LOCAL AUTHORITIES?

Yes, reverse charge is applicable in respect of services provided by Government or

local authorities to any person whose turnover exceeds Rs.20 lakhs (Rs.10 lakhs for

Special Category States) excluding the following services;

(i) renting of immovable property,

(ii) services by the Department of Posts by way of speed post, express parcel post, life

insurance, and agency services provided to a person other than Government,

(iii) services in relation to an aircraft or a vessel, inside or outside the precincts of an

airport or a port;

(iv) transport of goods or passengers.

Thus, the recipient of supply of goods or services is liable to pay the entire amount of

tax involved in such supply of services or goods or both.

25. WHAT IS THE SCOPE OF ‘PURE SERVICES’ MENTIONED IN THE

EXEMPTION NOTIFICATION NO. 12/2017-CENTRAL TAX (RATE), DATED

28.06.2017 AND S.R.O.NO.371/2017 DATED 30.06.2017?

In the context of the language used in the notification, supply of services without

involving any supply of goods would be treated as supply of ‘pure services’. For

example, supply of man power for cleanliness of roads, public places, architect

services, consulting engineer services, advisory services, and like services provided by

business entities not involving any supply of goods would be treated as supply of pure

services. On the other hand, let us take the example of a governmental authority

awarding the work of maintenance of street lights in a Municipal area to an agency

which involves apart from maintenance, replacement of defunct lights and other spares.

In this case, the scope of the service involves maintenance work and supply of goods,

which falls under the works contract services. The exemption is provided to services

involves only supply of services and not for works contract services.

26. WOULD SERVICES IN RELATION TO SUPPLY OF MOTOR VEHICLES TO

GOVERNMENT BE TAXABLE?

Supply of a motor vehicle meant to carry more than twelve passengers by way of giving

on hire to a state transport undertaking is exempted from tax. The exemption is

applicable to services provided to state transport undertaking and not to other

departments of Government or local authority. Generally, such State transport

undertakings/corporations are established by law with a view to providing public

transport facility to the commuters. In some cases, transport undertakings hire the

buses on lease basis from private persons on payment of consideration. The services

by way of supply of motor vehicles to such state transport undertaking are exempt from

payment of tax. However, supplies of motor vehicles to Government Departments other

than the state transport undertakings are taxable.

27. CAN THE SUPPLIER OF SERVICES CLAIM THE TAX PAID UNDER REVERSE

CHARGE MECHANISM AS INPUT TAX CREDIT?

Yes. The supplier of services may claim the input tax credit on the amount of tax paid

under reverse charge mechanism subject to the provisions of Input Tax Credit Rules.

28. WHAT IS THE CONCEPT CALLED ‘TAX DEDUCTION AT SOURCE’?

As per section 51 of the CGST Act, the Government may mandate (a) a department or

establishment of the Central Government or State Government; or (b) local authority; or

(c) Governmental agencies; or (d) such persons or category of persons as may be

notified by the Government on the recommendations of the Council, to deduct tax at the

rate of one per cent on account of CGST and one percent on account of SGST from the

payment made or credited to the supplier where the total value of the supply under a

contract exceeds two lakh and fifty thousand rupees (excluding tax payable under the

GST Acts). The deductor shall remit the deducted amount to the Government and is

also required to furnish a certificate to the deductee by mentioning the details of the

amount deducted and payment of such deducted amount.

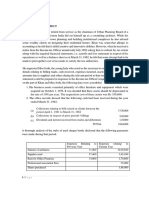

Illustration: ABC Ltd supplies the service valued at Rs. 3,00,000/- excluding tax to

Government department. The department while making the payment of Rs. 3,00,000/-

should deduct Rs. 3000/- on account of CGST and Rs. 3000/- on account of SGST and

make a net payment of Rs. 2,94, 000/- to ABC. Thereafter, the department shall pay the

amount of Rs. 3,000/- to the Central Government and Rs. 3,000/- to the State

Government and furnish a certificate to the deductee, containing the details of such

deduction including the details of such deductee.

29. WHETHER THE DEDUCTEE CAN CLAIM THE INPUT TAX CREDIT ON THE

DEDUCTION OF TAX AT SOURCE AMOUNT?

No. The tax deducted at source is not input tax credit. However, the amount deducted

shall be credited to the electronic cash ledger (upon being accepted by the deductee in

his Form GSTR-2A) of the deductee and can be utilized for payment of output tax.

30. WHETHER AN AMOUNT IN THE FORM OF ROYALTY OR ANY OTHER

FORM PAID/PAYABLE TO THE GOVERNMENT FOR ASSIGNING THE RIGHTS TO

USE OF NATURAL RESOURCES IS TAXABLE?

The Government provides license to various companies including Public Sector

Undertakings for exploration of natural resources like oil, hydrocarbons, iron ore,

manganese, etc. For having assigned the rights to use the natural resources, the

licensee companies are required to pay consideration in the form of annual license fee,

lease charges, royalty, etc to the Government. The activity of assignment of rights to

use natural resources is treated as supply of services and the licensee is required to

pay tax on the amount of consideration paid in the form of royalty or any other form

under reverse charge mechanism.

31. WHETHER A GOVERNMENT DEPARTMENT, REQUIRED TO DEDUCT TAX AT

SOURCE, IS LIABLE TO TAKE REGISTRATION AS A NORMAL TAXPAYER?

The Government Department is required to take registration as a normal taxpayer only if

it makes a taxable supply of goods and/or services and in such cases, the registration

shall be obtained on the basis of PAN. B. However, if it is not making any taxable supply

of goods and/or services, it is required to register only as a deductor of tax at source on

the basis of TAN/PAN.

32. WHETHER A GOVERNMENT DEPARTMENT MAKING ONLY NON TAXABLE

OR EXEMPTED SUPPLIES NEED TO TAKE REGULAR REGISTRATION?

No. but if it has liability to deduct TDS it will have to take TDS registration.

33. WHETHER THE GOVERNMENT DEPARTMENT WILL HAVE TO TAKE

REGULAR REGISTRATION FOR ALL ITS UNITS OR DISTRICT WISE OR OFFICE

WISE?

Institutional PAN can be obtained from IT department by any office. Hence, any office

can get registered under GST Act. But registration brings in responsibilities like timely

return filing,, . It is ideal that, an office of a department which is making regular taxable

supplies should take registration and those offices which have only occasional

transactions can file their details through higher offices having regular taxable supplies.

However, the matter is to be decided internally in the department.

34. WHETHER SEPARATE REGISTRATION IS REQUIRED FOR REGULAR

TAXABLE SUPPLIES AND FOR TDS.

Yes, if the Department makes taxable supplies, it will have to obtain regular registration.

if it deduct TDS, it will have to obtain TDS registration too.

35. WE WERE REMITTING TAX ON SUPPLIES IN VAT BY PAYMENT OF CHALANS

IN TREASURY. WHETHER WE CAN ADOPT THE SAME PROCEDURE IN GST?

No. Payments can be made only through by internet banking or by using credit or debit

cards or NEFT or RTGS or Generating chalan from the GSTN portal and make payment

to the bank. It can be done only based on a regular return or a TDS return.

36. HOW WILL YOU MAKE PAYMENT OF GST ?

Payment can be made any time through above means. This will be reflected in the

electronic cash ledger of the registered person. The amount in the electronic cash

ledger can be utilized for payment of tax while filing the returns.

37. WHAT WILL BE THE TAXES REQUIRED TO BE COLLECTED ON A TAXABLE

SUPPLY?

CGST and SGST for supplies within the state and IGST for Supplies made out side the

state. IGST would be the combined rate of CGST and SGST. This should be shown

separately in the tax invoice.

Eg: If for an intra state sale of timber tax to be collected is 9% CGST and 9% SGST. If

the timber is sold interstate, IGST would be 18 %.

38. What would be the rate applicable for CGST and SGST?

The notifications of tax rates under CGST AND SGST are given below

Description Notification

rates for supply of services under CGST Act 11/2017-Central Tax (Rate) ,dt. 28-06-

2017

exemptions on supply of services under CGST Act 12/2017-Central Tax (Rate), dt. 28-06-

2017

CGST Rate Schedule for goods notified under 01/2017-Central Tax (Rate),dt. 28-06-

section 9 (1) 2017

CGST exempt goods notified under section 11 (1) 02/2017-Central Tax (Rate),dt. 28-06-

2017

KGST rates for services S.R.O 370/2017

exemptions on supply of services under KGST Act S.R.O 371/2017

KGST Rate Schedule for goods notified under S.R.O 360/2017

section 9 (1)

KGST exempt goods notified under section 11 (1) S.R.O 361/2017

It is also available on CBEC Website http://www.cbec.gov.in/htdocs-cbec/gst/central-

tax-rate-notfns-2017 and Kerala Taxes Department

website http://www.keralataxes.gov.in/home documents/GSTC12.pdf

39. SHOULD THE DEPARTMENT NEED TO ISSUE AN INVOICE FOR A TAXABLE

SUPPLY OF GOODS OR SERVICES ?

Yes, as per the provisions of the Act, an invoice need to be issued.

40. WHAT SHOULD BE THE FORMAT AND CONTENTS OF INVOICE?

There is no specific format in GST. But the invoice should contain the following details:

Invoice number and date, Customer name, Shipping and billing address, Customer and

taxpayer’s GSTIN, Place of supply, HSN code, Taxable value and discounts, Rate and

amount of taxes i.e. CGST/ SGST/ IGST, Item details i.e. description, unit price,

quantity

41. WE PRESENTLY ISSUE TR-5 FOR RECEIPT OF GOVERNMENT MONEY.

WOULD IT SUFFICE FOR INVOICE IN GST ?

Since the above content cannot be incorporated in TR-5, invoice will have to be issued

in GST.

42. WHAT WOULD THE CONSEQUENCES, IF THE DEPARTMENT DOES NOT FILE

RETURNS ?

There will be automated interest and late fee. Penalty can also be levied.

The registered person who have bought goods from Government will not be able to

claim input tax credit in his returns.

43. WHO IS LIABLE TO DEDUCT TDS?

A department or establishment of the Central or State Government, or a Local authority,

or Governmental agencies, or Persons or category of persons as may be notified, by

the Central or a State Government on the recommendations of the Council,

44. WHICH ARE THE TRANSACTIONS LIABLE FOR TDS ?

All transactions where the total value of a taxable supply received under a contract

exceeds two lakh and Fifty thousand rupees (excluding GST). For the purpose of

deciding TDS liability, the whole contract amount is to be reckoned, irrespective of

individual periodic payments and TDS is to be deducted for such individual periodic

payments.

45. WHAT IS THE DIFFERENCE OF TDS PROVISIONS BETWEEN VAT AND GST ?

In VAT, TDS was applicable only to works contract, but in GST it is applicable on all

taxable supplies received.

In VAT there was varied rates of deduction based on the certificates issued by the

department. But in GST, there is only a single rate.

46. WHAT IS THE RATE OF DEDUCTION FOR TDS?

1% under CGST Act and 1% under SGST Act or 2% IGST

47. WHICH IS THE VALUE OF SUPPLY ON WHICH TDS IS TO BE DEDUCTED?

For purpose of deduction of TDS, the value of supply is to be taken as the amount

excluding the tax indicated in the invoice. This means TDS shall not be deducted on the

CGST, SGST or IGST component of invoice.

48. WHEN TDS IS PAID TO THE GOVT.?

TDS shall be paid within 10 days from the end of the month in which tax is deducted.

49. WHAT IS A TDS CERTIFICATE?

It is a certificate furnished by the deductor to the deductee (in Form GSTR 7A)

furnishing details of the decution made. It is to be issued to the deductee within 5 days

of crediting the amount to the Govt. failing which fees of Rs. 100 per day subject to

maximum of Rs. 5000/- will be payable by such deductor.

50. WHAT HAPPENS IF THE DEDUCTOR DEFAULTS IN PAYMENT OF THE

AMOUNT?

He will be liable to pay interest, in addition to the tax.

51. WHAT IS THE GST RATE OF PRINTED TENDER FORMS SOLD BY THE

DEPARTMENT?

12%. It should be collected by the Department and paid along with the returns.

52. WHAT IS THE GST RATE OF TENDER SUBMISSION FEES COLLECTED BY

THE DEPARTMENT WHILE SUBMISSION OF E-TENDER?

It is a service provided by the Department and the tax rate is 18%. But the department

need not collect the tax. It will be paid by the contractor on reverse charge basis while

filing his returns.

53. WHETHER TDS IS TO BE MADE OR EFFECTED FOR THE TAXABLE SUPPLY

RECEIVED FROM 01-07-2017?

No. The implementation of TDS provision are deffered till further notification.

(SRO.No…… ).

Effective date of TDS implementation will be notified by Central and State GST

Department in future with prospective effect.

54. WHAT IS THE RATE OF TAX APPLICABLE TO SUPPLY OF CONFISCATED

VEHICLES IN AUCTION SALE?

If the vehicles are supplies in auction sale with registration certificate, the rate of vehicle

shall be applied, i.e., 28%. If the vehicles are supplied as scrap, then the rate of iron

scrap, i.e.,18% will be applicable.

You might also like

- Act on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaFrom EverandAct on Anti-Corruption and the Establishment and Operation of the Anti-Corruption: Civil Rights Commission of the Republic of KoreaNo ratings yet

- Faq On Government ServicesDocument8 pagesFaq On Government ServicesSUNILNo ratings yet

- A Layman’s Guide to The Right to Information Act, 2005From EverandA Layman’s Guide to The Right to Information Act, 2005Rating: 4 out of 5 stars4/5 (1)

- Mactan Cebu International Airport Vs Marcos - G.R. No. 120082. September 11, 1996Document12 pagesMactan Cebu International Airport Vs Marcos - G.R. No. 120082. September 11, 1996Ebbe DyNo ratings yet

- Central Civil Services Rules CompleteDocument91 pagesCentral Civil Services Rules CompletePrashant ShindeNo ratings yet

- Limitations of TaxationDocument3 pagesLimitations of TaxationMarzan MaraNo ratings yet

- Ccs (Cca) RulesDocument72 pagesCcs (Cca) RulesDrPraful TambeNo ratings yet

- Petitioner Vs VS: Third DivisionDocument16 pagesPetitioner Vs VS: Third DivisionVenice Jamaila DagcutanNo ratings yet

- Mactan Cebu Intl Airport Authority v. MarcosDocument26 pagesMactan Cebu Intl Airport Authority v. MarcosOwdylyn LeeNo ratings yet

- Petitioner Vs VS: Third DivisionDocument17 pagesPetitioner Vs VS: Third DivisionCatherine Rona DalicanoNo ratings yet

- Ccs (Cca) RulesDocument53 pagesCcs (Cca) RulesRakesh GuptaNo ratings yet

- CCS (CCA) Rules 1965 20.1Document127 pagesCCS (CCA) Rules 1965 20.1mbanlj33% (3)

- CCS CCA Rules 1965Document74 pagesCCS CCA Rules 1965Dinesh YadavNo ratings yet

- Public Authority: MADE BY: - Tanya Singh Jindal Global Law School, Sonipat B.B.A. L.L.B., 1st YearDocument24 pagesPublic Authority: MADE BY: - Tanya Singh Jindal Global Law School, Sonipat B.B.A. L.L.B., 1st Yearmayank shekharNo ratings yet

- Balochistan Sales Tax On Services Act, 2015Document74 pagesBalochistan Sales Tax On Services Act, 2015AbidRazacaNo ratings yet

- CCS (CCA) RulesDocument76 pagesCCS (CCA) RulesHarsh EnterprisesNo ratings yet

- Rules of Ccs Cca 1965Document102 pagesRules of Ccs Cca 1965MykeeNo ratings yet

- Rules of Ccs Cca 1965Document102 pagesRules of Ccs Cca 1965MykeeNo ratings yet

- Central Civil Services: GeneralDocument83 pagesCentral Civil Services: GeneralSardar. Vikramjit Singh RandhawaNo ratings yet

- Ccs (Cca) RulesDocument62 pagesCcs (Cca) RulesravirainbowNo ratings yet

- CCS (Cca) 1965Document92 pagesCCS (Cca) 1965Paras SirwaiyaNo ratings yet

- Lokayukta Act Eng2Document17 pagesLokayukta Act Eng2Pranay KumarNo ratings yet

- GST CHAPTER I PreliminaryDocument51 pagesGST CHAPTER I PreliminaryElson Antony PaulNo ratings yet

- Central Civil Services (Classification, Control & Appeal) Rules, 1965Document93 pagesCentral Civil Services (Classification, Control & Appeal) Rules, 1965DHEERAJNo ratings yet

- Mactan Cebu International Airport vs. Marcos, 261 SCRA 667Document15 pagesMactan Cebu International Airport vs. Marcos, 261 SCRA 667Machida AbrahamNo ratings yet

- The Lokpal and Lokayuktas Act, 2013Document26 pagesThe Lokpal and Lokayuktas Act, 2013vivek kumar singh100% (1)

- Maharashtra Right To Public Services Act 2015.31 PDFDocument11 pagesMaharashtra Right To Public Services Act 2015.31 PDFKiran MoreNo ratings yet

- JK-Civil-Services-Decentralization & Recruitment-ACT, 2010Document6 pagesJK-Civil-Services-Decentralization & Recruitment-ACT, 2010Akshay DharNo ratings yet

- Mohd Hadi Raja Vs State of Bihar and Ors 28041998 0904s980480COM576314Document9 pagesMohd Hadi Raja Vs State of Bihar and Ors 28041998 0904s980480COM576314Prayansh JainNo ratings yet

- Regional and Local Government ModuleDocument21 pagesRegional and Local Government ModuleD.K. BonesNo ratings yet

- Other Acts and RulesDocument20 pagesOther Acts and RulesVaishnavi KumariNo ratings yet

- 2018-10-23 12 - 48 - 35balochistan-Sales-Tax-Act-2015Document74 pages2018-10-23 12 - 48 - 35balochistan-Sales-Tax-Act-2015ahmadNo ratings yet

- "State" For Purposes of Fundamental RightsDocument10 pages"State" For Purposes of Fundamental RightsDolphinNo ratings yet

- Slide # 1 How Is A Component City Being Converted?Document9 pagesSlide # 1 How Is A Component City Being Converted?Haven GarciaNo ratings yet

- CHAPTER 14 ConstitutionDocument3 pagesCHAPTER 14 ConstitutionmindeeNo ratings yet

- New Microsoft Word DocumentDocument110 pagesNew Microsoft Word Documentrkumar60No ratings yet

- Prevention of Corruption ActDocument15 pagesPrevention of Corruption ActTehsildar KishtwarNo ratings yet

- Municipal TaxationDocument137 pagesMunicipal Taxationdash5453No ratings yet

- Public CorporationDocument41 pagesPublic Corporationchiqycc100% (1)

- BookletDocument371 pagesBookletRohan KulkarniNo ratings yet

- CCS (CCA) RULES, 1965 - Department of Personnel & TrainingDocument126 pagesCCS (CCA) RULES, 1965 - Department of Personnel & TrainingBani GandhiNo ratings yet

- Election Laws and RADocument5 pagesElection Laws and RAAlisa WadeNo ratings yet

- Local GovernmentsDocument10 pagesLocal GovernmentsGraceNo ratings yet

- Miaa Vs Pasay CityDocument3 pagesMiaa Vs Pasay CityJon Gilbert MagnoNo ratings yet

- Public Services (Management) Act 1995 (Consolidated To No 24 PDFDocument33 pagesPublic Services (Management) Act 1995 (Consolidated To No 24 PDFdesmond100% (1)

- Pub Cor Reviewer PDFDocument14 pagesPub Cor Reviewer PDFnomercykillingNo ratings yet

- Unit 1 Taxation NotesDocument74 pagesUnit 1 Taxation Notesstevin.john538No ratings yet

- Consti 1 Case DigestDocument49 pagesConsti 1 Case DigestRALPH CORTESNo ratings yet

- IGST Act With Amendments 1Document14 pagesIGST Act With Amendments 1sanjitaNo ratings yet

- Pub Corp Reviewer SummarizedDocument16 pagesPub Corp Reviewer SummarizedBudoyNo ratings yet

- 3rd Page - FAQS - EngDocument4 pages3rd Page - FAQS - Enggomesmonica75No ratings yet

- Central Civil Services (Classification, Control & Appeal) Rules, 1965Document54 pagesCentral Civil Services (Classification, Control & Appeal) Rules, 1965Aradhna MathurNo ratings yet

- Mactan Cebu International Airport Authority Vs MarcosDocument3 pagesMactan Cebu International Airport Authority Vs MarcosRaymond RoqueNo ratings yet

- GST in IndiaDocument13 pagesGST in IndiaDeepesh SinghNo ratings yet

- 10 Imbong V Ochoa - Art10s1Document2 pages10 Imbong V Ochoa - Art10s1Tanya IñigoNo ratings yet

- Notebook On Corporate Criminal Laws - Part III - Look-Out CircularsDocument12 pagesNotebook On Corporate Criminal Laws - Part III - Look-Out CircularsAshish DavessarNo ratings yet

- White Collar CrimeDocument6 pagesWhite Collar CrimeTamana BansalNo ratings yet

- E. Instrumentalities: 1990 EO CPE TextDocument20 pagesE. Instrumentalities: 1990 EO CPE TextDavid LloydNo ratings yet

- Struktur Organisasi Personil OC-2 KOTAKU SumutDocument1 pageStruktur Organisasi Personil OC-2 KOTAKU SumuttomcivilianNo ratings yet

- Phase 2 - 420 & 445Document60 pagesPhase 2 - 420 & 445SNo ratings yet

- CIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Document2 pagesCIR V. MARUBENI 372 SCRA 577 (Contractors Tax)Emil BautistaNo ratings yet

- Astrategicanalysisofnokia 170126102444Document68 pagesAstrategicanalysisofnokia 170126102444mandivarapu jayakrishna100% (1)

- Roll No MBA05006039 (Priyanka Revale)Document83 pagesRoll No MBA05006039 (Priyanka Revale)Veeresh NaikarNo ratings yet

- KudumbashreeDocument12 pagesKudumbashreeamarsxcran100% (1)

- Running Head: Business Ethics - Week 5 Assignment 1Document4 pagesRunning Head: Business Ethics - Week 5 Assignment 1MacNicholas 7No ratings yet

- Ibm 5Document4 pagesIbm 5Shrinidhi HariharasuthanNo ratings yet

- In Re Facebook - Petition To Appeal Class Cert Ruling PDFDocument200 pagesIn Re Facebook - Petition To Appeal Class Cert Ruling PDFMark JaffeNo ratings yet

- HRM Assignment 1Document5 pagesHRM Assignment 1Laddie LMNo ratings yet

- Memorandum by Virgin Atlantic Airways: Executive SummaryDocument5 pagesMemorandum by Virgin Atlantic Airways: Executive Summaryroman181No ratings yet

- Chapter 1-: Operations & Supply Chain StrategyDocument40 pagesChapter 1-: Operations & Supply Chain StrategyDv DickosNo ratings yet

- Coca Cola Research PaperDocument30 pagesCoca Cola Research PaperUmarNo ratings yet

- Sajid Mahmood CVDocument3 pagesSajid Mahmood CVSajidMahmoodNo ratings yet

- INFOSYSDocument9 pagesINFOSYSSai VasudevanNo ratings yet

- Arijit Bose - KMBDocument3 pagesArijit Bose - KMBArijit BoseNo ratings yet

- Auction TheoryDocument1 pageAuction TheorySaurav DuttNo ratings yet

- 0455 s16 QP 22Document8 pages0455 s16 QP 22Alvin Agung IsmailNo ratings yet

- Principles of ManagementDocument225 pagesPrinciples of Managementsrisuji14No ratings yet

- Robbins mgmt14 PPT 18bDocument19 pagesRobbins mgmt14 PPT 18bAmjad J AliNo ratings yet

- 2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A RecessionDocument1 page2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A Recessionpan0No ratings yet

- Sample B Business Management EeDocument50 pagesSample B Business Management Eeapi-529669983No ratings yet

- Second Grading Examination - Key AnswersDocument21 pagesSecond Grading Examination - Key AnswersAmie Jane Miranda100% (1)

- Calgary Cooperative Funeral Services - Business PlanDocument21 pagesCalgary Cooperative Funeral Services - Business PlanastuteNo ratings yet

- The Town of Brookside Annual Financial Report 2021Document62 pagesThe Town of Brookside Annual Financial Report 2021ABC 33/40No ratings yet

- PT RulesDocument47 pagesPT RulesdewanibipinNo ratings yet

- PKxx27338334 20220527 IN0095788147Document3 pagesPKxx27338334 20220527 IN0095788147Rana Naeem 127No ratings yet

- Module 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Document18 pagesModule 5 Course Matterial Ipcomp Monopolies and Restrictive Trade Practices Act (MRTP)Ankush JadaunNo ratings yet

- Chapter OneDocument13 pagesChapter OneSofonias MenberuNo ratings yet

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Stiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreFrom EverandStiff Them!: Your Guide to Paying Zero Dollars to the IRS, Student Loans, Credit Cards, Medical Bills and MoreRating: 4.5 out of 5 stars4.5/5 (13)

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet