Professional Documents

Culture Documents

Taxation of Cross Border M-A - A Paradigm Shift PDF

Uploaded by

Sagar KadyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation of Cross Border M-A - A Paradigm Shift PDF

Uploaded by

Sagar KadyanCopyright:

Available Formats

CROSS BORDER

ACQUISITIONS

Taxation of Cross border

M&A- A paradigm shift?

Richie Sancheti* and Hanisha Amesur**

Introduction

Following global cues, M&A activity in India had reduced significantly

by the final quarter of 2008. The year 2010 however has seen India

emerging as an attractive destination for international investors. The

cumulative amount of equity inflows, under the direct investments (FDI)

route from April 2010 to July 2010, stood at US$ 7,592 million, according

to the data released by the Department of Industrial Policy and Promotion

(DIPP). 1

The attractiveness of India is considered its domestic market potential, Richie Sancheti

cost effectiveness, historically good returns on investment, the predominance

of English as the language of business, and the well-established rule of

law. However, it should also be borne in mind that perhaps second only

to the ability to generate high internal rate of return (IRR), the next issue

that holds a private equity investors attention is a stable business environment

that the investee companys jurisdiction affords. This includes the position

of law governing transactions and certainty in tax regime.

The spate of proposed legislations on corporate and tax laws that seek

to redraw the Indian regulatory framework and extend boundaries on the

investments front, does not do so without causing complications. Of

course, much would depend on how the legislations are finally enacted.

The Companies Bill allows for merging with offshore entities, resulting

in the concerned foreign entity holding Indian assets. Permanent establishment

issues assume consequence here. Further, the Direct Taxes Code introduces

General Anti Avoidance Rules (GAAR) that allow the income-tax authorities

* Richie Sancheti is a member of the International Tax Practice group at Nishith Desai Associates, a research-

focused global organization providing strategic, legal and tax counselling.

** Hanisha Amesur is a member of the International Tax Practice group at Nishith Desai Associates, a research-

focused global organization providing strategic, legal and tax counselling.

152 INTERNATIONAL TAXATION n VOL. 3 n OCTOBER 2010 n 40

| CROSS BORDER ACQUISITIONS |

to disregard transactions or entities and to re- payment chargeable under the Tax Act to any

characterize instruments or reallocate income non-resident considers that the whole of such

between parties. This presupposes an arrangement sum would not be income chargeable in the

as impermissible if it has been entered into with case of the recipient, the payer may make an

the objective of obtaining a tax benefit and lacks application to the tax officer to determine the

commercial substance. appropriate proportion of the income so chargeable

and thereafter tax is required to be deducted

This article assesses some of the recent tax rulings

at source on such appropriate income. Therefore,

along with proposed legislations that seem to

a withholding tax certificate under this section

change the regulatory and tax landscape for

is specifically required when an apportionment

foreign investments into India. The article also

(for instance to reduce expenses) is to be made

attempts to highlight some of the key issues

to reduce the income chargeable to tax in India.

that arise in withholding tax obligations taking

the recently pronounced rulings in Vodafone and For the purposes of section 195, the situs of the

GE India Technology Centre Pvt. Ltd. as cases in payment or the source of the payment is not

point. a relevant consideration. While applying the

provisions of section 195, whether the payment

Tax framework for inbound investments is made within India or outside India, the same

Under the Indian Income-tax Act, 1961 (Tax would be subject to withholding obligations.

Act), non-residents would be taxable in India The various Courts in India have given their

only to the extent of their Indian-source income, diverse views on the applicability of section 195

(being income received, accrued or deemed to of the Tax Act. The Supreme Court of India in

have accrued or been received in India). Tax the case of Transmission Corpn. of A.P. Ltd. v.

implications on such income would have to be CIT,2 has held that the main consideration would

determined in light of the provisions of the Tax be whether or not the sum paid to a non-resident

Act, read with the provisions of the applicable is chargeable to tax under the provisions of

double taxation avoidance agreement (or tax the Tax Act. Unless payments are not explicitly

treaty). declared exempt under the provisions of the

While setting up investment structures, the benefits Tax Act, the person making the payments would

that may be derived from tax treaties of be under an obligation to withhold tax at source

intermediary jurisdictions should be thoroughly and the payer could free himself from the liability

examined. Certain treaties such as those signed to withhold tax only if he obtained the assent

with Mauritius and Singapore allow eligible of the tax officer under section 195(2). The tax

investor entities the flexibility to have their capital treaties are entered into under the provisions

gains taxed in the investors jurisdiction. Certain of the Tax Act, which specifically provide that

other treaties such as the Cyprus treaty allow between a tax treaty and the Tax Act, a taxpayer

interest payouts to the foreign lender to be can opt for whichever is more beneficial to him.

taxed at a lower rate than prescribed under the Subsequently, the Karnataka High Court in the

Tax Act. case of CIT v. Samsung Electronics Co. 3 delivered

Position of law on tax withholding a judgment that unsettled the position as commonly

understood regarding the applicability of section

obligations

195 of the Tax Act. The High Court arrived at

Under section 195 of the Tax Act, a person a view that section 195 not being a charging

responsible for making a payment to a non- provision, the tax officer could not embark on

resident that is chargeable to tax under the Tax an exercise to determine the actual nature of the

Act, is under an obligation to withhold tax at income or the tax liability of the non-resident

the applicable rates. Further, section 195(2) provides assessee. They concluded that the resident payers

that, if any, person responsible for making a liability to withhold tax springs into action the

INTERNATIONAL TAXATION n VOL. 3 n OCTOBER 2010 n 41 153

| CROSS BORDER ACQUISITIONS |

moment there is a payment to be made to a resident or the actual tax liability thereof since

non-resident, if such a payment is per se income the scope of the Assessing Officers powers is

in the hands of the recipient. The Court observed restricted to determine only the percentage of

that such payer would be relieved from his the payment that bears the character of income.

obligation to withhold tax either wholly or partially,

only upon making an application to the tax Recent rulings and implications there-

officer under section 195(2) of the Tax Act and under

demonstrating that the entire payment does not

The Bombay High Court in its recent order

partake or only partially partakes the character

upheld the tax departments jurisdiction to proceed

of income. The High Court observed that in a

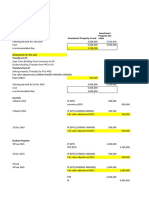

against Vodafone on its USD 11.1 billion acquisition

case where payments are being made for the

of Hutchisons Indian telecom operations. As a

import of certain goods, the entire costs of the

matter of brief background, the transaction under

goods by itself may not constitute income in the

consideration involved Vodafone International

hands of the non-resident. It is only the income

Holdings BV, Netherlands entering into a sale

component as may be determined in the manner

purchase agreement with Hutchison Telecommuni-

provided under the Tax Act which should be

cations International Limited, Cayman Islands,

subjected to the withholding provisions. However,

for acquiring Cayman-based CGP Investments.

in such a case too it must be borne in mind that

an application under section 195(2) is not an A simplified structure for the transaction could

exercise for assessment of income of the non- be understood as follows -

The decision of the Court in Vodafone accepts that the taxpayer is under no obligation and

the principle that income earned by a non-resident does not invite a moral dilemma or the risk of

from an offshore transaction cannot be taxed in legal invalidation, as long as the structures/

India, unless the assets transferred have sufficient transactions are designed legitimately and utilized

territorial nexus with India. The court stated for a bona fide purpose, even if the consequences

154 INTERNATIONAL TAXATION n VOL. 3 n OCTOBER 2010 n 42

| CROSS BORDER ACQUISITIONS |

of such structure lead to legal mitigation of tax chargeable to tax in India and, hence, the provisions

incidence. This of course is subject to the absence of section 195 should not as such apply. It is

of statutory provisions to the contrary in the pertinent to note that applicable provisions of

fiscal laws applicable to such transaction. Quite Indian exchange control laws require that where

correctly, the court also acknowledged that a a remittance has to be made to a non-resident

company had a distinct and separate legal entity from India, such remittance would only be made

from its shareholders and the business of the subject to payment of taxes. The banker making

company should not be held synonymous to the a remittance either would require a section 195

business of the shareholder. certificate or would require a certificate from a

chartered accountant stating the fact that taxes

If viewed from section 195 perspective, the much

payable, if any, have been paid. However, with

talked about Vodafone ruling also leads to an

that being said, parties to a transaction pursuant

interesting issue whether section 195 could be

to rulings in E*Trade Mauritius Limited7 and Vodafone

invoked in respect of payments made by a non-

have become vary and, at times, the buyer of

resident and the power of the tax authorities to

shares insists on either a 195 certificate or a

compel a non-resident to withhold taxes on

strong tax indemnity or a tax insurance or necessary

payments made to another non-resident. This

escrow arrangements. In the alternative,

could further lead to a substantive question as

approaching the Authority for Advance Ruling

to whether the offshore transaction is chargeable

(AAR) is a facility available to non-residents to

to tax or not. Section 195 should not per se, lead

determine their Indian tax liability.

to an enquiry into the concerned non-residents

presence in India and scope of activities being Takeaways/Key Points

carried out.

The ruling in GE India does clarify that no taxes

The Supreme Court, recently, in the case of GE need be withheld if the underlying income is

India Technology Centre Pvt. Ltd. 4, pronounced a not chargeable to tax, it does however leave one

judgment in a batch of appeals over-ruling the loose end. The ruling indicates that the payer

judgment of the Karnataka High Court in the (i.e. the purchaser) should approach the tax

case of CIT v. Samsung Electronics and laid down authorities in order to determine the withhold-

the law on application of withholding tax at ing tax liability in case of doubt. While the

source provisions in the Tax Act. In this ruling, position in the judgment is very clear, one cant

the Court held that in determining whether there help but wonder if this will create further ambiguity

is a withholding tax obligation, the benefits by an Indian payer alleging doubt in case of

under the concerned tax treaty would also have future payments. The intent however seems to

to be taken into consideration and where by have been made clear by the Supreme Court

virtue of the concerned tax treaty, the income that based on the principle of proportionality

is not taxable in India, there should not be any such exercise is only to be undertaken in case

withholding tax obligations. In respect of sale of composite payments and not otherwise.

of shares of an Indian company by a Mauritius

company, the Supreme Court in the case of The Vodafone order reinforces the need for offshore

Azadi Bachao Andolan5 has held that the capital sellers to ensure that the exit structure takes

gains tax benefit under the India-Mauritius Tax into account diverse legal concerns ranging from

Treaty would apply so long as the Mauritius the enforceability of tax indemnities to the ring

company has obtained a tax residency certificate fencing of potential legal risks. It would also

from the Mauritius Tax Authorities. 6 entail a coordination between the formal terms

of the agreements and various disclosures or

Thus, in a case where a Mauritius resident is filings made before public authorities. The Court

realising capital gains from the sale of shares has also reiterated the common law principle

of an Indian company as opposed to a multi- that a share is a distinct capital asset in its own

layered structure, the same should not be right. It is a fundamental principle that the

INTERNATIONAL TAXATION n VOL. 3 n OCTOBER 2010 n 43 155

| CROSS BORDER ACQUISITIONS |

business and assets of a corporation are not the investments into India by sending negative signals

business and assets of its shareholders. The mere in terms of consistency of the regulations and

fact that the shares of a foreign company are the regulators willingness to attract foreign

acquired would not lead to any transfer of interests investment. The aggressive stance towards global

in its underlying subsidiary companies. transactions adds an additional element of risk

and a perception of unpredictability. Going

Globally, there is a fight for capital and given

forward, future transactions would be governed

the present scenario in financial markets where

by the Direct Taxes Code which, in its current

most of capital surge is predominantly foreign

shape, clearly provides for circumstances under

institutional investors (FII) led, it is imperative

which an indirect transfer could be subject to

that private equity and strategic investors be

Indian taxes. However, this should not apply

encouraged as they bring stable long-term capital.

to transactions already consummated under the

The recent rulings may discourage foreign

current position of law (being the Tax Act).

1. Based on information provided in Fact Sheet On Foreign Direct Investment (FDI) From August 1991 to July

2010" and could be accessed at http://dipp.nic.in/fdi_statistics/india_FDI_July2010.pdf

2. [1999] 239 ITR 587 (SC)

3. 320 ITR 209

4. Civil Appeal Nos. 7541-7542 of 2010

5. Union of India v. Azadi Bachao Andolan 263 ITR 706 (SC)

6. Circular No. 789, dated April 13, 2000 clarifies that capital gains derived by a Mauritius resident from the

sale of shares of an Indian company, in accordance with the Treaty are taxable only in Mauritius. The circular

further indicates that a certificate of residence issued by the Mauritian tax authorities would constitute sufficient

evidence for accepting the status of residence as well as beneficial ownership for applying the treaty.

7. E*Trade Mauritius Limited v. ADIT [WP. No. 2134 of 2008].

156 INTERNATIONAL TAXATION n VOL. 3 n OCTOBER 2010 n 44

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- WLDoc 18-10-22 7 - 27 (PM)Document3 pagesWLDoc 18-10-22 7 - 27 (PM)Sagar KadyanNo ratings yet

- Special Defence Recruitement PDFDocument15 pagesSpecial Defence Recruitement PDFSagar KadyanNo ratings yet

- Supreme Court rules monetary compensation for terminated employeeDocument4 pagesSupreme Court rules monetary compensation for terminated employeeSagar KadyanNo ratings yet

- WLDoc 18-10-22 7 - 27 (PM)Document3 pagesWLDoc 18-10-22 7 - 27 (PM)Sagar KadyanNo ratings yet

- WLDoc 18-10-22 8 - 1 (PM)Document11 pagesWLDoc 18-10-22 8 - 1 (PM)Sagar KadyanNo ratings yet

- WLDoc 18-10-22 7 - 48 (PM)Document7 pagesWLDoc 18-10-22 7 - 48 (PM)Sagar KadyanNo ratings yet

- WLDoc 18-10-22 8 - 1 (PM)Document11 pagesWLDoc 18-10-22 8 - 1 (PM)Sagar KadyanNo ratings yet

- WLDoc 18-10-22 7 - 48 (PM)Document7 pagesWLDoc 18-10-22 7 - 48 (PM)Sagar KadyanNo ratings yet

- 2014 1 PDFDocument1 page2014 1 PDFSagar KadyanNo ratings yet

- Supreme Court rules monetary compensation for terminated employeeDocument4 pagesSupreme Court rules monetary compensation for terminated employeeSagar KadyanNo ratings yet

- ICAI Training Presentation PDFDocument46 pagesICAI Training Presentation PDFSagar KadyanNo ratings yet

- Whether Linking of Janaadhar With Welfare Scheme Is in Violation of Right To Privacy?Document10 pagesWhether Linking of Janaadhar With Welfare Scheme Is in Violation of Right To Privacy?Sagar KadyanNo ratings yet

- Fun Things To Do at HampiDocument4 pagesFun Things To Do at HampiSagar KadyanNo ratings yet

- Naman PPT Computer VirusDocument23 pagesNaman PPT Computer VirusSagar KadyanNo ratings yet

- Webcasters ProformaDocument1 pageWebcasters ProformaSagar KadyanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 30 Sample Essays Band 9 IELTS of SimonDocument29 pages30 Sample Essays Band 9 IELTS of SimonKhang TranNo ratings yet

- Understanding Rwanda Agribusiness and Manufacturing SeDocument258 pagesUnderstanding Rwanda Agribusiness and Manufacturing Seooty.pradeepNo ratings yet

- Benchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationDocument14 pagesBenchmarking as a Long-Term Strategy: A Case Study of Xerox CorporationJenny BascunaNo ratings yet

- Lean Retailing at Tanishq BoutiquesDocument100 pagesLean Retailing at Tanishq BoutiquesAgraj BhartiyaNo ratings yet

- Chapter 02 National Differences in Political EconomyDocument38 pagesChapter 02 National Differences in Political EconomyNiladri RaianNo ratings yet

- Consumer Awareness ProjectDocument3 pagesConsumer Awareness ProjectBincy CherianNo ratings yet

- Skill Development Is Key To Economic Growth - Role of Higher Education in IndiaDocument34 pagesSkill Development Is Key To Economic Growth - Role of Higher Education in IndiaAmit Singh100% (1)

- Virtual Construction LTD: Purchases Order Form (POF)Document31 pagesVirtual Construction LTD: Purchases Order Form (POF)Shoyeeb AhmedNo ratings yet

- Revenue Regulations on Compromise SettlementDocument6 pagesRevenue Regulations on Compromise SettlementMilane Anne CunananNo ratings yet

- P.G.Apte International Financial Management 1Document15 pagesP.G.Apte International Financial Management 1Alissa BarnesNo ratings yet

- Answer Key - Ic - Mock Exam - Set A PDFDocument9 pagesAnswer Key - Ic - Mock Exam - Set A PDFZyzy Lepiten80% (46)

- Project Management Process OverviewDocument49 pagesProject Management Process OverviewIlyaas OsmanNo ratings yet

- Ust 2014 Bar Q Suggested Answers Civil LawDocument15 pagesUst 2014 Bar Q Suggested Answers Civil LawKevin AmanteNo ratings yet

- African Tax Outlook 2019Document200 pagesAfrican Tax Outlook 2019The Independent Magazine100% (3)

- Pei201509 DLDocument46 pagesPei201509 DLanjangandak2932No ratings yet

- VAT Codal and RegulationsDocument6 pagesVAT Codal and RegulationsVictor LimNo ratings yet

- Risk Assessment Process For Ayala Land Inc. v22Document11 pagesRisk Assessment Process For Ayala Land Inc. v22Nelzen GarayNo ratings yet

- Import Purchase ProcedureDocument20 pagesImport Purchase ProcedureAbdul KhaderNo ratings yet

- Company Profile 032019 (Autosaved)Document29 pagesCompany Profile 032019 (Autosaved)ePeople ManpowerNo ratings yet

- IimmDocument31 pagesIimmRahul KunwarNo ratings yet

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- Full Notes SapmDocument472 pagesFull Notes SapmJobin JohnNo ratings yet

- Unit III - Application of Theory of ProductionDocument16 pagesUnit III - Application of Theory of ProductionPushpavalli MohanNo ratings yet

- Llegado-Chapter 1Document13 pagesLlegado-Chapter 1Mary LlegadoNo ratings yet

- MoU - 2023 - 24 - LBAS - MADocument5 pagesMoU - 2023 - 24 - LBAS - MAMetilda AcademyNo ratings yet

- SmeDocument68 pagesSmevictorNo ratings yet

- A Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDocument255 pagesA Geographical Analysis of Bell - Metal Industry in Sarthebar PDFDhiraj DaimaryNo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Zero Base BudgetingDocument15 pagesZero Base BudgetingSumitasNo ratings yet

- Tracxn Startup Research Global SaaS India Landscape May 2016 1Document125 pagesTracxn Startup Research Global SaaS India Landscape May 2016 1Shikha GuptaNo ratings yet