Professional Documents

Culture Documents

Ain 20201025074

Uploaded by

HAMMADHROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ain 20201025074

Uploaded by

HAMMADHRCopyright:

Available Formats

2017 2018 2019

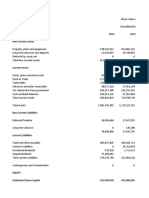

ASSETS

Non-current assets

Right-of-use assets – 75,538

Property, plant and equipment 1,121,578 1,105,932 1,101,670

Depriciation 107,361 104,569 106,914

Advances for property, plant and equipment 3,888 4,161 2,849

Goodwill 275,933 275,933 275,933

Intangible assets 90,387 85,923 82,908

Other financial assets 3,887 7,582 –

Total non-current assets 1,603,034 1,479,531 1,538,898

Current assets

Inventories 313,595 338,045 335,900

Trade and other receivables 404,736 536,769 580,307

Government compensation receivable 35,628 37,727 27,782

Due from related parties 387 194 1,115

Cash and bank balances 692,842 571,255 637,234

Total current assets 1,447,188 1,483,990 1,582,338

Total assets 3,050,222 2,963,521 3,121,236

EQUITY AND LIABILITIES

Equity

Share capital 600,000 600,000 600,000

Legal reserve 167,459 188,509 202,212

Translation reserve (42,036) (55,815) (57,475)

Other reserve (6,445) (3,943) –

Retained earnings 1,093,880 1,193,326 1,216,448

Equity attributable to the owners of the Company 1,812,858 1,922,077 1,961,185

Non-controlling interests 33,641 29,643 28,535

Total equity 1,846,499 1,951,720 1,989,720

Non-current liabilities

Provision for employees’ end of service benefits 74,967 74,228 80,458

Bank borrowings 278,928 179,919 8,115

57,098

Lease liabilities –

Total non-current liabilities 353,895 254,147 145,671

Current liabilities

Bank borrowings 314,023 340,142 513,437

Lease liabilities – 16,932

Trade and other payables 425,504 414,904 446,191

Due to related parties 2,940 2,608 9,285

Total current liabilities 742,467 757,654 985,845

Total liabilities 1,096,362 1,011,801 1,131,516

Total equity and liabilities 2,942,861 2,963,521 3,121,236

Share Price 6.95 4.12 5.00

Market Capitalization 4,170,000 2,472,000 3,000,000

Income Statement 2017 2018 2019

Revenue 2,047,957 2,001,316 2,039,263

Cost of sales (1,369,456) (1,315,227) (1,382,294)

Gross profit 678,501 686,089 656,969

Selling and distribution expenses (333,081) (328,643) (358,018)

General and administrative expense (158,775) (149,566) (168,491)

Research and development cost (6,662) (7,421) (6,931)

Other income 23,392 8,766 9,753

Operating profit 203,375 209,225 133,282

Finance income 203,375 21,017 21,017

Finance expense/Interest Expense (20,174) (22,221) (22,221)

Profit before tax and zakat 386,576 208,021 132,078

Income tax and zakat expenses (342) (1,455) 3,924

Profit for the year 386,234 206,566 136,002

6.95 4.12 5.00

EPS 0.64 0.34 0.23

2017 2018 2019

Revenue ### ### ###

Profit for 386,234 206,566 136,002

Revenue Vs Profi t

2,500,000

2,000,000

1,500,000

1,000,000

500,000

0

2017 2018 2019

Revenue Profit for the year

Ratios 2017 2018

Liquidity Ratios

Current Ratio = CA / CL 2.16 1.95

Quick Ratio = (CA – Inventory) / CL 1.53 1.51

Cash Ratio = Cash / CL 0.93 0.75

NWC to Total Assets = NWC / TA 0.28 0.24

Interval Measure = CA / average daily operating costs 1.06 1.13

Computing Long-term Solvency Ratios

Total Debt Ratio = (TA – TE) / TA 39.46% 34.14%

Debt/Equity = TD / TE 19.17% 13.02%

Equity Multiplier = TA / TE = 1 + D/E 119.17% 113.02%

Long-term debt ratio = LTD / (LTD + TE) 13.12% 8.44%

Computing Coverage Ratios

Times Interest Earned = EBIT / Interest 10.08 9.42

Cash Coverage = (EBIT + Depreciation) / Interest 15.40 14.12

Inventory Turnover Ratio

Inventory Turnover = Cost of Goods Sold / Inventory 4.37 3.89

Days’ Sales in Inventory = 365 / Inventory Turnover

83.58 93.81

Computing Receivables Ratios

Receivables Turnover = Sales / Accounts Receivable 5.06 3.73

Days’ Sales in Receivables = 365 / Receivables Turnover 72.13 97.90

Computing Total Asset Turnover

Total Asset Turnover = Sales / Total Assets 0.67 0.68

NWC Turnover = Sales / NWC 2.91 2.76

Fixed Asset Turnover = Sales / NFA 1.28 1.35

Computing Profitability Measures

GPM = (Sales – COGS) / Sales 33.13% 34.28%

OPM = EBIT / Sales 9.93% 10.45%

Profit Margin = Net Income / Sales 18.86% 10.32%

Return on Assets (ROA) = Net Income / Total Assets 12.66% 6.97%

Return on Equity (ROE) = Net Income / Total Equity 20.92% 10.58%

Market Value Ratio

P.E ratio = Price per share / EPS 10.8 12.0

Market-to-book ratio = Market value per share / Book value per share 7.0 4.1

Enterprise value = market value of stock + book value of liabilities – cash 3,198,230.0 1,720,826.0

EBITDA ratio = Enterprise value / EBITDA 15.7 8.2

MV=Market Capitalization/Total Book Value 7.0 4.1

2019 % Change 2017-2018 % Change 2018-2019

2017

1.56 -9.55% -20.063% Current Ratio = CA / CL 2.16

1.26 -0.94% -16.407% Quick Ratio = (CA – Invento 1.53

0.65 -19.20% -14.270% Cash Ratio = Cash / CL 0.93

0.18 -13.66% -27.258% NWC to Total Assets = NWC 0.28

1.14 6.77% 1.454% Interval Measure = CA / ave 1.06

2017

36.25% -13.48% 6.181% Total Debt Ratio = (TA – TE) 39.46%

7.32% -32.06% -43.777% Debt/Equity = TD / TE 19.17%

107.32% -5.16% -5.044% Equity Multiplier = TA / TE 119.17%

0.41% -35.68% -95.188% Long-term debt ratio = LTD 13.12%

2017

6.00 -6.60% -36.297% Times Interest Earned = EBI 10.08

10.81 -8.32% -23.454% Cash Coverage = (EBIT + Dep 15.40

2017

4.12 -10.91% 5.770% Inventory Turnover = Cost 4.37

Days’ Sales in Inventory =

365 / Inventory Turnover

88.70 12.24% -5.456% 83.58

2017

3.51 -26.31% -5.749% Receivables Turnover = Sal 5.06

103.87 35.71% 6.099% Days’ Sales in Receivables 72.13

2017

0.65 0.58% -3.253% Total Asset Turnover = Sale 0.67

3.42 -5.19% 24.077% NWC Turnover = Sales / N 2.91

1.33 5.88% -2.035% Fixed Asset Turnover = Sal 1.28

2017

32.22% 3.47% -6.026% GPM = (Sales – COGS) / Sal 33%

6.54% 5.27% -37.483% OPM = EBIT / Sales 10%

6.67% -45.27% -35.386% Profit Margin = Net Income 19%

4.36% -44.95% -37.487% Return on Assets (ROA) = N 13%

6.84% -49.40% -35.418% Return on Equity (ROE) = N 21%

2017

22.1 10.84% 84.326% 10.8

P.E ratio = Price per share / EPS

5.0 -40.72% 21.359% Market-to-book ratio = Ma 7.0

2,354,651.0 -46.19% 36.833% Enterprise value = market va ###

17.7 -47.70% 114.799% EBITDA ratio = Enterprise 15.7

5.0 -40.72% 21.359% MV=Market Capitalization/ 7.0

2018 2019

1.95 1.56

1.51 1.26

0.75 0.65

0.24 0.18

1.13 1.14

2018 2019

34.14% 36.25%

13.02% 7.32%

113.02% 107.32%

8.44% 0.41%

2018 2019

9.42 6.00

14.12 10.81

2018 2019

3.89 4.12

MV=Market Capitalizati on/Total Book Value

93.81 88.70

8.0

2018 2019

3.73 3.51 7.0

97.90 103.87 6.0

2018 2019 5.0

0.68 0.65

4.0

2.76 3.42

3.0

1.35 1.33

2018 2019 2.0

34% 32% 1.0

10% 7%

0.0

10% 7% 2017 2018 2019

7% 4%

11% 7%

2018 2019

12.0 22.1

4.1 5.0

### ###

8.2 17.7

4.1 5.0

Value

2019

You might also like

- DG Khan Cement Financial StatementsDocument8 pagesDG Khan Cement Financial StatementsAsad BumbiaNo ratings yet

- Competitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Document6 pagesCompetitor 1 Sanofi Aventis Pakistan Limited Balance Sheets and Income Statements 2016-2020Ahsan KamranNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- HOndaDocument8 pagesHOndaRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Tesla 2018 Production ForecastDocument61 pagesTesla 2018 Production ForecastAYUSH SHARMANo ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Balance Sheet: Particulars 2014 2015 AssetsDocument11 pagesBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNo ratings yet

- TeslaDocument5 pagesTeslaRajib ChatterjeeNo ratings yet

- Kamel Genuine Parts CompanyDocument4 pagesKamel Genuine Parts CompanyShamsher Ali KhanNo ratings yet

- Quiz RatiosDocument4 pagesQuiz RatiosAmmar AsifNo ratings yet

- Sultan Drug Corporation-CaseDocument5 pagesSultan Drug Corporation-CaseSohad ElnagarNo ratings yet

- Income Statement - PEPSICODocument11 pagesIncome Statement - PEPSICOAdriana MartinezNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- ABS-CBN Financial StatementsDocument10 pagesABS-CBN Financial StatementsMark Angelo BustosNo ratings yet

- 1321 Behroz TariqDocument11 pages1321 Behroz TariqBehroz Tariq 1321No ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Maple Leaf Balance Sheet AnalysisDocument12 pagesMaple Leaf Balance Sheet Analysis01290101002675No ratings yet

- Forecasted Income Statement and Balance Sheet for Green Zebra with Store ExpansionDocument14 pagesForecasted Income Statement and Balance Sheet for Green Zebra with Store ExpansionJessie FranzNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Tyson Foods Income Statement Analysis 2016-2014Document13 pagesTyson Foods Income Statement Analysis 2016-2014Adil SaleemNo ratings yet

- 5 EstadosDocument15 pages5 EstadosHenryRuizNo ratings yet

- Tesla Financial Statement Analysis 2017-2021Document10 pagesTesla Financial Statement Analysis 2017-2021Minh PhuongNo ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- BSNL Balance SheetDocument15 pagesBSNL Balance SheetAbhishek AgarwalNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- JohnsonDocument12 pagesJohnsonJannah Victoria AmoraNo ratings yet

- Suzuki Motors (AutoRecovered)Document8 pagesSuzuki Motors (AutoRecovered)AIOU Fast AcademyNo ratings yet

- SDPK Financial Position Project FinalDocument33 pagesSDPK Financial Position Project FinalAmr Mekkawy100% (1)

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Accltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. CroreDocument59 pagesAccltd.: Balance Sheet Summary: Dec 2010 - Dec 2019: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Gul Ahmed Quiz 2 QuesDocument5 pagesGul Ahmed Quiz 2 QuesTehreem SirajNo ratings yet

- HUBCO Financial Statements Analysis 2015-2020Document97 pagesHUBCO Financial Statements Analysis 2015-2020Omer CrestianiNo ratings yet

- Balance SheetDocument6 pagesBalance SheetayeshnaveedNo ratings yet

- 5 6120493211875018431Document62 pages5 6120493211875018431Hafsah Amod DisomangcopNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Agriauto industry financial ratios and trendsDocument5 pagesAgriauto industry financial ratios and trendsSader AzamNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- IbfDocument9 pagesIbfMinhal-KukdaNo ratings yet

- Purcari Lucru IndividualDocument7 pagesPurcari Lucru IndividualLenuța PapucNo ratings yet

- FMOD PROJECT WeefervDocument13 pagesFMOD PROJECT WeefervOmer CrestianiNo ratings yet

- Ghani Value Glass consolidated balance sheets and profit ratiosDocument10 pagesGhani Value Glass consolidated balance sheets and profit ratiosZaigham Bawar FastNUNo ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- 2004 Annual ReportDocument10 pages2004 Annual ReportThe Aspen InstituteNo ratings yet

- Estados Financieros Tesla 2022 ClaseDocument16 pagesEstados Financieros Tesla 2022 ClaseJorge MarioNo ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Tesla Income Statement and Financial Ratios 2016Document5 pagesTesla Income Statement and Financial Ratios 2016Mary JoyNo ratings yet

- National Foods Balance Sheet: 2013 2014 Assets Non-Current AssetsDocument8 pagesNational Foods Balance Sheet: 2013 2014 Assets Non-Current Assetsbakhoo12No ratings yet

- AGL Financial Analysis ReportDocument13 pagesAGL Financial Analysis ReportMohamed NaieemNo ratings yet

- Finance Ratios AnalysisDocument27 pagesFinance Ratios AnalysisIfraNo ratings yet

- Edited Final RatiosDocument68 pagesEdited Final RatiosHammad KhanNo ratings yet

- Financial PlanDocument25 pagesFinancial PlanAyesha KanwalNo ratings yet

- Receivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkDocument6 pagesReceivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkYonatanNo ratings yet

- Assets Non - Current AssetsDocument12 pagesAssets Non - Current AssetssssssssNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Branch Audit Rating Model (Submitted)Document9 pagesBranch Audit Rating Model (Submitted)HAMMADHRNo ratings yet

- CAPM Rate and DCF Valuation of CompanyDocument17 pagesCAPM Rate and DCF Valuation of CompanyHAMMADHRNo ratings yet

- CAPM Rate and DCF Valuation of CompanyDocument17 pagesCAPM Rate and DCF Valuation of CompanyHAMMADHRNo ratings yet

- MMBL-RRS Eaudit UAT Findings SheetDocument9 pagesMMBL-RRS Eaudit UAT Findings SheetHAMMADHRNo ratings yet

- eAuditIssuesReported 23may21 PostTestingDocument25 pageseAuditIssuesReported 23may21 PostTestingHAMMADHRNo ratings yet

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- Solution 1: Unrealized Profit EliminatedDocument10 pagesSolution 1: Unrealized Profit EliminatedHAMMADHRNo ratings yet

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- 35Document1 page35HAMMADHRNo ratings yet

- CAPM Rate and DCF Valuation of CompanyDocument17 pagesCAPM Rate and DCF Valuation of CompanyHAMMADHRNo ratings yet

- 34Document1 page34HAMMADHRNo ratings yet

- CAPM Rate and DCF Valuation of CompanyDocument17 pagesCAPM Rate and DCF Valuation of CompanyHAMMADHRNo ratings yet

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- 38Document1 page38HAMMADHRNo ratings yet

- 37Document1 page37HAMMADHRNo ratings yet

- Solution 1: Unrealized Profit EliminatedDocument10 pagesSolution 1: Unrealized Profit EliminatedHAMMADHRNo ratings yet

- 39Document1 page39HAMMADHRNo ratings yet

- Working With Others Support Learning: (CITATION Bur11 /N /T /L 1033)Document2 pagesWorking With Others Support Learning: (CITATION Bur11 /N /T /L 1033)HAMMADHRNo ratings yet

- 36Document1 page36HAMMADHRNo ratings yet

- 40Document1 page40HAMMADHRNo ratings yet

- Without QuestionsDocument8 pagesWithout QuestionsHAMMADHRNo ratings yet

- Running Head: Title of The Paper 1Document5 pagesRunning Head: Title of The Paper 1Jerry Jr. MosawanNo ratings yet

- Sexual AbuseDocument2 pagesSexual AbuseHAMMADHRNo ratings yet

- Emotional AbuseDocument1 pageEmotional AbuseHAMMADHRNo ratings yet

- Health and Social Care: Student Name Affiliation Course Instructor Due DateDocument3 pagesHealth and Social Care: Student Name Affiliation Course Instructor Due DateHAMMADHRNo ratings yet

- Critical Discussion of A Starbucks' Approach To Managing Risk and Coordinating Resilience in Its Supply ChainDocument1 pageCritical Discussion of A Starbucks' Approach To Managing Risk and Coordinating Resilience in Its Supply ChainHAMMADHRNo ratings yet

- Institutional AbuseDocument2 pagesInstitutional AbuseHAMMADHRNo ratings yet

- ReferencesDocument1 pageReferencesHAMMADHRNo ratings yet

- Neglect: Signs, Symptoms, Indicators and Behavior That May Cause Concern Relation ToDocument1 pageNeglect: Signs, Symptoms, Indicators and Behavior That May Cause Concern Relation ToHAMMADHRNo ratings yet

- Chapter 9 Special and Combination Journals, and Voucher SystemDocument3 pagesChapter 9 Special and Combination Journals, and Voucher SystemZyrene Kei Reyes100% (3)

- ENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Document4 pagesENTREPRENEURSHIP FINALS - 2018-19.docx Version 1Gerby Godinez100% (1)

- Samsung C&T 2014 Financial StatementsDocument126 pagesSamsung C&T 2014 Financial StatementsJinay ShahNo ratings yet

- Go.151 Leave Travel Concession-Ltc-RulesDocument3 pagesGo.151 Leave Travel Concession-Ltc-RulesVanagantinaveen Kumar100% (1)

- Ayala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Document932 pagesAyala Corporation - SEC Form 17-A - 8april2020 - 0 - FY2019Captain ObviousNo ratings yet

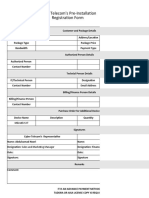

- Pre-Installation Registration FormDocument5 pagesPre-Installation Registration FormMustafa NazariNo ratings yet

- Form No 1Document6 pagesForm No 1Mai-linh Polero DeanNo ratings yet

- Inventory of Seized Tillman PropertiesDocument76 pagesInventory of Seized Tillman Propertiescitypaper100% (1)

- The Secret CurrencyDocument12 pagesThe Secret CurrencyDavid de LafuenteNo ratings yet

- The Business PlanDocument3 pagesThe Business PlanRose Ann de JuanNo ratings yet

- RFBT q1q2Document11 pagesRFBT q1q2Mojan VianaNo ratings yet

- Hidden Champions Study Reveals Insights on Central Eastern Europe SME SuccessDocument20 pagesHidden Champions Study Reveals Insights on Central Eastern Europe SME SuccessAna-Maria Nastasa100% (1)

- Fin Power BSNL CivilDocument10 pagesFin Power BSNL CivilagmlmbsnlNo ratings yet

- ATFX Advantages: Regulated Broker with MT4 PlatformDocument39 pagesATFX Advantages: Regulated Broker with MT4 PlatformNurul Mutmainnah NadarNo ratings yet

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument2 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- Ghana Tax Exemption Regime and Impplication On The Economy (A Case Study at Gra and Ghana Nut Company Limited - Bono East Techiman)Document33 pagesGhana Tax Exemption Regime and Impplication On The Economy (A Case Study at Gra and Ghana Nut Company Limited - Bono East Techiman)Dangyi GodSeesNo ratings yet

- Will Courts Fraudulent Documents To Prevail? Declaration in Support of Opposition - Actual Fraudulent Documents Upon Which Foreclsure Is Based Are Attached.Document61 pagesWill Courts Fraudulent Documents To Prevail? Declaration in Support of Opposition - Actual Fraudulent Documents Upon Which Foreclsure Is Based Are Attached.BlaqRubi100% (1)

- Ratio Tell A StoryDocument6 pagesRatio Tell A StoryHeru MuskitaNo ratings yet

- Book of Accounts: Prepared By: Marichu C. CarretasDocument62 pagesBook of Accounts: Prepared By: Marichu C. Carretaskiera hshaNo ratings yet

- Nature Description: PT Telekomunikasi Selular and Its Subsidiaries Trial Balance July 31, 2019Document102 pagesNature Description: PT Telekomunikasi Selular and Its Subsidiaries Trial Balance July 31, 2019Agniyyy TNo ratings yet

- 05 Chapter 1Document49 pages05 Chapter 1Ankit GodreNo ratings yet

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Document32 pages4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNo ratings yet

- Wojtowicz TestimonyDocument1 pageWojtowicz TestimonyWDET 101.9 FMNo ratings yet

- Currency PairsDocument9 pagesCurrency PairsyousufNo ratings yet

- Herbalife Investor Presentation August 2016 PDFDocument38 pagesHerbalife Investor Presentation August 2016 PDFAla BasterNo ratings yet

- Financing of Constructed FacilitiesDocument24 pagesFinancing of Constructed FacilitiesLyka TanNo ratings yet

- Bharat Chemicals Ltd. CPHi46l2eHDocument2 pagesBharat Chemicals Ltd. CPHi46l2eHChickooNo ratings yet

- Bank statement activity summaryDocument16 pagesBank statement activity summaryrahmie clinicNo ratings yet

- ABC Packaging Limited: Sample Completed Business PlanDocument20 pagesABC Packaging Limited: Sample Completed Business PlanAbdullahi Abdulkadir Hassan-kadleNo ratings yet

- Mall ManagementDocument15 pagesMall ManagementPankaj SonawaneNo ratings yet