Professional Documents

Culture Documents

Payment of Tax

Uploaded by

dinesh kasnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Payment of Tax

Uploaded by

dinesh kasnCopyright:

Available Formats

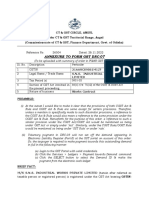

PAYMENT OF TAX

(GST Sections 49,50,51,52 & 53 CGST Rules 85, 86, 87& 88)

SECTION 49 PAYMENT OF TAX INTEREST PENALTY AND OTHER AMOUNTS

Sub-sec.1 Every deposit of tax, interest, penalty and fees through internet banking of debit card and credit NEFT RTGS

through the electronic cash ledger account.

Sub-sec.2 Input tax credit as self-assessed in the return.

Sub-sec.3 Amount available in Electronic cash ledger may be used towards tax, interest, penalty, fees or any other amount

payable.

Sub-sec.4 Amount available in Electronic credit ledger account for payment of output tax.

Sub-sec.5

IGST Credit: First to IGST Second to CGST Third to SGST to UTGST Section 44 (5) a CGST Act

CGST Credit: First to CGST Second to IGST (Not allowed to SGST) Section 44 (5) b CGST Act

SGST Credit: First to SGST Second to IGST (Not allowed to CGST) Section 44 (5) c d SGST Act

Sub-section.6. Balance amount can claim as refunded in accordance with the provisions of Section 54

Sub-Sec.7 All records maintained electronically.

Sub-Sec.8

Sub-sec.9

SECTION .50 INTEREST ON DELAY PAYMENT OF TAX

1).Interest on delay payment of tax @ 18%. (Section 50 of CGST & SGST act NT.13/2017)

2).Interest on delay payment of tax @ 20%.

3).Interest on delay payment of tax @ 24%. (Excess claimed ITC not paid output tax)

SECTION .51 TAX DEDUCTION AT SOURCE

Mandate to deduct the tax on the contract value (goods or services or both) exceeds Rs.2.5 (Two lakh fifty thousand).

No deduction shall be made supplier and supply in the same state or UTT.

Deducted amount shall be remitted to the govt. by the deductor before 10th of next month.

Deduction amount not remitted to the Govt. within 5days 100 rupees per day or 5000/-.

SECTION .52 COLLECTION OF TAX AT SOURCE

Order of discharge liability:

Self-assessed tax and other dues related to returns of previous tax periods.

Self-assessed tax and other dues related to returns of current tax periods.

Any other amount payable under this act or the rules made there under including demands under sections 73 & 74.

You might also like

- Indirect Tax Notes Tybaf Sem 6Document27 pagesIndirect Tax Notes Tybaf Sem 6Krutika sutar100% (1)

- CA Inter Payment of GST Notes @mission - CA - InterDocument36 pagesCA Inter Payment of GST Notes @mission - CA - InterKush BafnaNo ratings yet

- Payment of Tax: (SECTION 49 To 53A)Document36 pagesPayment of Tax: (SECTION 49 To 53A)Mehak KaushikkNo ratings yet

- Taxation Sec B May 2024 17077203Document13 pagesTaxation Sec B May 2024 17077203Umang NagarNo ratings yet

- Section 49Document19 pagesSection 49Shiwang AgrawalNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- No Interest Under GST On Delayed Filing.....Document6 pagesNo Interest Under GST On Delayed Filing.....qt9m2bqvzkNo ratings yet

- Chapter 10 - Payment of Tax - NotesDocument22 pagesChapter 10 - Payment of Tax - Notesmohd abidNo ratings yet

- 66522bos53752 cp9Document39 pages66522bos53752 cp9Chandan ganapathi HcNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- 74822bos60500 cp13Document48 pages74822bos60500 cp13Looney ApacheNo ratings yet

- 10 Payment of TaxDocument44 pages10 Payment of TaxSandilya CharanNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Ayment of AX: Learning OutcomesDocument38 pagesAyment of AX: Learning OutcomesJaymin JogiNo ratings yet

- Payment of TaxDocument40 pagesPayment of TaxMayur samdariyaNo ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- 12 Week DAY1 GST E-Content Computation of Tax Liability and Payment of Tax and InterestDocument5 pages12 Week DAY1 GST E-Content Computation of Tax Liability and Payment of Tax and InterestSameer XalkhoNo ratings yet

- Inpu T Tax CRE Dit!: Week 6Document39 pagesInpu T Tax CRE Dit!: Week 6himeesha dhiliwalNo ratings yet

- Payments Under GST ICAIDocument8 pagesPayments Under GST ICAIAishuNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Effective GST Changes W.E.F. October 01 2023Document9 pagesEffective GST Changes W.E.F. October 01 2023ravitop2006No ratings yet

- NN 14 2022 EnglishDocument13 pagesNN 14 2022 EnglishManish sharmaNo ratings yet

- Highlights of 47th GST Council Meeting - Taxguru - inDocument2 pagesHighlights of 47th GST Council Meeting - Taxguru - inBharath ChootyNo ratings yet

- Payment of Tax: FAQ'sDocument23 pagesPayment of Tax: FAQ'smun1barejaNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- GST UpdatesDocument10 pagesGST Updatesswati.gargchdNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- 2023-24 - Indirect Tax DossierDocument3 pages2023-24 - Indirect Tax DossierCA Manish BasnetNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- Composition SchemeDocument4 pagesComposition Schemecloudstorage567No ratings yet

- Budget 2023 - SummaryDocument2 pagesBudget 2023 - SummaryAliNo ratings yet

- 9 of 2023 Customs Circular InstructionsDocument4 pages9 of 2023 Customs Circular InstructionsUniversal CargoNo ratings yet

- Adobe Scan 21-Feb-2024Document8 pagesAdobe Scan 21-Feb-2024rahatkokate7No ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- TaxmanDocument4 pagesTaxmanMaunik ParikhNo ratings yet

- Final New Indirect Tax Laws Test 3 Detailed May Solution 1617180255Document17 pagesFinal New Indirect Tax Laws Test 3 Detailed May Solution 1617180255CAtestseriesNo ratings yet

- GST Amendments For June 22 Students by CA Vivek GabaDocument6 pagesGST Amendments For June 22 Students by CA Vivek GabayashNo ratings yet

- GST Update130 PDFDocument3 pagesGST Update130 PDFTharun RajNo ratings yet

- GSTR 9, 9C 22-23 by CA Aanchal Kapoor 2nd DecDocument85 pagesGSTR 9, 9C 22-23 by CA Aanchal Kapoor 2nd DeckaniananthoppoNo ratings yet

- E-Invoicing-Whether The Relevant Provisions of GST Law Require PatchworkDocument3 pagesE-Invoicing-Whether The Relevant Provisions of GST Law Require PatchworkELP LawNo ratings yet

- 1ms - Mecon LTD (DNS) - blr-Sl22-23113Document1 page1ms - Mecon LTD (DNS) - blr-Sl22-23113Dipan DasNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- Recent Developments in GSTDocument27 pagesRecent Developments in GSTAravindNo ratings yet

- Amendment Booklet NOV 21 - by CA Yachaa Mutha BhuratDocument46 pagesAmendment Booklet NOV 21 - by CA Yachaa Mutha BhuratSuraj BijlaniNo ratings yet

- Chapter 5 Composition Scheme Nov 2020Document41 pagesChapter 5 Composition Scheme Nov 2020Alka GuptaNo ratings yet

- GST MCQS - 2 Without AnswerDocument9 pagesGST MCQS - 2 Without AnswerSpidy MacNo ratings yet

- DRC-07 AdvisoryDocument4 pagesDRC-07 AdvisoryGaurav KapriNo ratings yet

- JT GST Amendment Dec 2023 - 231226 - 175329Document7 pagesJT GST Amendment Dec 2023 - 231226 - 175329shahsakshi172002No ratings yet

- Key Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestDocument23 pagesKey Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestshwetaNo ratings yet

- SET 23 24 Detail Guide EDocument20 pagesSET 23 24 Detail Guide ENishan MahanamaNo ratings yet

- GSTDocument40 pagesGSTsangkhawmaNo ratings yet

- ITC Notes Sent To B.COM 2023 BatchDocument40 pagesITC Notes Sent To B.COM 2023 BatchViral OkNo ratings yet

- Memo No 1304Document8 pagesMemo No 1304chandra shekharNo ratings yet

- GST Weekly Update - 37-2022-23Document5 pagesGST Weekly Update - 37-2022-23mohan bNo ratings yet

- SPC GST (TDS TCS)Document12 pagesSPC GST (TDS TCS)Aritra BanerjeeNo ratings yet

- Summary of Notifications Issued by CBIC Dated March 31 2023 PDFDocument14 pagesSummary of Notifications Issued by CBIC Dated March 31 2023 PDFclareson serraoNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Draft Payment RulesDocument5 pagesDraft Payment RulesLillyLalithaNo ratings yet

- TDS 21-22Document25 pagesTDS 21-22dinesh kasnNo ratings yet

- CBEC-20/16/15/2018-GST Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and CustomsDocument2 pagesCBEC-20/16/15/2018-GST Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customsdinesh kasnNo ratings yet

- Compensation Cess-2017 NT. No Date Subject Amendment To NTDocument1 pageCompensation Cess-2017 NT. No Date Subject Amendment To NTdinesh kasnNo ratings yet

- Order1 CGST Central TaxDocument1 pageOrder1 CGST Central Taxdinesh kasnNo ratings yet

- CGST CircularsDocument18 pagesCGST Circularsdinesh kasnNo ratings yet

- Circular No Date File No SubjectDocument2 pagesCircular No Date File No Subjectdinesh kasnNo ratings yet

- GST NT RatesDocument21 pagesGST NT Ratesdinesh kasnNo ratings yet

- Central Tax (Rates) Notifications-2017Document2 pagesCentral Tax (Rates) Notifications-2017dinesh kasnNo ratings yet

- Frequently Asked Questions (Faqs) On E-Way BillDocument5 pagesFrequently Asked Questions (Faqs) On E-Way Billdinesh kasnNo ratings yet

- Mixed & Composit SuppliesDocument2 pagesMixed & Composit Suppliesdinesh kasnNo ratings yet

- Input Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)Document3 pagesInput Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)dinesh kasnNo ratings yet