Professional Documents

Culture Documents

84 LongevityInAstrology

Uploaded by

nabin shrestha0 ratings0% found this document useful (0 votes)

9 views12 pagesPhysics

Original Title

84-LongevityInAstrology

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhysics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views12 pages84 LongevityInAstrology

Uploaded by

nabin shresthaPhysics

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

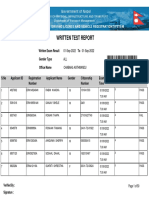

You are on page 1of 12

D.N.Adhikari Associates

ICAN No: 7256

PAN: 301761268

Registered Audtior

Tarakeshwor-10, Kathmandu

REPORT OF THE INDEPENDENT AUDITORS

TO THE MEMBERS OF

JAMUNA ALAICHI UTPADAN FARM

We have audited the accompanying financial statements of SAMUNA ALAICHI

UTPADAN FARM of 16th July 2018, (Corresponding to 32»! Ashad 2075 | and

related Profit and Loss Account, Cash Flow Statement and Statement of Changts in

Equity of the Company for the period ended on that date annexed thereto ard a

‘Summary of significant Accounting Policies and other explanatory notes.

Management’s Responsibility for the financial statements

‘Management is responsible for the preparation and fair presentation of these financkl

statements in accordance with Nepal Standards on Auditing. This responsibility

includes designing, implementing and maintaining internal control relevant to tht

preparation and fair presentation of the financial statements that are free from the

material misstatement, whether due to fraud or error, selecting and applying

appropriate accounting policies and, making accounting estimates that are reasonable

in the circumstances.

Auditor's Responsibility

Our responsibility is to express an opinion on these financial statements based on our

audit. We conducted our audit in accordance with Nepal Standards on Auditing. Those

standards require that we comply with ethical requirements and plan and perform the

audit to obtain reasonable assurance whether the financial statements are free from

material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts

and disclosures in the financial statements. The procedures selected depend on our

professional judgment, including the assessment of risk of material misstatement of the

financial statements, whether due to fraud or error. In making those risk assessments,

we considered internal controls relevant to the entity's preparation and fair presentation

of the financial statements in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion on the effectiveness

of the entity’s internal control. An audit also includes evaluating the appropriateness of

the accounting policies used and the reasonableness of the accounting estimates made

by management as well as evaluating the overall presentation of the financial

statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to

provide a basis for our audit opinion.

Opinion

As per the requirement of the Companies Act 2063 we further report that:

a)

b)

¢)

@)

e)

We have obtained all the information and explanations, which to the best of our

knowledge and belief were necessary for the purpose of our audit.

In our opinion the Company has kept proper books of account as required by law

so far, as appears from our examinations of those Books.

The Balance Sheet are in agreement with the books of account.

In our opinion and to the best of our information and according to the explanation

given to us, the said Balance Sheet and Profit and Loss Account, read together with

the notes forming part of the accounts give the information required by the

Companies Act in the manner so required and give a true and fair view:

i) In the case of Balance Sheet, of the state of affairs of the Company as at 32%

Ashad, 2075; and

ii) In the case of the Income Statement and Cash Flow Statement, Profit and Cash

inflow and outflow of Company for the year ended on that.

Neither we have come across any of the information about the misappropriation of

fund by the directors or any of the representative or company's staffs during the

course of our audit nor have we received any such information from the

management.

Dina Nath Adhikari

Registered Auditor

Date:

Place: Kathmandu

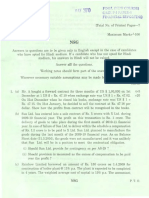

Jamuna Alaichi Utpadan Farm

Dolakha, Nepal

INCOME STATEMENT FOR THE YEAR ENDED S2nd ASHAD 2075

A) INCOME,

Income from business un 1,125,000.00

1,125,000.00

Other Income

‘Other Income

TOTAL 7735,000.00_

1B) EXPENDITURE

Direct Expenses 7 401,000.00,

401,000.00

Indirect Expenses

‘Administrative Expenses 2 117,000.00 113,000.00

Depreciation 4 147,500.00 110,000.00

Interest Expenses 150,000.00,

414,500.00 [323,000.00

TOTAL ——="wiss0000, | 587,000.00

NET PROFIT/(LOSS) BEFORE TAX & PROVISIONS 402,250.00

PROVISION FOR BONUS

NET PROFIT /(LOSS) BEFORE TAX 402,250.00

PROVISION FOR INCOME TAX & PENALTIES 116,000.00

386,250.00

PROFIT/(LOSS) AFTER TAX

[REVERSAL OF DEFFERED TAX

PROFIT (LOSS) UPTO PREVIOUS YEAR

ACCUMULATED PROFIT AFTER ADJUSTEMENT

DIVIDEND PAID

ACCUMULATED PROFIT/(LOSS) CARRIED TO BS

Significant Accounting Policies & Notes on Accounts, 10

“The schedules refered to above from an integral part of financial Statements

[As per our report on even date attached

Manager

‘Mem ICAN No: 7256

Place: Kathmandu Accountant

Date:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- MangalacharanDocument2 pagesMangalacharannabin shresthaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Microwave Oven: Owner'S ManualDocument30 pagesMicrowave Oven: Owner'S ManualRonnie DoberNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- P 2419 HDocument67 pagesP 2419 HchochoroyNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Mangal GrahaDocument2 pagesMangal Grahanabin shresthaNo ratings yet

- Shree SuktamDocument8 pagesShree Suktamnabin shresthaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Written Exam ResultsDocument50 pagesWritten Exam Resultsnabin shresthaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Ward Maps of Five MunicipalitiesDocument99 pagesWard Maps of Five Municipalitiesnabin shresthaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Exam 441801312478493Document11 pagesExam 441801312478493nabin shresthaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- 17 DeathInAstrologyDocument17 pages17 DeathInAstrologyAsaf Demir100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Longevity in AstrologyDocument10 pagesLongevity in AstrologyjanakrajchauhanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- SK DecorDocument11 pagesSK Decornabin shresthaNo ratings yet

- UtsahaDocument2 pagesUtsahanabin shresthaNo ratings yet

- Tax NoticeDocument1 pageTax Noticenabin shresthaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Nepal Population Situation Analysis PDFDocument90 pagesNepal Population Situation Analysis PDFnabin shresthaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Fall 2019 CoursesDocument1 pageFall 2019 Coursesnabin shresthaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Indepth Arudapada Astro PT Sanjay RathDocument1 pageIndepth Arudapada Astro PT Sanjay Rathnabin shresthaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nepal Gazette Section 5 Dated 2073.2.15Document431 pagesNepal Gazette Section 5 Dated 2073.2.15PJain100% (1)

- 1008 Petals: The Mayonnaise JarDocument2 pages1008 Petals: The Mayonnaise Jarnabin shresthaNo ratings yet

- Indepth Arudapada Astro-Pt Sanjay RathDocument19 pagesIndepth Arudapada Astro-Pt Sanjay RathRishu Sanam Garg100% (8)

- Aarthik Bidheyak 2072 - 20150714013705Document391 pagesAarthik Bidheyak 2072 - 20150714013705Dibesh AmatyaNo ratings yet

- NBSM Nepal Budget 2073 PDFDocument20 pagesNBSM Nepal Budget 2073 PDFnabin shresthaNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Financial Reporting (Group-I, Paper-IDocument7 pagesFinancial Reporting (Group-I, Paper-Inabin shresthaNo ratings yet

- BCP D1 Homework: Monday, January 28, 2019 9:44 PMDocument1 pageBCP D1 Homework: Monday, January 28, 2019 9:44 PMnabin shresthaNo ratings yet

- Financial Reporting (Group-I, Paper-IDocument7 pagesFinancial Reporting (Group-I, Paper-Inabin shresthaNo ratings yet

- Arthik Bidhiyak 2074 - 20170529022754Document502 pagesArthik Bidhiyak 2074 - 20170529022754mechNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Financial Reporting (Group-I, Paper-IDocument7 pagesFinancial Reporting (Group-I, Paper-Inabin shresthaNo ratings yet

- Bos 25517 CP 10Document19 pagesBos 25517 CP 10nabin shresthaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)