Professional Documents

Culture Documents

Revenue Recognition and Measurement at BCA

Uploaded by

Yusuf RaharjaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revenue Recognition and Measurement at BCA

Uploaded by

Yusuf RaharjaCopyright:

Available Formats

2018

REVENUE RECOGNITION AND

REVENUE MEASUREMENT IN

PT. BANK CENTRAL ASIA, TBK

BASED ON PSAK No.23

Yusuf Raharja (008201600066)

Capital Market (Mon 10.30)

Submitted in Partial Requirement of Accounting Theory Final Project

Final Project Accounting Theory 2018

Revenue Recognition and Revenue Measurement in BCA Based PSAK No. 23

12/18/2018

Table of Contents

CHAPTER I (Introduction) ..............................................................................................................2

CHAPTER II (Literature Review) ...................................................................................................4

CHAPTER III (Framework Writing) ..............................................................................................6

CHAPTER IV (Analysis and Discussion) .......................................................................................7

CHAPTER V (Conclusion and Suggestion) .....................................................................................9

REFERENCES .................................................................................................................................10

FINAL PROJECT ACCOUNTING THEORY 2018 1

CHAPTER I

INTRODUCTION

1.1. Background

Banking is at the core of each country's financial system. Therefore, the Bank as a

financial institution that helps the Government achieve prosperity has an important role in

increasing national development. The function of banking institutions is as a financial

intermediary between parties who need funds with parties who are excessively funded. In

addition, banks also function as intermediaries for payments. Therefore it can be said that the

bank is the lifeblood of the financial system which is active in receiving deposits from the

public in the form of savings, current accounts, deposits etc., which then funds collected from

the community are channeled back to the community in the form of credit.

In each accounting period the company will generally make financial statements.

Based on reports made, interested parties in the company can see the company's financial

position and management can take policies for the continuity of the company for the future.

Financial statements are part of financial reporting which consists of several elements, namely

balance sheet, income statement, statement of changes in equity, cash flow statements and

notes to financial statements. Compiling financial statements is an important basis for

knowing the company's financial performance which includes revenues and expenses.

Revenue is a key element and fundamental to reporting on a firm’s activities. Revenue

Recognition is an important thing to determine when an income is recognized as revenue.

Revenue accounting analysis is an analysis carried out on the recognition, measurement, and

presentation of revenue is very important to get a reasonable profit and loss.

Even though determining revenue is important, measurement is not always easy

because of the many types of industrial models available. This research will be conducted at

PT. Bank Central Asia which is a Private Bank. Choosing research at PT. Bank Central Asia

because it is a Well-known and Big private bank that already advanced so that it is possible to

analyze the presentation of financial statements in the accounting practices of PT. Bank

Central Asia Bank mainly on revenue recognition. Based on the statement, the author chose

this topic for the final project of Accounting Theory with the title: Revenue Recognition and

Revenue Measurement PT. Bank Central Asia Based on PSAK No. 23.

FINAL PROJECT ACCOUNTING THEORY 2018 2

1.2. Problem Statement

Based on the explanation of the background section, the problem that will be discussed

in this article is determine What the method revenue recognition and revenue measurement

applied by PT Bank Central Asia, TBK is and What the recognition and measurement of

income applied by PT Bank Central Asia, TBK in accordance with PSAK No.23 is.

1.3. Article Purposes

According to background section and problem statement, this article is written with the

purpose of:

a. Determining the revenue recognition of by PT Bank Central Asia, TBK.

b. Determining Revenue measurement of by PT Bank Central Asia, TBK.

c. Comparing the theory with practical related to the revenue measurement and recognition

in by PT Bank Central Asia, TBK based on PSAK No. 23.

FINAL PROJECT ACCOUNTING THEORY 2018 3

CHAPTER II

LITERATURE REVIEW

2.1. Definition of Revenue

(Godfrey, 2010) stated that revenue represents a physical and a monetary flow.

Revenue has been defined by standard setters as an inflow of economics benefits. The

behavioural view of revenue suggest that revenue (and profit) come about because of

something done by the firm. All the firm’s activities form part of its earning process, apoint

for recognising revenue must be determined.

2.2. Revenue Recognition and Measurement according to the Statement of Accounting

Standards (PSAK) No.23

1. Revenue Recognition

The provisions of PSAK No.23 (2007, p.23.6) concerning the recognition of

income for services sale transactions are as follows: if a transaction that includes the

sale of services can be estimated reliably, revenue in connection with the transaction

must be recognized with reference to the level of completion of the transaction at

balance sheet date ". What is meant reliably according to PSAK No.23 (2007, p.23.6) is

if all the conditions below are met:

a. The amount of income can be measured reliably;

b. It is probable that the economic benefits associated with the transaction will be

obtained by the company;

c. The level of completion of a transaction at the balance sheet date can be

measured reliably; and

d. Costs incurred for the transaction and costs to complete the transaction can be

measured reliably.

2. Revenue Measurement

The Indonesian Institute of Accountants (2009) defines measurement as the process

of determining the amount of money to recognize and include every element of

financial statements in the balance sheet and income statement. This process concerns

the selection of certain bases. PSAK No. 23 paragraph 8 states that income is measured

by the fair value of the benefits received or acceptable. The amount of income arising

FINAL PROJECT ACCOUNTING THEORY 2018 4

from transactions is usually determined by the agreement between the entity and the

buyer or user of the asset. The amount is measured by the fair value of the benefits

received or received by the entity minus the amount of trade discounts or volume

rebates allowed by the entity.

Based on PSAK No.23, a company can make a reliable estimate of the income that

will be received after the company reaches agreement with other parties in the

following matters:

a. The rights of each party whose implementation can be enforced by the

force of law relating to the services provided and received by these

parties.

b. Rewards that must be exchanged.

c. Ways and terms of payment and settlement

Financial Accounting Standards (2007, p. 23.3) state that income must be measured

by the fair value of received or acceptable benefits. The further explanation of the

statement stated by the Financial Accounting Standards (2007, p. 23.3) is the amount of

income that relatively arises from a transaction by agreement between the company and

the buyer or user of the asset. The amount is measured by the fair value of the benefits

received or received by the company minus the merchandise discounts and volume

rebates allowed by the company. In general, the benefits are in the form of cash or cash

equivalents and the amount of income is the amount of cash or cash equivalents

received or acceptable. However, if the inflows from cash or cash equivalents are

deferred, the fair value of the benefits may be due to the nominal amount of cash

received or acceptable.

3. Previous Research

a. According to Synthia Marcella (2014) in her research entitled Analysis of

Recognition and Measurement of Income Based on PSAK No. 23 At PT Pandu

Siwi Sentosa Palembang. The results showed that the income measurement of PT

Pandu Siwi Sentosa based on the fair value of the benefits received or that could be

received in the form of cash or cash equivalents was in accordance with financial

accounting standards, because so far the company recognized income based on

rupiah units. This is in accordance with PSAK No. 23

FINAL PROJECT ACCOUNTING THEORY 2018 5

CHAPTER III

WRITING FRAMEWORK

3.1. Framework

Every type of industry has different accounting treatment. So that bank also has

accounting treatment itself. The main purpose of the bank to carry out the activities of using

funds or investing funds is to earn income in the form of income. Bank income must

absolutely exist to guarantee the continuity of the bank concerned. According to Hasibuan

(2009: 99) bank income is If the amount of income received is greater than the amount of

expenditure (costs) incurred.

The income obtained by the bank will have the opportunity to increase profitability

and will affect the percentage of performance achieved by a bank. The income services

obtained by banks for the products and services provided to the public according to Kasmir

(2008: 120) can be divided into two groups, Interest income and non-interest income (fee

based income). Each will explained as follows:

1. Interest income

The income earned in the form of interest on the provision of credit as a channel of

funds to the public both individuals or business entities and also the placement of funds

to other banks.

2. Fee based income

Fees, fees or commissions obtained by banks that are not interest income. This income

can also be obtained from product marketing and banking services transactions.

Hasibuan (2009: 100) suggests that the source of bank income comes from Credit

interest distributed by the bank concerned, Other costs across payments,Sales of check

books, demand deposits, deposits, and deposit notes, Rent a safe deposit box,

Commission and provision, Forex trading, Shrinkable inventory sales, Call money

market, Share agio, And others.

Recognition of accrual income results in an increase in bank income at the time of

interest fall. While the recognition of income on a cash basis causes an increase in the

administrative account of interest arrears at the time of maturity of interest payments and

income will increase when the money has actually been received by the bank from the non-

performing customer.

FINAL PROJECT ACCOUNTING THEORY 2018 6

CHAPTER IV

ANALYSIS AND DISCUSSION

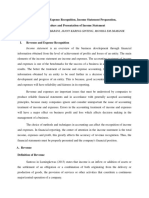

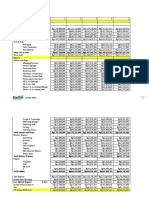

4.1. Sources and Types of Income PT Bank Central Asia

The PT Bank Central Asia’s recognizes revenue based on the time of the transaction

(Accrual Basis). In running its business, PT Bank Central Asia generates revenue from

interest income (Interest Income from Loans, Interest Income from Placements with Bank

Indonesia and Other Banks, Interest Income from Securities, Interest Income from

Consumer Financing and Leasing, Other interest income ) and Operating income other than

interest (Earning Assets Yield, Fee and Commission Income, Customer deposit income,

Administrative income from credit cards, Trading Income, Swap Premium Income, Other

Operating).

4.2. Analysis of Revenue Recognition of PT. Bank Central Asia

PT Bank Central Asia's revenues are grouped into interest income and operating

income other than interest. The Bank and Subsidiaries initially recognise loans receivable

and deposits on the date of origination. Regular way purchases and sales of financial assets

are recognized on the trade date at which the Bank and Subsidiaries commit to purchase or

sell the asset. All other financial assets and liabilities are initially recognised on the trade

date at which the Bank become a party to the contractual provisions of the instrument.

Application of revenue recognition at PT. Bank Central Asia is in accordance with

PSAK No. 23 concerning Revenue, where PSAK No. 23 only recognizes two methods,

which is Cash basis and Accruals Basis. Accrual basis is used to measure assets, liabilities

and fund equity. Thus an accrual basis is an accounting basis that recognizes the effects of

transactions and other events when the transactions and events occur regardless of when

cash or cash equivalents are received or paid. Recognition of income occurs if there is a

transaction, at first the customer comes to the company to do it. After the customer agrees,

he will first make an agreement with the company. After the agreement between the

customer and the company, there will be income for the company where the income is

recognized when a transaction occurs.

PT. Bank Central Asia uses the accrual basis method because Revenues and

expenses are recognized when the transaction occurs and the information provided is more

reliable, reliable even though cash has not been received. Second it is widely used by large

FINAL PROJECT ACCOUNTING THEORY 2018 7

corporations (in accordance with Financial Accounting Standard Conditions which require

a company to use an acural basis). Third An increase in company income because cash that

has not been received can be recognized as income. That the existence of cash that has not

been received by the company is recognized as a receivable but will generate income.

4.3. Analysis of Revenue Measurement of PT. Bank Central Asia

Bank Central Asia measure the fair value of financial instruments using the

valuation techniques or quoted price of an active market for that instrument The best

evidence of the fair value of financial transactions, i.e., the fair value of consideration given

or received. If the transaction price and the fair value are evidenced by a quoted price of an

active market for an identical asset or liability based on a valuation technique that uses only

data from observable markets, then the financial instrument is measured at a fair value, an

adjusted to defer the difference between the initial value and the initial transaction price.

Application of revenue measurement at PT. Bank Central Asia is in accordance with

PSAK No. 23 that contain about income must be measured by fair value received or

acceptable. The amount of income arising from a transaction is usually determined by the

agreement between the company selling goods and services and the buyer or consumer. The

amount must be measured by the fair value of the compensation received or acceptable to

the company minus the amount agreed upon.

Second Revenue Measurements is the measurement from interest income and

operating income other than interest is to use the exchange rate is the best measure to find

out the proceeds from bank services. The exchange rate is measured in rupiahs, not in other

foreign currencies. PT Bank Central Asia uses the exchange rate for the provision of

services is the measure to be received when cash is received. Revenues from the sale of

these services are considered reasonable.

PT. Bank Central Asia is in accordance with the standard financial accounting,

because so far the company recognizes income based on rupiah. Then the transactions that

are valid in foreign currencies will be adjusted to the standard exchange rates prevailing at

the time of the transaction. Thus Revenues from bank services (the interest income from

loan, etc) are considered reasonable.

FINAL PROJECT ACCOUNTING THEORY 2018 8

CHAPTER V

CONCLUSSION AND SUGGESTION

4.1. Conclussion

Based on the discussions from previous chapters, the conclusions that can be given

in accordance with the research at PT Bank Central Asia are as follows:

1. PT Bank Central Asia's revenues are grouped into interest income (Interest Income

from Loans, Interest Income from Placements with Bank Indonesia and Other Banks,

Interest Income from Securities, Interest Income from Consumer Financing and

Leasing, Other interest income ) and operating income other than interest (Earning

Assets Yield, Fee and Commission Income, Customer deposit income, Administrative

income from credit cards, Trading Income, Swap Premium Income, Other Operating).

2. PT Bank Central Asia in the revenue accounting policy that the company recognizes

revenue based on the time of the transaction (Accrual Basis). Application of revenue

recognition at PT. Bank Central Asia is in accordance with PSAK No. 23 concerning

Revenue, where PSAK No. 23 only recognizes two methods, which is Cash basis and

Accruals Basis.

3. Application of revenue measurement at PT. Bank Central Asia is in accordance with

PSAK No. 23 that contain about income must be measured by fair value received or

acceptable.

4. PT. Bank Central Asia is in accordance with the standard financial accounting, because

so far the company recognizes income based on rupiah. Then the transactions that are

valid in foreign currencies will be adjusted to the standard exchange rates prevailing at

the time of the transaction.

4.2. Suggestion

1. As the biggest private bank in Indonesia, PT Bank Central Asia have been applied the

Revenue Recognition and Revenue Measurement based on PSAK No. 23. It is

Expected that the company will continue to do so in managing its finances.

2. For the future research, it is better to add other variables outside the variables beyond

those that have been studied on the revenue recognition and revenue measurement

according to PSAK No.23.

FINAL PROJECT ACCOUNTING THEORY 2018 9

REFERENCE

Apsa, S. (2014). Evaluasi Pengakuan, Pengukuran Dan Pelaporan Pendapatan Berdasarkan PSAK

No.23 Pada PT. Pelayaran Liba Marindo Tanjungpinang Periode 2013. Universitas Maritim

Raja Ali Haji, 1-12.

BCA, B. (2018). Annual Report 2017. Jakarta: PT Bank Central Asia TBK.

Delloite. (2018). Delloite Center for Financial Servicesn. Retrieved from 2019 Banking and Capital

Markets Outlook: Reimagining transformation:

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-

dcfs-2019-banking-cap-markets-outlook.pdf

Deloitte & Touche LLP. (2014, July 2). The Wallstreet Journal. Retrieved from Revenue

Recognition Standard: Implications for Financial Services:

https://deloitte.wsj.com/cfo/2014/10/03/revenue-recognition-standard-implications-for-

financial-services/

Ernst and Young. (2014). IFRS 15: The new revenue recognition standard. Retrieved from

Financial Accounting Advisory Services:

https://www.ey.com/Publication/vwLUAssets/IFRS_15_The_new_revenue_recognition_sta

ndard/$FILE/IFRS15_low.pdf

Garmong, S. (2014, June 23). How the new FASB standars on revenue recognition may impact

banks. Retrieved from BankDirector.com:

https://www.bankdirector.com/committees/audit/how-the-new-fasb-standard-on-revenue-

recognition-may-impact-bank/

Godfrey, J. (2010). Accounting Theory 7th Edition. New York: Wiley.

Hidayat, F. M. (2017, February 12). Syariah ESF 15. Retrieved Desember 16, 2018, from

Akuntansi Pendapatan dan Biaya bank: http://syariahesf15.blogspot.com/2017/02/akuntansi-

pendapatan-dan-biaya-bank.html

FINAL PROJECT ACCOUNTING THEORY 2018 10

Hulme, G. (2007). Revenue Recognition Impacts on Bank. Retrieved December 12, 2018, from

Softrax: https://revenuerecognition.com/industry/banking/

Ikatan Akuntan Indonesia. (2007). Pernyataan Standar Akuntansi Keuangan. Jakarta: Salemba

Empat.

Lumingkewas, V. A. (2013). Pengakuan Pendapatan dan Beban Atas Laporan Keuangan Pada PT.

Bank Sulut. EMBA, 199-206.

Marcella, S. (2010). Analisis Pengakuan dan Pengukuran Pendapatan Berdasarkan PSAK No.23

Pada PT. Pandu Siwi Sentosa Palembang. 1-10.

Stanakuntansi. (2018, May 15). Jenis dan Sumber Pendapatan Dalam Akuntansi. Retrieved from

Stan Akuntansi: https://www.stanakuntansi.com/2018/05/jenis-dan-sumber-pendapatan-

dalam.html

Stephen D. Simpson, C. (2017). The Banking System: Commercial Banking - How Banks Make

Money. Retrieved from Investopedia: https://www.investopedia.com/university/banking-

system/banking-system3.asp

Syinen, A. (2014, December 10). Ukhwah Asyifusyinen. Retrieved December 17, 2018, from

Lembaga Perbankan: https://azharnasri.blogspot.com/2016/11/lembaga-perbankan-

makalah.html

Wahdatana, A. (2014). Analisis Pengakuan Pendapatan dan Beban Pada PT.Duta Satrya Adhi

Persada Banjarbaru. Sekolah Tinggi Ilmu Ekonomi Pancasetia Banjarmasin, 1-17.

Widodo, N. D. (2014). Analisis Pengakuan dan Pengukuran Pendapatan Menurut PSAK No. 23

Pada Usaha Peternak Ayam Petelur Bayu Farm Di Kabupaten Semarang.

Wikipedia. (n.d.). Bank Central Asia. Retrieved December 18, 2018, from Wikipedia:

https://en.wikipedia.org/wiki/Bank_Central_Asia

FINAL PROJECT ACCOUNTING THEORY 2018 11

You might also like

- A Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesFrom EverandA Beginners Guide to QuickBooks Online: The Quick Reference Guide for Nonprofits and Small BusinessesNo ratings yet

- 1431 3633 2 PBDocument9 pages1431 3633 2 PBIndira RamadhinaNo ratings yet

- Recognition of Construction Contract Revenue Based On PSAK 34 at PT Tunggal Jaya RayaDocument8 pagesRecognition of Construction Contract Revenue Based On PSAK 34 at PT Tunggal Jaya RayamegakadirNo ratings yet

- Financial Reporting and AnalysisDocument17 pagesFinancial Reporting and AnalysisDebora BongNo ratings yet

- Accrual Basis of AccountingDocument17 pagesAccrual Basis of AccountingLiban MhNo ratings yet

- Evaluasi Pengakuan Pendapatan Dan Beban Kontrak Serta Pengaruhnya Terhadap Laba Perusahaan Konstruksi Sesuai PSAK 34 Revisi 2010 173Document8 pagesEvaluasi Pengakuan Pendapatan Dan Beban Kontrak Serta Pengaruhnya Terhadap Laba Perusahaan Konstruksi Sesuai PSAK 34 Revisi 2010 173Apriyanti ThalibNo ratings yet

- 7360 Advanced Financial AccountingDocument11 pages7360 Advanced Financial AccountingSIMON BUSISANo ratings yet

- QRG Sap Revenue RecognitionDocument34 pagesQRG Sap Revenue Recognitionsampath100% (1)

- Accounting Concepts and Principles - 2020 Online ClassDocument40 pagesAccounting Concepts and Principles - 2020 Online ClassGhillian Mae GuiangNo ratings yet

- Jurnal 1Document12 pagesJurnal 1musliminNo ratings yet

- Mawlana Bhashani Science and Technology University: Course Title: Accounting Theory Course Code: AIS 421Document33 pagesMawlana Bhashani Science and Technology University: Course Title: Accounting Theory Course Code: AIS 421rakibul islamNo ratings yet

- AS Theory CA IPCC I & IIDocument19 pagesAS Theory CA IPCC I & IICaramakr ManthaNo ratings yet

- Implementation of Lease Accounting in Indonesia: A Case Study of PT. BFI Finance Indonesia TbkDocument12 pagesImplementation of Lease Accounting in Indonesia: A Case Study of PT. BFI Finance Indonesia TbkArie WidodoNo ratings yet

- Accountancy Notes ch-2Document4 pagesAccountancy Notes ch-2Ansh JaiswalNo ratings yet

- AFM Short NotesDocument56 pagesAFM Short NotesthamiztNo ratings yet

- Conceptual FrameworkDocument8 pagesConceptual FrameworkQuỳnh Anh NguyễnNo ratings yet

- Fundamental of Financial AccountingDocument26 pagesFundamental of Financial AccountingShirish JhaNo ratings yet

- Accounting PrinciplesDocument15 pagesAccounting PrinciplesGroundXero The Gaming LoungeNo ratings yet

- Tutorial - Week3 AnsDocument12 pagesTutorial - Week3 AnsAnis AshsiffaNo ratings yet

- Introduction To AccountingDocument54 pagesIntroduction To AccountingDanny KdNo ratings yet

- Accountancy Chapter 2: Theory Base of Accounting: Business Entity ConceptDocument6 pagesAccountancy Chapter 2: Theory Base of Accounting: Business Entity ConceptKutty Kiran KumarNo ratings yet

- Accountancy Chapter 2: Key Concepts and PrinciplesDocument6 pagesAccountancy Chapter 2: Key Concepts and PrinciplesKutty Kiran KumarNo ratings yet

- IC-26 Accounts For Life InsuranceDocument623 pagesIC-26 Accounts For Life InsuranceVasu Pandiarajan100% (1)

- CAC 1101: Financial Accounting Part 1Document100 pagesCAC 1101: Financial Accounting Part 1LOVERAGE MUNEMONo ratings yet

- Sms Pharmaceuticals LTD.: December 26, 2021Document3 pagesSms Pharmaceuticals LTD.: December 26, 2021Sreedhar Babu KarimiNo ratings yet

- ACCTG CONCEPTS AND CONVENTIONSDocument26 pagesACCTG CONCEPTS AND CONVENTIONSIshaan PaliwalNo ratings yet

- Accounting Lec 1Document28 pagesAccounting Lec 1Swati OzaNo ratings yet

- 2.1 Concept of Corporate Financial ReportingDocument23 pages2.1 Concept of Corporate Financial ReportingAnilNo ratings yet

- International Financial Reporting (2021/22)Document13 pagesInternational Financial Reporting (2021/22)Md Jonayed HossainNo ratings yet

- RakshitaDocument3 pagesRakshitaRakshita ChaubeNo ratings yet

- MD - Siful Malak Srijon 1Document5 pagesMD - Siful Malak Srijon 1Sohel MahmudNo ratings yet

- Introduction To AccountingDocument41 pagesIntroduction To AccountingKritika Singh100% (1)

- GBH210790 - Asm1 - 5038Document18 pagesGBH210790 - Asm1 - 5038Pham Thi Khanh Linh (FGW HN)No ratings yet

- Financial ManagementDocument13 pagesFinancial ManagementMayuri MistryNo ratings yet

- Audit Prsentation On WiproDocument9 pagesAudit Prsentation On WiproNaina ChaudharyNo ratings yet

- BRIDGING COURSE IN BUSINESS MANAGEMENT WORKBASED ASSIGNMENTDocument4 pagesBRIDGING COURSE IN BUSINESS MANAGEMENT WORKBASED ASSIGNMENTJackline Hellen OdukNo ratings yet

- Concepts Statement No 8 Amended August 2018Document12 pagesConcepts Statement No 8 Amended August 2018Adham AghaNo ratings yet

- Revenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementDocument11 pagesRevenue and Expense Recognition, Income Statement Preparation, Procedure and Presentation of Income StatementAbigail Elsa Samita Sitakar 1902113687No ratings yet

- Sas 1-18Document165 pagesSas 1-18btee2No ratings yet

- NPTEL Construction Economics & Finance Module 6 Lecture 1Document23 pagesNPTEL Construction Economics & Finance Module 6 Lecture 1Saurabh Kumar SharmaNo ratings yet

- Chapter 7Document15 pagesChapter 7rachel banana hammockNo ratings yet

- Accounting Concepts and ConventionsDocument27 pagesAccounting Concepts and ConventionsravindergudikandulaNo ratings yet

- Accounting for Common Control Transactions Exposure DraftDocument22 pagesAccounting for Common Control Transactions Exposure DraftYasir KhanNo ratings yet

- What Is Accrual Accounting ?Document1 pageWhat Is Accrual Accounting ?Manar ZahraniNo ratings yet

- Module 2 Financial StatementsDocument17 pagesModule 2 Financial StatementsRoss JorgensenNo ratings yet

- Cycle-7 Notes 2 Theory Base of AccountingDocument4 pagesCycle-7 Notes 2 Theory Base of AccountingChhaya AcharyaNo ratings yet

- Analisis Pengakuan Pendapatan Dan Beban Kontrak Pada Ud Gunawan Steel Wahyu Sapto Rini EllyDocument8 pagesAnalisis Pengakuan Pendapatan Dan Beban Kontrak Pada Ud Gunawan Steel Wahyu Sapto Rini EllyIndra PramanaNo ratings yet

- Tutorial 1 Accounting Environment, Regulatory Framework, Conceptual FrameworkDocument3 pagesTutorial 1 Accounting Environment, Regulatory Framework, Conceptual FrameworkHidayatul HusnaNo ratings yet

- Accounts Theory Q&A - CA Zubair KhanDocument16 pagesAccounts Theory Q&A - CA Zubair KhanAnanya SharmaNo ratings yet

- 5f334509dc9eb - Acounting Principal by - Nishesh RegmiDocument4 pages5f334509dc9eb - Acounting Principal by - Nishesh RegmialxaNo ratings yet

- Concepts Statement 8-Chapter 1 (As Amended)Document28 pagesConcepts Statement 8-Chapter 1 (As Amended)Dian AngeleneNo ratings yet

- Recognizing Revenue: Realizable, Earned & Period RecognitionDocument6 pagesRecognizing Revenue: Realizable, Earned & Period Recognitionkms6575No ratings yet

- Assignment On Accouting Prin-Assum-RulesDocument4 pagesAssignment On Accouting Prin-Assum-RulesNazimRezaNo ratings yet

- Budgetary control essentialsDocument11 pagesBudgetary control essentialsSumit YadavNo ratings yet

- 1.1: Identify The Principles of Accounting AnsDocument5 pages1.1: Identify The Principles of Accounting AnsSheetal ShahNo ratings yet

- 07 Revenue February 2021Document34 pages07 Revenue February 2021Mthembeni Cyril MbanjwaNo ratings yet

- IND ASyear-end-consideration-tl - EYDocument56 pagesIND ASyear-end-consideration-tl - EYDilip ChoudharyNo ratings yet

- Financial Accounting Cash Flow StatementDocument11 pagesFinancial Accounting Cash Flow StatementmeetNo ratings yet

- I1.2 FR NOTES AND PAST PAPERSDocument209 pagesI1.2 FR NOTES AND PAST PAPERSJustin MUNYAMAHORONo ratings yet

- Accounting concepts and financial statementsDocument8 pagesAccounting concepts and financial statementsnandhuNo ratings yet

- Top 10 Accounting Interview QuestionsDocument13 pagesTop 10 Accounting Interview QuestionsYusuf RaharjaNo ratings yet

- MarketingDocument2 pagesMarketingYusuf RaharjaNo ratings yet

- AccountingFundamentalsCoursePresentation 200607 222026 PDFDocument69 pagesAccountingFundamentalsCoursePresentation 200607 222026 PDFXee Shaun Ali BhatNo ratings yet

- Session 3, BUS, Descriptive Stat, Exploring Data-Var Analysis, SincihDocument109 pagesSession 3, BUS, Descriptive Stat, Exploring Data-Var Analysis, SincihLili GuloNo ratings yet

- KontanDocument22 pagesKontanYusuf RaharjaNo ratings yet

- Statistics For Business and Economics: Statistics, Data, & Statistical ThinkingDocument14 pagesStatistics For Business and Economics: Statistics, Data, & Statistical ThinkingYusuf RaharjaNo ratings yet

- Analisis Kinerja Fundamental Dan Persepsi Pasar PT Astra Agro Lestari, TBKDocument19 pagesAnalisis Kinerja Fundamental Dan Persepsi Pasar PT Astra Agro Lestari, TBKYusuf RaharjaNo ratings yet

- Investment SummaryDocument3 pagesInvestment SummaryYusuf RaharjaNo ratings yet

- Bookkeeping Video Training: (Handout)Document22 pagesBookkeeping Video Training: (Handout)Yusuf RaharjaNo ratings yet

- The Jakarta PostDocument12 pagesThe Jakarta PostYusuf RaharjaNo ratings yet

- Chapter 3 - ProbabilityDocument61 pagesChapter 3 - ProbabilityVeronicaNo ratings yet

- Statistics For Business and Economics: Random Variables & Probability DistributionsDocument117 pagesStatistics For Business and Economics: Random Variables & Probability DistributionsfarhanNo ratings yet

- Chapter 2 Math of BusinessDocument30 pagesChapter 2 Math of BusinessYusuf RaharjaNo ratings yet

- Statistics For Business and Economics: Inferences Based On A Single Sample: Estimation With Confidence IntervalsDocument56 pagesStatistics For Business and Economics: Inferences Based On A Single Sample: Estimation With Confidence IntervalsYusuf RaharjaNo ratings yet

- CH14 PPTDocument37 pagesCH14 PPTfame charity porioNo ratings yet

- Calculate Future Value of AnnuityDocument32 pagesCalculate Future Value of AnnuityYusuf RaharjaNo ratings yet

- Application Linear FunctionDocument25 pagesApplication Linear FunctionYusuf RaharjaNo ratings yet

- Mathematics of Business Functions and GraphsDocument55 pagesMathematics of Business Functions and GraphsGio VanniNo ratings yet

- 7.3 Projected Profit Loss: IncomeDocument10 pages7.3 Projected Profit Loss: IncomeYusuf RaharjaNo ratings yet

- Dividend Policy and The Earned Contributed CapitalDocument28 pagesDividend Policy and The Earned Contributed CapitalPratiwi SidaurukNo ratings yet

- Arens Chapter06Document42 pagesArens Chapter06indahmuliasariNo ratings yet

- Ifrs 15Document78 pagesIfrs 15KunalArunPawarNo ratings yet

- SA 501 - Group3Document31 pagesSA 501 - Group3Yusuf RaharjaNo ratings yet

- English Final Project (Finished)Document15 pagesEnglish Final Project (Finished)Yusuf RaharjaNo ratings yet

- Summary - PSAK 53Document8 pagesSummary - PSAK 53Yusuf RaharjaNo ratings yet

- 04 Atlassian 3 Statement Model CompletedDocument18 pages04 Atlassian 3 Statement Model CompletedYusuf RaharjaNo ratings yet

- Accounting ReportDocument3 pagesAccounting ReportYusuf RaharjaNo ratings yet

- Why Earnings Don't Matter for Digital CompaniesDocument7 pagesWhy Earnings Don't Matter for Digital CompaniesYusuf RaharjaNo ratings yet

- Fixed Income Final No. 2Document10 pagesFixed Income Final No. 2Yusuf RaharjaNo ratings yet

- Accounting For Typical Transactions in The Football IndustryDocument44 pagesAccounting For Typical Transactions in The Football IndustryYusuf RaharjaNo ratings yet

- Three Phase Transformer Model For TransientsDocument10 pagesThree Phase Transformer Model For TransientsYeissonSanabriaNo ratings yet

- Engineering Economy Course SyllabusDocument11 pagesEngineering Economy Course Syllabuschatter boxNo ratings yet

- WORKSHOP ON ACCOUNTING OF IJARAHDocument12 pagesWORKSHOP ON ACCOUNTING OF IJARAHAkif ShaikhNo ratings yet

- Unit Test, Part 2: Literature With A Purpose: Total Score: - of 40 PointsDocument3 pagesUnit Test, Part 2: Literature With A Purpose: Total Score: - of 40 PointsAriana Stephanya Anguiano VelazquezNo ratings yet

- Testing Your Understanding: The Dash, Slash, Ellipses & BracketsDocument2 pagesTesting Your Understanding: The Dash, Slash, Ellipses & BracketsBatsaikhan DashdondogNo ratings yet

- Kung Fu MedicinesDocument9 pagesKung Fu MedicinesDavid HewittNo ratings yet

- Bhaktisiddhanta Appearance DayDocument5 pagesBhaktisiddhanta Appearance DaySanjeev NambalateNo ratings yet

- PallavaDocument24 pagesPallavaAzeez FathulNo ratings yet

- Vadiyanatha AstakamDocument4 pagesVadiyanatha AstakamRaga MalikaNo ratings yet

- Reconsidering Puerto Rico's Status After 116 Years of Colonial RuleDocument3 pagesReconsidering Puerto Rico's Status After 116 Years of Colonial RuleHéctor Iván Arroyo-SierraNo ratings yet

- 59-33 ATO Implementation Journal KSA 100Document18 pages59-33 ATO Implementation Journal KSA 100nicolas valentinNo ratings yet

- Gcse English Literature Coursework Grade BoundariesDocument8 pagesGcse English Literature Coursework Grade Boundariesafjwfealtsielb100% (1)

- Homework WatergateDocument8 pagesHomework Watergateaapsujtif100% (1)

- Verbs Followed by GerundsDocument10 pagesVerbs Followed by GerundsJhan MartinezNo ratings yet

- 14-15 TDP HandbookDocument28 pages14-15 TDP Handbookapi-266268398No ratings yet

- DRR Module 4 Detailed Lesson PlanDocument8 pagesDRR Module 4 Detailed Lesson PlanFe Annalie Sacal100% (2)

- Wjec Gcse English Literature Coursework Mark SchemeDocument6 pagesWjec Gcse English Literature Coursework Mark Schemef6a5mww8100% (2)

- Test Unit 3Document2 pagesTest Unit 3RAMONA SECUNo ratings yet

- Blind and Visually ImpairedDocument5 pagesBlind and Visually ImpairedPrem KumarNo ratings yet

- BUMANGLAG - CLASS D - JEL PlanDocument3 pagesBUMANGLAG - CLASS D - JEL PlanMAUREEN BUMANGLAGNo ratings yet

- Al-Rimawi Et Al-2019-Clinical Oral Implants ResearchDocument7 pagesAl-Rimawi Et Al-2019-Clinical Oral Implants ResearchSohaib ShujaatNo ratings yet

- CSEC Notes US in The CaribbeanDocument8 pagesCSEC Notes US in The Caribbeanvernon white100% (2)

- Source: Sonia S. Daquila. The Seeds of RevolutionDocument6 pagesSource: Sonia S. Daquila. The Seeds of RevolutionJulliena BakersNo ratings yet

- Unpacking of StandardsDocument41 pagesUnpacking of StandardsJealf Zenia Laborada CastroNo ratings yet

- 50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefDocument263 pages50 Cool Stories 3000 Hot Words (Master Vocabulary in 50 Days) For GRE Mba Sat Banking SSC DefaravindNo ratings yet

- Neoclassicism: Romanticism Realism ImpressionismDocument16 pagesNeoclassicism: Romanticism Realism ImpressionismErika EludoNo ratings yet

- Chapter 9 MafinDocument36 pagesChapter 9 MafinReymilyn SanchezNo ratings yet

- Curriculum VitaeDocument8 pagesCurriculum VitaeChristine LuarcaNo ratings yet

- 5 - Econ - Advanced Economic Theory (Eng)Document1 page5 - Econ - Advanced Economic Theory (Eng)David JackNo ratings yet

- The Human Element is Critical in Personal SellingDocument18 pagesThe Human Element is Critical in Personal SellingArsalan AhmedNo ratings yet