Professional Documents

Culture Documents

Abda PDF

Abda PDF

Uploaded by

Putri Rizky MayLinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abda PDF

Abda PDF

Uploaded by

Putri Rizky MayLinaCopyright:

Available Formats

PT Asuransi Bina Dana Arta Tbk.

(Formerly PT Dharmala Insurance Tbk) Insurance

Head Office Plaza ABDA 27th Floor Summary of Financial Statement

Jl. Jend. Sudirman Kav. 59

Jakarta 12190 (Million Rupiah)

Phone (021) 5140-1688 (Hunting) 2012 2013 2014

Fax (021) 5140-1698-99 Total Assets 1,731,600 2,153,350 2,681,038

E-mail: contactus@abdainsurance.co.id Current Assets 658,261 965,831 1,276,640

Website: www.abdainsurance.co.id of which

Business General Insurance Cash and Cash Equivalents 504,879 798,030 1,034,077

Company Status PMA Premium receivables 98,043 145,999 218,968

Receivable from reinsurers 4,315 4,384 6,585

Brief History: PT. Asuransi Bina Dana Arta Tbk, was es- Non-current Assets 1,073,339 1,187,519 1,404,398

tablished and located in Jakarta as per Notarial Deed from Kar- of which

tini Mulyadi SH, No. 78 dated October 12, 1982. Fixed Assets-Net 64,227 72,588 97,679

The Company is engaged in providing general insurance Investment 754,283 855,558 1,179,527

Deffered Tax Assets-Net 3,557 4,469 5,651

for : Fire, Motor Vehicles, Engineering, Liabilities, Marine Cargo,

Other Assets 2,319 1,938 1,863

Heavy Equipment, Health, Miscellaneous and others.

In its first year, the Company’s name was PT. Asuransi Liabilities 1,110,144 1,337,036 1,461,378

Current Liabilities 50,018 88,277 88,801

Bina Dharma Arta and in 1994 changed into PT. Dharmala in-

of which

surance. The Company was renamed PT. Asuransi Bina Dana Claims payable 17,740 21,920 23,790

Arta Tbk, also known as ABDA Insurance since 1999. Payable to reinsurers 4,152 3,240 5,804

At present, the Company’s head office is located in Plaza Taxes payable 6,516 9,401 3,979

ABDA, Jl. Jend. Sudirman, Kav. 59, Jakarta. It operates through Non-current Liabilities 1,060,126 1,248,759 1,372,577

29 branches and representative offices. Besides, we are expand- Shareholders' Equity 621,459 816,313 1,219,660

ing our network all over Indonesia. Paid-up capital 193,317 193,317 193,317

Paid-up capital

in excess of par value 8,109 8,109 8,109

Retained earnings 420,033 614,887 1,018,234

Revenue 972,983 1,204,836 1,438,611

Operating Expenses 938,092 1,035,446 1,258,341

Operating Profit (Loss) 34,891 169,390 180,269

Other Income (Expenses) 75,332 7,385 8,410

Profit (loss) before Taxes 110,223 176,775 188,679

Comprehensive Profit (loss) 216,143 219,690 449,857

Revenue Breakdown

Premium Income 972,983 1,121,249 1,292,992

Investment Income (expenses) 69,331 83,587 145,618

Expense Breakdown

Reinsurance Premiums 228,048 165,205 177,719

Claims Paid 427,645 526,319 632,417

Others 282,399 343,922 448,206

Per Share Data (Rp)

Earnings (Loss) per Share 364 354 725

Equity per Share 1,046 1,315 1,964

Dividend per Share 40 75 85

Closing Price 1,830 4,250 6,250

Financial Ratios

PER (x) 5.03 12.01 8.63

PBV (x) 1.75 3.23 3.18

Dividend Payout (%) 10.99 21.20 11.73

Dividend Yield (%) 2.19 1.76 1.36

Operating Profit Margin (x) 0.04 0.14 0.13

Net Profit Margin (x) 0.22 0.18 0.31

Expense Ratio (x) 0.96 0.92 0.97

Loss Ratio (x) 0.44 0.47 0.49

Shareholders Solvency Ratio (x) 0.83 0.85 1.09

Barclays Bank PLC Singapore-Wealth Management 20.00% ROI (%) 12.48 10.20 16.78

Coutts an Co., Ltd., Singapore 19.12% ROE (%) 34.78 26.91 36.88

ABN AMRO NOMINEES Singapore Pte., Ltd. 7.67% PER = 30,51x ; PBV = 4,47x (March 2015)

Barclays Bank PLC Hongkong-Wealth Management 7.09% Financial Year: December 31

Public 46.12% Public Accountant: Paul Hadiwinata, Hidayat, Arsono, Ade Fatma & Rekan

826 Indonesian Capital Market Directory 2015

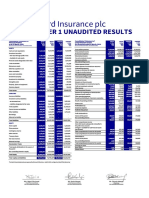

PT Asuransi Bina Dana Arta Tbk.

(Formerly PT Dharmala Insurance Tbk) Insurance

Board of Commissioners Board of Directors

President Commissioner Tjan Soen Eng President Director Candra Gunawan

Commissioners Herlani Sunardi, Sarkoro Handajani Directors Dody Sjachroerodly, Eka Listiani Kartono,

Jeni Wirjadinata

Number of Employees 598

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 06-Jul-89 06-Jul-89 900,000 900,000

2 Company Listing 25-Aug-89 25-Aug-89 4,500,000 5,400,000

3 Private Placement 07-Aug-90 07-Aug-90 200,000 5,600,000

4 Right Issue 07-Aug-90 07-Aug-90 3,240,000 8,840,000

5 Dividen Shares 06-Oct-93 06-Oct-93 886,000 9,726,000

6 Cooperative 06-Oct-93 06-Oct-93 100,000 9,826,000

7 Bonus Shares 26-Feb-96 26-Feb-96 7,860,800 17,686,800

8 Stock Split 16-Dec-96 16-Dec-96 17,686,800 35,373,600

9 Right Issue 15-Jan-02 06-Feb-02 70,747,200 106,120,800

10 Bonus Shares 7-Aug-03 7-Aug-03 31,836,240 137,957,040

11 Right Issue 21-Dec-04 21-Dec-04 137,957,040 275,914,080

12 Right Issue 1-Apr-11 27-Apr-11 344,892,600 620,806,680

Underwriters

PT INDOVEST, PT MERINCORP

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price Shares Traded Trading Listed Market

Month High Low Close Volume Value Frequency Day Shares Capitalization

(Rp) (Rp) (Rp) (Thousand Shares) (Rp Million) (Rp Million)

January-14 4,000 4,000 4,000 71.00 285.00 27 10 620,806,680 2,483,227.00

February-14 4,525 4,000 4,525 232.00 1,013.00 43 13 620,806,680 2,809,150.00

March-14 5,675 4,005 5,300 120.00 559.00 100 18 620,806,680 3,290,275.00

April-14 5,800 4,800 5,225 658.00 3,717.00 58 14 620,806,680 3,243,715.00

May-14 5,600 4,750 5,050 104.00 551.00 51 15 620,806,680 3,135,074.00

June-14 5,500 5,000 5,000 9.00 43.00 5 5 620,806,680 3,104,033.00

July-14 5,500 5,000 5,500 571.00 3,116.00 47 13 620,806,680 3,414,437.00

August-14 5,725 4,500 5,700 133.00 732.00 65 16 620,806,680 3,538,598.00

September-14 5,925 5,025 5,250 100.00 584.00 71 14 620,806,680 3,259,235.00

October-14 5,900 4,900 5,875 13.00 73.00 60 6 620,806,680 3,647,239.00

November-14 6,075 5,900 6,075 216.00 1,302.00 34 8 620,806,680 3,771,401.00

December-14 6,250 6,100 6,250 1,093.00 6,796.00 63 9 620,806,680 3,880,042.00

January-15 6,550 6,225 6,550 375.00 2,354.00 36 13 620,806,680 4,066,284.00

February-15 6,650 6,525 6,650 802.00 5,300.00 34 13 620,806,680 4,128,364.00

March-15 6,825 6,200 6,825 202.00 1,321.00 32 13 620,806,680 4,237,006.00

April-15 7,125 6,850 7,125 53.00 369.00 21 9 620,806,680 4,423,248.00

May-15 7,425 7,100 7,425 5.00 38.00 5 4 620,806,680 4,609,490.00

June-15 7,750 5,975 7,750 13.00 98.00 11 7 620,806,680 4,811,250.00

Stock Price and Traded Chart

Stock Price (Rp) Thousand Shares

8,000 20

18

7,000

16

6,000

14

5,000

12

4,000 10

8

3,000

6

2,000

4

1,000

2

- -

Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15

Institute for Economic and Financial Research 827

You might also like

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalDocument2 pagesCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)

- Lex Service PLCDocument11 pagesLex Service PLCArup Dey0% (1)

- Armstrong-83. Cap. Structure 0-324-53116-8 - 0001-1Document8 pagesArmstrong-83. Cap. Structure 0-324-53116-8 - 0001-1Tien Pham HongNo ratings yet

- Abda ICMD 2009Document2 pagesAbda ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaNo ratings yet

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- Abba PDFDocument2 pagesAbba PDFAndriPigeonNo ratings yet

- PT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)Document2 pagesPT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)MaradewiNo ratings yet

- KrenDocument2 pagesKrenMaradewiNo ratings yet

- Akku PDFDocument2 pagesAkku PDFMaradewiNo ratings yet

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocument2 pagesPT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Abmm PDFDocument2 pagesAbmm PDFTRI HASTUTINo ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- Rmba - Icmd 2011 (B02)Document2 pagesRmba - Icmd 2011 (B02)annisa lahjieNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNo ratings yet

- 2018 Quarter 1 Financials PDFDocument1 page2018 Quarter 1 Financials PDFKaystain Chris IhemeNo ratings yet

- 1st Quarter Report - tcm391-593715Document1 page1st Quarter Report - tcm391-593715Ahm FerdousNo ratings yet

- A SriDocument2 pagesA SriMugiwara LuffyNo ratings yet

- Spma ICMD 2009Document2 pagesSpma ICMD 2009abdillahtantowyjauhariNo ratings yet

- UEU Undergraduate 394 LampiranDocument54 pagesUEU Undergraduate 394 Lampiranali71usmanNo ratings yet

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocument2 pagesPT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNo ratings yet

- IcbpDocument2 pagesIcbpdennyaikiNo ratings yet

- PT Hexindo Adiperkasa TBK.: Summary of Financial StatementDocument2 pagesPT Hexindo Adiperkasa TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Tri Banyan Tirta TBK.: Summary of Financial StatementDocument2 pagesPT Tri Banyan Tirta TBK.: Summary of Financial StatementAndre Bayu SaputraNo ratings yet

- GGRM - Icmd 2011 (B02)Document2 pagesGGRM - Icmd 2011 (B02)annisa lahjieNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- 2019 Quarter 1 FInancial StatementsDocument1 page2019 Quarter 1 FInancial StatementsKaystain Chris IhemeNo ratings yet

- KLBFDocument2 pagesKLBFKhaerudin RangersNo ratings yet

- UBL Annual Report 2018-154Document1 pageUBL Annual Report 2018-154IFRS LabNo ratings yet

- 4q19 Cimb Group Financial StatementsDocument70 pages4q19 Cimb Group Financial StatementsShaheer AliNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- PT Hero Supermarket TBK.: Summary of Financial StatementDocument2 pagesPT Hero Supermarket TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- M4 Example 2 SDN BHD FSADocument38 pagesM4 Example 2 SDN BHD FSAhanis nabilaNo ratings yet

- Saip ICMD 2009Document2 pagesSaip ICMD 2009abdillahtantowyjauhariNo ratings yet

- Fintech Company:Paytm: 1.financial Statements and Records of CompanyDocument7 pagesFintech Company:Paytm: 1.financial Statements and Records of CompanyAnkita NighutNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- AZ FS SpreadsheetDocument16 pagesAZ FS SpreadsheetSasmit BagherwalNo ratings yet

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- Hand Protection PLCDocument8 pagesHand Protection PLCasankaNo ratings yet

- Net Cash Flows From Financing Activities 108,523 49,112 2,996Document11 pagesNet Cash Flows From Financing Activities 108,523 49,112 2,996Hong NguyenNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Excel Sheet - SAMPLE 2Document23 pagesExcel Sheet - SAMPLE 2Bhavdeep singh sidhuNo ratings yet

- Afaa InsuranceDocument9 pagesAfaa InsuranceARAIB TAJINo ratings yet

- 2018 Quarter 2 Financials PDFDocument1 page2018 Quarter 2 Financials PDFKaystain Chris IhemeNo ratings yet

- Acc AssignmentDocument25 pagesAcc AssignmentMyustafizzNo ratings yet

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Please Input: Formula, Do Not Change: Required Minimum DataDocument117 pagesPlease Input: Formula, Do Not Change: Required Minimum DataDwiputra SetiabudhiNo ratings yet

- 2020-08 Financial StatementsDocument7 pages2020-08 Financial StatementsDenis GonzálezNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- 1Q 2014 Op Supp Final 7-21-14Document19 pages1Q 2014 Op Supp Final 7-21-14bomby0No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Top Activist Stories - 4 - A Review of Financial Activism by Geneva PartnersDocument9 pagesTop Activist Stories - 4 - A Review of Financial Activism by Geneva PartnersBassignotNo ratings yet

- Registrars To An Issue and Share Transfer Agents Registrars To An Issue (RTI) and Share TransferDocument13 pagesRegistrars To An Issue and Share Transfer Agents Registrars To An Issue (RTI) and Share TransferselvamanagerNo ratings yet

- Meaning and Different Types of AssetsDocument2 pagesMeaning and Different Types of Assetspugalendh123No ratings yet

- Dividends and Other Payouts c19Document38 pagesDividends and Other Payouts c19Corey WuNo ratings yet

- A Comparative Analysis of Kohl's Corporation and J.C. Penney CorporationDocument18 pagesA Comparative Analysis of Kohl's Corporation and J.C. Penney Corporation2plump2cNo ratings yet

- Chapter 11 Corporate Performance, Governance and Business EthicsDocument7 pagesChapter 11 Corporate Performance, Governance and Business EthicsNGO KAI YAN FLORENCENo ratings yet

- Charting A Company'S Direction:: Its Vision, Mission, Objectives, and StrategyDocument58 pagesCharting A Company'S Direction:: Its Vision, Mission, Objectives, and Strategyashrafalam1986No ratings yet

- Pantheon Study Cash Management Strategies For Private Equity InvestorsDocument18 pagesPantheon Study Cash Management Strategies For Private Equity InvestorsEmir KarabegovićNo ratings yet

- Franchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Document2 pagesFranchise Application Form: (I) APPLICANT INFORMATION (For Individuals, Please Fill in Applicable Fields)Nha Nguyen HoangNo ratings yet

- Issue of SharesDocument2 pagesIssue of SharesAarya KhedekarNo ratings yet

- Toa 1405Document5 pagesToa 1405chowchow123No ratings yet

- Hedge Fund StrategiesDocument13 pagesHedge Fund StrategiesptselvakumarNo ratings yet

- Preparing Simple Consolidated Financial StatementsDocument10 pagesPreparing Simple Consolidated Financial Statementstapia4yeabuNo ratings yet

- Tufano, 1996Document3 pagesTufano, 1996Palo DzurjaninNo ratings yet

- Latihan Soal Advanced Accounting Chapter 3Document18 pagesLatihan Soal Advanced Accounting Chapter 3JulyaniNo ratings yet

- Five Companies From Same Industry and Their Vision & Mission Statement AnalysisDocument9 pagesFive Companies From Same Industry and Their Vision & Mission Statement AnalysisAyesha Akhtar KonikaNo ratings yet

- Week 1 Slides s06 2Document50 pagesWeek 1 Slides s06 2Pallavi ChawlaNo ratings yet

- Practice Problem 1 - Asset AcquisitonDocument1 pagePractice Problem 1 - Asset AcquisitonShine ValdezNo ratings yet

- Solved Several Dozen Managers and Directors of Foreign Based Pension PLDocument1 pageSolved Several Dozen Managers and Directors of Foreign Based Pension PLAnbu jaromiaNo ratings yet

- Since All The Data Needed To Construct An Income Statement Are AvailableDocument3 pagesSince All The Data Needed To Construct An Income Statement Are AvailableShay MortonNo ratings yet

- Financial Accounting A Managerial PerspectiveDocument3 pagesFinancial Accounting A Managerial PerspectivezeenatjahanNo ratings yet

- Sensitivity AnalysisDocument5 pagesSensitivity AnalysisMohsin QayyumNo ratings yet

- Panasonic Energy India CompanyDocument37 pagesPanasonic Energy India CompanyCA Disha AgrawalNo ratings yet

- Company Formation in The United Arab Emirates (Ajman)Document12 pagesCompany Formation in The United Arab Emirates (Ajman)Offshore Company FormationNo ratings yet

- Financial Accounting & Reporting 1Document232 pagesFinancial Accounting & Reporting 1Its Ahmed100% (1)

- Neo Group Offer Document Jul 2012Document347 pagesNeo Group Offer Document Jul 2012suonodimusicaNo ratings yet