Professional Documents

Culture Documents

Sample Pages Complete GUNNER24 Trading and Forecasting Course

Uploaded by

Manish ShahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Pages Complete GUNNER24 Trading and Forecasting Course

Uploaded by

Manish ShahCopyright:

Available Formats

GUNNER24 Trading and Forecasting Course - Table of contents

Preface

Purpose and structure of the manual

A) The GUNNER24 Trading and Forecasting Technique

Introduction

Chart adjustments and time frames

High/Low rules and fixing of the GUNNER24 Impulse Move

Examples of traditional techniques vs. the GUNNER24 Initial Impulse

The GUNNER24 Initial Impulse

So, what does a GUNNER24 Initial Impulse look like? By which characteristic

features is it identified?

The 1st GUNNER24 Square

Change in trend at the Gann Angles, the horizontal lines and the diagonals

(mere trend lines) of the squares

Four dynamic space zones within the squares result in secure trading constants

Price action at a double arc – the further price development depends widely on

the conduct of the quotation at the moment when it reaches or approaches a

double arc

The important 1st double arc

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com -2-

The meaningful color sequence of the 5 GUNNER24 Double Arcs

The temporal influence of the double arcs

The GUNNER24 Time Lines

The GUNNER24 Fine Adjustment by the GUNNER24 Elliptical Setup

When does the selected GUNNER24 Setup expire and when can an opposite

GUNNER24 Setup be installed?

B) Background information as to why the GUNNER24

Forecasting Method will work for you

The basic idea of the square – 25 squares are described in the GUNNER24

C) Trading tips in reference to the GUNNER24

Trading and Forecasting Technique

Trading tips on the trend lines of the GUNNER24 Squares and the Gann Angles

Watch the lost motion

Stops and loss limitations considering the lost motion

Profit ensuring strategies

D) Trading success and psychology and the truth

about stock and commodities trading

How much time will it take until you cope with the GUNNER24?

Are you guaranteed to make money with it?

17 general trading rules

E) 33 GUNNER24 Guidelines and Recommendations

for your better trading performance – Overview

of all secrets and tips

F) Definitions pertaining to the GUNNER24/Appendix

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com -3-

You will see how simply you can fix and determine the Initial Impulse and the future

schedule of any stock and any index, and in addition of any future, commodities,

bonds and foreign exchange – at any time level, national and abroad.

The GUNNER24 Forecasting Method gives you a completely new and very successful

cyclic technique. Thus, you recognize the market development earlier and surer than

the others. The GUNNER24 is applicable together with your previous trading signals as

an additional controlling instrument.

You gain a maximum of safety for your transactions. After a short settling-in period

you will learn to anticipate the market movements.

The special cyclic technique of the GUNNER24 opens to you a completely new way of

seeing. Now you will find some turning points which have nothing to do with the

conventional cyclic techniques which were new and undiscovered so far.

With the trading signals of the GUNNER24 Forecasting Method you will have the

decisive trading advantage. With that, you will be one of a few traders who win! The

GUNNER24 Forecasting Method is new and not discovered by the crowds, yet. That's

your competitive edge!

I wish you lots of success

Yours

Eduard Altmann

Innovator and Founder GUNNER24

Purpose and structure of the manual

The Complete GUNNER24 Trading and Forecasting Course should enable you to trade

with more efficiency, safety and success by means of the new GUNNER24 Techniques.

You will be supported in it by concrete real-life examples with many illustrations and

pointers.

As a trading newcomer you will profit from the very simple and most manageable

GUNNER24 rules as well as from its easy operation.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com -6-

GUNNER24 Snap Version – Chart courtesy of stockcharts.com

The recommendations, opinions and target marks by Gurus end experts can be

examined immediately by means of charting technique in order to form one's own

opinion on their argumentation. Very frequently you will see your opinion results

contrary. And that's good. Because the majority of the investors always lose money.

GUNNER24 indicates the possible points and switches where the actual price data can

go to. Those tendencies can be followed by your trading without any reservation. You

simply see where the market wants to go and you recognize the moment and the

finishing line when and where the market turns into a different direction. You will get

the feeling for short term highs and lows and you will recognize immediately the last

high and low of the actual movement. And then, emotionally you will be prepared to

react the appropriate way, contrary to the market.

GUNNER24 is based on the fact that the first impulse of a movement defines the

frame of the height and the depth of the price action as well as the duration of a

future trend. From out the first initial impulse, the majority of the trend setters define

not only the further zones of support and resistance but also the dynamic space

zones, all the important turning points as well as the duration and length of the future

price movements.

Combined with some firm trading rules which an investor applies, according to his

position within the GUNNER24 Setup, the frame of a complete GUNNER24 Setup

enables the interested and educable investors, swing traders and day traders to

increase their trading success in a surprising way.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 14 -

st

The 1 GUNNER24 Square

Behaviour of the GUNNER24 Up in the 1st square:

You will detect in the price history when the last GUNNER24 Down Setup

ends. That happens mostly at the end of the influence of the 3rd or 5th

double arc of the previous GUNNER24 Down Setup.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 25 -

To set up the 1st square initial impulse in the GUNNER24 Forecasting Charting

Software, please proceed as follows:

1. Click on the icon for the GUNNER24 Setup .

2. Left mouse click the beginning of the initial impulse.

3. Keep your left mouse key pressed down and pull the cursor to the right until the

first developed blue circular arc in the 1st square is flush with the other extreme

point of the initial impulse.

4. Let go of the left mouse key and the GUNNER24 Forecasting Setup will now

overlay your chart.

When you work with the GUNNER24 Up Setup, you will first have to mark up the low,

the beginning of the initial impulse, and draw it to the top right until the developing

blue circular arc is flush with the high of the initial impulse in the 1st square.

1. Mark the low 2. Draw the blue arc 3. To the top right

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 29 -

The important 1*1 Gann Angle:

• As a time unit, a price unit is assigned to the 1*1 Gann Angle, i.e. the diagonal

line which separates the 1st square from left up to right down. That line is a 45°

angle in a normal falling trend movement. Those trends which fall in the line

are rather durable. If the prices fall steeper than 45° that means a very fast

and deep descent, but a rapid return is possible.

At the GUNNER24 Down Setup everything under the 1*1 Angle is bearish, above you

find the bullish area

• Here the breaks of the 1*1 Angle are to be paid much attention to. Very strong

signals emerge at the recapture of those angles: If the price rises through the

1*1 Angle after the GUNNER24 Down Setup, then rebounds at the 1*2 Angle

and breaks again through the 1*1 Angle from above downwards that points to

the resumption of the GUNNER24 Down Setup. The speed of the downtrend

mostly increases fast in those cases!

Here again the well-known Fibonacci Retracements at 50% and 61.8% support our

reentry.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 38 -

Change in trend at the Gann Angles, the horizontal lines and the

diagonals (mere trend lines) of the squares

This rule is valid: A change in trend happens when the price meets the Gann Angles,

the horizontal lines and the diagonals (mere trend lines). W.D. Gann: "When price

meets time, a change is imminent."

That means for you that the price: A) may rebound from the lines and diagonals that

is to say change the direction and B) that sometimes the existing trend suffers a

momentum change and that the price collapses at the break of the horizontal lines

and diagonals accelerating thus the original trend.

Derivation that the GUNNER24 Square consists of four dynamic space zones:

To square time and price we construct a square. Within the square we construct other

squares. Every square within the original square delivers different long and short

signals. Finally we count the long and short signals for the whole square.

1st GUNNER24 Square with long/short signals exactly at the starting point of

an upwards GUNNER24 Initial Impulse

I I I

L

% % % % 0% 3%

L LKKKS S

3% 7% % 6999% 33%

S S LS SS SS

L GG LL SSL SSL1

% 0% 3% % %777 % 8~ S

ES GSG S

SL

% S

S S

% % % % %

L

50%

L

% $$%

23% ##%

I I X I

The square is divided by the diagonal and the diagonal is always an angle of 45

degrees. It is a timing line to keep track of the passage of time from past. At this

angle, at all angles, time and price are in equilibrium or equal if it is a 45-degree

angle. So at and near that diagonals long and short signals cancel each other out.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 44 -

This is where you see another typical

price conduct at the double arc.

he reached low of the reversal

movement is arrived before the end of

the temporal influence zone of the

double arc.

The rebound starts when the support

field of the square is reached. The

original GUNNER24 Setup is revived.

You can have yourself stopped in

with the reversal candle technique and

turn your position. At the low work with

the reverse and double technique.

This is an

example where

the temporal

influence zone of

a double arc ends

precisely within

the double arc.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 58 -

The GUNNER24 Fine Adjustment by the GUNNER24 Elliptical Setup

You may begin with the fine tuning of the GUNNER24 Setup when the prices pass the

3rd and the 4th square. Use for that purpose the elliptic GUNNER24 Setup.

In the full version of the GUNNER24 Forecasting Charting Software you start the

elliptical setup with this symbol . Put the elliptical GUNNER24 Setup precisely at

the point where the last initial impulse by the Circle Bow technique you define it now

by the Ellipses method.

For that put the vector from the beginning to the end of the initial impulse. But move

the elliptic GUNNER24 Setup a little bit to the right and a little bit vertical at the same

time. And keep the left mouse key pressed.

You have to pay attention now to hit the highest possible number of passed turning

points at the time lines and price contacts to the square lines as well as the pricing at

the arc and at the double arcs.

The more precise turning points you hit dragging within the important time lines (right

and left limit as well as the square center).

GUNNER24 Circle Up Setup

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 66 -

C) Trading tips in reference to the GUNNER24

Trading and Forecasting Technique

Trading tips on the trend lines of the GUNNER24 Squares and the Gann

Angles

All the lines of all the GUNNER24 Squares as well as the Gann Angles at first are

important resistance and support lines. They are treated like trend lines. Here you can

apply all the methods which are applicable for the trend lines.

As shown already the assumption is valid that the prices should reach the next

Gann Angle towards the trend, if one Gann Angle is broken. In that case, normally the

broken Gann Angle is not re-broken within a valid GUNNER24 Setup!

In case of pullbacks and shakeouts very frequently the price happens to reach the

broken Angle again, to work its way along or to sway around the angle, testing it

again in a way. But in that case it works like a resistance line which virtually never is

re-broken to last. Situations like that result in excellent trading possibilities, of course.

Generally you should pay attention to this: Whenever the price reaches one of the

lines in the GUNNER24 Squares or a Gann Angle, time and price are in an important

mathematical correlation since there the emotions of the price setters bundle up into

one price at a certain time. In cases like that always a turning trend shows.

But if the turn does not happen and the lines and angles are broken there will be a

strong tendency of a trend continuation.

In all the horizontal GUNNER24 Square Lines and the Gann Angles, the rule of 3 and

the rule of 4 generally have a great importance. Mostly after a break in the 3 or 4th

attempt some big moves follow.

Typical for the horizontal and diagonal lines of the GUNNER24 Squares is a short little

A-B-C correction before the break, often as ZigZag or a Flat. The correction waves

commonly lead to vehement movements, sometimes they can be recognized just in a

lower time frame. If you are trading in the hourly chart, for instance, you should

change to the 15 or 5 minute chart in order to see them.

If a horizontal line in the GUNNER24 Setup is broken on final price basis you can be

pretty sure there will be a try to reach the next horizontal line towards the trend.

Then, often it is reached but rarely broken at the first attempt because the price move

is stopped by the double arcs which are located in front of the horizontal square lines.

The whole game continues towards the main trend until finally a double arc

initiates a change in trend. Usually that is the 3 and the 5th double arc.

Most important are those bottoms and tops where the horizontal line of the square

is not reached completely because they are stopped by the double arc which is in front

of them. That is always a sign for a strong trend into the other direction.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 74 -

32. Smaller retracements to the main trend normally last between 2 and 2.5 time

lines. From one time line to the other equals one time unit. Afterwards, you should be

prepared for the resumption of the trend. If the retracement lasts longer than 2 to 2.5

time lines the price normally is in the influence zone of a double arc.

33. In the 3, 5, 8, 11 or 13 passed square, there are often some vehement turning

points within the GUNNER24 Setup.

F) Definitions pertaining to the

GUNNER24/Appendix

In the following two charts and in the further definitions section, you will find the

definition of the terminological concepts which are used in the "Complete GUNNER24

Trading and Forecasting Course".

The GUNNER24 Setups, the vector of the initial impulse, The Gann Angles, the 1st

square, the blue arc, the 1st to the 5th double arc, the color of the 1st to the 5th double

arc according to the GUNNER24 Setup, the horizontal square lines, the diagonal

square lines, the four dynamic space zones and the time lines.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 93 -

Appendix

Transition from an old GUNNER24 Setup to the new GUNNER24 Setup

Situation: UNG (United States Natural Gas Fund) NYSE, is down 13 months within

only a very small retracement. This very rare monthly situation indicates a big upturn.

Remember: the future schedule of the price is defined by the first initial impuls. In

85% of all cases, this latter spans 1, 2, 3, 5, 8, 13 or 21 etc. time units.

But also: if the first impulse is 4, 6, 7, 9, 10 etc. time units, there is something wrong

with the market and a failure is probably underway…

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 97 -

Final forecast for the next 8-10 days – The price will retrace to

12.80. If the 5th double arc holds the 2nd price target is

14.50 - near the overhead resistance at the red double arc.

Final forecast for the next 6-8

days –First target for this

GUNNER24 Up Setup is 12.80

or a little lower. Then a good buy

is possible.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 111 -

More GUNNER24 Services – click on the links below

to get more information

Subscribe for your FREE GUNNER24 Newsletter now

For your investigations of the published past GUNNER24

Newsletters click here

Trading Manuals - Overview

GUNNER24 Products - Overview

Membership – 7 day RISK FREE TRIAL

Commissioned Charting Forecast – 20 to 50-year price forecasts

GUNNER24 Forecasting The GUNNER24 Forecasting Charting

Charting Software Software will show you a completely

new and highly successful cycle

technique. You will recognize

turnarounds with bull’s eye precision

in advance and, most importantly,

you will also be able to see at which

price levels the cycles will in fact

change. After a brief period of

learning, you will already have

developed the skill to anticipate

market movements. The special

GUNNER24 Cycle Technique will

open your thinking to a completely

novel approach. You will identify

milestones of paradigm shifts that

have absolutely nothing in common

with the conventional and obsolete

cycle technique. They are absolutely

innovative and have not yet been

discovered. Order NOW!

Contact us or send feedback

GUNNER24 Members – Please Login here

----------------------------------------------------------------------------------------

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 112 -

Copyright © 2009 Eduard Altmann

®

Developed and released by

All rights reserved. Developed and released in Germany. Permission is granted

for this material to be shared for non-commercial, educational purposes,

provided that this notice appears on the reproduced materials, the full

authoritative version is retained, and copies are not altered. To disseminate

otherwise or to republish requires written permission from GUNNER24.

This publication is designed to provide accurate and authoritative information

with regard to the subject matter covered. It is published with the

understanding that the publisher is not engaged in rendering legal, accounting,

or other professional advice. If legal advice or other expert assistance is

required, the services of a competent professional person should be sought.

© 2009 GUNNER24. All rights reserved. GUNNER24, the GUNNER24 Logo, the

GUNNER24 Forecasting Method, the GUNNER24 Forecasting Technique, the

GUNNER24 Impulse Wave Technique, the GUNNER24 Initial Impulse and the

GUNNER24 Websites are either registered trademarks or trademarks of

GUNNER24 in Germany and/or other countries.

Complete GUNNER24 Trading and Forecasting Course © www.GUNNER24.com - 113 -

You might also like

- Bradley and TechEdge Summation Users GuideDocument13 pagesBradley and TechEdge Summation Users GuideKrishnamurthy HegdeNo ratings yet

- The Best Gann Fan Trading StrategyDocument15 pagesThe Best Gann Fan Trading StrategyMassimo Manzoni100% (3)

- Ichimoku Trading GuideDocument7 pagesIchimoku Trading GuideLowell Griffin100% (1)

- Renko Ashi Trading System 2Document18 pagesRenko Ashi Trading System 2pelex99100% (2)

- Aquabounty CaseDocument6 pagesAquabounty CaseNapl AhmedNo ratings yet

- ECO2201 - Slides - 2.1 - Budget Constraint PDFDocument29 pagesECO2201 - Slides - 2.1 - Budget Constraint PDFjokerightwegmail.com joke1233No ratings yet

- Contract To Sell: Know All Men by These PresentsDocument3 pagesContract To Sell: Know All Men by These PresentsMarvel Felicity100% (3)

- Technical IndicatorsDocument13 pagesTechnical IndicatorsTraders Advisory100% (1)

- Gann TheoryDocument36 pagesGann Theoryamveryhot09100% (4)

- Eduard Altmann - GUNNER24 Trading Setup Examples 2009 PDFDocument96 pagesEduard Altmann - GUNNER24 Trading Setup Examples 2009 PDFJayamurugan Palanivelu100% (1)

- The Rate of VibrationDocument6 pagesThe Rate of VibrationJohn LobanNo ratings yet

- Mesa (Maximum Entropy Spectral Analysis)Document9 pagesMesa (Maximum Entropy Spectral Analysis)Francis LinNo ratings yet

- The Best Gann Fan Trading StrategyDocument15 pagesThe Best Gann Fan Trading StrategyAhmed Saeed AbdullahNo ratings yet

- Cambridge SummaryDocument1 pageCambridge SummaryMausam Ghosh100% (1)

- Fibonacci Trader Journal (Volume 1, Issue 2) (En) (8s)Document8 pagesFibonacci Trader Journal (Volume 1, Issue 2) (En) (8s)Eugen CorpaceanNo ratings yet

- The Trend Following Trading StrategyDocument5 pagesThe Trend Following Trading StrategySubhas MishraNo ratings yet

- MR - Nims Renko Aschi Scalping System: Metatrader IndicatorsDocument6 pagesMR - Nims Renko Aschi Scalping System: Metatrader IndicatorsAndres MedinaNo ratings yet

- Gann TradingDocument6 pagesGann TradingGirish NairNo ratings yet

- Renko Ashi Trading System 2Document18 pagesRenko Ashi Trading System 2girilingam100% (1)

- Gann 2-Bar Swings: What Is A Gann Swing Chart?Document17 pagesGann 2-Bar Swings: What Is A Gann Swing Chart?kixeraNo ratings yet

- Cloud Chart Secrets Volume 1Document87 pagesCloud Chart Secrets Volume 1hansondrew100% (1)

- Anty SetupDocument3 pagesAnty SetupMarv Nine-o SmithNo ratings yet

- Bollinger BandsDocument10 pagesBollinger Bandsarvindk.online6095No ratings yet

- Trading The Pivots, Support and ResistanceDocument6 pagesTrading The Pivots, Support and ResistanceVictoria Schroeder100% (1)

- Cycles - Research - Institute - GANN - Docx Filename UTF-8''Cycles Research Institute GANNDocument3 pagesCycles - Research - Institute - GANN - Docx Filename UTF-8''Cycles Research Institute GANNrajeshrraikarNo ratings yet

- The Definitive Guide To ScalpingDocument28 pagesThe Definitive Guide To ScalpingSaad Tate100% (2)

- Esignal Manual Ch6Document10 pagesEsignal Manual Ch6dee138100% (1)

- The Best Gann Fan Trading Strategy PDFDocument15 pagesThe Best Gann Fan Trading Strategy PDFDoug TrudellNo ratings yet

- Marketing Case Study BritvicDocument7 pagesMarketing Case Study BritvicAvril Anderson100% (1)

- A Summary of W D Gann MindsetDocument8 pagesA Summary of W D Gann MindsetpolNo ratings yet

- Summary of W.DDocument6 pagesSummary of W.Dapi-3749193No ratings yet

- Mam SQ16 OmDocument106 pagesMam SQ16 OmlistentomerijnNo ratings yet

- W D Gann Technical Analysis WizardDocument36 pagesW D Gann Technical Analysis WizardAbhi PatNo ratings yet

- BBT Tradebook Strategies Cheatsheet PDFDocument13 pagesBBT Tradebook Strategies Cheatsheet PDFRaghavendra Rao TNo ratings yet

- Kevinhaggerty 062210Document46 pagesKevinhaggerty 062210mr12323100% (5)

- Gann - Basic Trading StrategyDocument8 pagesGann - Basic Trading StrategyMian Umar RafiqNo ratings yet

- Agimat & Renko RevBDocument12 pagesAgimat & Renko RevBn1ghtwalk3rr0% (1)

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- PressedDocument20 pagesPressedMC Tanoh JerkNo ratings yet

- New Trading System - GUNNER24 Trading ManualDocument16 pagesNew Trading System - GUNNER24 Trading ManualGUNNER24 ForecastsNo ratings yet

- Uk100 GuideDocument13 pagesUk100 GuiderpmaiaNo ratings yet

- LINE PC Software Terms and Conditions of UseDocument2 pagesLINE PC Software Terms and Conditions of UseMeiza PratiwiNo ratings yet

- Aviation Formulas PDFDocument2 pagesAviation Formulas PDFArinze AnozieNo ratings yet

- TDU Belt System White BlueDocument3 pagesTDU Belt System White BlueIvan Olmo ForniesNo ratings yet

- Trading Systems IndicatorsDocument3 pagesTrading Systems IndicatorsKam MusNo ratings yet

- JOT Fall 2012 BloombergDocument10 pagesJOT Fall 2012 BloombergSergey HusnetdinovNo ratings yet

- Conservation of Mass: & Continuity EquationDocument32 pagesConservation of Mass: & Continuity Equationminervini markNo ratings yet

- Mam Sq16 Cheat SheetDocument2 pagesMam Sq16 Cheat SheetlistentomerijnNo ratings yet

- L4 - Centre Pivot IrrigationDocument17 pagesL4 - Centre Pivot IrrigationSnothando PrivilegeNo ratings yet

- Current Trade Challenges and Opportunities - OECD-globle Stock TradingDocument3 pagesCurrent Trade Challenges and Opportunities - OECD-globle Stock TradingSunil PatilNo ratings yet

- Met A Quotes Language 4Document78 pagesMet A Quotes Language 4Marcelo Mohr MacielNo ratings yet

- FXTrade User ManualDocument81 pagesFXTrade User ManualgokedaNo ratings yet

- Technical and Fundamental AnalysisDocument10 pagesTechnical and Fundamental AnalysisRakesh BhardwajNo ratings yet

- BB As An Entry TechniqueDocument6 pagesBB As An Entry TechniquekosurugNo ratings yet

- Detailed Gunner24 Action SheetDocument5 pagesDetailed Gunner24 Action Sheetj dNo ratings yet

- Price: Tech Analysis by John MurphyDocument24 pagesPrice: Tech Analysis by John MurphyPuneet BhasinNo ratings yet

- Bollinger Band (Part 2)Document5 pagesBollinger Band (Part 2)Miguel Luz RosaNo ratings yet

- 2 4 Multiple Time FramesDocument13 pages2 4 Multiple Time FramesNidhaaNo ratings yet

- US Technical IndicatorsDocument11 pagesUS Technical IndicatorsSupriyo BhattacharjeeNo ratings yet

- 99982d1270108051-Elite-Indicators-The Schaff Trend CycleDocument6 pages99982d1270108051-Elite-Indicators-The Schaff Trend Cyclejim blackNo ratings yet

- Quantifying The Market Type With ROC and ATRDocument4 pagesQuantifying The Market Type With ROC and ATRPRABHASH SINGHNo ratings yet

- EN IchimokuTradingGuideDocument7 pagesEN IchimokuTradingGuidetanyan.huangNo ratings yet

- Introduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsDocument5 pagesIntroduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsPapy RysNo ratings yet

- Vertex Indicator - A Successful Combination of IndicatorsDocument4 pagesVertex Indicator - A Successful Combination of IndicatorsMubashirNo ratings yet

- Technical AnalysisDocument43 pagesTechnical AnalysisAhsan Iqbal100% (1)

- Recurring Phase of Cycle Analysis - John EhlersDocument8 pagesRecurring Phase of Cycle Analysis - John EhlersTrader CatNo ratings yet

- 10 KMDocument3 pages10 KMManish ShahNo ratings yet

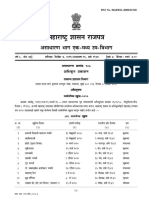

- Maharashtra Revision of D.A. 01.01.2020 To 30.06.2020Document2 pagesMaharashtra Revision of D.A. 01.01.2020 To 30.06.2020Manish ShahNo ratings yet

- Gujarat Shop & Establishment (RE &CS) Rules, 2020Document8 pagesGujarat Shop & Establishment (RE &CS) Rules, 2020Manish ShahNo ratings yet

- The Karnataka Industrial Employment Standing Orders Amendment Rules 2019Document2 pagesThe Karnataka Industrial Employment Standing Orders Amendment Rules 2019Manish ShahNo ratings yet

- TN Minimum Wages March 5,2019 Basic WagesDocument6 pagesTN Minimum Wages March 5,2019 Basic WagesManish ShahNo ratings yet

- WB - Hotel & Restaurant 1st Jan 2020 To 30th June 2020Document2 pagesWB - Hotel & Restaurant 1st Jan 2020 To 30th June 2020Manish ShahNo ratings yet

- MLWB User ManualDocument35 pagesMLWB User ManualManish ShahNo ratings yet

- Amendment To The Tamil Nadu Motor Vehicle Accident Claims Tribunal Rules.Document2 pagesAmendment To The Tamil Nadu Motor Vehicle Accident Claims Tribunal Rules.Manish ShahNo ratings yet

- Jammu and Kashmir State List of Holidays 2020Document4 pagesJammu and Kashmir State List of Holidays 2020Manish ShahNo ratings yet

- Karnataka Labour Welfare FundDocument1 pageKarnataka Labour Welfare FundManish ShahNo ratings yet

- Maharashtra State List of Holidays 2020Document8 pagesMaharashtra State List of Holidays 2020Manish ShahNo ratings yet

- NEEM NotificationDocument16 pagesNEEM NotificationManish ShahNo ratings yet

- Maharashtra Real Estate Regulation AuthorityDocument5 pagesMaharashtra Real Estate Regulation AuthorityManish ShahNo ratings yet

- Revenue Manual EsicDocument666 pagesRevenue Manual EsicManish ShahNo ratings yet

- Amendment Rajasthan Shops and Commercial Establishment 1959Document2 pagesAmendment Rajasthan Shops and Commercial Establishment 1959Manish ShahNo ratings yet

- Karnataka S&E 24X7 Exemption & New RulesDocument3 pagesKarnataka S&E 24X7 Exemption & New RulesManish ShahNo ratings yet

- The Odisha Minimum Wages Effective 1st Oct 2019Document2 pagesThe Odisha Minimum Wages Effective 1st Oct 2019Manish Shah100% (3)

- Chapter 10: InventoriesDocument39 pagesChapter 10: InventoriesCarl Aaron LayugNo ratings yet

- Solved SSC MTS 7th August 2019 Shift-3 Paper With SolutionsDocument39 pagesSolved SSC MTS 7th August 2019 Shift-3 Paper With SolutionsRathikanta PalNo ratings yet

- 4Document29 pages4zakalNo ratings yet

- 19L-1634 Sec B - Unilever in BrazilDocument3 pages19L-1634 Sec B - Unilever in BrazilFaria MehboobNo ratings yet

- Single's Bakery: Sta. Rosa, Abulug, CagayanDocument3 pagesSingle's Bakery: Sta. Rosa, Abulug, CagayanImee Claire PacisNo ratings yet

- Request For Quotation: Conflict Mitigation Assistance For Civilians (COMAC)Document15 pagesRequest For Quotation: Conflict Mitigation Assistance For Civilians (COMAC)Faisal CoolNo ratings yet

- Forex - DerivativesDocument5 pagesForex - DerivativesRusselle Therese DaitolNo ratings yet

- Presentation On:-Case Study of Jet Airways and Kingfisher AirwaysDocument27 pagesPresentation On:-Case Study of Jet Airways and Kingfisher AirwaysRaj K. SinghNo ratings yet

- Problem Set 1 PDFDocument2 pagesProblem Set 1 PDFlowfw880% (1)

- Chap 2 Concepts and Conventions (Class)Document14 pagesChap 2 Concepts and Conventions (Class)nabkillNo ratings yet

- Philips Returns To The 4 Ps of MarketingDocument9 pagesPhilips Returns To The 4 Ps of Marketinganubhav17may100% (1)

- This Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionDocument6 pagesThis Study Resource Was: Business Combination Practical Accounting 2 Date of AcquisitionAnneShannenBambaDabuNo ratings yet

- Sales ManagementDocument16 pagesSales Managementashish_phadNo ratings yet

- Buraq Education InstituteDocument1 pageBuraq Education InstituteTopak KhanNo ratings yet

- Chapter 2 Topic 3 Discount Inflation and TaxDocument9 pagesChapter 2 Topic 3 Discount Inflation and TaxJoash Normie DuldulaoNo ratings yet

- Padhle 11th - 2 - Consumer's Equilibrium - Microeconomics - EconomicsDocument12 pagesPadhle 11th - 2 - Consumer's Equilibrium - Microeconomics - Economicssrishti AroraNo ratings yet

- NoneDocument1 pageNonebaliNo ratings yet

- Mustapha Hasni Hartmann & Benz GMBH What You Have Always Wanted To Know About GoldDocument6 pagesMustapha Hasni Hartmann & Benz GMBH What You Have Always Wanted To Know About Goldmustaphahasnieasygold24No ratings yet

- VariancesDocument45 pagesVariancesanonNo ratings yet

- 4 - Capital Market ProductsDocument40 pages4 - Capital Market ProductsPratik BafnaNo ratings yet

- Core Finance: Management Accounting (CO)Document7 pagesCore Finance: Management Accounting (CO)sam sam0% (1)

- Managerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020Document27 pagesManagerial Economics ECO 502 Sbs - Mba / MSC: Submission Date: 12 March, 2020SZANo ratings yet

- Industry Analysis StratmaDocument2 pagesIndustry Analysis StratmaRobert Adams0% (1)

- Unit 4 Economics Market Structure.Document68 pagesUnit 4 Economics Market Structure.Devyani ChettriNo ratings yet