Professional Documents

Culture Documents

Budget 2023 - Summary

Uploaded by

AliOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 2023 - Summary

Uploaded by

AliCopyright:

Available Formats

Budget 2023- AK

Direct Tax Proposals

Personal Income-tax:

(i) Rebate limit increased to 7 Lakh INR in the New Tax Regime i.e, No tax on income upto 7

lacs

(ii) Proposes to reduce the number of slabs to 5 and increase the exemption limit to 3 Lakhs

(0-3 lakhs - NIL, 3-6 lakhs 5%, 6-9 lakhs 10%, 9-12 lakhs 15%, 12-15 lakhs 20%, above 15

lakhs 30%)

(iii) Nominal Increase in Standard Deduction

(iv) Highest surcharge for income above INR 5 Cr. to be reduced from 37% to 25%, resultant

reduction in MMR to 39%. I.e, Surcharge @ 25% on income exceeding INR 2 Cr.

(v) No change in old regime & New income tax regime to become default tax regime but

taxpayers allowed to take benefit of the old regime

Next generation ITR i.e, Common ITR Form to be rolled out

Enhanced limits for presumptive taxation for MSMEs and Professionals at Rs. 3 cr & Rs.75 lacs

turnover, respectively provided the receipts on cash are less than 5%.

Expenses allowable on payment basis in case of MSMEs u/s 43B

Default u/s 194R & 194S, the newly introduced TDS provision in Budget 2022, to now attract

penalty/prosecution in line with other sections.

Expands the definition of ‘perquisite’ u/s 28 to cover benefits received in cash

In case of special audit, the scope has been extended by including stock valuation.

Reducing litigations in income tax - 100 joint commissioner to dispose of pending appeals and

reducing the number of cases subject to scrutiny.

Reduces time provided for furnishing TP report to 10 days from previous 30 days.

Propose to limit capital gains exemption u/s 54 & 54F on investment in residential housing

restricted to Rs.10 Cr.

Proposes increasing TCS from 5% to 20% for certain classes of overseas remittance w.e.f 01 July,

2023.

New Cooperatives into manufacturing to enjoy lower tax rate of 15%

Start-ups sunset clause extended upto Mar 31, 2024 & to be allowed carry forward of losses on

change in shareholding for 10 years

Extension of period for relocation of funds into IFSC upto Mar'25

EEE status to Agniveer Fund, accordingly payment received from fund exempt.

Exclude notified NBFCs for interest deductions from thin capitalisation limitations.

Allow the taxpayers to take TDS credit w.r.t. deduction made in a subsequent FY

The exemption limit of leave encashment has been increased from 3 lacs to 25 lacs for central

govt. employees. Clarity awaited on private sector employees.

Finance Bill stipulates 'time-period' of 6 months for SEZ units to bring forex in India for claiming

Sec.10AA deduction.

Widening of scope of Sec. 9 to cover gifts from resident to ‘not ordinarily resident’, further

proposes bringing non-residents within Sec. 56(2)(vii)(b) ambit;

Restrict the exemption of charitable trusts and institutions on donations made to other charitable

trusts and institutions to only 85% of the donation amount.

New capital gains provision for market linked debentures, taxing income from insurance policies

where premium is more than Rs.5 lacs.

Cost of acquisition of the asset or the cost of improvement thereto shall not include the

deductions claimed on the amount of interest under clause (b) of section 24 or under the

provisions of Chapter VIA;”.

Conversion of gold into electronic gold receipts and vice versa not to be treated as capital gains

Reduces TDS on taxable portion of EPF from 30% to 20%.

Relaxation in TDS on cash withdrawal in cooperative sector

Online Gaming TDS threshold of Rs.10,000 to be removed

Goods & Service Tax (GST) Proposals

Disallowance of Input tax Credit on CSR expenditure

Raises the threshold for launching prosecution from Rs 1 cr. to Rs. 2 cr, reduces the compounding

amount from 50%-150% to 35%-100%, and decriminalize certain offences specified in section

132(1) (g), (j) & (k) relating to obstruction an officer, tempering of material evidence and failure to

supply the information, respectively;

On return filing front, proposes to restrict the filing of returns/ statements to a maximum period

of 3 years from the due date of filing of the relevant return / statement.

Revises the definition of “non-taxable online recipient” and “online information and database

access or retrieval services

Specifies the ‘place of supply’ irrespective of destination of the goods, in cases where the supplier

of services and recipient of services are located in India.

Enables unregistered suppliers and composition taxpayers to make intra-state supply of goods

through E-Commerce Operators (ECOs), subject to certain conditions.

New section 158A in CGST Act to enable sharing of information furnished by taxpayers in his

return or application of registration or statement of outward supplies, or the details uploaded by

him for generation of electronic invoice or E-way bill or any other details on the common portal,

with other systems

You might also like

- The SUPER Budget AnalysisDocument15 pagesThe SUPER Budget AnalysisMahaveer DhelariyaNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- 1.0 Direct Taxes: India Budget 2014 - 15 - in A NutshellDocument3 pages1.0 Direct Taxes: India Budget 2014 - 15 - in A Nutshell61srinihemaNo ratings yet

- Pankaj Agrawal's analysis of key direct tax proposals in Budget 2020Document18 pagesPankaj Agrawal's analysis of key direct tax proposals in Budget 2020Princess SoniyaNo ratings yet

- GST Council 43rd Meeting Key RecommendationsDocument6 pagesGST Council 43rd Meeting Key Recommendationssuhani singhNo ratings yet

- Financial Budget 2013Document9 pagesFinancial Budget 2013Mitesh PanchalNo ratings yet

- Statutory Updates For Nov-21 ExamsDocument50 pagesStatutory Updates For Nov-21 ExamsShodasakshari VidyaNo ratings yet

- Salient Features For Income TaxDocument6 pagesSalient Features For Income TaxRimsha AslamNo ratings yet

- CREATE Bill Cuts CIT Rate to 25% by 2023Document2 pagesCREATE Bill Cuts CIT Rate to 25% by 2023Mats Lucero100% (1)

- Salient Features For The Budget 2010-11Document11 pagesSalient Features For The Budget 2010-11kaashifhassanNo ratings yet

- Budget 2021 Highlights SummaryDocument10 pagesBudget 2021 Highlights Summarybackup mypcNo ratings yet

- Salient Features Income Tax)Document5 pagesSalient Features Income Tax)bbaahmad89No ratings yet

- Budget 2020-21 PointersDocument19 pagesBudget 2020-21 PointersJaved MushtaqNo ratings yet

- Vinuth Hegde and Co - Finance Budget Lega - Feb 2023Document6 pagesVinuth Hegde and Co - Finance Budget Lega - Feb 2023Raghav HNo ratings yet

- BUDGET 2017 by Taxpert Professionals Private LimitedDocument48 pagesBUDGET 2017 by Taxpert Professionals Private LimitedTaxpert mukeshNo ratings yet

- BDO Budget Snapshot - 2012-13Document9 pagesBDO Budget Snapshot - 2012-13Pulluri Ravikumar YugandarNo ratings yet

- Pankaj Kumar Agrawal: "Acche Din Aane Wale Hai?" "How They Prepared For Acche Din ?"Document18 pagesPankaj Kumar Agrawal: "Acche Din Aane Wale Hai?" "How They Prepared For Acche Din ?"Anjani Kumar PoluparthiNo ratings yet

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocument10 pagesIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNo ratings yet

- Budget Highlights 2012-13Document7 pagesBudget Highlights 2012-13Vikas JainNo ratings yet

- Amendments in Income Tax Act: Submitted To-Prof. Atul KochharDocument11 pagesAmendments in Income Tax Act: Submitted To-Prof. Atul KochharKUNAL GUPTANo ratings yet

- IT&STDocument2 pagesIT&STPraveen DsouzaNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Latest GST Changes 28-5-21Document5 pagesLatest GST Changes 28-5-21phani raja kumarNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Budget Highlights Athena Law-R1Document4 pagesBudget Highlights Athena Law-R1Ashar AkhtarNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- Decoding Indian Union BudgetDocument6 pagesDecoding Indian Union BudgetkumarNo ratings yet

- Tax Updates For June 2012 ExamsDocument37 pagesTax Updates For June 2012 ExamsShanky MalhotraNo ratings yet

- Budget 2023 - Analysis of Direct Tax ProposalsDocument49 pagesBudget 2023 - Analysis of Direct Tax ProposalsJigar ShahNo ratings yet

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocument4 pagesIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuNo ratings yet

- Key Highlights of the Union Budget 2012-13Document5 pagesKey Highlights of the Union Budget 2012-13Cn NatarajanNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- PSX Budget ProposalDocument28 pagesPSX Budget ProposalAhmed WaleedNo ratings yet

- CA CS CMA Final Statutory Updates For Nov Dec 2020Document43 pagesCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNo ratings yet

- Write-Up CITIRA BillDocument3 pagesWrite-Up CITIRA BillMaeJoNo ratings yet

- Tax and Business Strategy - Impact of New Ghanaian Tax LawsDocument6 pagesTax and Business Strategy - Impact of New Ghanaian Tax LawsM ArmahNo ratings yet

- Direct Tax AmendmentDocument1 pageDirect Tax AmendmentDevarajan VeeraraghavanNo ratings yet

- Union Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation MattersDocument29 pagesUnion Budget 2012-13 Pre-Budget Memorandum on Income Tax, Corporate Tax and Other Taxation Mattersnikhilsawant93No ratings yet

- Budget 2018 Highlights Direct Tax ChangesDocument5 pagesBudget 2018 Highlights Direct Tax ChangesSrushti BhattNo ratings yet

- Union Budget 2021 Highlights and ImpactDocument10 pagesUnion Budget 2021 Highlights and Impact200409120010No ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamsshrutishindeNo ratings yet

- Taxmann - Budget Highlights 2022-2023Document42 pagesTaxmann - Budget Highlights 2022-2023Jinang JainNo ratings yet

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- Budget 2023 CKDocument16 pagesBudget 2023 CKVenkateswar raoNo ratings yet

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- P - BudgetDocument5 pagesP - BudgetSumit GoyalNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- AFF Tax Memorandum v5Document28 pagesAFF Tax Memorandum v5Azhar AliNo ratings yet

- Project Report On BUDGET (2022-23) : Computer Applications in BusinessDocument15 pagesProject Report On BUDGET (2022-23) : Computer Applications in BusinessDeepu yadavNo ratings yet

- Amendments in CG AY 2023-24 - Skyhigh SymposiumDocument13 pagesAmendments in CG AY 2023-24 - Skyhigh Symposiumzalak jintanwalaNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- Old Vs New Personal Tax Regime 010323Document20 pagesOld Vs New Personal Tax Regime 010323Sreehari RaoNo ratings yet

- Finance Act 2023 HighlightsDocument45 pagesFinance Act 2023 Highlightsvishwa jothyNo ratings yet

- Goods and Service Tax NoDocument5 pagesGoods and Service Tax NonitinNo ratings yet

- Federal & Provincial Finance Acts, 2022 SummaryDocument61 pagesFederal & Provincial Finance Acts, 2022 SummaryABODE PVT LIMITEDNo ratings yet

- Budget 2015Document7 pagesBudget 2015Shubham GuptaNo ratings yet

- Overview of Key Changes to Income Tax Provisions Under TRAIN ActDocument49 pagesOverview of Key Changes to Income Tax Provisions Under TRAIN ActFaith FernandezNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Importance of Optimal Capital StructureDocument2 pagesImportance of Optimal Capital StructureShruti JoseNo ratings yet

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al Supreme Court Third Division, GR No. 209303 Promulgated 14 November, 2016Document10 pagesNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al Supreme Court Third Division, GR No. 209303 Promulgated 14 November, 2016Kriezl Nierra JadulcoNo ratings yet

- The Economy of Andhra Pradesh PDFDocument326 pagesThe Economy of Andhra Pradesh PDFurike rajNo ratings yet

- Finance IGNOU PDFDocument197 pagesFinance IGNOU PDFAakash BanjareNo ratings yet

- CFI - Accounting Fact Sheet PDFDocument1 pageCFI - Accounting Fact Sheet PDFClaudia FilipNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- 3C TAX Part 2 Digest Consolidated-SEMI COMPLETEDocument50 pages3C TAX Part 2 Digest Consolidated-SEMI COMPLETEClarence Octaviano-Salanga100% (1)

- Taxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxDocument32 pagesTaxation: Unit 1: Income Tax Basic Concepts Residential Status and Incidence of TaxnikkiNo ratings yet

- The Employee'S Provident Act1952: Name: Yogesh SinghDocument10 pagesThe Employee'S Provident Act1952: Name: Yogesh Singhyogesh singhNo ratings yet

- Montgomery - Cra Mrn-NeemDocument38 pagesMontgomery - Cra Mrn-NeemSagar MoradiyaNo ratings yet

- ELP-Exclusive Analysis Budget 2017Document66 pagesELP-Exclusive Analysis Budget 2017Panache ZNo ratings yet

- Mayor's MessageDocument3 pagesMayor's MessageJordan AllardNo ratings yet

- 11case StudyDocument6 pages11case StudyJefwardjohnNo ratings yet

- MINDANAO SHOPPING DESTINATION CORPORATION Vs HONDocument2 pagesMINDANAO SHOPPING DESTINATION CORPORATION Vs HONTrixia BermosaNo ratings yet

- Module 1 BALOBCOX Introduction To Obligations and ContractsDocument35 pagesModule 1 BALOBCOX Introduction To Obligations and ContractsLiza SadiwaNo ratings yet

- Contract - Selectum Real Estate Brokers LLCDocument7 pagesContract - Selectum Real Estate Brokers LLCyersaiyn.kairzhanovNo ratings yet

- Digital Services TaxDocument97 pagesDigital Services Taxngungo12345678No ratings yet

- Chapter 11 Global Capital Markets: International Business: Environments and Operations, 16e (Daniels Et Al.)Document28 pagesChapter 11 Global Capital Markets: International Business: Environments and Operations, 16e (Daniels Et Al.)batataNo ratings yet

- PR Week 1 - Teuku Aldefa AngkasaDocument3 pagesPR Week 1 - Teuku Aldefa AngkasaTeuku AldefaNo ratings yet

- Soneri BankDocument42 pagesSoneri BankFahad JavaidNo ratings yet

- SAP Business ByDesign - ServiceDocument136 pagesSAP Business ByDesign - ServicekameswarkumarNo ratings yet

- Prudential SurrenderDocument5 pagesPrudential SurrenderBriltex IndustriesNo ratings yet

- The Food Processing Industry (Thai)Document5 pagesThe Food Processing Industry (Thai)Ivan WongNo ratings yet

- Unit 11 - Lesson 4 - Principles of Proportional Progressive Regressive TaxesDocument13 pagesUnit 11 - Lesson 4 - Principles of Proportional Progressive Regressive Taxesapi-260512563No ratings yet

- 2-2 Stock Options Elliott StephanieDocument4 pages2-2 Stock Options Elliott StephanieStephanie ElliottNo ratings yet

- Business World (Jan. 14, 2016)Document27 pagesBusiness World (Jan. 14, 2016)Peter RojasNo ratings yet

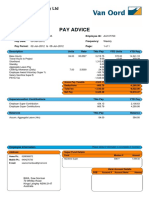

- Van Oord Australia Pty Ltd pays its employeesDocument1 pageVan Oord Australia Pty Ltd pays its employeesNorman BwaNo ratings yet

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- The Economics of Progressive TaxationDocument8 pagesThe Economics of Progressive TaxationEphraim DavisNo ratings yet

- Serbia's Rich Aviation History and Strategic PositionDocument36 pagesSerbia's Rich Aviation History and Strategic PositionDalia MuraddNo ratings yet