Professional Documents

Culture Documents

Charge Type Home Loan (INR) Non Home Loan (INR)

Uploaded by

NISHA BANSAL0 ratings0% found this document useful (0 votes)

50 views1 pageOriginal Title

Schedule-of-Charges-Version-22.0.0-wef-1st-June21-Final

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

50 views1 pageCharge Type Home Loan (INR) Non Home Loan (INR)

Uploaded by

NISHA BANSALCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

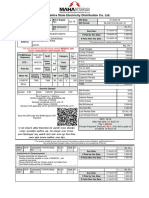

Version 22.0.

0

Effective from June 01, 2021

Schedule of Charges and Applicable Taxes for Retail Loans

Charge Type Home Loan (INR) Non Home Loan (INR)

Processing Fee* 1% of the loan applied for + GST 2% of the loan applied for + GST

Legal Fee (for loan appraisal) As per actual

a. NIL - In case property is in the name of Individual

& loan is not a Non-Housing / Business purpose loan

a. NIL - In case property is in the name of Individual ;

b. 3% - of principal prepaid + GST - If property is in

b. In case property is name of non individual entity, it will

the name of Individual & Purpose is non

Part or Full Prepayment of loan (on Floating Rate of Interest) be considered as business purpose loan and a charge of 3%

housing/business

** of Principal paid + GST will be applicable

c. In case property is name of non-individual entity, it

will be considered as business purpose loan and a

charge of 3% of principal paid + GST will be

applicable

a. NIL - In case property is in the name of Individual and

payment is made from own sources ;

b. In case property is in ame of individual and payment is

made by/from third party, charge of 2% of principal prepaid

Part or Full Prepayment of loan (on Fixed Rate of Interest) ** 3% - of Principal prepaid + GST

+ GST will be applicable ;

c. In case property is name of non individual entity, it will be

considered as business purpose loan and a charge of 3% of

Principal paid + GST will be applicable.

Rs 750/- + GST (1st Bounce)

Cheque/NACH Mandate Form return (Bounce charges)

Rs 1000/- + GST (2nd Bounce - same instrument representation)

Overdue Charge 24% p.a on unpaid EMI for delayed period

Legal Recovery Fees Actuals Actuals

a. E-Statement will be sent on mail,free of cost on quarterly basis ;

Statement of Account b. Soft copy of Statement can be downloaded free of cost from web/mobile portal

c. Rs 500/- + GST will be charged if adhoc request received at Branch / on e-mail ;

a. 2 times in a year repayment schedule will be emailed free of cost ;

Repayment Schedule Fee b. Soft copy of repayment schedule can be downloaded free of cost from web/mobile portal ;

c. Rs 500/- + GST will be charged, if adhoc request received at Branch / on e-mail ;

a. Nil, if requested within initial 6 months of 1st disbursement

List of Documents Fee

b. After 6 months from 1st disbursement - Rs 750/- + GST, if request is received at Branch / on email

Loan Preclosure statement Rs 750/- + GST Rs 750/- + GST

Provisional interest certificate (for Income tax) for current

a) 2 Provisional & 1 Final Interest will be sent through e-mail every year, free of cost ;

financial year

b) Any request received over and above will be charged at Rs 500/- + GST per instance ;

Final interest paid certificate (for Income tax) for previous

c) No charge for self-download from Website / Portal / IVR

financial year

Rs 500/- + GST, if received through an e-mail ;

Copy of Property Documents Rs 1000/- + GST, if printed copies (subject to max of 50 pages) ;

Rs 1500/- + GST, for more 50 pages ;

Free, if moving from PDC mode to NACH mode ;

Swap of Repayment Instructions Free, if moving from NACH mode to E-NACH ;

Rs 750/- + GST, if physical mode - PDC/NACH ;

ROI Change - Fixed to Floating 3% of POS + GST 3% of POS + GST

ROI Change - Floating to Floating (reduction in rate) 0.5% of POS + GST 1% of POS + GST

ROI Change - Fixed/Floating to Fixed Conversion to "fixed" rate of interest is not available.

Swap of Property Fee Rs 25000/- + GST Rs 25000/- + GST

Fee for EMI payment in cash/single cheque Rs 1000/- + GST Rs 1000/- + GST

Custody Charges (for property documents not taken back after

Rs 1000/- + GST p.m (after 1 months of Loan closure / maturity)

maturity / foreclosure of loan)

Original Property Documents retrieval on request Rs 1000/- + GST Rs 1000/- + GST

Nil - For delivery after 15 working days of loan closure ;

Charges for release of documents on loan closure Early Delivery (on request) between 7 - 15 working days - Rs 1000/- + GST ;

Early delivery (on request) between 5 - 7 working days - Rs 1500/- + GST ;

CERSAI Fees as per the rules of CERSAI for loans disbursed

Rs 100/- + GST

after January 31, 2016

CERSAI Fees as per the rules of CERSAI for loans disbursed

Rs 500/- + GST

prior to January 31, 2016

MODT/Registration of Charge - Creation/Cancellation Rs 500/- + GST

ROC charge creation/ cancellation NA Rs 500 + GST

Title Search Fees As per actual As per actual

*1)Minimum Processing Fee is INR 10,000 + Applicable Taxes. The entire fee has to be paid in full at the time of making a loan application. In case a loan application is not

approved, then PNB Housing Finance Ltd will retain processing fee for -

a) Home Loan - INR 3000 + GST collected out of full processing fee for each property evaluated by PNB Housing Finance Limited.

b) Non Home Loan - INR 5000 + GST collected out of full processing fee for each property evaluated by PNB Housing Finance Limited.

** 2)For a payment to be considered and applied as part payment of loan, the amount should be at least 5 times the prevailing EMI

3) "Residential Plot Loan" is considered as "Non-Home Loan" till the time residential building, with all necessary regulatory approvals, is constructed on it.

3) The effect of reschedulement in loan account, i.e., part prepayment or rate of interest conversion, shall be given in the next installment cycle as per the mutually agreed terms

and conditions.

4) Customers are requested not to make any payment to third parties for services.

5) Part/Full pre-payment requests can be accepted on all days, except between 25th of the month and last day of the month (both days inclusive). Customers are requested to

schedule their plans for part payment (if any) accordingly.

Schedule of Charges and Applicable Taxes for Deposits

Particulars Deposit by Individual Deposit by Non-Individual

Pre-matured withdrawal is not permissible within 3

Minimum lock in period of 3 months Pre-matured withdrawal is not permissible within 3 months.

months.

Interest payable @ 4% per annum for the period for which

Pre-matured withdrawal after 3 months but before 6 months No interest is payable.

deposit has run.

Pre-matured withdrawal after 6 months but before the date of

Interest payable 1% lower than the interest rate applicable for the period for which the deposit has run.

maturity

In case of premature withdrawal, the excess brokerage (total brokerage paid minus the brokerage for the period

Pre-matured withdrawal

which the deposit has actually run) will be recovered from the customer.

Note: The aforesaid fees/charges are subject to change at the Company’s discretion.

You might also like

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillRajesh UpadhyayNo ratings yet

- Ajeet - Furniture CarpenterDocument6 pagesAjeet - Furniture CarpenterGAYATRI INTERNATIONALNo ratings yet

- Aadhaar update form for Anjali SinghDocument4 pagesAadhaar update form for Anjali Singhrahul chaudharyNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument3 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDIGITAL ZONENo ratings yet

- MANAPPURAM FINANCE LIMITED LOAN DOCUMENTDocument5 pagesMANAPPURAM FINANCE LIMITED LOAN DOCUMENTBHUSHAN DahaleNo ratings yet

- Aakanksha Jee 2 Result 2022Document1 pageAakanksha Jee 2 Result 2022Komet Study AbroadNo ratings yet

- Aadhaar Update Form: Only Fields Mentioned Here Will Be Updated at ASK CenterDocument3 pagesAadhaar Update Form: Only Fields Mentioned Here Will Be Updated at ASK CenterChandan DasNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)omkargokhaleNo ratings yet

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS.) 1. Monthly Rental 500.00 2. Taxes 51.50Document2 pagesYour Reliance Communications Bill: Summary of Current Charges Amount (RS.) 1. Monthly Rental 500.00 2. Taxes 51.50Vel MuruganNo ratings yet

- Aadhaar Enrolment Form: Application Details Appointment DetailsDocument4 pagesAadhaar Enrolment Form: Application Details Appointment DetailsRohit MinzNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntarySushant YadavNo ratings yet

- Summary of ChargesDocument6 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- About BlankDocument2 pagesAbout Blankसंग्रामसिंह जाखलेकर पाटीलNo ratings yet

- MANAPPURAM FINANCE LIMITED LOAN DOCUMENTDocument5 pagesMANAPPURAM FINANCE LIMITED LOAN DOCUMENTManohar NMNo ratings yet

- Signature Not Verified P.O. for PrinterDocument2 pagesSignature Not Verified P.O. for PrinterSSE WASNo ratings yet

- GAIL Senior Engineer Application FormDocument4 pagesGAIL Senior Engineer Application FormBhuvan GanesanNo ratings yet

- Passport Appointment RecieptDocument3 pagesPassport Appointment RecieptMohit ChinchkhedeNo ratings yet

- Aadhaar Update Form: of Incapacitated Person, The Signature Will Be Done by Legal Guardian of Incapacitated PersonDocument4 pagesAadhaar Update Form: of Incapacitated Person, The Signature Will Be Done by Legal Guardian of Incapacitated PersonIqbal FarukNo ratings yet

- EMS ResultDocument2 pagesEMS ResultSmeeta AralikattiNo ratings yet

- Print Application FormUPPSCDocument2 pagesPrint Application FormUPPSCSayantan PaulNo ratings yet

- Hemant ResumeDocument2 pagesHemant Resumehemant kirarNo ratings yet

- Batch Sequence No.: वदेश मं ालय भारत सरकार Ministry of External Affairs, Government of India Online Application ReceiptDocument3 pagesBatch Sequence No.: वदेश मं ालय भारत सरकार Ministry of External Affairs, Government of India Online Application ReceiptBhadrasahi Cement Casting IndustriesNo ratings yet

- Application FormDocument2 pagesApplication FormShubham JoshiNo ratings yet

- IDFC FIRST Bank Personal Loan Account Statement and ChargesDocument4 pagesIDFC FIRST Bank Personal Loan Account Statement and ChargesGaurav SongraNo ratings yet

- GNGGN00252970000208293 NewDocument3 pagesGNGGN00252970000208293 NewHimachali VloggerNo ratings yet

- PDS CS Form No 212 Revised2017Document4 pagesPDS CS Form No 212 Revised2017JAMES JAYONANo ratings yet

- Ogl 099521645876244615Document5 pagesOgl 099521645876244615Rajesh KumarNo ratings yet

- 03-Mar-2013 Idea BillDocument7 pages03-Mar-2013 Idea BillMohd NafishNo ratings yet

- Untitled Document AshishDocument4 pagesUntitled Document AshishSushant SharmaNo ratings yet

- Pay bill and view charges onlineDocument8 pagesPay bill and view charges onlinepradeep3110850% (1)

- Appointment RecieptDocument3 pagesAppointment Reciept7 A Anushka Mishra 26No ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryRahulNo ratings yet

- JEE Main 2020 Confirmation PageDocument1 pageJEE Main 2020 Confirmation PageJatin SinghNo ratings yet

- InvoiceDocument1 pageInvoiceThirumal K SNo ratings yet

- PDFDocument3 pagesPDFAkhlad AlqurayshNo ratings yet

- Registration Form for Uttarakhand Technical UniversityDocument2 pagesRegistration Form for Uttarakhand Technical UniversityShubham JoshiNo ratings yet

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument3 pagesवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment Receiptdream onlineNo ratings yet

- InvoiceDocument2 pagesInvoiceWinNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryPak or Ind cricket newsNo ratings yet

- Maharashtra Electricity Bill DetailsDocument1 pageMaharashtra Electricity Bill Detailskishor chandaliyaNo ratings yet

- 1.11091338 - 12 Mar 2013Document5 pages1.11091338 - 12 Mar 2013Deepak KumarNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)Niranjan KumarNo ratings yet

- Seller/Consignor Tax InvoiceDocument1 pageSeller/Consignor Tax InvoiceRAJESH KUMARNo ratings yet

- SHANBIDocument4 pagesSHANBIAshish BiswakarmaNo ratings yet

- Oiler Motor Man Biodata ResumeDocument2 pagesOiler Motor Man Biodata ResumePRAKASH CHAND DWIWEDINo ratings yet

- Acknowledgement 1647346050386Document4 pagesAcknowledgement 1647346050386Admin LoginNo ratings yet

- Aadhaar Enrolment Form GuideDocument4 pagesAadhaar Enrolment Form GuideMd EjazzuddinNo ratings yet

- InvoiceDocument1 pageInvoiceShiva RamanathNo ratings yet

- Statement of Account For 405dpfip400747: Bajaj Finance LimitedDocument3 pagesStatement of Account For 405dpfip400747: Bajaj Finance Limitedletsdraw 2010No ratings yet

- Mita Dhara AckDocument1 pageMita Dhara Acksurajit jatiNo ratings yet

- Tax Invoice BreakdownDocument1 pageTax Invoice BreakdownPatriotNo ratings yet

- CPCL TA 2020 21 Advt Final WebDocument5 pagesCPCL TA 2020 21 Advt Final WebSivasankariNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoMohan PvdvrNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryRavella VenkatakrishnaNo ratings yet

- Foreclosure 14 07 11Document3 pagesForeclosure 14 07 11Muhammed Yazeen PMNo ratings yet

- InvoiceDocument1 pageInvoiceOmprakash NandlaNo ratings yet

- Umar Passport ApplicationDocument3 pagesUmar Passport ApplicationaliNo ratings yet

- Application No. 2105 2013 7035: UGC-NET December 2020 and June 2021 CyclesDocument1 pageApplication No. 2105 2013 7035: UGC-NET December 2020 and June 2021 CyclesMantasha KhanNo ratings yet

- ONLINE APPOINTMENT RECEIPTDocument3 pagesONLINE APPOINTMENT RECEIPTkalpana katkeNo ratings yet

- SOC - Prime - Dec 10 2023 - V27Document1 pageSOC - Prime - Dec 10 2023 - V27sehgaNo ratings yet

- Profile of GMAT Testing: ResidenceDocument36 pagesProfile of GMAT Testing: ResidenceNISHA BANSALNo ratings yet

- Ratios Analysis and TrendsDocument14 pagesRatios Analysis and TrendsNISHA BANSALNo ratings yet

- Tutorial # 5: Indian School of Business Financial Accounting in Decision Making, DHM1: 2022-23Document3 pagesTutorial # 5: Indian School of Business Financial Accounting in Decision Making, DHM1: 2022-23NISHA BANSALNo ratings yet

- Railway Budget Analysis 2019Document7 pagesRailway Budget Analysis 2019NISHA BANSALNo ratings yet

- 2021 Gmac Research Brief Value of TestingDocument9 pages2021 Gmac Research Brief Value of TestingNISHA BANSALNo ratings yet

- Practice Set 9 BondsDocument11 pagesPractice Set 9 BondsVivek JainNo ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- GMAT Geographic Trend Report Testing Year 2021Document64 pagesGMAT Geographic Trend Report Testing Year 2021NISHA BANSALNo ratings yet

- BCOM Group Assignment Estimate ISB Student StepsDocument2 pagesBCOM Group Assignment Estimate ISB Student StepsNISHA BANSALNo ratings yet

- SMMD: Practice Problem Set 2 Topics: Sampling Distributions and Central Limit TheoremDocument2 pagesSMMD: Practice Problem Set 2 Topics: Sampling Distributions and Central Limit TheoremNISHA BANSALNo ratings yet

- TCFSL Remuneration PolicyDocument4 pagesTCFSL Remuneration PolicyNISHA BANSALNo ratings yet

- IIMC Summer Interview Experiences - 57th BatchDocument147 pagesIIMC Summer Interview Experiences - 57th BatchNISHA BANSALNo ratings yet

- Graduate Management Admission Test Official Score Report - Test TakerDocument3 pagesGraduate Management Admission Test Official Score Report - Test TakerNISHA BANSALNo ratings yet

- Finance Research Letters: Bhagwan ChowdhryDocument6 pagesFinance Research Letters: Bhagwan ChowdhryNISHA BANSALNo ratings yet

- Personal Development Plans: Case Studies of PracticeDocument84 pagesPersonal Development Plans: Case Studies of PracticeNISHA BANSALNo ratings yet

- CV1 Anirudh Singh 61910258Document1 pageCV1 Anirudh Singh 61910258NISHA BANSALNo ratings yet

- Income Tax Declaration Form For The Financial Year 2021-22Document6 pagesIncome Tax Declaration Form For The Financial Year 2021-22NISHA BANSALNo ratings yet

- CV1 Spurthi Reddy 61910607Document1 pageCV1 Spurthi Reddy 61910607NISHA BANSALNo ratings yet

- CV1 Jinal Shah 61910206Document1 pageCV1 Jinal Shah 61910206NISHA BANSALNo ratings yet

- CV1 Lata Asnani 61910103Document1 pageCV1 Lata Asnani 61910103NISHA BANSALNo ratings yet

- Isb Cas - Details For The Job Yes-PepDocument27 pagesIsb Cas - Details For The Job Yes-PepNISHA BANSALNo ratings yet

- Assignment 1Document3 pagesAssignment 1SaiPraneethNo ratings yet

- Work Experience 3 Years 8 MonthsDocument1 pageWork Experience 3 Years 8 MonthsNISHA BANSALNo ratings yet

- ISB Graduate Seeks Marketing and Strategy RoleDocument1 pageISB Graduate Seeks Marketing and Strategy RoleNISHA BANSALNo ratings yet

- Sun Pharmaceutical Industries Limited Consolidated Profit and Loss Statement for FY 2021Document20 pagesSun Pharmaceutical Industries Limited Consolidated Profit and Loss Statement for FY 2021NISHA BANSALNo ratings yet

- Solution Major Nov2017 Hul311Document7 pagesSolution Major Nov2017 Hul311NISHA BANSALNo ratings yet

- Unit 7: Elasticities of DemandDocument7 pagesUnit 7: Elasticities of DemandNISHA BANSALNo ratings yet

- Isb Cas - Details For The Job Vice PresidentDocument2 pagesIsb Cas - Details For The Job Vice PresidentNISHA BANSALNo ratings yet

- FADM Final All InfoDocument182 pagesFADM Final All InfoNISHA BANSALNo ratings yet

- English File 4th Edition Intermediate WorkbookDocument85 pagesEnglish File 4th Edition Intermediate WorkbookElyce CattleNo ratings yet

- GIPS Compliance QuestionsDocument5 pagesGIPS Compliance QuestionsBảo TrâmNo ratings yet

- Financial StatementsDocument3 pagesFinancial StatementsNana LeeNo ratings yet

- Invesco WilderHill Clean Energy ETF Document SummaryDocument2 pagesInvesco WilderHill Clean Energy ETF Document SummaryRahul SalveNo ratings yet

- PCI Slide PresentationDocument16 pagesPCI Slide PresentationsomethingNo ratings yet

- TF 00000055Document3 pagesTF 00000055YustofiNo ratings yet

- PlumHQ Aims To Solve India's Missing Middle Puzzle in Digital InsuranceDocument9 pagesPlumHQ Aims To Solve India's Missing Middle Puzzle in Digital InsuranceShatir LaundaNo ratings yet

- PDIC-Illustrative Cases On Deposit Insurance CoverageDocument16 pagesPDIC-Illustrative Cases On Deposit Insurance CoverageAmore FidelisNo ratings yet

- Working CapitalDocument12 pagesWorking CapitalYasin Misvari T MNo ratings yet

- West Bengal eProcurement Refund ReportDocument2 pagesWest Bengal eProcurement Refund ReportKalyan GaineNo ratings yet

- Mortgage Key Facts SheetDocument2 pagesMortgage Key Facts Sheetpeter_martin9335No ratings yet

- Module No 1 Corporate LiquidationDocument10 pagesModule No 1 Corporate LiquidationKrishtelle Anndrhei SalazarNo ratings yet

- Aft of Swift MT 760 (Icc 600 Urdg 75 DR 8) : (For Assignment of STAND BY LETTER OF CREDIT)Document1 pageAft of Swift MT 760 (Icc 600 Urdg 75 DR 8) : (For Assignment of STAND BY LETTER OF CREDIT)Crest CapitalNo ratings yet

- Unique Document Identification NumberDocument3 pagesUnique Document Identification Numberniravtrivedi72No ratings yet

- Accounting For Partnerships: Weygandt - Kieso - KimmelDocument70 pagesAccounting For Partnerships: Weygandt - Kieso - Kimmel409005091No ratings yet

- Digital Bank Revolutionizes Customer ExperienceDocument76 pagesDigital Bank Revolutionizes Customer ExperienceAafreen Choudhry100% (1)

- Cover Scope Business Insurance SolutionDocument2 pagesCover Scope Business Insurance Solutioncoverscope1No ratings yet

- Unit 4: Relative ValuationDocument47 pagesUnit 4: Relative ValuationMadhvendra BhardwajNo ratings yet

- Coindaq PDFDocument1 pageCoindaq PDFmuruganNo ratings yet

- EC - MODULE 3-NBFC - PPT - Procedure NBFCDocument10 pagesEC - MODULE 3-NBFC - PPT - Procedure NBFCAnanya ChaudharyNo ratings yet

- Intermediate Accounting 3Document6 pagesIntermediate Accounting 3Carla Neil Ely SantosNo ratings yet

- Wattal Committee ReportDocument2 pagesWattal Committee ReportKunwarbir Singh lohatNo ratings yet

- AGL GasDocument3 pagesAGL Gasvu ducNo ratings yet

- Imad A. Moosa: Department of Accounting and Finance Mortash UniversityDocument6 pagesImad A. Moosa: Department of Accounting and Finance Mortash UniversitySamina MahmoodNo ratings yet

- Customer Statement PDFDocument2 pagesCustomer Statement PDFTrust WalletNo ratings yet

- Unibank and Commercial Bank HandoutsDocument4 pagesUnibank and Commercial Bank HandoutsmorningmindsetNo ratings yet

- Business Com Theories (Q1)Document10 pagesBusiness Com Theories (Q1)수지No ratings yet

- Final RevisionDocument9 pagesFinal RevisionVo Phuc An (K17 HCM)No ratings yet

- Financial Statements and Ratio AnalysisDocument2 pagesFinancial Statements and Ratio AnalysisRyan MiguelNo ratings yet

- Investment Project Design - 2011 - Kurowski - Front MatterDocument13 pagesInvestment Project Design - 2011 - Kurowski - Front MatterFrancis LewahNo ratings yet