Professional Documents

Culture Documents

Saip ICMD 2009

Uploaded by

abdillahtantowyjauhariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Saip ICMD 2009

Uploaded by

abdillahtantowyjauhariCopyright:

Available Formats

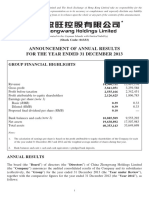

PT Surabaya Agung Industri Pulp & Kertas Tbk.

Paper and Allied Products

Head Office Jalan Kedungdoro No. 60 8th-10th Floor Summary of Financial Statement

Surabaya 60251 Jawa Timur-Indonesia (Million Rupiah)

Phone (031) 548-2003-18 2007 2008 2009

Fax (031) 548-2039, 548-2040 Total Assets 2,661,804 2,523,434 2,413,703

E-mail Address: ird@suryakertas.com Current Assets 232,365 222,830 212,436

Homepage: http://www.suryakertas.com of which

Cash and cash equivalents 1,714 4,762 2,793

Factory Jalan Raya Driyorejo, Gresik, Jawa Timur Trade receivables 78,464 62,765 72,159

Phone (031) 750-7129-30 Inventories 132,918 139,027 123,819

Fax (031) 750-7363 Non-Current Assets 2,429,440 2,300,604 2,201,267

E-mail address: ird@suryakertas.com of which

Fixed Assets-Net 2,413,289 2,284,339 2,190,105

Homepage: http://www.suryakertas.com

Business Paper Industry Liabilities 3,373,606 3,669,939 3,224,643

Company Status PMDN Current Liabilities 107,007 233,011 234,513

of which

Short term-debt 17,003 135,969 173,854

Financial Performance: The Company successfully booked Trade payables 58,032 55,418 37,823

net income at IDR335.5 billion in 2009, while in previous year Taxes payable 1,781 5,571 1,016

suffered net loss at IDR434.7 billion. Non-Current Liabilities 3,266,598 3,436,927 2,990,131

Brief History: The Company was founded on August Shareholders' Equity ( 711,801) ( 1,146,504) ( 810,941)

Paid-up capital 1,540,860 1,540,860 1,540,860

31st 1973 by Tirtomulyadi Sulistyo, equipped with modern Revaluation of fixed assets 197,548 n.a n.a

computerized machines which occupy 45 hectares of land Retained earnings (accumulated loss) ( 2,450,209) ( 2,687,364) ( 2,351,801)

at Driyorejo. It started its commercial production in 1976 Net Sales 673,176 653,101 452,652

with an initial production capacity of only 5,000 tons a year. Cost of Goods Sold 677,779 677,073 441,733

On 1998, the company has operate 8 (eight) units of paper Gross Profit ( 4,604) ( 23,972) 10,918

Operating Expenses 84,030 86,773 60,608

machinery, for papers and boards, with total annual production Operating Profit ( 88,634) ( 110,745) ( 49,690)

capacity of 329,400 tons. Surabaya Agung operates with sincere Other Income (Expenses) ( 130,141) ( 498,216) 501,363

Profit (Loss) before Taxes ( 218,775) ( 608,960) 451,673

integrity and commitment to its customers, employees, share- Profit (Loss) after Taxes 203,847 ( 434,703) 353,564

holders and incessantly controls the quality and performance of

Per Share Data (Rp)

highly qualified products. Earnings (Loss) per Share 127 (126) 102

Equity per Share ( 443) ( 332) ( 235)

Dividend per Share n.a n.a n.a

Closing Price 335 190 113

Financial Ratios

PER (x) 2.64 (1.51) 1.10

PBV (x) (0.76) (0.57) (0.48)

Dividend Payout (%) n.a n.a n.a

Dividend Yield (%) n.a n.a n.a

Current Ratio (x) 2.17 0.96 0.91

Leverage Ratio (x) 1.27 1.45 1.34

Gross Profit Margin (x) n.a n.a n.a

Operating Profit Margin (x) n.a n.a n.a

Net Profit Margin (x) 0.30 n.a 0.78

Inventory Turnover (x) 5.10 4.87 3.57

Total Assets Turnover (x) 0.25 0.26 0.19

ROI (%) 7.66 (17.23) 14.65

ROE (%) 28.64 (37.92) 43.60

PER = 2.32x ; PBV = -0.71x (June 2010)

Financial Year: December 31

Public Accountant: Anwar & Co.

(million rupiah)

2010 2009

June June

Total Assets 2,406,167 2,414,938

Current Assets 256,086 173,078

Non-Current Assets 2,150,081 2,241,860

Liabilities 3,163,069 3,431,493

Shareholders' Equity (756,903) (1,016,555)

Shareholders Net Sales 241,232 245,069

ZT Holding Pte., Ltd. 76.28% Profit after Taxes 54,038 129,949

PT Bank Resona Perdania 6.31%

PT Intan Teguh Sejati 6.20% ROI (%) 2.25 5.38

Public 11.21% ROE (%) (7.14) (12.78)

216 Indonesian Capital Market Directory 2010

PT Surabaya Agung Industri Pulp & Kertas Tbk. Paper and Allied Products

Board of Commissioners Board of Directors

President Commissioner Zhang Hui Han Sindu President Director Tirtomulyadi Sulistyo

Commissioners Imanuel Robert Najoan, Hariyadi Welim Directors Y.M. Kenny Wailanduw, Any Indrawati,

Rasmachahjana Sulistyo

Number of Employees 1,217

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 03-May-93 03-May-93 20,000,000 20,000,000

2 Company Listing 03-May-93 23-Nov-93 92,000,000 112,000,000

3 Bonus Shares 02-Jan-95 02-Jan-95 56,000,000 168,000,000

4 Right Issue 15-Mar-96 15-Mar-96 126,000,000 294,000,000

5 Additional Listing without

Pre-emptive Rights 27-Dec-07 27-Dec-07 3,156,607,595 3,450,607,595

Lead Managing Underwriter PT Jardine Fleming Nusantara

Underwriters PT G.K. Goh Ometraco, PT Jasereh Utama, PT Morgan Grenfell Asia Indonesia, PT Baring Securities Indonesia,

PT Niaga Securities, PT Danareksa Sekuritas, PT Agung Securities Indonesia, PT Mashill Jaya Securities

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price and Traded Chart

Stock Price (Rp) Thousand Shares

200 180

180 160

160

140

140

120

120

100

100

80

80

60

60

40

40

20 20

- -

Jan-09 Feb-09Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10Mar-10 Apr-10 May-10 Jun-10

Institute for Economic and Financial Research 217

You might also like

- p94-1738 Instrumentation t2000Document6 pagesp94-1738 Instrumentation t2000AaronNo ratings yet

- Yanmar SMSV15 - SV17Document356 pagesYanmar SMSV15 - SV17kokosik22100% (3)

- Mathematics Form 1Document339 pagesMathematics Form 1JacintaRajaratnam67% (9)

- SEAFARERSDocument29 pagesSEAFARERSJohanna Arnaez100% (1)

- Chapter 2 1 Determination of Interest RatesDocument63 pagesChapter 2 1 Determination of Interest RatesLâm Bulls100% (1)

- Case 29 Gainesboro Machine Tools CorporationDocument33 pagesCase 29 Gainesboro Machine Tools CorporationUshna100% (1)

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNo ratings yet

- Spma ICMD 2009Document2 pagesSpma ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaNo ratings yet

- Fasw ICMD 2009Document2 pagesFasw ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- Akku PDFDocument2 pagesAkku PDFMaradewiNo ratings yet

- SCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022Document13 pagesSCB BursaAnnFSNotes 4th Quarter Ended 30.6.2022kimNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNo ratings yet

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocument2 pagesPT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- PT. Great River International TBK.: Summary of Financial StatementDocument1 pagePT. Great River International TBK.: Summary of Financial StatementroxasNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- PT Astra Agro Lestari Tbk Financial Summary 2010Document2 pagesPT Astra Agro Lestari Tbk Financial Summary 2010Intan Maulida SuryaningsihNo ratings yet

- PT Panasia Indo Resources Tbk Financial Performance Textile CompanyDocument2 pagesPT Panasia Indo Resources Tbk Financial Performance Textile CompanyMaradewiNo ratings yet

- AMAN SHURAL ROH FL FAC Forcasted BudgetDocument4 pagesAMAN SHURAL ROH FL FAC Forcasted Budgetalemayehu tarikuNo ratings yet

- PT Hexindo Adiperkasa TBK.: Summary of Financial StatementDocument2 pagesPT Hexindo Adiperkasa TBK.: Summary of Financial StatementMaradewiNo ratings yet

- IcbpDocument2 pagesIcbpdennyaikiNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Abda PDFDocument2 pagesAbda PDFTRI HASTUTINo ratings yet

- 91invuf 2Document1 page91invuf 2Mahamadali DesaiNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- 2018 Quarter 1 Financials PDFDocument1 page2018 Quarter 1 Financials PDFKaystain Chris IhemeNo ratings yet

- 2019 Quarter 1 FInancial StatementsDocument1 page2019 Quarter 1 FInancial StatementsKaystain Chris IhemeNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDaniyal NawazNo ratings yet

- Samsung Electronics Co., Ltd. interim cash flow statementDocument2 pagesSamsung Electronics Co., Ltd. interim cash flow statementMohammadNo ratings yet

- CR-July-Aug-2022Document6 pagesCR-July-Aug-2022banglauserNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocument2 pagesPT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- PT Hero Supermarket TBK.: Summary of Financial StatementDocument2 pagesPT Hero Supermarket TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- A SriDocument2 pagesA SriMugiwara LuffyNo ratings yet

- Heidelbergcement Annual Report 2016Document308 pagesHeidelbergcement Annual Report 2016someshNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- AMTEXDocument87 pagesAMTEXBilal Ahmed KhanNo ratings yet

- Q2 2023 Financial SchedulesDocument30 pagesQ2 2023 Financial SchedulesVinieboy De mepperNo ratings yet

- HMSP - Icmd 2011 (B02)Document2 pagesHMSP - Icmd 2011 (B02)annisa lahjieNo ratings yet

- August 11, 2023: 153/LG/SE/AUG/2023/GBSLDocument8 pagesAugust 11, 2023: 153/LG/SE/AUG/2023/GBSLmd zafarNo ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsUkaaaNo ratings yet

- 2019 Quarter 2 FInancial StatementsDocument1 page2019 Quarter 2 FInancial StatementsKaystain Chris IhemeNo ratings yet

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- PT Aqua Golden Mississippi Tbk. Financial SummaryDocument2 pagesPT Aqua Golden Mississippi Tbk. Financial SummaryMila DiasNo ratings yet

- Super Gloves 2Document6 pagesSuper Gloves 2anon_149445490No ratings yet

- BSRM Steels Limited Balance Sheet (Unaudited)Document4 pagesBSRM Steels Limited Balance Sheet (Unaudited)azadbdNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- 1333 HK Full YrDocument38 pages1333 HK Full Yrwilliam zengNo ratings yet

- Takaful Companies - Overall: ItemsDocument6 pagesTakaful Companies - Overall: ItemsZubair ArshadNo ratings yet

- Financial Statements enDocument30 pagesFinancial Statements enNHÃ THY TRẦN PHƯƠNGNo ratings yet

- Interim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesDocument2 pagesInterim Consolidated Statements of Cash Flows: Samsung Electronics Co., Ltd. and Its SubsidiariesMike TruongNo ratings yet

- Minerals for Civil EngineersDocument6 pagesMinerals for Civil EngineersConrado Seguritan IIINo ratings yet

- Proceedings of 2006 WSEAS Conference on Heat and Mass TransferDocument7 pagesProceedings of 2006 WSEAS Conference on Heat and Mass TransferAnonymous knICaxNo ratings yet

- MVP Software User Manual: MVP Maestro II - Design Client MVP System Configuration ToolDocument50 pagesMVP Software User Manual: MVP Maestro II - Design Client MVP System Configuration ToolDan CoolNo ratings yet

- How To Read An EKG Strip LectureDocument221 pagesHow To Read An EKG Strip LectureDemuel Dee L. BertoNo ratings yet

- CH 6 SandwichesDocument10 pagesCH 6 SandwichesKrishna ChaudharyNo ratings yet

- WBOX 0E-1GANGSIRN Spec SheetDocument1 pageWBOX 0E-1GANGSIRN Spec SheetAlarm Grid Home Security and Alarm MonitoringNo ratings yet

- Upper Limb OrthosisDocument47 pagesUpper Limb OrthosisPraneethaNo ratings yet

- 6 1 Reducing Rational Expressions To Lowest TermsDocument21 pages6 1 Reducing Rational Expressions To Lowest Termsapi-233527181No ratings yet

- L05 - Selection of Indicators (ENG)Document9 pagesL05 - Selection of Indicators (ENG)killerkissNo ratings yet

- SDS SikarugasolDocument9 pagesSDS SikarugasolIis InayahNo ratings yet

- IPv4 - IPv4 Header - IPv4 Header Format - Gate VidyalayDocument15 pagesIPv4 - IPv4 Header - IPv4 Header Format - Gate VidyalaySakshi TapaseNo ratings yet

- RSSC IntroductionDocument31 pagesRSSC Introductioncalamus300No ratings yet

- Strings: - A String Is A Sequence of Characters Treated As A Group - We Have Already Used Some String LiteralsDocument48 pagesStrings: - A String Is A Sequence of Characters Treated As A Group - We Have Already Used Some String LiteralsJNUNo ratings yet

- Illrigger - GM BinderDocument8 pagesIllrigger - GM BinderDorothyNo ratings yet

- Polycab PVCDocument32 pagesPolycab PVCshilpidangiNo ratings yet

- Aesseal Capi Dual SealDocument2 pagesAesseal Capi Dual SealSulaiman Kadher KNo ratings yet

- Kanishkar H - ResumeDocument1 pageKanishkar H - ResumeSURYA ANo ratings yet

- Behaviour of Rectangular Travelling Wave (Unit Step Function at Transition Points-Typical CasesDocument1 pageBehaviour of Rectangular Travelling Wave (Unit Step Function at Transition Points-Typical CasesAngela VaughnNo ratings yet

- Man 040 0001Document42 pagesMan 040 0001arturo tuñoque effioNo ratings yet

- A Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryDocument13 pagesA Case Study On Strategies To Deal With The Impacts of COVID-19 Pandemic in The Food and Beverage IndustryPeyman KazemianhaddadiNo ratings yet

- Materi MatrikulasiDocument72 pagesMateri MatrikulasiAyziffyNo ratings yet

- Investigating and EvaluatingDocument12 pagesInvestigating and EvaluatingMuhammad AsifNo ratings yet

- Job DescriptionDocument4 pagesJob Descriptionnafis hasnayenNo ratings yet

- Business Math - Interest QuizDocument1 pageBusiness Math - Interest QuizAi ReenNo ratings yet

- bài tập ôn MA1Document34 pagesbài tập ôn MA1Thái DươngNo ratings yet