Professional Documents

Culture Documents

Impact of GST On Real Estate: SL. No. Particulars Remarks Applicable GST

Uploaded by

Roshanjit ThakurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of GST On Real Estate: SL. No. Particulars Remarks Applicable GST

Uploaded by

Roshanjit ThakurCopyright:

Available Formats

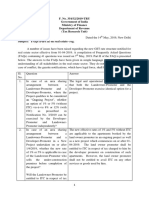

IMPACT OF GST ON REAL ESTATE

SL. Particulars Remarks Applicable GST

No.

01 Completed Flats/Property or Ready To Move In Refer Note 1 Nil

Properties

02 Under Construction Property :

a Property on which completion certificate Builder got the Nil

issued completion certificate

before you purchase it,

then it is considered as

ready-to-move-in

property

b Payment for property made by buyer in full Service Tax @ 4.5% No

before 1st July 2017 was chargeable

c Part payment for property made by buyer Service Tax @ 4.5% GST @12% (effectively) will be

before 1st July 2017 was applicable on the applicable on part payment

part payment made after 01st July 2017

before 01st July 2017

d Payment for property made by buyer in after - Gst @ 12% (18% less 1/3 for

before 1st July 2017 Land)

Note 1

Whether Flats/Properties are considered as Goods ?

Goods u/s 2(52) of GST Act

“Goods’’ means every kind of movable property other than money and securities but includes

actionable claims ,growing crops, grass and things attached to or forming part of the land which

are agreed to be severed before supply or under a contract of supply.

To be classified as Goods under GST Act, it shall also satisfy the test of Movability. The term

“Movability of property is defined in the section 3(36) of the General Clause Act, 1897 to mean

“Property of every description, except immovable property”.

Section 2(26) of the General Clauses Act “Immovable property” shall include land, benefits to

arise out of land, and things attached to the earth, or permanently fastened to anything

attached to the earth.

Going by the definition of Immovable property u/s 2(26) of the General Clauses Act, Flats are

immovable property and hence not “goods”

You might also like

- GST On Development AgreementDocument3 pagesGST On Development Agreementparasshah.kljNo ratings yet

- Impact of GST Law On Real EstateDocument14 pagesImpact of GST Law On Real EstateHumanyu KabeerNo ratings yet

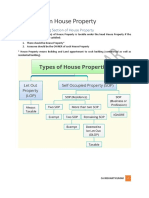

- (uploadMB - Com) 18 - House PropertyDocument22 pages(uploadMB - Com) 18 - House PropertyhariomnarayanNo ratings yet

- SL - No Services Provided Month Month of Invoice Raised Month of Payment Made Forward /reverse ChargeDocument9 pagesSL - No Services Provided Month Month of Invoice Raised Month of Payment Made Forward /reverse ChargeAssistant Engineer CivilNo ratings yet

- Overview of GST in Real Estate SectorDocument5 pagesOverview of GST in Real Estate Sectorprawin karnNo ratings yet

- GST Study On Real Estate and Works ContractDocument22 pagesGST Study On Real Estate and Works ContractLGopal ShahNo ratings yet

- Pre-Exam Marathon 3 - House Property, Capital Gains, IFOS, Salaries, PGBP, TDS, TCS, Advance Tax, PDFDocument106 pagesPre-Exam Marathon 3 - House Property, Capital Gains, IFOS, Salaries, PGBP, TDS, TCS, Advance Tax, PDFParmeet NainNo ratings yet

- 2020 Oct Indiaassetz TNCDocument1 page2020 Oct Indiaassetz TNCshashaank91No ratings yet

- Charge Type Home Loan (INR) Non Home Loan (INR)Document1 pageCharge Type Home Loan (INR) Non Home Loan (INR)NISHA BANSALNo ratings yet

- Tax HandoutDocument6 pagesTax Handoutshekharsuhani5No ratings yet

- BDO India Indirect Tax Weekly Digest 30 May 2023Document7 pagesBDO India Indirect Tax Weekly Digest 30 May 2023VenkuReddy KoduruNo ratings yet

- Real Estate Sector: Types of Construction Projects & It'S TaxabilityDocument7 pagesReal Estate Sector: Types of Construction Projects & It'S TaxabilityPrasanthNo ratings yet

- Taxability of Real Estate Transactions Under GST: Particulars Applicability Rate of TaxDocument5 pagesTaxability of Real Estate Transactions Under GST: Particulars Applicability Rate of Taxnastaeenbaig1No ratings yet

- GST On Real Estate Converted 1Document4 pagesGST On Real Estate Converted 1jvnraoNo ratings yet

- GST Lon Landowner ShareDocument6 pagesGST Lon Landowner ShareJigmeNo ratings yet

- Taxation 2-4 ExamDocument65 pagesTaxation 2-4 ExamStephanie PublicoNo ratings yet

- SIMS - GST 1st Internal Assessment (Group Project)Document6 pagesSIMS - GST 1st Internal Assessment (Group Project)simranNo ratings yet

- GST@FAQ Builders 09.10.2017Document10 pagesGST@FAQ Builders 09.10.2017NIKHIL KASATNo ratings yet

- QuickRef GST Changes JDA 1Document8 pagesQuickRef GST Changes JDA 1umesh bagwaleNo ratings yet

- InDirect Tax Notes - Xavier'sDocument42 pagesInDirect Tax Notes - Xavier'sPallabi Mishra100% (1)

- Impact of GST On Construction and Real EstateDocument7 pagesImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- SOC - Prime - Dec 10 2023 - V27Document1 pageSOC - Prime - Dec 10 2023 - V27sehgaNo ratings yet

- Income From House Property PDFDocument7 pagesIncome From House Property PDFGiri SukumarNo ratings yet

- Tax ManagementDocument31 pagesTax ManagementrakeshkakaniNo ratings yet

- Real Property Tax Class ProjectDocument59 pagesReal Property Tax Class ProjectEuodia HodeshNo ratings yet

- GSTDocument19 pagesGSTPRANAV GOSWAMINo ratings yet

- 28 4 2020 Manoj Nahata Jda Taxability Under GSTDocument30 pages28 4 2020 Manoj Nahata Jda Taxability Under GSTPasumarthi VenkateshNo ratings yet

- Income From House PropertyDocument32 pagesIncome From House PropertyDrishtiNo ratings yet

- TRAIN On ESTATE TAXATIONDocument6 pagesTRAIN On ESTATE TAXATIONCanapi AmerahNo ratings yet

- Press Release, Dated 8 December, 2018 Effective Tax Rate On Complex, Building, Flat EtcDocument1 pagePress Release, Dated 8 December, 2018 Effective Tax Rate On Complex, Building, Flat EtcChirag RautNo ratings yet

- A Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered PersonsDocument8 pagesA Comprehensive GST Checklist Before Finalisation of Balance Sheet For The Fy 2017 - 2018 For Registered Personsजयकरण शर्माNo ratings yet

- GST On Construction Done For Landlords Under Joint Development Agreement PDFDocument7 pagesGST On Construction Done For Landlords Under Joint Development Agreement PDFAman JainNo ratings yet

- taxguru.in-GST शासतर Joint Development Agreement Taxability other aspectsDocument6 pagestaxguru.in-GST शासतर Joint Development Agreement Taxability other aspectsinspira buildersNo ratings yet

- HĐ Thuê - EnglishDocument16 pagesHĐ Thuê - EnglishVinpearl Resort & VillasNo ratings yet

- Income From PropertyDocument21 pagesIncome From PropertyBrown BoiNo ratings yet

- GST On Real EstateDocument37 pagesGST On Real EstateRupali GuptaNo ratings yet

- SupplyDocument25 pagesSupplyNEHA BBA2020EBNo ratings yet

- GST Issues Real Estate Sector Yashwant KasarDocument49 pagesGST Issues Real Estate Sector Yashwant KasarSaikrishna AlluNo ratings yet

- Brief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inDocument5 pagesBrief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inPrakhar MaheshwariNo ratings yet

- Taxability of Joint Development Agreement It GSTDocument14 pagesTaxability of Joint Development Agreement It GSTJay SorathiyaNo ratings yet

- Short Notes of House PropertyDocument3 pagesShort Notes of House PropertyutsavNo ratings yet

- gstr2011 d002Document83 pagesgstr2011 d002jndelamora18No ratings yet

- Gam Wu Qobl NDMEHr K5 PNW I08 HDocument46 pagesGam Wu Qobl NDMEHr K5 PNW I08 Hsamruddhi gharoteNo ratings yet

- 6 - Annual Value of House PropertyDocument2 pages6 - Annual Value of House PropertyAnupam BaliNo ratings yet

- Form 12 CDocument1 pageForm 12 Cmkharb941No ratings yet

- CA Inter IPCC IDT Amendments May2020 ExamDocument25 pagesCA Inter IPCC IDT Amendments May2020 ExamMohammed IbrahimNo ratings yet

- Income From House PropertyDocument9 pagesIncome From House PropertySukritiNo ratings yet

- Unit - 2: Income From House Property: After Studying This Chapter, You Would Be Able ToDocument47 pagesUnit - 2: Income From House Property: After Studying This Chapter, You Would Be Able Toadityaraj purohitNo ratings yet

- House Property - Summary (PY 2020-21 AY 2021-22)Document5 pagesHouse Property - Summary (PY 2020-21 AY 2021-22)Aruna RajappaNo ratings yet

- First Exam Transcript Taxation Law Ii: Title Iii Estate and Donor'S TaxDocument15 pagesFirst Exam Transcript Taxation Law Ii: Title Iii Estate and Donor'S TaxAure ReidNo ratings yet

- White Paper: Analysis of GST Implications On Real Estate Sector in IndiaDocument9 pagesWhite Paper: Analysis of GST Implications On Real Estate Sector in IndiaAyushi PanditNo ratings yet

- Indiana Property Tax Benefits: State Form 51781 (R14 / 1-20) Prescribed by The Department of Local Government FinanceDocument5 pagesIndiana Property Tax Benefits: State Form 51781 (R14 / 1-20) Prescribed by The Department of Local Government FinanceBock DharmaNo ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- FAQ (II) Real Estate Sector 1405Document9 pagesFAQ (II) Real Estate Sector 1405raj pandeyNo ratings yet

- GST AnswerDocument57 pagesGST Answerdarekaraaradhya0No ratings yet

- HP and PGBP PDFDocument106 pagesHP and PGBP PDFRavi YadavNo ratings yet

- Determination of Annual ValueDocument4 pagesDetermination of Annual ValueStudy AllyNo ratings yet

- 56465bos45796cp4u2 PDFDocument49 pages56465bos45796cp4u2 PDFNarendra VasavanNo ratings yet

- Supply Under GSTDocument14 pagesSupply Under GSTTreesa Mary RejiNo ratings yet

- All About ESIC and PF With New Rates of ESICDocument7 pagesAll About ESIC and PF With New Rates of ESICRoshanjit ThakurNo ratings yet

- BS 2019Document1 pageBS 2019Roshanjit ThakurNo ratings yet

- Shri Mata Vaishno Devi Shrine Board - Donation SlipDocument1 pageShri Mata Vaishno Devi Shrine Board - Donation SlipRoshanjit Thakur100% (1)

- SAKTI BULDERS - Written Submission Submitted On 131119 PDFDocument38 pagesSAKTI BULDERS - Written Submission Submitted On 131119 PDFRoshanjit ThakurNo ratings yet

- SAI KRIPA TREXIM MGT7 2018 (27100, 27.8.19, HDFC BK.)Document1 pageSAI KRIPA TREXIM MGT7 2018 (27100, 27.8.19, HDFC BK.)Roshanjit ThakurNo ratings yet

- Amogh Shiv KavachDocument9 pagesAmogh Shiv KavachgeorgeinpuneNo ratings yet

- Depreciation CalculatorDocument8 pagesDepreciation CalculatorRoshanjit Thakur100% (1)

- Auditors CertificateDocument8 pagesAuditors CertificateRoshanjit ThakurNo ratings yet

- 101 Square Meals PDFDocument129 pages101 Square Meals PDFHenrik Björnklint100% (1)

- Sa 500-509Document30 pagesSa 500-509Roshanjit ThakurNo ratings yet

- ComputationDocument1 pageComputationRoshanjit ThakurNo ratings yet

- CookbookDocument16 pagesCookbookPrince Israel EboigbeNo ratings yet

- Independent Directors Aptt. LetterDocument10 pagesIndependent Directors Aptt. LetterLolitambika NeumannNo ratings yet

- Limited Liability Partnership AreementDocument15 pagesLimited Liability Partnership AreementRoshanjit ThakurNo ratings yet

- Sa 700 PDFDocument67 pagesSa 700 PDFRoshanjit ThakurNo ratings yet

- U W A A: Sing The Ork of Nother UditorDocument8 pagesU W A A: Sing The Ork of Nother UditorRoshanjit ThakurNo ratings yet

- Auditor CertificateDocument2 pagesAuditor CertificateRoshanjit ThakurNo ratings yet

- ExpenseDocument1 pageExpenseRoshanjit ThakurNo ratings yet

- Duediligenceunderfemabyca Sudhag Bhushan 110824230226 Phpapp01Document52 pagesDuediligenceunderfemabyca Sudhag Bhushan 110824230226 Phpapp01Taxpert mukeshNo ratings yet

- Auditor CertificateDocument2 pagesAuditor CertificateRoshanjit ThakurNo ratings yet

- Sa 700 PDFDocument67 pagesSa 700 PDFRoshanjit ThakurNo ratings yet

- Nayab New EwayDocument2 pagesNayab New EwayRoshanjit ThakurNo ratings yet

- Certificate of ServiceDocument1 pageCertificate of ServiceManuj DuaNo ratings yet

- Duediligenceunderfemabyca Sudhag Bhushan 110824230226 Phpapp01Document52 pagesDuediligenceunderfemabyca Sudhag Bhushan 110824230226 Phpapp01Taxpert mukeshNo ratings yet

- Capital GainsDocument12 pagesCapital GainsRoshanjit ThakurNo ratings yet