Professional Documents

Culture Documents

Continental Law

Uploaded by

Anonymous AOCRjX4Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continental Law

Uploaded by

Anonymous AOCRjX4Copyright:

Available Formats

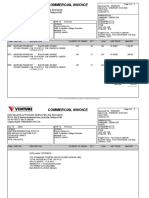

Jurisprudence has laid down a clear distinction between a letter of credit and a guarantee in that the

settlement of a dispute between the parties is not a pre-requisite for the release of funds under a letter

of credit. In other words, the argument is incompatible with the very nature of the letter of credit. If a

letter of credit is drawable only after settlement of the dispute on the contract entered into by the

applicant and the beneficiary, there would be no practical and beneficial use for letters of credit in

commercial transactions.

The engagement of the issuing bank is to pay the seller or beneficiary of the credit once the draft and

the required documents are presented to it. The so-called “independence principle” assures the seller or

the beneficiary of prompt payment independent of any breach of the main contract and precludes the

issuing bank from determining whether the main contract is actually accomplished or not. Under this

principle, banks assume no liability or responsibility for the form, sufficiency, accuracy, genuineness,

falsification or legal effect of any documents, or for the general and/or particular conditions stipulated in

the documents or superimposed thereon, nor do they assume any liability or responsibility for the

description, quantity, weight, quality, condition, packing, delivery, value or existence of the goods

represented by any documents, or for the good faith or acts and/or omissions, solvency, performance or

standing of the consignor, the carriers, or the insurers of the goods, or any other person whomsoever.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Lower Court Also Denied MR of Petitioners For Lack of Merit and Appointed Bernardo As The Administrator of The Intestate Estate of The Deceased ClemenciaDocument1 pageThe Lower Court Also Denied MR of Petitioners For Lack of Merit and Appointed Bernardo As The Administrator of The Intestate Estate of The Deceased ClemenciaAnonymous AOCRjX4No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- G1Document1 pageG1Anonymous AOCRjX4No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Today Is SundayDocument44 pagesToday Is SundayAnonymous AOCRjX4No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- AgainDocument2 pagesAgainAnonymous AOCRjX4No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 420Document2 pages420Anonymous AOCRjX4No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Jerez VS NietesDocument6 pagesJerez VS NietesAnonymous AOCRjX4No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Table of ContentsDocument4 pagesTable of ContentsAnonymous AOCRjX4No ratings yet

- On November 15Document1 pageOn November 15Anonymous AOCRjX4No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- On October 28Document1 pageOn October 28Anonymous AOCRjX4No ratings yet

- Hassle ThisDocument1 pageHassle ThisAnonymous AOCRjX4No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Under Article 40 of The Family CodeDocument1 pageUnder Article 40 of The Family CodeAnonymous AOCRjX4No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Special Proceedings Compilation of CasesDocument30 pagesSpecial Proceedings Compilation of CasesAlpha BetaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- DOZENDocument1 pageDOZENAnonymous AOCRjX4No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Remedial Law (Evidence) Memory Aid Ateneo CentralDocument23 pagesRemedial Law (Evidence) Memory Aid Ateneo Centralbhaby05honey88% (8)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Tuna Processing v. Philippine Kingford (Case Digest)Document3 pagesTuna Processing v. Philippine Kingford (Case Digest)Vince Leido100% (3)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 2017 Blank Monthly Calendar 01Document12 pages2017 Blank Monthly Calendar 01almanriqueNo ratings yet

- Concept of A State - Chapter 2 6 - 29Document59 pagesConcept of A State - Chapter 2 6 - 29denbar15No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Facts:: Enforcement of Foreign Arbitral Award Before The RTC of Makati City. Respondent KINGFORDDocument1 pageFacts:: Enforcement of Foreign Arbitral Award Before The RTC of Makati City. Respondent KINGFORDAnonymous AOCRjX4No ratings yet

- SUBJECT MATTER: Special Laws Letters of Credit Independence Principle Case SummaryDocument1 pageSUBJECT MATTER: Special Laws Letters of Credit Independence Principle Case SummaryAnonymous AOCRjX4No ratings yet

- William Golangco Construction Corporation VDocument2 pagesWilliam Golangco Construction Corporation VAnonymous AOCRjX4No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Special Proceedings Compilation of CasesDocument30 pagesSpecial Proceedings Compilation of CasesAlpha BetaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Evid HW6 PDFDocument19 pagesEvid HW6 PDFAnonymous AOCRjX4No ratings yet

- MCC Industrial Sales CorporationDocument1 pageMCC Industrial Sales CorporationAnonymous AOCRjX4No ratings yet

- Transfield v. Luzon Hydro Corp DIGESTDocument3 pagesTransfield v. Luzon Hydro Corp DIGESTkathrynmaydeveza100% (5)

- GDocument3 pagesGAnonymous AOCRjX4No ratings yet

- William Golangco Construction Corporation v. Ray Burton Development Corporation, G.R. No. 163582, August 9, 2010Document3 pagesWilliam Golangco Construction Corporation v. Ray Burton Development Corporation, G.R. No. 163582, August 9, 2010Kris RazoNo ratings yet

- Unilateral Rescission Improper and IllegalDocument2 pagesUnilateral Rescission Improper and IllegalAnonymous AOCRjX4No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- William Golangco Construction Corporation VDocument2 pagesWilliam Golangco Construction Corporation VAnonymous AOCRjX4No ratings yet

- Malayan Insuranca SBDocument2 pagesMalayan Insuranca SBAnonymous AOCRjX4No ratings yet

- 1 Fundamentals of EconomicsDocument17 pages1 Fundamentals of EconomicsRod100% (6)

- Purchase - Order - Details 5634Document2 pagesPurchase - Order - Details 5634Eris Joseph TanayNo ratings yet

- STUCO Project Planning PacketDocument13 pagesSTUCO Project Planning Packetkevin elchicoNo ratings yet

- Economic Essays Grade 12Document56 pagesEconomic Essays Grade 12pleasuremaome06No ratings yet

- A Bottom-Up Approach To Residential Load ModelingDocument8 pagesA Bottom-Up Approach To Residential Load ModelingFazlul Aman FahadNo ratings yet

- Dexretail-Capo-LED ColourDocument8 pagesDexretail-Capo-LED ColourFarag MohamedNo ratings yet

- 2023 Post Mission Highlights (West Africa) Final3Document26 pages2023 Post Mission Highlights (West Africa) Final3scottNo ratings yet

- Mounting Parts For Copeland Scroll Compressors Technical Information en GB 4209566Document5 pagesMounting Parts For Copeland Scroll Compressors Technical Information en GB 4209566Gustavo MedeirosNo ratings yet

- Furniture Catalog For IDAp ProjectsDocument13 pagesFurniture Catalog For IDAp ProjectsSheik HassanNo ratings yet

- Non-Current Assets Held For Sale: CA51016 - 2MA1Document21 pagesNon-Current Assets Held For Sale: CA51016 - 2MA1The Brain Dump PHNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- RDL Masterclass Version 2Document35 pagesRDL Masterclass Version 2Vic Speaks100% (1)

- Debit and Credit Rules-1Document23 pagesDebit and Credit Rules-1Mubeen JavedNo ratings yet

- Chapter 2 - Ideas and Theories of Economic Development, Part 2Document20 pagesChapter 2 - Ideas and Theories of Economic Development, Part 2Rio RamilNo ratings yet

- A-308 - BKH - Roof - Floor - Ceiling Plan - Rev02Document1 pageA-308 - BKH - Roof - Floor - Ceiling Plan - Rev02Ahmed LaithNo ratings yet

- Return On Invested Capital (ROIC)Document4 pagesReturn On Invested Capital (ROIC)VinodSinghNo ratings yet

- Apauline IciciDocument41 pagesApauline Icicihalotog831No ratings yet

- Petty Cash FundDocument8 pagesPetty Cash FundCrystal NadalaNo ratings yet

- Bipard Prashichhan (Gaya) - 87-2023 2ndDocument2 pagesBipard Prashichhan (Gaya) - 87-2023 2ndtinkulal91No ratings yet

- Preview 30302494Document6 pagesPreview 30302494SNEHA GHODENo ratings yet

- Establishing Company Direction - Lecture 2Document6 pagesEstablishing Company Direction - Lecture 2api-3710170100% (1)

- Daftar PertanyaanDocument97 pagesDaftar PertanyaanNeviNo ratings yet

- Science Q1 W1 EditedDocument15 pagesScience Q1 W1 Editedkatherine EspirituNo ratings yet

- Bussiness EconomicsDocument5 pagesBussiness EconomicsAbdul Hadi SheikhNo ratings yet

- ISKANDAR ATELIER Costing AssignmentDocument1 pageISKANDAR ATELIER Costing AssignmentKotak ChannelNo ratings yet

- Snijders TAB-Multilevel Analysis An Introduction To Basic and Advanced Multilevel Modeling-Pp74-93Document21 pagesSnijders TAB-Multilevel Analysis An Introduction To Basic and Advanced Multilevel Modeling-Pp74-93100111No ratings yet

- Planning Guidelines For Developing Industrial Areas in JaipurDocument170 pagesPlanning Guidelines For Developing Industrial Areas in JaipurAnkit Kashmiri GuptaNo ratings yet

- Jetty Project Cost Estimate Andesite Mining Project Cost EstimateDocument2 pagesJetty Project Cost Estimate Andesite Mining Project Cost EstimateJonas Arifin0% (1)

- Ges Manufacturing Services (M) SDN BHD: This Is A Computer Generated Document, No Signature Is RequiredDocument2 pagesGes Manufacturing Services (M) SDN BHD: This Is A Computer Generated Document, No Signature Is RequiredSya FatinNo ratings yet

- Functions Notes BBA 2023 QT 1Document5 pagesFunctions Notes BBA 2023 QT 1vvineetjain115No ratings yet

- Comparison Table: SwiftstandardsDocument12 pagesComparison Table: SwiftstandardsJacquet JeanNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)